By Nicholas Shaxson, the author of Treasure Islands, an award-winning book about tax havens. Originally published at Fool’s Gold

Recently we have written about how supposedly ‘competitive’ national policies on tax and the financial sector in Britain tend to favour large multinational firms over smaller, more locally-based ones, and how they also tend to lead to less competition in markets too.

Recently we have written about how supposedly ‘competitive’ national policies on tax and the financial sector in Britain tend to favour large multinational firms over smaller, more locally-based ones, and how they also tend to lead to less competition in markets too.

This is the result of what we sometimes call the “Competitiveness Agenda”, which pushes the idea that you have to pamper and give subsidies to mobile capital, for fear that it will flee to more hospitable jurisdictions. Of course the firms that are most able to flee (or partly flee) to foreign jurisdictions are naturally the internationally-focused ones – and that usually means larger multinational corporations. The smaller locally-focused ones, which are most wholly embedded in the local economy won’t generally flee.

The result is that this ratchets up the tendency for the big to overwhelm the small, based on factors (such as tax breaks) that have nothing to do with wealth creation and everything to do with unproductive wealth extraction.

This morning Good Jobs First in the United States have published an important new report entitled In Search of a Level Playing Field: What Leaders of Small Business Organizations Think About Economic Development Incentives. Its findings very much reflect the workings of the Competitiveness Agenda. Its summary states:

“A national survey of 41 leaders of small business organizations representing 24,000 member businesses in 25 states reveals that they overwhelmingly believe that state economic development incentives favor big businesses, that states are overspending on large individual deals, and that state incentive programs are not effectively meeting the needs of small businesses seeking to grow.”

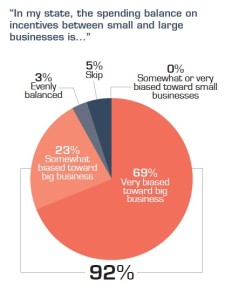

Specifically, 92 percent believed that the spending balance on incentives between small and large businesses in their state was biased toward big businesses (69 percent strongly believe). Also, 79 percent believed that their state was overspending on big incentive deals, hurting state finances (56 percent strongly).

“When asked what their members need most now, respondents almost unanimously named greater access to capital—not tax breaks.

Beyond greater access to capital, respondents next said they favor community investments that benefit all businesses and grow the local consumer base. Of greatest benefit to their member businesses, they said, are workforce, transportation and education investments.”

And those core factors, of course, all require tax — not tax breaks. And of course subsidies to big business are not neutral for small businesses: they are actively harmful. As one of the respondents in the new survey put it:

“We’re not necessarily looking for any incentives from the state; we just don’t want to see incentives going to large businesses to the detriment of the state and small businesses.”

Our emphasis here highlights two separate channels for harm from these incentives: loss of state functions, plus the help given to big businesses that enables them to crowd out the small. Another quote highlights a third source of harm:

“We oppose funding that goes out of the community by attracting global corporations that will leave after their incentive is finished.”

In a word, leakage.

Although this particular report does not get very explicitly into ‘competitiveness’ arguments, the authors have weighed in on this issue many times in the past — as they’ve described it:

“Worse than zero-sum, this is a net loss game, with footloose companies shrinking the tax base necessary for the education and infrastructure investments that benefit all employers.”

Amanda Ballantyne, the National Director for the Main Street Alliance, a major association of small business owners, captures much of the trouble:

“Over the past five years, we have surveyed thousands and thousands of small business owners across the country, asking the question, ‘what do you need most to help your business thrive?’ The overwhelming response that we get is not necessarily what you’d expect. Small business owners don’t call for more tax breaks or fewer workplace standards. They call for more customers.

Small business owners need more customers in their stores, purchasing the products and services that they sell. For this reason, we need more investment in our communities, and policies that ensure that more customers have stable jobs, earn decent wages, and have access to the benefits they need to keep their families healthy and economically secure. Those policies ensure a strong customer base for local small businesses. We know that Main Street businesses thrive when the customers in their communities are also thriving.”

On this latter subject — the relationship between corporate tax breaks and demand in an economy — we’ll be writing more, shortly. (For a taster of that, see point Seven (on p14) of the document Ten Reasons to Defend the Corporate Income Tax.)

They call for more customers.

What a shocking revelation.

Nowhere in the favored macroeconomic theory, especially that espoused by the USTR, is there any mention of customers. It is all about cutting taxes,

How could all our experts miss this point?

These small business owners must be wrong.

Of greatest benefit to their member businesses, they said, are workforce, transportation and education investments.

Bunch of bleeding hearts.

Customers are the real job creators, and small business owners know that.

So the Export-Import Bank is just a scam, the strategic triad of transoceanic trade agreements is a fraud, and Cisco’s John Chambers claiming that the US isn’t bribing big business enough to make progress happen is a brazen cash grab.

Just as a purely hypothetical premise: what happens if we outlaw transnational corporations and require wholly independent entities with no control over foreign businesses?

Autarky?

Great article. All those small business owners who understand that a more secure customer-base is what they really need to succeed should make easy converts to the MMT camp, I would think.

Great post. The US Court’s Citzen’s United decision opened the flood gates to corporate campaign contributions to politicians. One imagines larger, richer companies can deliver larger, richer campaign contributions.

…pushes the idea that you have to pamper and give subsidies to mobile capital, for fear that it will flee to more hospitable jurisdictions.

or to more hospitable politicians.

Thanks for sharing this important post! I really liked the phrasing of Amanda Ballantyne:

“Small business owners don’t call for more tax breaks or fewer workplace standards. They call for more customers.

Small business owners need more customers in their stores, purchasing the products and services that they sell. For this reason, we need more investment in our communities, and policies that ensure that more customers have stable jobs, earn decent wages, and have access to the benefits they need to keep their families healthy and economically secure. Those policies ensure a strong customer base for local small businesses. We know that Main Street businesses thrive when the customers in their communities are also thriving.”

One of the few small towns thriving in upstate N.Y. now has over 100 small businesses– who have voluntarily chosen to go through a rigorous certification process to be designated “living wage employers.”

http://www.ithacajournal.com/story/money/2015/06/05/living-wage-employers-ithaca/28542553/?from=global&sessionKey=&autologin=

Thanks for that link. It’s great to hear about this outstanding local incentive. Kudos to Ithaca.

From the article is a quote from Amanda Ballantyne, Director of Main Street Alliance (association of small business owners):

This seems exactly right since most of us at lower income levels have reduced disposable income since we’re paying 30-50% of our gross incomes on rent and another 25-40% of our gross income on regressive government taxes like payroll, sales and income taxes. (State income taxes especially are often relatively flat and thus not progressive). If 50% to 75% of monthly income is taken by various levels of government and landlords (or banks if the household has a mortgage), this leaves little disposal income left over for most families to buy goods and services to boost the “real” economy.

We can trace the destruction of household economic demand back to the early 60’s through the ’80’s when the rates of the most regressive tax, the payroll tax, was ratcheted up from a fairly low percentage to over 15% (when the employer match is added). If we could eliminate payroll and sales taxes and replace them by an equal amount of tax on the largest earners of passive incomes (rents, interest, dividends, capital gains), we’d see an explosion of economic activity as the lowest 80% of earners spend their extra disposable income into the real economy.

Because states receive most of their funding from income, sales and property taxes paid by workers, the significant tax subsidies some states give to large businesses to relocate make perfect economic sense to grab jobs from other states. The transferred employees (or new local hires) will pay state income, sales and property taxes on their incomes, which will more than offset the large tax subsidies given to the relocating businesses. If I’m a state looking to increase my tax base and /or employment ratio, the $30 million in tax subsidies I might give to a large business may sound like a lot, but in exchange the state gets hundreds or thousands of jobs over the 15 or 25 year investment period. The state usually comes out ahead because of the income and sales taxes paid by the transferred workers (or new hires), and from the tax revenue paid by employees of the ancillary supplier companies that either follow the large business to the state, or from the increased employment of local businesses servicing the large companies induced to move to the state.

If small businesses are really looking for help to compete more effectively against large multinational businesses, they should be fighting to repeal the ineffective and largely corrupt corporate income tax (Repeating my mantra: “corporations don’t pay taxes, only people pay taxes”) and replace it altogether with a tax on business gross receipts. A progressive gross receipts tax would exempt the smallest companies; medium sized businesses would pay a modest GR tax, and the largest businesses (wherever they might be located across the globe) would pay the highest GR taxes. The current corporate tax system is a fraud on workers and households since it’s so easy to manipulate where profits are earned, especially now that we live in a very fragmentized world, where an efficient transportation system (mostly fast jets) and the internet makes it fairly easy to move business operations to the most favorable locations, including the most favorable tax locations. A business gross receipts tax cuts through all of these nefarious machinations and imposes taxes where the goods or services are used, not where some artificial construct called profits are allocated by company economists, accountants and lawyers much smarter than the rest of us.

“the significant tax subsidies some states give to large businesses to relocate make perfect economic sense to grab jobs from other states.”

Except that it rarely works like that. Here in Alabama the state government has given away millions in tax breaks to large multi-nationals and there is no evidence at all that these companies have brought in jobs from other states. They can’t even show that any increase in income, sale or property taxes due to the increased hiring of the favored corporation. In many cases the companies have not even hired the number of people agreed to in the incentive agreements and there are never any clawback provisions when the companies don’t live up to their part of the bargain.

Great article…right on point…now if congress had thought of a law in the mid 70’s that would balance out the loss of local capital when s&p and Moody’s twisted erisa to bleed money from local communities…we could call it the community reinvestment act to make sure that banks were federally mandated to lend All required capital needs so the Fed could fulfill its statutory mandate of full employment…and…hey…

Now…wait a minute…the drugs are wearing off…there is such a law…but let’s not mention it in front of the children…might give them a sugar rush

The American Dental Association has dedicated substantial research into the business of dentistry – which despite corporate inroads, is still primarily comprised of small businesses. While dentists (along with all other healthcare providers) have been hammered by politicians about access to care problems, research continues to show that the main barrier to care is financial, not access. Supply side solutions have been driving the policy bus, resulting in a huge expansion in the number of dentists graduating every year, and yet there continues to be widespread dental problems that result from people not obtaining dental care until there is a problem they can’t ignore. Certainly, my sympathies lie with people who need care they can’t afford. But since this is a post about small business, it’s also important to remember that when people can’t afford to go into to see the dentist, it is difficult to keep dentists (small businesses) in business. Corporate dental groups are growing and small business dental offices shrinking because the financial and tax structure of the corporate dental business is completely different (and far more lucrative) than that of a private practitioner. I’d go one step further than Amanda Ballentyne and say that small business owners not only what more customers (or in my case patients) but also a level playing field – the tax breaks given to corporate dental owners kill the small business dentists over the long run because of the huge financial advantage they have and should NOT be ignored.

I’m glad the ADA has the research to fight back against supply side solutions, but any private dentist could have told them the the biggest problem facing our patients is not enough money. The supply side solutions have been extremely good for corporate dentistry – most of the new dentists go on to be employees of corporate dental groups instead of small business owners. None of this is good for patients or our communities as continuity of patient care and community involvement is lost.

http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_1014_2.ashx