It been remarkable to witness the casual way in which central banks have plunged into negative interest rate terrain, based on questionable models. Now that this experiment isn’t working out so well, the response comes troubling close to, “Well, they work in theory, so we just need to do more or wait longer to see them succeed.”

The particularly distressing part, as a new Wall Street Journal article makes clear, is that the purveyors of this snake oil talked themselves into the insane belief that negative interest rates would induce consumers to run out and spend. From the story:

Two years ago, the European Central Bank cut interest rates below zero to encourage people such as Heike Hofmann, who sells fruits and vegetables in this small city, to spend more.

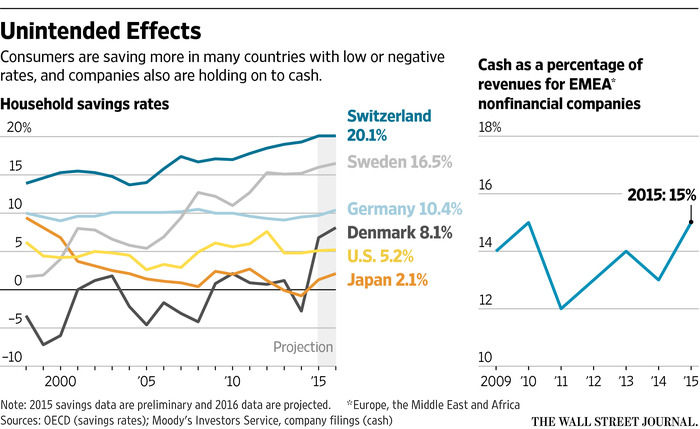

Policy makers in Europe and Japan have turned to negative rates for the same reason—to stimulate their lackluster economies. Yet the results have left some economists scratching their heads. Instead of opening their wallets, many consumers and businesses are squirreling away more money.

When Ms. Hofmann heard the ECB was knocking rates below zero in June 2014, she considered it “madness” and promptly cut her spending, set aside more money and bought gold. “I now need to save more than before to have enough to retire,” says Ms. Hofmann, 54 years old.

Recent economic data show consumers are saving more in Germany and Japan, and in Denmark, Switzerland and Sweden, three non-eurozone countries with negative rates, savings are at their highest since 1995, the year the Organization for Economic Cooperation and Development started collecting data on those countries. Companies in Europe, the Middle East, Africa and Japan also are holding on to more cash.

The article then discusses that these consumers all went on a saving binge..because demographics! because central banks did a bad job of PR! Only then does it turn to the idea that the higher savings rates were caused by negative interest rates.

How could they have believed otherwise? Do these economists all have such fat pensions that they have no idea what savings are for, or alternatively, they have their wives handle money?

People save for emergencies and retirement. Economists, who are great proponents of using central bank interest rate manipulation to create a wealth effect, fail to understand that super low rates diminish the wealth of ordinary savers. Few will react the way speculators do and go into risky assets to chase yield. They will stay put, lower their spending to try to compensate for their reduced interest income. Those who are still working will also try to increase their savings balances, since they know their assets will generate very little in the way of income in a zero/negative interest rate environment.

It is apparently difficult for most economists to grasp that negative interest rates reduce the value of those savings to savers by lowering the income on them. Savers are loss averse and thus are very reluctant to spend principal to compensate for reduced income. Given that central banks have driven policy interest rates into negative real interest rate terrain, this isn’t an illogical reading of their situation. Ed Kane has estimated that low interest rates were a $300 billion per year subsidy taken from consumers and given to financial firms in the form of reduces interest income. Since interest rates on the long end of the yield curve have fallen even further, Kane’s estimate is now probably too low.

Even though central banks so far have tried to shield retail savers from the impact of negative interest rates, which would amount to an actual haircut of their holdings, they can anticipate that that might come next. The idea of keeping money outside the banking system to avoid that is also unsettling to a lot of people.

The second effect is that of inflation signaling. Again, consumers are reacting correctly to the message central banks are sending. Negative interest rates signal deflationary tendencies and that central banks think deflation is a real risk. And what is the rational way to behave in deflation? Hang on to your cash, because goods and services will be cheaper later.

Put it another way: How could economists possibly think that consumers would behave the same way in inflationary/deflationary times as they do during times of high inflation? In the mid 1970s, when inflation was running at 6-7% a year, I’d get a college spending allowance at the beginning of the school year from my parents. 6-7% was high enough inflation to lead me to buy everything I needed right away because my money would go further in September than the following May. Why would the officialdom expect people to behave the same way with the opposite fact set?

Yet here we have what passes for the policy logic:

Low interest rates should encourage consumers and businesses to spend by depressing returns on savings and safe assets such as government bonds. Such spending should create demand for goods, help lift sagging inflation and boost economic growth.

Earth to economists: savings and spending may look fungible to you because they are alternative uses for income but they serve very different functions. Once people have put enough away that they have a good reserve for emergencies and enough to have a comfortable retirement, then saving and spending can be regarded as close substitutes. But in the US, with safe income on investments running below inflation levels, and Medicare being actively crapified (for instance, a 70 year old friend with a bad leg break is having to pay for $25,000 of expenses in a rehab facility herself), a retirement-aged couple would need over $3 million in liquid assets to allow for 20-30 years of living expenses and possible medical costs. How many are in that boat?

Now perhaps this rationalization was simply central bank patter for wanting to depress the value of their currency and spur growth through more exports. Thus, the idea that consumers might spend more was just a convenient cover for their real aim that some economists who were not clued in took seriously. But whatever the cause, the central bank hallelujah chorus regularly claimed has been made that negative interest rates will lead consumers to run out on a shopping spree. The one bit of good news in this article is that the Bank of England is not persuaded, and even though the Fed has admitted it might take up the negative interest rate experiment, it remains keen to raise rates. Mind you, it’s not clear that this skepticism is due to greater intellectual rigor. Banks have lost safe sources of earnings with zero and negative interest rates, and are increasingly pressuring central banks to increase interest rates, even though they’ll take hits during the adjustment period.*

John Maynard Keynes said, “f economists could manage to get themselves thought of as humble, competent people on a level with dentists, that would be splendid.” He should have carried that thought out to its logical conclusion, that economists should be licensed. That way, they could be cast out of the discipline for malpractice. That sort of sanction would do a lot to reduce policy misfires like this one.

____

* Banks are structurally long financial assets; there isn’t remotely enough hedging capacity with credible counterparties for even a single TBTF bank to go net short its entire balance sheet. The best they can do is skinny up their exposures and minimize their holdings of long-dated assets. Thus, for example, the recent complaints about the lack of liquidity in the bond markets, which is being blamed on Dodd Frank, may be much more to do with banks minimizing their holdings of risky assets of all sorts now that the Fed is halting engaged in tightening.

The central banks can drive interest rates deeply negative, but the peasants see none of that. Credit card rates are astronomical, and once they have you in their vicious leg hold trap, will bleed you till death and then pursue your corpse.

Do these economists all have such fat pensions that they have no idea what savings are for, or alternatively, they have their wives handle money?

Exactly. The useless eaters think everyone leads a life of leisure just like they do, and their throne at the policy table reenforces their conceit.

There are no negative interest rates anywhere that I can see that people can get hold of.

When TBTF banks get around to paying joe six pack money every month if he takes out a mortgage then I’ll believe in negative rates.

Charging people to park money in a savings account is just another fee. It’s not negative interest rates.

The spread between loan interest paid by me and savings rates paid to me needs to invert before I buy into any of this.

There must be somebody somewhere who will run out and spend because of low/negative rates.

And conversely, there are obviously those who will do the opposite as retirement becomes a tougher nut to crack.

All you have to do is count heads and estimate the dollars influenced by the countervailing incentives.

So where’s the research program? How hard can it be?

If it wasn’t so important, you could laugh at the fed and other central bankers…Half of them arguing that we need to keep rates low to boost the economy and the other half arguing that they need to raise rates to prevent inflation. Well we’ve had rates near zero for years and we haven’t seen much of either. There’s been little growth in the economy (though the stock market has been goosed) and little sign of inflation. But when your only tool is a hammer, everybody is wearing a nail-shaped hat. They are predisposed to believe that the interest rates that THEY set are an important influence on the economy, despite strong evidence that this is not currently the case. Because the alternative is that they are mostly powerless to do anything about the lingering effects of the great recession. So they continue to argue incessantly about boosting growth vs inflation risks instead of figuring out what is REALLY wrong and if anything can be done about it.

Great comment.

There is massive inflation in food, but of course since CPI doesn’t include food then there’s no official inflation.

Sugar and coffee used to be sold by the pound. Bleach used to be sold by the gallon. No more. But the price remains the same as the older larger packaging.

Ask anyone and they would be thrilled to pay prices from 3 or 4 years ago for everything, “there’s no inflation” is an absolute joke, this site shows why, it’s a real-world gauge of the real-world items people actually need purchased in real-world stores.

http://www.chapwoodindex.com/

And this is with the $4T in Fed printing sterilized on their balance sheet, just wait until non-sterilized stuff like helicopter money gets going.

I think that it’s been something like 20 years since I saw coffee sold by the pound. The CPI doesn’t measure food and fuel because those prices are SO volatile. If they did, there still wouldn’t have been much inflation over the last ten years because the fall in gas prices is so significant. And really inflation is always noticeable over 10 years…3% over 10 years is a 34% rise in prices. Even so that counts as moderate inflation to those of us who remember the 70s and early 80s, when inflation was regularly more than 10% per year.

Listen, Liberal may inspire publication of a few new books:

Listen, Economist

Listen, Neo-Liberal

Listen, Neo-Conservative

Be sure to collect the whole set…

The, ahem, profession certainly seems to ignore reality. I saw a telling quote about economists recently, and the sentiment would fit in a New Yorker cartoon. We know it works in practice, but does it work in theory.

no inflation but rents keep going up ….

Related is that the value placed on labour, the only thing most people have to trade, has also entered negative growth territory. Thus, many, if not most “ordinary” people have no excess value coming in to save. The upwards redistribution of wealth will become clear and plain for all to see once savers start having ‘haircuts’ forced upon them while local ‘rich folks’ still tool around town in their conspicuous consumption autos. The “lower classes” can be treated like third class citizens and have already internalized this self image. The old guard “middle class” is a different matter. Being put upon is no big deal when one has always suffered so. When, however, being put upon is a new and humiliating experience, all h— is waiting to break loose. As an aspect of political economy, this is fertile ground for demagogues of all stripes. If the characterization of the ‘unwashed masses’ as having short attention spans and mediocre intelligence holds any credibility, or even if such is promoted among the “movers and shakers” of this society, than interesting times are ahead. If power is indeed lying in the street, then he or she who is willing to stoop the lowest will gain possession.

“Ed Kane has estimated that low interest rates were a $300 billion per year subsidy taken from consumers and given to financial firms in the form of reduces interest income”

and

“Now perhaps this rationalization was simply central bank patter for wanting to depress the value of their currency and spur growth through more exports. Thus, the idea that consumers might spend more was just a convenient cover for their real aim”

globalisation costs money? So, stated aim, free up money for consumers, true aim, free up money for banksters….sounds about right to me…probably a combo, give money to banksters and make the slop they’re shoveling be cheaper on the global market.

John Maynard Keynes said, “If economists could manage to get themselves thought of as humble, competent people on a level with dentists, that would be splendid.”

Evidently in his day dentists were humble, competent people. Is that still true today?

Well some of them are so humble they have to indulge in canned hunting for lions named Cecil to bolster their undeveloped egos….

The article almost gets this, but in the end seems to miss the point that, when central bankers behave so innovatively/desperately, people have reason to believe a crisis looms and that they should prepare for it by cutting current consumption.

Negative rates also allow otherwise insolvent debtors to continue servicing debt.

Do you know anyone with a negative interest loan? No, it’s done to provide spread for the lenders, their 3.5% loan now yields them 4%, benefits to the consumer are ancillary.

I love this essay. It is so obviously true. As Dean Baker says, if economists were held to the same standards as janitors, most of them would be fired for failing to do their jobs.

>Heike Hofmann, who sells fruits and vegetables

The first, very first requirement a person has before borrowing money is some confidence, or at least a smidge of hope, in the future. To financiers bankruptcy is just a set of number, even when they (after hiding all the roof-over-their-head-food-on-the-table assets) go thru it themselves.

Ms. Hofmann at least is selling something that there will still be a demand for in 5 years. She may have problems with Walmart, etc. but still. I can’t say the same for my job.

There will always be people willing to borrow their way to the poor house. Optimists borrow money but the real optimists lend it to them. The RE bubble was largely driven by all the money in Wall Street created* by the low interest rates that were supposed to fix the economy after the dot com bust. All the fraud-y bonds created by pooling and tranching made bad mortgages look like good business. Until all of a sudden they weren’t. And now people with access to money and credit aren’t nearly as likely to trust bond ratings. Student loans are now the big growth area for debt pushers because they can’t be easily discharged in bankruptcy. It is ever more difficult for money given/lent out to banks and Wall Street to find its way out of the Wall Street circle jerk and out into the real economy.

*let’s just leave the argument about how money is created for another time.

Yves, You have earned a place in the Pantheon of Institutional Economics Great Ones by your attention to the details of financial transactions and your active refusal to be hoodwinked by “theory”. Bravo.

I’m not an economist. That makes it a lot easier :-)

Touché!

Give the average saver a 10% savings rate, and you’ll need to hold him back from the mall with teams of horses.

Give him a 0% savings rate, and he’ll eat oats for the rest of his life.

Economists shocked that public listens to austerity messaging and increases propensity to save.

In other news, man bites dog.

I had 100K “extra” when I retired. I figured with that money, I had “medical emergency” money, as I continuously find that my supposedly premium health insurance, what with co-pays, adjustments, adjustments to the adjustments, (I’m not kidding) puts me in the situation where I feel I really need to have a very large emergency fund above and beyond the emergency fund for house and car and whatnot, as these medical people, after slicing you open, will not sew you back together without payment.

I figured that money, in a bank saving account, would in the interim give me 3-4K a year in interest for a few modest driving vacations.

NOPE – not one, because my bank account savings rate is 0.08% yup, with the interest I can go out for pizza and beer quarterly. Well, that’s not true because I have already had eye tests that cost me 400$ out of pocket (who knows what they cost my insurance company) and who knows how much it would cost me if they had found something wrong.

Inflation is a strange thing. The inflation I experience is in medical costs, that I can only rationally expect to increase not only because of inflation but because I will get more infirm as I age.

Here is a link to FRED showing inflation in health care (very, very robust – IS THAT A GOOD THING??? as compared to inflation in all that crap that I don’t need to LIVE) For some reason, economists seem unable or unwilling to distinguish between the two….

https://goo.gl/aI6zVW

One of the major reasons why it is so difficult to pursue discussions re: the impact of inflation is the sad fact that economists have passively accepted the utterly fallacious notion that price inflation is a phenomenon that disseminates evenly across the whole of the economy, affecting all economic participants in basically the same way.

The actual truth is that price inflation affects different income groups at different rates. It is entirely possible for one group of income earners to experience very robust levels of inflation at the same time that another group is experiencing disinflation, or even outright deflation.

That is, indeed, what we have seen over the past 3-4 decades in the U.S. Increased global competition and outsourcing have depressed the disposable incomes of wage earners at the same time that big tax breaks for the wealthy provided all wealthy people with the same big boost in their disposable incomes.

This, of course, set off a big round of price inflation in those markets which serve the rich: the art, real estate, stock markets.

The problem is settling for a single ‘average’ rate of inflation that supposedly affects ‘most’ urban dwellers when that average rate tells you almost nothing re: how much actual inflation is a part of your own, particular financial life.

I have argued that if the BLS were to publish a spectrum of inflation rates that different income groups have been experiencing recently, it would provide policy makers with much more useful data upon which to base their policy prescriptions.

Yes, it would be nice if a single number could tell you what everyone is experiencing, but such is not the world in which we live. It’s time we threw out the CPI, the GDP deflator and all other inflation measures which try to capture an imagined commonality that doesn’t actually exist.

James Kroeger

August 9, 2016 at 2:35 pm

Well said.

” Now perhaps this rationalization was simply central bank patter for wanting to depress the value of their currency and spur growth through more exports. Thus, the idea that consumers might spend more was just a convenient cover for their real aim that some economists who were not clued in took seriously.”

This is seriously the only explanation that makes any sense to me. Once the ECB went nutty-negative the rest of the smaller central banks had to follow suit or else they had to 1) face a rising currency or 2) pile up a ton of fx reserves, chinese-style. Switzerland felt compelled to break its peg under the pressure.

ZIRP is crazy

NIRP is suicidal

http://www.zerohedge.com/news/2016-08-09/james-grant-negative-interest-rates-will-end-badly

My understanding of the recent Fed strategy was helped a lot by watching this recent talk given by by Koo in Germany at the ACATIS Konferenz 2016. (Thanks to the NC commenter who posted this link.)

It is one of the most clear, comprehensive and illuminating talks I’ve seen on this subject, including fascinating comparisons with the mistakes made by Japan in its policies, which are now being repeated the the ECB, and the particular conundrum facing Janet Yellen.

While Koo’s personal economic mindset retains the assumptions that money creation must involve debt creation–i.e., he does not consider MMT scenarios–within the framework of current money-making procedures, to my non-specialist understanding he seems internally consistent, backs up his reasoning with data in clear graphs, and makes sense.

Again and again he points out that the current situation–low interest rates combined with a lack of borrowers–was never addressed in economic education, because no one anticipated such a situation would ever occur. It’s a balance sheet issue requiring a different approach than what has prevailed in the EU.

Koo’s proposed remedies are interesting within the existing non-MMT context.

As for the risks if the current policies continue unabated? Koo doesn’t hold out much hope for soft landings anywhere, given the blinkered perception of the ECB. Can you say catastrophic financial & economic collapse lasting for decades? This seems to be his warning, though he uses tempered words suitable for central bankers such as “a very rocky road” and “challenging”.

Hello,

If you are interested in the Japanese economy you may like this?

“Princes of the Yen: Central Bank Truth Documentary ”

https://www.youtube.com/watch?v=p5Ac7ap_MAY

Thanks for posting that link to that great documentary. Although I need to research Richard Werner the main protagonist there. Towards the end he was sounding more and more like a Goldbug who groups and trashes all Central Banks. The Reserve Bank of India (RBI) and the Canadian Central Bank did a great job of resisting the siren call of the Wall Street hyenas to float their currencies and institute convertibility. The RBI Governor went around the USA and the World in general giving lectures on how they avoided the nasty shoals of the 2007 crash.

When the price of money is ZERO…. Money has little value…

Hence Boomers hang on to their jobs rather than retire. Speculators take on outsized leverage amd risk.

And savers increase their own risk in a desperate search for yield…

I have a piece of paper that has my name and a title of MBA. I learned more from helping run a company in bankruptcy for 18 months than I did from the professors.. Every model “assumed” too many things to ever work in the factory that employed me…. But the things I learned from those on the floor, who made product, solved everyday problems and made the tools for new products have stayed with me to this day.

Unfortunately the “Professors” are running the Central Banks… The reaction of most people since the 2008 financial meltdown are entirely rational. Boomers got a wake up call… HELLO you are approaching retirement and you are unprepared…. So we: Spend less, pay down debt and save more..

The “professors” assumptions have proven WRONG and are making the situation worse..

In other words: The beatings will continue until the moral improves!!!!!!

This doesn’t mention the Fed’s most ludicrous justification: “So far, the results of our actions are negative or non-existent, but things would really be bad if we hadn’t done them”. Wouldn’t it be great if the rest of us could use this justification for crappy results from our work!

What is also left out is that the Fed is not only pushing savers to take more risk but it is also by itself creating much more investment risk. Why? Even if credit/earnings risk remains stable, the Fed has pushed duration risk to its highest level in history.

As a person with moderate savings who is looking at retiring in a few years, I need to avoid the risk of potential large losses of principal if rates return to normal – which is the Fed’s stated goal. My downside is eating cat food in a cold apartment in my 70s and 80s which highly motivates me to avoid risk, especially when it appears I won’t be receiving the income I had hoped for from my savings.

Duration risk impacts both fixed income and equities through PE adjustment (which again are at historically high levels). Like the person quoted in the article, I get more concerned, risk adverse and spend less as rates go down. Even something as “risk-free” as 10yr Treasuries could lose 30%+ in principal if rates return to normal. At the current 1.5% yield, I’d be a fool to risk it.

The Fed Board and senior executives should get out of their cloistered environment behind an army of security gaurds, X-ray scanners and PR specialists, stop spending all their time at self-referential conferences and preparing resumes written to generate speaker fees and spend some time in the real world. Folks are starting to wake up to the fact that the king has no clothes.

It will never happen…..till they find themselves up that real world lamp post……….

At the current 1.5% yield, I’d be a fool to risk it.

Especially when some credit unions are offering 4 or 5 year CDs at 1.8%. When most of the options are ugly, there are still some that are less ugly, and as we all do our unique silly balancing acts certainly some people will be looking for those rather than the mutual funds that could wipe out >30% of their principal in a week. It all comes down to what we personally regard as the best of the bad options. Why the economists don’t get it is beyond me, but I do thank Yves for spelling it out!

“……apparently difficult for most economists to grasp” Not True much simpler explanation

In so many subjects (not just this one) the institutional experts whether Academics or Think Tanks sell opinions based upon “where do you want to go and I’ll give you the selective facts and subjective interpretations” to back into conclusions and justify anything even……… murder. Coupled with a MSM media echo chamber to create doubt in the reality of the real world to make it stick.

The entire system is based upon Fraud starting with Representative Democracy being representative of the citizens objectives.

Call me a cynic, but I see it everywhere I look. As the Barack Peddling Fiction Obama administration legacy becomes the standard for all communications and activities.

“Well, they work in theory, so we just need to do more or wait longer to see them succeed.”

Does it ever occur to them that their theories are for sh*t? Do they not understand the difference between a theory and a belief? A theory that completely fails in practice is false. Those who do not accept this can no longer claim to have a theory; they have a belief. Or they are lying. If economics were a serious field of study individuals who cling to beliefs that conflict with reality would be marginalized and dismissed. But it’s not and they won’t be. And the world is worse for it.

I would not trash the whole field. John Maynard Keynes and others who understood his clever insights of how to use central banking to temper the greed of finance capital, managed to cage the greedy hyenas through the creation of the Bretton Woods Institutions which worked really well until Nixon took the dollar off the gold convertibility agreement. The book ‘The Battle of the Bretton Woods’ captures in detail the crowning denouement of Keynes writings, exhortations and career. Harry Dexter White Asst Sec of Treasury in the Roosevelt cabinet right after WWII made sure that the main lessons of Keynes were not forgotten and that capital was chained and shackled so as to prevent its owners from perpetual mischief. It was post the ‘Powell memo’ and the assault of the combined forces of the Chambers of Commerce and private moneys on the business and economics departments in the USA that the rot set in again. We had Hayek being hired into the U of Chicago (Goebbels Department of Economic Misinformation) economics department and the general purse flinging that happened in the direction of all business departments. Today they are all a single monolith and the only chorus they sing is ‘Shareholder Value Hallelujah!’ But at the end of the day, all this transformation was made possible by the iron political will of one person, FDR who took the maximum advantage of the Great Depression’s aftermath and the acute memory and pain of the populace to ring in the changes.

Personally NIRP talk has had a different effect upon me. I’m not spending more, nor am I saving more. Instead I’m reducing how many hours I work, thus reducing my income. Time has always been more valuable than money and that’s never more clear than in a ZIRP economy. One thing these rate antics ensure is a lack of confidence in the people running the economy but also in the stability of the economy and monetary system. What’s the point of long term savings when one can’t know what value such money will have in the future? The only certainty is that those running things will not be looking out for my interest because they’re working to protect the interest of the financial parasites who have cannibalized the real economy. The only ways I can express my vote of lack of confidence is by posting here and withdrawing from the system as much as possible. So I’ll take an extra ten hours a week to myself and just earn enough to cover my current expenses. Have to deal with the future when it comes because there’s no way to bank on anything right now.

This strategy is what people in banana republics have been doing. Don’t borrow, don’t save, and work just hard enough to generate income to cover current expenses.

You pretty much have to do this when any amount of savings are likely to get stolen, usually by the government. Borrowing is to be avoided because there is no guarantee of generating enough income to repay your creditors. Windfalls are spent on whatever as they come in. Poor people in developed countries never stopped doing this.

If your entire country starts doing this, there will be no prospect of any economic growth. But the lack of economic growth is probably going to happen anyway for ecological and demographic reasons.

That, along with zero population growth , is what we need to avert ecological disaster. We humans are currently eating ourselves out of house and home , rapidly depleting the fundamental wealth of the planet. This applies to both the renewable wealth, I.e.biodiversity- 30percent of species extinct in the last 40 years according to WWF, and the non renewable wealth, I.e. Minerals and fossil fuels. People don’t seem to realise that you can only dig ’em up once though. And extinction is forever, which is what will probably happen to Homo sapiens within this century if we don’t get our collective shit together very soon.

Negative interest rates are like a guy’s goofball plan to find a girlfriend.

He gets a hundred-dollar haircut, heads to Barney’s for some stylish threads and craazyman English shoes, and then parks himself in Times Square, waiting for a passing supermodel to notice his square-jawed handsomeness and sweep him off his feet.

In a hundred years of fashionable idling in Times Square, this approach is not going to yield any girlfriends.

That’s the plight of wallflower central banksters: all dressed up and nowhere to go.

…or like friedman get a $100 dollar moustache trim and park it in the lobby of goldman sachs and wait for a supermall heiress to notice how undertanding it is…

I believe that the low interest rates are right now creating more problems than solving.

In fact, I’m starting to think that ZIRP is a similar millstone round our neck as gold standard was in 1930s – especially for someone like UK, where depreciating currency may make the overall situation worse rather than better (the economic theory of substitution of imports is few decades out of touch, at the very least – courtesy of globalisation of value chains).

Bankers used to live by the 3-6-3 rule: borrow at 3%, lend at 6%, and be on the golf course by 3 o’clock.

That is being revised to the 0-4-47 rule: borrow at 0%, lend at 4%, and stock up your secure compound with AK-47’s and lots of ammo to dissuade your depositors from pursuing some frontier justice.

Let me know when I can get negative interest on my mortgage. Until then, not so much.

Excellent point. If they are “professionals” – what profession isn’t licensed?? I know of none.

: He should have carried that thought out to its logical conclusion, that economists should be licensed. That way, they could be cast out of the discipline for malpractice. That sort of sanction would do a lot to reduce policy misfires like this one.

> Low interest rates were a $300 billion per year subsidy taken from consumers and given to financial firms in the form of reduce interest income.

You say that like it’s a bad thing!

Imagine: people who foresee needing money in the future are saving more when conditions threaten their nest egg! Yet another example of elite stupidity, dark plans, or both. Two other similar examples come to mind.

There was a Davos economic summit, back in the 90’s I believe, where one of the speakers expressed surprise that developing nations were engaging in high-tech manufacturing rather than the lower-tech activities they were supposed to perform. (Wish I could find the record). Imagine! Managers turning to businesses that had the potential for producing the highest profit. Were they not supposed to see this?

Then the globalization drumbeat for China. Back in the 90’s, development of manufacturing in China was promoted with the idea that it would create a large consumer base that would buy American-manufactured goods. Here, evidently the cheerleaders never got the memo that increased economic activity was likely to be competitive rather than synergistic, especially regarding labor.

These and the present example demonstrate breathtaking elite incompetence (as has recently been exemplified further with Thomas Friedman). Whether by stupidity or malice, they promote policies claiming one outcome and express (feign?) surprise when things turn out badly, but in a way that was obviously predictable. I don’t care whether it’s due to competence or corruption, they need to be ousted. The trouble is, their control extends so deep that the freedom to do this is held only by fringe groups and persons who haven’t yet been co-opted (they just captured Bernie), so we’ll have to risk transferring power to dangerous elements, and suffering disrupting consequences (Brexit), or both. I don’t see how this can be helped, but I don’t believe that changes will necessarily lead to a worse long-term outcome than moving further along our present direction.

” But in the US, with safe income on investments running below inflation levels, and Medicare being actively crapified (for instance, a 70 year old friend with a bad leg break is having to pay for $25,000 of expenses in a rehab facility herself), a retirement-aged couple would need over $3 million in liquid assets to allow for 20-30 years of living expenses and possible medical costs. How many are in that boat?”

Is the 70 year old friend in this situation even with Medicare Part B?

The retirement-aged couple must be spending $100,000 per year over thirty years (3000000/30) in their retired life. If this is true, it must be a comfortable life!

She’s competent (ran her own business, was working part time). The leg break was nasty and she’s had to be in the facility for three months. I have no idea why the services aren’t covered, or perhaps this is some sort of co-pay.

A friend of mine worked where the contractual agreement was that retirees got coverage for life which provided their prescription and supplemental coverage, with Medicare as the main insurance.

Since contracts mean little to employers feeling they must “economize” and that all must have “skin in the game,” the insurance coverage was changed. So, now, instead of no co-pay for visits or physical therapy, everything has a minimum $20 co-pay. Which isn’t so bad if there aren’t many appointments, but now my friend needs PT and it definitely mounts up: $60/week, $240 minimum per month. An unexpected expense, along with the more regular doctor’s appointments.

Put not your trust in employers….

Or, uh, Hillary, either.

Based on the behavior of employers these days, organizations like unions should be negotiating for cold hard cash instead of benefits the employer can later conveniently renege on like pensions or health care for retirement.

Medicare doesn’t cover long-term care. Sounds like your friend has rehab needs that don’t fit their strict time limits and requirements. Many people are surprised to find that long-term care is all out-of-pocket until you impoverish yourself enough for Medicaid.

Put all your money in retirement annuities that pay little over a long time.

Then apply for medicaid

Thanks for the explanation. So sad to hear that. Hopefully she’s recovered from the leg break but the financial hit was bad news.

Ah, yes, economists seem to have so little understanding of how being in the lower economic quintiles lessens one’s ability to spend money! I mean, it’s so obvious that even Henry Ford figured out that if his employees could not afford to buy the automobiles they were making he would not achieve economies of scale and higher sales numbers and ongoing profits.

Yesterday, The Takeaway on NPR (WNYC my local station) was teasing the day’s program with continued questioning of why so few Americans know how to swim and so many do not swim well. The expert on the program, a swimming coach and developer of an instruction method called xxxx, said that humans naturally have a fear of water. Okaaaay. I never had any fear of water, but, hey, that’s probably just me. I could not wait until I could actually swim and not just float and dogpaddle. My mother, on the other hand, had a deep fear of water, based on living in area where the only swimming holes were in rivers with strong currents and where kids drowned if the currents ran faster than usual. She never learned to swim. But my dad taught all us kids.

But I sooooo miss the opportunity to swim since I moved to NJ. As one commenter states at The Takeaway segment link, NJ tends to have privatized swimming places (pricey) and even the public pools require entire season memberships, which were slightly less pricey. Plus the hours meant the pools closed about the time I was getting back from work: my biggish Midwestern city pools were open until 10 PM, until midnight during continuous heat waves. (My Borg announced at one point that all employees would be required to work a 40 hour week, and the entire floor erupted in sarcastic cheers, with people asking if that meant they could now actually have actual evenings…. Management made clear that the change merely meant we just had to keep working the hours necessary to meet the division goals, and that meant minimum 50 hour weeks.)

I was raised swimming in inland lakes and gently flowing rivers, and I’ve not enjoyed salt water (nor is getting there easy and sometimes is also very expensive. I haven’t swum in NJ since my back issues meant I could no longer play tennis — and that was where I had access to a small but swimmable pool. Not great for laps but better than nothing.

But, back to my point: Economists seem to have no actual understanding of what it means to live within one’s means when the means are not generous.

Thanks for posting on this, I saw the WSJ headline and was intrigued that that particular newspaper would run that story!

In a related story, the Bank of England failed to meet its target for buying bonds, because pension funds and insurers refused to sell their long-dated assets.

Gresham’s law is a statement of the “principle of substitution” applied to money or other words, that a commodity (or serve) will be devoted to those uses which are most profitable. It is another one of the paradoxes of money that, unlike articles in the market, the bad drives out the good.

Interest is the price of loan-funds. The price of money is the reciprocal of the price level.

AD was dropping between 1/1/2013 and 1/1/2016, i.e., money was too tight / insufficient (until c. February – August 2016), and thus there’s been a prolonged period of an excess of savings over investment (which is deflationary). That’s why the price of oil dropped as the dollar rose – both in response to a mis-guided FOMC policy directive.

Given limited upward and downward price-flexibility, unless money expands at least at the rate prices are being pushed up, incomes will fall, output can’t be sold, and jobs will be lost.

Monetary policy objectives should be formulated in terms of desired rates-of-change, roc’s, in monetary flows, M*Vt (our means-of-payment money times its velocity of circulation), relative to roc’s in R-gDp.

Roc’s in N-gDp (though “raw materials, intermediate goods and labor costs, which comprise the bulk of business spending are not treated in N-gDp”), can serve as a proxy figure for roc’s in all transactions, P*T, in Yale Professor Irving Fisher’s truistic “equation of exchange” (where the proper index # provides clues to the overall economies’ “price-level”).

Roc’s in R-gDp have to be used, of course, as a policy standard. This is inviolate and sacrosanct. And it has been true for over 100 years (unbeknownst to the 300 Ph.Ds. employed on the Fed’s technical/research staff).

– Michel de Nostradame

On page 81 of Macmillian’s 1949 edition, “The General Theory of Employment, Interest and Money” Keynes informs us: that it is an “optical illusion” to suppose “that a depositor and his bank can somehow contrive between them to perform an operation by which savings can disappear into the banking system so that they are lost to investment…”

The process of “monetizing” time/savings accounts in the commercial banks began in the early 1960’s (coinciding with the rise in chronic monetary inflation & in anticipated inflation). Today there is no restriction on their growth – as all deposit rate ceilings have been removed, along with any legal reserve requirement (credit control device). As there is no longer appreciable “gate keeping” (restriction of withdrawal), the conversion from demand to time deposits, changes savings-investment accounts, to a means-of-payment role, viz., auxiliary money. These changes were adopted because of the universal misconception: that commercial banks are financial intermediaries (and don’t create new money), pooling depositor’s funds, and then loaning them out.

The massive diversion into, and growth of, time/savings accounts was not because these balances were saved, but because of the structural changes in the banking system that made most of these time deposits a type of auxiliary money.

From the standpoint of the system, it is an accounting truism, that there is a one-to-one relationship between time and demand deposits. An increase in time deposits depletes demand deposits by the same amount.

It’s an intellectually confounding delusion from a micro-economic perspective (the trees). But from a macro-economic perspective (the forest), Interest-bearing bank deposits, rather than being a source of loan-funds for the commercial bankers, are entirely the indirect consequence of prior bank credit creation. The source of time/savings deposits is almost exclusively, non-interest bearing DDs, and the growth of DDs can be largely accounted for by the expansion of bank credit.

That there is a close connection between aggregate bank credit and the aggregate volume of bank deposits (demand and time), can be verified by comparing the net changes in commercial bank credit (the CBs, MSBs, CUs, and S&Ls), to the net changes in total demand and time deposits for any given period. I.e.., bank credit proxy (surrogate for loans and investments), used to be an FOMC target (as “loans create deposits”). “from Sept 66, when the committee first began including a bank credit proviso clause in its directive until Dec 1969.”

But wholly unreconciled, is that bank deposits (i.e., savings or funds held beyond the income period in which received), can only be spent by their owners, they are not, and cannot, be spent by the bankers.

while lowering rates hasnt helped much, but then again if people wont spend with low rates, why would they do it with higher ones? and while food is up, fuel is down, way down since 2009, when for no apparent reason it hit over $100 a barrel, and today it may be heading $30. and as pointed out almost nobody gets the fed rate. but other than credit card rates, most of the others arent all that bad (considering the rates from the 70s). so raising rates will lead to even less demand, as consumers are still struggling to recover from the 2008 shocking news that houses wont always go up and that they will need to live on their incomes alone. with no raises.

READ THE BOOK YOU DOUGNUTS, JAPAN HAS BEEN IN THIS SITUATION FOR 25 YEARS AND WORKED OUT WHAT TO DO AND IT ISN’T NIRP.

We need to move away from the idea that consumer spending power through debt and through wages are the same things.

Aid programs from the US, IMF and World Bank have not been gifts but loans, and there is a world of difference, as we can see from the countries that have received this aid and have been left looking like Greece on a bad day.

This is where fiscal policy is streets ahead of monetary policy, where jobs and wages are created, that are spent into the economy and trickle up (aka Keynesian stimulus).

The private sector are aware that they are over-loaded with debt, even if the Central Banks aren’t.

The reserves from QE just sit in the banking sector untouched and rate reductions will make no difference.

Japan has spent twenty five years in a balance sheet recession and knows what to do:

https://www.youtube.com/watch?v=8YTyJzmiHGk

Ben Bernake and Janet Yellen had read Richard Koo’s book and ensured the US didn’t impose austerity and go over the fiscal cliff.

Mario hasn’t read Richard Koo’s book and pushed the Club-Med nations over the fiscal cliff.

The harsh austerity on Greece, killed the Greek economy altogether.

Reading Richard Koo’s book is important, if only Mario would get a copy before he wipes out the Club-Med economies and banking systems.

Fiscal Policy works

Monetary Policy does nothing

Austerity makes things worse.

Fiscal policy works, low interest rates are helping make the debt easier to repay but do not kick start anything.

Thanks for the link, worth watching.

Koo’s clueless. QE only expands the money stock given non-bank counterparties. And remunerating IBDDs emasculated the Fed’s “open market power”. The economic backdrop undermined QE, i.e., a countercyclical increase in bank capital cushions, bad debt provisioning, etc. destroys the existing money stock (estimated to be c. 1 trillion dollar depletion).

Then the FDIC expanded insurance coverage which caused saver/holders world-wide to transfer their balances from income producing conduits (where S = I), to where savings were further impounded within the CB system (where savings can’t contribute to gDp).

There was no Treasury-Reserve Bank collaboration during Treasury issuance and refunding operations. Not only may the Treasury exercise important monetary powers through the timing of borrowing, but specific monetary objectives may be achieved through a choice of the types of issues to float. We’ve duplicated the Great Depression’s problem during the Great-Recession – a scarcity of safe-assets before, during, and after the Great-Recession (demand so strong that rates become negative).

Treasury Secretary Jack Lew:

(1) reaffirmed his stance Friday that a strong United States dollar is a “good thing.”

(2) “Treasury’s decisions about how to manage government debt are made independently of the Fed’s monetary policy choices, he said”

The Fed didn’t collaborate with the Treasury on the type of debt to be issued. EFFECTIVE MONETARY MANAGEMENT IS IMPOSSIBLE WITHOUT THE CO-OPERATION OF THE U.S. TREASURY (ECB’s problem)..

People who know what they are talking about can convey it easily to others.

Richard Koo’s explanation is easy to understand, fits in with other known facts and makes sense.

This looks like incomprehensible obfuscation and as I have no idea what you are talking about, I will ignore it.

It sounds like rubbish and I am sure it is.

– after the Great-Recession (demand so strong that rates become negative).

Please support this statement with a fact.

Ah yes. Officialdom and economists have splendid theories about other peoples’ money. People however see their own money as real, not theoretical.

Great post.

Inflation is experienced differently across classes.

When the gaps between classes is relatively minor, or tending to narrow, then we can allow ourselves the convenience of being able to use a few broad inflation measures.

But when gaps between classes are significant, and tending to widen, we no longer have that luxury. If we want to actually understand what is happening, we have to model inflation based on class-differentiated consumption profiles.

In our time, the proletariat are experiencing steady, grinding, inflation: food, housing, education, and medical treatment are all rising faster than incomes.

Inflation doesn’t have to be Weimar-style, to damage people’s lives.

Now the classes with the greater disposal incomes, who spend more on luxuries, are experiencing little overall inflation. Rising food or electricity costs are negligible, in their view, when offset by the static wages paid to domestic servants, or by the actual decline in price of things such as performance automobiles or sophisticated electronics. It’s never been cheaper to be rich, than nowadays.

Central banks are governed by unelected people, who are all drawn from the bourgeois class. They prefer to use methods of estimating inflation which justify loose money policy. Loose money has conclusively proven to be of maximum benefit to the owners of finance capital.

Well said.

Gresham’s law is a statement of the “principle of substitution” as applied to money: that a commodity (or service) will be devoted to those uses which are the most profitable. That it is one of the paradoxes of money, that the bad drives out the good. And, the more valuable money, is held as a “store of value” and the less valuable, will be used as a “medium of exchange”.

Alfred Marshall’s “cash-balances” approach is complementary, viz., all motives which induce the holding of a larger amount of money will tend to increase the demand for money – and reduce its velocity (which requires a differentiation between ex ante expectations and ex post realizations).

Interest is the price of loan-funds, not the price of money (as the FRB-NY’s “trading desk” operations has assumed c. 1965). The price of money is the reciprocal of the price-level. Therefore Keynes’ liquidity preference curve (demand for money) is a false doctrine.

I.e., the “demand for money” should not be confused with the “demand for loan-funds”. The demand for loan-funds is not a demand for money, per se, but a demand which reflects the advantages of spending borrowed money. And the equilibrium effect will never be reached if new and disturbing factors are continually being introduced.

The GR, etc., introduced:

(1) a world-wide “flight-to-safety” and to “safe-assets”

(2) a flight to Sheila Bair’s “unlimited” FDIC transaction deposits

(3) an increase in the money stock of the preferred funding currency in the “carry trade”

(4) a self-reinforcing, “safety-net” boost in a national currencies’ exchange rate

(5) massive debt monetization thru sterilization (reducing the demand for loan-funds)

(6) a reduction in money velocity by the destruction of non-bank lending/investing

(7) a reduction in money velocity due to the further impounding of savings in the CBs

(8) increases in bad debt associated with a higher proportion of CB financing vs. NB financing

(9) countercyclical increases in bank capital

(10) the long-term corrosive impact in the demand for capital goods and thus inevitably CapEx

I have been a huge critic of the Fed and its nonsensical policies since the start of the crisis. But they’re only partly to blame. They are attempting to use monetary policy in unorthodox and desperate ways only because politicians everywhere have ruled out using fiscal measures.

Regardless of what they say publicly to please their political masters, most central bankers wish their governments would start a fiscal program to make up for the collapse in private sector demand. They also agree that the only reason the USA Has had a better recovery than Europe is because we at least attempted a half hearted fiscal stimulus while Europe imposed austerity. Monetary policy had very little to do with the different outcomes of the US and Europe regardless of ZIRP / NIRP /etc.

I agree about central banker stupidity but we must also recognize that’s only a response to the even greater stupidity and corruption of their respective elected governments.

What is the optimal interest rate to spur economic recovery? That’s the wrong question to ask. But politicians are happy to talk about it since it shifts attention away from their own misguided fiscal policies.

A couple of points:

So what do you do if you have expenses looming in the future – college for the kids, retirement, down payment for house, etc … – and you aren’t willing to gamble in the markets? When interest rates are lower, do you save more, or less? You have to save more. There was a talk by David Einhorn I saw once where he made the same point (I wish I could find it, it was pretty interesting).

I have all the ‘stuff’ I need. Lower interest rates isn’t going to make me go out and buy more of it. I suspect a lot of people are in pretty much the same place.

It would be an interesting project if universities had dedicated economists as “researchers” who would for 2 years, inhabit different communities as practical participants: middle class, skirting the poverty-line, homeless, and the top end as well. They could do this for a deferred windfall at the end of the 2 years, with a safety net for medical and psychological issues. Then these economists, and the larger academic community, could meet semi-annually, and discuss the researcher’s practical experiences. Might even be an interesting Americorps opportunity for aspiring economists, but I fear the results would be dismissed as young adult idealism. The biggest problem I see in economic/fiscal/banking policy is utter ignorance of the practical day to day issues of the economic realms that successful economists and policy makers no longer inhabit.

With the majority of Americans living paycheck to paycheck, and most being unable to come with 2K in the case of an emergency, and more importantly, most Americans now aware of their vulnerability, the idea that reducing the income on their nest egg, their children’s college savings, and their liquid emergency funds (if they have one), is going to make them feel free to spend, spend, spend, is senseless. Yes, Americans will vote against their own interests, and borrow against their own interests, but over time, they can wise up. The only place I can see these negative rates positively impact the majority of consumers is in mortgages, and car loans. But 20% down on a home is a pipe-dream for most, and people have wised up to the danger of exotic or imprudent home loan structures, and banks aren’t doing much of that anyway (except in CRE). As far as car loans, these are predictably growing, as a car is a necessity, and up-scaling can be justified by the lower rates.

But other discretionary spending? The lower rates do not apply. Most MClass buy on credit. The low rates only instill panic in the hearts of those who actually save. The outcome is obvious and predictable, if you are on the ground: the price of middle class “luxury” goods are dropping. The market for luxury goods is shrinking to match more closely the tier where wealth is concentrated. The very top tier of luxury goods may be ridiculously high, but these are items that the middle class only saw on “Lifestyles of the Rich and Famous” anyway.

The price of necessities is going up, simply because the market HAS to bear it. Prices rise slightly, but the packaging is smaller. Fresh produce has gone very high. Most families are one medical catastrophe away from bankruptcy, and they know it. Gas is lower, but people who look out for themselves are using that extra to pay off debt, or maybe bring one less bag lunch. The CPI is completely erroneous, as it under-represents necessities, and includes non-essentials that are dropping in price.

Theory is process-driven, practicality is outcome reliant.

Perhaps the crapfication of social safety nets – heck, we have a whole mainstream ideology dedicated to destroying them, have caused individuals to lose confidence in the future. To compensate, increase savings, destroy demand.

Yes. Even people with decent savings/investments are worried about their financial security. Universal health care and extended social security/basic income would go along way to alleviating these concerns for most everyone.

Economists at a key central bank organization are warning of potential risks from the negative interest rates in place in Europe and Japan.