Yves here. This post is written in economese, but it clearly depicts the oil price decline of recent years as being the result primarily of “expectations,” which one can regard as a combination of “deflationary expectations” and “greater financialization of oil pricing”.

By Domenico Favoino, Research Assistant in the Energy and Climate Policy area at Bruegel, and Georg Zachmann, a Senior Fellow at Bruegel, as well as a member of the German Advisory Group in Ukraine and the German Economic Team in Belarus and Moldova. Originally published at Bruegel

Oil prices fell to a 12-year low at the beginning of 2016. We find that the drop in the past two years was primarily driven by expectations. In fact, changes in oil prices since 2008 are increasingly explained by expectations. In the past, expectation-driven oil prices drops were good news for the EU economy. However, the declining importance of actual changes in demand and supply for oil prices raises doubts about whether we can still expect a positive impact on EU GDP.

By February 2016, the price of oil had fallen to about 30 USD —from about 100 USD per barrel in 2014. There are three possible causes: real changes in supply, real changes in demand and changes in expectations regarding the future oil demand-supply balance.

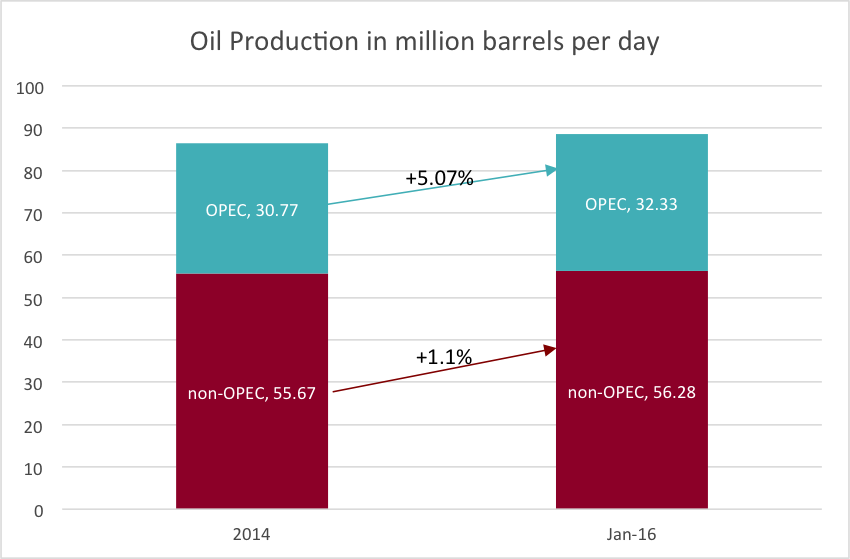

Oil supply continued to increase in 2015, as US shale oil production was more resilient than previously thought, and countries like Iran returned to the market. In addition, OPEC, a cartel of oil exporters, is not restricting supply. As a result, at the end of 2015, oil production had increased by about 3 percent compared to the 2014 average: from 86 to 88.5 million barrels per day. The International Energy Agency foresees that the world will be “awash in oil” in the near future[1]. This increasing supply put downward pressure on oil prices.

Figure 1: oil production 2014 vs. January 2016 in million barrels per day

source: OPEC

Currently aggregate demand is sluggish. Growth in emerging market economies is slowing and macroeconomic risks in developed countries persist. This reduces oil demand and hence puts additional pressure on oil prices. Finally, price developments are not only explained by changes in real demand and real supply, but also by market actors’ expectations about the future demand-supply balance.

The impact of lower oil prices on the EU economy depends on the relative importance of these three drivers. We find that in the last three years about 12% of the oil price decrease can be attributed to a fall in aggregate demand and 15% to an increase in current oil supply. 73% of the price drop can be attributed to expectations about the oil demand and supply balance. This is the finding of an analysis based on Kilian (2009), where we decompose oil price shocks into these three elements by estimating a structural VAR model in which the oil price reacts – with some delay – to changes in monthly oil supply and a measure of economic activity. Essentially, we update the analysis of Kilian and apply it to the EU economy.

Figure 2: Aggregate oil price shocks from 2000 until 2016

Source: own calculation

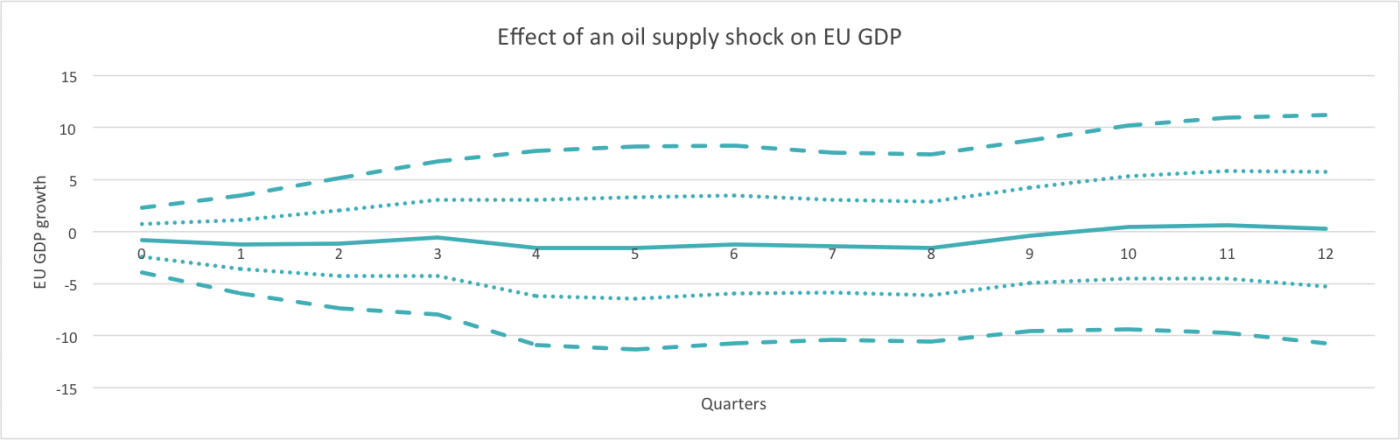

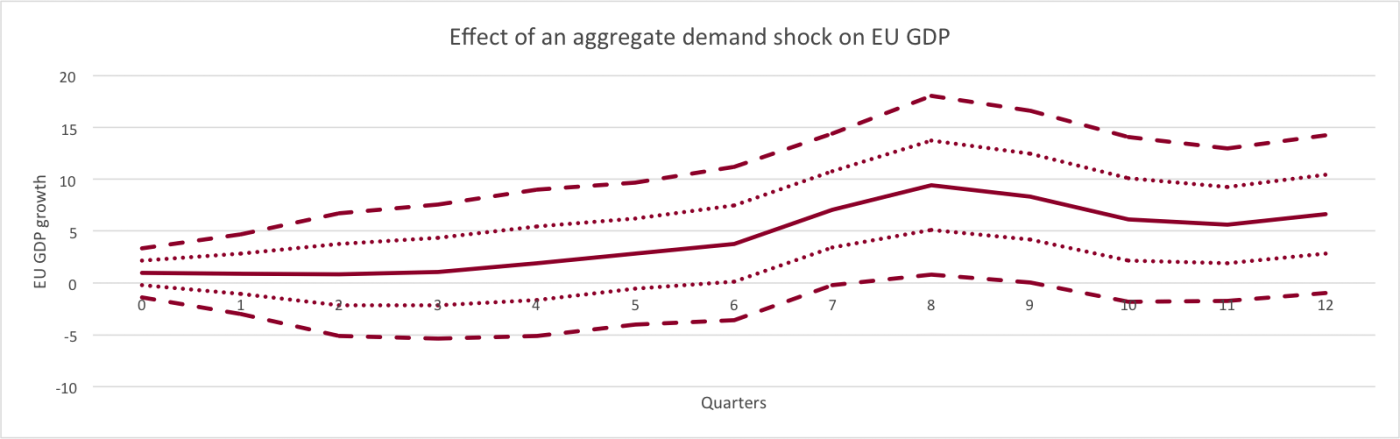

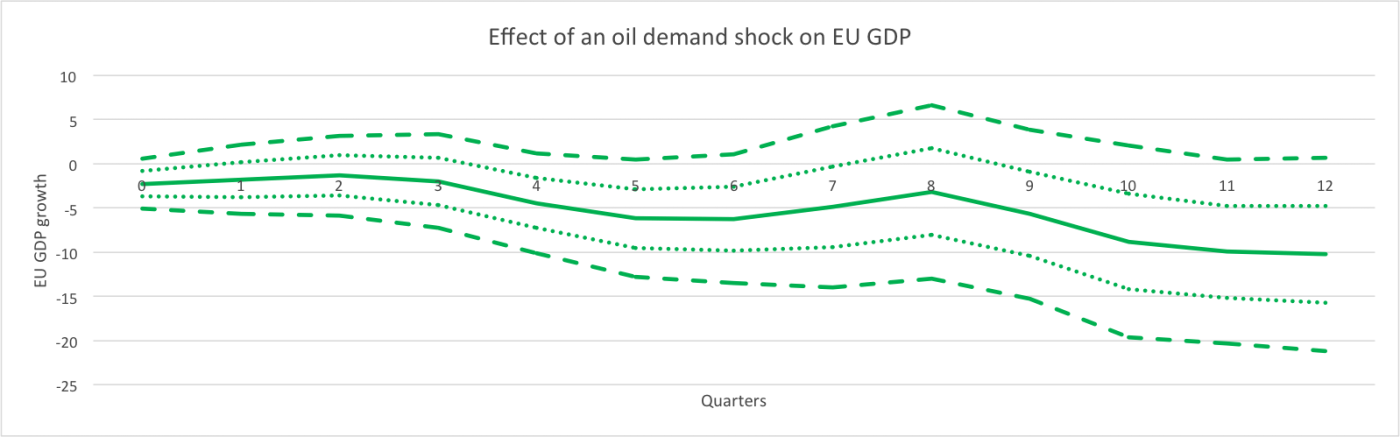

What does this imply for the EU economy? Past experience has shown that the three components have structurally different impacts on the economy (see graph):

- A supply shift has no significant impact on EU GDP within the following three years. Hence, the impact of increasing supply in 2015/2016 should not boost GDP.

- Higher aggregate demand, that also caused oil prices to rise, let to even higher GDP 18 month later. Hence, the lower aggregate demand that caused oil-prices to decrease in 2014 and early 2016 should have a depressing effect on GDP – while the positive demand shock identified for 2015 should have an inflating effect on GDP. Overall, the magnitude of the negative aggregate demand shock should prevail.

- Finally, expectations regarding the future oil demand-supply balance which drove down oil prices used to have a positive impact on GDP. Consequently, the observed lower oil prices, which are primarily driven by such expectations, might well be a good sign for the EU economy.

Figure 3: Effect of oil price shocks on EU GDP growth; GDP is measured in USD, seasonally adjusted and expressed in log differences

Source: own calculations

Note: relative q-o-q percentage change of GDP due to a 1 percent change in oil price due to a supply/demand/expectation shock. The solid lines correspond to pint estimates; dotted and dashed lines identify one- and two- standard error bands, respectively.

The most striking result of this decomposition is that the role of expectations has dramatically increased since 2008. The data imply that that it is very unlikely (less than 5% probability) that oil prices after 2008 are driven by the same combination of factors as before 2008. In fact, expectations regarding the future oil demand-supply balance seem to have become the main driver of oil price changes. This would be consistent with a hypothesis that oil markets are becoming more detached from observable supply-and-demand fluctuations (one possible explanation being loser monetary policy).

In conclusion, the observed drop in oil prices should have a slightly positive in pact on the EU economy. However, this prediction presumes that past relations between oil demand, oil supply, oil prices and GDP still hold. In fact, the structural increase in the importance of expectations in oil price formation raises doubts about the stability of these past relations. The true impact of the oil price drop therefore remains to be seen — and could prove disappointing in the end.

Acknowledgement:

Very helpful comments by Zsolt Darvas are gratefully acknowledged. All remaining mistakes are the author’s sole responsibility.

[1] https://www.iea.org/oilmarketreport/omrpublic/

Yves, did you see that California filed a lawsuit on behalf of CALPERS against Morgan Stanley for misrepresenting the quality of the mortgage loans causing CALPERS to lose millions?

But of course, no call to stop the unlawful foreclosures associated with the unlawful origination and deceptive practices targeting homeowners.

Pricing is at the margins – I think what this analysis misses is the effect of small shifts in supply on oil prices – the invasion of Iraq, for example, took 2 million BPD offline for several years – look what happened to oil prices in 2007 ($160 Bbl). IMHO a major contributing factor to the crash – not only Wall St.

At one level of analysis, the invasion of Iraq resulted in the oil majors making the largest profits ever made by any corporation in history. And drove the country into recession. It’s hard not to conclude that this was an unspoken reason for the invasion by a cartel that took over our government. Consider the final year comp for the retiring CEO of BP prior to the crash – $487 million! It’s pillage.

(one possible explanation being loser monetary policy)

The truth, even if it’s by accident!

Is there a way we could get financiers (and cartels) to develop expectations of fairness, equity and public (not private) investment in infrastructure?

Then we could sing to them,

“All of me…,

Why not take all of me.

Don’t you See,

I’m no good without you…”

structural increase in the importance of – hope – in oil price formation raises doubts about the stability of these past relations.

There, fixed it

In other words, there is no way of telling what’s going to happen until it happens. (The first -and only- law of economics.)

Interesting post. Presumably “Expectations” = Crude Oil Futures Contracts. If so, who controls the price of Oil futures contracts and made the decision to throw the Bakken under the bus, along with more than a few sovereign nations who rely to a significant degree on oil exports economically and to maintain domestic political stability?

Role of demand suppression from high levels of consumer debt, China’s economic slowdown, ongoing fallout from the 2008 financial collapse, neoliberal government austerity policies, improvement in energy efficiency, emergence of renewables, and other factors were understated here IMO.

In the past here has also been a variable time lag between low oil prices and rising levels of economic activity.

But maybe this development is overall not such a bad thing given global warming considerations.

CG, I was thinking something similar, that “expectations” is the euphemism for speculation in the futures markets, which, as most know from this site, is now dominated by investor-speculators. The model they used refers to Killian who is one of the handful of academics who try to refute anyone who argues speculators have influenced oil (and other commodity) prices.

My own take (anyone interested can read it here) is there was a series of bubbles generated from the futures market that created the belief higher oil prices were here to stay.

Interesting blog post. Thanks, TiPS.

Noted your article was written before the Central Banks-Primary Dealer cartel renewed pumping equities on February 11 IMHO. Jury is out on whether they’ve jumped the shark. Also, whether they care.

‘The observed drop in oil prices should have a slightly positive impact on the EU economy.’

Probably true. But likely there’s a “J-curve effect.”

That is, the initial deflationary shock hikes corporate bond spreads (driven by the energy sector) and feeds recession fears. Such fears encourage investors to seek the safe haven of government bonds, at the expense of stocks and credit bonds.

Later as confidence returns, the beneficial effect of lower energy costs (including bolstered consumer demand) can actually be realized.

Arguably, Jan-Feb 2016 constituted the bottom of the “J.” We’ll see.

Are demographics collapsing faster than the critters can spawn artificial demand, leaving producers to ramp production on falling demand, to maintain sunk asset prices, now the basis of bank balance sheets, getting worse by the day?

Funny, Russia keeps finding more gas and oil, and Putin is a practical money changer, promoted accordingly over decades, surviving all other political leaders installed before him. It’s like Russian Roulette in a circle, and Putin keeps providing more bullets.

The fact oil price is almost 75% financialized with oil at $100 /bl would naturally cause one to expect efforts to restore those lucrative conditions.

Substitution.

Not one word about it.

Oil has to drop 10-20% a year just to stay competitive with solar. Most new energy generation in the last year was renewables. It’s starting to decouple oil from GDP.

Where’s the analysis on that?