Earlier this year, we broke the story of how CalPERS’ Chief Operating Investment Officer Wylie Tollette told CalPERS’ board that CalPERS did not keep tabs on one of the biggest forms of compensation investors like CalPERS pay to private equity general partners, namely, the profit share that is widely called a “carry fee.*” Worse, Tollette claimed, incorrectly, that no one in the industry could get the information.

Other reporters called out CalPERS, not simply for its failure to record carry fee data, but for its astonishing claim that the information could not be obtained. Less than a month after our report, CalPERS reversed itself and requested carry fee data for all of its funds for the entire history of those funds.

Now one would think that CalPERS’ Scaramento sister CalSTRS, which is the second biggest public pension fund investor in private equity, would recognize that not collecting carry fee data was an untenable position, particularly in light of the well-established pattern in private equity that once CalPERS breaks new ground on transparency, other investors eventually follow.

But instead, as we wrote, CalSTRS has chosen to double down in the private equity carry fee reporting scandal. This should probably come as no surprise, since as former North Carolina Chief Investment Officer Andrew Silton wrote**:

As best I can tell, CalSTRS’s fee disclosure for PE is among the worst in the country. The pension’s annual report doesn’t even disclose management fees let alone carried interest.

From our July post:

When the larger of the giant Sacramento-based public pension funds, CalPERS, was caught out for failing to track the biggest fee that private equity investors pay, carry fees, CalPERS rapidly reversed course once media criticism started snowballing. CalPERS scrambled to gather information across its entire program, contacting all its private equity general partners and demanding responses by July 13.

The Financial Times broke the story that CalSTRS, the second largest public pension fund investor in private equity, was not capturing carry fee data either. But while CalPERS was sheepish when caught out, CalSTRS has tried to depict the desire to have that information compiled as an unreasonable request. From the Financial Times story:

The second-largest US public pension fund has admitted it has failed to record total payments made to its private equity managers over a period of 27 years….

A spokesman for Calstrs, which helps finance the retirement plans of teachers, said the fund does not record carried interest. “What matters is the overall performance of the portfolio.”…

Ms [Margot] Wirth [director of private equity at Calstrs] argued it was “wrong to conflate the fees paid to private equity managers with carried interest”.

She said: “Carried interest is a profit split between the investor and the private equity manager. The higher that carried interest is, then the better both the investor and private equity manager have performed.”

This line of argument is prima facie evidence of an advanced case of private equity intellectual capture at CalSTRS….

The only way to assess the reasonableness of private equity fees and costs if you can see all of them.

The idea that a profit participation shouldn’t be regarded as compensation to the general partners is ludicrous on its face. It’s tantamount to saying any performance-based pay, like brokerage fees and sales commissions, aren’t costs to the party using that agent.

And as a further demonstration that CalSTRS’ position is untenable, two CalSTRS board members, the state controller Betty Yee and the investment committee chairman Sharon Hendricks made flagrant misrepresentations in their efforts to defend CalSTRS’ flagrantly pro-general partner, anti-beneficiary posture:

Dennak Murphy***, American Federation of Teachers: We understand that you have been working hard on this issue. It is astonishing and troubling that hedge funds, private equity funds, and many real estate managers do not fully disclose the complete cost of investing. We know all of you, especially Controller Yee and and Treasurer Chiang, have been working hard on this and urge your persistent attention until full transparency of all investment fees and costs becomes the standard for all pension investors, their managers, and their consultants. We understand this will take some time, we understand there are concerns about being an investor of choice, we understand that some alternative assets deliver superior returns over time and that’s important to remember, and we know that costs matter. What is not measured is not managed. While net returns is clearly what matters most, hidden, secret, and need I say embarrassingly high fees should be disclosed. We believe that undisclosed fees and unreported fees are significant and are a fiduciary challenge. We again urge you to lead in this effort through your workplans or a fee workshop or a consortium with like-minded investors to investigate and address this embarrassing risk that we believe is as yet unmanaged.

We thank you again for your extraordinary work on behalf of California teachers and taxpayers. Thank you.

Sharon Hendricks, Chairman, Investment Committee : Mr. Murphy, we appreciate that. As you know, I’m going to read a statement from I guess myself as the chair of the investment board. Just to respond, that our board is reviewing private equity reporting and accounting practices. I think the challenge for us is balancing our responsibility to achieve the highest return while being as transparent as possible. So as part of this process, we’ve asked our staff current industry standards on profit-sharing arrangements or what we’ve talked about today is called today “carried interest”. Currently staff can estimate with a reasonable level of accuracy the amount of carried interest its investment partners receive, but as a board, we want more information regarding this issue to follow up on the recent public debate. So we have asked staff to identify strategies to address these concerns and report back to us. So, thank you. Miss Yee?

Betty Yee, Controller, State of California: Thank you, Madame Chair. I just want to thank Mr. Murphy for coming forward. I just want to assure him that we are definitely giving this issue serious consideration and I appreciated your statement while identifying the complexities of really getting our arms around this. This is a complex asset class but I just want to assure you that this board is being very diligent about some of the concerns being raised.

Bear in mind that Murphy, despite the use of the deferential tones of official discourse, threw down a gauntlet to CalSTRS: that of achieving full transparency on fees and costs in all alternative investments. But he gave CalSTRS an unwarranted escape route: that of allowing for the One Excuse That Rules Them All of private equity: that it delivers better performance than investors can get elsewhere, ergo you have to put up with cheating as long as they deliver the desired net returns. We’ve debunked that idea repeatedly. The results of funds like CalPERS and CalSTRS have show that private equity has persistently failed to generate enough in return to justify the risks involved over the past ten years, and by very large margins. And that’s before you factor in that return comparisons are not on an apples-to-apples basis. Limited partners like CalPERS and CalSTRS use internal rates of return for private equity, which exaggerates performance.

And don’t try the excuse that private equity returns have been attractive over a 20 year time horizon. Funds like CalPERS and CalSTRS has only small programs 20 years ago. And while the legal life of a fund may extend beyond ten years, the overwhelming majority of the distributions will have been made before then. Talking about PE returns 20 years ago is like talking about US economic performance of the 1990s as a guide for what we can expect to achieve in the “new normal”.

But what do we observe from Hendricks and Yee? Hendricks, in an telling show of defensiveness, goes from Murphy’s push for full transparency across all types of investments to talk about the hot issue of carry fees, and offers the lame excuse, “We have staff working on it.” This is when CalSTRS is already well behind its peers on the reporting of fees and costs. Since much less well-staffed South Carolina Retirement System Investment Commission is getting vastly more fee and cost data, what pray tell is CalSTRS’ real reason for continued foot-dragging?

CalPERS got virtually all carry fee data in a mere two weeks, including the July 4 holiday weekend. The Financial Times reported on July 12 that it has gotten the information sought from all but six managers. Recall its deadline as July 13, so this was still a work in progress.

I submitted a Public Records Act request (California-speak for a FOIA) to CalPERS about the format of its data request and the correspondence with general partners that had failed to provide the information.

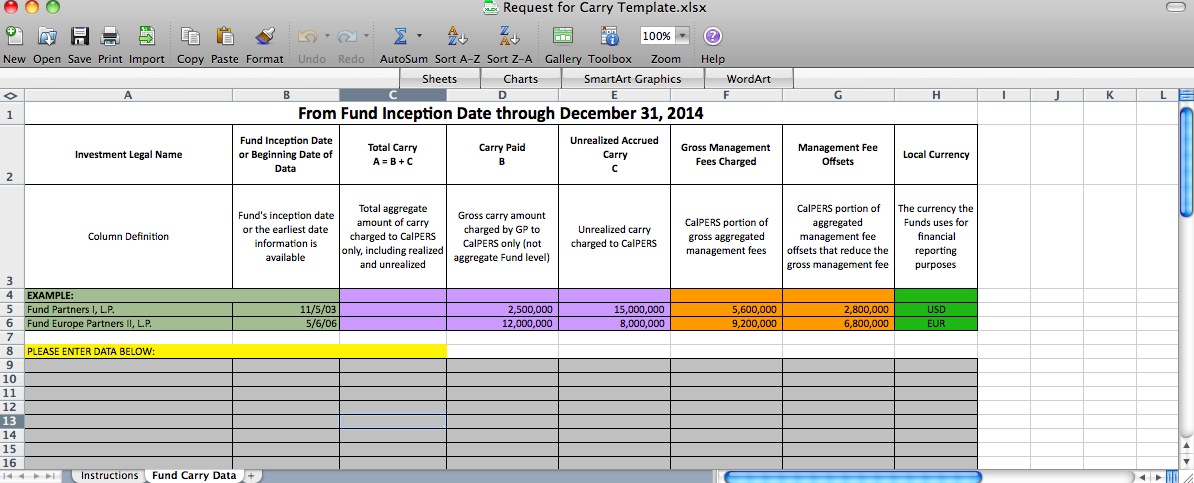

This was the template that CalPERS sent to its managers:

Only three failed to provide the data in the end, out of over 800 funds that CalPERS has invested in over the life of its private equity program. Two of the three said they’d already provided the information and described where it apparently could be found. This was the only flat-out refusal:

We reference the request from CalPERS of July 8 regarding carried interest. It is our understanding that CalPERS has already agreed to transfer its commitment to the Audax funds and, therefore, we believe the request does not apply to us. With respect to accrued management fee and carry information, to the extent CalPERS has agreed to a secondary sale of its interests in our funds, we provided extensive information regarding those interests during the sale process, which we hope can be helpful to this inquiry. Please feel free to contact us if we can be of any further assistance.

Elizabeth Conte

Audax Group

101 Huntington Avenue

Boston, MA 02199

So CalSTRS has no excuse for pretending it can’t get this information. There’s basis for trotting out phony justifications, as Yee does, that “We’re giving this matter serious consideration.” That’s code for, “We aren’t keen to expose how much we’ve been paying in carry fees and we plan to hold out as long as we possibly can.” Yee’s apology is indefensible given that she also sits on CalPERS’ Investment Committee. She therefore knows about how CalPERS has gotten the carry fee information that CalSTRS is falsely telling its constituents that it has to engage in a huge study process before it dare approach the general partners about coughing it up.

I hope Murphy and other union leaders put more heat on CalSTRS. And I hope readers in California will as well. Remember, both CalPERS and CalSTRS are underfunded, and taxpayers are ultimately responsible for shortfalls. Private equity’s excessive fees thus come out of your pockets. It’s time to tell public officials and legislators that you find the complacency of CalSTRS and CalPERS on these issues to be unacceptable.

I urge you to write Treasurer John Chiang as well as Betty Yee, since both of them sit on CalPERS’ and CalSTRS’ Investment Committees. Send a carbon copy to your state Senator and Assemblyman (contact information here and here).

Here are their contact details:

Mr. John Chiang

California State Treasurer

Post Office Box 942809

Sacramento, CA 94209-0001

(916) 653-2995Ms. Betty Yee

California State Controller

P.O. Box 942850

Sacramento, California 94250-5872

(916) 445-2636

Please also contact your local newspaper and television station, as well as the Sacramento Bee. Tell them you think this story is important for all California taxpayers and you wonder why they haven’t taken it up. You can find the form for sending a letter to the editor here.

The fact that unions are starting to demand that pension funds to do a much better job in getting fee information is an important step forward. Keep the momentum going with your letters and calls.

___

* “Carry fees” are typically 20% of the profits after a so-called “hurdle rate” or “preferred return” it met, which is typically 6% to 8%. On so-called American-style deals, the carry fee is paid on each deal, which raises the possibility that carry fees paid out on early, successful company sales are offset by the dogs that are sold later. WE’ve discussed at some length how the provisions to square up the carry fee payments at the end of a fund’s life, the co-called “clawback provision” does not in fact achieve that outcome.

** More on his devastating post tomorrow.

*** I believe that is the correct spelling of his first name based on this Facebook page and the participation of “Dennak Murphy” in this report. Sincere apologies if not.

Murphy: . What is not measured is not managed. While net returns is clearly what matters most, hidden, secret, and need I say embarrassingly high fees should be disclosed. We believe that undisclosed fees and unreported fees are significant and are a fiduciary challenge.

NC’s PE reporting is having a good effect. I can’t imagine this statement being made (and the board being called out) without these reports. They cast a bright light on the failings of pension fund due diligence wrt PE investments. Thanks for your continued reporting

+1, I’m sure yves persistence is rattling some nerves

I will write to Chiang and Yee AGAIN. I hope they are getting annoyed enough with my letters to actually, you know, do their jobs.

Thanks, as always, for your persistence on this Yves and for the clarity you provide on this topic which can be obscure. Great work – and these issues apply to big government pension schemes across the country, not just in CA.

Oh, I suspect they have assistants who are responsible for being annoyed with constituents’ letters. Kinda like Congress folks and their assistants.

This knit of corruption is everywhere. Yves keeps pulling at the threads revealing ever larger holes in what can be justified and and awareness grows.

It is beginning to look self reinforcing and due largely to the persistence of this site!

This is how differences are made. Yves continues to be an inspiration!

Some standardized reporting across the jurisdictions would help all concerned, so that performance, etc are compared even-up. With all that money at stake, or even if not as much, there is a need for more transparency.

This continues to be fascinating. It’s interesting to see the thin veneer of politeness that’s drawn over the responses, and I think seeing this may help people to spot the same language techniques when used in other professional settings. Great pieces, Yves.