Yves here. This otherwise fine post is marred by an outbreak of debt fear-mongering at the end. A fiat currency issuer like the US can never go bankrupt. It can create too much inflation but we are nowhere near that happening. General inflation leads to more brisk demand, as people stockpile goods or accelerate the purchase of services because if they buy them later, they will cost more in real terms. That in turn increases demand, which leads to higher employment and more labor bargaining power…which can increase prices more (demand-pull inflation).

Call me when we have tight labor conditions. Until then, the inflationistas are still fighting the last war.

And even though we are seeing some ugly price increases in certain sectors, like healthcare and higher education, neither is due to too many Treasury/central bank created dollars bidding up prices. As regular readers know well, health care cost increases are due to it not being a market good. You get driven to an emergency room and you have no control over what they will do to you, let alone what it will cost. The pricing of operations is totally opaque. Even if you go for an office visit, the doctor may add procedures, making the visit more costly than expected. And how many patients say “no” to unnecessary tests, like EKGs for people at low risk of a heart attack?

Similarly, the explosion in college costs is due to the perceived necessity of getting a degree, combined with colleges who are hardly neutral parties effectively selling loans to students who are ill-equipped to evaluate them and too often misrepresenting the earning potential of graduates.

And as more and more economists are finally acknowledging, decades of weak to non-existant anti-trust enforcement means more and more industries have become oligopolies, which means companies can set their prices artificially high.

By Ilargi, editor at Automatic Earth. Originally published at Automatic Earth

Benoît Hamon won the run-off for the presidential nomination of the Socialist party in France last weekend. The party that still, lest we forget, runs the country; current president François Hollande is a Socialist, even if only in name, but he did win the previous election. Hamon ran on a platform of shortening the workweek from 35 to 32 hours, legalizing cannabis and ‘easing’ the country into a universal basic income of €750/month per capita. He’s way left of Hollande, who has a hilariously low approval rating of 4%.

Hamon doesn’t appear to have much chance of winning the presidency in the two voting rounds taking place on April 23 and May 7, but we all know how reliable election predictions are these days, and in that regard France is as volatile as the next country. With conservative runaway favorite François Fillon accused of having paid his wife $1 million for doing nothing and Marine Le Pen, already desperately short on funds, targeted by the EU over money, who knows what and who will decide the election? Hamon may simply be the only one left standing on the day after the vote.

I bring up Hamon, about whom I know very little, not least because he was more or less a late minute addition to the field that was supposed to have been an easy win for his former boss Manuel Valls, I bring up Hamon because he confirms something I’ve been talking about for a while. That is, the fact that ‘leftist France’ chooses to go even more left than expected, goes a way towards proving my ‘theory’ that voters in many if not most western countries will move away from their respective political centers, and towards extremes.

This is an inevitable consequence of traditional, less extreme, politicians and parties having all become clustered together in shapeless and colorless blobs in the center, both in the US and in most European countries, combined with the fact that all of their policies -especially economic ones- have spectacularly failed vast amounts of people (or voters, if you will).

The failure of their policies has been hidden from sight by interest rates squashed like bugs, ballooning central bank balance sheets, real estate bubbles, fabricated economic data, and fantasy stories in their media that seem(ed) to affirm the ‘recovery’ tales, but they all ‘forgot’ to -eventually- line up reality with the fantasies. They never made 99% of people actually more comfortable. The entire politics-economics-media deus ex machina has failed because it was/is based on lies and fake news, meant to hide economic reality (i.e. negative growth), and this will have grave consequences.

People have started noticing this despite the official and media-promoted data. And they’re not going to “un-notice”. Not only don’t people -once they find out- like having been lied to for years, they dislike worsening living conditions even more. And that’s all they get; the only people who get it better are the rich, because without that the machinery can’t continue pumping up the ‘official’ numbers.

And what do you get? People complain about Trump. And they focus on one of his -seemingly- crazy ideas: temporarily closing US borders to refugees from nations with large Muslim populations. Which is a fine thing to resist, because yes, it’s a pretty silly idea, but why haven’t they paid similar attention to how they’ve been lied to for years on both the economy and on Syria, on how Obama became the Drone King and how many innocent people lost their lives because of that?!

To how favorite all-American gal Hillary screwed up Northern Africa when she declared We Came We Saw He Died and the death of Libya’s Gaddafi, who gave his country the highest living standards in the region, free education and free health care, but was murdered by Hillary’s US troops, co-created the chaos that led to so many people wanting to flee their homelands in the first place?

Why is that? Why are there protests when people are halted at an American border crossing but not when American and British and French and Australian forces blow the very same people’s homes to smithereens? Could that have something to do with where the protesters get their information? With how much they know about what’s happening in the world before it reaches their doorsteps?

Yes, people are suffering, and it’s very unfair what’s happening to many caught in the Trump Ban, but does anyone really believe that that’s where it started, that this is the first time (or even a unique time) that protest is warranted, or more so? And if not, why is it happening? Because people only notice stuff when it hits them in the face, I would presume, but who among the protesters would volunteer to agree they live their lives with blinders on? Not many, I would venture. So why do we see what we do? Where were you when Obama ordered yet another child, a family, which hadn’t yet made it to a US airport but might as well have, to be collateral damage?

I get why you’re protesting the Trump ban, but I don’t get why that’s your prime focus. I am guessing that most of the protesters would not have voted Trump in the first place, and would have been much happier -to put it mildly- for Hillary to be president right now. But if you would have paid attention in history class, you would know that it was Hillary who brought the refugees to your welcome mats to begin with.

Take it a step further, like to the January 21 women’s march, and you would realize that the vast majority of the refugees would have much preferred to stay where they grew up, where the women in their families, their sisters and aunts and daughters used to live. Most of whom are gone now, they’re either dead or diaspora-ed to Jordan, Turkey, Alberta, Sweden, Greece. All on account of Obama and his crew. Who of course blamed it on Assad and Putin. “I killed 1000 children, but I had to because those guys are so dangerous….”

This generation of refugees, of the huddled masses that the Statue of Liberty is supposed to teach you about, didn’t come to America because it’s the promised land; they came because America turned their homeland into a giant pile of rubble surrounded by garbage heaps and minefields. I don’t know if you’ve ever seen pictures of Aleppo before it was destroyed, but I dare you to tell me there is even one existing American city today that’s more beautiful than Aleppo was before Americans and their allies reduced it to dust. Here you go. This is Aleppo before America got involved in Syria:

There’s very little left of that beautiful city, with its highly educated people and their lovely happy children. And none of that has anything at all to do with Donald Trump! I don’t want to give you pics of what Aleppo looks like now. I want you to remember how lovely it was before ‘we’ moved in, years go. Sure, what you hear and see in the west is that Assad and Putin are the bad guys in this story. But now that the US/EU supported ‘rebels’ are gone, dozens of schools are reopening, and medical centers, hospitals. Who are the bad guys now?

And yeah, Trump is an elephant, and elephants are always awkward and they’re messy and they tend to kick things over and when they make mistakes those tend to be huge, but how much valuable china does the US really have left anyway? Isn’t it all perhaps just a sliver off target, the demos, the outrage and indignation? Is the idea that your army can destroy people’s living environments with impunity without you protesting in anything approaching a serious way, and that then you get to demand, through protest, that those same people are allowed entry into your country? That’s way too late to do the right thing.

I started out making the point that as our politico-economic systems are failing, voters will move away from the center that devised and promoted those systems, and that this will happen in many countries. The US could have had Bernie Sanders as president, but the remaining powers in the center made that impossible. Likewise, many European countries will see a move towards either further left or further right.

Since the former is mostly dormant at best, while the latter has long been preparing for just such a moment, many nations will follow the American example and elect a right wing figurehead. This will cause a lot of chaos, but that’s not necessarily a bad thing. People need to wake up and become active. The recent US demonstrations may be a first sign of that, even though they look largely out of focus. More than anything else, people need a mirror, they need to acknowledge that because they’ve been in a state of mindless self-centered slumber for so long, they have work to do now.

And that work needs to consist of more than yelling at the top of your lungs that Trump and Le Pen and Wilders are such terribly bad people. For one thing because that will only help them, for another because they were not the people who put you to sleep or were supporting mindless slaughter in faraway nations or were making up ‘official’ numbers as your economies were dumped into handbaskets on their way to hell. So ask yourselves, why did you believe what Obama was saying, or Merkel, or Cameron, Sarkozy, Rutte, you name them, while you could have known they were just making it all up, if only you had paid attention?

Why? What happened? Why did the term ‘fake news’ only recently become a hot potato, even though you’ve been bombarded with fake and false news for years? Is it because you were/are so eager to believe that your economy is recovering that any evidence to the contrary didn’t stand a chance? If so, do realize that for many people that was not true; it’s why they voted for the people you now so despise. Is it perhaps also because you’re so eager to believe your ‘leaders’ do the right thing that you completely miss out on the fact that they’re not? And whose fault is that?

In yet another angle, people claim that the planet’s in great peril because Trump doesn’t ‘believe’ in climate change. But it’s not Trump’s who’s the danger when it comes to climate change, you are, because you’re foolish enough to believe that things like last year’s infinitely bally-hood Paris Agreement (CON21) will actually ‘save’ something. That belief is more dangerous than a flat-out denial, because it lulls people into sleep, while denial keeps them awake.

It’s the idea that there’s still time to rescue the planet that’s dangerous, because it’s the perfect excuse to keep on doing what you were doing without having to feel too much guilt or remorse. You’re not going to save a single species with your electric car or whatever next green fad there is, the only way to do that is through drastic changes to your society and your own behavior.

That’s not only true with respect to the climate, it’s just as valid with respect to the refugees on your doorstep. If you want to rescue them, and those who will come after them, the only thing that makes any difference is making sure the bombing stops, that the US and European war machines are silenced. If you don’t do that, none of these protests are of any use. So sure, yeah, by all means, protest, but make sure you protest the real issues, not just a symptom.

That doesn’t mean you should shut the door in the face of these frail forms fainting at the door, that’s just insane, but it does mean that after welcoming your guests, you will also have to make sure what brought them there must stop. If you stop killing and maiming these people, and help rebuild Aleppo and a thousand other places, they won’t need to come to your door anymore.

As for the political field, unrest will continue and grow because the end of economic growth means the end of centralization, and our entire world, politically, economically, what have you, is based on these two things. Today, unrest is the only growth industry left. And it’s not going away anytime soon. It’s a new day, a new dawn, it’s just that unfortunately this is not going to be a pretty one.

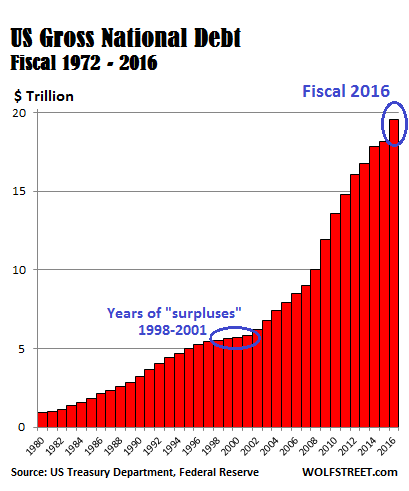

Still, none of it is unexpected. The Automatic Earth has been saying for years, and with us quite a few others, that this was and is inevitable. Of course there are those who say that we cried wolf, but we’ll take that risk any day. Saw a nice very short video of Mike Maloney saying in 2011 that Obama would have to double US debt between 2008 and 2016 just to keep the entire system from starting to collapse, running to stand still, Alice, Red Queen and all. And guess what?

I am relieved by Trump’s climate science denial after watching the target-setting charades of the previous administration. The climate science virtue-signalers have a battery of evasions and wishful thinking to enable them to claim they are addressing the issue when they clearly are not.

Decoupling GDP growth from carbon emissions is denial tactic #1. There is no such thing. Stocks are not correlated with flows and relative decoupling does not metamorphose into absolute decoupling. Climate, atmosphere and oceans are systems whose complexity is not even remotely grasped by the mechanical metaphor of decoupling.

Wind and solar is denial #2. There are such things but not on the scale to effect denial #1. “But the PRICE is coming down!” That’s just ducky, but the trend of today’s prices doesn’t predict the trajectory of prices over the next 30 or 40 years. If they did, EVERYBODY could get rich playing the stock market. Just ask Mr. Ponzi.

The Environmental Kuznets Curve is a more obscure denial tactic. It is a failed analogy based a failed empirical theory. We might as well be talking about the Environmental Philips Curve, Environmental Phrenology or Environmental Phlogiston.

There is ONE thing and one thing alone that can reduce carbon dioxide emissions and thus may mitigate climate change. That is diminished industrial activity. Officially, that is not only not on the agenda of the virtue signalers but is a perspective to be ridiculed and marginalized.

The tactics you mention fit into the “bargaining” stage of grief — slightly more advanced than “denial” but falling short of “acceptance” that we are headed toward the collapse of industrial civilization.

If you are worried about climate change, you should see the imminent collapse of industrial civilization as good thing.

In other words, things are looking, if not up, at least on a less bad trajectory, if the collapse thesis is true.

Depends on how old you are. If you are older, your time to suffer is reduced so your mortality is somewhat a comfort. You won’t see and experience the worst of it: wholesale wipeout of species after species, the full collapse of numerous ecosystems, the inevitable famines to come, the misery. If younger, you get the front row seat. The ecological devastation, the industrial collapse that means you will see no mitigation of your misery because modern medicine does with the collapse of the industrial system. Your coming cancer will go undetected and untreated. Your various diseases will play out in full while you fight for a drink of water or bite of food.

Good times. The gold plated apocalypse shelters of the psycho rich won’t protect them from the same either. A silver lining of sorts.

It’s going to be one country at a time, one state at a time, one city at a time.

Some places will do well but many more will implode.

Mr Sandwichman, although having some sympathy with your views, I find that, even if your view was 100% correct it would still be “wrong”.

You say that only “diminished industrial activity” may bring C02 down. God knows what THAT means in practice. Negative growth ? The partial or complete liquidation of “selected” industries ?

All sound politically …implausible at the moment… so does not your view also amount to DENIAL ?

Nor am I particularly keen on your casual write-off of solar, wind etc. Will they ALONE save the planet ? Perhaps not…but they’re far more politically palatable than deindustrialisation… & just maybe they might, if pursued aggressively, give us breathing space to WAKE UP.

In the mean time it could be purely academic given US Elites’ willingness to constantly provoke its nuclear armed neighbours…

No. If you want to “reduce carbon dioxide emissions,” you have to shut down fossil fuel production.

Not well versed in financial wizardry. But i find legitimacy in concerns over high debt levels, even in the land of the world’s reserve currency.

For one, the dollar’s claim as the reserve currency seems more and more tenuous with the euro & renminbi as potential competitors. Part of America’s ability to maintain high debt levels rests on their control of the reserve currency, right?

Two, debt financing requires an ample supply of creditors. Who’s to say that’ll always be a given?

Of course, the idea of a theoretically infinite fiat currency in a world of finite resources is a grotesque paradox to begin with. Water shortages, desertification of arable land, & deforestation are some of the trends worth careful attention. Economic data would look very different if environmental degradation was quantified and factored in.

Anyways i have no faith in economists to accurately model the very distorted, very elusive capital markets of today using yesterday’s theories. Honestly the problem is evident even to the uninitiated, so to obfuscate the issue and feud incessantly is at best a means to justify, however feebly, their relevance (their tenure).

When GDP gains end up primarily in the pockets of the super wealthy & deflationary fiscal policy (austerity) is in vogue, a logical result would be insufficient demand for everything except what the super wealthy want buy. Real estate, vintage collectibles like wine or art, are where our inflation has gone, but i suspect they dont figure prominently in the CPI. But the forbes cost of living extremely well index conveys this.

Of course the financial service ppl are more than happy to give the rest of us a taste of the good life too, with a usurious markup.

I cant take economic thought seriously. Wealth inequality is the problem. Anything else is peripheral. Wall street’s way of financializing the entire real economy and subjecting it to the dictatorship of short-term, speculative hot money is destroying social/political institutions, lives, and the environment. It’s infectious and rapidly globalizing. Inequality, period.

“Part of America’s ability to maintain high debt levels rests on their control of the reserve currency, right?”

No. Why would it?

“Two, debt financing requires an ample supply of creditors. Who’s to say that’ll always be a given?”

Not when you create the currency yourself. How can we run out of dollars that we alone can make an unlimited supply of?

“When GDP gains end up primarily in the pockets of the super wealthy & deflationary fiscal policy (austerity) is in vogue, a logical result would be insufficient demand for everything except what the super wealthy want buy.”

Right.

“Inequality, period.”

Exactly, and one of the easiest stories that is told to convince us of the need for inequality is the supposed shortage of money and how the banks know best how to care for our economy, when in fact they are the very parasite feeding off of us in the first place.

I would argue that our Western problem is a high energy / resource lifestyle that, over time, can only be enjoyed by a small percentage of the population.

The 99% cling to this lifestyle refusing to notice that there are now 6 billion people vying for these resources.

The popularity of vampires and zombies in popular culture is the expression of our shadow selves. To paraphrase the sage: We have met the undead, and he is us. The “resistence” as in the Womens March is still based on projecting blame (Putin, Comey, Trump,Bannon, Assad…so many villians to choose from) and contains only the slightest stirrings of awakening and awareness.

Exactly. I look at these protestors and see the narcissism of small differences.

Unrest seems too gentle a word for what is coming; upheaval and chaos are more apt terms. The author is correct that the green mirage (“fighting” climate change) hides the hard road, and most of us are unprepared for the hardships we will either endure or perish from and most will perish. The sad thing is that our leaders ought to have vision but instead they promote our own delusions of continued prosperity in a world of exponentially growing population, dwindling resources, accelerating habitat loss and mass die-off of other life forms. A mountain of evidence shows we are in the petri dish saturation stage just prior to collapse, yet a large proportion of the supposedly educated elite are blind and ignorant of it. They are the ones that determine who shall lead us into the chaos, but we should know better than to accept and follow.

As I have said before, the only solution to alleviate some of the suffering is a GENERAL STRIKE demanding a constitutional convention to remove money from politics once and for all. Everyone must withhold their tax payment this coming April. Why isn’t this being proposed on every (non corporate) alternative website?

switching off fossil fuels, which cause global warming, is not a mirage. it’s going to take major adjustments to our system, and the people that run it are going to fight that tooth and nail, but it isn’t hopeless. it’s going to be bad, no doubt, but we can avoid the worst. it may take fighting.

Saw an article about a Constitutional Convention just fairs ago but it isn’t for the purpose you describe. There are now 34 states, all GOP/ALEC controlled, seeking an Article V Convention with one of its purposes to force through a balanced budget Amendment. They literally seek to murder, wholesale, the economy and all “surplus” proles by forcing a cold halt to Social Security, Medicate, SNAP, etc, on one hand, and denting the government all means to do anything in ANY crisis because “debt”.

Like they did in Brazil right after overthrowing Dilma Roussef?

Let us hope for the USA that, in the time it takes to convene that constitutional convention, the impact of the self-imposed Brazilian shackle will be obvious.

A cold halt to SS, Medicare, SNAP, etc. would mean an instant uprising. I may be old and comforted by the fact that I won’t live to see wholesale destruction of the planet; but I am more comforted by the fact that America is a heavily armed country and therefore revolution may come sooner than expected.

“Where life had no value, death, sometimes, had its price.”

Most laborers don’t have the option of tax rebellion, as their annual tax is withheld from each paycheck. Nor would a tax rebellion harm the Federal government. They can create all the money they need, and use it to utterly crush as many individual lives as needed to end such a rebellion. Only local governments would be harmed — states, counties, cities — since they cannot print money. They will play ball with the Federal government’s crackdown in exchange for newly printed money to replace any missing taxes.

If the goal is to bring about concerted action to stop this runaway train we are all on, why not change the conductors and engineers? Just because a politician is in office doesn’t mean we must wait two or four or more years for their term to end. Launching a recall petition, and getting them out of office now is more effective action than the general chaos created by denying local government its annual April revenue.

Which gets us to the real nub of the problem — we are a populace that is perfectly willing to be soothed by the usual lies, and happy to sleep through another term or few of the politicians doing the lying. So it is a matter of stirring the general population to action, and we, the people, want safety, security, and a couple of meals every day more than we want to save the planet.

A “general strike” is a great idea, but it has nothing to do with paying taxes.

Yves: ” This otherwise fine post is marred by an outbreak of debt fear-mongering at the end. ”

Ilargi: “And to think that federal debt isn’t even the worst threat, personal debt is, and so many of us carry so much of that, and try to pass off our mortgaged homes as assets, not debt. An increasingly desperate game on all fronts.”

I have analized the effect of gov’t and private debt on GDP growth in G7 countries. Growth decreases in mean as a power function of debt (either gov’t or private) and increases in variance (i.e. volatility) with increasing debt (either gov’t or private). These are facts in the data. Is it possible to accommodate MMT insights/assumptions/simplifications with those facts?

Sounds like you’re treating private and fin sector debt growth as a cause, rather than an effect that in turn engendered different developments. Also, have you corrected for the fact that a lot of govt debt growth post-2007 is actually fin sector debt moved around (as David Harvey likes to point out), both sectorally and geographically (eg Fed backstopping EU banks, ECB backstopping Greek debt)? That aside, you can’t construct a meaningful narrative explanation (best example: Harvey’s The Enigma of Capital) without looking beyond the financial data.

I have looked at it both ways, as either current gov’t debt (IMF gross) or private debt (fin+households+corps from BIS) causing mean growth in next 2,…,10 yr, or as current growth causing debt in next 2,…,10 yr. There are two different underlying mathematical processes (power and Gompertz, respectively) and I haven’t yet connected these in a dynamics, as implied in your first sentence.

I have used the officially available IMF and BIS data as it is, and in the reports of the authors of the databases they have written about best efforts to correct for mis-allocations.

I don’t catch the meaning of your last sentence, it’s too terse to my divining abilities.

Not claiming to speak for Foppe, but it doesn’t take much “divining abilities” to conclude that you can’t extrapolate and project into the indefinite future anything that purports to “exponentiate” ( “growth”), hence the reference to ” Harvey’s The Enigma of Capital”…all observations are always context-dependent, and it’s not possible to make clear distinctions in the behavior of what’s being “measured” (observed) and how ‘it’ interacts with the means of “measurement”. The constraints on the ‘user’ of a currency is nominal, whereas the constraints on the issuer is the real, and context always matters.

Comparing GDP growth to gross debt numbers is a horrendous oversimplification and tells us nothing on its own. X country has $10 trillion debt and only 1 percent GDP growth and Y country has $5 trillion debt and 2 percent GDP growth, oh that must mean debt is bad! You can’t be serious with this kind of analysis?

I was talking about gross debt divided by GDP, sorry the format of these conversations is not conducive to providing all relevant detail.

Seems I didn’t express myself clearly. Let me try again. Apologies for the word count, but I hope it serves a purpose, and is easier to follow.

Central point, briefly put: I do not think it is useful to look at debt level developments without understanding the (world-wide) societal and demographic developments in which they occur. And I know that mainstream macro doesn’t do a good job of that at all — and that’s putting it mildly.

Point is, you can’t look at growth/debt data in isolation, let alone extrapolate from (semi-)current developments, because of how growth has stagnated with the ‘maturation’ of most of the now-affluent economies, coupled with the fact that real wages have been flat/dropping for decades in the West, while other societies generate barely any internal demand, because of low median wages, exploitation and the like. Western ‘growth’ has been personal-debt-financed since the mid-1990s; while the economic slowdown (and worker impoverishment) simultaneously led to lots of money sloshing around, a dearth of investment opportunities relative to pension fund/SWF/corporate cash hoard levels, etc.. This was temporarily/partly addressed by privatizing public assets, and the M&A booms, but that wasn’t enough either, and worsened the employment/demand problem in the long run.

Separate-but-connected, we have the “invention” of speculative instruments, which made possible the growth of financial sector debt levels, accumulation by dispossession, speculative transfers of savings from regular people to the rich/banks, etc.. Mortgage bubbles are a part of that as well. Hence, unhealthy-debt-financed GDP ‘growth’, which later on leads to govt debt growth because of forced nationalizations/bailouts which further worsen debt/gdp ratios, and lead to recessions.

I would really suggest that you have a look at this talk by Mark Blyth from ~2013, as he presents the high-level developments from 2008-13 (with sectoral debt trend charts) in an accessible and slightly wonky fashion: https://www.youtube.com/watch?v=V3FPmu2_J_0

For the longer-term story, see Harvey’s https://www.youtube.com/watch?v=9cXyxdVu9H8 and/or Blyth’s Global Trumpism talk: https://www.youtube.com/watch?v=Bkm2Vfj42FY

(You might also have a look at the work of Steve Keen, who has done lots of work in the area that interests you.)

Thanks for the extended explanation of your concerns regarding studying debt and growth in isolation. My database has many other co-variables that I agree with you have an effect as well, you mention some of them.

However, science often advances but modeling a few variables at a time and aggregating the effects of other variables into some parameters of the model with few variables. When this approach yields confirmed results then it is possible to refine the analysis with more relevant variables, making the model more precise. For instance, in the relations between growth and the debt to GDP ratio that I have observed in the data, the variance in GDP growth increases when increasing the debt to GDP ratio (it has been reported quite often recently that quarter GDP growth in the USA has contradicted expectations, and the USA is now at the high debt regime). This means that as the debt to GDP ratio increases other variables apart from debt play a bigger role, while at very low debt GDP growth is very well predicted just by debt, probably because a maximum potential is reached.

Generally it is not convenient to try to understand everything in one go, meaning attempting to include all relevant variables when exploring new terrain is not fruitful.

One more thing, the relations I have observed is consistent with the view that excessive financialization (leading to excessive debt) is an impediment to growth.

Debt is a problem under current macro configuration regardless of the tenets of MMT. MMT has to deal with this reality. I offered a hypothesis consisting of self-imposed restrictions.

That may be, but it escapes me how what you’re doing is meaningfully different from the (quite problematic, cause/effect-confusing) work by Reinhart & Rogoff.

As such, again, I think that you would do well to make the time to watch those talks, and look into Keen’s work, then pondering the methodological implications, before continuing your own attempts.

What I’m doing is similar to Reinhart & Rogoff except that it is technically correct and that it looks a both forward and backward causation (debt to growth, and then growth to debt, in a dynamical feedback, I am after the mathematics underlying this dynamics).

Thanks for the advice about those talks, I’ll look at them when time permits. I am familiar with Keen’s work, like him and others I think that debt and excessive financialization is a big problem, that it is necessary to remove a whole lot of it to resume growth.

I think you have a point, but as somebody once said ‘ It all depends on what you mean by……….’ In this case ‘ Growth ‘ . I’ve also thought about this a great deal and I am always ( who isn’t ) driven back to basics , meaning in this case strip out everything that is not a good or service which is in essence the MMT position . Then I think you will find the MMT ‘ insights/assumptions/simplifications ‘ as you call them not so wide of the mark as you appear to think they are.

Instead of changing the data (i.e. a more restricted definition of Product, say Good-Services Product, GSP, instead of Gross Domestic Product, GDP) a strong 2-way dynamic relations between growth in GDP and debt (either gov’t or private) as observed in the data may arise under MMT (in spite of Yves’s disregard for debt because of well you know that part about the solitary sovereign exuding currency) if the community somehow imposes restrictions upon itself, the community shackles itself to the ground in fear of taking off to the heights.

Otherwise Ilargi is right in his/her instincts and debt does stunt growth.

Your analysis is worthless, not least because 3 of your G7 are members of the Eurozone and don’t control their own currency. Conflating private and public debt is another major mistake.

Budget deficits are best looked at as a thermometer gauge on the economy. They don’t mean much in themselves but they indicate the change in tax receipts and automatic stabilizers like unemployment insurance payments during slumps and booms. Countries that run a trade deficit have no choice but to run a budget deficit unless they want their economy to enter permanent contraction or unsustainable levels of private sector debt.

My analysis starts in 1950, so for most years in the database European countries had their own currency, and my analysis does not conflate private and public debt, it treat them separately.

Interesting that you’d say “…debt (either gov’t or private) as observed in the data…” AND ” my analysis does not conflate private and public debt, it treat them separately.

Apart from my perception that these statements seem to contradict each other, you seem to conflate all “gov’ts”, and consequently and seemingly can’t clarify what’s “public” and what’s “private”…e.g., in the U.S. of A., State “gov’t”, City “gov’t”, County “gov’t” etc., are USERS, as are business’s, non-“profits”, households, indiviuals etc., whereas the federal “gov’t” is the ISSUER of the US$…can you think of any rational reason why ‘it’ would need to borrow what ‘it’ alone can issue?

The gross debt gov’t data that I am using was compiled by the IMF and they wrote a lengthy report on their criteria for building it. I read it and it seemed to me they did a good job. This was about an earlier version. Recently they sent me the updated database.

When I say “either gov’t or private” I mean that I carried out parallel analyses, on the one hand with gross gov’t debt and on the other hand with private debt (this time complied by the BIS with another lengthy report on their methods that once again looked very professional to me. Steve Keen have used the same BIS database and there was a post here about it).

So regarding the data, I rely on workers at these two institutions, my take starts at the modeling stage.

If you don’t distinguish between ‘user’ and ‘issuer’, then any distinction between “public” and “private” becomes meaningless and obfuscatory at best, and sophistic and deceptive at worst. And the term “gov’t” alone does not clarify. Remember that context always matters and the constraints on a user are not the same constraints on the issuer

With populists rising across the West, the problem is obvious.

“It’s the economy stupid”

Even in a globalised world it is very rare that anyone looks around to see how others have done it.

China is today’s success story but that has been unable to make the transition to a developed world economy where there is strong internal demand. If everyone was like China the global economy would collapse through lack of demand.

All the Asian Tigers have done extraordinarily well and in the 1980s Japan looked as though it was going to take over the world. Japan had low inequality and a good welfare state and was able to fully transition into a developed world economy.

China has high inequality and almost no welfare state and so is unable to make the transition to a developed world economy.

Japan, and the other Asian Tigers, achieved this success by channeling lending into productive business and industry and keeping bankers away from their usual financial speculation.

Even our bankers know what they should be doing; they tell us how banks must be saved/re-capitalised to maintain lending into business and industry.

Closer inspection reveals the vast majority of their lending goes into financial speculation and blowing up real estate bubbles around the world. This is the easy way for bankers to make money and with TBTF who cares when it all blows up?

Japan looked as though it was going to take over the world in the 1980s and they decided to leave bankers to their own devices on lending. Japan was now so successful what could possibly go wrong?

The bankers engaged in financial speculation, blew up a real estate bubble, which burst and Japan has never really recovered.

Ensuring bank lending is mainly aimed at the real economy and is not used for financial speculation is the key to economic success.

The difference between a developed world economy and a developing world economy?

Low inequality and a good welfare state providing internal demand.

The difference that has always existed between first world and third world nations.

Take them away?

The middle class disappears and the US starts to look like a third world nation.

The bottom up approach of today’s economics, neoclassical economics, which works everything up from micro-economics, gives the opposite conclusions to those observed in the real world.

After neoclassical economics last outing, that ended in the Great Depression, Keynes came up with his macro-economics.

He looked at how the world worked and came to his conclusions from there.

The top-down and bottom-up approach should of course meet in the middle.

The Keynesian era is based on an assumption:

Capitalism naturally diverges and polarises, the surplus must be recycled on the personal and national level.

If the surplus is not re-cycled the system will collapse through a lack of demand

Today’s ideology is based on an assumption:

Capitalism naturally converges to reach stable equilibriums.

Debt is used to tide things over until that stable equilibrium is reached.

Totally different and we know today’s bottom-up approach comes to conclusions that are the opposite of those observed in the real world.

If you observe the world and draw conclusions from that, little can go wrong.

If you work up from low level assumptions, little mistakes at the bottom become big mistakes at the top.

Also, the bottom-up approach is susceptible to the influence of vested interests tailoring these assumptions to their requirements.

There was a fundamental problem with early economics as the Classical Economists observed the world of small state, basic capitalism around them (today’s ideal). Of course our expectations of small state, basic capitalism are rather different to the reality where the rich lived in luxury and the poor lived in squalor.

The early Classical Economists realized those at the top were parasites on the system, idle rentiers. The Classical Economists differentiated between “earned” and “unearned” income.

In neoclassical economics the distinction between “earned” and “unearned” income disappears and the once separate areas of “capital” and “land” are conflated. The landowners, landlords and usurers are now just productive members of society and not parasites riding on the back of other people’s hard work.

Unearned income is so easy, it’s the UK favourite.

Most of the UK now dreams of giving up work and living off the “unearned” income from a BTL portfolio, extracting the “earned” income of generation rent.

The UK dream is to be like the idle rich, rentier, living off “unearned” income and doing nothing productive.

Also, the assumptions on money and debt do not reflect the true nature of money and debt leading to further problems like 2008.

. . . A fiat currency issuer like the US can never go bankrupt. . .

To think that there could have been peace through bankruptcy.

Bomb economics. It seems the last bastion of manufacturing left in North America is bomb making. Demented Uncle Sam whips up some fantasy money and spends it on bombs, and those bombs then become Uncle Sam’s real capital. From nothing comes something, bombs.

Those bombs are then used to turn the capital, sweat equity and life of the people of Aleppo into dust and blood. Something becomes nothing and the bomb circle is complete.

Very well said. Our collective delusion that something imaginary has a finite supply. And our collective nightmare when that illusion is channeled into blowing apart our fellow human brothers and sisters like it is a game.

This is the crux of the problem. If this disease is not cured, you’ll wait for concrete material benefits till hell freezes over. This government’s a cancer, sucking resources from protective capacity to repressive capacity so every form of violence hypertrophies and squeezes out what people want. You get state cops with tanks and bayonets making $200K, thousand-acre server farms storing everything you ever said and did and thought, special forces goons selling JCET murder and torture worldwide, flying turds like the F-35, the DHS.

It’s self-limiting – the state is crippled like a filariasis victim carrying his balls in a wheelbarrow. Why let it totter around in agony? Just kick out the plug and let this state die, dismember it. The threshold for reform is what happened to the Soviet Union.

Once the USA is dead, the successor states will be sovereign only to the extent that they adopt the world’s acquis: the UN Charter, the Rome Statute, and the International Bill of Human Rights. The latter entails a binding commitment to devote resources exclusively to protective capacity under independent oversight by ECOSOC treaty parties. Education, health, social security, livelihoods, everything you need, itemized in the ICESCR subject to the implementation guidance of General Comments and the Limburg Principles. Do it now, locally, get ready for the USA’s death throes.

Sadly, this country’s infantile civil society features 30 million armchair politicians reinventing all these wheels and exhorting statist parties with catchy new slogans. It’s fantasy football for fraternity misfits and it goes nowhere.

I won’t get into the public debt issue as that gets too ideological. Private debt, however, is important. It represents our economic inequality and how those in power are turning entire generations into debt slaves. It also reflects upon the actual people who make up our society. Yes some people are forced to take on debt just to survive, however the majority keep taking on more debt in order to afford the luxuries they currently enjoy. I don’t see too many people giving up things because they are in debt. They’re still buying their 4 coffees a day at Tim Hortons!

As usual Ilargi’s post is top notch. He touches on our hypocrisies on issues far more dire than personal debt. Perhaps pointing out truths that make NC readers uncomfortable. Yet to look at our society as a whole and the people who populate it, I can’t help but wonder if our civilisation is made up of adult 6 years olds. The irresponsibility and apathy astound me. Is this modern western man? As children we ignore everything except our immediate needs, leaving our parents to tend to our actual survival. Then as adults we focus mainly on instant gratification, leaving our governments take care of the things that really matter. The society that never grew up? Considering that, does it really matter if we follow hard money or easy money policies?

As an aside to your introduction regarding inflation fear-mongering.. it’s always important to consider what is being inflated in relation to what. In the case of the US, yes we have had the “steady, healthy” inflation that the Fed targets (I believe in the 2% range per year), but the problem is, as you mentioned, what is being inflated.

And it damn sure ain’t peoples incomes, and that is due to the rapacious, highly regressive labor market conditions we have today. So, they can call it steady inflation when healthcare, housing, and education costs go through the roof for decades DESPITE any real wage growth. We could also call it steady inflation if healthcare, housing, and education were to drop significantly and incomes were to rise for the people of this (once-great?) nation. We could most easily accomplish this by removing the pay to play state of politics and nationalizing banks, healthcare, and education while simultaneously enacting a JG and/or guaranteed income.. as has been previously discussed.

Money is not fiat. For it to have any value, it has to be backed by an obligation and that’s where debt comes in.

What needs to be learned is that as a publicly supported economic circulation system, it needs to be treated and regulated as a public utility. Like roads. Trying to create enough to keep everyone happy only means creating enough debt to keep most people broke.

We have to make economic reciprocity a more organic and social function again and maybe we will have a less atomized culture, as well.

” For it to have any value, it has to be backed by an obligation and that’s where debt comes in.”

No, it doesn’t. It is just a token that allows goods and services to be exchanged, and is only as good as the economy that printed it. We can make as many or as little dollars as we want, the only consequence is inflation or deflation. Right now, as you may have noticed, there are far few dollars in the hands of the people that need it most.

The Fed doesn’t just print it up. they buy government debt. That is what gives it value, just as in the old gold backed days, Fort Knox was the theoretical basis of the currency. It might seem unnecessary or meaningless, but without it, it would just be a lot of hot air and very unstable. Is it a confidence trick? Yes. Think how much people trust government bonds, even though the money is mostly spent on things with no actual return.

Yes the treasury does currently issue debt to raise money, but there is zero possibility of it not being purchased, the fed would just purchase it itself if it had to.. And the whole thing is unnecessary and meaningless as you say, it just (unfortunately) perpetuates the idea that there is some limit to the amount of money available, which is impossible. A government that is the sole issuer of digital ones and zero’s in bank accounts cannot run out of said ones and zeroes.

Taxes are an obligation

I’m not sure what to make of this post, though I agree with most of its points. The climate is irreparably damaged, the lives in Aleppo are irreparably lost — so why does he make his final, takeaway point about *Bernie voice* the damn debt? Debt can be refinanced; debt is managed and enforced by political and transnational institutions over which our Treasury holds power.

Debt hawkery always seem to be out of stupidity or simply bad faith.

Side point: there should be some etiquette about financial journalists/bloggers like Zero Hedge, Wolf, et al having transparent wealth portfolios. For the sake of all the rubes that have gone broke by investing based on their forecasting and advice (which is, in short, almost always: SELL EVERYTHING (traded in dollars (and buy what isn’t))).

What circumstances and events could cause the US Dollar to no longer be the reserve currency? Losing that position would be catastrophic. If a competitor arises, what steps would be taken to maintain the fiat position?

There is a house-of-cards element to a fiat currency that relies to some extent on the goodwill of those creditors in the rest of the world to support that house.

…or the force of an aggressive super-powered military to ensure that nobody strays from that currency. That is what the US has and employs, whether directly or through proxies. Note that Saddam & Ghaddafi attempted to turn away from the Petrodollar and were served-up as examples; Russia, China, Brazil, and the other BRICS are being pressured through somewhat less violent means. The US is the center of the most violently aggressive mafia racket ever devised. Our “exceptional” way of life is based largely on the exploitation, impoverishment and destruction of others.

Trump is a soft target. We had women out on the streets protesting about him in the UK.

A case here has seen a gang groom and rape young girls in the UK. No need to go into where the gang is from save to say the police ignored complaints (1500 young girls were abused over many years) because they were afraid of being labelled racist.

And the protesting women out to look after the sisterhood?

…….crickets…………

Tells me everything I need to know about the ‘children’ out there thinking they want to change the world for the better.

A lot of this talk of “didn’t you know this was happening before? What’s so different about Trump?” etc. is confusing to me (and I’ve seen quite a bit of it on this site). It’s absolutely true that left and progressive movements are totally unorganized, have been dormant, and paid little attention to Obama’s et al.’s neoliberal agenda and hawkish military endeavors. But the I told you so rhetoric comes off as just self-righteousness and I don’t see what it advances at all.

Look, I’m sure there are lots of us who tried to convince our unconvinced friends about all the failures of the Dems, the corporate press, and so on. But no one cares now about how “enlightened” we were. Social movements do not just pop up from injustices as soon as they start. Hardly. The Vietnam War went on for years and years before there were any meaningful demonstrations. People are now joining protests who have never been in protests before. Lefty orgs (DSA for example) have in some cases doubled their membership. Is it all too late? Maybe, but asking people “where were you when…?” is definitely going to turn people off…

> A lot of this talk of “didn’t you know this was happening before? What’s so different about Trump?” etc. is confusing to me

The reason we’re saying it is because the last time these useless loser Democrats got stirred up it was during the Bush 2 administration. They kicked up such a beautiful fuss about civil rights and illegal wars. And as soon as they got in power they changed absolutely nothing. They doubled down on failure. And they lost.

All they wanted was power for themselves. Have you learned nothing?

What you need to do, as a believer in these useless loser protests, is explain why this time is different. Because it certainly doesn’t look that way to me. You can follow the corporate Dems and their loser ID politics down a rabbit hole, just don’t expect me to follow. Wake me up when they start arguing for Medicare for All or a Job Guarantee.

I hope you also see the point that the issues aren’t caused a single candidate, or by either of the two parties, though. And the importance of pointing this out, so as to not repeat the mistakes that were made during the years before Hope & Change Inc. took the reins. And, lastly, that pointing this out has nothing necessarily to do with “self-righteousness”, even if some people act self-righteously.

That said, it is certainly a big problem that people do not learn to own their past choices, and that many prefer reinserting their heads in the sand over temporarily experiencing psychological discomfort simply because the messenger is carrying around past frustrations that at times interfere with the educational work they are engaging in.

I couldn’t agree with either of you more. I’m guessing we have very similar politics. Despite reslez’s rush to judgement, I detest the Dems and would love nothing more than medicare for all, full employment and more. And while we should learn from history so we’re not stuck between Trump and “extreme center” Dems down the road, that’s not what I take issue with.

I take issue with the fact that there’s been an uptick in protests and a growth in progressive and left organizations, and I see leftists sitting back and scoffing, not willing to engage, not willing to do the hard work of organizing, teaching and so on. It’s a shame people didn’t care earlier and it’s a shame class politics has taken a back seat (to put it mildly), and yes, we need to understand why, but this is the hand we’ve been dealt and we (might) have (some) opportunity to rectify the situation. We’re not going to build a mass movement if tilt our chins up at would be converts…

Some of us progressives have been calling out the Dems as neoliberals, pointing out their sins of comission and omission, etc. for years, only to be subject to ridicule, threats, and gaslighting by the “vote blue no matter who” crowd. This is still going on today unabated.

The Clinton Machine is more organized than you would think given the outcome, but they were quite efficient at such this as media narrative control, licking the boots of oligarchs, crushing competition from the left, and raising megabutts of money while avoiding indictments. They have 1.5 billion reasons why they don’t think they failed.

I believe that the most difficult task for progressives / the (Cassandra) Left is not going to be defeating/resisting Trump/GOP/fascism. No, it will be removing the Clinton taint from any position of potential power for something, anything to the left. Heracles, clean the stables!

“This otherwise fine post is marred by an outbreak of debt fear-mongering at the end.”

That should tell you enough about the Automatic Earth. If Illargi and his ilk still dont know such basic economics, that I suppose most of the readership here does, after so many years of doom-mongering then to me it points to dishonesty. They just simply havent bothered to check their suppositions.

“Naked Capitalism – This otherwise fine website is occasionally marred by a helping of doom-peddling posts from blogs trying to profit off its reader’s anxieties”

“Automatic Earth – Peddling doomer nonsense since 1945! Your anxieties are our profit!”