By Rob Parenteau, CFA, sole proprietor of MacroStrategy Edge and a research associate of The Levy Economics Institute

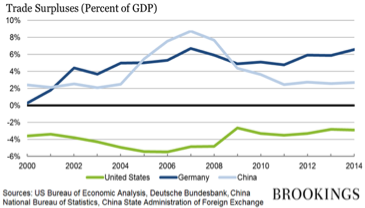

That Germany has pursued something of a neo-mercantilist growth strategy is no great secret. Even newly minted econoblogger Ben Bernanke (apparently, Fed Chair pensions are not what they used to be) has duly noted Germany’s ascension to the throne of the Chief Instigator of Global Imbalances (CIGI) in his post dated April 3, 2015 (see here). At 7% of GDP, Germany’s trade surplus has clearly unseated China’s prior well-vaunted position as CIGI. Clearly, Frankfurt, not Shanghai, has become the new capital city of Global Saving Glutistan, in the nation of West Secular Stagnationa.

To his credit, and also as a shining example to his fellow New Keynesians (who, as we detailed in our previous piece on Paul Krugman – see here – are not really Keynesians at all, but rather Old Pre-Great Depression Fisherians, or possibly New Friedmaniacs and Wacky Wicksellians), Gentle Ben revives the simple yet powerful point that Lord Keynes attempted to make a lifetime ago, and was enshrined in a somewhat diluted fashion in the enabling legislation of the IMF (see, especially, the notorious scarce currency clause), but was largely ignored or betrayed by the American negotiating team as they were determined to cement into place America’s prospective post WWII status as the Imperial Creditor du jour. Keynes was too hopped up on truth serum (an unintended side effect of his heart medicine, according to one recent account) to completely outfox his opponent, the communist spy William Dexter White, who was leading the American delegation at Bretton Woods, but Keynes’ line of march was clear. In the case of chronic current account imbalances, the burden of adjustment must necessarily be placed on the current account surplus nation, if a pro-growth solution, rather than a deflationary “solution”, was the preferred outcome.

Germany’s status as the penultimate chronic current account surplus nation within the Eurozone has also been duly noted as an indication of one of the central design flaws in the EMU. There is no explicit policy mechanism, nor does there appear to be any spontaneous market driven Invisible Hand, that channels the money earned from a chronic current account surplus back into productive and profitable investments that can enhance the capital stock and the competitiveness of tradable goods industries in the chronic current account deficit nations. None.

Instead, in the case of the Eurozone, current account surpluses got recycled in the financing of housing bubbles and household deficit spending in many peripheral nations, with the predictable sudden stop issue rearing its horrifying head once the Global Financial Crisis went full tilt in 2007/8. And so it is nearly inevitable that the chronic current account deficit nations will eventually default on their external liabilities that build up over time with these persistent trade imbalances, often taking the core financial institutions in the Eurozone down with them – unless of course these costs can be externalized and socialized, by sending the bill to taxpayers, as we witnessed circa 2010 in the Eurozone. The lenders, in other words, are equally culpable, in playing a financing game that they must know, on the basic math of it, could only end very badly, as the loans they were making were not, generally speaking, improving the capacity of trade deficit nations to earn the income required to service this external private debt.

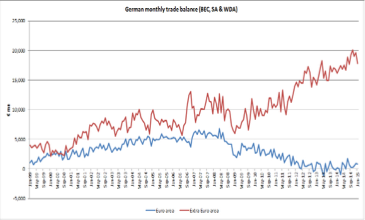

Now as compelling as the logic of this criticism of the EMU may be, and as welcome as it is to hear a New Keynesian like Ben Bernanke actually echoing an idea that Keynes actually professed and pursued in real world policy proposals, there is a little problem with this story. As Raoul Ruparel pointed out in a subsequent blog (see here), Germany’s magnificent and oh so virtuous trade surplus has gone to hell with the Eurozone as Austerian policies have cratered final demand in the periphery, while Germany’s trade surplus with countries outside the Eurozone has surged since the GFC.

While the first result was anticipated by those of us who were warning in 2010 about the self-inflicted wounds the core would end up imposing on their own tradable goods sectors, as well as on their own financial institutions (see in particular points 9 & 10 sketched out in somewhat prophetic fashion herein), the second accomplishment clearly was not widely anticipated. In addition, recognition of the shifting composition of Germany’s trade surplus may also hint at some of the reasons why German policy makers may not be terribly interested in Ponzi financing the external liabilities of peripheral Eurozone governments much longer. After all, the periphery no longer appears to be where the main customers of their tradable goods companies dwell any longer. It is, in other words, not inconceivable there may be a Germexident before there is a Grexident, as Germany has less to lose with respect to its neo-mercantilist growth strategy now if the peripheral economies are left to fend for themselves in servicing their existing external debt loads. Recall also, as depicted in a recent piece called Draghi’s Doom Loops (see here), that the profitability of Germany’s banks and insurance company is also being undermined by the ECB’s PSPP initiative.

For the time being, however, the result of the rabid pursuit Austerian policies has essentially made somewhat obsolete the hand-wringing over the Eurozone current account recycling mechanism design flaw that can be found in places like Yanis Varoufakis’ masterful treatise, The Global Minotaur. We will simply have to wait with bated breath for the second edition to be scribbled and released once the Troika has insured the current Greek Finance Minister will have much more free time on his hands.

This brings us to what we can and should recognize as Herr Schäuble’s Foibles. For you cannot possibly ask a country that has pursued a neo-mercantilist growth strategy to just drop it. You especially cannot expect a warm, favorable response from said country when key policy authorities and their key economic advisors, believe the whole world can (and should) follow in its virtuous footsteps by also running trade surpluses – a bold challenge to the rest of the world which unfortunately ignores the small algebraic fact that global trade balances have to net to zero. At least, that is, until we open up trade with Martians and Venusians.

You especially cannot expect to get anywhere by asking a neo-mercantilist nation to just drop it and take steps to deliver a trade deficit, if the policy makers of that nation also believe it is equally virtuous to maintain a fiscal balance near zero. Simply put, if you take away their trade surplus as a driver of growth, that means they can only get growth if their domestic household or business sectors are willing and able to deficit spend in perpetuity.

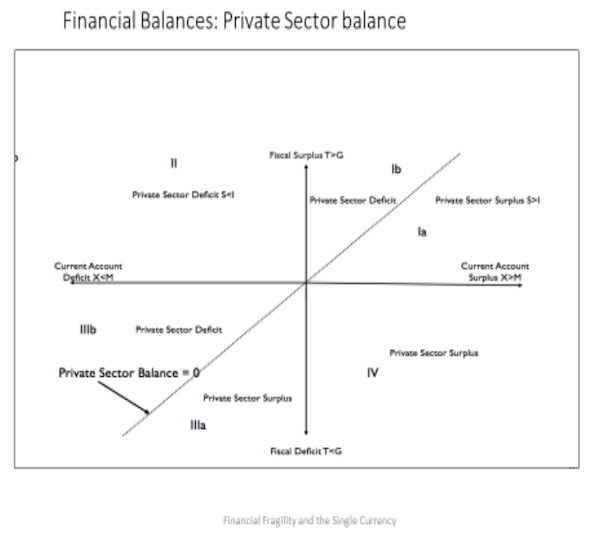

This surprising conclusion follows from the macrofinancial balance (MFB) equation, which simply says the income and expenditures of the Government, Foreign, and Domestic Private Sectors must net to zero in any accounting period – a result of double entry book keeping, not of high Keynesian theory.

Domestic Private Financial Balance + Government Financial Balance – Current Account Balance = 0

or

DPSFB + GFB – CUB = 0

An elementary derivation and application of the MFB equation can be found in Jan Kregel’s recent piece at the Levy Economic Institute entitled Europe at the Crossroads (see here). In particular, this point is made very clear on p. 7, chart 5, reproduced below. In the MFB map, fiscal balances appear on the vertical axis, while current account (largely trade) balances appear on the horizontal axis. The 45-degree line running from the southwest to the northeast depicts all those points on the MFB map where the DPSFB is zero (meaning households and nonfinancial businesses are spending exactly the amount they are earning), and CUB is equal to the GFB. The region to the right of this 45-degree line depicts zones where the domestic private sector is running a surplus or net saving position on its financial balances, while the zone to the left depicts zones where households and firms are deficit spending.

Jan has further classified the zones of the MFB map to clarify the state of the DPSFB under various possible combinations of the GFB and the CUB.

Assuming the diktat of fiscal responsibility means that no persistent deviation from a GFB = 0 is allowed, and assuming a chronic current account surplus nation is required, under some plausible global rebalancing criteria, to run a deficit, the DPSFB can only inhabit points along the horizontal axis that are to the left of the origin or intersection of the GFB and CUB axes. Note that all points on this section of the CUB axis, as well as all points close to it in sectors II and IIIb, are areas where households and firms are chronically deficit spending.

Or to put it another way, because the CUB is less than the GFB, more net income is flowing out of the DPS. And of course, the larger the current account deficit that is targeted for a former CIGI, the deeper the resulting deficit spending by domestic firms and households, and the larger the build up, over time, of debt to income ratios (specifically, in this case, external liabilities) in the DPS. A demand for trade deficits placed on a CIGI nation like Germany that also wishes to pursue the virtues of fiscal responsibility, is implicitly a demand that, for example, Herr Schäuble be prepared to guide German households and firms onto a trajectory of increasing financial fragility, and inevitably, a severe and possibly debilitating financial crisis. This is not really a very reasonable demand at all.

Ignoring, for the moment, that slight stumbling block, there are other practical difficulties with the proposal that Germany rebalance its trade/current account. German companies, like most of the rest of the Western world, are not so interested in reinvesting profits in capital spending, at least not in Germany itself. The incentives to extract profits by driving productivity gains well in excess of real wage gains (a blatant violation of the marginalist law of distribution that sits at the heart of neoclassical economics, and is also trumpeted as another justification for the virtues of free exchange in capitalist economies), and to then redistribute those profits to shareholders and managers who own stock and stock options, all ostensibly in the service of maximizing shareholder value, are just too strong. Maximizing free cash flow is the corollary to maximizing shareholder value, and this the same thing as minimizing the reinvestment of profits in productive capital equipment and structures, hence minimizing long term economic growth prospects. So unless incentive structures associated with corporate governance and institutional investor behavior change, Germany’s GDP growth is unlikely to be fueled by corporate investment in excess of profit incomes.

Germany’s households are notoriously conservative and prudent, so they tend to maintain a high and steady gross saving rate of between 10% and 12% of income. In addition, they tend to rent rather than own their homes, so they usually do not get caught up in real estate bubbles (though a housing bubble appears to be starting to brew in Germany of late, and this has been a repeated fear of the Bundesbank) and the household deficit spending associated with those bubbles. In addition, as mentioned above, Germany’s neo-mercantilist growth strategy has required real wage suppression, which tends to hold back the growth of household purchasing power. With real wages growing more slowly than productivity (which is also growing more slowly, closer to 1% vs. the 2.5-3.8% achieved over the half-decades from 1970-1995, because of low corporate reinvestment rates – so perhaps you can now see how this all is nested and cumulates in an increasingly disequilibrium fashion over time), households cannot possibly buy all that they produce without net selling assets to another sector, or increasing their debt loads.

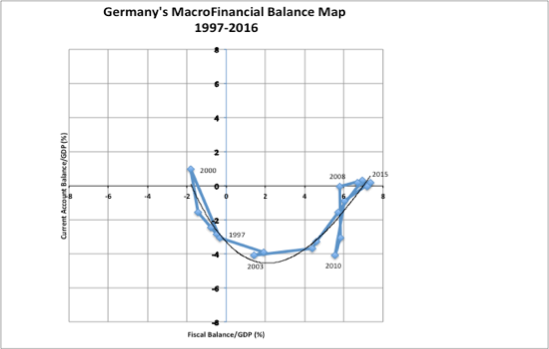

In other words, Germany’s households and firms are unlikely to be terribly interested in chronic deficit spending – a deficit spending that must be sustained if the GFB is to be kept close to zero, and the CUB is to be kept in deficit. A quick glance at the actual migration of the DPSFB over the past nearly two decades reveals that in fact, the German private sector has sought and achieved increases in its net saving position, from a low in 2000 with a DPSFB/GDP of -2.8%, to a peak of 9.6% in 2010. Germany’s private sector net saving position is closer 7% of GDP in the last few years, which must mark one of the highest, if not the highest DPS surplus amongst the mature economies.

Even if you were able to convince some German companies to reinvest their export earnings in productive capital equipment in their trading partners in the Eurozone periphery, as Keynes would have recommended for any sustainable current account rebalancing mechanism, these companies would likely be accused of undermining Germany’s trade driven growth strategy, as German imports would increase, or companies based in Germany competing in those tradable goods sectors would face margin squeezes as the tried to maintain market share in the face of more competitive foreign producers.

So as beautiful as Keynes’ ideas about rebalancing trade may be, with the onus being placed on the chronic current account surplus nations, it is hard to see how you could convince Germany to take the bait. At a minimum, they would have to implement policy measures that encouraged or forced domestic non financial firms to reinvest their profits in their home country, so these companies would actually be serving the accumulation function that capitalist firms are supposed to perform to generate the benefits of rapid growth and development. The promise of rapid growth through profit seeking and profitable reinvestment activity was, after all, supposed to be the reward for putting up with capitalism’s various shortcomings, including routinization and speedup of work, frequently externalized costs, widespread corrosion of social organizations and “social capital” outside the capitalist firm, as well as the destruction of the biosphere – a consumption or degradation of “natural capital” which has become all too obvious in recent years with climate disruption and the acidification of the oceans.

To conclude, if Herr Schäuble believes the whole world should follow the virtuous neo-mercantilist growth strategy that has served his homeland so well, he may want to consider the fact that he is facing a small adding up problem with that ambitious policy prescription, barring the discovery of life elsewhere in the solar system. While Germany’s massive trade surplus has become less of an issue since 2008 for the Eurozone – as a predictable but perhaps unintended consequence of the Austerian demands placed on the periphery – it has not become less of an issue for the world. Herr Schäuble still appears to be the Finance Minister of a nation that qualifies as a CIGI.

Well intentioned calls for Herr Schäuble to rethink and reverse his neo-mercantilist tendencies run into another unrecognized and unintended consequence, but one which can be made perfectly coherent by recognizing the constraints imposed by the simple algebra of the macrofinancial balance equation. If Herr Schäuble could somehow be persuaded to take on the vice of trade deficits while at the same time he insisted on maintaining the virtue of a balanced fiscal budget, he would unwittingly fall into the trap of consigning his nation’s firms and businesses to a path that ultimately must lead to financial instability, and possibly even a financial crisis, along the lines that Hy Minksy depicted decades ago. Alternatively, if he instead agreed to a current account surplus recycling mechanism of some sort, he would be inviting the eventual undermining of the competitiveness of his own tradable goods companies, as well as the eventual erosion of his highly valued and virtuous trade surplus – not a high odds bet, at all.

Herr Schäuble’s Foibles are many. But of course, these foibles are not merely his, as they belong to a deeply entrenched neoliberal consensus in the economic profession (if we dare call such a frightful circus by that name) which has, as more an more people appear to be recognizing, judging by the 700 or more people attending the Institute for New Economic Thinking’s confab in Paris this week, outlived its usefulness on this planet. Herr Schäuble cannot be expected to pursue the vice of a trade deficit if he is going to hold fast to the virtue of balanced fiscal budgets. Nor is he, or any other finance minister of a nation pursuing a neo-mercantilist growth strategy, likely to be terribly interested in recycling trade surpluses into tradable goods industries in chronic trade deficit nations, thereby financing his own competitors. Nein, nein, nein.

Crafting new solutions, like the Greek Finance Minister’s proposal that he reiterated during Thursday’s afternoon session at the INET conference (see here), to have the European Investment Bank play a much larger role in recycling these surpluses into infrastructure investing in the periphery, may indeed point in the direction of promising new design solutions for the Eurozone and beyond. But until we recognize the binds that neoliberal faith-based economics have tied our policy makers with, and until we jettison the neoliberal liturgy that is spewed daily in the mainstream media, in universities, in central banks, and in Treasury departments around the world, Schäuble’s Foibles will continue to rule the roost, and more unnecessary suffering will have to be endured by more nations. Perhaps it is time to admit we can do better than that – a lot better, in fact.

I have often wondered how beggar thy neighbour policies could work in the context of supply & demand. Sill I suppose when the race to the bottom is confined to the many, while the minority who are steering, charge in the opposite direction, only seeing the loot in front of them – Game on.

Such policies inevitably turn into “bugger thy neighbor.”

Noeclassical and Neoliberal economists both claim that markets create the highest marginal utility for everyone, but articles like this speak to how bankrupt that first postulate is. In the short term, there is a finite balance of resources, and absent government interference (in the form of deficit spending) a person must have their marginal utility on life decreased in order to finance the gains of another. Therefore, in the short term total marginal utility is conserved and poverty rears its head in direct proportion wealth. In the long term, the accumulation of wealth is often simply the sequestration of potentially productive resources from the working economy thus creating a net drag on growth and a decrease in total utility generated by the consumption of existing resources. A “free” economy can only generate highest marginal utility for everyone in the absence of resource constraints and at that point a competitive economy is a waste unto itself. If either claim I’m making is wrong please enlighten me as to how, this seems like an important thing to know.

Stephen: You point to a fatal flaw in the micro based maximization logic that dominates economic discussions and policy making these days. The point of the above work is, at its simplest, mainly to recognize that the spending and financing decisions made by individuals in one sector influence the choices and outcomes available to other sectors. Interdependence, not independence, is central. Everything is connected, not atomistic. The same holds with real resources. My choices about real resource consumption or real resource hoarding will influence the choices available to other people especially if I have the power/right to make those choices effective, or can impose more of my will on others than they can impose upon me by having prior legal or illegally enforced claims. So I agree with what I believe you are highlighting, and wish we could get this common sense message across to mainstream economists and policy makers influenced by these economists.

” in the absence of resource constraints ”

What resource constraints?

This is what I find perpetually disturbing about Keynesian analysis, however virtuous in other respects: it pretends that growth is an infinite good, that the world is flat and extends forever in all directions (Discworld economics.) The whole construct is a counterfactual.

Worse yet: it’s likely that Keynesian measures simply won’t work in the face of resource constraints, which have begun to bite very seriously. Instread, they blow bubbles. Futility is the strongest argument of all.

It’s asking a lot of Rob that he complicate his technical analysis, which is very convincing, with acknowledgment of deeper, darker dynamics. But the whole thing may be a destructive waste of effort if we don’t.

Admittedly, any attempt at a steady-state economics has to address distribution, the underlying issue here, or it will be little more than a recipe for profound poverty.

Oregoncharles: I am not convinced green growth is impossible. I remember running into these issues during the second oil price shock in the ’70s. I suspect there are more renewable energy replacements to the current technologies than we can even imagine, but the oligopoly positions of the rent extracting oil owners and producers keep us from their development and implementation. Imagine if we attempted a “Space Race” like that of the ’60s, but for renewable energy. Similarly, imagine if we used rainwater catchment and greywater reuse systems and maybe even composting toilets in most homes. Imagine if you turned your lawn or your rooftop into food forests. Imagine if the US developed public transport equal to that in the eurozone. And on and on. History suggests necessity is the mother of invention, and so we have a history of finding or creating replacements for scarce materials. Hitler’s autobahn was filled with Volkswagens running on ethanol purchased in neighborhood gas stations from potatoes grown on the outskirts of towns, because Hitler did not have the foreign exchange to be purchasing oil, and what oil was being purchased probably when straight into chemical production. So while the depletion and degradation of the biosphere under the myopic and rapacious calculus of capitalism has brought this species to the edge of the abyss, perhaps we can find a way to step back from the abyss, having seen where we are about to send our children and grandchildren. Though it will be a close call, indeed, and I do think the issue of environmental sustainability trumps most of these financial sustainability questions, and does not to constantly be put in front of us since we seem to prefer to deny the problem exists. I will promise, in atonement, to write a future post on the permaculture and parallel currency based solution I am working on in California to address the drought to show you how I believe growth can be reconciled with biosphere sustainability. Robert Pollin at PERI has also done excellent work in this regard. In many ways, a large part of what is required in the mature economies right now to lift us out of the secular stagnation trap is a full bore green infrastructure initiative, on the scale of say WWI or WWII expenditures, with a great emphasis on R&D, and a public/private initiatives, many at the community level to replenish the social capital that we have also managed to deplete in the last two or three generations.

OKay, there’s no shortage of analysis, is there ?

And it’s finally crystal clear to both friends and foes that the debt-deflation-liquidity TRAP is no small monster… Minotaurs anyone ?

It will wipe out creditors allright, but it will also destroy currencies together with it.

Literally, NO (valid) money around, understand ?

People worldwide will ask : ‘Where has all the money gone ?’

So,

Diagnosis = 99% progress

Therapy = ? ?? ???

Georgie: I am not as convinced as you that we are all doomed, especially creditors, and especially money users. See my proposal, for example, in the “Get a TAN, Yanis” piece which appears on this website. There is a follow up one as well. I am told by people who are in the know that this approach is under serious consideration in Athens. And when I shook his hand two days ago at the INET conference in Paris, and told him to get a TAN, a certain finance minister from that part of the world offered a knowing smile in return. We simply have to be prepared to be more creative and more courageous than we have in the past – there really is no other choice, at this point.

Robert,

So you are not even convinced of the debt-deflation-liquidity TRAP ??

So you’d be back-pedalling your own ‘Draghi’s Doom Loops’ conclusions then.

Hmmm…

I don’t see the TANs working out at this late stage of the game, way too complex, way too little, way too late.

* Worldwide derivatives exposure = $ 1.5 Quadrillion

* Worldwide GDP = $ 80 trillion (and deflating rapidly)

* Worldwide debt = $ 200 trillion (and rising rapidly)

* Worldwide UN-funded liabilities = $ 400 trillion (and rising like a rocketship to Pluto)

If the money does not move to Greece, Kosovo or Afghanistan or sub Saharan Africa the people of these areas will move to Germany which we see now and the profits created by exporting Mercedes and BMW’s to their native kleptocrats will be used to support their people. It looks like we have a solution underway now.

Love it Felix. But far too close to the truth.

Best,

Robert

Yes, I agree. Capitalist markets at their finest. No?

Yes Felix, close to the truth (sorta) but, sorry, I don’t love it.

Furthermore, I can’t understand why anyone would, including the author.

For far less than what you are describing many wars have started.

And massive immigration wouldn’t just be from far away lands: it’d be from Club Med countries, Eastern Europe,,,

In summary, the world’s financial system is coming apart at the seams.

(We already knew that, didn’t we ?)

Now then, besides ever-more precise descriptions of the problem at hand, which is the solution ?

WW3 ? Yes ? No ? Other ? Which other ? More of the same ? Forever ? Really ?

End fractional reserve banking and change the method the Federal Reserve adds money to the economy.

Wow !

Till the commentariat, the authors (and the editors) focus on Beene’s input and its knock-on consequences, we will just remain in ‘paralysis by analysis’ mode…analysis for analysis sake… just extending and pretending… being an ACTIVE part of the problem but NOT of the solution.

Beene and Georgie: I am 100% against 100% reserve money, or the gold standard, or any likeness thereof, and I promise to craft a future essay on why Positive Money is Positively Nonsense, as is the entire attempt to revive the Chicago Plan and its various likenesses. Credit creation for productive activity that earns a future social or monetary return is essential, I believe, to economic growth. The issue is how best to manage financial sustainability issues that brings along with it, because until recently, policy makers refused to address the pathologies of credit markets, even though economists like Hy Minsky and (post near personal bankruptcy after the Great Depression) Irving Fisher and others treated this subject explicitly. The MFB map above provides some valuable clues to how to to go about this, though it should be noted, for example, that even countries that manage to run large and prolonged current account surpluses, and so appear golden in external debt sustainability terms, are subject to disastrous episodes of financial instability. See the US going into the Great Depression, Japan circa 1989, and perhaps more recently, China (as well, I suspect, as Germany in the very near future, if I am correct about who is most exposed to Draghi’s Doom Loops, namely German finanzkapital).

Robert,

Your response is appreciated.

You are now officially on record…”… against the gold standard, or any likeness thereof…”…

I am eager to see how your Positive Non-Sense article handles further (!!) credit creation at this very late stage of the fiat money cycle. If it were decades ago I’d easily understand what you would be writing about, but not today under “current pathologies of existing credit markets” including (but not limited to) Draghi’s Dooms Loops and its impact upon the Eurozone (which you explained so well here last week) and German finanzkapital… with the Fed’s unsustainable balance sheet and NIRP looming above everybody’s head… and Japan’s three (broken) arrows as 21st. century top-notch financial technology.

Robert, I enjoyed your lapsus linguae regarding …”…appear golden…”…

You seem awfully impressed by zeroes on balance sheets. There is no unsustainable Fed balance sheet.

Who would end up eating the loss?

Those who created the loss not the government (tax payer).

Who created the loss?

Beene – agreed, but how does this address the foreign trade and Eurozone issues the article is about?

No Oregoncharles no, the article is not about “foreign trade and Eurozone issues”.

That’d be a very narrow reading.

The article is about lending, money, deficit spending, the Global Minotaur(sic), the severe financial crisis we are undergoing right NOW, leaving clearly on record that the only (theoretical) way out is to start trading with Martians and Venusians (I kid you not).

So Beene’s point is right on subject as the US dollar is the world’s reserve currency remember ? So if you are concerned about the Euro and Eurozone issues you better not dare to dig into the dozens and dozens of Trillions of US dollars sloshing around the world with 0 (zero) reserves to back them up other than and equivalent amount of toxic, utter unpayable debt and/or US future production of competitive products and services (something which nobody believes in) plus more than $ 100 Trillion in un-funded liabilities…

So Rob Parenteau’s just beats the matter to death by analyzing the matter at hand with nitty-gritty scholarly granularity which, we frankly don’t really need at this very late stage of the game.

Ending fractional reserves will not alter how bank monies work. They don’t act as a vector for adding money from the Federal Reserve but issue their own IOUs, while the Fed itself does not add money to anything; it does so at the decree of Congress.

Its not “the world’s financial system is coming apart at the seams.” More like “they are using the world’s financial system to reinforce power structures.”

Don’t forget that, for instance, a Greek default would be just an “act of God” (I mean an act of sovereign power, be it the Greek Government or the EU bureaucracy that triggers it) worth 300B€ or so. A sudden shift in the European power structures. What Varoufakis proposes is that the power structure of the EU is shifted slowly in the other direction, instead of the finally inescapable crash we are quickly going towards.

I mean, don’t get lost in the numbers, and specially in the glitter of gold: money is just a fine distilled blend of power.

Negative yield (truly reliable, mind you) Spanish bonds.

100-year Mexican euro bonds (also very very reliable, trust me)

Question: will the euro even exist 100 years from now ?

Let’s see, what else we’ve got ?

20,000 Nikkei with 250% Japanese debt to GDP ratio.

Aaahhh, almost forgot !

We’ve also got $ 1200 gold.

Bah, that doesn’t matter any (sorry)

Agreed, it doesn’t matter.

I think the author means Harry Dexter White. http://en.wikipedia.org/wiki/Harry_Dexter_White

I was gonna mention that. Maybe Harry was his nickname?

Interesting. Various security and law enforcement and even legislative critters back in the mid to late ’40s and a little beyond were all busy rooting out Commies in the bowels and brains of American (had not yet morphed into “U.S.,” a much bigger thing… yet) rulership. All these senators worried about penetration of the hallowed halls of “government” by inimical “Commie” forces, so it could be written,

The concentration of Communist sympathizers in the Treasury Department, and particularly the Division of Monetary Research, is now a matter of record. White was the first director of that division; those who succeeded him in the directorship were Frank Coe and Harold Glasser. Also attached to the Division of Monetary Research were William Ludwig Ullman, Irving Kaplan, and Victor Perlo. White, Coe, Glasser, Kaplan, and Perlo were all identified as participants in the Communist conspiracy … http://en.wikipedia.org/wiki/Harry_Dexter_White

A little cut and past might cast a different light on how far the nation has descended from fears that the great national tenets were being subverted and poisoned by those who hoped to profit by taking the rest of us down, to what passes for government today:

The concentration of Wall Street and financial industry (sic) sympathizers in the Federal Reserve banking system, the Treasury Department, and particularly the Division of Monetary Research, and of course in Congress, the Departments of State and Commerce, and the NEC, is now a matter of record. Robert Rubin, Henry Paulson, Timothy Geithner, Michael Froman and many well-related and well-connected others, were brought into senior government positions by President Barack Obama, and were all identified as participants in the neoliberal conspiracy to take down the remainder of the middle class wealth and decent employment… For a somewhat dated but fairly complete list of the malefactors of great wealth in the current incarnation of Gilded Agery, and the outlines of their attack on America, The Briefly Somewhat Like What It Has Pretended To Be, look here: “Obama’s Big Sellout: The President has Packed His Economic Team with Wall Street Insiders… insiders intent on turning the bailout into an all-out giveawayhttp://www.commondreams.org/news/2009/12/13/obamas-big-sellout-president-has-packed-his-economic-team-wall-street-insiders

Charge!

First We Take Manhattan….Then We Take Berlin.

As they are frequently edited by fanatic “POV-pushers” obsessed by Venona etc, pages like those on White at Wikipedia are not trustworthy. I think I put in the quote from Stephen Schlessinger on the White page a few years ago. And on one of those pages I think I quoted (historian) Amy Knight to the effect that the books on Venona etc that Wiki-fanatics use only come to their definitive conclusions by lowering the usual standards of scholarship. So “alleged” or “accused” spy White would have been better.

Harry: Thanks for catching the error, as it is Harry D. (Red) White not Bill White I was after, but at 4am in Paris, I was unfortunately prone to making such stupid mistakes, especially since I had been speaking with Bill White (http://www.williamwhite.ca) the prior afternoon, and Bill is much more of an Austrian Schooler, or an Austro-Keynesian (yes, such people exist – see Kurt Richebacher who made a career out this as Deutsche Bank’s chief economist, at least until his benefactor at the bank was kidnapped and murdered by the Rote Armee Fraktion) than a card carrying Marxist, which I doubt they allow into positions like his at the OECD.

I’m intrigued by this line of thought. The transmission mechanism for turning “persistent trade imbalances” into national default is bailing out incompetent and/or criminal enterprises. The privatization of gains and socialization of losses. Trickle down economics. Looting. Predation. Tax breaks for the rich. Whatever we want to call it.

Is the author seriously claiming that EMU member nations have no choice but to bail out the fraudsters? The words crime and fraud don’t even appear in this post.

(In a deeper sense, the very concept of persistent trade imbalances makes no sense. Trade always balances. That’s the definition of trade. An unbalanced trade isn’t trade. It’s a gift or theft.)

Washunate: Nowhere do I condone the socialization of creditor losses, so please avoid putting words in my mouth, or at least amongst electrons I have influenced, in the future. Trade need not ever balance, at least not until the creditor realized the loans they made to parties in the deficit spending nations are not likely to be repaid, so the claim the creditors thought they had on future output in return for providing credit for past and present output of tradable goods sold to the chronic deficit spending nation will never be forthcoming. Why we allow policy makers to then turn around and at least partially validate these future claims on output by the creditors is very telling about who the puppet masters actually are in the so called democratic capitalist nations we inhabit. Finanzkapital appears, in other words, to have our political representative by the short hairs, though perhaps in the eurozone, ECB President Draghi is about to inadvertently change that by vaporizing the bank and insurance sectors, as well as some pension funds, in his quest for QE and infinitely negative nominal interest rates (see, by way of explanation, the earlier piece on this website, Draghi’s Doom Loops).

You’re not answering the comment I offered, though. I didn’t say you condone it – that implies a choice. I have no ability to speak to your intent. I’m talking about what is written in the post.

I’m asking if you are seriously suggesting that EMU countries do NOT possess such a choice. That they must take private sector financial debts and transfer them to the public sector balance sheet. That’s what your words say. You write that nations will eventually default on their liabilities that build up over time. Those liabilities are private sector liabilities, not public sector ones. My understanding is that you are a native French speaker, so I know there can be some language difficulties. English is a terribly maddening second or third language. That’s why I’m very intrigued by this claim. It’s either not what you meant to write, or it is a very provocative interpretation of the limits of sovereignty enjoyed by EMU member nations.

As far as your notion that trade need not ever balance, that’s nonsensical to the point that I assume you are making some kind of technical argument separate from plain English? I agree current account deficits need never balance. That’s because there are other parts of the Balance of Payments, like capital accounts and remittances to foreign countries. In a financial system, people don’t barter goods and services directly. They exchange goods and services for financial assets.

What people do not do in commercial transactions is give away goods and services for nothing. That is either a gift by the party supplying the good or service, or theft by the party taking the good or service.

Sounds like BMW shoulda put their new Mexican plant in Greece instead of Mexico. Then the Greeks coulda had some way of working off the debt besides selling a squillion olives. Sometimes it makes you wonder if the EU is really serious about all this?

Make all those wage frozen Germans buy back their products.

It is possible that Deutsche Bank can facilitate this. If they aren’t already. They can repossess all the BMWs they financed in Greece and make them available in the used BMW market in Germany*. This way German workers whom have been made competitive with China, Mexico, or whatever other hellhole in the world, can afford a used entry level Bimmer as a first step on the rung of the ladder which leads upward, ever upward… to prosperity. Sounds like it could all work out after all?

*assuming the steering wheel is on the correct side – but it’s easy to change laws if not.

craazyboy: Please tweet Herr Schauble with your rebalancing idea. Tell him you are channeling Hjalmar Schacht though, so he will listen up. You have thread the needle with macrame knots even I never imagined possible. Bravo!

Thank you for this and your prior posts here, Rob Parenteau. My question relates to the broader global paradigm, and specifically the U.S. dollar’s role as the global reserve currency and the petrodollar. Isn’t it necessary for the U.S. to run ongoing current account and fiscal deficits for this system to work? And wouldn’t this also prospectively be true for Germany with the euro (and China with the yuan) should they decide to pursue this strategic option? If so, is the so called “currency war” really internecine in nature?

Who says the US dollar world reserve system is working ???

Hint: it ain’t.

But what are the healthy levels of current account deficits to support international commerce?

Do we just keep importing, importing and importing, because our money is good anywhere?

Our money was good anywhere in the world (for good reason) till August 15, 1971, ominous day in which by Executive Decree Order and only as a temporary measure US President Richard Milhouse (‘Tricky Dick’) Nixon unilaterally violated the Bretton Woods Agreement and decided that no longer would $ 35 of foreign trade surplus be exchanged for an ounce of gold (or any specific, official amount)

Today, the commentariat, the authors (Including Rob Parenteau) and the editors can keep beating around the bush all they want but it’d just be lip service and hot air till deep gold discussion gains access into the act.

Meanwhile, we all act ignoring that China keeps hoarding gold hand over fist with the specific intention of soon taking control of the current international financial system as we know it.

King Dollar is dying as we speak.

Come to grips with the consequences instead of analyzing to death every possible detail of its funeral.

Object fetishes are a poor cognitive precursor wrt prescriptivism purism.

“Money as a Medium of Exchange. And Gold, Too.

=====================================

Stories evolve over time and become accepted with the retelling, becoming embellished over time. Sometimes additions and modifications to the story erode whatever logical power the story may once have had, rather than enhancing it.

This goes unnoticed, as everyone who retells the story does so under the assumption that surely somebody must have examined every premise and found it sound, since it is so often repeated.

The goldbug story of money is such.

Consider the opening volley, in which we are primly admonished that money is “first and foremost a medium of exchange.”

Let’s accept that, then examine what it means.

A medium is a backdrop on which something of value is printed, photographed, painted, or inscribed.

The medium itself is of no value.

A contract is a thing of value, which is printed in a piece of paper. The medium, the paper itself, gives the contract no value.

The value is dependent on the meaning we draw from the words written on it.

We do not demand that contracts be written on sheets of gold lest they have no “intrinsic” value. We accept them on valueless paper because we believe the enforceability of the promises conveyed by the meanings of the words written on them.

Yet oddly, a certain percentage of people demand illogically that a thing they claim is a medium, money, must have “intrinsic value” rather than serving as the medium they claim it ought to be.

We do not expect paper, film, or canvas to be valuable: it is the promises and messages we put on them that are the source of value we are looking for.

We cannot begin by announcing that money is a medium, then discard the notion of a medium and claim it should be a tool of barter with some direct utility.

A medium carries a message. Gold carries none, unless we engrave it with some promise. The promise is no better or worse for being engraved on gold or on paper. If we inscribe a piece of gold with a promise, it is not the gold that gives the promise value any more than it is the paper that gives a contract value.

The promise derives its value from our belief that it is enforceable.

So if money is a medium, our emotional attachments to gold matter not. Gold is not an issue.

The issues are issues of policy with respect to money, not with respect to the substance on which it is printed.” – LET

Skippy…. “medium of exchange” thingy….

Skippy, our loveable quintessence of the paperbug.

Money is far more than a ‘medium’.

Money necessarily is (1) store of value, for otherwise it’d be just DEBT as it is today (2) unit of account and (3) the medium of exchange “thingy”.

You ignore the above.

When all paper burns (as Rob Parenteau has clearly explained) you’ll finally understand the consequences.

How do you shove the value [subjective] into a physical object other than by contract or are you invoking the supernatural.

Numbers are a unit of account which aforementioned can be assigned to anything.

As far as debt goes, try 5000 years of debt, that should ground you in the basics as observed by forensic anthro.

Skippy… Your tautological pejoratives are not a refutation nor counter argument, faith is not applicable here.

Why do Central Banks hoard gold Skippy ?

Not diamonds, not contracts, not watermelons, not other “thingies”

JPMorgan, 1913: “Gold is money, everything else is credit”

Faith in paper ?

That’s for paperbugs like yourself.

Gold has 6000 years watching all these paper experiments.

None (0) have succeeded.

Would the US dollar be also part of your ‘American exceptionalism” also ?

BTW, your criptographic fancy footing doesn’t fool anyone.

I think Grillo got it right. Why are we digging the gold out of the earth and then putting it in bank vaults? Why not just plop the banks down on top of the gold mines and save ourselves a lot of trouble?

What do you mean, “succeeded”?

“None (0) have succeeded”

Not a single one of the fiat money experiments ever attempted lasted more than a few decades. So none (0) were successfull in that every one failed miserably, either through hyperinflation or just by dying out.

There have been more than 500 (five hundred) fiat currency attempts, all short-lived. Such 100% failure record should be enough to disqualify any further fiat money experiment, but humans tend to stumble upon the same stone many times it seems.

Your sense of humor could be well taken if the situation weren’t so dire. Gold is dug out and safely stored because for 6000 (six thousand) is has been considered as the most valuable financial asset on planet earth. Fiat money with only unpayable toxic DEBT to back it up is rather different, isn’t it ?

Government authority gave gold its worth after being a decorative medium for some thousands of years, not the most important ether. Yet those 6000 years were even more barbaric than the last few hundred when contextualized and not romanticized.

Skippy…. well that enough throwing rocks in the loon pond wrt this thread.

You are confused as to how a gold standard works. Gold does not impart value to a currency, a government uses its power to declare gold has a set value in the currency. Hence during Bretton-Woods gold was valued at $35 per ounce because governments made it so. A gold-linked currency is still a fiat currency.

Georgie, if you check your history books, you will find that gold, silver, commodity currency, and fixed exchange rate regimes have also had a near 100 percent abandonment and hence failure rate. We still do not quite know how to get money right, in which case it may be time to let a thousand flowers bloom, notgeld or not.

Lambert, nice catch, and Beppe must have read Keynes, as he has a similar sarcastic line suggesting expansionary fiscal policy for goldbugs might require digging holes in the ground and filling them with vessels full of money for others to dig up. And the hilarious thing is, some of the gold fetishizing Austerians cite this as evidence that Keynes was a charlatan and a buffoon, the joke being pointed directly at the them having fully escaped them, whoosh, right over their tinfoil’d heads.

Robert,

If you check YOUR history books, the reason that gold-backed currencies were abandoned is that politicians want their hands free for their welfare-warfare activities.

Otherwise they can’t print (supposed) “money” into existence. So their paperbug policy is very popular for a while (of course) until we run into the type of problems that we are finding right now including your Draghi Doom Loops.

Imagine dozens of trillions of dollars coming home to roost. That’ll be paperbug fun, won’t it ?

Gold is a hangover for some, tho per your China statement, its an asset class of which, its used in a basket of other assets to include foreign FX, as a hedge.

Anywho private banking credit is another issue, that its denominated in FRN when in physical form, is not a direct representation of Fiat. Seems the Freedom and Liberty sorts saw fit to Laissez-faire the crap out of that sector, a condition which had nothing to do with the medium imo.

“Would the US dollar be also part of your ‘American exceptionalism” also?”

I live in Australia and have a healthy aversion to elitism of any stripe.

Skippy…. Your inability to countenance LET’s argument is noted. Nor was anyone else at the Mises board.

The Federal Reserve is as “Federal” as Federal Express and unmitigated, utterly un-payable DEBT are its reserves, except the gold that it might still have (if any) after years of selling off to the East.

In what sense are reserves unpayable?

Also, skippy is a very sharp guy in addition to his entertainment value. I recommend listening to him.

Georgie, I am going to leave this goldbuggering alone after this, but please do take into consideration 1) the profits of the Fed go straight to the Treasury, revealing the true owners, and 2) the liability the government is agreeing to by issuing Federal Reserve Notes is to accept these same funny pieces of green toilet paper to settle all debts, and to enforce the settlement of a ll private debts disputed in legal conflicts in these vary same pieces of green toilet paper. Since most government seem quite capable of dreaming up nearly infinite ways to tax its citizens, the “backing” of Federal Reserve Notes is quite high, and to be clear, subject to the threshold of tax rates that promote wholesale emigration, and/or a tax revolt/revolution, neither of which appear to be binding constraints that any mature fiat currency economy has hit in my lifetime, though I did hear earlier today that Louis Vitton disembarked from France, and is now domiciled in Belgium…or was it Luxemburg…for reasons je ne said quo is…but should be obvious to all.

You argue that when a non-gold linked currency fails this is due to lack of metallism, but when metallism fails it is because politicians screw it up. This is called an un-falsifiable argument as it depends upon your perdonal assumptions and biases: if the system you like fails you claim malfeasance, if a system you dislike fails you claim vindication. You’ve made yourself sole arbiter of what works and what does not without recourse to logical consistency.

Why do Central Banks hoard gold Skippy ?

They buy gold because it’s a legal method of increasing financial assets in the banking system.

If the CB buys a bond it replaces a balance in a securities account with a balance in a reserve account, no net change in quantity of financial assets. If a CB buys $1 billion in gold the banking system now has $1 billion more in financial assets than before the deal. Removing gold from the private sector also increases its value and supports bank capital valuation.

Then you and Skippy can hold each other’s hand with the flame of your paperbug romance keeping you both warm and cozy as the international financial system comes apart.

Re-read Rob Parenteau’s article plus his other one a week ago (approx.)

I sign off, no hard feelings, nice meeting you both, take care

Private paper is quite exposed, might be something to do with poor underwriting standards coupled with woeful risk assessment.

Funny thing…. no force was involved… self inflicted as it were…

Skippy…. holding hands, love, romance, tragedy, quite the active imagination you’ve got there, seems a bit preoccupied in a excessive normative mannerism. IYKWIM….

Bravo, skippy, though let us not ignore the fact that commodity currencies have actually existed in the past, regardless of the goldbug medium of exchange rant, and that these systems appear to have their own shortcomings revealed repeatedly down through history, especially when it is a matter of life and death for a nation at war, in which case self-imposed financial constraints appear to be easily unimposed, by degrees, and often by decrees. If you are familiar with the history of fiat currencies, as gold based currencies should of course be, you know there is a reason why they keep resurfacing through history – actually, a whole set of reasons – that have more than a little something to do with the all too evident shortcomings of commodity currency or fixed exchange rate regimes.

And yes Skippy, the history of private money, particularly private bank credit money, has also tended not too end very well either. We simply must admit we have not been down out of the trees long enough to lose all of our monkey fur, even if we do recognize and mourn the loss of our tales, nor have we stopped swinging from the branches long enough to quite figure out how to manage this thing called money, though a low inflation full employment policy along the lines of ELR/JG proposals by the neo-Lernerian pro-Knappian crowd may just be a large step in the right direction. As may a proliferation of complimentary currencies, crafted for various purposes, as Bernard Lietaer has documented and encouraged.

Tell me about it Rob, whats a body to do.

Those that confuse stock and flow accounts and how those flows arise, wrt to time preferences, yet to a fault some seem myopically focused on the object [be it commodity or a mattress] and not how it got there or what to do next, yet are fixated on the object in a addictive mannerism.

Skippy…. tho we can plainly see what extraordinary excesses of future profits can wrought.

Robert Parenteau, please make up your mind.

With the right side of your mouth you offer grueling detail about the current death process of our international financial system (Draghi’s Doom Loops, this article, your comments)… and with your left side you pretty much insist of more of the same.

Beware: such flip-flopping will necessarily come back to bite you Sir.

Chauncey: I think you raise an important question, to which I would like to offer the following vignette, one with which you should have some familiarity, as something of an allegorical answer.

https://www.youtube.com/watch?v=YgGvd1UPZ88

President “Bobby”: Mr. Gardner, do you agree with Ben, or do you think that we can stimulate growth through temporary incentives?

[Long pause]

Chance the Gardener: As long as the roots are not severed, all is well. And all will be well in the garden.

President “Bobby”: In the garden.

Chance the Gardener: Yes. In the garden, growth has it seasons. First comes spring and summer, but then we have fall and winter. And then we get spring and summer again.

President “Bobby”: Spring and summer.

Chance the Gardener: Yes.

President “Bobby”: Then fall and winter.

Chance the Gardener: Yes.

Benjamin Rand: I think what our insightful young friend is saying is that we welcome the inevitable seasons of nature, but we’re upset by the seasons of our economy.

Chance the Gardener: Yes! There will be growth in the spring!

Benjamin Rand: Hmm!

Chance the Gardener: Hmm!

President “Bobby”: Hm. Well, Mr. Gardner, I must admit that is one of the most refreshing and optimistic statements I’ve heard in a very, very long time.

[Benjamin Rand applauds]

President “Bobby”: I admire your good, solid sense. That’s precisely what we lack on Capitol Hill.

Chauncey: A more polite answer to your question is that yes, when you have a hegemon, the hegemon and its trading partners need to have an agreeable mechanism for issuing credit in sufficient quantities to the chronic trade deficit nations in the hegemon’s currency, or at least in means of settlement the hegemon’s creditors are willing to accept. Now it is not necessary for there to be a hegemon or imperial power for international trade to flourish, but it seems to help (though again, we have to be careful, as hegemons tend to have a rather self-serving definition of free trade, usually one that allows both protection of its own infant industries, as well as colonization and exploitation of so called underdeveloped nations – see the opium trade of the British East India Company, for example). And if there is not a mechanism for recycling the current account surpluses of the hegemon in a way that maintains the debt paying capabilities of the chronic current account deficit nations, the trading system will eventually collapse, or at least by purged from time to time by voluntary or involuntary debt jubilees. Notice also the current hegemon, the US, has been running a trade and current account deficit since around 1969 or 1970, one year before Tricky Dick Nixon took the US out of the Bretton Woods Agreement, and notice also that the other wannabe hegemon, China, has a dwindling trade surplus since the 2008 Global Financial Crisis, which leaves Germany as the next Prospective Global Imperial Power…and I believe we have seen that movie a couple of times before, and are all too familiar with its ending scenes, though perhaps this time it is different, and there will be a BMW in every garage around the globe, if only Deutschebank can figure out the appropriate financial engineering trick to make it so (hint to Herr Schoible: please read up on Hjalmar Schacht’s New Plan, and have lunch with the senior management at DB, soon).

In honor of his irrationalities, we should henceforth spell his name: Schoible. It would help the imbalances if Germany aligned with the EEU and Russia/China because that is Germany’s real market. Market-crossing should be an economic crime. Until true globalism is achieved a century from now. And for the record, I have been waiting for this sentence for a long time: “The lenders… are equally culpable in playing a financial game that they must know on the basic math of it could only end very badly, as the loans they were making were not… improving the capacity of trade deficit nations to earn the income required to service this external debt.” I’m framing this sentence like a verbal icon. It applies to all levels of society.

I request permission, Other Susan, to lift your new moniker or Herr FinMin S. Nicely done. And frame away. Though be careful, I have been known to get somethings dreadfully wrong, so keep your own frontal lobes well engaged and deeply discriminate before visiting the frame shop, please.

What do you say to somebody who says “If they made products we wanted, we’d spend our money on them.”

That’s a hard one.

It’s like a drug dealer and a drug addict. The trade balance gets recycled if the addict is also a movie star or a rock star or a prostitute. But if the addict isn’t a movie star or a rock star or a prostitute, and frankly isn’t anything at all, like most people, like most of us, it gets harder.

Why does the addict use drugs? What is the drug dealer supposed to spend the money on? Who decides? Why? Deep thoughts in the peanut gallery.

WRT your final paragraph, I might look for the answers in Sartre or Camus . You yourself might look elsewhere.

And it seems that every so often, someone asks, rather tentatively and often plaintively, away and beyond that balance of trade thing and other issues and evidences of incipient disruption, one sort of fundamental question that also gets blown off, frequently by reflexive recursion to yet another axiom of all things economist, the sanctity of the notion that GROWTH is the panacaea for all these many problems.

Somebody want to explain how that is supposed to work? Population has to grow? energy use (green or otherwise) and extractables have to increase, and Housing Starts! and the Housing Market! have to keep growing although population maybe really ought to stop growing and every new “development” seems to dump externalities that non-participants in the “market” have to eat, the costs of schools and roads (soon to be privatized, along with prisons, etc., in a polity near YOU), and so many new “developments” are crowd-sourced and defined by the moniker “favela” http://www.urbandictionary.com/define.php?term=favela, along with potable water use and “inputs” to factory farming and of course DEFENSE! and the whocaresaboutitbecauseitsnotreal notional dollar metric of all those ever-growing derivatives and the wagers made on the wagers on the wagers?.

So there’s this sentiment that it’s all the fault of deadbeat “consumers” and zombie borrowers, http://www.dancortes.com/blog-posts/zombie-borrowers-and-their-credit-pushing-lenders/, who are not doing their duty to God, country and The Market by paying impossible debts and also growing their purchases of shit they don’t need that is actively antipathetic to continued habitability of the planet by said consumers (who used to be called “citizens”) with money that they don’t have any more thanks to collapsed wages and ever-increasing prices of actual necessities, not even in the form of debt they can dutifully take on, all on the basis of mortgaging the stuff they don’t even own and now have to rent, thanks to the infinitely inventive monetization, financialization and crapification of pretty much everything.

Is there a simple explanation for a non-economist as to how that paradigm of GROWTH is supposed to work? In a frame that makes sense and is honest and incorporates all the political-economy bits of need, greed, want, chicanery, cupidity, duplicity, stupidity (http://harmful.cat-v.org/people/basic-laws-of-human-stupidity/ ), and other elements that seem to be the real stuff of which the Dead Hand, both that magical marketplace type, and this, http://www.whatdoesitmean.com/index1788.htm, are made?

Just asking, of course… looking for a gentle comforting answer… please?

Obviously we all need to produce more, export to the Ferrengi whom pay in Gold Pressed Latinum, and eventually quality of life on Earth will improve for all!

JTMcPhee: I entirely agree the whole debate around the financial sustainability is entirely contingent upon our ability to deal with the absence of an appropriate and effective policy response to the central market failure of our time: the failure to deal with the proper pricing and valuation, both in a monetary sense and an ethical sense, of biosphere sustainability. In other words, fiscal sustainability, or current account sustainability, or private sector financial sustainability, is all totally irrelevant if we do not deal with biosphere sustainability. And our ability to so forcefully deny this, and our failure to deal with it, will not be looked on favorably by future generations…if there are any. But part of getting to that central question is clearing up the framework for contesting these various misconceptions that are dominating our policy discussions these days so we can then get on with it and begin to try to tackle the issue of biosphere sustainability, and its interaction or interdependence with all these sectoral financial sustainability issues. For example, fiscal policy pushing green infrastructure public/private projects may be central to any plausible approach to skin this cat. So we need clarity about what fiscal spending and possibly fiscal deficits to do that may be, and how that influences other sectors financial positions. The MFB map gives us a way to deal coherently with these issues, where at the moment, the ad hoc reasoning about these things is totally unproductive, and wasting valuable time that we need to be using to build a regenerative and resilient economy, not a Death Cult economy.

These sentiments are reflected by Stathis Kouvelakis in his recent interview in Jacobin ‘Dangerous Days Ahead’

‘Now we can say that we’ve seen the limits of this strategy. We’ve seen that these European institutions are not receptive to this kind of political or democratic argument, which says “we’re an elected government with a mandate to carry out, and you’re our central bank, and we can expect you to do your work and let us do what we were elected to do.”

This is not at all what it is about. These institutions are there in order to lock in extremely harsh neoliberal policies’

Agreed, fm, at which point the next question is, why are these institutions there to lock down neoliberal polices, or perhaps more accurately, who benefits from the application of the Neoliberal Jackboot to the necks of so many people The answer my friend is blowing in the wind: sociopathic finanzkapital, uber alles!

This is very well written, taking a rather arcane and technical subject and making sense of it in an accessible and friendly way. That it is at the same time apparently incomprehensible to the majority of professional economists is quite an indictment of the profession.

Maybe Germany should follow the example of Detroit?

Combine shortsighted, incompetent management with shortsighted unions and add a sprinkle of corrupt and incompetent government…. The result? Detroit rebalanced & who gained? The median worker in the US?

The German neo-mercantilist strategy are said to be beneficial for Germany. Then what is Germany, the people there or numbers in the bookkeeping ledger. The wage suppression isn’t primarily targeting engineers and workers in the export industry, they make fairly good money. What is suppressed is the domestic economy, that’s where the wage suppression is significant. Mini jobs, workfare to create artificial low unemployment figures. The normal is that the domestic market is the dominant share of any economy. That was what created post war record economy, not trade/export. Globalization have inflated export as share of GDP in Germany and elsewhere, import share have rises in parallel then the export industry is the largest importer for its intermediate input. The actual value added is much lower than the export number indicate. Don’t no the net share for Germany but what they probably doing is suppressing at least 70% of the German economy that is the domestic part. So is also poverty and wages you can’t live on rising, quite a success? For whom? Just another of these neo-liberal con-scheme to transfer wealth from the many to the few. Germany prevent it’s own people to enjoy the countries enormous productive capacity. And the people hail it as virtue.

Good point – and reason the Left (which does not mean the SD) has been gaining in recent elections. Ironically, Merkel actually LOST the last one and rules by virtue of a Grand Coalition with the SD – an inherently shaky arrangement.

The author identified the solution to the trade imbalance: open up trade with the Martians and Venusians. Does Germany know something we don’t know?

No, Germany knows nothing about spatial exports nor interstellar banking.

With the Martians and Venusians “thingy” the author has tried (to no avail) to impress upon us how unsolvable the situation is as fiat paper currencies worldwide are destroyed as we speak… while China keeps hoarding all of the Western world’s dirt cheap gold in order to take over the crumbling world’s financial system with a gold-backed yuan.

The People’s bank is buying up gold to inject net financial assets into its banking system. There is no secret plan to sieze global hegemony by making the renminbi convertible to gold.

Georgie: If you are familiar with China’s monetary history, they seem to oscillate over long stretches of time between the excesses of fiat currencies, of which they allegedly are the inventors around 1100AD, and the disastrous consequences of commodity currencies, particularly silver. They may be well on their way to another such oscillation, this time toward the yellow shiny metal, but the transition to it, given the massive debt load they have accumulated domestically, will be, if you can pardon my Franglais, une bitche. One might also read more than a little something into their burst of dollar denominated borrowing by their corporate sector since the Global Financial Crisis in 2008. Borrowers are notorious for wanting to pay back their debts in depreciated currencies, so one could read this as a fairly explicit bet that the RMB in which most of their revenues are probably denominated will be appreciating persistently against the US dollar…which means they better hurry the hell up and figure out a replacement for their neomercantilist growth strategy, or we’ll be talking about a revolution, like a whisper, in no time (anyone know of a Tracy Chapman wannabe in mainland China?)

Yup, clear enough.

One ‘bitche’ way out would be to hyperinflate their Renminbis jointly with the US Dollar, almost in lockstep, hand in hand like all paperbugs should.

Once debts are mopped up, there’s blood in the streets and people (very) angry, they would proudly announce their gold-backed New Yuan…

There are other ways out, all of them bitche enough, trust me, but always with the un-nameable yellow shiny metal to back them up. No other way out, sorry, after the MESS that CBs have made of fiat.

Gold-linked currency is fiat currency as government fixes the value of gold by diktat, which it can change at any time and historically has done so whenever convenient.

Parenteau couldn’t be more wrong as Germany has been in trade negotiations with the Romulan Star Empire for years. No way they would limit themselves to a market so small as our solar system.

It was apparent from the start that Germany’s purpose for the EU was to resolve or minimize a number of issues by externalizing costs via trade surpluses. If the EU can no longer absorb these costs, Germany no longer has a use for it, and we are seeing the end game. As I commented in the “Scapegoating” article, the remaining issue then is whether German capitalists need to keep scapegoating Greece. If they can no longer scapegoat Greece, or if they find a better scapegoat, game over.