By Delusional Economics, who is determined to cleanse the daily flow of vested interests propaganda to produce a balanced counterpoint. Cross posted from MacroBusiness.

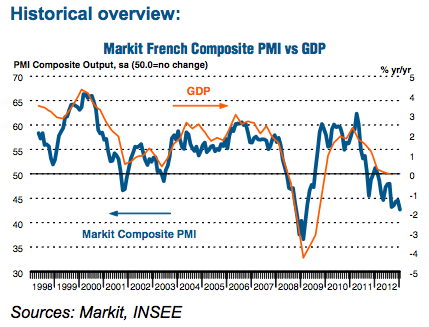

While the latest European PMI is showing some improvement it has become apparent that imbalances are growing ever-greater in the zone:

Germany – output grew at the fastest rate for just over a year- and-a-half – contrasting with ongoing downturns in France, Italy and Spain. Output in France fell at the steepest rate of these four countries, registering the fastest monthly decline since March 2009 and causing the gap between the headline indices for France and Germany to increase to the widest in the survey history.

This harps back to the original issues within the Eurozone, in which German domestic policies were a major catalyst for imbalances that began to grow after the adoption of the euro. As I mentioned again earlier in the week, France was always vulnerable under the fiscal compact given the structure of its economy, and the latest PMI data shows that is now coming home to roost:

Final Markit France Services Activity Index(1) at 43.6 (45.2 in December), 46-month low.

Final Markit France Composite Output Index(2) at 42.7 (44.6 in December), 46-month low.

French service providers signalled a further reduction in business activity during January. Moreover, the rate of contraction accelerated to the fastest since March 2009. Incoming new business fell at a slower pace, but there were accelerated declines in both backlogs and employment. Input prices rose further, but output charges decreased at a sharper rate. Future expectations bucked the trend seen for current activity, improving to a five- month high.

And the comments from Markit’s Chief economist aren’t exactly awe inspiring:

The deepening malaise in the French service sector mirrors the trend seen for manufacturing, and points to a broad-based deterioration in the private sector economy at the start of 2013. Firms are clearly facing significant headwinds as clients cut spending amid heightened levels of uncertainty. Accelerated job cutting meanwhile raises concern that unemployment could be headed higher in the coming months. The bright spot in an otherwise grim set of figures is an improvement in service providers’ confidence regarding future activity, albeit remaining at a historically muted level.

The other ‘core’ country that I have expressed concern over in the last few months is the Netherlands. On Tuesday Fitch adjusted the country’s outlook to negative (full text here):

Rating agency Fitch cut its outlook on the Netherlands’ AAA credit rating to negative on Tuesday, citing worries about falling house prices, the banking system and the high state debt burden.

The other major rating agencies, Moody’s and Standard & Poor’s, have already put their Netherlands’ ratings on a negative outlook. The country is one of just four in the 17-nation euro zone to have kept a full set of top ratings.

“The leveraged Dutch economy has suffered a number of shocks,” Fitch said in a statement.

It pointed to a sharp fall in house prices which it said was worse than it had previously expected. Fitch recently revised its projected peak-to-trough decline to 25 percent from 18 percent, and said this will continue to depress household spending.

In other news, as I type we are waiting on the ECB to make a decision on rates, the expectation is for no action, but I suspect the comments will be interesting due to the recent LTRO repayments and what it means for exchange rates and interbank liquidity. We’ve also got a Spanish bond auction in the next 24 hours which will be the first since the Rajoy scandal broke. Lastly, there is the EU summit starting tomorrow where EU leaders will attempt to come to some level of agreement on the EU parliament budget. Richer nations are looking for cuts while poorer are looking for the opposite, meanwhile the parliament has already stated it would veto any budget it felt undermined its function. Lots of politicking ahead.

This is not going to end well.

When you have a free trade zone that has $50+/hr labor (French Citroen worker) in the West and $10-ish/hr in the East (Audi worker in Hungary), one side is going to be disappointed in the long run.

Shouldn’t you get equalization in the long run?

“Equalization downward” is the sole, whole, and only point of these Free Trade Areas. What the overclass hopes for is to equalize France 4/5ths downward and Hungary 1/5th upward. NAFTA was designed for the same purpose here. MFN for China even more so.

From the North American experience I think we can deduce that both sides are likely to be disappointed in the long run. (If we’re talking about the general population, that is.)

Its a classic labour theory of value crisis in Europe caused by the hard non state Euro money system.

It best seen in the car industry with them spending new capital in new car plants further and further east………but this supply chain drives up the cost of capital which means credit cannot be provided to replace lost wages.

Causing a collapse of demand.

http://www.youtube.com/watch?v=DueEBHTEA-o&list=UUazDBRKv_Bh6Gf0ebKbFRPQ&index=18

Europe always seeks to “add value” to products so as to pay for raw material inputs.

The problem is these absurd added value cars and other stuff do not really add physical value……..

France needed to go back to a 2cv world of cheap petrol cars….no need to add value in a useless Germanic fashion.

It can only do this with the Franc

The car supply chain will then get much tighter again.

PS

You can see this in all Euro industries (its just that the car industry is perhaps the most extreme)

The Irish horsemeat in beefburgers scandal did not so much illustrate health and safety issues but the desperate efforts employers will go to so as to avoid labour value.

The Euro was designed around this objective.

The problems is of course these manic efforts to avoid labour inputs drives up real capital costs ($ price of oil) to unheard of and sustained levels.

Dork of Cork,

Could you explain in non technical language what it is you’re saying here?

Are you saying that workers are adding value to the products when working on them but employers are trying to keep this to a minimum and substituting labour input for inferior products(Horsemeat etc)?

Sorry, know little or nothing about economics and am reletively knew to this blog, I live in Cork though. ;¬D

Cheers.

@Confused

The money is not local to a economic hinterland.

The euro does not function like state money.

It is not really a money token.

It is a international capital token.

Therefore it sucks in exterior resources (oil & stuff) that get turned into higher value products with bells and whistles but no real function.

Example – look at Spains recent trade (now going into current account surplus)……..it must export to afford it imports.

No real effort is made to use the local resources to the best effect as it cannot.

(Spain has seen the biggest investments in rail systems in Europe by a wide margin but cannot use them )

As the euro money has no relationship to the local physical economy.

So you see a collapse of local trade & commerce as all resources are committed to long distance trade which is very input heavy in the modern world.

Rational Domestic demand collapse has been a characteristic of the euro areas since at least 1980…..

After 1979 (Ireland left the Sterling peg) there was a major political push to increase in productivity for export

First through a deflation ( think of Ireland in the mid 80s mini depression)…….after 1987 that surplus created /exported came back to these shores via bank credit where it was malinvested as there was no rational wage / money demand.

Frank Hall warned us about this.

This 1980 programme is a classic lesson in Labour theory of value stuff.

http://www.youtube.com/watch?v=GBXtWetS1Jk

See 45.30………….

@Dork of Cork,

appreciate the response. It’s still jargon heavy though! Sorry. Some further queries:

So Ireland uses the ‘International Capital Token’which allows us and our domiciled industrial interests cheaper Oil (non labour inputs) etc than would be the case under the Punt, but using this international Capital Token, makes our exports overvalued? Is that what you mean?

And what is the “Local physical economy”? Real people looking for work??

Finally, what effect did the Delors Internal Market reforms on the mid-80’s have on the European Economies, if domestic demand has been obvious since 1980?

Thanks for the Halls Pictorial Weekly clip, before my time!!

@Confused

Try to forget about imports and exports for a second.

These are gold internationalist ideas.

Imagine a local economic hinterland

Local trade.

The function of the eurosystem was to destroy this.

To destroy redundancy.

It started in Ireland in the early 70s……..the destruction of local small farmers with low productivity (but also crucially low input costs)in favour of larger more productive farmers (but with high input costs)

Nothing much internal happens within euro countries……all of the supply chains have been extended to a absurd degree.

They have created a Giant Belgium in Europe ………dependent on inputs from the Congo if you will.

When the Congo no longer wants to play ball you have a bit of a problem.

Contrast this with Irish farmers of the 30s……. back then all they needed from external sources was tea & sugar.

May I summarize….

France’s and Spain’s labour is expensive relative to Eastern Europe. Furthermore due to the arrangements/laws of the ECB, there is free trade in the Eurozone and free flow of Capitol. So French and Spanish companies can relocate to cheaper labour/lower tax/lower environmental regulation enforcement countries of Europe(Side note: The Euro zone has fairly uniform environmental regulations, but are they enforced equally? I suspect not) and take advantage of much lower labour and total costs of production, which increases short term corporate profits. Furthermore, the companies can shift sales revenues and profits out of higher tax regions of Europe, while still being able to sell to the richer western europe nations, resulting in better short term profits, and loss of tax revenue for the nation in which the goods are sold. Hence corporate profits have reached record levels, with a corresponding increase of cash on corporate balance sheets, even as national goverments record declining tax revenues, which results in national governement deficits.

Unfortunately, loss of manufacuring, means loss of Jobs, which means less spending income for workers and less tax income for France. Since spending goes down , the national economy shrinks.

Again this loss of redundancy is captured in television programmes from that era…..

http://www.youtube.com/watch?v=XbypfjTJha0

Cattle in exchange for coal during the 30s cattle trade war….

Now the supply chains are beyond absurd.

The European entrepot.

No longer sustainable me thinks.

http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS-SF-12-051/EN/KS-SF-12-051-EN.PDF

The Amsterdam Entreport.

en.wikipedia.org/wiki/Amsterdam_Entrepôt

The EU is a market state

It is not a nation state.

It will never become a nation state.

Its a giant Amsterdam.

The problem ?

You cannot run a entire continent as if it were a dynamic port sucking in the riches from the new world and expressing extractive profits.

Amsterdam on such a scale has no economic hinterland it can plunder.

The more nation state a country is – the more it must depend on its own hinterland for wealth flows…..

A country cannot plunder its own resources like a colony ……..

Its why nation state France developed the Physiocrat school of economics.

France was a very wealthy agricultural (the energy system of that pre industrial time) nation but its wealth base was more or less internal.

Unlike the Hapsburg trading centres of the lowlands and England.

“A country cannot plunder its own resources like a colony”

Surely that is exactly what is happening in the United States?

A real country perhaps……….

Maybe there was no such thing as a real country ….

The EUs goal was / is to become a bigger better US of fucking A…….a borderline failed state.

A market state.

So we got a standardization of eveything ,, a pushing of resources upwards and upwards into the debt / industrial ether of what now only exists in financial stratosphere.

Therefore given the extreme standardization / efficiency efforts of the Eu all nation state redundancy is lost.

That is partly what Charles Walters was describing and analysing and condemning decades ago in his book Unforgiven

and in numerous articles and editorials he wrote over the years in Acres USA.

http://www.amazon.com/Unforgiven-Charles-Walters/dp/091131167X

He suggested an antidote/recovery program in his book Raw Materials Economics.

http://www.amazon.com/Raw-Materials-Economics-Charles-Walters/dp/B004IA8HZI

Yes . . . Charles Walters got enough formal “economics” training that he could be called an “economist”. But he also had some genuine real agronomic knowledge as reflected in books on agronomy and farming that he also wrote. He came from a depression-era high-plains farm background in Western Kansas.

“It pointed to a sharp fall in house prices which it said was worse than it had previously expected. Fitch recently revised its projected peak-to-trough decline to 25 percent from 18 percent, and said this will continue to depress household spending.”

IMO – It will depress household equity spending – (debt financed equity extraction from the homeowners asset/house).

IMO – falling house prices is not a problem because it will leave more room for the home buyer to consume other things – let’s hope home prices decline and the interest extraction is lowered. The big problem is debt overhang and lost jobs or lower paying jobs that will reduce overall demand.

Dear Tom;

The problem is, what if the house prices fall, and the debt extraction is NOT lowered. Absent a haircut by the investors, the “real” economy takes a massive hit. The spiral intensifies, cue the rough beast…

Yes – well let the investors take a huge hit – clobber the crap out of them. The housing market is one of the basic things required for survival – food, shelter, water. The investors (financing of assets to extract interest streams) drove the bubble up and created a demand problem for themselves in all sorts of markets. Fuck-em

Not that I care so much about investors in Dutch mortgage debt, but why would housing price reductions require a haircut of them? Does the resale value of a house influence the ability of a debtor to repay in some manner? No matter what happens to prices in a housing market, repaying mortgage debt always contrains borrowers’ capacity for other kinds of consumption, and usually does so in an entirely predictable manner. Borrowers tend to be less happy paying a mortgage on a property that is not appreciating in line with their hopes or dreams, but why should an investor take a haircut because of someone else’s unrealized hopes or dreams?

I have a dumb question I couldn’t answer in a conversation two days ago. Also can’t find the answer. It is this: do the EU countries pay taxes to the ECB?

European Central Bank http://en.wikipedia.org/wiki/European_Central_Bank

Although the ECB is governed by European law directly and thus not by corporate law applying to private law companies, its set-up resembles that of a corporation in the sense that the ECB has shareholders and stock capital. Its capital is five billion euro which is held by the national central banks of the member states as shareholders. The initial capital allocation key was determined in 1998 on the basis of the states’ population and GDP, but the key is adjustable. Shares in the ECB are not transferable and cannot be used as collateral.

… The owners and shareholders of the European Central Bank are the central banks of the 27 member states of the EU.

Thank you. I should have just searched for the ECB. Duh.

A heavy currency for a Low-labor productivity market-place or continent where capital substitution for labor is low is bound to have serious problems. Europe tethered to a Germanic

currency is asking for serious trouble.

The problems of French auto production and its mistakes are legion. They could have made a Prius, but no. All electric cars are not selling because they are too expensive and range limited. And, of course rich dividends must be paid to Government susbsidized companies like Peugot. You can only extract so much out of the Asian hinterland. Greece all over again.

1 Euro = 1 USD and then perhaps!

All of this suggests that if European Union member countries were allowed the right to use tariffs amongst themselves to balance their current accounts the destabilizing dysfunctionality would tend to abate bar the usual smuggling operations.