By Marshall Auerback, a portfolio strategist and Roosevelt Institute fellow

There are plenty of legitimate reasons to criticize Barack Obama’s dismal stewardship of the US economy, and God knows I’ve voiced quite a few of them, but it does not follow that every criticism made of his economic policies is therefore legitimate.

There is quite the misleading sleight of hand in a Megan McArdle post yesterday, “ A Visual History of U.S. Government Deficits“. She starts by invoking her readers to set up a straw man argument:

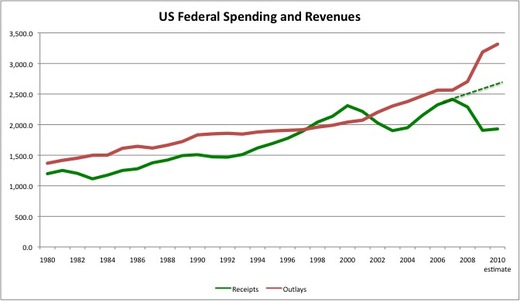

A number of my readers are claiming that the only reason Obama is running such a big deficit is that revenue has collapsed. I don’t see that in the data:

These figures are in constant dollars, so they’re unaffected by inflation/deflation, or the collapse in GDP; they’re simply an assessment of the absolute increase in spending compared to taxes. As you can see, there’s a huge increase under Obama–that huge upslope is the change between 2008 and 2009 spending levels…

Of course, you can argue that this spending was necessary, and at least in some cases, I agree. But I don’t think that you can argue that the deficit is mostly just a result of collapsing tax revenues. That dotted green line I’ve drawn represents the growth rate of revenue in the final year before the financial crisis; had revenue continued growing at that rate (a not-too-shabby 4%), Obama would still be running a huge deficit.

This “revenues have collapsed” as the sole and therefore supposedly bogus rationale for the growth in deficits is a distortion, pure and simple. While it is clear revenues fell sharply, if you read any serious account of this financial crisis (including from economists who take umbrage at large deficits relative to GDP, such as Carmen Reinhart and Kenneth Rogoff, to the Bank of England, and the IMF), they all contend that the overwhelming reason for the fiscal deficits blowing out was direct budgetary effects of the crisis, with bailouts and stimulus program playing comparatively small role (save perhaps in China, which suffered fewer direct effects of the crisis and implemented a very large spending program).

So how do we square that with the McArdle chart? Because most of that increase in spending that she blames on Obama was not discretionary.

Despite all the conservative uproar against Obama’s “wild spending”, the largest portion of the increase in the deficit has come from automatic stabilizers and not from discretionary spending. This is easily observable in the graph below which shows the rate of growth of tax revenues (automatic), government consumption expenditures (somewhat discretionary) and transfer payments (again automatic) relative to the same quarter of the previous year:

In 2005 tax revenues were humming, with a growth rate of 15% per year—far above GDP growth–hence, reducing nongovernment sector income—and above growth of government spending, which was just above 5%. As shown in the figure above, such fiscal tightening invariably results in a downturn. When it came, the budget deficits increased, mostly automatically. While government consumption expenditures remained relatively stable over the downturn (after a short spike in 2007-2008), the rate of growth of tax revenues dropped sharply from a 5 % growth rate to a 10 % negative growth rate over just three quarters (from Q 4 of 2007 to Q 2 of 2008), reaching another low of -15% in Q1 of 2009. Transfer payments, as expected, have been growing at an average rate of 10% since 2007. Decreasing taxes coupled with increased transfer payments have automatically pushed the budget into a larger deficit, notwithstanding the flat consumption expenditures. These automatic stabilizers and not the bailouts or much-belated and smaller-than-needed stimulus are the reason why the economy hasn’t been in a freefall a la the Great Depression. As the economy slowed down, the budget automatically went into a deficit putting a floor on aggregate demand.

As estimated by the New York Times, even if we were to eliminate welfare payments, Medicaid, Medicare, military spending, earmarks, social security payments, and all programs except for entitlements, and in addition stopped the stimulus injections, shut down the education department, got rid of a number of other things and doubled corporate taxes on top of all of this, the budget deficit would still be over 400 billion. This further demonstrates the non-discretionary nature of the budget deficit. And of course this doesn’t take into consideration how much more tax revenues would fall and transfer payments would rise if these cuts were to be undertaken. With the current automatic stabilizers in place, the budget cannot be balanced, and attempts to do so will only cause damage to the real economy as incomes and employment fall.

But this set of facts is much less attractive, apparently, than simple Obama bashing.

All spending is discretionary. Congress can change the law any time they want.

Utterly spurious.

That’s simply not accurate on any short term time frame. I suggest you look at the number of programs now in place versus how many bills Congress can deal with in a single term. The inertial factor is huge due to the level of extant programs.

And the sort of non-discretionary programs where spending rises in bad times, like food stamps, are considered to be automatic stabilizers, since their spending level falls when the economy is strong. That’s considered to be very desirable from a macroeconomic standpoint, but your simplistic one liner misses their role and value as well.

Can a Representative/Senator cut discretionary spending and stay in office after the next election?

Do we elect them so they can figure out how to get re-elected?

Or just wait around for a report from a blue-ribbon panel?

Isn’t one of the laws of the internet that Megan McCardle is a hack who will write any rubbish if it supports the cause of her libertarian overlords? While its probably necessary to discredit her, I do find it rather depressing that anyone takes her seriously. She makes stuff up, she distorts figures, she’s incredibly ignorant of basic economics (while pretending otherwise). Awful woman.

Libertarian overlords? Even if that were true, wouldn’t you rather have more of those than more of the same voices you hear everday in public discourse?

I vote for more Kucinichs, Pauls, Chomskys, etc…Not less.

“I vote for more Kucinichs, Pauls, Chomskys, etc…Not less.”

The Libertarian Overlords he’s referring to are right-wing rent-collecting thugs like the Koch brothers, not “left libertarians.”

Libertarians and John Birchers are different, explaining the difference between Ron Paul and the Koch Brothers, whose Dad, Fred, was a cofounder of the John Birch Society.

Pet peeve: there is no such thing as “negative growth” – it is called “contraction”.

Thank You.

I am not a fan of black and white arguments although I can see merits in both arguments. From my view there is an element of deficit spending which shows that regardless of political persuasion government as over spent. That is not to say it is necessarily wrong, but that politicians struggle during the good times to reign in the budget. On the other side we have an argument that the single biggest problem is unemployment and we should be spending more to tackle it. This also has its merits although it could be constrained by a world view of such actions through feedbacks in global trade, bond markets and currency. Some will argue that those constraints are not evident and are unlikely to exists, but my hunch is that at some point those constraints will appear.

Nobody really tends to ague for the grey option. This may involve a complete review of current spending and the structure of spending so that going forward government gets the biggest bang for its bucks with regard to the future resilience of the economy. That may involve shifting spending from one area to another. I am also not a fan of stimulus because eventually it needs to be removed so the grey option may be to spend now on a permanent structure to improve unemployment. All of this will only work if there is a credible plan to reduce the deficit in the future, so the grey plan might be scheduled tax increases and spending cuts when certain GDP and inflation targets are met.

What I find disappointing is that both views seem short term. We either get stimulus and spending or cut backs and austerity. Nobody really looks at elements of both and we only get arguments to add or subtract spending. What is wrong with a credible long term plan where we add in some places, subtract in others, refocus, set up a spending structure to benefit the long term prosperity and set realistic objectives to contain the deficit on a long term basis. That may well mean that in total more is spent now and a lot less in the future.

Neither Obama or Bush are totally innocent in my book because I see discretionary non collection of taxes from business rather than discretionary spending as a culprit in the structural deficit. US politics looks mired in its inability to structurally reform its self.

I think you’re on the right track. What you need to factor in is that austerity and stimulus used as strategies to restart real economic growth cannot work. Ecological and thermodynamic forces set the parameters of human economies. It looks very much like the plateau of oil extraction hit five years ago is the first and biggest sign of reaching the limits to growth. If you don’t have the physical inputs, especially cheap energy, you must downsize and re-calibrate the economy. Of course humans, particularly Americans, will strongly resist this because we’ve been socialized to believe the laws of nature do not apply to us -the “non-negotiable” braggadocio and “dominion over nature” rhetoric reflect this worldview.

DanB, exactly. Which makes it hard for me to read *any* commentary on economics these days, since far more intelligent people than Ms. McArdle refuse to acknowledge such limits, which—essentially—obviate capitalism entirely whether one likes it or not, independent of any political ideology.

Capitalism is a physical impossibility in a contracting world.

Lidia, there is economic writing out there that embraces the existence of reality. Herman Daly and Mason Gaffney have their heads screwed on right – good places to start. Of course, there is the classic “The Role of Money” by Frederick Soddy, which focuses on applying physical laws to human (economic) interactions. It’s over 70 years old, but as relevant as ever.

We need to re-invent the language of economics, because it is impossible to say anything relevant in the current economic newspeak.

Thank you, Birch, for those references.

I have also just come across an individual I need to read more from: John Ikerd, a professor of agricultural economics who understands the sciences of ecology and of thermodynamics.

http://web.missouri.edu/~ikerdj/papers/SFT-Sustainable%20Captialism.htm

You live on a planet in orbit around a fusion reactor and with a molten core heated primarily (80%) by radioactivity. Developing access to abundant clean energy (e.g hydrothermal vents, geothermal, ocean thermal, solar photovoltaic & nantennas, tidal, wind) and efficient energy storage (e.g. catalyzed water splitting to H2 and O2 gas) would enable increased recycling and pollution sequestration as well as return resources to nature. For example, it would empower local food production in automated vertical farms that use a combination of aeroponics and aquaponics (no pesticides, no patented GMOs, reduced water/fertilizer requirements, no energy wasted transporting food across the planet). Imagine how much agricultural land we could let return to nature.

What happened in the 00’s that made spending rise so much. After 2008, I can understand, but before?

A trillion bucks for a couple of wars?

Unfunded prescription drug benefit? Lots and lots of pork-barrel spending? The creation of new domestic and international ‘intelligence’ apparatus(es)?

Mike, I think increased spending is baked into the capitalism/FRL cake.

Each year, the amount of money/debt grows—not by choice, it’s a mathematical imperative.

My point of view is that—just as the demand for mortgage securitization and CDOs called forth bad loans and wasteful RE construction—the whole economy is FORCED to extract/spend/waste increasingly large amounts of real wealth in order to chase the (always positive) exponential increases required by the mechanism of interest (FRL) and profit (capitalism).

Since neither interest nor profit can come from anywhere except within the system, extraction must increase exponentially for everything to seem to “work”.

It’s the capitalist system itself which conjures up increased waste/spending. We are yoked to it, imo, and it’s not fixable. The only way out is to step off the gerbil wheel entirely.

You missed a few paragraphs:

“If you assume that “tax revenue collapse” refers only to an actual decline in revenue, then the breakdown is as follows:

$150 billion 2007 Bush deficit

$485 billion decline from 2007 revenues

$750 billion spending growth

This should not be taken as an argument that Obama has increased spending by $750 billion, however. Obama has spent a lot of money, but a lot of that extra spending simply comes from the fact that government spending is designed to grow. It grows in good times, and it especially grows in bad times, as entitlements add beneficiaries who have been hurt by the economic setbacks.”

Megan,

The rate of growth of tax revenues did collapse post the crash. My main point is those who continue to rail about “wasteful government spending” fail to articulate the most basic macroeconomic fact that confronts them – unemployment is rising across the country and production generally is stagnant because there is not enough demand for sales of goods and services. If the private sector won’t provide that demand then the government sector has to given that they cannot rely completely on net exports to cure the deficiency. If our new members congress move to more restrictive fiscal responses they are not only prolonging the agony the citizens are facing but are also engaging in a self-defeating strategy. As we are seeing budget deficits are rising as austerity is imposed across the Euro zone. What makes you think it will be any better in the US? The reality is that most governments need to expand their deficits significantly. But that would require some analytical nous to work out and the paranoid deficit hawks would struggle to engage in that level of debate, which is all I am trying to do here.

To get back to the specific point, at present, the household sector is lifting its saving rate as a means of reducing its precarious debt-laden balance sheets. Primary commodity prices have recovered and are clearly strong. The question is whether the growth in net exports is strong enough to allow the private domestic sector to net save and fund public services while maintaining aggregate demand at levels which increase capacity utilisation rates and sustain full employment.

That is the question that the deficit hawks continue to dodge, which I am trying to force them to answer. The fact is that net exports are not strong enough to simultaneously support a reduction in private debt and a public surplus while pushing growth to its full employment level. The advocacy of the current government’s position (which is that we’ve eventually got to deal with these deficits, sooner, rather than later) will actually create the OPPOSITE effect of what they desire if carried out now. I know you agree with that.

Growth will slow. The automatic stabilizers will kick into gear. Tax revenues will fall further. DEFICITS WILL GO HIGHER. So in an attempt to force people to “live within their means”, one achieves precisely the opposite effect.

That is the main point I was trying to get across.

Wow . . . the intensity of the monetarists wrath that this article has provoked seems a little desperate on the monetarists part. The one question I have for the monetarists is this:

What if the demand that does not exist naturally in the economy and which is “temporarily” being subsidized by government spending never picks up due to structural imbalances?

It seems a reasonable question in light of Japan’s lost decade and the intuitive thought that stimulus must have decreasing marginal benefits. Have we gotten to the point that stimulus is delaying the point that demand increases.

Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”

The stimuli were a classic case of too little, too late, as I predicted in April, 2008.

Rodger Malcolm Mitchell

Perfect, Rodger.

It certainly is a conundrum. Yes, ‘austerity’ will increase the deficit as a percentage of GDP (you forgot to mention the denominator in one of your arguments).

However, clearly the economic policies of the recent years (Bush, Obama), etc. aren’t working. A continued move to a service-based, debt-laden, consumption-driven economy isn’t (and never was) sustainable. Part of the issue, addressed by another commenter above, is the likelihood of peak oil.

More deficit spending to encourage final demand is more of the false-god thinking that economies can and should grow to infinity. As if this one and only one element of ‘science’ can escape the laws of physics and thermodynamics. There’s never a discussion of why growth, what sort of growth, quality of life, etc. It’s a shame that we define ourselves by the number of FRN’s moved around, rather then the increasing strains on the citizenry in so many different ways. And that perhaps a lower GDP might actually increase the standard of living – using emotional factors as well.

IMHO, what we need is a wholesale restructuring of the economy. Simply tinkering with it now, is expecting different results from 20+ years of the same – which resulted in declining or flat real wages, increasingly unhealthy food production, etc., etc. We’re running on a treadmill, and simply asking to run a bit faster, doesn’t really get us anywhere different.

Oh, and in the current construct of private fractional-whatever banking, US Treasury sales to purchase privately created currency (the FRN, as opposed to direct issuance of US currency) represents nothing but a direct subsidy paid to bankers and bond-holders – unnecessarily so. Therefore, speaking of more deficit spending gives this class of citizen one more giant payment required of other taxpayers…

Population will probably plateau at around 8-9 billion people, and absolutely every one of them should have access to an energy-rich, high-tech lifestyle. We have room to grow, especially coming at it both ways in terms of efficiency and energy abundance. Clearly we need better manufacturing technologies that waste less and recycle more, and over time nanotechnology will offer us exactly that. As for energy, radioactivity in the Earth perpetually heats the core and the sun perpetually shines energy down on us (up to 1 kilowatt of power per m^2). Energy is anything but scarce, but we need more efficient ways to store it, such as the catalyzed splitting of water that doesn’t depend on scarce platinum. Developing energy harvesting and storage solutions for cheap abundance should be our top priority because it’s critical for many other systems that could improve quality of life such as large-scale recycling, pollution sequestration, and vertical farming (return agricultural land to nature).

Megan,

Thanks for dropping by Naked Capitalism. Would you say then, that the proper response to the deficit is to eliminate the automatic stabilizers?

The proper response to the deficit is to increase it.

Also, Megan, you write: “These figures are in constant dollars, so they’re unaffected by inflation/deflation, or the collapse in GDP.”

that’s just wrong. constant dollars means they’re unaffected by inflation/deflation, but it DOES NOT omit the effect of the collapse in REAL GDP. that’s just the Econ 101 definition of “constant dollars.”

Another one: Note that the big deficits start in late 2008 and early 2009. Of course, as you probably or at least should know, budgetary decisions for a fiscal year are set prior to its beginning. So, it was in fact the Bush budget that was in effect when the widening between revenues and spending started to occur.

“A number of my readers are claiming that the only reason Obama is running such a big deficit is that revenue has collapsed. I don’t see that in the data:

These figures are in constant dollars, so they’re unaffected by inflation/deflation, or the collapse in GDP; they’re simply an assessment of the absolute increase in spending compared to taxes. As you can see, there’s a huge increase under Obama–that huge upslope is the change between 2008 and 2009 spending levels.”

In January 2009, prior to Inauguration Day, the Congressional Budget Office estimated FY2009 revenue, expenditure, and deficit based on then-current legislation as signed by George Dubya Bush.

http://www.cbo.gov/ftpdocs/99xx/doc9957/01-07-Outlook.pdf

It estimated

2009 expenditure: $3,543B

2009 revenue: $2,357B

2009 deficit: $1,186B

http://www.treas.gov/press/releases/tg911.htm

Actual

2009 expenditure: $3,520B

2009 revenue: $2,104B

2009 deficit: $1,416B

You read that right. Actual FY2009 expenditure was $23B *less* than the CBO estimated it would be *before President Obama was even inaugurated. Therefore, that was George Dubya Bush’s spending, not Barack Obama’s.

This does show how “fiscally conservative” Barack was, though he will never get credit for that from present “fiscal conservatives” who are thus exposed as shameless liars.

For me, this fact shows how timid he was in responding to the economic catastrophe that happened in the Summer and Fall of 2008. This timidity cost our country dear, and is the main reason the Democrats are going to lose the House of Representatives today.

Once the rethuglicans gain the power to subpoena the Obama Administration, life will be miserable in the Executive Branch. The sole order of business in the rethuglican House of Representatives will be endless investigation of the Obama Administration, with a view to trumping-up Articles of Impeachment.

And Barack Obama deserves nothing less, for his timidity in response to the financial catastrophe, and for his stupidity in cultivating Olympia Snowe and “Holy Joe” Leiberman more than the Democratic base.

I do feel sorry for innocent Executive Branch staff who will have their finances and lives ruined by the legal bills to come. That’s on Barack’s head too.

Everyone says excessive debt is the problem. Since people were driven into debt by what is essentially a government backed counterfeiting cartel then why not apply some justice and bailout the population?

Even Mervin King, a central banker) is expressing doubts* about fractional (fictional?) reserve banking. If it is bad (and it is) then why not bailout the victims of it and abolish it or at least remove any government support for it?

* http://www.washingtonsblog.com/2010/10/head-of-bank-of-england-maybe.html

Here, here! Fractional-banking, run by private banks, is fundamentally flawed, and creates a giant siphon off of the economy. I do not believe we will ever fix anything until we change our present private debt-money system, which is doing exactly as it was designed to do – siphon wealth from the middle and lower classes to the banking elite.

poor mcmegan. daddy’s little girl worked so hard to land a gig at The Atlantic only to be beat up on by the likes of krugman, Farrell, Yves, et. al. Because here’s the thing. There are three kinds of people in this world, and she knew most of them in high school. So if the Fed continues to cut interest rates, deficit spending for capita will only encourage bad behavior due to….

It’s not the government spending I object to, it’s the inefficiency and waste. How many of you have ever audited the doctor bills for a parent, and found a full doctor’s charge on the bill when you took your parent to see a physicians assistant?

Why can’t the government use their purchasing power to negotiate better rates for drug purchases? Why do we pay postal workers to deliver junk mail 80 % of the time?

Why do we throw so much money away in middle eastern wars and maintain troop presence in 140 countries abroad? Why do we never read about fraud in the government being detected and prosecuted? I’m sure all of you folks can think of a thousand different examples of government waste.

State’s providing housing to illegal immigrants and half-way houses by writing blank checks to landlords, which drives the price of rentals up for the working poor, and eventually drives them to the street. If you want free flow of immigration between Mexico and the U.S., fine, then allow the U.S public to vote for it and devise programs to integrate them into the economy intelligently. Don’t just exploit them and play them off against the working poor.

I’m fine with spending money on the American people but not the banks and multi-nationals. I just object to the waste, corruption, cronyism and fraud. No, I’m all for the government helping my fellow citizens, but they (govs) need to exercise a little intelligence and care.

Reading McArdle is always a waste of time. If revenues collapse one would expect to see the mirror image in expenditures which one does. Only if expenditures were cut as well would one see them only hold their own. The point of financial stabilizers is to preserve spending when revenues collapse and is a feature, not a bug.

Is there anyone out there who understands the difference between federal finance and state/county/city finance? Is there anyone out there who understands the difference between monetary sovereign (federal) and monetary non-sovereign (state/county/city)?

Those who do understand these differences know the federal deficit, far from being a problem, is an absolute necessity for economic growth, and the bigger the federal deficit, the more growth. Those who do not understand these differences should go to the link and learn.

Megan, that goes for you, especially.

Rodger Malcolm Mitchell

Another worshiper to the false god of infinite ‘growth’ for growth’s sake. What sort of growth? For whom? Nominal or real? Why growth? Why measure an economy solely based upon the number of FRN’s moving around? What about peak oil, peak resources? Is our standard living really better after 20 years of growth? Are families really that much happier?

And please discuss the difference between deficits and DEBTS – which in our present money system we incur debts to fund deficits. Debts require the payment of interest, which is a taxpayer subsidy to bondholders.

Sophistry, but I prefer growth to recession.

So called “deficits” are the difference between federal spending and federal tax receipts, in any one year. “Debts” are the total of T-securities outstanding, from all years.

Contrary to popular wisdom, the federal government can have either one without the other.

Because the U.S. is a monetarily sovereign nation (Do you know what that is?), federal spending is constrained neither by taxes nor borrowing. Federal spending is constrained only by inflation.

The federal government has the infinite ability to spend without collecting one penny in taxes or borrowing. For that reason, taxpayers do not pay a subsidy to anyone. Bondholders are paid by ad hoc federal money creation.

Those who understand Monetary Sovereignty know this.

Rodger Malcolm Mitchell

For that reason, taxpayers do not pay a subsidy to anyone. Bondholders are paid by ad hoc federal money creation. Rodger Mitchell

True but it is an a unnecessary gift to bondholders, isn’t it? Why borrow what one has a sovereign right to create? To defer inflation into the future without raising taxes?

The government should never borrow money, end of story.

From what I have read of Rodger’s material and website, he makes little to no distinction between private money creation (FRN’s in a fractional-banking world) and Treasury-issued currency. His reply to me indicates he on some level “gets” Treasury-issued currency, but he does not decry privately-created debt-money like I think you and I do. He will not acknowledge that the Treasury must first, unnecessarily, borrow FRN’s before it can spend them.

@Rodger – I once again argue that the sheer number of FRN’s circulating/being generated/earned in our economy should not be the principle measure of the health of our society.

@Rodger,

Nice site! I agree.

@traderjoe,

Rodger does not address FRL at his site. I think y’all are talking about different thing.

F. Beard,

You are correct. There is no reason for the federal government to borrow. As always, not understanding the meaning and implications of MONETARY SOVEREIGNTY is the root of all debt-hawk problems.

Rodger Malcolm Mitchell

“Growth” is a misnomer. It’s a euphemism for WASTE.

If I re-use a glass jar or plastic bottle in my home, I unpatriotically don’t contribute to GDP.

If I throw it away and go out and buy another one, I’ve raised GDP!!

I’ve also used more energy & raw materials (wasting energy, time and materials is good for GDP): I’ve created more private jobs for supermarkets and bottle makers, more public jobs for garbagemen, more fees for landfill people, sold more diesel fuel and garbage trucks as my need to throw stuff away increases.

WIN/WIN, we are trained to think!

Recently we have David Brock encouraging Obama to consider war with Iran as a BOOST TO THE ECONOMY.

And this is what passes for sanity, these days.

This is the most ridiculous thing I’ve read on the internets in ages!

Megan says (quoted in this very post for all to see), “Of course, you can argue that this spending was necessary, and at least in some cases, I agree.”

Then Marshall goes on to argue that this spending was, well, necessary!

And next, Megan is quoted as saying, “But I don’t think that you can argue that the deficit is mostly just a result of collapsing tax revenues.”

Followed by Marshall’s response “This “revenues have collapsed” as the sole and therefore supposedly bogus rationale for the growth in deficits is a distortion, pure and simple.”

So all this huffing, just to agree with her two main claims???

jaymaster,

Huh? Seriously.

The point of her post (in case you didn’t bother to read it) is to hector Obama for the increase in the deficit. She does that by arguing that the fall in tax revenues don’t adequately explain it, and then points to the rise in spending.

And in context, McArdle’s “necessary” is a throwaway, and does not mean “non-discretionary.” The thrust of the piece is to criticize Obama as a spender, ergo, the magnitude of the deficit is to a significant degree the result of his actions. The breakdown Auerback showed and the comment of rkla at 8:38 AM shows this to be incorrect.

Yes, seriously, 100%. And I did read her full post.

I see her simply arguing against is the claim “that the only reason Obama is running such a big deficit is that revenue has collapsed.”

To quote her opening:

“A number of my readers are claiming that the only reason Obama is running such a big deficit is that revenue has collapsed. I don’t see that in the data:”

Marshall uses almost that exact same wording in his post.

I quote Marshall again:

“This “revenues have collapsed” as the sole and therefore supposedly bogus rationale for the growth in deficits is a distortion, pure and simple.”

Are they not saying the exact same thing? Maybe I’m interpreting Marshall incoorectly.

And Megan even bolded this line:

“This should not be taken as an argument that Obama has increased spending by $750 billion, however. Obama has spent a lot of money, but a lot of that extra spending simply comes from the fact that government spending is designed to grow. It grows in good times, and it especially grows in bad times, as entitlements add beneficiaries who have been hurt by the economic setbacks.”

That is essentially the same discussion Marshall follows with, at least the way I interpret it. That basically, most of this increased spending is automatic, and beyond Obama’s control.