Crossposted from New Deal 2.0.

By Mike Konczal, a Fellow at the Roosevelt Institute.

No one else has been a stronger advocate for public disclosure. There’s a debate going on about who should be nominated to run the Consumer Financial Protection Bureau at the Federal Reserve. One side says Elizabeth Warren, while another says someone from Treasury, likely Michael Barr. At a quick glance you might not see a big difference. As Felix notes, Michael Barr is very strong on consumer finance. But I think Warren would be a far superior choice. There are many reasons why, but I want to discuss a very specific one here that distinguishes her from anyone in Treasury. The biggest: she is a strong critic of HAMP, Treasury’s largest intervention into the massive foreclosure crisis hitting millions of regular Americans, and she demands accountability on behalf of the people.

HAMP As Failure

The Home Affordability Modification Program is widely considered to be a failure. Here is Shahien Nasiripour reporting on the latest numbers from June. They haven’t remotely hit the numbers they projected. Homeowners continue to suffer from a lack of modifications due to servicer problems and the overvaluation of their books. I wrote here about how the creator of the mortgage bond instrument in the early 1980s said in 2007 that a major market failure was coming. There was need for government action.

HAMP is such a failure that it is a bit of a game among the financial bloggers as to who has the best write-up of how bad it is each month and what the killer statistics are that prove it. I’m calling Stacy-Marie Ishmael over at FT Alphaville this month’s winner with BarCap vs HUD on HAMP.

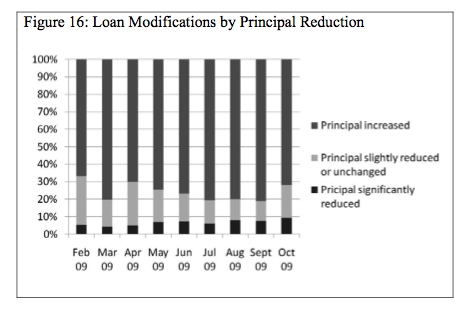

Evidence shows that there are principal increases for 80% of the people who go through HAMP. That is the exact opposite of what you’d like to see! It lowers interest rates, but it also increases the length of the loan.

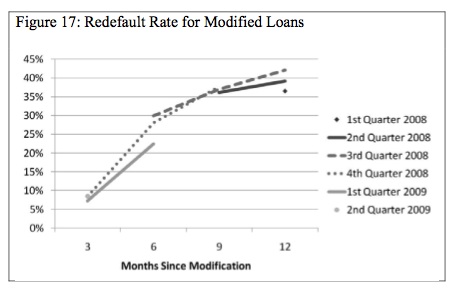

And for those who don’t have principal reduction, there is a massively high redefault rate. People lose their homes anyway, even after jumping through cumbersome hoops.

Predatory lending is hard to define, but a product is predatory that sinks people deeper into debt without the expectation that they can pay it off. And that is exactly how HAMP functions. For millions of people HAMP is their main interaction with the government and embodies what the government is capable of, and this creates disillusionment and discredits the liberal state in a profound way.

And Warren Demands Accountability

The Congressional Oversight Panel, lead by Warren, has been in the lead at making information public and bringing the complaints of the people straight to those in power. (It falls under her jurisdiction because HAMP uses TARP money.) When you see the fights on youtube between Warren and Geithner, the biggest ones, the ones that make Geithner cringe the most, it is about how HAMP isn’t working. Click through on that link to watch a video that gets straight to this. She demands accountability from the government and from the banking sector on the single most important issues facing Americans right now.

This is important. There’s pressure to be quiet, to hope that a quick housing and economic recovery will just make this whole foreclosure crisis go away. But Warren has demanded answers. COP released a report in early 2009 about the problems with HAMP, data collection and foreclosure, a report that still stands up. She’s done that at every step of TARP, but it matters here specifically for consumer protection.

And this is exactly how the CFPA should work. They fight to get good information disclosed to the public about how the banks and the Treasury department are failing the American people, reporters and wonks explain the information to the public, Treasury is held accountable. Treasury is currently working overtime to make HAMP work better; every month they are putting pressure where they can to make it better. That’s how a healthy government is supposed to work, but it can only be done if the tone is set by an outsider. And Elizabeth Warren is the one qualified candidate with a proven track record of standing up to the banks and to the Treasury.

And as Steve Clemons wrote: “It’s about time that at minimum, the White House got a ‘team of rivals’ on economic policy rather than just a ‘Team of Rubins.’”

Elizabeth Warren is a good cop bad cop system tool. She wants the ‘consumer’ to have financial gang rape “contracts they can understand” and thereby condones the continued financial gang rape.

Get rid of the parasitic banks!

Deception is the strongest political force on the planet.

Hay I was in queue. Let them worship false hope bawahahahaha.

hay IONTBP do consumers have the same rights as ummm patriots…ummm…citiazans or is it just executives?

What a ludicrous set of rules we have sujorned too.

Elizabeth Warren is a side show, a carrot of possibility, a woman with a sword (same historical play) only to suffer a cross of fire, if she really threatens the mob.

Skippy…wise up silly people.

“carrot of possibility”… lol.

Nevertheless, she’s one sharp “carrot”. She also distinguishes herself from 99.9% of her cohorts in that she’s made the effort to actually comprehend what the hell has happened in US finance/economy, and has likewise distinguished herself in proposing some sensible remedies.

All of which likely makes her appointment to this position unlikely, of course.

But HAMP shouldn’t work, so why should Warren get any particular credit for pointing out that it doesn’t? She may well be the right person for this particular job, but her views on HAMP have nothing to do with it. If she were to declare that HAMP doesn’t work and should be killed and not replaced with any other program that would be most refreshing. This sounds harsh, but what works for many, many borrowers is no recourse foreclosure.

I’m one of those people who was offered a modification. It not only added to the debt, as you note, it was also three times more costly than a routine refi I had done three years earlier.

To openly object to a program one’s boss touts takes courage. It is not merely Ms Warren’s smarts I admire, but her undaunted courage. It will take courage to be an effective advocate for consumers in the world of finance which tends to view its customers in a manner similar to how polar bears view baby seals. This is also precisely why she will not be offered the job.

HAMP is a huge success. These loans were bought by the taxpayers from the banks. The banks win, the taxpayers lose billions

The choice is not between cynicism and naivete. It’s senseless to be aggravated by the fact that the vast majority of humans still cannot fathom anything other than wage slavery/debt serfdom. That said, i on the ball patriot’s message is necessary at this time.

Three paths — withdrawal, war, education. Even given good information, people will often make poor choices, for various reasons. The outsiders will persistently confront/expose the abuser-victim dynamic on all social levels.

The internet is a relatively recent development. Freedom of speech is a strong force. The question is whether it can overcome deception. I tend to think that the most powerful political act is the relentless application of honesty in personal relationships.

Internet democracy will have had a very short lifespan if net neutrality is defeated. As we speak the telecom rackets have launched a full-scale offensive to strangle the FCC’s proposal in the cradle.

It’s kind of amazing to me that net neutrality isn’t a primary issue on every kind of blog right now, since by its definition if you’re online and you aren’t rich, it’s your issue.

But the very people who depend so much upon it don’t seem to care about it much. The only blogs who focus on it are blogs specifically devoted to Internet freedom.

To paraphrase Trotsky, “You may not be interested in net neutrality, but (the death of) net neutrality’s interested in you.”

Absolutely CORRECT!!!

It’s vital that Net Neutrality be maintained and access be expanded.

These technologies are our best hope for scaling the needed role of the citizen as a counter-balance to forces of oligarchy.

If we are to have any chance at all of averting the trend towards power and wealth concentration and the unfortunately profitable propagation of ignorance, it will have to include the preservation of this new landscape.

The only minor point where I sometimes find myself disagreeing with attempter is that I think its likely we’ll experience catastrophic collapse and significant die-offs before the idiots running the current paradigm ever manage to put together the “Brave New World” we’re careening towards.

Up to THREE MILLION homeowners. That’s how many people were promised help under HAMP last year.

Warren in right to point out that this is a dismal failure economically. What makes Geithner so utterly bathetic is that he seems to think it was helpful for the government to squander billions on a program that promised desperate people the chance to save their homes but delivered even more debt, false hope, and ultimately despair.

Economically, this is a fail. Politically, it is suicidal.

Why not just send people about to be foreclosed on a ticket for half-off on the move, or their first month in a rental free? Yknow, something they can actually use??!!

Give Warren the job because someone in Washington has to care about the pain of the middle and working classes. She is the designated carer. And the men hate her for it.

I want Elizabeth Warren to have her own Senate seat; I don’t want her in the CFPA. Certainly it would be good for her, and certainly she deserves it. Elect her to the Senate and put her on the Banking Committee and the Judiciary Committee.

The CFPA is Liz Warren’s brainchild. Shouldn’t that be enough? Of course if I was Liz Warren I think that I’d prefer to stay on as TARP COP. I think the CFPA will put her under someone else’s authority, no? Or will she free to do what she thinks is right?

Does Ms. Warren even want the job? If she does then let her have it, maybe she’ll make a difference but she is just one person afloat in a sea of bought people. Congress people, no less.

I would vote for her for any position she seeks. I’d also understand if she turned away after giving the good fight she has pursued over the last few years.

For skippy and i-ball, Geithner doesn’t support her, now there is a tool of the system. That alone is enough for me to see beyond your points and hope she gets the spot.

mg,

I have followed her for years, and as much as one can discern from video and news print I take her at face value (a person of high moral and ethical standards). That not withstanding, she is one person, of which little can be achieved save as a token banner for change.

Maybe she is on ice for the day they need her, if things get bad enough (pitch forks), hold the mob back with a few heads held high.

Personally I find it hard to believe that after all (trillions in backstops) that has been done that anyone would be allowed to shock the markets in ANY manner. We have years of unwinding (derivatives) and enemies at the FX gates.

Sadly markets do not recognize human values, in fact they are an impediment to its function, increasing the the value of electrons bouncing between exchanges and OTC players.

False hope is deadly.

For skippy and i-ball, Geithner doesn’t support her, now there is a tool of the system. That alone is enough for me to see beyond your points and hope she gets the spot.

That sounds like the problem. If they were all Geithners you might recognize that the system is corrupt and tyrannical beyond redemption and give up counterproductive false hope in it, and turn your energies to finding an alternative.

But Warren (not intentionally, I assume) keeps serving to astroturf this false hope.

Look at the CFPB:

1. It’s intentionally structured to be weak – auto loans are exempt, OCC has pre-emption power, just to give two examples.

2. It’s housed in the Fed, which will aggressively try to restrict it to a purely cosmetic role.

Given the whole architecture of failure, and given how hostile this and any other conceivable administration for the forseeable future will be, do you really think a particular person who’s accidentally concerned with the public interest is likely to make a significant difference within the system? The system is criminal. I think it’s more likely her presence would just drag out the false hopes which are such a dead weight upon us.