The lead story at the Financial Times is based on a study by the Pew Research Center, on the dramatic decline of the US middle class. This is particularly noteworthy because while Pew plays straight up the center in its research on reporting, it is known among pollsters for skewing its questionnaires on economic issues to support conservative viewpoints (mind you, it’s subtle; Pew is no Rasmussen).

The Pew study, The American Middle Class Is Losing Ground is more anodyne than the Financial Times writeup, and the pink paper seems to have made very good use of its embargo period. I’m relying on its account more heavily than I would normally, even though the underlying report is out, in part because (as you’ll see below) the FT supplemented the Pew report with some useful short profiles of Americans who are doing well and less well. But it is also instructive to see how the FT has spun the Pew report.

The underlying data is so bad as to be beyond remedy by porcine maquillage. And even traditional conservatives may recognize that the rise of His Trumpness and the popularity of Bernie Sanders are telling them that conditions for most Americans are worse than they realize in their upper-income echelons, and it might behoove them to understand what is going on.

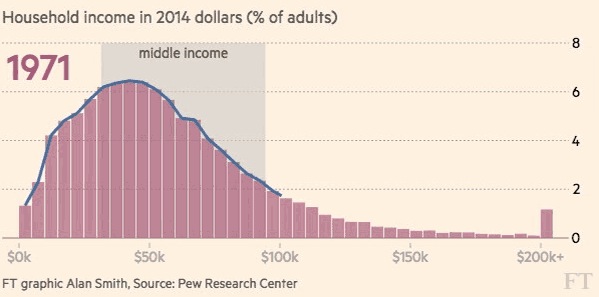

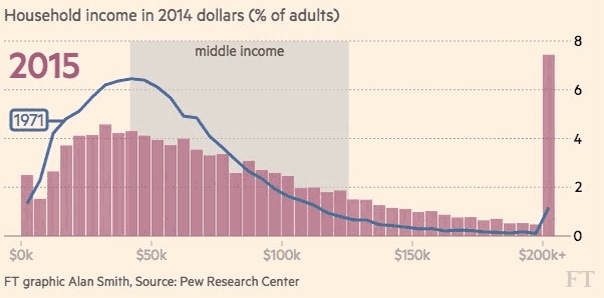

The Financial Times headline is uncharacteristically dramatic: America’s Middle Class Meltdown: core shrinks to half of US homes. And I find their infographic that charts the the shrinkage of the middle class cohort over time to be more informative than the Pew charts that presented the same information; we are partially replicating it by showing the starting and end shots:

I strongly urge you to read the article or at least the executive summary of the Pew report. If you look at both, you’ll see the Pew report makes an undue amount of effort to steer readers into the details in a way that reduces the focus on the losses for the once great middle. Hence the perhaps unusual emphasis on the Financial Times account. For instance, consider the pink paper’s lead paragrpah:

America’s middle class has shrunk to just half the population for the first time in at least four decades as the forces of technological change and globalisation drive a wedge between the winners and losers in a splintering US society….

Pew used one of the broadest income classifications of the middle class, in a new analysis detailing the “hollowing out” of a group that has formed the bedrock of America’s postwar success.

Contrast that with Pew’s opener:

After more than four decades of serving as the nation’s economic majority, the American middle class is now matched in number by those in the economic tiers above and below it. In early 2015, 120.8 million adults were in middle-income households, compared with 121.3 million in lower- and upper-income households combined, a demographic shift that could signal a tipping point, according to a new Pew Research Center analysis of government data.

In at least one sense, the shift represents economic progress: While the share of U.S. adults living in both upper- and lower-income households rose alongside the declining share in the middle from 1971 to 2015, the share in the upper-income tier grew more.

Yves here. I will leave it to experts on this beat to indicate Pew was generous in what it defined as “middle class.” From the full version of report:

In this study, which examines the changing size, demographic composition and economic fortunes of the American middle class, “middle-income” Americans are defined as adults whose annual household income is two-thirds to double the national median, about $42,000 to $126,000 annually in 2014 dollars for a household of three.

Needless to say, if other studies typically define “middle class” as a narrower income band, you would have seen lower “middle class” membership, and the decline could also have looked greater.

Back to the Financial Times:

The core of American society now represents 50 per cent or less of the adult population, compared with 61 per cent at the end of the 1960s. Strikingly, the change has been driven at least as much by rapid growth in the ranks of prosperous Americans above the level of the middle class as it has by expansion in the numbers of poorer citizens….

Recent political debate has been dominated by the view that US society has been distorted by staggering gains for the top 1 per cent of the country at the expense of the remaining 99 per cent.

Pew’s research gives a more nuanced picture however. Better off households — defined by Pew as earning more than $125,608 a year — account for more than one-in-five of the US population. That is the highest share the study has found, as well-educated Americans from finance to computer programming and biotech enjoy strong prospects. “On balance, there is more economic progress than regression,” the report says.

Yves again. You can see the effort to put a happy face on this story. First, we have an apples and oranges comparison. The share of income and assets controlled by the top 1% and top 0.1% has doubled since the early 1980s, and the top 0.1% has pulled out in a very dramatic way from the top 1% overall. In addition, that increase in concentration is almost certainly understated, since Gabriel Zucman of Berkeley has estimated that a full 6% of global wealth is in secrecy jurisdictions and not reported. It’s a given that that hidden lucre is owned pretty much entirely by the top 1%.

Thus the “more people are in the upper middle class slice” story does not contradict the notion that the top 1% and top 0.1% have seen a stunning increase in their incomes and wealth, and with it, their power. Moreover, I’d like to see the geographic distribution of these top 20% earners. $125,000 does not go very far in high tax, high housing cost areas like New York City, San Francisco, or Silicon Valley. A lot of smaller cities like Memphis or Kansas City are vastly more affordable, but prevailing wage levels are also lower.

We see Pew showing its bias in the remark about “more economic progress.” Recall the precise statement from the executive summary:

The share of U.S. adults living in both upper-and lower-income households rose from 1971 to 2015, but the share in the upper-income tier grew more.

Huh? First, we have the issue flagged by Elizabeth Warren in her book The Two Income Trap: that households that have higher incomes in real terms than those in 1970 (which was the starting point of her study) are often not better off because it takes two workers to produce the income, and the need for two earners was to live in districts with good schools, Intensification of competition to be in those locations led to more competition for housing, driving living expenses up. Moreover, a two-earner family has a bigger nut to cover, staring with two cars. She found typical households had less discretionary income than in the 1970s, which often also meant lower savings, and even when they had decent buffers, were more bankruptcy-prone by not having a non-working spouse as a reserve labor force that could be tapped if the primary earner could no longer work or suffered a big fall in income.

In addition, there is a great deal of research that shows that highly stratified societies score worse on social indicators like crime rates, average educatioal attainment, suicides, and teen pregnancies. The US hews to this pattern. Even worse people in highly stratified societies pay a price in terms of their health and longevity, even those at the very top. Stratified societies have people at every level having low community engagement, thin social network, and for those who are well or very well off, pressure to maintain their economic status, since if they lose that, they lose their social network. They can no longer afford to engage in many of the same activities, they might even have to move into cheaper housing, and the result is that they lose most if not all of their current “friends”. And it’s hard to see how Pew can claim there has been “more progress” when labor force participation is low by historical standards.

And we see the “more progress” spin contradicted by other findings:

The research also tracks different demographic groups to find the winners and losers in recent decades. Older Americans were the biggest gainers by far in terms of their progression up the income tiers during the current century, and also when compared with the start of the 1970s, it finds. The group aged 18-29 has seen the biggest slide.

How is an economy showing “more progress” when it cannot generate enough well paid work for its young people, who are the most energetic and most adaptable, and on whom future growth depends?

I suspect other commentators will identify the impact of simplifying assumptions. I find this one to be odd:

Pew’s data, which draw on official numbers, adjust for inflation and put everyone in a three-person household to make figures more comparable.

The Financial Times supplemented the Pew study by doing a set of interviews to give more flavor to who was winning and losing. Extracts from two of the mini-profiles:

Julie Ruhlen works in one of the wealthiest counties of the US, but she says the idea of living there is out of her reach.

Ms Ruhlen is a state school teacher at Harper Park Middle School in Loudoun County, Virginia, a leafy suburb dotted with multimillion dollar mansions that is one of the richest localities in the US.

Like many public school teachers, however, she has to supplement her income with a part-time job — in her case, working at one of the state’s wineries — to maintain the lifestyle she wants.

Teachers have been among the poorest performers in terms of income mobility since the 1970s. Among the 14 professions tracked by Pew between 2001 and 2014 they have suffered the biggest slide down the income ladder as states have slashed budgets, resulting in stalled wages or job cuts for a broad range of middle-class public sector workers.

“It is not just affecting me personally but also the people I am out there to help,” said Ms Ruhlen, who commutes 50 minutes each way to work. “I could do so much more if I were able to live in the community where I teach.”

And:

Liz Heath has been waiting for five years but work is finally under way on the renovation that will more than double the size of her 1927 bungalow in Atlanta’s gentrifying Grant Park neighbourhood.

It helps that Ms Heath is an architect and drew the plans for the 3,100-square-foot renovation herself. But beyond fulfilling a long-held goal, her project is a sign of renewed confidence. After starting her career in the shadow of the 2008-09 recession, Ms Heath senses that she and her peers are living in a more hopeful economy.

“We came out of school and after a few years we hit a point where we were earning less than we did out of school,” she says. “But since then things have started moving forward. We are feeding back in to the economy.”

Ms Heath has been the beneficiary of a boom in professional services, such as architecture, that has yielded what is now a much more white collar middle class.

In 1971, 18 per cent of the American middle class worked in business and professional services; today, one-third of it does. Almost one in three of the 66,000 jobs that the Atlanta area added in the year to August were in business and professional services.

Again, I hope you will read the story in full (clear your cookies and Google the headline) and/or the report proper and discuss where the picture you see there is consistent with what you are seeing in your community.

I see a glaring flaw here! If you’ve already adjusted incomes to in the same 2014 dollars, how can you logically say that to be middle class in 1971 means your income was between what looks like about $35,000 and $95,000 while in 2014 middle class means $42,000 to $126,000?!?! The spreads are not constant but yet they are using constant 2014 dollars. Their mathematical logic in defining “middle class” is not analytically logical.

No. They are adjusting the dollars so that both units (dollars then, dollars last year) are the same. Then you adjust the intervals, for verisimilitude. Look at the bars. Look at the curves.

At has to do with how they define middle income–“two-thirds to double the national median”. So a higher median leads to a bigger spread. That said, I still agree with you that they aren’t comparing apples to apples.

No. A higher median does not lead to a bigger spread. That is not how medians work. A median is a resistant measure of the average. It is much closer to the “real average” than the mean is, especially in data as skewed as U.S. family income.

Yes, mathematically, a higher median leads to a bigger spread (using their definition of middle income).

Their definition of middle income is “two-thirds to double the national median”, or roughly .66x to 2x for a national median of x. That makes the spread 1.34x. Note that x is still a factor in that formula, so the bigger the value of x, the bigger the spread.

What the “demise of the middle class” headline really means is that the curve is flattening out, not that more households are worse off (in fact, the higher median means that more households are better off, at least in dollar terms). What the flattened curve really means is that fewer households are experiencing the exact same situation as other households. What effect this will have on American society as a whole remains to be seen.

Of course, this “household” data hides some things (as pointed out in the article) — one example is that more households now have multiple full-time earners. So an increase in median household income doesn’t necessarily mean an increase in median worker income. Another is that younger earners are making comparatively less (and older folks are even more comparatively better off). These factors are also changing American society, perhaps even more so than the flattening of the curve.

Coincidentally, Jeremy Grantham of GMO delves into the topic of U.S. economic malaise in the final portion of GMO’s quarterly newsletter, beginning on page 17. A couple of excerpts:

If 1997 was indeed the inflection point in the U.S. participation rate, why was that? It’s hard to identify anything in particular that happened then, other than the launch of the final three mad years of the Internet bubble (Bubble I, retrospectively).

Some people dropped formal jobs in order to day trade stocks or flip houses, and it became difficult for them to go back to punching the clock. But this can’t be the whole explanation for our plight today, as American exceptionalists in the hands of an angry god.

Jim,

Good comment, I’ll try to build on what you’ve started.

1997…start of the Asian Crisis! I think a lot of people understate and underestimate the importance of this event. Prior to the Asian Crisis, there was the long fall of the USD which started from the Plaza Accord in the mid 80s and bottomed out right around the start of the crisis. Previously, the USA was able to export to the rest of the world. But once the crisis started, the dollar jumped against all the other currencies of the world as they devalued and tried to export their way out of trouble (the US Treasury, and IMF weren’t interested in other options). Capital from the rest of the world flooded into the US. This period also marks the start of a new era of trade/CA deficits for the US and a new round of de-industrialization as the East Asian countries conquered electronics and computer manufacturing.

I think the rest of the world took the hard lessons from that period and said “the west isn’t going to help us in a crunch, so we need to stockpile massive currency reserves to protect ourselves.” China took the lessons to heart most of all and I think it’s key as to why their policy makers steered their economy towards the model that still exists today.

Related to that, after 1997, I think the core economic model of the world becomes increasingly bubble-centric with each cycle. Starting with the tech bubble, which was mostly US based (and EU to a lesser degree). Then, the real-estate bubble that started in the early 2000s and blew up in several spots around the world. In some places it’s still going.

Hey, I was thinking the same thing, Johnny. This chart (from the Ambrose E-P article about China in today’s links) shows that the US dollar took a mighty leap as the Asian crisis launched:

http://i.telegraph.co.uk/multimedia/archive/03522/dollar_index_3522515b.jpg

And it’s doing it again since mid-2014, as J-Yel tightens while the rest of world plays competitive devaluation.

*sigh*

Maybe we can work as gardeners, trimming the hedges in front of the Federal Reserve Bank (and planting a little cannabis in the flowerbeds, now that it’s legal in DC).

They’re certainly not going to hire us to polish the gold bullion, as (1) they don’t trust us, and (2) probably the gold paint would rub off of the tungsten core.

that gives me an idea for new federal reserve crest/shield design…… three pot leaves in the upper diagonal w/ a gold trimmed tungsten bar in the lower side!

How about NAFTA, folks. Effective in 1994, killed a million U.S. jobs, perhaps 45% of them in high-paying manufacturing industries, affecting hardest Michigan, Indiana, Ohio, Pennsylvania and California. Not to mention the foregone pay raises workers may have gained were it not for their employers being able to hold a “take it or we leave” sword over them.

Do not also forget the free trade deal with China. We had trade with China before but after Clinton negotiated this destroying US manufacturing so Financial Service firms will have the opportunity to open branches in China. In other words, Clinton threw US manufacturing workers under the bus right about this time to enrich his financial buddies. Can you say Ruben!

And yet, it is not an issue for repubs (if the 0.01% is getting richer, I don’t understand what you think is a problem), and scarcely for the dems, who might have to acknowledge that “free” trade IS NOT HELPING!!!!!!!

And I’m sure to the extend a solution is offered, its education…

Since I’m Crazy Horse I don’t hesitate to look back in our history for the basis of a moral revolution. Historically among the tribes of the Pacific Northwest status was not earned by how many canoes or slaves a chieftain owned, but by how big a party he threw while giving away his possessions.

Since it might take a little bit of cultural adjustment to arrive at that standard of value, initially we might have to codify it into law:

1- Every year the richest 500 families in the country shall be required to give away half of their wealth to causes determined by the entire nation’s voters.

2- Penalty for cheating or failure to comply shall be execution by firing squad.

3- Adopting the Potlach system would do wonders for changing the shape of the income distribution curve and converting rentier capital to productive use.

I’m all in with that proposal.

I’m especially keen on the execution for cheats and liars, ie, unrepentant looters.

. . . in the hands of angry gods.

We tried that numerous times between 1917 and 1955. Turns out It doesn’t solve much.

You should read some economic policy history before spouting off.

I would argue that what we need is legal reform of corporations such that boards and shareholders are more responsible for the long term economic health of companies rather than short term earnings, but that would require significant systemic change and the plutocrats in charge aren’t up for that. We’re going to keep going as is till we run head-long into violent revolution followed by socialism.

Have your bug-out bags ready.

how about abolishing corporations entirely….what’s wrong with that?!!

Finally! A plan that might do what is claimed for it!

A welcome proposal.

–Gaianne

According to the Credit Suisse Global Wealth Report, the middle class makes up only 38% of US adults. The poor make up 50%!

https://www.credit-suisse.com/ch/en/about-us/research/research-institute/publications.html

The only real population growth in the US is at the extreme lower end. Nowadays we see fewer and fewer white baby boomers working. For now employers can hold their prices up somewhat because the baby boomers still consume and the employers now can profit because their labor gets less and less money. This will only last until the baby boomers die out. The replacement workforce and the workforce for the future is brown and sees minimum wage as a huge improvement over the situation in their native countries. The US is in the midst of transforming itself into a much lower wage environment for all employers. This study should be combined with a demographic analysis. My suspicion is that the “middle class” is simply dying off to be replaced by third world refugees who are going to earn a lot less.

The millennial generation is larger than the baby boomers, and I’d guess the majority are Caucasian.

Where I live most of the houses around are the definition of “middle class” for England, and it has been a middle class neighbourhood for about a century. You can tell this from the houses types — starting at Edwardian villas with an attic for one (two at the most) live-in maids which would have been the bottom-run of middle class at the time, through to post-war medium sized houses, townhouses, a couple retirement bungalows then some more recent building from the mid-1990’s. Nothing is much over 2000 sq. ft. and most are a little less than that. The majority of residents have lived here for 20+years (until recently, it had an extremely stable population base) and their occupations are, again, what you’d have thought of as being text-book middle class (teachers, local government mid-ranking managers, skilled manufacturing, some semi-skilled such as CNC machine operators but no unemployed households or people who are forced to rely on social security.

Now the most telling part: Of the households with children in their twenties (a mixture of high school only and graduates in an approximately 50/50 mix of the two) none — absolutely none — can afford to live in the same style as their parents did. I will emphasis again, this is not historically 1%’er or even a 10%’er neighbourhood. Up until the last 20 years, it was the middle of the middle. Those will college educations (most have had to return to their parents’ houses, which is a social issue in itself) are having to wait until they — so they hope — get pay significant rises from their starting salaries to find a place which is not so far down the level they have been accustomed to or else move in with a partner (which again is a social issue because relationships are more difficult to sustain if they begin to be forced by the need to find suitable accommodation).

Those with no college degree are having, again, to live with their parents until they can afford somewhere to rent. This sounds ridiculous (the whole point of renting should be that you don’t need to tie up capital or much savings) but because rents are so high this close to London, such a significant portion of their likely incomes will be tied up in rent that they need a cash cushion to survive the inevitable periods where work is not easy to come by and they have to take whatever is offered. Either that or, again, they need to be in a relationship and have someone to split the rent with. But founding a relationship is kind-a hard while living with your folks.

Traditionally, parents might have been able to help their kids with a loan deposit. But many parents already cleared themselves out of their own savings paying tuition fees and the worst excesses of their children’s student loans so they would at least not end up starting out £30-£50k in debt. Even if they hadn’t done that, a 10% deposit comes in at £25k on the sorts of housing which the middle classes expect to be living in — the kids’ parents have been so hollowed out over the last two decades that they don’t have that sort of money lying around. Oh, and even if they did, a £225k mortgage is — rightly — outside of most mainstream lender’s mortgage criteria for those on a “middle class” job/salary combination as huge salary multiples are no longer available.

Even with college educations, while people in their twenties might be fairly able to get a job in London and the Home Counties paying, say, £30k pa. before taxes, they will have travel costs of £3-5k a year which takes a big chunk out of that before they’ve even started. Student loan payments will take another couple of thousand out of pre-tax income. If they live link monks (or nuns), they might just about be able to save £5 to £10k a year. Which means it will be another 5 to 7 years before they can achieve any sort of financial or family-life independence — they’ll be pushing 30 in other words.

Without college, they are facing renting very poor accommodation for the rest of their days, with no viable option to improve their lot.

So it’s RIP the Middle Class, in South East England anyway. If it’s died here, I can’t think where it might still have any hope of being alive. I’ve not even mentioned pension provision here, so old age will hold no succour whatsoever.

The FT piece was a Panglossian interpretation of this reality.

Just wanted to say I appreciated this comment. I see the realness of what you have described in Central Ohio, USA myself. Thank you.

My god, that graph. They could have titled it I Drink Your Milkshake!

https://m.youtube.com/watch?v=a5d9BrLN5K4

I am a former 6-figure earner who has been fighting foreclosure on my house for six years. Right before the last go-round with the bank, I lost the job I got in 2010 (after a year and a half of unemployment.) So, rather than getting a job, I fought the foreclosure pro se for two years.

Just got new employment and am earning $14/hr.

BTW, my former career was marketing to architects. The gal in Atlanta is crazy to think that the newest construction boom will keep her employed. During my employment in 2010, I would ask architectural firms how the Greatest Depression affected their office. Most never responded to that question, however I will never forget one pricipal replied, “Eight out of our ten employees lost their homes to foreclosure.”

You just can’t bounce back after losing everything in middle age.

Why are you fighting to keep your house? If its worth more than you owe, you can sell. If not, you are probably better off mailing your mortgage company the keys and walking away.

Well, I imagine it’s more about the principle than the principal.

And there are the matters of credit rating and equity in the house. And for many people a house is their home (neighbors, friends, cultural history, etc.).

Well it could be that the creditor no longer has a legal right to the property–which is really common these days–but are trying to ram a foreclosure through the courts anyway–which is also super common. For some odd reason judges seem inclined to go along with this scam unless the property owner puts up a long, arduous fight. Blows my mind too!

Damn those neo-liberals, damn them to hell!

America’s middle class has shrunk to just half the population for the first time in at least four decades as the forces of technological change and globalisation drive a wedge between the winners and losers in a splintering US society….

FT might be better than Pew but it’s still tech change and globalisation, not politics and certainly no active agents, doing the ruining.

It is easily fixed but politicians refuse to recognize this and political parties and special interests actively mislead the public to think it IS just the way it is and cannot be changed.

1. The right to be a corporation is NOT writ in stone nor is it written as an ironclad right in the US Constitution. Incorporation is a PRIVILEGE offered by government, not a REQUIREMENT. The rules can, and must be changed:

a) Refocus towards the view of the Founders with regards to corporations so that they are of limited duration, rather than perpetual looters. They MUST re-incorporate after some period of time, paying a fee for the privilege AND, this is KEY: they get dissolved if they break the law AND the corporate officers are personally legally responsible for corporate wrongdoing.

b) Corporate taxes CAN be reformatted to discourage offshoring AND paying outrageous incomes to dead weight CEOs at the top: Tax a corporation MORE for every job off-shored AND tax a corporation more based on the gap between top compensated executive to average worker pay in the corporation. Set the sweat spot at a 70 to 1 differential, MAX. In other words, any compensation to any executive in a corporation that sends their TOTAL income above 70x the average actual income for that corporation’s workers (temps and such count as de facto EMPLOYEES). Corporate taxes go up too for every worker off-shored above 10% of the total corporate work force. You WILL benefit the country that allows you to exist or you will be taxed out of existence, your assets (corporate AND personal) seized, and used to compensate the taxpayers.

3. Penalize, HEAVILY, corporate inversions AND make them impossible without heavy cost. A smaller entity cannot buy a larger entity, so the larger entity CANNOT transfer headquarters to the country of the smaller entity. ANY corporate that DOES expatriate will pay a heavy exit fee and will see whatever their product is taxed upon import and sale for perpetuity.

…and tax policy. Read David Cay Johnston. Tax policy is politics.

In 1997, some guy wrote this about the effects of globalization:

If a vanishing middle-class is the price that needs to be paid for the triumph of Econ 101, so be it. /s

The ONLY reason these corporate scum downsize is to artificially drive up “productivity” numbers, not real growth in anything, just productivity (because fewer workers NOW have to do the work of 3, and THAT for less pay than before! Instant explosion in productivity!). This only serves to bump up share prices which don’t actually reflect anything of value or even approach reality on its own terms. They get to say, “See? Massive increase in productivity, so pay me a bazillion damn dollars in ‘bonus'”.

Every pay cut, every job loss should be legally tied to a requirement to lay off a proportionate number of execs AND a proportional cut to top pay and compensation. The income of the top MUST be hard-locked to pay for workers. Worker pay and compensation decreases, then so MUST executive pay and compensation.

“If a vanishing middle-class is the price that needs to be paid for the triumph of Econ 101, so be it.”

Open ended process with zero accountability for anything and an excuse for any systemic disaster after the fact is why Econ101 is an irresponsible pile of *&%$. The bridge fell down on 35W because the invisible hand of gravity did it and that’s OK with the civil engineering department and MNDot?

538 has posted a doltish analysis claiming that this is all a big misunderstanding.

What do you expect from someone who started his excruciatingly boring book The Signal and the Noise with a long testimony to his “belief” in free markets? 538 is a faith-based blog.

In response to Steve Gunderson:

So you would like me to be like threst of American lemmings and let the bank win?

I salute you with my middle finger, Dude.

We, foreclosure fighters, are the only Americans standing up to the fake fiat system, in which the bank cannot even show the accounting of which “mortgage company” should be handed the keys if I should decide to walk (your ignorant solution, not mine.)

How does the bank win?

If he owes more than the house is worth the bank books a loss.

I fail to see the emotional attachment to a house. Its just a bunch of lumber.

You do not understand how money is created and exactly what a bank, near bank or credit corporation does. Mortgage money is created out of thin air by moving a bank balance up ie. – a $100k mortgage is supplied by having the property owner open an account and the financial institution simply moves the balance in the account up from zero to $100k and gives the borrower a cheque book. So assuming the ‘bank’s’ straight up expenses for the loan were $2k, if the borrower only repays $50k the ‘bank’ will only profit by $48k because the $100k loan was not taken from anywhere and does not need to be “repaid” or “replaced” by the ‘bank’. Henry Ford said that if Americans realized how the money system works there would be a revolution before morning. Keeping Americans ignorant about money creation IS “The Big Lie”!! When the bank repossesses a home for non payment its costs are only paperwork and employees necessary to make the loan and repossess the home – NOT the principal amount of the loan.

The obvious solution to any circumstance where no one can show what bank or entity actually holds title to a house is…to award the title to the home occupants/mortgagee.

No paper, no house. House goes to the person paying the mortgage, or expected to pay the mortgage.

Do that a few dozen times and you’d see and end to the nonsense chopping up of mortgages into thin slices that then get scattered all over the place. Simply REQUIRE the mortgage lender to HOLD THE NOTE. The note cannot be subdivided, it can be sold to another but it cannot be broken down into any mashup “security” or other “innovation” (what bullcrap THAT is…not an innovation).

The mortgage thing is very silly indeed. We have an entity that we know how to slice in fine slices. Corporations and shares would have served perfectly to equally divide ownership of a set of mortgages. That they come with responsibilities attached is tough beans… Society has no particular obligation to honor ownership rights that the owners themselves can’t be bothered to keep proper track of.

Oh Steve, btw, it really irks me to hear many people worldwide talking about the poor Syrian refugees that are homeless. When these same people cannot connect the dots to the economic war being waged by the collusion of the criminal financial industry and the western governments to render millions of their own citizens homeless. And the same people feeling sorry for the Syrian refugees tell their own fellow neighbors to “send in the keys” and surrender the war.

You keep fighting, perpetualWAR. I applaud your courage.

The subject is income, but I am surprised that so few of the comments have mentioned other

things like the astronomical costs of college and professional education. And, a host of other

costs that eat at one’s income. Would be interesting to see 1971 and 2015 graphs of these items, individually or in some aggregated form.

Here is an interesting report which would answer some of the questions you may have:

http://trends.collegeboard.org/sites/default/files/trends-college-pricing-web-final-508-2.pdf

Frederick Soddy, WEALTH, VIRTUAL WEALTH AND DEBT, p. 78

ibid, p. 102

Ferdinand Lundberg, “America’s 60 Families”, The Vanguard Press, New York, 1937, p. 7

Multiply that ‘wealth’ by the leverage a country’s bankers are able to create with fractional reserve lending and you get:

http://michael-hudson.com/2010/10/why-the-imf-meetings-failed/

America’s and Europe’s middle class is dying because:

a. time marches on. We don’t need armies of workers laboring day and night to create REAL, NEEDED wealth

b. the world’s 0.01% would rather continue “doing God’s work” than share the wealth created by advances in science and technology with their “laboring cattle”. A leisure class with a genuine clue about what real needed wealth is and what is really happening in the world constitutes a genuine threat to the established order and to all that ‘wealth’ the 0.01% has piled up in the form of money. (See graph above)

All those jobs this country has off-shored with all the technology and education it takes to perform them ARE real wealth – along with things like renewable energy.

If it really is such a big surprise that countries like China are becoming relatively more wealthy and powerful than the U.S. then the world’s rich really are as stupid as many of us believe they are.

Well, I’ll throw in a socialist comment and hope I’m not flamed.

Isn’t it the case that everyone needs a roof over their heads, food and clothing? Perhaps a bicycle too. These things and free education are the minimum a government should supply to its people.

One reason that those 18-29 have seen the greatest slide in income is that so many more are in school now than in 1971. They aren’t generating income, or at least very little.

Clive’s comment about kids not being able to buy houses in the neighborhoods they grew up in is very much on point. The same phenomenon can be observed here in the US, partly, according to Elizabeth Warren in ‘The Two Income Trap,’ because we can’t seem to solve our education problem. People pay up to live in good school districts.

Both the left and the right have the idea that they way to improve the affordability of housing is by giving more tax breaks to builders of low income housing, but this is only a partial and greatly inadequate solution. The only enduring solution for our housing problem is for it to become cheaper across the board, the same way that education and health care have to become drastically cheaper in order to right those ships.

I don’t think the middle class shrinking because some people are making more money is necessarily a bad thing. I only wish the upper middle class would not seize state resources to favor their own kids with superior educational opportunities, as they do in my state. It’s a situation where the public pays for stuff, courses, and extracurriculars. Every kid theoretically has the opportunity to use them, but only the upper middle class are in a position to take advantage of the opportunities.

Even though I’m certain PEW significantly under-states the severity of the hit taken by working people, it’s nonetheless perfectly evident the reason the 1% was able to get away with mammoth looting was that it paid off for all of the ‘upper-income’ group and the top end of the middle-income group – without which TPTB truly would be broken.

It has been assumed by the liberal-left for well over a century that public education would not only propel incomes (somewhat as we see) but also, would lift up the social sensibilities of tomorrow’s leaders and elite as a whole, something which seemingly proved true until at least Reagan, when the Right took dead aim at liberal education itself.

It shows.

The Middle-Class Shrunk MUCH MORE than Pew Claims

http://bud-meyers.blogspot.com/2015/12/middle-class-shrunk-more-than-pew-claims.html

America was a young country full of opportunity, like China a decade or two ago.

As a nation matures the wealth concentrates without strong progressive taxation and high inheritance taxes.

Now US social mobility is on a par with the UK, putting it at the second lowest in Europe which is pretty bad.

Our privately educated elite are an obvious cause of low social mobility in the UK and perhaps private universities are doing the same job in the US.

If we want equality of opportunity we should think what a meritocracy would look like.

“What is a meritocracy?”

1) In a meritocracy everyone succeeds on their own merit.

This is obvious, but to succeed on your own merit, we need to do away the traditional mechanisms that socially stratify society due to wealth flowing down the generations. Anything that comes from your parents has nothing to do with your own effort.

2) There is no un-earned wealth or power, e.g inheritance, trust funds, hereditary titles

In a meritocracy we need equal opportunity for all. We can’t have the current two tier education system with its fast track of private schools for people with wealthy parents.

3) There is a uniform schools system for everyone with no private schools.

Thinking about a true meritocracy then allows you to see how wealth concentrates.

Inheritance and trust funds are major contributors.

When you start off with a lot of capital behind you, you are in life’s fast lane.

a) Those with excess capital invest it and collect interest, dividends and rent.

b) Those with insufficient capital borrow money and pay interest and rent.

If the trust fund/inheritance is large enough then you won’t need to work at all and can live off the rentier income provided by your parents wealth and the work of an investment banker.

If you are in life’s slow lane, with no parental wealth coming your way, you will be loaded up with student debt, rent, mortgages and loans.

To ensure the children of the wealthy get the best start we have private schools to ensure they get the best education and make the right contacts ready for the race of life.

The children of the poor are born in poor areas where schools are typically below average and they are handicapped before they have even started the race of life.

Wealth concentrates because the system is designed that way.

A meritocracy gives everyone equal opportunity but that is the last thing those in charge want for their children

It is easier to see what is going on if we put things in a historical perspective.

Is Capitalism the first social system since the dawn of civilisation to trickle down?

Since it is based on self-interest this seems highly unlikely.

It would be drawn up in the self-interest of those that came up with the system, i.e. those at the top.

The 20th Century saw progressive taxation to do away with old money elites and so looking at the playing field now can be rather deceptive.

Today’s ideal is unregulated, trickledown Capitalism.

We had unregulated, trickledown Capitalism in the UK in the 19th Century.

We know what it looks like.

1) Those at the top were very wealthy

2) Those lower down lived in grinding poverty, paid just enough to keep them alive to work with as little time off as possible.

3) Slavery

4) Child Labour

Immense wealth at the top with nothing trickling down, just like today.

The beginnings of regulation to deal with the wealthy UK businessman seeking to maximise profit, the abolition of slavery and child labour.

At the end of the 19th Century, with a century of two of Capitalism under our belt, it was very obvious a Leisure Class existed at the top of society.

The Theory of the Leisure Class: An Economic Study of Institutions, by Thorstein Veblen

The Wikipedia entry gives a good insight.

This was before the levelling of progressive taxation in the 20th Century.

It can clearly be seen that Capitalism, like every other social system since the dawn of civilisation, is designed to support a Leisure Class at the top through the effort of a working and middle class.

After the 20th Century progressive taxation the Leisure Class probably stay hidden in the US. In the UK, associates of the Royal Family are covered in the press and show the Leisure Class are still here with us today.

It was obvious in Adam Smith’s day.

Adam Smith:

“The Labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

With Capitalism it’s better hidden:

The Rothschild brothers of London writing to associates in New York, 1863:

“The few who understand the system will either be so interested in its profits or be so dependent upon its favours that there will be no opposition from that class, while on the other hand, the great body of people, mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear its burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests.”

Everyone works in their own self interest even economists.

Malthus – supports the vested interests of landlords and so finds nothing wrong with parasitic landlord rent extraction.

Ricardo – supports the vested interest of bankers coming from a banking family, sees problem with feudal landowners but not bankers that create money out of nothing

The Austrian School – Austrian aristocrats, of the European Leisure class, support investor’s interests. Anti-Government as they are trying to do away with the old European aristocracy. Give preference to those with money:

You are free to spend your money as you choose.

No money, no freedom.

Money is freedom.

Most classical economists differentiated between earned and unearned wealth.

The Austrian Aristocrats benefit from inherited wealth and hide the distinction.

As members of the European Leisure class, they liked to invest and make money from the hard work of others while doing very little themselves.

A monetary system devised by bankers where they create money out of nothing and lend it out charging interest to make a profit.

When you come up with a system you make sure it works for you.

How is the legal system loaded?

Why do people use expensive barristers/legal teams?

It increases your chance of winning the case.

What if you can’t afford expensive barristers/legal teams?

You decrease your chance of winning the case.

It’s loaded.

Our current wealth distribution is more the product of meritocracy than of inheritance. Harvard decided to go meritocratic back in the ’50s. The average IQ of the incoming freshman class skyrocketed. There were still legacies, of course, but the whole Ivy League opened up to highly motivated, highly intelligent strivers. The result, in my view, and in the views of ‘The Bell Curve’ and ‘The Revolt of the Elites’ was a cognitive elite taking all the best jobs. Ivy league dominance of the most desirable positions in the FIRE sector, government, and the judiciary is far more pronounced today than it was in 1950.

What would the smartest strivers of the last sixty years have been doing if they hadn’t gone to the Ivies? For one thing, they’d probably be living in the Heartland, or wherever they were from. They might have gone to a local college. IQs at local schools have dropped as IQs at the Ivies have risen. They might have worked at a union job. Losing people in the top 1% of intelligence to the Goldman Sachs and McKinseys of the world has been a terrible blow to those segments of society whose interests needed to be protected from unfettered capitalism.

I wish the terminal lefties here at Naked Capitalism would stop trotting out the tired old horse of wealth being perpetuated across generations. By and large, in the United States, it is dispersed over time. Europe may be a different story. There are still wealthy Fuggers, etcetera. But in the US it tends to get dispersed. Only one member of the Forbes 400 of which I am aware has a tie to a great 19th century fortune: David Rockefeller, and he worked at Citigroup. See Rob Arnott’s take on wealth dispersion, and Dr. William Bernstein’s.

“I wish the terminal lefties here at Naked Capitalism would stop trotting out the tired old horse of wealth being perpetuated across generations. By and large, in the United States, it is dispersed over time.”

There is a very narrow sense in which this is true. We do not enforce a system of male primogeniture among a landed aristocracy here in the United States. The fact that some of my ancestors once owned large estates, in New Holland and New York, doesn’t entitle me to life as a lord of the manor today. What it did do for me however, was give to my maternal grandparents the easy circumstances necessary to pursue their own interests with no desperate struggle for survival. This allowed my parents to pursue careers in philosophy and linguistics. My generation saw my brother become a physicist and myself a medievalist. We will never be as wealthy as our great-great grandparents were. Yet, because of their wealth, (even much dispersed over time) we were given opportunities to pursue interests that are simply not often available to many others.

I always hear how Bill Gates was a “self-made” man. Really? His mother, Mary Maxwell House Gates was on the board at First Interstate Bank of Washington, and his father William H. Gates, II, was a wealthy attorney and philanthropist.

I know that not all DuPonts, Rockefellers, Whitneys, Vanderbilts, Sharpes, Hutchinsons, Van Rensselaers, etc. are super wealthy today. Yet the vast majority of them are at least comfortable, just as Bill Gates would have been– even if he had never worked a day in his life.

You don’t seem familiar with the actual data. The US is more unequal than any other major industrialized nation on the planet. By a lot. And it’s not a leftist thing. When Americans are surveyed about their desired wealth distribution, the mainstream – not leftist – viewpoint is that the ideal distribution looks roughly like Sweden.

Also, in a meritocratic society, the socioeconomic status of the parents would have no material impact on the child. In the US, by contrast, the parents are highly predictive of the child. Google the general term social mobility if you are interested in this. For example, we can predict that some kids will be arrested by police more than others simply by looking at the zip code of the parents at the time of birth. Stuff like that is nuts and completely incompatible with a merit-based hypothesis.

I think I’m pretty familiar with the data, Washunate.

http://www.researchaffiliates.com/Our%20Ideas/Insights/Papers/Pages/359_The_Myth_of_Dynastic_Wealth_The_Rich_Get_Poorer.aspx

I am saying that the meritocratic turn that the education system in the US took in the 1950s has been a negative for working people, because it has diminished the quality of their leadership. Individuals that better themselves may in fact be hurting the class that they are leaving by leaving. It is a particularly American illusion to believe that choices that help the individual might not be harmful to the group.

It is hard to compare the US and Europe, because the Europeans are so much poorer than we are. My French mother-in-law is adamant on this point.

Parents will always be the most powerful influence on their children, and yes, their socioeconomic status is important for the child’s outcomes, too. I imagine this to be true everywhere in the world.

Ulysses: I’m not saying that it isn’t advantageous to have had wealthy ancestors, just that the pile of money is likely diminishing if you had wealthy ancestors and are an American. Somehow, the Europeans are more likely to hang on to it, probably because they don’t give as much to charity.

Does Research Affiliates generate product that isn’t just a Rob Arnott axe-grind? Because I haven’t seen much of anything that wasn’t toeing the Rand Paul of Club for Growth line.

As Arnott points out, the three authors of this study come from different political perspectives. Bernstein is a Democrat, Wu a moderate Republican.

Social mobility in the US is about the same as the UK and its bad.

Within Europe the UK has the second lowest social mobility.