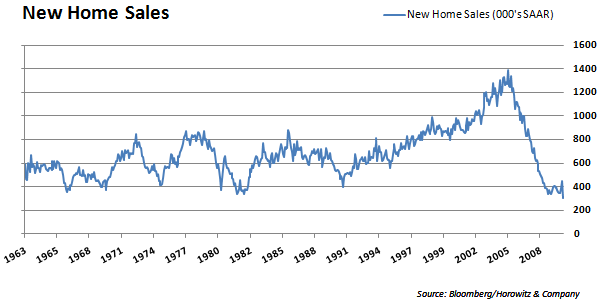

Charts courtesy Andrew Horowitz. Notice how the late 1980s-early 1990s housing downturn, which was considered to be serious at the time, pales in comparison in contrast to our current slump. And in that downturn, it took fifteen quarters for prices to bottom.

That’s a deadly decline. And new home sales are a leading indicator for the economy/unemployment.

Naa. It’s totally different now. A hole-new-pair-oh-dimes.

Put another mark in the deflation column.

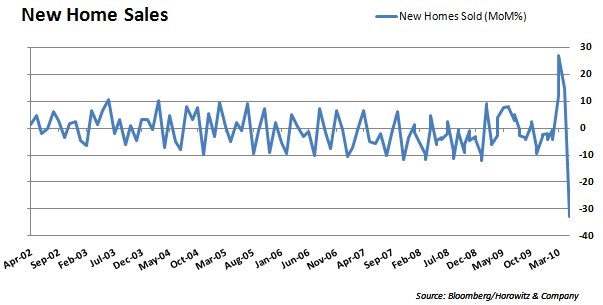

Now that we can see these numbers, it is clear that the housing momentum was indeed a result of the stimulus plan (not speculation anymore). As any average economist would suggest, before a true housing recovery can commence: 1) unemployment must return to average levels, 2) median housing prices must align with median income, 3) credit must be available, 4) consumers must have confidence that their home values will appreciate over time. Given that none of these four things are happening, its going to be a long, miserable fall to the bottom.

I wonder what the market-clearing price is?

The “market clearing price” is the cost of opperating a bulldozer (see Detroit). This way they remove inventory from the market???

Re: average economist

Something tells me, after listening to “average economists” for the past few years they’d all conclude something different, and – in the end – wrong.

All signs point to a double dip starting sometime in the second half of this year: drop in house sales, initial claims and payroll data, the tailing off of the stimulus, the budget cuts by the states starting in a couple of weeks, the shipping indicators, pretty much everything.

Yves;

Just to let you know that your podcast with Andrew Horowitz on TDI was excellent. I don’t often re-listen to podcasts, but I made an exception in this case.

Is this the V-Recovery Chart or the Green-Shoots Chart? It kind of looks like the Pin the Tail on the Pinata Trading Pattern, with a little bit of a Piercing Kicker Candlestick tossed in as a sort of dressing — a pattern so rare, that many dare not discuss it, but since I have a few minutes, as the clouds drift by, I feel this is probably the time and place to educate some of the dumbass people that missed this pattern in daytrade school a few years back:

Piercing Kicker Candlestick (PKC): Unlike the Bearish Kicker Candlestick Pattern the PKC is like a SUPER confirmation that all sorts of shit is about to take place, which is NOT correlated to any of the other broken models that you once thought (and hoped) might work on a really good or bad day, depending of course if you were short or long — but we all know that doesn’t matter, because the market is efficient and so are you.

A PKC, is sort of like a Come To Jesus Moment (CTJM) which lasts far beyond just a simple moment — it’s actually the start of a life-changing event that will suck (really suck) you deeper into the black hole {(BH) really F’ing deep BH}. The BH has obviously always been there, sort of like Ebenezer Scrooge’s soiled bedding — however, the BH is not like sprites and phantasma which we can in general ignore, and hence, train ourselves to deny, BH’s are especially challenging, because, as we are told in the Disney cartoons … ” they are regions of space from which nothing, including light, can escape. Imagine that, or not.

Oooo, shudder, too bad for the idiots that are standing too close to the flame-licking fire in the kitchen, maybe they should have listened to Granny about the wolf and how one shouldn’t play with F’ing fire or entertain bad sexual practices…. but no, the little wolves always need to find new ways to burn down the housing market, and destroy the ocean and destroy everything they get there F’ing little paws on …. so, who are these little wolves and how does the PKC relate to the BH?

PKC/TARP = BH

The sun is out again…

I Can’t believe Bernanke still has a job! I can’t believe Greenspan hasn’t been taken out and tarred and feathered. And, at the time, I couldn’t believe people were buying homes with zero down, 100% LTV and 6x plus income.

I guess I have different genes…

Don’t need to worry about hyperinflation until the last underwater homeowner walks!

“I can’t believe Greenspan hasn’t been taken out and tarred and feathered.”

I can’t believe he hasn’t committed suicide, being the person who was most responsible for the bubble and crash.

I disagree that Greenspan is most responsible for the bubble. I think we must blame Clinton, Bush, and Congress for pushing through legislation for “affordable housing.”

So, so, so much blame to go around. So little punishment.

Still trying to blame this on “affordable housing”? Sad.

If you look at the new home sales chart, it reminds you of an osciloscope, just before the signal degenerates into chaos, as it fluctuates wildly about the x-axis.

And that’s the fear about the economy as well – one minute deflation and the next, it flips over to hyperinflation.

Don’t worry, it’s not like all the major economic thinkers believe that the economy magically exists in an equilibrium state with exogenous shocks causing minor perturbations that will eventually resolve themselves.

Or as Steve Keen says, “This slide shows my model. Don’t worry about the differential equations, I just use them to scare the economists in the audience.”

Now just imagine how bad it is in per-capita terms over that time period!

The real surprise was that people were surprised.

So you are unsurprised.

I guess some houses are “surpriced”.

I was surprised it went as high as it did. For $8,000? When prices will be dropping by the tens of thousands?

Elton John ‘a Little Surprised’ at Rush Limbaugh Wedding Invite

http://www.mashceleb.com/2010/06/15/elton-john-a-little-surprised-at-rush-limbaugh-wedding-invite

I guess they will share diet tips?

http://www.youtube.com/watch?v=mTa8U0Wa0q8

I received an email this morning with these numbers:

CREs are a 1.4 trillion dollar investment

Commercial Real Estate transactions have dropped 90% since 2007

Commercial property values have fallen more than 40% from their high

The construction industry (total) has lost over 2 million jobs, including 35,000 last month

Commercial vacancy rates continued to increase, albeit at slower rate.

Then there’s this quote from L. Yun of NAR

“However, the office, warehouse and retail sectors continue to experience the delayed effects of the recession. These sectors should see gradual improvement after jobs pick up and create additional demand for space, meaning a broader improvement in commercial real estate is likely in 2011.”

What happens in the event employment(a distinct possibility) doesn’t pick up? No improvement likely in 2011?

Yes. If employment doesn’t pick up, and the economy in general doesn’t pick up, construction will continue to lag, which will probably create more lag in the economy, as all those households, (LIKE MINE!) just cut and cut down to bare essentials only: groceries, power bill, etc.

March 2010 report on construction unemployment, per the Association of General Contractors: 27.l%. Yes, you read that correctly: almost 1 of every 3 workers looking for work. Link: http://newsletters.agc.org/newsandviews/2010/03/05/construction-unemployment-rate-hits-271-percent

The other problem, besides “oversupply” which may or may not be the case – here in the PNW, it appears to be the case in that office space can be had very cheaply – but the other problem is that businesses are tightening their facilities and improvements budgets to correspond with the downturn in revenues. Grocery stores, big box retail, other outlets are not doing the amount of normal renovations that would be required just due to wear and tear. Instead, they are keeping their money and their employees. So “fill in” work of this type is also very difficult to be had. And public works? Forget it. Budgets so low they don’t even approach the actual cost of the work, so every guy with a pickup and a bond is getting the work, while anyone with even $10 of overhead is priced out. (I could tell you stories that you wouldn’t believe…)

To me this is good long term. There is too much supply already built. Next “healthy” move would be the BK of some of the national builders. Another one would be for the banks to eat their loses and start moving their foreclosure inventory at realistic prices (a % of salaries) to put homes in the hands of people who can afford it. The other healthy step would be for people to stop thinking of their houses as “investment” when they are just a consumer item like say a car

Agreed. Let the prices fall. Let new construction slow to whatever is the replacement rate, for as long as the supply/demand situation persists.

There’s no realistic alternative, IMHO.

Re: Let the prices fall.

My 2Big2Fail Zombie bank is not pleased with this attitude.

Fannie Mae is now going after “troubled borrowers who do not try in good faith to work out a deal, but have the capacity to pay”. They brand an entire population as ruthless strategic defaulters when most are just average people stuck in underwater mortgages.

A friend of mine graduated from college with a good job, got married and bought a house. Did everything right except he came of age in the middle of a housing bubble. Now he’s got two kids and a dog stuffed in a tiny two-BR town home with no way to sell. He can afford the mortgage but he can’t afford to take a $30k loss to trade up to something larger. So there’s somebody out with a house they can’t sell because my friend can’t sell his.

How many people are stuck in houses just like this? How much sclerosis does this add to the housing market? And now we see clueless government agencies making things worse by branding everybody a financial sociopath. They’re terrified people will just walk away and collapse their house of cards. Of course, should a business walk away from a deal it’s “just business” and the “efficient market in action”. I’m sorry to tell you but debt forgiveness or default is the way out of this mess. Branding people with a scarlet F (for Foreclosure) and forbidding them from buying a house for 7 years is not going to improve the situation.

http://www.msnbc.msn.com/id/37879718/ns/business-real_estate/

Couple more points:

1) The mortgage contract has a built in penalty for people who don’t pay: the bank gets the house. If people decide to exercise that option the mortgage holder already has a contractual remedy. As attempter would say, they don’t also have the right to punch you in the nose. There’s nothing in the mortgage contract that says they get to penalize you in additional ways.

2) The government pretty much is the mortgage market today, so if you can’t get a government-sponsored loan (because you exercised your put) you’re not buying a house.

3) Creating a new underclass of people who aren’t allowed to buy a house for years on end is not going to help the market recover.

WEll here in Canada, mortagaes have a covenant to repay which is independent of the security represented by the property deed….in other words, the bank can foreclose, sell the house, and come after you for their loss from the contract, if the sale is insufficient to pay the debt.

Nor do we allow mortgage-interest payments to be a tax deductible: but any capital gain on one’sprincipal residence is wholly free of tax.

I note our banks have done relatively well over the past few years.

More than co-incidence?

Hmmm…no being american, I would not know for sure, but my understanding is that one may deduct one’smortagage interest payments against income, while any gain in the home’s value upon sale is subject to tax.

…if I’m right about that, would not the taxing entity be taking a hit in revenues on a large, across-the-board fall in house prices?

In Canada, the State does not risk any great loss of revenue due to a fall in the nominal price of residential real estate.

Is the situation different Stateside?

“any gain in the home’s value upon sale is subject to tax”

No. Since 1997 the first $250k in profit on the sale of a primary residence is tax exempt ($500k if you’re married).

“More than co-incidence?”

No. Here in the US some states have recourse loans like in Canada, and the housing bubble/burst has been bad there too. Very few people buy an overpriced house because they figure they can walk if they get into trouble. Also it’s the bank’s responsibility to ensure that the collateral is adequate. That, combined with the fact that non-recourse laws were no secret to the banks, means I don’t feel too sorry for the poor well-meaning banks who just wanted to help put some nice young couple in their first home.

I’d also defend the non-recourse approach because AFAIK it’s pretty standard in commercial real estate. Recently there have been “strategic defaults” on some multi-billion dollar commercial properties. AFAIK the non-recourse for CRE isn’t a legal requirement, but is probably put in the contracts because otherwise XYZ Commercial Properties, Inc. would just set up a shell corporation or something.

Canada’s secret is that they continued to regulate the banks and the mortgage practices just like they used to in the US. Start gloating and well start yelling “54-40 or fight!” and foreclose on every house in Vancouver.

Mish Shedlock had some good posts about Canada’a housing on his site. Long story short-Canada’s banks haven’t done bad because their housing bubble hasn’t burst yet. YET. You don’t find out who’s been swimming naked until the tide goes out.

Same same Australia, in spades.

Prices have gone up maybe 20% in the last 18 months in the face of rising interest rates, after flattening out but NOT falling (except in Perth) in 2007/08.

Then read this…

Amnesty for the Banksters, Debtor’s Prison for the Serfs

by William Norman Grigg

http://www.lewrockwell.com/grigg/grigg-w151.html

This reinforces my deflation hypothesis. No recovery until existing housing inventory is absorbed and unemployment levels drop.

The next major item to come into play may be disappointing corporate earnings.

http://whatisthatwhistlingsound.blogspot.com/2010/06/another-look-at-corporate-earnings.html

Well, dropping unemployment levels = recovery, does iyt not…I mean, it’s close to tautologous…

@EP

“As any average economist would suggest, before a true housing recovery can commence: 1) unemployment must return to average levels, 2) median housing prices must align with median income, 3) credit must be available, 4) consumers must have confidence that their home values will appreciate over time. Given that none of these four things are happening, its going to be a long, miserable fall to the bottom.”

I don’t believe 1) is correct. Housing starts lead the recovery in employment, or are at least synchronous with it. So says, I believe, Calculated Risk, who I am most definitely not going to argue with. So employment recovers because more construction is going on. Which, of course, explains the desperate attempts to get housing going – gaming the ten year and the thirty year, taking a load of Fannie, keeping Freddie behind the wheel of the mystery machine, and having fava beans and a nice chianti with the FHFAFAFAFAFA.

I’m not convinced 2) is required either. Or perhaps it is more correct to say that 3) (which is the result of 4) ) will trump 2). Given that 4) is the result of 3), you’re kind of in a pickle. We in Ireland are in a similar pickle with the added mayo that we are, as a state, broke and in no position to ham and cheese it up with some stimulus.

Never mind, we’ll do our best to talk ourselves into a recover. It’s all about confidence donchaknow…

@MrMoney

“No recovery until existing housing inventory is absorbed and unemployment levels drop.”

Given the shadow inventory that exists and the general restrictions on immigration that seem to be happening, could it be that there is oversupply of housing?

Given that organic growth in population (i.e. hey Berts without immigration) are at replacement level and likely to fall (?), could it be that peak housing requirement has been reached? (Short of another burst of immigration to soak up the excess).

shares use a superb website decent Gives appreciate it for the effort to assist me

Housing and auto the economy of the post war era seems to be unresponsive to the governments various pokes. Road building is growing maybe that can become a university degree along with recreation and ethic studies. The idea that we have become overdependent on auto sales,auto parts,auto repair,auto road building,auto body shops and now the companion to this obsession urban sprawl both residential and commercial is not a surprise but it should at least give us a moment to pause before attempting to jump start these aging industries using various innovative financial engineering products disguised as excessive easy credit to pump up lagging sales. No the same folks that sold America on this economic technology model are still at the helm selling the new technology story as if the answer to our economic situation can be solved by new math or some robotic industry or even better a replacement for the 20,802,000 barrels of oil that gets burned each day.

Look at the spike on the second chart from Oct ’09 to the peak,the result of artificial prop up before the slide from the peak. It was the stimulus and not true demand!

The owner[{ship} society] ah hahahahahahah!

You never own your house till near death and then use it to suck out any worth to support your self, if not HELOC’ed to death, supporting collage kids or used as lifestyle extension ladder et al.

The land is home, not what you stick upon it.

Skippy….the ancestral hearth has become a debt alchemy machine, Doc bunsen honeydew demonstrates see:

http://www.youtube.com/watch?v=k4313pfaORM&feature=related

I have no problems with people who somehow or other fall behind on their house payments and decide to hand over the keys and move on. But I do have a problem with those who decide to stop paying, use the mortgage money for other purposes, and continue to live in the house until the sheriff evicts them. To my mind this at is stealing.

Two counter points to this:

1) With individuals in the home it is far less likely to fall victim to abuse (be that from the weather, the next door neighbor needing a replacement air conditioner or the local teens needing a house to party in).

2) The laws, timeframes and restitutions in regards to individuals staying in the home until the sheriff are well known and are therefore part of the original purchasing contract, in so far as the legal repercussions are known at time of signing by both sides. If the banks (heeheehee, who are we kidding… the trusts/tranches/etc.) want the occupants out they have well trodden paths to make that happen within the bounds of the law.

So given point 2, why don’t the banks/whatever force out the occupants? My guess is because of point 1 (not to mention the complexities of who the “who” is in trusts/tranches/etc).

In my view, the occupants are exercising their rights under the contract to stay in the property until the legal process has taken its course. And it’s not like the banks are not getting anything out of the situation (a maintained house, or at least not a derelict one).

Besides… what’s good for the goose… If the captains of industry (analogy: parents) act in such as way, why is it all that surprising that the plebs/proles (analogy: children) act likewise? It’s just business, after all!

As Yves has said… one can no longer undertake a contract on good faith, you now have to codify all possible outcomes within the contract else invariably the other party will leverage any ambiguity to their advantage. So why should we expect Joe and Jane 6-pack to act differently?

Cn

Why? Because there is one law for us, and another for you. That’s why.

“Do as I say! Not as I do…” are the best “parents”, with the best results (“children”), aren’t they? =)

You know, whenever I personally get caught by the wife of such a maneuver I tend to fall back on this simple explanation/excuse: “Babe, it’s a little thing called a ‘double standard’!”

Cn

Such a thing may be called a “rule”, but does not deserve the name “law”.

At least, not in modern American Courts.

And I’m not about to discuss the so-called “law of the streets/jungle”, becausethat’sthe state of no-law, not a state of “law” at all.

In other words, when it comes to laws, you do not know what you are talking about…..

Exactly pithead! They deserve to have us throw them in jail and throw away the key. No one steals from us. No one.

I can understand that point of view if you are a private mortgage investor. After all, you did not recieve a ‘Bail out’. However, had the same amount of money, disbursed as tarp and stimulus, been used to pay off private mortgages; then there would have been little personal debt. And a lot less suicidal people.

I’m no socialist. I can see no reason why “some should be ‘more equal than others’.(Animal Farm)

BK of some of the national builders! That is a trend I would like to see, along with nationalization of the banking system and then serious regulation, including sacking everyone in the SEC, DOJ and Treasury, as well as Fannie, Freddie employees.

I think home numbers were far worse in the 1700’s, for the Native Americans in North America.

numbers were far worse in the 1700’s, for the Native Americans in North America.

I was just about to study that issue, starting here; http://www.youtube.com/watch?v=BhCfFR0w0ho

==> On stardate 4842.6, the starship USS Enterprise arrives at an earthlike planet while en route to deflect a financial derivative asteroid that is heading to the world on a collision course. With little time to spare before intercepting the asteroid, Captain Kirk beams to the surface along with his first officer Mr. Spock and chief medical officer Dr. McCoy, for a half-hour investigation. There they find the land breathtaking with snow-capped mountains, thick pine forests and a sparkling blue lake.

The team then comes across an ancient McMansion of unknown origin. The structure is made of a mysterious metal that resists sensor scans and is covered with strange writing by Ben Bernanke. They also discover a group of primitive humanoids living nearby whose customs and appearances closely resemble North American Indians; more specifically as Spock describes, is a mixture of Mohican, Navaho, and Delaware tribes….

What about the KLEPTONS? where do they fit in?

“Notice how the late 1980s-early 1990s housing downturn, which was considered to be serious at the time, pales in comparison in contrast to our current slump.”

That’s true, but…

Look at the runup that preceded this decline compared to the runup that preceded the decline in the late 80s and early 90s. When you look at the runup, this decline should have been expected.

Ouch! The fundamentals are rotten. Many of us have been pointing this out for a long time, in fact all through the stock market rally and before it. The double dip recession is something of a myth. We had a crash and then various poorly designed and poorly targeted stimuli (ZIRP, the Obama stimulus, the military Keynesianism of the wars) which created some flux in the downward trajectory but never really reversed, or even addressed, much of the downward pressure on the economy. Now the resultant bubbles are getting old. The stimulus programs are running out of steam. The wars grind on but the demand they represent is all we are likely to see from them. And there are increased foreign shocks. In short, the downward pressure of the deteriorating underlying fundamentals is reasserting itself. The next collapse could occur at any time now, but there is, barring a Lehman size event, the likelihood that we will muddle through the elections and so likely to the end of the year. As I have said often enough here, 2011 looks awful. We will have a new even more corrupt and brainless Congress. Stimulus will be gone. Europe seems poised to go into heavy duty deflation. And the fundamentals will continue to get worse. At some point we hit the wall, go splat, go over the cliff, melt down, collapse, go Kerblooey. Pick your metaphor.

Nice snapshot, no argument there. The $64M unknown is what happens after…

What sort of economy reforms? Barter? After all, the US is a poorly run service economy. The rise of black marketeers? A post apocalyptic society of looters and scavengers? Most likely, social contracts will hold up. Contracts between societies will not be honored, as each community looks inward to develop means of production internally, and look outward only for what it cannot produce. The US will continue to import as long as the dollar is the reserve currency, which means federal spending must be checked. What happens when unemployment hits stratospheric numbers, and the term “Second Great Depression” begins to be bandied about?

Many economic centers are used to being self-sufficient. I expect we’ll see social darwinism begin to play out. It’s a pity, but it’s going to get a lot uglier before there’s any improvement, if we even see it in our lifetimes.

Having said that, however, I have the utmost respect for chart watchers.

Disagree: in my experience, people draw together during hard or difficult times.

IMHO the great mass of the American public are not yet being politically active.

People are still fat, and there’s a lotof imaginary hobgoblins being waved in the air by people seeking to distract…I think we are all richer than we think, or even care to admit to ourselves, much less others.

Americans need to chill.

If you look at any of the charts from about 2001 to 2010, you see the pre-fraud build-out with the Bush Ownership Society and then the explosive wave of financial tsunami collusion which spikes the bubble — then reality sets in, and then the crash, then the next phase of the cycle is the super-charged TARP bullshit which places the downward slope into a parabolic deep-sea plunge, not unlike the BP well disaster. What we have here is a really, really bad mess that is just getting worse by the day. Without a doubt, beyond a doubt, I have no doubt that all wall street banks need to be nationalized and placed into conservatorship.

Also see: In other legal terms, a conservatorship may refer to the legal responsibilities over a person who is mentally ill, incapacitated or is in some other way unable to make legal, medical or financial decisions on behalf of themselves, like most of the CEO’s on wall street who are retarded idiots — like their cousins in washington DC that pretend to be lawmakers … or is that rainmakers….

http://www.youtube.com/watch?v=KeYf-rhMQIQ&feature=related

Doc,

This started BEFORE Bush was in office. Yes, he helped it along, but it started under Clinton.

Doc,

One other thing…

Read Thomas Sowell’s “The Housing Boom and Bust.” I have read several books on the housing crisis and Sowell’s is one of the best.

Looks like a great day to buy some very cheap ocean-front foreclosed property…

Vinny

It’s not cheap enough, yet, unless you sold at the top, and you’re sitting on the sidelines. Banks hold the notes on these types of properties, and so far, have been unwilling to take a loss. It might put downward pressure on their compensation.

I sold my properties in 2007, just before the crash. But I am still waiting for prices to drop further. The east coast of Florida is looking good.

Vinny

Buy low, sell high.

Ancient wisdom for the markets.

Here in Canada, because mortgage interest is not tax-deductible, the after-tax internal rate of return on paying off your mortgage is the equivalent of about twice the interest rate on mortgage [if you invested the money and paid tax on the profits, you would have to get quite a high rate of return to be as well of as if you had simply applied the capital against your mortgage balance].

Long story short: I and many others paid off our 30-year mortgages in 5-6 years.

Our kids were quite little then, and were interested to learn that we owned our house [as they say in Alberta]:

“All the way down to Hell, and all the way up to heaven.”

[We own the mineral and air rights, as well as the land.]

This should not have been news to any sentient being. Run an “incentive” that pulls sales forward from the future for an extended time, then turn it off, and where are you?

The future … without the home sales you pulled forward.

The quintessence of bad policy: relieve the pain for a moment, by blasting future prosperity for a generation.

Does the graph for new home sales annualized rate take into account the increase in US poplation from 1963 to current? Anyone know? If not, this data is even more chilling.

Billings Headed Down Bumpy Road

Following strong spring, AIA billings index tumbles again, pointing to long, uneasy recovery

Couple months ago the situation of real estate market seemed to be turning the good direction. Yet the steep decline of new home sales numbers is looking quite disturbing. However it is pretty good news for home-buyers because the price of estates will probably continue falling.