The Baltic Dry Index, which some use as a proxy for the outlook for global manufacturing, has been falling since late June, not long before the commodities bubble burst in July, and has been in retreat since then. What is particularly worrisome is its steep dive in the last two days, despite Herculean efforts to get the banking system operational.

The Guardian article suggests that the culprit may be a rapid deterioration in the Chinese economy, but we are concerned that another factor may be at work that the financing of trade is seriously impaired. in our post “International Trade Seizing Up Due to Credit Crisis,” we cited reports that banks are refusing to honor letters of credit from other banks. If this persists, international trade will break down.

Update 8:40 PM A couple of readers in comments pointed out that BDI is volatile and has been at lower levels in the not-too-distant past. We have mentioned the volatility of BDI in past posts, as well at the fact that it has as often as not given false positives regarding coming economic slowdowns. The flip side is that the BDI also has a weak seasonal pattern, with volume often but not always falling sharply towards the end of the year, although in past years, the deterioration has come a bit later.

Back to the original post:

From the Guardian:

The Baltic Dry shipping index, which has been flashing amber signals about the world economy for the past couple of months, is telling us there is something going badly wrong because it is now stuck firmly on red.

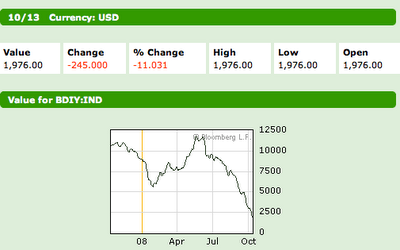

The index, a proxy for world trade flows, suffered its second biggest-ever fall yesterday, to 11%, which took it down under the $2,000 mark and it fell another 8% today to $1,809. The drop means it has fallen more than 80% since July’s peak of around $12,000 and is now at a three-year low.

The index has long been seen as a good leading indictor of future economic production levels because it charts the cost of freight movements in 26 of the world’s biggest shipping lanes of “dry” materials, such as coal, iron ore and grain which feed into the production of finished goods some weeks or months ahead.

Think back to the first part of the year and there was a boom in oil and commodities prices, which pushed up demand for the ships to carry them. Now we seem to be stuck in the bust phase. We know that oil and commodity prices have fallen sharply because demand has faded in the face of high prices and because the world economy is being deflated by the global financial crisis.

There is some hope today that the worst of the financial crisis may be over, thanks to the mass injections of capital into banks by governments in Europe and the US. But the damage to the world economy is already a fact of life and the Baltic Dry is pointing to a further slowdown in both output and inflation in many of the world’s economies.

The index may also be telling us something scarier. It may be telling us that the world’s great industrial powerhouse, China, could be in trouble and that its imports of raw materials are collapsing at a far greater pace than the slow slide in demand from the West for China’s finished goods would imply.

There have been increasing concerns about China this year. It has been booming for years and growing, if the official figures are to be believed, at more than 10% a year. That has, in turn, given rise to a stockmarket and housing market boom which now look to be going pop, as ours have done.

The great Asian miracle economy might now be coming apart at the seams, in spite of the official figures suggesting everything is stillfine. But the Chinese authorities cannot control the Baltic Dry.

This chart from Bloomberg does not include the 8% fall today, but it illustrates the magnitude of change (click to enlarge):

Update 8:40 PM: Reader FairEconomist found this five-year BDI chart less worrisome because it showed that we have not breached not-too-long-ago lows. But that may not be the case, since (as noted in the original post) it does not include the 8% fall today, and the trajectory is unprecedented in recent history. Each to his own reading!

first

Wow…and its still about 60 points above its 2006 low of 1750ish. It looks like the ramp up began in sept 2007, along with every other commodity…right about when china began hoarding diesel and other commodities in front of the olympics.

first

Congratulations. As your door prize an entire shipload of iron ore has been scheduled to be delivered to your home next week.

If you want it sent somewhere else it’s ok. Just produce a certified bank letter of credit so we can arrange shipping with a freight forwarder.

Is this such a big deal? I mean, aren’t shipping rates very cyclical? Rates start to rise, more keels are laid, and just as the cycle reaches climax and begins to fall, there’s a lot of new capacity hitting the oceans…

A few years ago I was invested in some shipping firms because they paid completely absurd dividends. But I was warned off that and told they would plummet with wicked speed because the new ships almost always arrive after the slowdown started.

I think the Guardian has a tendency towards hysteria. A collapse in commodity prices is generally a good thing for China.

Matt Dubuque

There is far, FAR more to resolving this crisis than merely restoring trust among banks to lend to each other.

That’s just a TINY beginning of what needs to happen.

The most likely scenario now is, unfortunately, that the banks will simply HOARD all the cash, lending some amongst themselves but virtually nothing to the world at large.

That’s a recipe for a depression and PRONTO.

We need leadership. We need Volcker to bash the banker heads together telling them to STOP hoarding cash.

It’s an emergency. This is not a movie. We need to get organized.

Matt Dubuque

mdubuque@yahoo.comP

The one-year chart you’re showing is somewhat alarmist, because it shows Baltic Dry coming off a crazy commodity boom high. “Normal” Baltic Dry numbers are in the 2000-5000 range over the past five years (use the bloomberg chart and click 5yr) so while this is near 5-year lows it’s not “OMG, we’re all gonna die” bad. Not yet, at least.

Yves,

You have mentioned in the fairly recent past that you have not been able to make sense of the “overproduction” argument. This post regarding Baltic Index provides a good indication of overproduction. Allow me to make a very brief stab at an explanation, relying on Marx’s view.

The basic thrust (made extremely simply here, to keep it short), is that capital increases profits by reducing cost. One of the primary areas in which cost can be reduced is by reducing labor expenses, i.e. reducing wages. The eventually result of this is that the worker is no longer as well positioned to consumer as much due to declining wages, yet this occurs while profits increase and with it expanding production. But as more and more goods are produced, the “consumer” is buying less. Thus overproduction.

The Baltic Dry Index MAY point to this development of overproduction. With the shift of much of the world’s industrial production from advanced capitalist countries to less advanced, in pursuit of cheaper labor, we now, after a number of decades, find ourselves with too many goods chasing to few buyers. As debt (after having served as a substitute for declining wages in advanced countries exported jobs overseas to reduce costs), is being deflated in the West, and with it a decline in consumption, the means of production will now have to accommodate that reduced consumption. So . . . what we have today is an overcapacity of production exceeding the ability to consume. The Baltic Index then reflects the deflating prices one would expect as overproduction becomes more apparent: that is, there are more goods produced than designation for those goods.

Combine this with the credit squeeze on shippers, then the problem is not only one of too much supply, but also failure in distribution. An explosive combination, indeed.

Non recourse lending at work

All the shippers are in hock to their eyeballs b/c banks lend to them secured by the vessels.

Once there’s a touch of oversupply, rates drop precipitously as the most overextended shippers drop prices to fill their holds so as to continue to meet their debt servicing burden (can’t pay interest if the ships are in port).

They’re willing to sail for cost of fuel + interest expense

Once a few owners go bankrupt, the banks don’t want to hold on the the ships, so they sell them for pennies to Newshippingco, which now gets to sail for cost of fuel + a much lower interest expense (based on the fire-sale price of the ship)

This forces more of the existing shippers into bankruptcy, which drops rates even further

Its ugly and unstable. Positive feedback on way down.

Never get involved in an industry which funds its assets with non-recourse loans (airlines, shipping, housing). They always trend towards overcapacity and returns always faill towards operating costs and NOT cost of capital, per the mechanism above. Plus the assets tend to trade at either inflated prices (when bought from builder, or zilch, when bought from bank. Assets never at ‘fair value’ based on estimate of cash flow)

btw…speaking of 80% decliners (and bubbles)…if anybody recalls, Yves posted back in mid-june, “Oil Runup Exceeded Dot-Com Bubble”.

One of the subjects of the post was that of a brand-new brazilian oil “company” that had secured rights to drill in Brazil’s salt basin. The Company employed 30 people, had no rigs, yet managed to do an equity offering that valued them at $22bn.

Just as an update, that company topped out 2 weeks later, and subsequently tanked 80%.

Its amazing how, during a bubble, charts and the stories behind them are always the same old faces…just with different names.

Don,

I NEVER said anything regarding the “overproduction” argument. You must be attributing a comment by someone else to me.

The only thing I can ever recall saying on that topic is indirect, when I got in a huge fight with Brad DeLong on (mainly) asset bubbles, and it was DeLong, not, me, who said he didn’t believe in them because he didn’t buy the overproduction thesis of Marx/Engels/Hayek.

FYI, I agree, and should have said, that BDI is volatile and often gives false positives as far as recessions are concerned (I have said this in previous posts on BDI, will revise this one). But I find the slippage right on the heels of the rescue to be troubling, particularly in combination with the earlier word on letters of credit.

Yves,

I stand corrected. In going over the post, I mistakenly read DeLong’s words as yours. My apologies.

Here is the link in case your readers might be interested.

http://www.nakedcapitalism.com/2008/04/on-de-longs-objections-to-my-critique.html

Citing same Baltic Index, Faber says shipping companies headed for bankruptcy.

http://businessmirror.com.ph/index.php?option=com_content&view=article&id=363:economic-slump-may-push-shipping-lines-into-bankruptcy-says-investor&catid=29:shipping

It would be terrible if the Chinese economy collapses. They have something like 20 million excess young males (because of the one child policy) and a history of national humiliation at the hands of foreign powers. All that frustration would have to be focused somewhere, and the authorities are likely to prefer that it be directed outward than inward.

I have recently been on the wrong side of this trade. I am hesitant to use it as a leading indicator of economic activity for the same reason that I am reluctant to use oil prices for that purpose. Both are crowded trades with a lot of speculative momentum traders.

Yves, you’re right. We need to be concerned that the BDI is still dropping despite the efforts of the world powers. OR, it may suggest that they simply haven’t seen the benefits of what the world powers are doing. Granted, there hasn’t been much time for their actions to take effect. Words aren’t the same as actions, in this case. But the lack of confidence a continuing-to-fall BDI suggests that we may yet be in for some serious pain.

Here’s a link to a chart that goes back to 1985

.http://bespokeinvest.typepad.com/bespoke/2008/09/credit-cruuuunc.html#comments

Bubble, bubble toil and trouble….

A slightly longer view of the BDI, from January 2000:

http://investmenttools.com/images/wfut/crb/bdi.gif

The index bottomed out around 750-800 in late 2001 — so there is still a ways to go before it’s panic time.

“it was DeLong, not, me, who said he didn’t believe in them because he didn’t buy the overproduction thesis of Marx/Engels/Hayek.”

Do board-room executives or central bankers but heads over classical economics? My guess is

such banter is for the blogs. I can’t imagine Paulson strategizing on the basis of time honored theories. In fact, I’d say after age 30 most economists perceptions become ossified and myopic, clinging to a few favored lines of thought.

I definitely don’t think a global slowdown will be good for China, or that China’s economy will escape this financial catastrophe unscathed, but the pertinent changes happen at the margin. I don’t think it’s going to be the Chinese goods at WalMart that people will forego during a prolonged recession. It will be the more expensive goods. Sure, this global slowdown will inhibit growth, but until the US adopts tougher trade restrictions, China’s cheaper labor and its lax attitude toward environmental regulation will continue to eat away into the manufacturing sectors of developed countries. The bursting of the oil bubble only furthers this phenomenon.

“He also pointed to Brazilian iron ore exporters’ efforts to win higher prices from Chinese steel mills, which has led to a drying-up of cargoes on the normally busy China-Brazil route.

Ships lying idle off Brazil were willing to accept almost any price for a new charter, he said.

Philippe Van den Abeele, of Castalia, the shipping hedge fund, said there were no (Brazilian) cargoes available and empty ships everywhere.”

September 26 2008

http://www.ft.com/cms/s/0/6fa59546-8be5-11dd-8a4c-0000779fd18c.html?nclick_check=1

It would be terrible if the Chinese economy collapses. They have something like 20 million excess young males (because of the one child policy) and a history of national humiliation at the hands of foreign powers. All that frustration would have to be focused somewhere, and the authorities are likely to prefer that it be directed outward than inward.

My new mainland Chinese bride tells me if anything the obverse is happening. Rural people in particular get married and have children until a male offspring is born. They won’t register any of the first children but they will register the male.

Under that scenario it is more likely China has an actual surplus of females or it is possibly a wash.

Marx doesn’t have an overproduction thesis…so Delong will need another excuse.

If he ever manages to find one in Marx’s writings, I hope he will post it and prove me wrong.

The shipping business indeed goes through brutal boom-bust cycles, like Anonymous 8:24 says.

Having said that, the real world economy is still in reasonable shape (yes, it is). Just look at crude still near $80/barrel. The BDI has dropped a lot but remember that it was lower on June 29, 2005. Of course, if BDI continues dropping, then the shipping industry will be in serious trouble. After an exceptionally profitable period, the bust will be spectacular.

The shipping business will probably crash due to the usual reason: Overcapacity. Lots of ships added in the last few years. The book of orders for new ships is about $800 billion. Chances are that 30-40% will have to be canceled if demand drops drops further. This will not be good for economies such as South Korea’s.

Matt:

Shouldn’t need Volker to bash heads and force bankers to lend.

Full balance sheet disclosure could melt the iceberg of distrust (ahem). If banks are not lending because they don’t know if counterparty(s) are solvent, balance sheet disclosure would remove that uncertainty.

One would think solvent institutions, if such a beast existed, would disclose everything.

Since they are disclosing nothing, perhaps that is because they don’t have too – they can keep pulling on the CB teet. Forever. Indefinitely.

Perhaps the thesis is wrong… but one would think “solvent” institutions would do a full disclosure, and would hitherto resume lending and be party to other institutions that do same.

“Insolvent” ones would disclose nothing, and eventually go bankrupt because no one would do any biz with them.

What if the CB shut the facilities down – that would force disclosure. Disclose or perish would be the new mantra. Pull the plug on TAF et al, see what happens. Could see TED go to 0.1 in that scenario.

BTW : I thought Volker was out of power? He back in the fold?

Just to be clear – the 5 year chart is less worrying and I think you’ll agree. But I certainly agree it’s still worrying. The 5 year chart also provokes some thinking about the commodity bubble – amongst other things, it shows there was certainly a bubble component. Also, the rapid collapse merits some thought. A number of commentators on the econ blogs have said the commodity bubble was driven by the loose credit regime and resulting monetary inflation. A fast collapse raises the possibility of deflation, from unwinding and from cash-hoarding by individuals.

@12:16 – There is considerable potential for internally driven growth in China. However, they’ve geared much of their growth for export, and if that fails, they have massive misinvestment and resulting losses.

A better source on the Baltic Dry Index. 5 year up to date chart, breaks out components of index, lists reported fixtures (new charters that are directly changing the composite values)

via DryShips

The company CEO has done a few interviews recently, and the spot price is down in part because speculators had bought time on ships with the intention of flipping them on before taking delivery. Now some are unable to pay the cost and the ships are taking what they can get on the spot market. This is not good for shipping, but not bad for established companies that built up books of multi-year contracts (~6 years)

Important to this story is that China is in a dispute with Rio Tinto and Iron Ore supplies from Brazil (or something close to that effect) where China wants to negotiate a lower price, and Rio Tinto is confident in its market position to keep prices up.

As a result there are no ships doing that route right now, but China can’t hold out forever. There is still strong demand in China and India to attract many new steel plants in the coming years.

There are 2 things China will do to stimulate its own economy. The first would be to upgrade/introduce health care and pensions to discourage high saving at this time. The second will be to continue/increase infrastructure projects which at recent levels require massive imports for ashphalt and steel.

An enormous number of small-margin export-dependent factories have shuttered since the beginning of the year. However the consumption of ore or the Baltic Dry Index is not a good proxy for their health, and their growth+health is important to the economy of China

Also in related news, ArcelorMittal has started the 10-15% cuts in European steel production. Expect other producers to follow, the high-end production is smaller/stable so look for the production cuts to come in the lower end sector with the most competition

Story on Bloomberg:

“Shipping Lines Say Tight Credit Cutting World Trade”

Quote from story, “Letters of credit and the credit lines for trade currently are frozen.”

First: the Chinese just announced a major land reform policy that allows peasants to trade or sell the land they currently occupy. The expectation is that the peasants will sell their farm land to collectives and move to the cities with oodles of cash–jumpstarting a domestic economy to replace the currect export economy.

This is the biggest land reform in China in ten years say non-Chinese family based in Beijing. http://www.iht.com/articles/2008/10/12/asia/china.php

This decision indicates their decision to turn inward during this crisis–rather than supporting their corrupt and insolvent customers in the West.

The negotiations must have been intense–given Bush’s decision to sell $6B or arms to Taiwan the week before.

But the knock-on effect of the credit crisis and the slow down in exports will be a huge hiccup for Chinese industry, with it’s already restive worker population. they won’t be able to retool overnight.

Finally, the imbalance in gender (118 boys for every 100 girls) is prompted by the one child policy but ensured by abortion and baby girl infanticide.

Comment from< i believe the Financial Post re; grain stockpiling in western Canadian terminals as shippers can't get LOC honoured. Alluded to lower volumes in LA for same reason. Cdn wheat Board said they've not encountered problems.

Why would you think these prices have anything to do with commerce? Perhaps they have more to do with financial swaps being created and unwound, in a hurry, by AIG. Simply create a timeline of AIG events beginning last Sep’t and go forward to the current time. Its not that difficult

Yves

It’s unlikely that long-term trade contracts will be settled by L/C because of the costs. L/Cs tend to be used for new customers, and one-off deliveries.

Two Cents

While the spot rates (BDI) are down, shares in the dry bulk shippers are up. I don’t think we’ve sailed off the edge of the world yet.

BDI just tanked another 10%, blew through 2006 lows

Doug Kass at TSC.com pointed out some comments made by the CEO of mining company, Rio Tinto:

“The long-foreshadowed deceleration in economic activity has resulted in a marked reduction in Chinese commodity demand growth from the overheated levels we saw in 2007,” Rio Tinto Chief Executive Tom Albanese said in a statement.