By Arthur E. Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Originally published at OilPrice

The lead editorial in Friday’s Wall Street Journal was pure energy nonsense.’

“Lessons of the Energy Export Boom” proclaimed that the United States is becoming the oil and gas superpower of the world. This despite the uncomfortable fact that it is also the world’s biggest importer of crude oil.

The Journal uses statistical sleight-of-hand to argue that the U.S. only imports 25% of its oil but the average is 47% for 2017. Saudi Arabia and Russia–the real oil superpowers–import no oil.

The piece includes the standard claptrap about how the fracking revolution has pushed break-even prices to absurdly low levels. But another article in the same newspaper on the same day described how producers are losing $0.33 on every dollar in the red hot Permian basin shale plays. Oops.

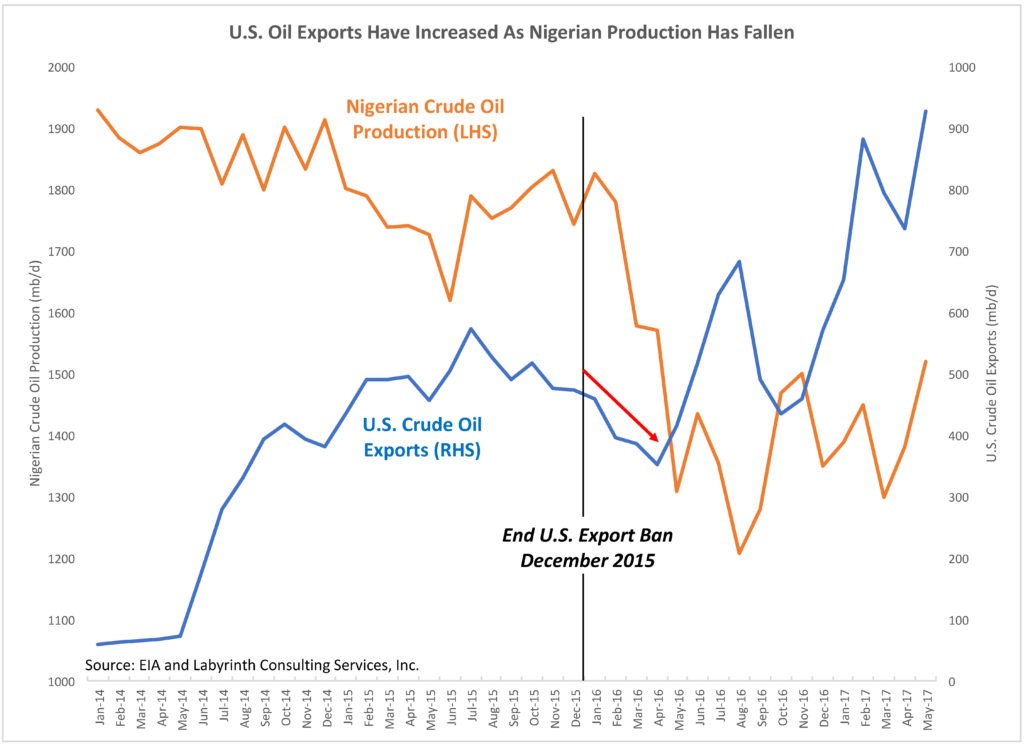

The main point of the editorial, however, is to celebrate a surge in U.S. oil exports to almost 1 million barrels per day in recent weeks. The Journal calls lifting the crude oil export ban that made this possible “a policy triumph.” What the editorial fails to mention is that exports actually fell after the ban was lifted, and only increased because of Nigerian production outages (Figure 1).

(Click to enlarge)

Figure 1. U.S. Oil Exports Have Increased As Nigerian Production Has Fallen. Source: EIA and Labyrinth Consulting Services, Inc.

Tight oil is ultra-light and can only be used in special refineries, most of which are in the U.S. It must be deeply discounted in order to be processed overseas in the relatively few niche refineries designed for light oil. That’s why Brent price is higher than WTI.

It must also displace other light oil such as Nigerian Bonny Light. Civil unrest in the Niger Delta region interrupted oil output and provided a temporary opening for U.S. ultra-light to fill. Nigerian production is now increasing so look for U.S. crude exports to decline.

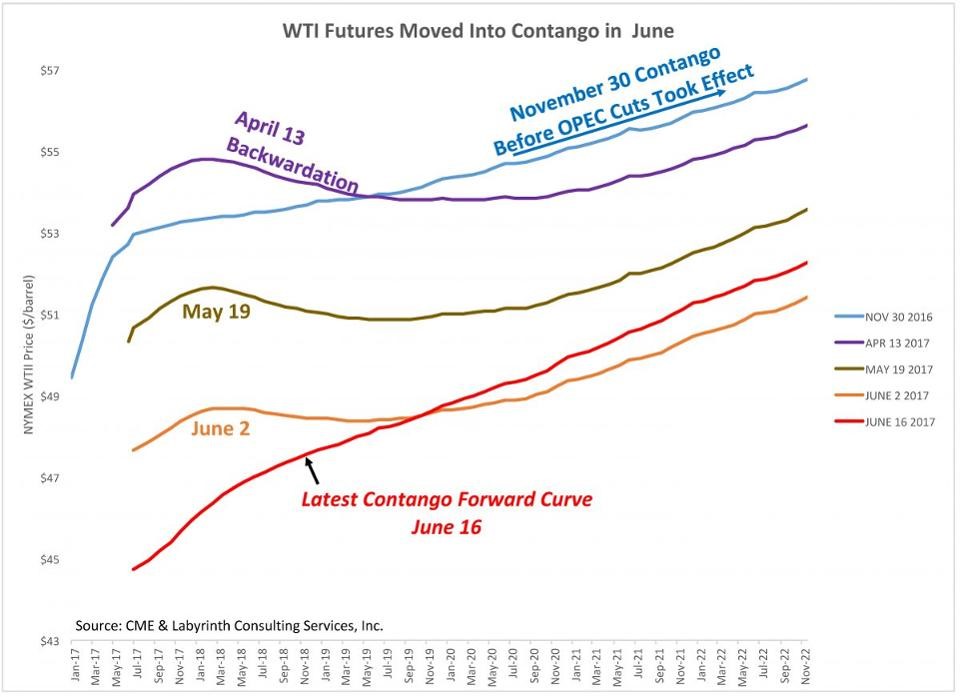

Backwardated oil futures prices are another factor that favored oil exports. Since the OPEC production cuts were finalized in late November 2016, the value of futures contracts has been lower than spot price. That encouraged selling at a discount to avoid even bigger losses in coming months (Figure 2).

Figure 2. WTI Futures Moved Into Contango in June, 2017. Source: CME and Labyrinth Consulting Services, Inc.

Since early June, however, oil futures have returned to contango. Longer-dated contracts have more value than spot prices—so the fire-sale incentive to sell is over.

Friday’s editorial goes on to also rejoice in the rising tide of potential U.S. natural gas exports. This is taken by the editors as further evidence that free markets do the right thing. Perhaps they haven’t noticed that international LNG prices crashed along with oil prices, and that U.S. gas prices have almost doubled in the last year.

Asian gas demand is saturated and the price for LNG in Europe is only $4.80/mmBtu. The Journal extolls Energy Secretary Rick Perry’s approval of more U.S. LNG projects in April but a Wood Mackenzie analysis concluded that “the numbers proposed far exceed what the world realistically needs.”

The newspaper has fallen into the trap of mistaking production volumes for profit.

Shale gas and tight oil companies have shown consistent negative cash flow since the shale revolution began. Investors continue to pour capital into them in their desperate search for short-term yield in a zero-interest rate world.

The Wall Street Journal believes that the expansion of U.S. oil and gas exports demonstrates the wisdom of free markets. I think it shows just the opposite.

Wrong picture 1

Sorry, fixed! Tech problems today.

Seems like the world is awash in oil and gas. Sure easy fossil fuels will be more difficult in the decades ahead; but the more we use them, the faster we speed up our demise.

Seems to me, the rats are grabbing what they can before the ship sinks. So silly that they don’t see they’re rats:

” I got nasty habits, I take tea at three

Yes, and the meat I eat for dinner

Must be hung up for a week

My best friend, he shoots water rats

And feeds them to his geese….”

Blessings, tawal

For us proles, what’s an E&P?

Oil Exploration and Production. I always like to imagine Ewing Oil as the archetype in this role https://youtu.be/4-P1NZ_L7n8

I always wondered why the world was so entertained by a manipulative oilman, JR (who’s first initials I shared until I got family and friends to quit using them). But then my earliest lessons on the seedier side of the oil business were formed by my dad’s early association with John R. Stanley (later of TransAmerica Energy Corp), who my dad said offered to make him a partner when he couldn’t pay him the wages he owed him.

My dad had some second thoughts when the guy who had to keep his 4 gas stations opened until 4 in the morning to get the cash to keep the check he paid the supplier from bouncing got his supposed net worth up to something like $200,000,000. It didn’t take him long to conclude that there was no profit worth what he had to do to get to where Stanley had gotten by the last he knew of him.

A little follow up at http://john-r-stanley.blogspot.com/ shows that “Jack” topped $2 Billion before he died, and, from that link:

“…Mossack Fonseca leaks reveal nine separate trusts in five European tax havens. Each Trust containing up to 500 million Euro. The origin of the money is not known but it has been wildly speculated that the younger Stanley moved the money offshore from his World Energy Corp which held 28 separate Oil and Gas businesses and may have been connected with his father. As soon as the leak at Mossack Fonseca became public, bank accounts were closed and money moved in an effort to hide the fortune but the fact that they were there at the time of the leak is indisputable…”

There is some fascination in the EU about the relatively low prices at Henry Hub, and a fixation with Russia as an unreliable source (really because Ukrania is an unreliable place for pipeline passage). Some believe that what is needed in the EU is more “free-market wisdom”.

There will never be free markets. They are always controlled by the state or by the .1% in power.

Ah ha! A new oxymoron to add to my collection: “free-market wisdom”. Right up there with “military intelligence” I tell you. ;-)

An inevitable product of political science.

Bernie Sanders: The business of Wall Street is fraud and greed.

The newspaper has fallen into the trap of mistaking production volumes for profit.

It’s no trap. If a “newspaper” about business gets this wrong they are worse than useless and are accessories to the crimes.

The thing is that cheap oil means the status quo. That’s what the top quintile wants.

The newspaper has fallen into the trap of mistaking production volumes for profit.

Trap? Amazon is flirting with $1,000 per share and buying up the planet. Some trap. Profits are for suckers.

It’s remarkable that the shale industry continues to be unprofitable and yields so little return to the public at large yet is allowed to continue onward. The environmental destruction figures to raise public costs to astronomical levels as all these fracking concerns go bankrupt and leave Joe Public holding the tab for the clean up.

It’s remarkable that the shale industry continues to be unprofitable and yields so little return to the public at large yet is allowed to continue onward.

The notion that corporations exist to maximize shareholder value is a misconception. (Purposely I might add) The reality is that corporations exist to maximize STAKEHOLDERS wealth and profits. Shareholder value is merely a byproduct. You may think there are no profits but when you simply answer the question, cui bono? the answer to why any corporate activity exists becomes apparent. (See my comment about Jeff Bezos above.) You don’t have to be a CPA to understand the fundamental concept that assets minus liabilities equals wealth and profits. The wealth and profits end up in the stakeholders hands and the liabilities (debt) ends up in the ether. Stakeholders get the mine and someone else gets the shaft. If we are really too stupid to understand this which was not only made apparent by the 2008 GFC, but rubbed in our faces for the last 8 years, then we deserve what we are getting. It’s called Financialization by the way.

Many in the financial press also fall for the increasing profit totals story, while the underlying reality is a lower RATE of profit in most investments. I believe this is the reason for all the “greed” we see, as profit rate is the indicator for future maneuvers, and the finance wizards see its trajectory. It feeds the mergers & acquisitions gurus’ trust in size to aid capital’s political power (we can lie bigger than you and buy a pass) as well as its ability to use fraud and theft to cover for the loss of “fair” profit.

As a side note, while we have had our noses rubbed, you must consider the psychology of a true revolt – there is such a thing as “tipping point” for every society, based upon the three-legged stool of fear, status, and opportunity (fear of reprisal/loss vs. fear of worse if no action, status within family/community as a drag vs. outrage shared, opportunity measured against the power of us vs. them).

Mike – since your reply appears to be directed to me, I feel obliged to say that I couldn’t have said it better. It is truly us against them – and until we elect one of us (Trump has clearly tried to create an image of an outsider but he as just as clearly not) we will continue with the status quo.

“Stakeholders get the mine and someone else gets the shaft” – wonderful, thanks

other energy nonsense: some are saying that the US will become the world’s largest LNG exporter. we will become the world’s largest natural gas importer before that happens.

It seems that cheaply priced debt is what currently drives shale plays, not high oil prices (which originally got things started). File this bubblicious industry under lambert’s ‘the bezzle’.

Or am i wrong? I’m not buying into shale ‘revolution’ until we see a good, solid shake up in the junk debt and leveraged loan markets. There’s still a lot of money sloshing around looking for investment opportunities. There’s a kind of late-cycle subprime feel to things, i suspect.

Those who know better please correct me on this if i misread.

johhnygl you are not misread. It is precisely as you see it. Our hope is for more to agree to become enlightened. The notion that a bubble cannot be spotted in advance is….propaganda (I had a better term in mind but didn’t want to be “moderated”)

“The Journal uses statistical sleight-of-hand to argue that the U.S. only imports 25% of its oil but the average is 47% for 2017. Saudi Arabia and Russia–the real oil superpowers–import no oil.

The piece includes the standard claptrap about how the fracking revolution has pushed break-even prices to absurdly low levels. But another article in the same newspaper on the same day described how producers are losing $0.33 on every dollar in the red hot Permian basin shale plays. Oops.”

Readers may wonder why they first two sentences are wrong and the last sentence is trustworthy. For inaccuracy, they still have a way to go to catch up with political noise, er news coverage.

If you want to understand total petroleum flows into and out of the US, stay away from the WSJ or MSNBC or energy blogs or environmental blogs or anything else and go straight to the source:

https://www.eia.gov/dnav/pet/pet_sum_crdsnd_k_a.htm

Per EIA numbers, imports supplied 47% of the total US crude oil feed into refineries. Note, though, that we re-exported about 15% of the refinery output.

https://www.eia.gov/dnav/pet/pet_sum_snd_d_nus_mbbl_a_cur.htm

Why do we do this? Because declining fuel consumption in the US has left our refineries with excess capability, and we’re essentially using it to provide refinery services for other countries. If we quit providing refinery services for other countries (and quit importing the associated crude oil) and made them refine their own fuels, we’d still import 36% of our total crude.

It’s not as bad as it was in years past, but it’s still bad. Net petroleum imports into the US are an enormous number even today.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mttntus2&f=a

It looks like a trade war. The battle for a piece of the natural gas/LNG market, regardless of the real cost. Oil is almost a distraction. And the world has not recovered from the GFC so there is little demand. Doesn’t make much sense. Will somebody please remind me, why are we doing all this? Are we doing shale theater to buy time until alternative energy is secure and the old fossil-fuel fossils keel over?

Yes agreed Susan – it looks like trade war.

That boatload of fracked gas shipping to Poland recently was intended to persuade the EU to change to US gas but query, is there sufficient shipping to carry the trade?

btw, thank you for your many pertinent comments in the past.