The fact that rentier capitalism usually operates in corporate form and that US courts have endowed corporations with the weird status of legal personhood, and with it, the right to First Amendment protections, has given business a worse name that it deserves.

The Japanese see a business a community and regard it as important to protect and preserve those communities, to a degree that has ossified the economy. But even one of the aggressive entrepreneur in my circle defined the purpose of business as “having drinks with your buddies”.

Perhaps it’s just a function of cross-currents in Manhattan, but I can’t recall a year, even in the worst of the financial crisis, where so many businesses that I knew, either personally or by reputation, went under. And the part that bothers me is that a very high proportion were well established, as in they’d been around for more than ten years.

Mind you, we’ve had waves of various sorts of businesses failure over the last 25 years. Hardware stores and small retailers crushed by WalMart. Video rentals killed by downloads. Independent bookstores felled by Amazon. Clothing stores losing out both to “e-tailing” and more consumer dollars going to technology.

And even when it’s obvious why these displacements are taking place, that does not make it any less sad. The owners put not just money, but anxiety and years of their life into trying to make it a go. Having to make payroll, or even pay contractors, is a serious obligation. And I always worry about the workers. If we had any sort of decent economy, that wouldn’t be a big concern. In the old normal, if their employer failed, they might not get as convenient a location or schedule, or the new boss might be a jerk, but they’d at least be able to provide for themselves in reasonably short order. That is hardly the case now.

But what’s happening in my neck of the woods is a bit different. Landlords have been doubling rentals on Third Avenue, and I can’t fathom the logic. A huge number of storefronts are vacant, not just on Third but on Madison as well, and they stay empty for a long time. For instance, when a busy health food store where I shopped regularly was put out of business by one of those rent increases, it sat vacant for a full year. Its replacement, an upscale frozen food business (really!) remains open despite having no customers. Perhaps it’s a vanity project for the wife of a rich man, or a money laundering operation, but it bears no resemblance to a viable business.

In a story last August, the New York Times bemoaned the loss of small businesses. I was as surprised as the author was when Tekserve, the biggest independent Apple sales and support store in the city, closed its doors, along with other mainstays I had known, like Krup’s Kitchen and Bath, due to rent increases:

It’s not just a matter of my personal convenience or quirky shopping habits. The usually well-paying, stable jobs lost when family-owned shops close will not be replaced if chain stores with fast-changing work forces come in. And since many chains are already here, a lot of shop fronts will remain empty, producing no revenue — and no street life — at all…

I’m far from the first person to notice the rapid deterioration of the city’s street-level fabric. A writer who uses the pseudonym Jeremiah Moss has been bemoaning the problem on his blog Vanishing New York since 2007. His organization, #SaveNYC, is trying to hold back the tide through awareness and grass-roots lobbying. You can join in.

Mr. Moss has called for curbs on tax breaks for chain stores, laws ensuring reasonable rent increases and fines on landlords who leave their storefronts empty. He’s also pushing for a cultural preservation program, which would protect businesses that have contributed significantly to a neighborhood’s social fabric.

I’m not sure what these landlords are smoking. Do they posit a fixed relationship between residential and storefront rentals? That’s broken down with more and more in retail sales moving to the Web; for years, the big story in commercial real estate has been the glut of retail space. Moreover, rental prices have fallen in Manhattan in the last year, which is almost unheard of in the absence of a big downturn on Wall Street. So why do they think the market will support ever rising street-level rentals?

From my vantage, anodyne terms like “street life” don’t capture what is at issue. If you live in a city, where even if you are friendly with your neighbors, that almost never means, “friendly enough to have them in for a drink.” So the vendors you deal with regularly, even if you only know their faces and some of their quirks, become part of your routine. As one of my friends said, “That’s what makes city life bearable.” For instance, a couple of the coffee shops I frequented (one of which had its own daily visiting sparrow, that had figured out how to enter, clean the floor of crumbs, and escape) not only knew my regular order but would occasionally give me a freebie. Another store’s overweight Tabby has a following. Even though I don’t go often enough for him to remember me, I find it reassuring that the owner/operator of my local shoe store does many of the repairs himself (in view of the customers) as well as manning the register, and is clearly proud of his work.

So it’s even more disconcerting when a business which has created its own community fails. When I lived in Sydney, I adopted a local pub which had a great crowd, including many colorful regulars. It closed as a result of a major renovation of the building, which turned the pub and a neighboring space into a grocery store. Even though the neighborhood was lousy with bars, and we patrons tried finding a new venue where we could congregate, it never gelled. None of the other spaces were conducive to having a large group meet and mix easily.

To add to the stress of the Washington Post/PropOrNot “Russian propagandist” smear, one of my mainstays, my gym, closed permanently right before Christmas. I’m religious about working out, both for health reasons but also as a desperately needed daily mental health break. My gym was small (which made it fast to get in and out), oriented towards weight training, open early and late, and well appointed (no fluorescent lights, big glass windows, leather banquettes). The evening crowd skewed older and was mainly self-employed people, and I had gotten friendly with quite a few of them. So it was both a shock and depressing to learn my gym had folded with no warning.

It must be horrible for the employees, like the women who tended the women’s locker room, and the guys who cleaned and tied the floor and the men’s room, to be turfed out right before Christmas. I lost most of a year of membership payments, but I’m less bummed out by the monetary loss than by the fact that I was at that gym because I regarded the other options in the ‘hood as less desirable for reasons including: too big and impersonal or too skanky, less good weights (this one had dumbbells in 2.5 lb. increments up to 40 lbs), less good terms (I’d been a charter member, which was a fancy way of saying I joined before construction was fully complete, and the older membership terms, which I’d gotten grandfathered, were better than the current ones), and for the “better” gyms, a lot of amenities that I didn’t value (lots of classes, snack and juice bar, beauty services). And I don’t know how many of my old buddies will wind up at the nearby upmarket gym, or if they do become members, if we’ll see each other that much (with the exercise area on two large floors, we could miss each other even if we showed up at the same time).

So why did my old gym die? The closure message attributed it to an increasingly difficult competitive environment which had become unfavorable to its business model, especially in New York. I’m not sure about all its locations, but the local one looked to personal training as a significant source of income. My sense is that that market has changed a lot in Manhattan, and possibly elsewhere, due to:

1. The rise of micro-gyms. I don’t understand them, and think they are a fad about to die, but I’ve seen tiny gyms spring up in those formerly vacant retail spaces, with small classes featuring full body workouts. Who wants to work out in view of people on the street? And how are you going to get enough variety in a setting like that? The dirty secret of exercise is anything you do repetitively becomes routine activity and you quit seeing gains. That’s fine if your objective is general health, but not if you want to train for a sport, get stronger, or change your appearance.

2. Better workout facilities in new apartment buildings. Gyms have been a long-standing amenity in new apartment complexes. However, that used to consist of a couple of treadmills and a bike or two. Now apparently they are much better. Not only have these workout rooms bled off some who’d otherwise get a gym membership to work off winter weight gain, but also others who use trainers, since these in-house facilities are often well enough equipped that a trainer could work with clients there rather than in a full-service gyms.

3. Smartphones. I saw a lot of people at my gym using workout routines on their devices. Mind you, I didn’t think this was a great idea. Some of the routines looked dangerous (for instance, calling for the user to do jumps when you need to be able to squat 150% of your body weight for that not to put your joints at risk). In other cases, the routine might not be bad, but I could see the person working out in poor form (I assume either due to the program not showing proper form from the front and side, or the program not giving enough verbal cues, or the person not having enough command of their stance to absorb the instructions, as in they would benefit more than most from oversight and feedback). I suspect this led to some clients reducing or even dropping their use of personal trainers.

This is a long-winded way of using the sad demise of my gym to illustrate that small and mid-sized businesses, even long-established ones with loyal, upmarket clienteles (my gym’s branch had been open for 22 years) are facing unexpected pressures.

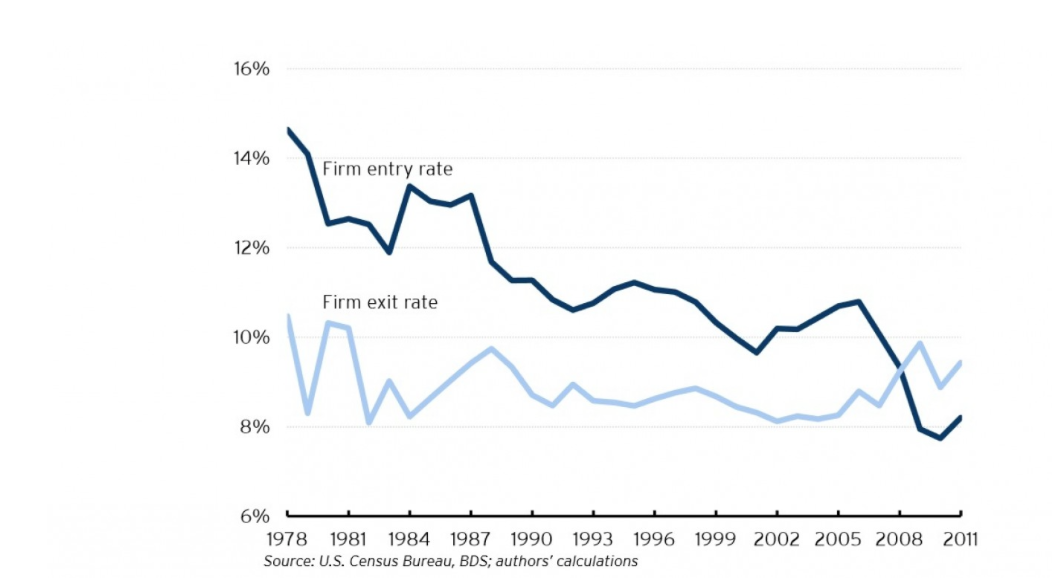

And this pattern raises a bigger set of issues. Economists have bemoaned a fall in entrepreneurship, as this chart from a 2016 Washington Post story illustrates:

But this should not be hard to understand. The level of business deaths has been hovering around the rate reached in the nasty 1980-1981 recession. That is consistent with what we have been saying for some time: with overall demand in the economy weak, small businesses for the most part have not been keen to expand. And that means starting a new enterprise is an even bigger gamble. On top of that, more young people are having to take menial jobs which may not give them the opportunity to identify unmet customer needs. Academic studies have ascertained that the new businesses that are most likely to survive are started by people who’ve worked for bigger firm and saw opportunities that industry incumbents were ignoring. And add to that the fact that student debt is another impediment to accumulating savings and/or having good access to credit.

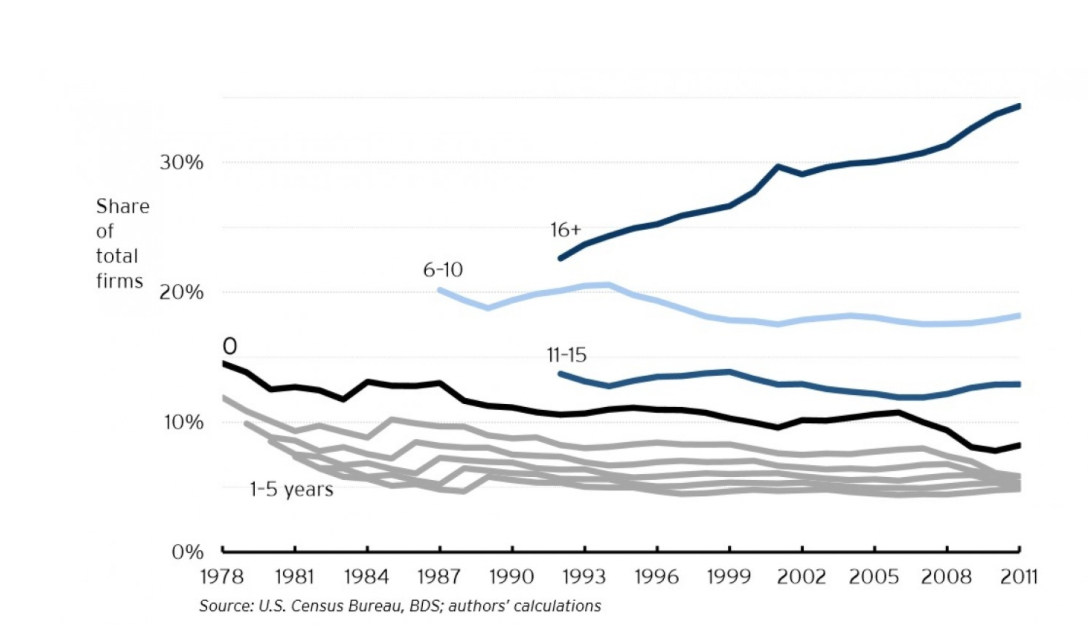

But the death of my gym, along with other long-lived businesses (for instance, Gracious Home, a successful Manhattan retailer that seemed to have a secure niche, also closed in December), points to another impediment: it used to be, as another Washington Post chart showed, that if a businesses made it to the ten year mark, it was likely to continue:

But perhaps that is not the best interpretation of that chart. The data does say that longer-established businesses constitute a growing proportion of all businesses. But the fact that younger firms are dying at a more rapid rate than in the past may mask the fact that older businesses are also failing at a higher rate than before but that the rate of increase is much lower than that of newer concerns.

I have long said that that starting your own business has been unduly romanticized in the US, and most people can and should be on a payroll. Entrepreneurship hype has too often served as an excuse for lowering worker rights (why should employers provide job security if workers can all go out and create their own employment?). Working for yourself has become even riskier. Just because traditional workplace options are lousy does not mean that jumping from the frying pan into the fire is a good idea.

It’s interesting that recent immigrants are a strong presence in starting new businesses, often family businesses. Our culture of individualism is stacked against starting family run businesses. Urban villages are supposed to help support small businesses but I never seem to live in one because of the higher rents.

I think that high rents are part of the story for businesses which have fixed premises. But it’s only one factor. There are so many others set against you. I’m not normally too keen on youtube videos to make a point (too much time taken as you can’t skim read) but the best way I can explain is via this example from a sole trader who operated in south central LA (Baton Rouge-ish I think). US readers do please correct any cultural faux pas I’m making, as I suspect is typical of people from that part of the world, he doesn’t make a habit of getting to the point quickly, which makes it even worse (I’m not selling this very well am I!)

But he really is a great guy and shares his knowledge so freely and so engagingly, the generosity of spirit (as well as genuine expertise) led me to follow him on youtube (one of only two people I do).

Anyhow, https://www.youtube.com/watch?v=tVuPljyun5g is the best one-stop-shop summary I’ve come across where someone who really has been there, done that and bought the t-shirt describes how difficult it is to run your own business and why he quit. The real explanation starts about 2m 30s in. For those who don’t normally watch videos, the conclusion is, even if you overheads are low, they can be as low as they like but it doesn’t matter a jot without income. The guy worked in a line of business with a strong seasonality in terms of busy and quiet times. When he was busy, he was stupid busy and didn’t see his family. When he was quiet, he had no work and no income.

While working for a company isn’t all biscuits and cucumber sandwiches, the downsides are less awful that those of working for oneself. Note too that healthcare was one of the key factors in his decision — this is a specific US problem, but I guess for you guys across the pond, it’s just part of the furniture so the detrimental effects on start-up entrepreneurship don’t seem to get played out in the media as much as I think they should, given how pivotal they are. But even leaving healthcare aside, there is simple so much that is bad about running your own business. Premises costs, if you have them, are just the icing on a really mouldy cake.

I worked for myself for five years, but took an office job just before the financial crisis, to ‘ride out the storm’. When I sat down to lunch at the office holiday party, I felt a relief and relaxation I hadn’t felt since… the last time I worked for someone else. Some people can handle the marketing, sales, delivery, accounting, taxes, HR, etc, but I’m better off outsourcing that to an employer.

Worker co-ops are also quite popular with immigrants. There have been quite a few formed in the last few years, doing all sorts of stuff (housekeeping, taxi driving, lawn care, home health care, etc).

http://www.geo.coop/story/leading-example

And here’s a manual on starting a worker co-op, geared specifically for immigrant communities, from Dennis Kelleher of Better Markets:

http://www.scribd.com/doc/221910321/Immigrant-Worker-Owned-Cooperatives-A-User-s-Manual

This family business thing among immigrants is an important point. People who have no fundamental loyalty to each other are unlikely to have good successful relationships over the long term, and a bad employee definitely has the potential to sink a business.

If I were running a business’s I’d practice nepotism assiduously and contract/gig out any work my family or best buds couldn’t do. Softwate automation would also play a big part. As for hiring people off the street–hell no.

Not so sure about that, I’ve seen plenty of friendships and families torn apart by conflicts over businesses, from real estate to small businesses. That’s why people who’ve been around for a while say that all business relationships should be contractual, so there’s no misunderstanding about what the deal actually is, how profits and losses are shared, what happens to assets if the business goes under, etc.

Nepotism is also a problem, there’s a ton of businesses in the United States that were started by someone with good business skills who passed them on to their children, who didn’t want to put in the time and effort or just viewed the business as a cash cow to milk to death to support their personal lifestyle as long as possible.

“Nepotism is also a problem, there’s a ton of businesses in the United States that were started by someone with good business skills who passed them on to their children, who didn’t want to put in the time and effort or just viewed the business as a cash cow to milk to death to support their personal lifestyle as long as possible.”

This is almost universally the case in “inherited businesses”

Where family business is good is where it provides some safety net and encouragement to start a business (as with many immigrants). But not when the ‘rents just pass it on to some kid who has never been an employee. If they’ve never been an employee they really aren’t fit to run a business most of the time.

To be clear, no one else is going to be making significant decisions in my business, and everyone who doesn’t perform is expendable, family or not. There won’t be any conflict becausr no one else id providing capital or taking rexponsibility. Also I’d be keeping people off the books, avoiding paying in USD etc–all of which is possible in the line of work I’m interested in.

I think this is a positive model that most businesses will be moving towards in the future, even as social programs continue to be slashed. Also, there’s always better software and robots lurking around the corner if even the people I know and trust prove to be less than ideal despite all the safeguards I take. So things should work out one way or another.

This is really true. Shortly before the holidays I was in a big restaurant supply store. Everyone shopping in it was an immigrant family, running a Mom and Pop business. No one looked well off. But there they were, spending their holiday time stocking up on supplies to feed other Americans during the holidays. It looked like hard, hard work, and like they needed a family to do it. American culture no longer encourages or enables families to start small businesses together. People were encouraged to fan out across the country to follow jobs, not to stay in one place because that was a “community.” Starbucks and Home Depot just can’t provide homey warmth. And in a lot of places, that’s all the “community” there is left.

I think there is something to it. If one really wants to do the entrepreneurship thing (and of course not everyone does!) then one can not do it alone. It’s just too hard.

In my hometown, there’s a law that allows landlords to charge like 10x the rent cap to banks. We have 10 banks that are nearly identical to each other, and a lot of empty storefronts waiting for more banks. The town next door passed a law that forced banks to inhabit the 2nd floor of buildings, so they don’t have the problems my hometown does.

America is on a march to becoming homogenized and characterless. Soon, with 3D printing, including 3D printed food, and Amazon drone and automated vehicle delivery, there will be less of a reason to go out to shop. But then, who will buy products if all these jobs are automated and/or streamlined? Universal basic income is likely the answer.

3D printing, btw, should scare the shit of designers and engineers of all stripes. People will create efficient and beautiful blueprints for free, and eventually AI will be able to create blueprints for you.

Just because it can be 3D printed doesn’t mean it’s good, or will work. I’ve seen far too many examples of this on Kickstarter and larger internet – many self styled “designers” and “engineers” have no idea about the materials and processes they are using to create “products”. This is not to say much of engineering and design can’t be automated (CAD and simulation software as it exists has made life much much easier), but a basic technical comprehension will always be needed if one wants products that don’t fail.

People will create efficient and beautiful blueprints for free . . .

Why? Once 3D printing gets past the toy stage, the designs will likely be licensed with some limitation on how many times the design can get printed. Crappy designs will be free.

. . . and eventually AI will be able to create blueprints for you.

Until AI is able to read your mind, I am skeptical.

How does one 3D print a steel forging for your car’s suspension?

How does one 3D print an aluminum automotive fender?

How does one economically 3D print a keycap for a computer keyboard?

One can look at almost any manufactured good and see metal stampings, metal castings, and plastic injection molded parts that are produced in great volume, vastly cheaper than 3D printing (if even feasible).

Designers have used CNC (computer numerically controlled) machining (AKA “subtractive” vs 3D’s “additive”) for many years.

There are “lights out” machine shops with automatic material feeders that feed material into CNC machining centers and operate with little human interaction.

With “subtractive” machining the designer can choose the metal alloy specifically for the job and elect to use a cast part vs a forged part when necessary.

Volume metal and plastic parts are cast/injection molded at low cost.

Where I work, 3D printing has been used to make physical concept mock-ups, probably for 30 years.

A couple of years ago I passed on an ancient (1980’s) 3D printing system that they were auctioning off for charity.

3D printing was previously known as “Stereo lithography” and an early process was patented in 1986.

see https://en.wikipedia.org/wiki/Stereolithography

I don’t think 3D printing “scares the shit out of designers and engineers”, as they have been using it for a long time and know its limitations and advantages.

3D printing is fine for prototyping a physical sample for people to try before going to volume production in a different process.

The 3D printing time, choice of materials, and cost of consumables make it unsuitable for volume production.

Agree completely with the above. The only people who 3D printing is making any money for are the people selling the machines. The inno-viduals, as I saw it said the other day.

Point this out at your own peril. Luddite.

Just as the ACA is nothing but a transfer of wealth to the unnecessary insurance industry, a UBI will be a subsidy to landlords. Rentiers of multiple industries will be ravenous for their oversized portion of any UBI.

Private ownership is countered with labour and public ownership. I’d also like to see a bunch of public housing, a base level of energy use and a food product card (not dollar amount) for everyone.

Different version of the same thing happened to a retail operation in my town. It didn’t last as long as Yves’ gym, but I wanted it to succeed for many of the reasons outlined in the above post. It was, though, a valuable illustration of some of the most common failings I’ve seen over the years made by proprietors of small businesses (in my time in retail “front line” banking, I dealt with a lot of retail lending that was going bad because of problems with the borrower’s small business or sole trader incomes).

Before going any further, let me echo Yves’ closing remark. I got this from a careers counsellor about acting and it applies here, too. If there is anything — anything at all — you can do apart from set up in business for yourself, do it. Setting up in business for yourself should be a last resort and this goes double if you have dependents. If you’ve got some financial resources behind you, then you are in a better position, but do not even think about it if you don’t have some savings to tide you through the lean times or a spouse’s income.

Anyhow, back to the anecdote. If you can escape the daily commute and work from home, that is nice, but one of the things you quickly discover is how easily it is to become isolated from other human contact. Again, as per the post, a lot of the reasons why people put up with, frankly, a lot of rubbish, in the workplace is because despite it all, we do get a shared sense of belonging, of place. If you don’t have that all that regularly, you do notice it and you do miss it. So to alleviate this sense of listlessness and even alienation, I make a habit of, daily, getting into to the real world for an hour minimum. Grocery shopping, walking by the river or in the local nature reserve are good ways I find to spend this time, but they are somewhat weather-dependent. sometime you just want to sit somewhere different and, being honest, be a bit nosey and do some people-watching.

Venues for this are limited in the town where I live. There are a couple of pubs, but these make it fairly clear that you’re expected to buy overpriced and not especially heathy food and / or drink. That’s fine, they shouldn’t expect their facilities to be used by people not paying their way. So I quickly discovered (or rediscovered, more accurately, they are a way of life in Japan) the appeal of coffee shops. There are around half a dozen in the town centre, I don’t like going to the same one, day in, day out. So I chop and change a little. There are two of the big chains present (in the UK these are Costa Coffee and Café Nero; luckily my town has avoided, somehow, for the present, a Starbucks infestation). There are also between four and five independents. These, it has to be said, come and go like the seasons.

I don’t normally get too attached to these places because, as is inevitable, the vast majority don’t succeed. But there was one place which I did hope would have some staying power. When the local transport hub was rebuilt, a new retail outlet was created with zoning (“planning permission”) for a café / restaurant. It was vacant for ages, at least six months after construction finished. But eventually it was leased by a couple of chaps from eastern Europe (I was always too polite to ask exactly where, but they arrived in the pre-Brexit influx). Now, to me, first off, that was an incredibly courageous thing to do. Everyone in government, big-business lobbying and the right-wing press talks about entrepreneurship. But most of those who talk about it don’t practice what they preach and prefer the safety and security of either government funded positions or enterprises which draw heavily on the public purse for their continued ability to remain in business. Here, though, was the real, human face (or faces, I think they were two brothers) of what so many blather and opine romantically about — people putting up their own money and a chunk of their own lives to try to start a business and make a go of it.

While they had my goodwill, unfortunately they made the classic in-business-for-yourself mistake of being too risk-averse and not spending enough on their proposition to make it attractive. What the market (Coffee shops in my town) wants is either:

To achieve this, the coffee shops must be well-appointed, have up-market, tasteful décor and give a lot of thought to layout (plenty of quiet spaces where two, four or six people can sit together and converse in reasonable privacy) and acoustics. They should achieve something of a separation from the rest of the outside world but still offer a chance to both observe and also participate in the separate, but related, tableaux vivants.

The start-up operators of the new coffee shop spend a lot on top-notch coffee machines, display cabinets for cakes and snacks and the coffee bar counter. The coffee was great, the best in town. The food offer was a real change from the usual — fresh and varied with some interesting specialities. But the rest of the café was skimped on. Cheap, hard, uncomfortable chairs, rattley tables and no soft furnishings made for an uncomfortable sit. The new building had floor-to-ceiling windows which gave a good view, but they felt clinical and needed diffusing with plush drapery. The ceiling was one of those modern “unfinished” types where you can see the utility services which was okay but needed acoustic baffles to prevent rather unpleasant echoes from reverberating. The owners also skimped on running costs — the place was way too cold in the shoulder months (I nearly froze to death in April) but you baked in July with all the unshielded glazing. Another £30 to £50k would have transformed the place and made it much more inviting and something of a “destination”. But I am guessing the owners were strapped for cash and figured that more opulent shop fitting was the area they’d have to cut corners on.

The café attracted the grab-and-go clientele, but the other outlets in town also catered to that segment, plus the supermarkets offered that sort of service at lower prices. It needed the longer-stayers who might also have higher Average Revenues Per Customer by buying food. It couldn’t attract those, because you didn’t want to spend much time there due to the poor ambience.

It closed after about 6 months. I was, as I mentioned, sorry to see it go.

One of the mega chains (Costa Coffee) took over the unit and refitted it much as I describe above where I listed what the optimum configuration needed to be. For a big conglomerate, a few extra tens of thousands on shop fittings is nothing. And they will spend this just to achieve the standard corporate “brand” look and feel. The place now attracts the kind of customer base it needs — those who want somewhere pleasant to kill a bit of time while shopping or waiting for their bus back to the affluent villages nearby after meeting up with a friend or two. So as a business proposition, the site is a good one and can be made to pay. But the original proprietors — like so many in the same situation — didn’t appreciate that they had to invest a lot in the hope (and hope is all you have) of succeeding. When it is your “own money”, this is a huge psychological hurdle to surmount.

But so many people who are in business for themselves can’t recreate the mentality of the big, established players. They concentrate too much on a line of thinking which is akin to the one you have when, say, buying a car or refurbing your house. Inexperienced business owners look at what they would “like” to spend, what they think they require and try to match the two up. This is completely understandable, but also completely wrong. You need to determine what the market you are trying to satisfy wants, what it will cost to satisfy that demand and work out if you have — or can raise — the money and if so, will the return on it justify capital expenditure and the risk. Very, very few can develop the level of detachment and objectivity required to make sensible investment decisions. Consequently, few are temperamentally suited to being their own boss.

Great post, this all seems very familiar to me here in Dublin. I am office based, but my work is mostly solitary and it allows me to disappear for a few hours to do quiet reading away from distractions, so nice urban cafes and restaurants are important to me. My favourite spot is just like the one you describe – run by two lovely Polish sisters – a place where you can get a delicious salad and great coffee for a good price – but in the tiny ground floor of a 17th Century house. They obviously put it together on a shoestring and I honestly can’t see how they can make much of a living from it as its just too small, so I dread its closing. My local Korean café/restaurant is great and cheap, but I wish I could persuade them to put the heating on in winter and some comfy seats (uncomfortable restaurants seems a Korean/Chinese thing). But its been there for 15 years so I guess they are doing something right.

Most of my favourite local businesses seem to be showstring efforts and probably can’t last too long. My local gym is a bare-boned free-weights place in an old industrial building, but really popular and fun, but it depends on the owner doing very long gruelling hours to satisfy her clientele. I’ve a great hot yoga place around the corner from where I live, but its too small I think to make much money for the owners. My closest neighbourhood bar has gone through repeated owners, each of whom have been unable to make it pay – its in a hidden lane and its too small to do food which seems the only way pubs can be profitable these days. My nearest commercial street has a handful of very nice independent retailers, but again, I suspect they struggle or are more hobby shop than real businesses. The only really successful one is a tiny drinks store which is an Alladins Cave of craft beers from around the world which I think makes much of its money from internet sales.

Thank you, PK. I enjoy similar distractions / get aways in London. It’s easier in the City than Canary Wharf. Many establishments in London and Buckinghamshire are run by foreigners, often families. Some struggled during or went under soon after the blockade of the Channel Tunnel a couple of years ago. They could not get supplies, but had bills to pay.

In many parts of London, it seems like one can’t swing a cat without hitting a Prêt-à-Manger (like Costa Coffee and Café Nero). Those seem to be staffed largely by ex-pats, and that leads to wondering what they’d serve in addition to the take-away menu. Perhaps there may be a trend toward more internationalisation of the menu, such as more Polish dishes?

Thank you so much for sharing, Yves and Clive. I have observed the same in Buckinghamshire and, with regard to a cousins, Mauritius and Sydney. Both cousins are struggling to keep their coffee shops going. The Sydney one has also invested in a motel, so is stretched. The strain on both and their relationships show. The Mauritian cousin (by marriage) is stubborn and has long wanted to be his own boss. My parents and I have given him money, without wanting / expecting a share of the business and its profits, but refuse to now as it’s a hopeless cause. We have suggested that he get a job, probably abroad, but he is having none of that and avoids us now, which is just as well. It did not help that his sister married into some money and enjoys the high life with her new family, which he would like to emulate.

@ Clive: I wonder if we have worked at the same Canary Wharf TBTF banks. I joined Deutsche from Barclays the week after the referendum and work mainly at Spitalfields, so near many of the coffee shops etc that you talk about. Let me know if you ever go to Lyle’s on Shoreditch High Street and try their latte with soda.

On the isolation of working from home and for ones self as a YouTube entrepreneur/freelance artist:

https://youtu.be/2MUhQTpyyZ4

Working from home nearly put me in the funny farm. That’s why I’m now a member of a coworking space.

It’s also useful advice for the long term (or even short term – even a few months can take their toll) unemployed, to get out there. Just being realistic about this economy.

You make a lot of good points. I wonder how a small businessperson who opens a coffee shop and appoints it well and sell good coffee and pastries survives. One would have to have a large volume operations to make any decent money, especially if students, work-at-homers, housewives and the elderly occupy the tables after buying a cup of coffee. I know that in Spain, France, Italy Japan people park out for hours after buying just a cup of java. How do they they stay in business? Low operating costs?

I’ve had friends in the coffeehouse business. In that biz, the long-term space occupiers are referred to as table suckers.

While I agree with your conclusion, it has a “glass is half empty” feel to it. My husband owns a small business. He and his business partner struggled mightily through the Great Recession. If I told you that he and his business partner stopped paying themselves salaries for a few payroll cycles so that they didn’t have to fire anyone during the holidays a few years ago, then I suppose you would say that they are not “temperamentally suited” to being their own bosses. That’s probably true. But, as is usually the case with entrepreneurs, they were optimistic about the future, and they take pride in creating good-paying jobs for people that they begin to regard as family. It could be their undoing in the long run, and, no, they won’t end up in the Capitalist Hall of Fame, but they couldn’t do it any other way.

It is not a little heartbreaking to say this in the face of your story of your husband’s ethics and social responsibility which we could use a lot more of, but a business that struggles to make payroll is not a healthy business. It is a big, red, flashing warning sign. Now, it is possible that it was just a blip and indicative of a short term downturn in a business cycle which waxes an wains. I’d need to see the books to say for sure. But proprietors confusing their businesses with charitable trusts is another red flag, too, so now I’m seeing two things that would have me worried.

I know no-one likes pessimism and negativeness. But it wouldn’t be honest for me to do pompom waiving when I’ve seen similar so well intentioned but ultimately ruinous courses of action followed by people who did not deserve the financial disaster which engulfed them.

If the business is now on an even keel, then it might be worth sticking with. But another spell when you end up cash flow negative should give you cause to sit down and have a good heart-to-heart talk.

Sorry again to sound like the Grinch who stole Christmas.

During a visit to NYC early this month I was struck by the number of empty storefronts throughout the city.

I have observed similar patterns in other places. Of course, recessions impact storefront businesses, especially in less prosperous locations. The “weak” (as in absent) recovery of Main Street has created a generally constant level of empty commercial properties; so increases of up to 2x may go largely unnoticed.

But there are other drivers for empty storefronts. At some point, the resale value of a property outstrips its rental value. Steep rent increases can be seen in neighborhoods where gentrification is planed: empty properties are simply cheaper in the long run, when tenants don’t have to be bought out. And a significant rate of empty storefronts hurts neighboring businesses as well, less foot traffic in the area, In and a generally less attractive venue for replacement businesses. On the other hand, this kind of business climate is good for tax write-offs and money laundering operations.

So my guess, already, was that, behind the scenes, major developers are eyeing sections of Manhattan for “strategic development”, and the word is out among the landlords, who generally know how to read the markets precursors. Yves’ observations further support this hypothesis for the area’s patterns.

In other areas, like New Mexico where I live, degradation of the business (and residential) environments weakens the over all real estate market. Why would land holders accept this? Many don’t, but some of the larger players are hoping to buy devalued properties for later resale to energy developers; New Mexico is an ideal environment for both wind and solar power development (and it has untapped mineral resources as well). Weakening the consumer real estate market weakens the constituencies of environmentally protective interests, both in number and in economic power. Alternatively to direct energy-source deployments, cheap real estate can later be developed for staff housing and maintenance facilities.

Real estate is generally a long game; the price booms of recent decades are something or an anomaly, driven by the conversion from direct wage growth to a debt-base consumer economy. Now it’s time to wind back some of those gains; inflation over a few decades also reduces actual gains from real estate investment.

Sorry if I’m not using all of the right language for these things, I’m just a systems guy.

Thank you, DK. I have observed the same in Buckinghamshire and the US.

My former GF has just moved from East 46th Street to Hells Kitchen for financial reasons. Some of the horrors of her new apartment block are the low rise and lack of lifts and concierge. Apparently, her former building is earmarked for an upscale revamp and marketing overseas. The other apartments were also occupied by foreigners, but they have to work like la bella sevillana.

Yes this is a familiar problem in small town America where decades ago downtowns were often abandoned for Malls (not just Walmart). Here too one reason was that downtown real estate owners were unwilling to accept reality and lower their rents. So residents of NYC’s downtown (Manhattan): welcome to our world. In my town they are trying to bring back the downtown with the “new urbanism” with mixed results.

Of course the high rollers who are the real beneficiaries of NY’s financialization revival probably don’t spend a lot of time shopping at the corner grocery and so are indifferent. Back in the 70s I lived for awhile in the East Village and like to think of it as the last time you could live in Manhattan and not have a lot of money. The then nearby Alphabet City–then a haven for drug users and dealers–is now doubtless full of million dollar condos.

+1. Good comment about real estate developers and current property owners pricing out existing businesses.

^^On the other hand, this kind of business climate is good for tax write-offs and money laundering operations.^^

Yeah, the above is apparently real phenomena. I’d love to know how deeply and how widespread is the phenomena of empty rentals being more financially advantageous (to some small subset of investors/finance) than having actual renters/users.

In my small western mountain town there’s a local institution of a bar/restaurant that’s been opened only sporadically, if at all, for the last 4.5 years. A year or two ago, a local, free monthly rag ran an editorial identifying the owner and lambasting him for keeping it closed. If memory serves, the owner had crawled out of the recesses of Silicon Valley having made his billions with some well-known social media site that I can’t remember right now. The editorial claimed the guy owned the bar/restaurant simply as some kind of tax write-off, had no incentive to have it open, and apparently no concern whatsoever that the place was an institution with a history and very much part of the fabric of this small town.

Never mind community or people. That one line in this guy’s portfolio is what is important.

REITs

http://www.nakedcapitalism.com/2016/12/when-a-business-you-like-dies.html#comment-2735406

The valuation of urban retail space has often been more alchemy than science. In any given city the value of residential/office/commercial or edge of town retail is always going to be fairly consistent and predictable, but the rents of urban shops can vary wildly within a few hundred paces because of a multiplicity of factors. I’ve long suspected this leads to some very dubious practices.

In Dublin, when the crash hit in 2008, some retail landlords notoriously refused to lower rates for otherwise viable businesses, and seemed to accept empty shops/restaurants rather than full ones on reduced rents. An explanation I heard for this was that it was an attempt to keep a notional capital value on the property to avoid the appearance of insolvency.

Its a variation on a common practice in periods of high inflation/rental values, whereby developers kept property vacant to allow annual revaluations, with would permit them to increase their leverage for other investments. A famous example was the CenterPoint Tower on Oxford Street in London, which was kept empty for several years in the 1970’s by a major developer for precisely this purpose.

I’ve no idea if this is the case with New York retail (or elsewhere), but I would suspect that the difficulty in identifying the ‘real’ rental value for ground floor retail space allows landlords to maintain fictional capital valuations for all sorts of purposes, whether that be to leverage further borrowings or just maintain a fiction of solvency. It may be that some supposedly sky high rentals are ‘on paper’ only, and the money is clawed back in some other way. If this is the situation, then real, live, profitable businesses are a nuisance rather than a benefit to a landlord.

Not only a nuisance, but a potential liability. Around here, letting a place go fallow may only cost lost taxes, while repairs to meet code can go an order of magnitude higher. Money is pouring in from overseas, and the ‘three stories on top of a storefront’ is taking over from older single-story buildings in the town center and at major intersections. The city gives quiet tax breaks on renovating broken-down structures. Wherever this happens street life decreases: fewer porches, less relaxed businesses, and dependent on more parking. The end cycle when wealth accumulates seems to be condos with all manner of inner businesses, but exterior walls with no windows below ladder height, and all walkers are suspect. And their own helipads and yacht docks (Naples Florida I’m lookin’ at you).

“An explanation I heard for this was that it was an attempt to keep a notional capital value on the property to avoid the appearance of insolvency. ”

It’s a little more than that. The value of the property is derived from what the going rate for rent it. If you lower rent, you’re lowering the value of the property.

This is a very big deal with properties that are mortgaged. Lower the rent and all of a sudden the property is underwater.

I think this is a very US problem with how RE taxes and interest payments are allowed to be deducted.

Most RE ownership is REIT like. The goal of ownership is not to own the building, but to own the tax and interest deductions.

In Denver, CO in the 1980s, a lot of builldings had been built in anticipation of a continued oil boom. After the bust, these became “see thru buildings” with no curtains and no furniture.

Anticipated rents had been 40/sq ft. market value was now 10/sq ft. The builders could no lower the rents because the resulting value of the building would drop from se $10M to $2M. This would bankrupt the builders and the financing banks.

They began renting office space at $40 sq/ft combined with give backs of $30 sq/ft that reduced the effective rent to $10 sq ft.

The banks and bank examiners all knew that this was a fraud, but according to the written rules the $10M building was still worth $10M and no one was going to challenge that at the cost of wiping out all the bankks in Colorado.

After 6 or 8 years the economy improved enough to let the investors get out with a whole hide.

REITs also, see below.

http://www.nakedcapitalism.com/2016/12/when-a-business-you-like-dies.html#comment-2735406

I don’t think you can analyze this correctly without taking into account the massive law changes and handouts to Property Owners known as REITs.

It wasn’t just simply forbearance. It was a wholesale change to well founded law and accounting that many thought was completely illegal. Reagan to the rescue! S&L’s failing? Too much property? Change reality! Turn that money loosing building into a tax break!

It’s very hard to describe in a few words. It’s also hard to give context to people who “earn” a few million a year. Trump gets it, very well.

Its all about the laws, and it starts with the most basic elements: education, health care. I think Clive makes really important tactical points about how to successfully operate a small business, but we have just about the worst structural setup for small business ownership in the U.S. Another one of those reasons that “America’s #1” is such an empty slogan of a bygone era. We’re not, and its easy to tell when you start actually looking and comparing America to other countries.

EDUCATION. In Europe and throughout most of the developed world, getting an advanced degree doesnt set you back financially the way it does in the United States. I FEARED not having a job out of college b/c the starting monthly payment on my first class education was $900 a year. Hard to start a business with that hanging over your head. Not to mention student loans being non-dischargeable.

HEALTH CARE: We don’t provide it at the societal level despite being one of the wealthiest countries in the world. Leave aside the gross inefficiencies of our current system and apply to the small business owner in this scenario. 1- you have to earn a lot of extra money to cover health insurance, therefore many people won’t start a business for the same fear factor i described above. The risk of “losing it all” now must also include your health (and perhaps that of your wives/husbands, childen as well). 2- prospective employees have a built-in inventive to “work for the big guy” b/c they provide (albeit crappy) health insurance by virtue of employment.

This is grossly simplified and I am surely missing more cause/effect points.

I recall a link from ~6 months past where this 22 year old in the Netherlands was able to grant-fund a project where he built a trash collector/compactor that could be deployed in the ocean. Think about how a similar project would work in the U.S. — hint … it wouldnt. Even if said U.S. citizen had a huge bankroll to actually do the project, big business would either lobby congress to make his activities illegal, would buy out the company and shut it down (as threatening to their inherent right to earn profit) or pull off some equally anti-societal move that I can’t even fathom.

It’s all about the laws.

Another legal aspect is the contractor vs employee distinction. Many small entrepreneurs are reluctant to shoulder the regulatory burden of taking on employees. The IRS guidelines for distinguishing employees from contractors are subject to interpretation.

Since the Fair Labor Standards Act of 1938, the general tilt is toward treating workers as employees, with the attendant regulatory burdens. This is one reason why immigrant families are prominent in small business start-ups: when the workers are “all in the family,” there won’t be any claims to the regulatory authorities.

For several years I worked as a contractor for a Japanese company in NYC. Almost certainly the IRS would have classified me as an employee, since I didn’t have other clients. But contractor status allowed me to set up a personal Keogh plan, obviating the risk of not getting vested in the employee pension plan (which takes five years).

In summary, the US regulatory tilt against contracting discourages small business entrepreneurship. Large immigrant families are better able to overcome this hurdle than lone Americans.

the only way to make contracting work for employees (and I’m not at all sure we should, I’m not sure a business that can’t pay employees as employees should even be considered viable) is to have a SERIOUS social safety net. Otherwise you have crap contracting jobs like well Uber, no benefits, chronic job insecurity etc..

From the WSJ article in Links about manufacturing businesses with no employees:

Never mind merely unemployment tax — with employees, you need to engage a payroll service, since the penalties for failing to submit withholding taxes on time are savage. Then there’s workers comp insurance. And the constantly changing, astronomical cost of health care benefits. And the extra pension plan paperwork. And so forth.

The legal bias against independent contracting is a job killer.

There is an answer to “employee” problems — with all attendant risks: assuming adequate CASH, you hire “black”

labour. Can work well in one area & not in another. It’s illegal – but not always immoral.

Also not great, because the cash you pay them doesn’t come off the bottom line at tax time.

The regulatory burden on simple businesses is obscene, too, and I think you left that out. Having started a nonprofit last year, I can attest to the fact that even starting something that is tax exempt and exists only for educational purposes is ridiculously difficult. You need an accountant or an infinite amount of time just to navigate federal and state tax codes.

Ref: See: Last 15 years in Hong Kong.

Sterile, more sterile than Singapore.

I have mentioned this before, but, the small business people I know, (a limited population, so, anecdotes will try to take the place of data,) are having a rough time in Mid Sized America. My metropolitan area, I have recently found out is rated at 150,000 people in size. This must be a hidden population effect since the City proper boasts only 45,000 people in population.

As a typical Southern City, we have a decayed city centre and several satellite suburbs, each with it’s own mini mall shopping district. Think of it as a cancer. A larger center tumour with strings leading out to smaller satellite tumours. Downtown is trying to gentrify. One place we looked at to buy three years ago was a very rundown two story brick building. The thinking was, business downstairs, living quarters upstairs. We must have been watching too many old black and white movies with neighborhoods filled with just such setups.

“Hey Joey,” sister yells out of the second story window, “Ma says come on inside and practice your violin!” “Aw gee sis,” replies her brother from the street, “me an the guys are practicing boxing!” Mom pokes her head out of the same window, while shooing sister back into the room, “What, you want to end up a gangster like Billys uncle? Now get in here, and while you do, ask your Pa in the shop what he wants for dessert!” Later on, John Garfield meets socialite Joan Crawford. Cue the Wagner music.

Instead of the Lebestodt, our real life mini drama requires the Gotterdammerung.

The owners of the building we were interested in didn’t lower their asking price for over a year. We made some inquiries and learned that the owners weren’t going to budge on the price at all. Eventually, the property sold to a land and property management syndicate for close to the asking price. Deep pockets won that day. The new owners semi renovated the structure, as in barely bring it up to code. The new owners then leased the downstairs to a niche “trendy” pub, and the upstairs to a dance studio. Both, I found out, were paying top dollar rents because of the location in a downtown that was supposed to be gentrifying. A year down the calendar and neither place is doing very well, but neither is shutting it’s doors. The hope of getting the “big bucks” keeps these two businesses open. I also found out that the pub pays it’s workers the least it can get away with. Scrabbling would be a good word to describe this dynamic with. The only people making out well are the landlords, who have deep pockets already. As one real estate agent I talk to on the odd moment said about it; “These people don’t worry about empty storefronts because they don’t really need the money. But, money is what they are all about. Talk about double standards!”

The other store story I have mentioned before is our local small Health Food outlet. Really vitamin stores, this one branched out into Tom’s Shoes. So, pills in front, shoes in back. She also has a specialty food outlet, Spiral Cut Ham, and mentioned to us that she tries to keep the two concerns firewalled off from each other. The food outlet does well during the holidays, but languishes otherwise. The health food store does steady business, but won’t make her rich any time soon. Each is situated in a smaller satellite mall out towards the wealthier suburban neighborhoods. In each case, the strip malls are managed by out of town companies who work for the owners. In both, store rents have steadily kept rising over time. Several years ago, the store owner asked about perhaps freezing the rent for a year or so. The management team didn’t even call her back. All she got was a boilerplate letter which basically took a page to say No. This happened at a point when a third of the bays in this strip mall were empty. She started looking around for a location further out into Suburbia and found even higher rents. The general excuse given for this to her was the these rents were designed to track and increase on the rents she was trying to flee. A form of metrics was driving the process. She’s still at her old location, and barely holding on.

My take on all this is that here we have some real world effects arising from wealth inequality. The “Owners” have become detached not only from their fellow poorer human beings, but also detached from the social element dimension of “owning.” Deep pockets win the day but at the same time lose touch with what it is they are “winning.” Decisions become skewed and consequences are buffered by the cushion of wealth. A healthy balance sheet does not translate into a healthy society.

Rant over.

This is probably the best explanation I’ve read for it all. There is so much “capital” out there among the big players that it dominates the system with just this sort of attitude. Storefronts are no longer the purpose of business. Rent is the purpose. And Capital can hold out for some sucker to pay unreasonable rent, hoping for the day when they’ll become a rentier, too.

. . . and so the answer is (perhaps) that cooperatives build commercial properties with the intention of finding (or being found by) small, interesting, local(ly owned) businesses.

I think we are on to something meaningful here.

1. The rents are up.

2. The realestate prices are up.

3. The places are empty – and it still only goes up and up.

You dont become become big realestate owner by being stupid an simultaneously not being named Paris Hilton.

There is no limit to printed money. There is no limit to capital, which is measured in state issued legal tender, which is demanded from you to pay taxes.

There is a limit to urban centre realestate, especially in crowded England or Japan.

So owners know that the rent will come from somewhere – and it is coming from those that have acces to freshly issued Q.E.

Big corporation like Apple or Costa can get the capital much, much easier than individual starting a coffe shop or phone repair business. Big guys can borrow money at almost negative interest rate. Which means it costs them almost zero to open up a new branch. They pay the landlord say £1 milion, which they borrowed from HSBC for almost zero interest, and when they will have to give it back, they count on borrowing another one for the same price. Meanwhile, the bank is happy to lend money to a big safe borrower. Until the next crisys comes, when big business will have to make a few flights to the goverment and back, and big banks will be bailed out to save the world.

In a simple everyday experience, Costa gives you better coffe in a better ambient for a lower price. Not for being smarter or more experienced than small business owners, but because it borrows money for free and pays almost zero taxes. I love their coffe :-(

I’d preffer unconditional basic income or just pure socialism to this top-down Q.E. Social state for big guys and “free market” for the masses.

Does anyone have any insight into the effect REITs have on these types of commercials rents? My feeling/theory is that since “investors” are looking for any yield, anywhere, perhaps there’s pressure to squeeze groups like small businesses with “nowhere else to go”?

First of all residential real estate is subsidized thanks to all kinds of policies and commercial can’t keep up. Real estate is not being priced on income but on capital gains.

Right now we have deep pockets who can sit on money for a decade or 2: pension plans investing in infra, private equity and reits.

Thanks to deep pockets and financial engineering, big pension plans can use alternatives which permit them to keep on using assumptions of long term returns of 7% or more even if rates are at all time lows.

They can pretend to generate income for quite a few years using return of capital and assuming that their real estate investments will generate a capital gain down the road.

Big pension plans are Wall Street’s bread and butter. But since no one wants to lose their pension, the flawed system keeps on suffocating Main Street.

But commercial real estate might not even be based on income and capital gains. A hunch tells me it is currently mostly based on access to easy money…

Find real estate, pretend there will be gains, raise capital and/or borrow money and use these funds to pay yourself multi-million dollar packages. And when the whole thing implodes in 5-10 years, the pension plans take the right down and the multi-millions are in your accounts.

Your view is completely Canada centric and does not align with reality.

“First of all residential real estate is subsidized thanks to all kinds of policies and commercial can’t keep up.”

That’s why commercial space is sitting vacant?

Please do show how I am wrong.

It is quite obvious that many players are not playing commercial on an income basis. If they were, they would make sure they are not vacant.

Look up who the players holding these asset are and you’ll quickly see why they can afford to sit on it.

Easy money is at the top of the list. Financial engineering a close second.

The concentration of wealth is moving up the curve… and it’s finally starting to hit the top 10-20% living in city cores… they buy multi-million dollar homes thinking they are moving to a walkable neighborhood only to find they’ll have to drive to a burb to get to the big box.

It would appear to me, being a human who can read, that your assertion doesn’t hold any water at all.

Commercial space is empty because of subsidies to residential?

What did I get wrong? It seems you said that. Just above. I’ll quote it again-

“First of all residential real estate is subsidized thanks to all kinds of policies and commercial can’t keep up.”

When residential real estate goes for 1800$ per square foot, your commercial real estate better be generating huge rents or else you’re better off converting it into residential.

Residential real estate is being propped up by all kinds of social fiscal and monetary policies which I refer to as subsidies.

So where is all this converted RE? Too much housing for people? We have a “too much housing” problem?

It seems to me, that you have it exactly backward with respect to the US RE market. The subsidies go to large commercial entities. There’s a post about vacant store fronts and the death of small businesses just above this. All the way to the top. You should read it.

How do you square large commercial entities being able to shoulder not having tenants for years? Sounds like a subsidy to me. And no, there is no “push” to make them residential, which is also, apparently, part of your contradicting claim.

http://online.wsj.com/articles/converting-commercial-properties-into-homes-1401401893

Arbitrage always has an effect on valuation whether they convert or not. Players can convert or sit on it. Those who sit on it obviously have deep pockets. Who has deep pockets?

Most of the time it’s a REIT, or private equity fund… thanks to easy money and big pension plans diving into alternatives.

Spoken like an aspiring BS expert.

“Arbitrage always has an effect on valuation”

WTF does that even mean?

Work on getting the first order effects of supply and demand correct, then work your way up to truisms.

Explain the very obvious, very apparent problem of vacant store fronts, and your batshit crazy assertion that it has to do with too much money being given to homeowners. Subsidies, as you called them.

Repeated, again-

“First of all residential real estate is subsidized thanks to all kinds of policies and commercial can’t keep up.”

I’m done with your bullying.

Take care.

Why don’t you let the high road hit you on the ass the way out?

I honestly mean that. I doubt the veracity of even your closing statement, so I thought I’d clarify.

In metro DC we have not only loads of spanking new condos, but also numerous conversions from commercial to resi. The commercial vacancy rate in my small, prosperous bedroom community just across the river is as high as it’s ever been.

Not sure where this fits in the argument, but in seattle there were codes enacted to encourage commercial on the street level and residential floors above with some height restrictions in some areas, but clearly not in ballard where they’re basically skyscraper apartments with a retail street level. The living spaces get bought or leased in some fashion while commercial sits vacant for long periods because no demand exists which imo is because rent is so high while pay stagnates. Developers look for the bad part of town, buy cheap and sit on it til the municipality does a redevelopment offering subsidies to gentrify at which point the money cashes out and moves to the next blighted area, willing to wait 10 years for the bubble to shift, it’s a rinse repeat operation and the devs have zero incentive to make it nicer, the game is all about where the new stadium will be built and we all know who pays for the stadium. QE takes all the pressure off the big money and was a massive subsidy to existing wealth but really we’re looking at a conflicting story, there is demand for housing at whatever cost, but no demand for commercial as no one is buying what they have to sell, at least not enough to pay the rent on the storefront, which and once again imo, is so high because the residential is so expensive.

I have suspected the same. I don’t have a strong vernacular to explain it, but I think this essentially shifts risk from banks to small businesses.

With TBTF (easy money) backstops, there are no consequences to issuing loans for ever higher valuations (the higher valuations which are premised on obtaining ever higher rents).

The small businesses have the outsized risk of covering these higher rents. Their margins go down (or negative) to try and cover the rent. If they can’t and faiil or the lot stays vacant, the banks don’t appear to have “consequences” (i.e. fire sales are no longer allowed post financial crisis).

You move to Manhattan for the 70s woody-allenness of it all, the authentic chinese restos and small art movie theaters…and there’s nothing but Starbucks, Duane Reade and a Chase branch on every corner.

In Manhattan, the Carnegie Deli is closing in two days. Gracious Home, a class act that was reason enough to move to NYC if you’re into diy interior decorating and the best kitchen, bath, hardware, and other items found nowhere else, closed recently. Bed, Bath & Beyond lives on down the street with its overall homage to over-consumption and more tackiness than not. A new Italian coffee bar across the street from the Symphony State venue closed, while Starbucks lives on. Last I saw, there was one antique store left on the UWS of NYC. One last hope in this neighborhood is the Edward Hopper-like Broadway Restaurant, which is a real diner on Broadway near W. 101st, where ‘everyone knows your name.’

Carnegie Deli closing? OMG, that was a mainstay and always busy, even at off hours.

That’s because NYC isn’t really owned by Americans any more, right? All I hear about is how foreigners are buying up apartment complexes in NYC. If so, the foreign real estate tycoons are the ones jacking up that rent. They have nothing to lose. They are in it for the long term.

So the reason NYC doesn’t feel like a real city anymore is because it isn’t. It’s a city for a global audience, which means global conglomerates run its spaces now.

Your description of the commercial rental scenario on the upper East side parallels what’s occurring in the West Village. Additionally, there have been several recent ventures that folded within months of opening, which were preceded by long-term local businesses. The most conspicuous was the recent closing of Mrs. Green’s — a pallid Whole Foods wannabe — that folded in less than 10 months. Prior to that, the space was occupied by Duane Reed for less than two years. Before that, it was a Gristedes for at least 15 years. And after Gristede’s left, the space was empty for several months prior to each transition. In each case, I suspect exorbitant rents played a significant role. I would really like to better understand how commercial property owners in NY can continue demanding higher rents when the increases are not driven by the ratio of supply to demand. 7th avenue south of Christopher is practically a ghost town, yet rents continue to increase. What gives?

It is not so much that these little shops and businesses close, it is that what has closed is the feeling of community and belonging which is especially valuable and life affirming in a big cosmopolitan city. Many of the stores I would frequent when living in Manhattan knew me which made me feel like part of the neighborhood, part of their lives – it was enriching. I would walk into a bar and the bartenders knew my name and what I would drink. I would call for Chinese and they would tell me what my order was. I would visit my Korean grocery stores and they knew what I would buy there and we would chat. It is these connections which make you feel at home in New York. There were cheese shops, coffee bean stores, pasta stores in Soho and the Village – all small and family owned – these gave such a texture of life to New York. I don’t think Millennials will carry on with these traditions as they are too busy checking their phones – I can’t imagine they would ever feel comfortable dealing with people or starting businesses. As for the rent increases in New York, I too would see lots of store fronts sit empty for months if not years which made me wonder what that was all about. Tax write-offs I would imagine.

One thing in Manhattan, and increasingly in parts of Brooklyn and Queens with lots of high rise construction, is that the focus on putting up towers means that the floor plates of ground floor retail spaces are often enormous, so big that the only business that can use or afford the space are CVS/Walgreens/Chase Bank, etc. So Manhattan retails areas are increasingly homogeneous. Added that to are landlords hitting smaller units with huge rent increases, so you’re emptying out smaller storefronts and then having the same chains over and over. For a while on the Upper East Side, I think I had 5 Duane Reades, 2 CVSs and a RiteAid within 10 blocks of my apartment.

If these developers had any sense, they’d facilitate the creation of Chelsea-Market style retail spaces in their buildings, which would attract exactly the kinds of wealthy people they want living there. Of course, that would mean taking a risk instead of a safe big corporate tenant, and then you’d be, at your own risk, making the neighborhood attractive for your competitor’s building down the block.

City government should extend the union square model and create a bunch of Montreal style markets with affordable stalls.

The city government might understand what is happening. Maybe they could answer your question.

I live in the DC suburbs and have been closely following our neighborhood community planning group for development. The desires and vision of the community are in line with keeping diverse small businesses in operation as the area is developed. That being said, the reality is that when these lots are developed, a good proportion of the establishments are chain stores. However, about 50% are small businesses like restaurants, yoga/martial arts studios, and specialty shops. However, for these businesses to last, there has to be a concerted effort on the part of the community to support and frequent them.

Our community list-serve is quite vocal about the ins and outs of these businesses and how they are doing. Just recently, a long time auto repair shop has closed (proprietor retired) and when word that the property was bought by the holding company of 7-11, there was quite a bit of concern since a 7-11 drive through is not in line with the vision of the developmemt of that area. It will be interesting to see how this plays out, but the fact that there is strong community input as well as a supportive local government on community input in development, should help create a neighborhood more in line with the wishes of the community rather than a hodgepodge of faceless chain stores.

Chalk one up for the neighborhood’s sense of community. I like that you characterized it as a social choice by residents to support those businesses.

Yes, in the end, to keep such businesses going a large portion of the community must be willing to support them, typically paying a premium to the Starbucks, Home Depot’s, chipotle’s, etc. It seems like my neighborhood is the exception to the rule.

DC suburb, fairly affluent? well-off upper middle class communities are heavy into buying local these days.

That being said, this is a very posh, yet progressive area so may not apply elsewhere.

ah! you took the words right ouf of my mouth :)

Excellent observations in Yves’s original post and in the comments: My neighborhood is vital and somewhat traditional for Chicago, so vital and traditional that we get tour buses. I should put on native dress, I suppose, which would be some kind of Swedish-immigrant outfit.

That written, what we have in Chicago in some viable neighborhoods appears to be a combination of high rents and high pass-throughs of the property taxes. Landlords keep the rents high, and they are unwilling to give deals. The situation is complicated by “absorption” of new buildings: About four blocks south of me, a large condo development went in with several thousand square feet on the first floor of each of the two buildings. After twelve years, there is one tenant, a kids’ language academy (yep, we’re turning into that kind of a neighborhood). Now, it may be that the site, across the street from a large, old, Catholic graveyard, complicates matters. The solution? A new condo building went in next door, with more retail on the first floor. (I don’t get it.)

Still, at Christmas, the local florist closed, which was a surprise. It was one of those stores with a following in the neighborhood. They kept the other location open, in groovy Wicker Park / Bucktown. Rent was an issue. It was an issue for the kid’s clothing store with reasonable prices and a local following, and that space is still vacant almost a year later.

Yet my neighborhood also suffers from the Portlandia effect: There is a limit on how well a poorly capitalized store can function, no matter how twee. A men’s store with absurd prices closed. One of those restaurants that serves drinks in canning jars closed, to be replaced with a pseudo-Italian place with “small plates” that lasted a month. (Undercapitalized or just plain non-functional?) We have a “cursed” restaurant space that killed off an Italian place and a tapas bar, which now will become a supposedly authentic Italian trattoria (with distressed tile floors–just like someone’s fantasy of Italy) specializing in Meat Balls. I’m not sure how long the Twee Limit will allow: Meat Balls are not a big factor in Italian cookery, and let’s face it, who goes out in Chicago in February for such a thing? So you have risk-averse investors investing in ideas that are plainly rather bizarre risks. Three hundred dollar shirts? Meatball menus?

The rise of the many, many small gyms that are basically just a personal trainer with some equipment is a mystery. Faddish, as Yves mentions.

As to being self-employed, the issue isn’t companionship so much as health insurance. For a long time, I was lucky, being covered by a Japanese-American organization (although not being of Japanese descent). But Obama’s reforms don’t seem to allow sale of policies across state lines, so they dropped us. Then I tried to deal with BC BS of Illinois, which contracted the hospital network. Luckily, someone I have worked with for years offered me a great job. Otherwise, I’d be stuck paying some 800 dollars a month for crappy health insurance. So I consider health insurance to be the big barrier to entrepreneurship in the U S of A. I also happen to be in a trade (writing and editing) with low capital requirements: Some computers and printers and you’re all set to go.

That written, I understand the need for neighborhood contacts. I have a regular coffeehouse. I am a regular at the Palestinian grocery. I am a regular at a local “diner” with pastries. It is good to be known as a local (who cares enough to spend money at small businesses). As Yves mentions, these daily contacts and brief conversations make urban life tolerable as it become increasingly tattered.

If/when single payer comes to America, we’ll have an entrepreneurial explosion, the likes of which we’ve never seen before.

I think that a student debt jubilee would have the same effect.

“If/when single payer comes to America, we’ll have an entrepreneurial explosion, the like of which we’ve never seen before.”

Not if your a Schumer … or a Clinton … or an obama !!

A few days ago someone here posted about an alternative (read: more accurate) measure of inflation to the government’s CPI. This is not the only alternative measure (I think Charles Hugh Smith did one), but they all indicate a much higher inflation rate in major cities than the CPI. I have to think that this real inflation rate contributes to the fragile retail environment described in the post.

In my neck of the woods building owners are taxed at a much higher rate on retail storefronts than on the apartments above. Many building owners would sooner ask higher rents and never rent than bring the rents down to where retailers can pay. Why? They immediately run to the assessors office