I quoted Lucy Kellaway, who once said (apropos management fads), “No idea is too ridiculous to be put into practice,” and warned that the credit crisis would soon get that sort of treatment.

A story in the Financial Times indicated we are getting closer to that stage:

Central banks on both sides of the Atlantic are actively engaged in discussions about the feasibility of mass purchases of mortgage-backed securities as a possible solution to the credit crisis.

Such a move would involve the use of public funds to shore up the market in a key financial instrument and restore confidence by ending the current vicious circle of forced sales, falling prices and weakening balance sheets.

The Fed apparently called Greg Ip at the Wall Street Journal to quash this leak, um, rumor (hat tip Calculated Risk) but don’t be surprised if it rears its ugly head in a few months.

Nevertheless, this is a curious and appallingly naive characterization of the problem. Yes, we are seeing credit contraction, and it isn’t pretty. But the deleveraging isn’t the result of a feedback loop operating in a vacuum; it’s that a lot of mortgage borrowers cannot make their payments, and their number will increase over the next few years to to ARM resets. And because prices in most markets had risen to levels that were way out of line with incomes, there are simply not even remotely enough people who could afford to buy the houses undergoing defaults at the prices at which they had been financed.

There seems to be a collective fantasy at work, that somehow the powers that be can wave magic wands and turn bad assets into good ones. While you can do that on a small scale, we have a roughly $20 trillion residential housing market that is being repriced for good reason. We’ve gone on about this ad nauseum; a fresh statement of the underlying problem comes from Bill Fleckenstein in “Catering to the Balioiut Nation” (hat tip Nattering Naybob):

Where will all this stop? Can those who behaved prudently afford to bail out those who behaved imprudently? Why should they have to? And is that what we really want? After all, this country’s median income of roughly $49,000 can hardly be expected to service the debt of the median home price of $234,000, up from approximately $160,000 in 2000.

Let’s do a little math. Forty-nine thousand dollars in yearly income leaves approximately $35,000 in after-tax dollars. Call it $3,000 a month. A 30-year, fixed-rate mortgage would cost approximately $1,500 per month. That leaves only $1,500 a month for a family to pay for everything else! (Of course, in many communities the math is even less tenable.) This is the crux of the problem, and the government cannot fix it.

Housing prices, thanks to the bubble and inflation, have risen well past the point where the median (or typical middle-class) family can afford them. Either income must rise — which seems unlikely on an inflated-adjusted basis — or home prices must come down.

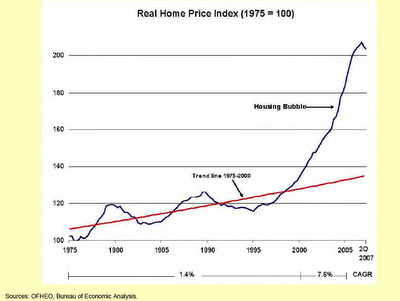

And if that didn’t convince you, have a look at this (click to enlarge):

Even coordinated government action cannot prop up asset prices when the underlying cash flow isn’t there. Japan tried that, and they had the advantage of having very high domestic savings. The Home Owners Loan Corporation of the Great Depression’s results are not comparable to our current situation. First, it was not implemented till 1933, so the weakest borrowers had already lost their homes. Second, mortgages were structured differently then than now: much shorter terms (15 year was the usual limit) and vastly loan to value ratios (50% was the max, and of course, paydowns would reduce that amount). HOLC refinanced these into 30 year mortgages. Thus even with large housing price declines, the HOLC in the vast majority of cases was issuing loans against homes that still had equity.

Conversely, the damage of letting housing fall to a market clearing level appears to be overstated, and the lack of empirical investigation into the results of housing busts in other advanced economies is a major lapse. This comes from a post last August:

Let’s look at what has happened in other countries that had large declines in real estate prices.

The housing recession of the early 1990s was far worse overseas…..

In the late 1980s and early 1990s, the United Kingdom, Finland, Norway, and Sweden experienced peak to trough falls in prices of greater than 25 per cent. Sharper falls have been observed in some South and East Asian economies over the 1990s, particularly in Hong Kong and Japan.

….yet despite Gross invoking the specter of the Depression, these economies suffered only short, nasty recessions. UK GDP fell 2.5% in 1991 and 0.5% in 1992.. According to NATO, Finland had a steeper fall because its contraction was caused by economic overheating, depressed foreign markets, and the dismantling of the barter system between Finland and the former Soviet Union under which Soviet oil and gas had been exchanged for Finnish manufactured goods. Thus its fall in housing prices was more a consequence than a cause of its recession. Sweden similarly suffered from disruption of its trade relationship with the former USSR. Hong Kong has enjoyed high growth and volatile real estate prices, but the only year it had negative GDP growth was 1998, the year after its reunification with the mainland, when it suffered a major capital flight.

So while these economies all have different structures than the US, their experience nevertheless suggests that even severe housing recessions do not inflict long-term damage. I’d very much like to hear the views of those who have studied the international record more deeply, but this quick survey suggests the price of a housing recession is a sharp but short-lived real economy contraction.

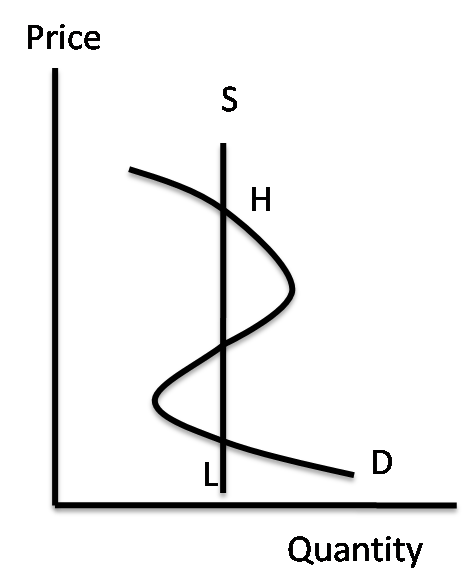

Another problem with the “let’s just go buy the mortgages” line of thinking is a propensity to rely on models rather than empiricism. With all due respect to Paul Krugman, who came to the right conclusion in his post, his analysis seems to have encouraged some other economists (witness this post from Brad De Long, whose analysis is mainly sound) who are trying to restore the bubble equilibrium (point H on Krugman’s chart):

But in the current situation, a lot of securities are held by market players who have leveraged themselves up. When prices fall beyond a certain point, they get calls from Mr. Margin, and have to sell off some of their holdings to meet those calls. The result can be a stretch of the demand curve that’s sloped the “wrong way”: falling prices actually reduce demand. So the market could look like this:

Krugman has the right insight: H exists only by virtue of leverage. He continued:

Implicitly, Fed policy seems to be based on the view that if only they can restore confidence — with extra liquidity to the banks, Fed fund rate cuts, whatever — they can get us out of L and back to H. That’s the LTCM model: Rubin and Greenspan met a crisis with a rate cut and a show of confidence, and the whole thing went away.

But at this point a series of rate cuts and other stuff just hasn’t done the trick — which suggests that maybe there isn’t a high-price equilibrium out there at all. Maybe the underlying losses in housing and elsewhere are sufficiently large that the situation really looks like this:

And in that case, the Fed can’t rescue the financial markets. All it — and the feds in general — can do is to try to limit the effects of financial crisis on the rest of the economy.

Let’s consider another complicating factor: that just about every effort to ameliorate the credit crisis has merely produced problems elsewhere. The “let’s just buy the mortgages” advocates forget that the sharp rise in Freddie and Fannie spreads that kicked off the latest round of deleveraging didn’t come out of a clear sky, It was a negative market reaction to the increase in the mortgage ceilings on the GSEs in combination of making them the refinancer of crappy mortgages. That would be enough to spook any investor. In a post earlier this week, we went thougt a list of unintended consequences (a more accurate term would have been backfires) of the Fed’s efforts to date. Reader Lune ventured what might happen next:

Now we have 3) Fed opens TSLF to broker-dealers. Given the track record of our esteemed Fed so far, I shudder to think what the unintended consequences of this one will be, and I’m disturbed that it’s very likely that no one has thought about that while running around in a panic shooting from the hip at any shadow that comes up. Anyway, here’s my speculation…

The Fed is already close to tapping its full balance sheet. The trigger for the collapse of the past few weeks has been the rise of agency spreads, which is the cause not the effect of all the implosions we’ve seen so far. So to stop the panic, the Fed would have to intervene in the agency market. But it’s remaining reserves of ~$400bil is tiny compared to the amount of debt out there. Furthermore, even a full faith govt. guarantee is unlikely to stop the rise in premiums (witness Ginnie Mae debt, where spreads are increasing even with a govt. guarantee). This is partially because of panic, and partially because agency debt will have fundamentally different behavior when it includes all the extra debt Congress is talking about stuffing it with. So with that uncertainty and unpredictability, it’s no wonder spreads are increasing.

As the spreads continue to claim more casualties, more firms will line up for funding (when do hedge funds get to drink directly from the punch bowl? At this rate, probably in a week or two), and the Fed, unable to say no, will have to start issuing treasuries to expand its balance sheet. Within a matter of a month or two, the Fed will find itself with a trillion or so dollars of impaired debt in a “repo” that can’t ever be recalled (some because the counterparty’s balance sheet is still too weak, others because the counterparty has gone BK). The ultimate casualty? The Fed itself, unable to lower interest rates below 0%, facing default on collateral on its hands, and counterparties (central banks) unwilling to trust the Fed to manage the dollar any longer.

Oh yeah, and mortgage markets will still be frozen.

We are unlikely to see a bottom to the housing market for quite a while (historical precedents suggest early 2011) and that solvency problems have to work there way through the system. If we must have rescue operations, I would much prefer something along the lines suggested by Robert Reich:

The next question is how to cushion the blow for middle and lower-income people who might lose their homes or their jobs, cars, medical insurance, and large chunks of their pensions. This may require federally-subsidized insurance — mortgage insurance so homeowners can meet payments, along with expanded unemployment insurance, health insurance, maybe even pension insurance. All hard to accomplish, but ultimately more important than bailing out the big banks.

I will admit to not having thought this idea through, but the intent of policy should be to limit damage to individuals rather than intervene in asset market in ways that are destined to fail anyhow. After all, isn’t all this hooplah to prevent a recession? And I thought recessions were bad because they increased unemployment (oh yes, and lower corporate profits too). Maybe it’s time to recognize that a recession is unavoidable, and that the efforts to contain it are producing serious side effects that are at least as bad as the problem they are intended to solve. And that’s just looking at the immediate impact; this becomes a net negative effort when the Fed’s credibility is irreparably damaged (and we are just about there).

The one bit of good news: the FT article made clear that any rescue program was not going to come into being any time soon, and that was before the Fed’s denial.

Great story there and very funny The Fed is involved in censorship! This reminds me of the bank in England that looks at shorting like bank robbery. I guess we all need to just buy into the same version of the story and go long on these government backed antitrust bailouts for bears (never did here what FTC said about that!

Interesting econ link not really related to this story, but about Fed speak

http://www.econtalk.org/archives/2008/03/cowen_on_moneta.html#highlights

Did you see this story?

http://business.timesonline.co.uk/tol/business/industry_sectors/banking_and_finance/article3599417.ece

US Congress scrutinises bailout of Bear Stearns

The US Congress has begun an inquiry into last weekend’s bailout of Bear Stearns by the Federal Reserve and JPMorgan Chase as Washington grows increasingly concerned that American taxpayers are paying the price for Wall Street’s mistakes.

EEEk!

No, thanks. Links to stories are always VERY much appreciated, even if I don’t comment on then. Due to the odd hours at which I post, sometimes I don’t seem them soon enough to make use of them.

Actually, it was reported earlier in the week by the Journal and MarketWatch, in somewhat less dramatic tones. Maybe Joe Lewis’ PR guys got the Times wound up.

I see that:

March 21, 2008

Are Central Banks Planning to Make Coordinated Purchases of Mortgage Backed Securities?

I’ve proposed that central banks purchase mortgage backed securities to remove risk from financial markets a couple of times as one part of a package of measures to free up credit markets,

>> Central banks float rescue ideas, by Chris Giles and Krishna Guha, Financial Times: Central banks on both sides of the Atlantic are actively engaged in discussions about the feasibility of mass purchases of mortgage-backed securities as a possible solution to the credit crisis.

http://economistsview.typepad.com/economistsview/2008/03/coordintaed-mbs.html

In regrad to news out-takes, I sent “several” scud missiles into CalculatedRisk a few minutes ago, under the heading of: Fed Denies Discussions to Buy MBS, as

scotty at the zoo | 03.22.08 – 1:59 am

It’s a little bit of cross pollination between every MBS story out there; it’s getting to be a great conspiracy novel!

When I saw the Krugman graphs I gagged. It reminded me a bit of the Laffer curve, where basically you have two points and you draw whatever curve you want to connect them. So much for the economics’ profession. In fairness to Krugman, he calls it a “cartoon model.” But he also calls it “more serious wonkery”. So I suspect Krugman realizes the argument is bull, but can’t quite reject the economist that’s deep in his innards.

My reaction was similar to yours, I was a little horrified that this was how Krugman chose to think about the markets (but it did lead him in an earlier post to make some useful analogies to currency market interventions). But he did come to a sound conclusion (ie, he pushed his little model around to acknowledge that his first version might not represent the situation accurately). I was more worried about De Long, who took the first version of Krugman’s model and ran with it to recommend policy solutions.

My father gave me almost no directives as to how to run my life, so it seemed very out of character when I went to college (many years ago) that he forbade me to major in either economics or sociology. “They won’t teach you how to write and they won’t teach you how to think.” So I must admit to looking at this discipline with a prejudice, but it often seems well founded.

You describe the problem well.

Personally I think nothing ought to be done if for no other reason than to expose the fraud of a FIRE-based economy sooner rather than later. Looking at first the tech stock price bubble and now housing prices, it seems clear that these phony asset bubbles have been the primary source of ‘wealth’ — i.e. compared to genuine income growth.

“every time it rains, it rains, manna from heaven

don’t you know each cloud contains, manna from heaven”

I can understand the reasoning for wanting to look at the economic impact of real estate meltdowns in other countries in the past.

However, I think that certain elements in the US economy make the situation radically different from what happened in those countries.

The overall debt as a % of GDP is far higher in the US. The US has a zero savings rate, so it is entirely dependent on foreign capital.

As well, very wide swaths of the debt are now held in the securities market (instead of banks). The securities market is now facing the equivalent of a bank run. The kind of bank run that resulted in the massive credit contraction of the Great Depression (as Paul Krugman mentioned).

Essentially, the US is a big pyramid of largely securitized debt now propped up by foreign governments. This may not be a novel concept by any means, but it is true.

That makes the US situation far more dangerous than what happened in those other countries.

Yves,

Please note that what you describe here as a negative feedback loop:

“But the deleveraging isn’t the result of a *negative feedback loop* operating in a vacuum;”

is a POSITIVE feedback loop. You money types should restrict yourself to talk of virtuous and vicious cycles since you can’t get your signs straight on feedback loops. ANY self-reinforcing process, no matter what the sign of its output effect, is POSITIVE when it comes to feedback loops.

It’s really not that hard if you’d stop to think about it a bit.

We desperately NEED negative feedback loops – they’re the ones that stabilize processes.

Short buying and selling is a classic example of positive feedback. The process is self-reinforcing on the way down and on the way back up. It creates an oscillation and it’s a bad thing.

Heresy. Right? I wish you guys had been forced to take a few Electronics Engineering courses on amplifier and oscillators. You’d be far better at what you do now.

As you stated, your background was liberal arts topped with a program you claim you could have been taught in six months.

That’s not much of an education if you stop to think about it. You fellows are supposed to be able to regulate and control the most complex system of financial computations ever devised.

And you’re clearly not up to it.

Anon of 10:18 AM,

I write probably over 2000 words a day, do the research for that, and publish daily without a line editor. You focus on one usage error out of God knows how many posts and declare my work and the work of many unknown others to be invalid, despite your failure to find anything basis for argument with the substance of the post.

Others who find minor errors like typps point them out; instead you decide that indicts an entire line of thought, no, an entire body of work.

That shows a lack of sense of proportion and an inability to distinguish the forest from the trees.

FEEDBACK LOOP!

Hurray! Another controls engineer with a brain!! You have discovered the very sad truth…that the economists who make predictions and policy decisions have very little or no knowledge of dynamic systems theory. Even the “Quant Jocks” from MIT who make 9,10-figure incomes fail to apply rudimentary finite difference equations! And the “world-famous economist” Feldstein won a Nobel Prize for such profundity as expressed in his “Fool in the Shower” analogy where he “discovers” the notion of “lag” in monetary policy effects on the economy.

With brilliant economists like Greenspan and Bernanke in charge, it is no wonder we are facing the problems we are.

BRING ON THE NEGATIVE FEEDBACK LOOPS

Yves

Sorry, don’t take my feedback on negative feedback as negative. In fact, I will offer some positive feedback on negative feedback. Your article on the whole was positively spot on. My only negative criticism was on your use of the word negative, which should have been replaced with positive.

But I DID want to positively reinforce the other engineer’s correction of your sign error as it applied to economists in general. My view of the state-of-the art is, well, negative.

Hope that clears things up for my anon post of 2:42, plus or minus a few seconds

“After all, this country’s median income of roughly $49,000 can hardly be expected to service the debt of the median home price of $234,000, up from approximately $160,000 in 2000.”

I assume the median income figure includes homeowners and renters, and the median income of just homeowners would be higher. Plus, I think a family making $49,000/year could afford a #234,000 home. I say this as the head of a family making #39,000/year who owns a $181,000 home. And $1,500/month in non-housing costs is also quite doable.

“Forty-nine thousand dollars in yearly income leaves approximately $35,000 in after-tax dollars.”

No way. The tax rate on a family making $49,000/year is much lower than that. Middle quintile income taxes would be 7.65% payroll tax and 3.3% federal income tax. State income taxes are harder to find info for, but surely they average less than 5% for these median income families. So that leaves over $40,000 to take home after taxes.

Anon of 2:42,

Sorry if I seem a bit touchy, and thanks for the compliment. I was reacting to the earlier comment.

I share your concern regarding the methodologies used in economics. A colleague of mine, Amar Bhide, is a Columbia B school professor who got his undergraduate degree in engineering.

He sent me a draft of his latest book, which is on entrepreneurship. He has a chapter on regression analysis, which I am sure you know is one of the most commonly used analytical methods in the social sciences. The chapter indicts the use of regression analysis and is compelling.

I called Amar and told him that the chapter on regression was fundamentally important, far more so than the rest of the book.

He said he had tried to get the chapter published as a paper. He had first run it by colleagues (who include Nobel Prize wining economists). It made them all very uncomfortable but no one could disagree with it.

He was unable to get the paper published. No journal would run an article that was an attack on the orthodoxy. So his only recourse was to slip it into his book.

Appalling.

very, very interesting. I have contacted a number of Ivy League PhD economists and they confirm the wide-spread, nearly exclusive use of regression analysis and seem surprised when I suggest there might be a deficiency.

is there any chance your colleague could send a copy of that chapter to me without violating copyright agreements?

I have approached the local Federal Reserve Bank with dynamic modeling methodologies and his thesis would lend credibility to my own.

I do not have a google email account but would be happy to email you directly with contact information.

Yves,

Agree that the implications of Brad’s post the other day were a bit disturbing (primarily because each action we’ve taken so far has had unintended consequences), but there’s at least a nugget of truth in there. MBS’s are dropping in value for three reasons: 1) Decline in the value of the collateral; 2) Loss of trust/transparency; 3) Forced de-levering among the brokers & hedge funds. A drop in supply (by the Fed or the agencies buying some) would definitely have some effect to the extent that the drop is being caused by #3 vs #1 & #2.

You say this is undesirable because of likely unforeseen consequences, but Bernanke & Co may realize that there are consequences but still think it’s worth trying…that would be a measure of how desperate they are rather than about how optimistic they are that they’ve found some magic bullet.

You linked approvingly I think to Dizard’s FT article from 2-3 wks ago in which he implied that the powers that be were instructing the brokers’ auditors to mark to market LBO debt at qtr’s end, but NOT to mark to market the structured debt. This seems to be exactly what LEH & others did…they took a writedown & sold off a decent chunk of the LBO loans, but left the mortgage debt in place (in fact, gross leverage actually INCREASED a bit). Eisinger sort of hints at this in his piece from Friday, though I think he comes to the wrong conclusion when he regards this as LEH thumbing its nose at the Fed…I think the Fed is fully aware of the situation LEH and the other brokers find themselves in…if they truly marked to market, book value writedowns would be measured in the tens of billions, and it’s possible that MER and LEH at least would have no book value left at all.

All this is a long-winded way of saying that the Fed’s actions this past week were probably not taken lightly, and DeLong’s final point is a good one: If you start down the road on a path (to save the brokers), it sets a very, very bad precedent not to succeed on that path.

The quote I saw in a Reuters article had the Fed denying it was in discussions with other central banks for coordinated purchases of mortgage-backed securities. Among other things, that does not preclude the Fed from buying them on its own, or from making “uncoordinated” purchases along with other central banks.

March 20, 2008) – Brascan Adjustable Rate Trust I (the “Fund”) (TSX:BAO.UN), today announced recent initiatives undertaken by the Manager in response to the ongoing challenges in the credit and mortgage-backed securities markets. The Fund was established to provide unitholders with an investment in credit securities, primarily mortgage-backed securities, on a leveraged basis. At March 13, 2008, the Fund had total net assets of approximately $8.8 million or $6.06 per unit.

Portfolio Update

In accordance with its investment objectives, the Fund has exposure to an actively managed portfolio of primarily mortgage-backed securities held by a partnership (“the Partnership”). The market for asset-backed and mortgage-backed securities has experienced unprecedented disruption over the past 12 months. This disruption has been precipitated by a severe credit contraction that is presently occurring in the United States. As a consequence, many securities have fallen in value notwithstanding that they retain high quality ratings from the rating agencies.

In order to reduce leverage and protect asset values, the Partnership has sold all of its Agency mortgage-backed securities, which have the greatest amount of current liquidity, and used the proceeds to repay debt and reduce its leverage to approximately 1:1. This strategy of reduced leverage is expected to enable the portfolio to better withstand the severe price volatility characterizing current markets. The Manager believes this action is in the best interests of the Fund, given the illiquidity and very heavy penalty for sales in the non-Agency mortgage-backed securities markets. As such, the Fund’s current holdings are 100% non-Agency mortgage-backed securities, with the majority of these holdings rated BBB. In light of these changes to the portfolio mix and the resultant weighted average rating factor, the Manager understands that the units of the Fund have been downgraded to ‘BBBf’ by Standard and Poor’s.

EDT March 20, 2008

Print RSS Disable Live Quotes

WASHINGTON (MarketWatch) — The Federal Reserve will auction off $75 billion of Treasurys for 28-day loans to its 20 primary dealers on March 27 in the first auction in its Term Securities Lending Facility announced a week ago. The Fed will accept mortgage-backed securities, including collateralized mortgage obligations (or CMOs), as collateral in the first auction. The second auction will take place April 3.

Fed’s first auction to accept mortgage-backed securities

http://www.marketwatch.com/news/story/feds-first-auction-accept-mortgage-backed/story.aspx?guid=%7B2786DEBD-4A82-4E0D-977A-E02AE63F3A05%7D&dist=hplatest

I am not in favor of central banks purchasing mortgage backed securities, at least in so many words. If these derivatives are purchased at a price level that leaves their holding institutions solvent, that’s a bailout since the probable value of these instruments is well below that point: this is why the holding institutions are in-solvent. I’m much more in favor of national banking regulators, most especially in the US, nationalizing insolvent institutions as quickly as possible, including investment banks, wiping out shareholders and bondholders, and _then_ stripping out the MBSs into goverment receivership for management, renegotiation, liquidation, or what have you. The re-made institutions receive some small value in Treasuries against the surrendered radioactive securities to give them a capital base, and then they are sold back to the public when able to stand alone.

The banking system can be saved without saving existing stakeholders: they are already lost, or should be; welcome to the destructive re-creation of capitalism. The solution will take public money, but there is no way to avoid that outcome now. By nationalization, though, the public fisc may actually cushion its upfront costs by realizing something out of the underlying mortgages in the mid-term. By buying up MBSs on the open market, we save the banking system at the coast of soaking the public for the losses of the few. This is what the political argument should be but hasn’t yet become: should banking shareholders take the hit along with the public, or should the public alone take the hit? I think we know how the public would vote on that one, but banking regulators are eager to avoid the appearance of a choice. Too eager.

It’s past time to be thinking about interventions, and fully time to begin implementing interventions—but nationalization, not a bail ’em out buy-up. We always hear that ‘it’s about saying the innocent millions,’ and yes, there is real truth to that: the best way to save us is to throw the feckless plutocrats out of the lifeboat so that we all can eat what lunch is left over. By all means, let’s get on with it.

Re: Reich’s proposal, I’m completely in favor of weaving up a better social safety net: This will take several years to get through Congress, if possible at all. Look how long it took to get the ‘New Deal’ in place; seven years, give or take. But, well yeah.

On regression analysis, I have thought for twenty years that the way regression was used in economics was loony toons, but I’m an historical theorist not a mathematician, and it wasn’t my brief to tangle with this one. But I’d read any good critque, for sure. And as for your colleague’s inability to get a peer reviewed journal to publish a professionally critical analaysis, hahahahahah, it’s a rigged game, this paper publishing, no? You only get to publish if you enhance existing academic stakeholders, not diminish them. Well, he knows that now.

Many good comments here, I am addressing them in reverse order and it is very late, so don’t be offended if I get to yours later (as in during the daylight) today.

Richard,

Thanks for the thoughful comment. Although I have not addressed it specifically, I agree in concept that nationalization should be a better option, and ought to be preferred to rescues that don’t wipe out the existing shareholders.

However, I suspect the Fed has a big problem. One, it completely lacks jurisidictional authority to take over an institution that has not failed or that it can declare to be insolvent. Bear was not a member bank. Even though it asked for help, the Fed was limited in what it could do.

Second, the Fed has no ability, zip, nada. to oversee all the fancy risks, particularly derivatives, that Bear was running, Even if the plan is an orderly liquidation, I doubt the Fed is competent to supervise even that.

I too have never understood the regression fixation in economics. My buddy Amar has managed to get tenure despite breaking lots of china and annoying people by not respecting revealed wisdom. But he has also made life far more difficult than for himself as a result.

I’m not sure when I can post his chapter (I assume not till the book is out, for some reason it takes almost a year for publisher to get a book on the shelves once the text is in final form) but if there is any way for me to circulate it sooner, I most certainly will.

So Yves,

The situation with BS (so apt, that acronym) was exceptional, and I’m not sure that I even oppose the actions undertaken. The real issue, as I saw stated by Meredith Whitney elsewhere on the web(where?) with whom I agree was the massive tangle of CDOs. ‘Too bad to blow’ was the word, so $30B is cheap not to have that experience. —Which could come from another direction or the same direction, any day, for months to come yet. There’s a chiller of a thought, right? We are all playing derivative roulette with a thousand champer pistol except no one knows how many _other_ bullets are in that puppy.

I understand, too well, that the Fed by itself lacks ‘formal’ authority to act before formal insolvency of member banks, and no ‘formal’ jurisdiction over the investment banks. [And while we’re at it can we all please, please stop speaking of “investors” and “investment banks”?: these are speculators, most all of them, that’s their trade. Truth in advertising, what?] But we are now _nine months_ into this thing, and day by day, the Fed and other authorities are, rightly, exceeding their formal authority, and inventing authority on the fly. That, too, is in the Fed charter, btw, ‘all such actions deemed necessary by the governors . . .’ or some such. What we need is to stop being _re_active and to start being _pro_active. And that is what all this talk about “Buy up the MBSs to ‘save the system’ (me first)” is, more charitably, all about, getting out in front of the problem before it runs over us all.

Somebody has authority to ‘regulate’ Lehman. The Fed definitely has the authortiy to regulate Citi—which is gorked, capital-dead, that’s stone clear. We can wait until they blow up or we can start reeling them in. I’m sympathetic to BenBer if he thinks he has toooo much on his plate on any day of the week to go _looking_ for trouble. But if he waits for it to come find him he’ll be in a corner by that time.

I don’t expect this to happen tommorrow, or this month, but it would be great for the ‘Regulation Team’ to send in a team of auditors to the major suspects, lock senior management in a boardroom, and say “Turn off your cells, we have 48 hours to know how far on the wrong side of the line you actually are as of today’s numbers. If we decide it’s too far, there’s police tape around your building, and next Monday this firm is open for business with a trustee sitting in your chair. If you are near the line or on the right side, then we’ll work with you on that.” If the Fed can take extraoridinary measures giving money away, it can dust off it’s Big Daddy clauses and get the knife well in, too. Oh, it may be the SEC’s auditors who walk in the door for some of these guys, but still. The government can FIND the authority, even if it’s a federal prosecutor who walks in the door at the head of the ‘extraction team.’ If management doesn’t want to play, the simple announcement that ‘the authorities are reviewing concerns with X firm regarding their standing’ would be quite, quite mortal in the present environment. Let’s not pretend that this couldn’t be done, it’s a question of how ruthless the public authorities want to be. None of us, the media, the pols, the traders, think we are at this point yet. . . . But really, we are.

And there will be no doubt whatsoever when the equities market finally turn turtle and drop to more realistic valuations. I mean, really, everything priced in $ is overvalued on a realistic basis by 30-40%: That’s what thirty years of balooning credit has done to us. In a severe economic downturn, equities at their top were likely 50% over any realistic value. 7000 Dow, anyone? Well, that sounds more like a bottom, and we may not get there this year, but we’re going to take a long step down and there is very little the Fed of the Beltway types can really do about this. And then, maybe, we’ll finally get ruthless about keeping the banking system running. Nobody want’s to re-live Argentina here. (And they got there just like we have, by having minimally regulated non-major banks issue colossal amounts of credit against very little capital. It killed their currency, and got them near to 20% unemployment; does anyone read the newspapers and remember. Just like we are risking, especially with regard to the currency. We just let the hedgies and the conduits to it. Or rather Greenspan waved them on, that’s his major sin.)

On regression, way back in the 19th century, Walrus, Pareto, and repackaging them both Marshall did some really rather sophisticated things working with trend quantification. Since then, economists have been convnced that they are ‘scientists;’ don’t laugh, this is their real view. The bedrock of their ‘science’ is getting economic activity to ‘look like trends.’ Using regression, no matter how violently inappropriate for the data and behaviors analyzed, will b’gosh mash up a trend. So it’s ‘science.’ Right, am I right? It doesn’t matter much that the process are dynamical, and the systems are open so that the accuracy not to say the substence of regression analysis is . . . open to question. Most of economics is the equivalent of the drunk looking for his lost keys under the street lamp where there’s light rather than down the block in the dark where he dropped them. I like economic historians (and Pareto was a rather interesting thinker who would be, I feel sure, up to his eyeballs in dynamical systems work today). I’m with your father in many ways; the fact that _any_ econmomist, say Joe Stiglitz of Paul Krugman, manage to think straight much of the time is manifest evidence of superior brain power given what their professional training requires them to do with the minds they were born with.

‘Nuff.

*Oof* I’m tired enough I’m bleeding typos. But if Amar wants to circulate his work, I’ll keep an eye out here put in for dibs or give you an email. Thanx.