A substantial portion of the site’s commentariat has wanted to believe that the Greek government’s defiance of the will of the Troika has been effective, either in and of itself, or as a means of preparing the Greek public and buying time before a Grexit.

As we’ve argued, Greece was almost certain not to prevail on its own. But outside help has been sorely lacking. While the US expressed concern early on, and argued the Greek case, that the nation needed debt writedowns and pro-growth policies, the Administration quickly abandoned its lobbying effort. The European left similarly has not taken up the Greek cause in a meaningful or consistent manner.

As for the notion that Syriza has been planning to depart the Eurozone, we argued that Finance Minister has long viewed that outcome as an unmitigated disaster for Greece and Europe. And perhaps most important, the government’s actions don’t bear that out. The first order of business should have been to impose capital controls. As reader Ishmael stressed, you declare bankruptcy before you run out of cash. This measure would have reduced the Troika’s leverage over Greece somewhat, and would be an absolutely essential step in preparing for a Grexit. Moreover, imposing those restrictions in response to withdrawals could have been positioned as a necessary protective measure if it had been done early on. Acting now would look like a desperate measure, either a last-ditch effort to protect the banks or an admission that Grexit risk was high.

A new story in the Financial Times illustrates what we said early on, that it is the ECB that holds the whip hand. It is the ECB that is keeping the Greek banking system on life support through the backstop of the ELA and also increased pressure on the Greek government by refusing to allowing Greek banks to increase their holdings of Greek government debt (raising the ceiling would have allowed the Greek banks to buy newly-sold government bonds and bills, thus providing the government with a desperately-needed funding mechanism).

Recall that in the talks over the memorandum between the Eurogroup and Greece last month, the final text did not come out of a negotiation. While Greece did submit draft language, the final version was dictated to Greece. The text was finalized without Varoufakis’ input, and Tsipras was presented with a “take it or leave it” version (one account said he signed the draft presented to him; another stated that Tsipras was permitted to change one word). That is not a negotiation. That is a diktat. And Greece has tried to deny that the text says what the Troika intended it to say (and how I also read it): that the hated existing structural reforms are in place. Greece may be allowed to negotiate substitutions that have no negative fiscal impact, and will hopefully be allowed to implement humanitarian relief (Varoufakis stated that that was agreed, but there hasn’t been much said either way by the creditors*).

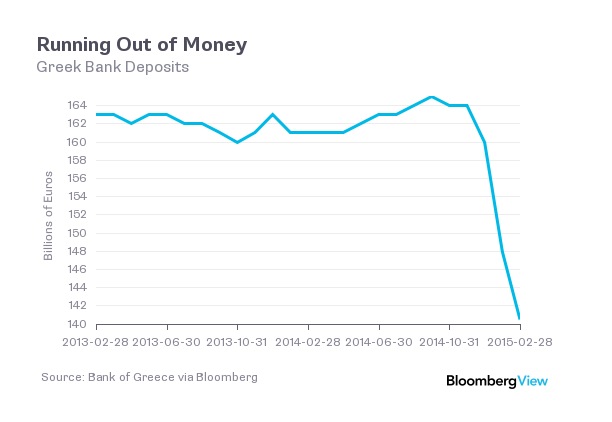

Here is how the bank run played into Greece’s already weak hand. From the Financial Times:

Greek companies and households pulled €7.6bn out of their bank accounts during the government’s standoff with its international bailout creditors in February, driving deposits down to €140.5bn — the lowest level in 10 years.

Although the withdrawals were lower than in January, the €20.4bn pulled out over the two months shows how close Greece came to a full-scale bank run before Athens reached agreement with eurozone authorities to extend its €172bn bailout into June…

Originally, Greece’s EU rescue programme was due to expire at the end of February. Repeated failures by the new Greek government to reach agreement with eurozone creditors led to a rapid speeding up of capital flight. Officials said that in the days before an extension deal was reached, almost €800m was being withdrawn from Greek banks every day.

Jeroen Dijsselbloem, the Dutch finance minister who led eurozone negotiations with Athens, told the Financial Times last month that the massive withdrawals were the primary force pushing the Greek government towards an extension deal.

“Mainly, the situation in the banks was becoming very urgent, and that was the biggest driver,” said Mr Dijsselbloem. “If you have large outflows from your banks, you can do that for a couple of weeks, but there becomes a point where it becomes too critical.”

Now bear in mind that the bank run was more severe in January, when Syriza took office, than at the end of February. However, the level of outflows in February was significant, and more important, was hitting a banking system that was already weakened. When banks lose deposits, the normal response is to sell assets to provide funding. But in reality, banks have limited liquidity buffers, and once the outflows exceed a not-very-high level, the assets sold will be less liquid ones. That means the bank will lose money via distressed sales, turning a liquidity crunch into a solvency crisis.

And this chart from Bloomberg illustrates the lessening of the bank run in February looks to be a distinction without much of a difference:

As Mark Gilbert put it:

So the Greek banking system had just a bit more than 140 billion euros at the end of February. That’s down almost 15 percent since the end of November, suggesting bags of capital are fleeing the country as fast as their little legs can carry them. And while extrapolation is an imperfect science, taking the trend from November and running it to the end of this month suggests there could be as little as 133 billion euros left at the current pace of withdrawals, which would be the lowest in more than a decade.

So what did Dijsselbloem mean by too critical? Back to the pink paper:

If withdrawals become so large that Greek banks are deemed insolvent, the European Central Bank would have to end its practice of allowing emergency loans to lenders to fund day-to-day operations. The only way to restart the banking system would be for Greece to print its own currency.

This is the scenario that is often described inaccurately as “accidental Grexit”. Bear in mind that any decision by the ECB to withdraw support would be no more an accident than the US refusal to backstop Lehman trading positions while Barclays got approval to buy the troubled firm. That decision was what left Lehman with no option other than to file bankruptcy. Paulson, Bernanke, and Geithner were under no illusion as to what the result would be. With the benefit of hindsight, they might deem it to be a mistake. But they’ve never tried pretending it was an accident. By contrast, the “accidental Grexit” meme in the media looks like an effort to pre-plant a narrative if the impasse continues and the powers that be decide the cost of letting Greece go is lower than the cost of the variances they insist on, given that Spain, France, Portugal and Ireland would also want the same breaks.

Mind you, Greece’s body language for the moment is that it will submit to the reform negotiation process. But we’ve had Greece buck the traces before. However, the threat of execution at dawn wonderfully focuses the mind. And Greece’s cash scramble and the resumption of its bank run shows that an endgame of some sort is approaching.

___

* I discount the offer by Jean-Claude Juncker of up to €2 billion in EU funds, which he said would go for humanitarian and growth projects. Some readers think it may come from programs that have onerous conditions, as indicated by the fact that Greece has monies available that it has not taken up.

Meanwhile, France continues to run a 4% structural deficit with national debt climbing, not reforming in any meaningful way (there is a lot to do here, trust me), bullshitting its way forward with Merkel, Dieselboom and the rest playing stupid.

With élections up in 2017, everyone knows that the French will continue to let the déficits high.

All Europeans are equal, some just more than others.

FrAAnce is still an AA-rated credit, while Greece has sunk to a single-B junk rating.

With an investment grade rating, one can get away with more fiscal shenanigans than a peer country who’s already in the junk-bond dog house.

That said, it used to be FrAAAnce. *wipes away a tear*

Too bad FrAAnce doesn’t have the fortune to own the global reserve currency, all by herself.

Very little has been said about the reasons for the Greek foot-dragging in this mess. This opinion piece in Ekathimerini (granted, very critical of Syriza) lifts a bit of the veil and doesn’t bode well to any focusing of the mind:

http://www.ekathimerini.com/4dcgi/_w_articles_wsite3_1_26/03/2015_548569

Since Kathimerini is an oligarch run paper that hates SYRIZA even more than the European MSM, everything they say should be taken with a pinch of salt

Kathimerini Is a Greek language, conservative paper. Ekathimerini is an English language website owned by the NYT. Not that that makes for all that much difference in POV or editorial line.

> the Finance Minister has long viewed that outcome [a Grexit] as an unmitigated disaster for…Europe

This supposedly was the ‘nuclear option’ (in Varoufakis’ own words) that would force Europe’s hand. But Greece openly forswore using it from the outset. Ironically, Varoufakis said that the major problem with the previous governments is precisely that they didn’t negotiate with the Troika, in that they didn’t threaten to do anything (ie a Grexit) that would cause tremendous harm to Europe !

I think I’ll re ask a question I’ve posed in another thread: What would capital controls have accomplished? Greek banks were dependant on ELA/ the ECB accepting their paper even before Syrizia got into government. If all supports are pulled they are dead. If they then want to recapitalize them they’ll need a new currency so have to default on all the debt anyway. What difference do a few tens of billions Euro in deposits make? Especially since in case of a break up all deposits still in the system are probably lost anyway.

And who or what are we trying to save here? The greek banks became zombies back in 2012 (PSI 1 & 2) and have since been recapitalized by the Greek taxpayers to the tune of 55 billion EUR of secret additional loans, arranged between ECB and BoG, and this information was withheld from parliament and the media. Effectively they are nationalized though under Troika’s command the profits from share sales that brought in new, vulture investors went to the same investors and not back into state coffers.

The rich had 5 years to send their money out of Greece – that’s gone; the present withdrawals are corporates & companies running accounts and the Greek people getting ready for probable default. Why should SYRIZA betray the Greek people’s interests with capital controls? Neither the Greeks nor SYRIZA went into this process with their eyes shut to the consequences, and you might consider that given the choice between Eurozone slavery & the dreaded ‘d’ word, we might be quite willing to pay the price.

Meanwhile an ongoing “analysis” based on the MSM shows only the activities of one side. Those rushing to hammer SYRIZA might ask themselves why SYRIZA has any obligation to reveal their hand in this poker game?

Um, Greece has been showing its hand way too openly. Its ministers and parliament officials, until a few days ago, have spouted off like crazy and show a lot of internal disagreement. Varoufakis was also discussing strategic issues and thinking on Greek TV, and that was quickly reported all over Europe.

When one is thrown into a crisis, ruthlessness is absolutely essential. The dimensions of one’s character, one’s hopes, dreams, fears, determine WHAT one will be ruthless about.

Greece decided to be ruthless about staying in the Eurozone. This was a great mistake, IMO.

Greece should have been ruthless about protecting its people and its capital. If that meant screwing the EU, ECB, IMF, etc…oh, well! And I’m not talking about Syriza…the ruthlessness should have started at the onset of difficulties under Pasok.

Most importantly, Goldman Sachs should have been an immediate target/victim of ruthlessness.

While it’s not too late, one has to wonder what might have been saved if the Greeks started off on the right foot to begin with…and when they will finally realize that it’s time for a little iron in the soul and steel in the spine.

I like your use of “ruthlessness” and agree with your assessment.

At the very least the political attitudes in Europe appear to be swaying against austerity. Witness strong protests over the new waste tax in Ireland. I how whatever the outcome is in Greece it starts a major backlash against bureaucratic insanity that is the Eurozone.

The ECB isn’t allowed to throw good money after bad. If Greek banks become insolvent due to cash flight then the assistance will be cut off. In the event of switching currencies capital controls would be a necessity to prevent a freeze in the payments system during transition. Either way I think the controls make sense and should have been the first order of business once Syriza gained control of the government.

Euromoney, Sep. 2014:

Looks like Greek banks were already insolvent last September. Having lost 15% of their deposits since then, it’s a wonder their doors are still open.

Pretending that Greek banks are solvent is just a convenient fiction that we’ve all adopted during the acute phase of the crisis, when cash flow is all that matters.

It’s acting like a biological system that is near death, and the brain floods the body with euphoria causing endorphins.

“Gotta pretend everything is great. Be happy.”

No, its not a wonder.

The ECB will never – ever, ever, ever – cut off the Greek banks from ELA unless there is a political consensus that Greece should be kicked out of the Eurozone. Its notable, that although they have kept the Greek system on a drip feed of ELA increases, they have increased ELA.

As for capital controls. That would have been tantamount to Grexit. No one believes capital controls would have been reversed. It would have taken all the pressure of the Euro side to keep Greece in the Euro, since everyone would have then viewed Grexit as inevitable.

I get the distinct sense that some here would like to see a Grexit just to vindicate their (correct) view that the Euro is a flawed currency structure.

That is incorrect. Precedents exist for implementation of capital controls anong eurozone member states, see Commision vs. Netherlands for one example in which the CJEU ruled in favor of controls in the “overriding general interest”. Controls do not equal grexit.

A bank run – that’s what’s going on in Greece – is a liquidity (not a solvency) problem.

In 2012 the ECB supported a much larger bank run on the Spanish and Italian banking systems.

The ECB is now trying to force Greece to cry “uncle” by threatening to suspend the ELA and thus cut off liquidity support for the Greek banks. But maybe it’s just a bluff. If it did yank the ELA then the Bank of Greece would just have to disobey and keep advancing reserves, no matter what.

Then the weapon left for the ECB to use would be to expel Greece from the TARGET2 system. That would mean expulsion from the eurozone – an illegal move that the conservative-minded bureaucrats at the ECB would likely be reluctant to take.

Ironically, there is one potential beneficial result for Greece as a consequence of the present bank run. If she were to quit the euro, there would be tens of billions of euro deposits originally from Greece parked in the German banking system as well as in Luxemburg (see the recent rise in the TARGET2 balances of these two countries, a sure sign of where the money is going to). If these euros later come back to Greece they would serve to prop up the exchange rate of the new drachma, helping prevent a risk of collapse of the new currency in the foreign exchange markets.

For the moment, Greece should in any case eschew capital controls and just demand that the ESCB fulfill its role of LOLR by keeping the ELA running until the panic subsides and the fleeing deposits return to Greece – just like they have returned to Spain and Italy after the 2012 panic.

Why does all this spinning and churning look and sound more and more like THIS? https://video.search.yahoo.com/video/play;_ylt=A0LEV70kjxVV5CMA5twnnIlQ;_ylu=X3oDMTBsa3ZzMnBvBHNlYwNzYwRjb2xvA2JmMQR2dGlkAw–?p=rube+goldberg&tnr=21&vid=247226FBC07D308E032C247226FBC07D308E032C&l=157&turl=http%3A%2F%2Fts2.mm.bing.net%2Fth%3Fid%3DUN.608016238313278925%26pid%3D15.1&sigi=11rm7pc47&rurl=https%3A%2F%2Fwww.youtube.com%2Fwatch%3Fv%3DxdPDn1KUz_A&sigr=11bsqbsfi&tt=b&tit=Purdue+Rube+Goldberg+Machine+claims+Guinness+World+Record&sigt=11pr8fau1&back=https%3A%2F%2Fsearch.yahoo.com%2Fyhs%2Fsearch%3Fp%3Drube%2Bgoldberg%2Bvideos%26ei%3DUTF-8%26hsimp%3Dyhs-001%26hspart%3Dmozilla&sigb=1304rdibd&hspart=mozilla&hsimp=yhs-001

Going for a new world record in the Guinness category, “Feckless Ineffectual Mortal Idiocy,” Europe The Schlosser, with assists from The PTB ™… Let’s hear it for Europe, folks! They’ve screwed things up all over the planet, time and again…

+1

I published about this Greek Euro Referendum possibility on March 12 (an eternity ago)

http://www.zerohedge.com/news/2015-03-27/will-greece-call-referendum-euro-membership

The Greek ‘impossible triangle’ tightens its noose, relentless.

Sorry but any other analysis seems (almost) unconsequential.

Greece ready to leave, soon pivot towards Russia.

http://www.zerohedge.com/news/2015-03-28/greece-prepares-leave

http://www.zerohedge.com/news/2015-01-27/greece-begins-great-pivot-toward-russia

The Ilargi post is pure unsupported speculation. Complete projection on his part.

The bit about Nikos Kotzias not liking the EU sanctions on Russia is also old news:

http://www.dw.de/greeces-new-foreign-minister-astute-opinionated-radical/a-18247643

Greece walked back those remarks in a big way in February. Most important, Russia is not interested in anything more than exporting agricultural goods to Greece right now. Greece is a mess and they have way higher priorities right now, namely Ukraine, Iran, Syria, China. Anything other than token gestures would be seen as a Cuban missile crisis level confrontation with NATO. The Russians are not self destructive. This is typical ZH running way ahead of facts.

Yves,

How about Russia taking advantage of the fact that (as you rightly say)

…”…Greece is a mess…“… ?

Rahm Emanuel: “You never let a serious crisis go to waste… it’s an opportunity to do things you think you could not do before.”

How about Russia helping out Greece by transferring its (heavily discounted) Ukranian bonds for full nominal payment of Greek debt to the IMF ?

How about Russia getting a jumbo-size military base in exchange ?

What if Russia

(a) Invested in Greece (jobs) starting with the now re-directed massive Russian gaspipe through Turkey right up to the Greek border, plus other required infrastructure

(b) Bought their stuff, particularly in view of Europe’s sanctions that today don’t allow Greece to sell Russia lots of stuff.

bank run or arbitrage play ?

the wonder of the euro is the capacity to move funds from point a to point b

long term greece will be better off inside the :”euro” instead of a new owl (glaux) or draxma…but this myth of some massive demise of greece if dr strangeluvauble gets to push out hellas is a bit rich…(to borrow the term from uncle mario)

greece has the worlds largest private shipping industry…and most of that money is held overseas and controlled by greeks…it is self sufficient in cotton, milk, tobacco, olives, rice, figs, almonds, tomatoes, fishing, beer, wine, oranges, tangerines, concrete, cheese, pistachios and a few other things…it gets most of its lemons that it does import for some reason, from argentina…it has a large gasoline refinery business and exports gasoline…other than farma and oil, it imports very little…its farma it could convert to sourcing from india and its cars it can wait on or can import from korea or china…german and italian cars are not some requirment…with the flare ups in the MENA there will be an influx of tourists this year…especially without the noise machine of protests that had existed before…pasok and new demo voters will not be on the streets, and despite the myth of XAXAXA (golden yawn)…most of those you might actually watch on youtube or vimeo have a very interesting not really greek accent…not sure where they are from…guessing they can be outed in short order…so, the food palate might be boring after a while, but greeks will be able to sustain themselves….20 billion euros a year from tourism will be traded for the new glaux…if it comes down to it…and greece exports mostly to turkey and eastern europe…meaning…there is no major need for the euro…sorry to disappoint on that front….BUT…greece does not currently have the human capital to have a drachma based economy…it is just reality…there is too much discooperation…so in theory, greece can in fact ask germany to get in cue for its money in a few years…but reality dictates, the ECB will shut down hellas and in the 90 days it would take to react to the bundesbank suddenly realizing it made a mistake in pushing off greece, the laos…the people of greece…well honestly…I wish it was different…but I don’t see the self discipline needed to pull it off…so stay in the euro is the responsible thing to do…if there were some back door negotiations going on with india, south korea, turkey, nigeria, argentina, and china to set a bretton woods type exchange rate for the new glaux/drachma for 120 days, then maybe…that would be a nice plan b…since austria established and germany has accepted this magical moratoruem on HETA, setting a nice precedant…what is good for the goose…heck…people forget…after ww1 the us was owed 24 million for aid and europe wanted the usa to waive on that claime so that austria could be given a 20 year moratorium on paying back its debts AND get fresh money….oh…and that agreement on reparations…the germans claim of an “agreement” the 1960’s with greece…how is an agreement signed by a german royal family (in its claim to ‘rule’ hellas) for the benefit of germany something that is somehow a release on the claims of the greek people…the greek JUNTA was supported by the germans and german royal family in its claim to “rule” greece…

reality, what a precept…

Thank you, Alex, for what I at least expect is a dispassionate, informed brief on the ordinary- people realities obscured by the focus on ” high finance ” (one wonders what it’s high on) and geopolitical jerkoffery. The fly in the ointment, as you point out, is the problem (absent maybe some pressing tribal exigiency) of getting enough ordinary people to pull on the same end of the rope. While banksters and hucksters and Military Geniuses are rolling rocks and logs under their feet, and stealing the sandwiches out of their lunch pails…

All along, Yves, you’ve misunderstood the strategy and the goal and what might then be considered “effective”. To have argued, as you did, that Greece should have used Grexit as a bargaining tool is rather like Blazing Saddles, “one more step and the nigger gets it”. Not credible. And especially so given the Schäuble bloc’s drooling over just that prospect. I’m convinced, now, that the first two bailouts, in the absence of a formal mechanism to remove a country from the euro, were designed to provoke just that outcome. What was achieved by “lashing themselves to the mast” and refusing Grexit was to remove that bloc from it’s central policy position. We can only hope that’s permanent. Those failed ideologies have more heads than hydra.

But you’re right about Greece not being able to prevail on it’s own. Greece must deal with somebody. But prevail in what way? To achieve a “debt reduction”? That isn’t enough. I think you’ve missed that too. Europe is in deep, deep trouble. Deep trouble. Greece needs a new business model. Spain needs a new business model. Italy needs a new business model. Portugal needs a business model, period. New business models require investment. Money, cash flow, beyond that necessary to meet current expenses. And that investment must come from the very people Greece already owes a lot of money to and can’t repay. And the people she must deal with to secure that investment are only marginally more reasonable. And they’re also politicians. At least these politicians don’t overtly want a Grexit.

Notice that after the Feb. 20th agreement – an agreement so vaguely worded as to give everyone the political cover to keep talking

pastto each other – but which was no agreement at all. Schäuble returned to Germany, not to tell Germans what he had done for Germany, or even to tell Germans what he had done for Europe at the expense of Germany; but to tell the world that the Greek government would have difficulty explaining the agreement to their voters! What a fool. Le misanthrope. But it illustrates the political dimension. These are negotiators, they are there to win, and it’s only about the optics, not the problems or solutions. You can’t find a solution talking to those people.Consider what happens if they default and refuse to impose capital controls. Of course their banks are dead, money runs out of the country. But the ECB and other European banks that are on the hook for that too. It won’t be just Greek banks that are insolvent.

There is a good Satyajit Das post here that explains the consequences of default.

Capital controls, a Greek euro, are another form of drachma. Forget “tied to the mast”. If they do that they may as well have jumped ship early. It’s hard for me to imagine that the Greek government would be so cooperative. To be credible they must make it known that it’s the Eurogroup who must find a solution.

Can that work?

The ECB has been decidedly unhelpful. But whip hand? This Dragi is all smoke. A legalist in an unlawful world. He does what he’s told. And he, maybe alone, understands the consequences of default. The fx markets have been pretty clear. Europe doesn’t benefit from a devalued euro. As many have acknowledged, this is Europe’s Lehman moment. If these politicians don’t recognize the danger of a Greek default it’s going to be bad.

Huh? The ECB has just launched QE despite the Bundesbank and Merkel’s objection. Draghi may be deliberate but he is no lackey. And it is the ECB cutting off the Greek government from funding and sending the very clear message that they are keeping the Greek banks barely alive that forced the Greeks to relent in February and is increasing their desperation now. You keep denying evidence that is in your face because it is at odds with your romantic beliefs.

As to Grexit, leaving the Eurozone is mutual assured destruction, like nuclear weapons. Are you telling me that being a nuclear power does not give the owners an advantage in the geopolitical sphere? Greece basically threw away its nukes by not imposing capital controls and making its unwillingness to Grexit if its creditors were abusive. There was an implicit recognition that the Greeks were not utterly powerless and that austerity is failing in the willingness (widely discussed before the Feb 20 negotiations) of the creditor to give a break on the unrealistic fiscal surplus targets for 2015 and 2016 and to further reduce the economic cost of the debt by extending maturities and reducing interest rates further. The value of Greece’s debt to GDP in real, as opposed to nominal, terms is more like 70% as opposed to the headline 170%. But that’s still way too much for an economy in depression. But Greece weakened its already disadvantaged position by visibly throwing away is one source of bargaining leverage. All they had to do was to take steps that showed they were keeping it open as an option, not overtly threaten.

Similarly, egarding the Feb 20 agreement, it was very clear, as I wrote at some length at the time, that it reaffirmed the existing structural reform agreement. It was not ambiguous on that issue, and that was a core issue. It was also unambiguous as to process, that Greece would have to get its reforms approved by the Troika and then by the Eurogroup, in order to get any money released. Greece has wasted a month fighting both issues, delivering a detailed reform list where it might (stress might) be allowed to swap some existing reforms for the reforms it prefer if it can convince the Troika and Eurogroup the changes have no negative fiscal impact. It has also tried bucking having to go through the Troika by going to the Eurogroup, the EC, and most recently, to Merkel directly. All efforts to end run the process clearly set forth in the February memo failed. Greece has repeatedly been told it has to go through the mandated steps and cooperate with the Troika inspectors.

To be generous, Draghi may feel that keeping Greece on drip feed forces both sides to the table. Anyway, I agree that he hasn’t been helpful. Even hurtful to Greece. Remember, he was thought to be the most “German” of the possible candidates for his position.

Default within the euro is equally a nuclear option. What have the fx markets been telling everybody? If Greece is forced out, including forced to install capital controls, most of the damage falls on Greece alone. That’s where Greece gives up its leverage. To remain in the euro forces the others who will remain in the euro to consider what can happen to the euro.

As ambiguous as that agreement was I agree that it left the old structure in place. We could have wished for more. And I agree also that there has been a lot of time wasted.

Marco Polo,

It’s funny you didn’t mention that (for obvious reasons) FRANCE also needs a new business model as well as dear GERMANY.

Come to think of it the EZ, or rather the whole of EUROPE needs a new business model,,,

Is everybody aware of what THAT entails politically and financially ?

Greece must go Icelandic. That’s the nuclear option. If Greek bank solvency remains a Greek problem, Greece goes down hard and the rest of us wait for the next domino to fall. If Greek bank solvency becomes a European problem we can hope some adjustment can be made to an unworkable monetary union.

Unless some dark, stealth derivatives, involving Greek banks, get tangled up somewhere in the abyss.

The ECB has just launched QE despite the Bundesbank and Merkel’s objection.

There is a difference between QE and Grexit. QE is a technical measure within the ECB’s purview – an asset swap. Forcing Grexit as a move with huge political consequences. In fact the story with QE argues directly against your point, because even for this narrow (compared to Grexit) move, Draghi had to prepare the ground because of the German objections, instead of just going ahead and doing it.

As for capitol controls and nukes, what you’re missing is that the capital controls are the nukes. Once you use them you lose all your leverage.

Has Greece wasted a month fighting ? Not clear. I suspect that after the mini-summit they will get a more accommodating set of reforms approved than they would have been able to otherwise. As I’ve said, it likely took time for the technical teams and the new political reality to line up.

Yves Smith: [Greece] … making its unwillingness to Grexit if its creditors were abusive.

—————–

Default, with all its potential consequences, including Grexit, has always been on the table.

Still is:

“As officials from the EU, the European Central Bank (ECB) and the International Monetary Fund (IMF) prepared to pore over Athens’s latest proposals, the country’s international economic affairs minister, Euclid Tsakalotos, raised the stakes, saying while Greece wanted an agreement it was prepared to go its own way “in the event of a bad scenario.”

He told the Guardian: “We are working in the spirit of compromise, we want a solution, but if things don’t go well you have to bear the bad scenario in mind as well. That is the nature of negotiations.”

[…]The desire was for a positive outcome, Tsakalotos said, but Athens’s new administration was not willing to abandon its anti-austerity philosophy. “

(emphasis added)

http://www.theguardian.com/business/2015/mar/27/greece-submits-reform-proposals-to-eurozone-creditors-with-a-warning

““The [Greek] government is not going to continue servicing public debt with its own funds if lenders do not immediately proceed with the disbursement of funds which have been put on hold since 2014,” said government aides.”

http://www.theguardian.com/business/2015/mar/27/greece-submits-reform-proposals-to-eurozone-creditors-with-a-warning

No, this is the first time they have said they might not pay. You forget that Varoufakis swore up and down that the IMF would be paid when another minister said Greece would run out of dough in March. He said something along the lines of that he’d get blood out of a stone if that was what it took . Varoufakis said he disputed whether Greece really owed all the ECB debt that matures in July-August. That is not part of the bailout discussion, that’s the negotiation that’s up next if they get through this one.

Moreover, this statement does not come from Varoufakis or Tsipras. There have been repeated instances when ministers other than Varoufakis or Tsipras have spoken out of school, and their remarks have been walked back. So it is not even clear that that minister is authorized to take that position.

You have propensity to make things up. It’s getting tiresome.

“Prime minister Alexis Tsipras is standing firm too, insisting over the weekend that his government would not accept any “recessionary measures”, such as slashing wages or making it easier to fire workers.”

http://www.theguardian.com/business/live/2015/mar/30/eurozone-greece-battles-to-unlock-bailout-funds-business-live

Yves Smith: It was also unambiguous as to process, Greece would have to get its reforms approved by the Troika and then by the Eurogroup, in order to get any money released. Greece has wasted a month fighting both issues,

——-

It’s has also been unambiguous that SYRIZA could not and would not abandon its anti-austerity position. So it’s not clear what you think SYRIZA could have gained by submitting detailed but unacceptable proposals earlier.

Honestly, I don’t know what Kool Aid you are drinking.

Syriza abandoned its anti austerity position in February, before its signed the memorandum with the Eurogroup. Varoufakis has firmly committed Greece to austerity, in the form of a fiscal surplus of 1-1.5%. He has dug that hole even deeper by saying later that Greece would alway run fiscal surpluses.

Syriza already threw in the towel but you are transfixed by their PR.

Yves Smith: Varoufakis has firmly committed Greece to austerity, in the form of a fiscal surplus of 1-1.5%

“Austerity” involves MUCH more than just running surpluses.

No, in ANY economy, running a meaningful surplus will produce a recession. Go look at the US. The track record is perfect on that front.

The only sort of exception is a country where one level of government is in surplus but it is more than offset by others running deficits. Australia has the Federal government running surpluses, but all of its states run large deficits.

In an economy that is already depressed, merely having a balanced budget would be contractionary. Bill Mitchell says that Greece needs to run deficits of 10% of GDP to get the economy back to growth.

A fiscal surplus of 1.0 to 1.5% IS austerity for Greece. You putting your fingers in your ears and yelling “Nah nah nah” does nothing to change facts.

I’m not sure of the level of transfers in the EU programs towards Greece, but it should be big (I can’t find precise data. See for instance this paper, with a graph from 2008. Greece is not charted, but it should be more than 1.5%). This is another part of the reason why the Juncker proposal makes sense: Greece is not able to take more money from some programs because the economy is too weak, so changing rules so that Greece can spend money reserved in different programs makes a lot of sense. I guess the 1.5% limit takes into account the “built-in” fiscal transfer of the different EU programs (Agricultural, Structural, R&D) that Greece is already receiving.

Yves Smith: Syriza already threw in the towel

If they had “thrown in the towel”, why didn’t they just submit a list of acceptable reforms and get their money already? Obviously, they are still resisting austerity. They may give up at some point– I don’t dispute that– but that has not happened yet.

They might even give up a bit until June 30th, which is the date that the MoU of the last bailout ends, which implies some “conditionalities” disappear. “The institutions” will surely like a nice Vogon stamp of “successfully bailed out” in their Greek dossier, and Syriza gets the money to survive the credit crunch until then.

This would leave the match going on until a nice date for defaulting: July 20th

Having hissy fits and refusing to comply when you have no intention of taking the course of action consistent with a real revolt is incompetence. This is a government full of people with absolutely no experience in governing. They routinely shoot from the hip, contradict each other in public, and can’t even estimate what their fiscal position is.

BTW Greece has capitulated. Reuters reports tonight that Tsipras walked back some obstreperous words from his foreign minister, and more important, the deal the government insisted it would not do, the privatization of the Piraeus port, is back on. And he’s reiterated that he’s sticking with his creditor overlords:

“My view has always been the same: a break from corruption, a solution with Europe.”

http://www.reuters.com/article/2015/03/28/eurozone-greece-tsipras-idUSL6N0WU0HL20150328

Tsipras said early on that they were going to review the Piraeus port deal in terms of whether it would benefit the Greek people. It wouldn’t be hard to believe that they are finding China easier to deal with than the EU.

Considering what we have passing for ‘governance’ these days I would prefer inexperience to the smooth talking status quo. I don’t see anything wrong with a healthy debate when they are facing complex issues.

“Greece has also not given up on its aim to renegotiate its debt to render it manageable, its deputy finance minister said.

“The solutions are known – either there will be a haircut or it will be extended, or (repayment) will be linked to an increase in output or exports, or there will be lower interest rates,” Deputy Finance Minister Dimitris Mardas told financial daily Naftemporiki. (emphasis added)

—————

http://uk.reuters.com/article/2015/03/30/eurozone-greece-debt-idUKL6N0WW12420150330

BTW, if Greece had actually capitulated (not merely moderated, compromised, delayed, partially backtracked etc.), the game would be over and we wouldn’t be seeing stories like this:

“Greek Economic Reform Proposals Don’t Make The Grade: Grexident Edges Closer”

http://www.forbes.com/sites/timworstall/2015/03/29/greek-economic-reform-proposals-dont-make-the-grade-grexident-edges-closer/

Yves Smith: …you are transfixed by their PR.

—————-

I judge on actions, not words. For example Syriza agreed to not take unilateral actions that would affect the budget etc. (words), but they went ahead and approved the humanitarian bill in violation of that agreement (action) . Syriza agreed to submit detailed reform proposals in line with previous agreed to structural adjustments (words) , but they dragged their feet doing that (action).

The fact remains that –by actions– Syriza has not –yet– capitulated to Troika demands. If Syriza had indeed “thrown in the towel”, then default/ Grexit would not still be looming. It is.

Sorry, Greece has been flailing around and they conceded they were implementing austerity from the very outset. The row about “the institutions” was all optics over substance. They have no Plan B and everyone knows it.

A pathetic 200 million euro poke in the eye, after Syriza’s poll ratings have fallen 20 points, does not change the macroeconomic impact, which is that Syriza has agreed to. The creditors will continue to break Greece on their rack. Greece will be allowed to rearrange some of the policies to gore the rich, if they can find them, a bit more than the poor. And see my comment above. They have capitulated. The Piraeus deal is on.

Marco Polo, this strategy here, that strategy there you say ?

What strategy ? Whose strategy ?

Plans ? Really ?

There are no plans, no strategies to speak of, neither from (1) Greece nor (2) its Europeans ‘partners’.

Both sides just react on the fly off the seats of their pants. No chain of command anywhere in sight while money keeps flowing out of Greece in unstoppable tsunami waves.

(1) Greece only has lots of confronting internal interests and lots of wishfull thinking.

Greece never ”planned” any strategy as such, so don’t try to figure it out.

(2) Europe has plenty of troubles (you know that) with PIIGS waiting in line, guaranteed deflation, Ukraine, etc., and no leadership to speak of.

So it’s two separate solar systems with lots of planets revolving around each sun… with us all trying to allign them straight. Mission impossible. The suns will clash and planets will crash, moons included.

Here’s what Varoufakis said about a year ago on a confrontation between Berlin and Athens:

I’m not knowledgeable enough about the banking system to know if this argument still holds or for that matter ever held any water. Varoufakis did think that the Greek government would have access to enough funds to continue for several months which apparently was not the case.

When it was reported earlier this week that ‘the European Central Bank has instructed Greece’s biggest banks to refrain from increasing their exposure to Greek government debt,’ one assumes Greek banks HAVE BEEN HOLDING Greek government debt for a while now.

His first point needs to be looked at again

See Jim Haygood above. The Greek banks are already insolvent. The ECB is in fact massively bending its rules to use the ELA, which is meant only to provide temporary liquidity support to solvent banks, as a long-term bailout mechanism for an insolvent banking system.

Who measures insolvency, how and when? By reasonable criteria I’m betting that a substantial portion of Spanish banks are insolvent. They hold massive amounts of houses valued at loan price, and not at market prices, or, after evictions, already at market prices, but they pretend that the original mortgage holder still owes them the difference. This, by the way, is the reason why in Spain we still don’t have a personal bankrupcy, or “second opportunity” law. They fear that too many people would give up on their underwater mortgages and the banks would have to stop pretending that they are solvent and put into the books similar levels of insolvency to the ones in Greece…

http://www.reuters.com/article/2015/03/27/us-eurozone-greece-exit-analysis-idUSKBN0MN1WO20150327?

Apparently the end is near – Reuters is debating the possibility of IOU’s…… in earnest.

Interesting, the link you put says:

This for me is the missing piece: They (the author is a good source for the Commission) consider the possibility of using the EFSF remaining funds to recapitalise the banks.

It describes very precisely what Greece is doing right now.

Sovereign v. private. If sovereign banking ever became established, the private banking empire would begin to die. Only by creating hardship does private banking maintain control. There are no reasons on earth for sovereign countries (that would be all countries with a constitution and a pulse) to use private bankers for public purposes. Is the EU a group of mentally incapable private banksters on a foolish power trip or is it an association of sovereign (or once sovereign) nations? How foolish can you be: a European Monetary Union of privateers. Whatever. This is just a tiny taste of the idiocy that will ensue if we pass the TPP.

Mmmm. And this makes Greenspan’s letter and Stanley Fischers “world history crash course” even more egregious. Let’s all pretend that the United States is sovereign while we steal it blind. Americans are so dumb they’ll never know the difference.

In an opinion piece written by Stathis Kouvelakis, who teaches political theory at King’s College London and serves on the central committee of Syriza, he indicates Syriza is considering a referendum for an exit from the Euro.

Satyajit Das also puts the dilemma squarely back to the EU: (and he definitely does not see the fallout as being limited to Greece)

http://www.economonitor.com/blog/2015/03/my-big-fat-greek-crisis/

There are now no more good options left for Greece. Whatever the outcome, the unwillingness of Europe to face reality means that problems will fester, dooming the continent to prolonged stagnation or worse.

Syriza’s problem in attempting to negotiate with the Troika is that Syriza has only a limited mandate from the voters of Greece.

The mandate given to Syriza by the Greek voters was to get relief from the austerity imposed by the Troika , and stop the fire sale of Greek assets, while remaining in the EU and retaining the Euro. Syriza has remained true to their mandate, seeking relief from austerity. Tsipras and Varoufakis have not tried to lead Greece out of the EU or out of the Euro, although the prospects of Grexit have been mooted about by politicians and commentators.

The Troika and Germany have sternly rebuffed Syriza’s requests for austerity rules relief, demanding that Greece re-commit firmly to austerity and continuing to take more loans from the Troika to meet loan payments as they come due. This practice is called “extend and pretend”, since it allows Greece to roll over its debts to new due dates while increasing its debt load, and allows debtor and creditors to pretend that the debts will eventually be repaid. The logical disconnect between reality and “extend and pretend” is obvious, so why do the Troika and Germany continue to insist on continuing it?

Germany and the Troika, and the political parties now forming the governments of Spain and Portugal, fear that any loosening of the Greek austerity rules would: (1) encourage similar demands from the rest of the PIIGS countries; (2) encourage anti-Euro political movements; and (3) raise doubts about the eventual payment of the debts of the PIIGS countries, thus weakening the Euro. Worse for Germany’s politicians, the idea that Greece would receive some easing of their debt burdens is seen by the voters of Germany as meaning that they would have to provide more money to help Greece while the Greeks laze about in the Mediterranean sun.

Hypocritically, the EU has allowed France and Italy to exceed the deficit limits imposed upon them as part of their austerity programs, while insisting that the Greek austerity program cannot be eased.

Greek banks have been coping with a run of withdrawals only because the emergency liquidity mechanism of the ECB has been available, and Greece’s limit has been raised repeatedly. The ECB refuses to include Greece in its QE sovereign bond buying program, and now says that it will not provide funding to Greek banks on the pledging of Greek sovereign bonds held by those banks. Thus Syriza is being squeezed ever harder by the Troika to continue austerity and extend and pretend. Syriza at least pretends to be trying to satisfy the demands of the Troika by supplying lists of “reforms”.

So what is Syriza’s game? Pundits say that Syriza has folded completely to the Troika and is facing complete defeat. But there is another possibility – that Syriza is playing along with the Troika while demonstrating to the people of Greece that there is no way out of austerity and the economic and social misery imposed upon Greece except by ditching the Euro and repudiating its debts. Hence Tsipras’ statement that Syriza intends to go to the Greek voters for a referendum. Syriza is increasingly in a position to tell the voters of Greece that they must choose between: (a) complete surrender to the Troika and debt slavery while retaining the Euro and remaining in the EU but continuing to live in misery; and (b) leave the Euro, repudiate the debts, and achieve freedom from debt slavery.

Option (b) would likely see banks failures and financial chaos, at least in the short term, but can be sold as the Iceland solution , i.e. short-term pain for long-term gain and democratic sovereignty.

If Syriza obtains a mandate from the voters of Greece to leave the Euro and repudiate its debts, Syriza then has the “nuclear grenade” with which to threaten the Troika.

First, the polls have now shifted, without government messaging, to majority support for Greece having its own currency.

Second, you seem to think the job of political leaders is to follow the herd. The government never tried moving public opinion. I can point to numerous cases in different countries where the government was able to move public opinion in a short period of time. An incumbent government has tremendous access to media.

Syriza has decided to allow the sale of the Piraeus Port to China to go through within the next few weeks. Hopefully this would ease the liquidity problem and give Syriza a little more breathing space in negotiations.

http://economictimes.indiatimes.com/news/international/business/in-u-turn-greece-will-sell-piraeus-port-stake-in-weeks-xinhua/articleshow/46726475.cms

Does anyone on this thread really believe the asertion from eu members that there would be no impact to them via Greek exit? Wouldn’t their leave precipitate balance sheet issues for the remaining members and push the ECB to unprecedented liquidity injections to save the Euro?

A lot of people, including Mr. Market, believe it. Periphery bond spreads haven’t budged. And a cheaper Euro is a godsend for the Eurozone.

Mr. Market as we used to know it is DEAD and buried long ago.

So Mr. Corpse can’t ‘believe’ or do anything.

Permanent market interventions and competitive devaluations may buy time (extend and pretend) but necessarily also buy SIZE.

True enough, periphery bonds spreads haven’t budged (yet) as Wall Street talking heads make a nice living pushing the bubble machine.

http://www.zerohedge.com/news/2015-03-28/bubble-machine-complete-soaring-stocks-push-investors-bonds-whose-issuers-buy-more-s

So far, a cheaper euro is a godsend for the EZ… until the Fed says enough is enough guys and another tsunami of US QE floods the world while Super Mario convinces the Germans into increasing his own even further. So, if currency wars is the strategy, just stop thinking and run for the lifeboats guys.

Meanwhile, the Fed Chairmwoman lets us know that “cash is not a store of value”

http://www.zerohedge.com/news/2015-03-28/bubble-machine-complete-soaring-stocks-push-investors-bonds-whose-issuers-buy-more-s

Mr. G., your comment makes a lot of sense, we are on the same page.

Spain, Italy, Slovenia, Portugal, etc., AND France are next in line.

CDSs are the canary in the coal mine.

The $ 100 Trillion Euro bond derivatives market just smiles while munching away his morning bananas.

It seems strange that the ECB plan of buying European government bonds, including the periphery, was announced at almost the exact time that it was becoming obvious that Syriza had a good chance of winning the election. Or am I being too cynical?

I think Mr Market thinks that the Greek debt bubble will be deflated slowly and not via default. After a default and grexit I think the markets would bite again Spain, Portugal and Italy, specially as the “pretend” in “extend and pretend” keeps vanishing.

IMO all will be well if a solution to the Greek problem is found, which it looks increasingly so, and more expansionary policies are followed in the South. If the “strict” austerians impose themselves, the Euro is doomed. And I think the markets think the same, and they will start moving as soon as it becomes clear that austerity will start again, and not be faked, as it has been happening in most of the South during the last year or so. Greece is the only place, due to the MoU, where austerity continued until ND fell.

So is Mr. Market saying: “Monday’s compromise is just to buy time for the bigger solution. No worries…..for now.” If so…what is that solution? Eurobonds, exit terms for all members, debt write downs for all and balance sheets reset to 0?

Your statement of the conditions and their implications in terms of Grexit are convincing. But that still leaves us with no viable explanation for what Greece is doing.

I see no reason to believe that the Greek government’s behavior so far has been a series of missteps. The actions of the government seem quite consistent to me, suggesting that there is a plan, or at least a set of firm principles.

Here’s what I see as the logic of the Greek approach:

Greece is bankrupt. Period. There is no pot of gold at the end of the current arrangement, whether or not Greece reaches an agreement with the Troika. I believe the Greek government accepts this fact and it is the primary driver of their behavior. Restructuring/write-down of the debt is a mandatory outcome, if not immediately through agreement with the troika, then through other means.

Exiting the Euro does not offer the same hope that it would have before the bailout, and there is no mandate from the Greek people to exit. It seems quite possible that an exit from the Euro would be worse than default within the Euro. Lacking a mandate to leave the Euro, and with no clear indication that the position of Greece would improve, it is a non-starter with the leadership of SYRIZA.

So what options does Greece have? As you have frequently pointed out – very few. The Troika does indeed have the whip hand in economic terms, and there is little Greece can do to change that situation within the rules of the game. If they want an agreement, they have no choice but to accede to the wishes of the Troika.

At the same time, it should be quite clear to all that austerity has been a colossal failure. And, indeed, the growth of anti-austerity parties outside Northern Europe offers hope that the political winds are shifting. As you have pointed out, though, any political changes aren’t going to happen quickly enough to help Greece with the current negotiations, and there has been precious little overt support for Greece from quarters where we could have expected a show of solidarity.

Nevertheless, Greece has been walking the austerity path, knows precisely where it leads, and absolutely refuses to continue that journey. That precludes any agreement with the Troika that does not substantially change the conditions in Greece.

I believe the two conditions which must be met for the leadership of SYRIZA are restructuring/write-down of debt and substantial change to the austerity regime. Neither of those conditions appears to be on offer. So what is to be done?

Nothing.

SYRIZA has continued to offer precious little in the way of a continued austerity regime, it is clear that it has no intention of leaving the Euro, and it continues to make clear that the current debt is unsustainable.

That can be seen as a failure to govern, but I disagree. That is, in fact, precisely what a democratically elected government should be doing. It is precisely what the Greek people voted for – austerity has to stop and no exit from the Euro.

Behaving as they have has made the possibility of accidental Grexit (a misnomer, as you have pointed out) or default within the Euro likely. But that outcome is clearly preferable to SYRIZA, and to the people of Greece, if the alternative is continued impoverishment and debt servitude to the Troika. It also constitutes the rough equivalent of a threat to leave the Euro in terms of its impact on the negotiations with the Troika, and in that sense, restores at least a bit of political power to the Greek side.

SYRIZA is definitely not playing the game in a way that will likely result in an agreement, but that does not mean that their approach is either irrational or ill-considered.

Thanks Reede. Well said, and correct. Greece is broke, bankrupt, and has been for 6 years. Every Greek knows that.

I’d add: one simple, all-important thing SYRIZA is doing is conducting negotiations as far as possible in the open. This has not pleased the Europeans but it has brought 80% of the population on board. For Greeks these negotiations are life & death, for the Europeans a disciplinarian issue. SYRIZA has not needed to proselytize since the attitude / actions of the Europeans are doing their work for them.

Meanwhile parliamentary work is well underway: the debt audit has started, humanitarian relief voted in by all parties, house seizures stopped, corruption prosecutions underway, reparations prioritised, tax reform is being formulated…

For the first time in years, the atmosphere is calm here, even cheerful, despite the hullabaloo from outside.

That’s an excellent point about conducting negotiations in the open. In addition to bringing the population on board, doing so has kept the issue primarily political, rather than technical, as the Europeans would prefer.

Long term, this is a political battle that the troika cannot win. The longer the struggle remains political, the greater the chances of significant change for all of Europe.

@Reede Stockton and Tsigantes

Yes, I think this may be the strategy – it is necessarily rather open-ended, because one cannot predict in advance the precise moves of the other side (although I suspect that possible moves were played through in advance, given YV’s academic specialization).

As Tsigantes noted, there is no need to persuade the Greek people of the impossibility of the situation, since the Troika (Institutions) are doing that for them. The government needed to conduct negotiations in the open for this to happen; although it is a highly-irregular procedure, it’s effective in that it has permitted the Greeks a look inside EU/EMU corridors of power.

And as Tsigantes also noted, a lot of legislation is being passed, some of which is short-term (house seizures stopped, humanitarian aid voted), some longer-term (debt audit, reparations). The real – and symbolic – meaning of this legislation is not lost on the Greek public.

Finally, as I’ve noted on other threads, it’s unclear to me who the Troika (Institutions) imagine they would be negotiating with in lieu of this government. Another thing not obvious outside Greece is that Syriza neutralized any other viable governing party in the run-up to and immediately following elections. The Greeks have decided to go it alone, and to go it with Syriza, come what may. Although this may not seem important to others, it suggests the population will remain cohesive in the face of the worst possible outcome (disorderly Grexit).

In other news: the Greek ForMin just returned from China in preparation for the PM’s visit in May. On Tuesday, a former FinMin was convicted of tampering with the Lagarde List. And a record tourist season is foreseen both by the GNTO and by foreign tour operators.

Greece is in no position to play a long term game. Financial time moves faster than political time.

Of course you’re right, financial time and political time are different measures. One thing I’m beginning to wonder about is whether a rift might be (being?) created between financial Germany (EMU) and political Germany (EU) – this is a question in my own mind, and if anyone were to ask me to offer concrete evidence, the only thing I could cite would be the fact that the German Chancellor and Greek PM spent seven hours over dinner on Monday last.

Fascinating but very stressful times for those of us following here.

Greece has no choice but to play a long term game. It is the only way their issues can be addressed.

That does not imply that they should not try to do whatever is possible to ameliorate the situation in the shorter term.

Exactly. The art of course is to play the long game, the game of diplomacy and statecraft, under the crushing short-term pressure Yves notes of “financial time”. Something I’d noted just after the election on this (or another?) site was that the one thing the Greek left does know how to play is the long game. They’ve had 70 years to analyze what happened at Varkiza, and I want to believe they’ve learned from this. Only time will tell.

It seems to me like the Greek leadership is backing themselves into a corner. My guess is that this is intentional. They don’t feel like they have a mandate to leave the Eurozone, so they put themselves into a situation where the EU gets to decide if Greece defaults or they give Greece more funds.

The absence of capital controls are really the best example of this. Capital controls would stop depositors from getting their money. This money could then be spent trying to pay back creditors of the Greeks. Letting the Greek people empty their accounts just means that there are less assets available if/when a default occurs; increasing the size of any haircut.

No, if Greeks empty their accounts, they have either euros under the mattress or in non-Greek banks. They still have the money. There will not be any haircuts. There may be economic reductions in the value of the debt, via extending maturities further. The economic value of Greek debt to GDP, as a result of past extensions in maturities and interest rate cuts, is only about 70% of GDP, not the nominal 170%. Hence the Bundesbank is saying Greece does not need any more debt relief.

In the event that Greece defaulted and the ECB pulled the ELA, forcing Greece to resort to drachma, the people who had pulled money out of the banks and held euros would be way better off than the ones that kept their money in, since bank deposits in Greek banks would be converted to drachma.

Sorry, I think that was the point that I was trying to make. Maybe I didn’t phrase it clearly, or maybe I misunderstand your response. But I think we’re in agreement. Not implementing capital controls is good for the average Greek person because they can get their money out and have it in euros in the event of a crisis, but bad for bondholders because there will be less assets to pay them back in the event of any defaults. If a crisis occurs, there won’t be a middle ground because the capital will have already fled.

The other thing I don’t see discussed much, but seems a very real possibility, is that Greece exits to the Ruble. This would require cooperation from the Russian central bank, but it provides a potentially less jarring option than default back to Drachma. Certainly Russia would welcome the influx of hard currency in exchange for some seed Rubles, and it would further their aim of portraying the Russian Federation as an alternative to the EU. Thoughts?

Why abandon one sub-optimal currency union for another?

I think a more likely option is that Greece defaults and Russia or the BRICs bank provides some sort of bridge financing. But if you’re gonna go through the pain of dropping the Euro, you might as well can back on a floating currency which is probably ideal for Greece in the long run.