The last few days have had more and more ugly revelations emerge about the botched OCC and Fed Independent Foreclosure Review settlement, with some particularly important ones coming out of the hearings in Robert Menendez’s Senate Banking subcommittee today. We’ll turn to that soon, but first wanted to cover some issues that have correctly stirred ire among the NC commentariat.

First was the embarrassing confirmation of complaints all over the web that paying agent Rust Consulting did not have sufficient funds in its account to cover the first batch of settlement checks sent out Friday. And this isn’t the first time that Rust has sent out checks that bounced in a settlement. And in some jurisdictions, passing bum checks is a crime. What gives?

Second is the fact that the envelopes themselves look like numerous scam letters, in particular debt collection letters and offers. Lisa Epstein kindly provided this example:

People who sent in letters to the IFR are waiting for payments and will presumably be on the lookout for the settlement letters. But what about the everyone else?

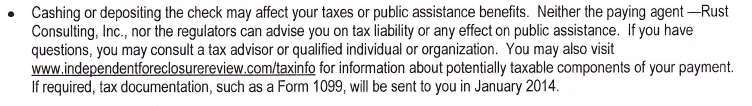

Third is that the check itself has stern “Valid for only 90 days” language (huh? why was that deemed necessary?) and the accompanying letter indicates that recipients will be liable for any taxes owed:

The “if required” is unnecessarily ambiguous. Rust has said it will issue 1099s if the amount is $600 or higher. Why not say that in the letter proper?

Of course, taxes could be an issue for the folks who do get a check. Despite Rust Consulting’s protest that it was trying really really hard to find borrowers, we’ve gotten reports that contradict that already. One attorney sent a scan of an IFR letter and a check on behalf of JP Morgan Chase with this message:

Our office has never heard of this individual and never represented her (we focus on business litigation estate planning and patent prosecution). It is an absolute mystery as to how we received or got named on this check. It was a mystery to Rust Consulting (“Rust”) as well. When I asked them about this they stated they simply received the address from the Servicer and did not know why our firm was associated with the file.

Also, it was next to impossible to find out how to get the check to the individual. After 30 minutes of being bounced around to different representatives, I was told to just write void on the check and return it to them at the address listed on the check. When I asked who to attention the return letter to they stated that they did not know who to attention the letter to and would figure out what to do with the check arrived (I wonder if the individual will ever receive this payment). Pursuant to Rust’s instructions, we voided the check and sent it back to them.

As we’ve indicated, another wee problem is that servicer records are hopelessly unreliable. One has to wonder why Chase is having Rust send checks to attorneys that are not in the foreclosure business, particularly when, in Senate hearings, the process they described where they were having trouble finding borrowers would not lead to a check being sent to a law firm, but to a residential address.

And we have this:

Now this might not be so aggravating if the amount paid were remotely adequate and weren’t doled out in an arbitrary manner. But as numerous critics indicated, this outcome was baked in from the get go. The OCC and Fed settled blindly, eager to shut down the reviews as more and more damaging leaks filtered out. And their objectives were the same as the banks, which was to find only the bare minimum amount of harm necessary to make the reviews seem credible. Problem was that any credible amount would have turned out to be more than the banks could stomach.

The Senate hearings Wednesday had fewer fireworks than the Consumer Protection subcommittee’s did, when Elizabeth Warren, Jack Reed, and Sherrod Brown all causing the OCC and Fed some badly deserved discomfort. Nevertheless, with a different set of Senators (Menendez and Jeff Merkley) and panelists (representatives of the GAO, Rust, the National Fair Housing Alliance , and Joseph Smith, the monitor of the other settlement, the state attorney general/Federal one reached in early 2012), there were still some important revelations. Deborah Goldberg, from the National Fair Housing Alliance, made many damning observations, but because they were made in a matter-of-fact, professional manner, they may not get the attention they warrant.

To me, this one describing how the arbitrary payments were arrived at, was critical. From a transcript prepared by our faithful anonymous transcriber:

Ms. Goldberg, NFHA: I’d like to correct one thing, Senator Merkley, which is that when the independent reviews were stopped, the decision was made not to find harm, not to worry about finding harm. So the categories, as I understand it, the categories that borrowers were placed in for purposes of payments was based on how far along they had gotten in the loss mitigation process, or the foreclosure process, with their servicer. So the fact that a particular borrower was in a particular category wasn’t a reflection of whether they were actually harmed, but just kind of what stage of the process they had gotten to.

So step back and think about what went down. The OCC negotiated a settlement number that was arbitrary. The Fed (speaking on behalf of both agencies) effectively admitted that last week, that they had negotiated the outcome with no idea what the actual damage to borrowers was. Since they didn’t know enough to make any allocation related to harm (they had reviewed only 100,000 files, many and likely most related to the statistical review, which was separate from the review of 510,000 borrower letters submitted) they had a bucket of money per servicer and they had to whack it up in some manner they could sorta-kinda justify. But the problem is the numbers in the table they’ve released on how many people got what amount of money aren’t remotely credible. For instance, “Servicer initiated foreclosure on borrower who was not in default” is a mere 589. There were at least 20 cases reported of people being foreclosed on who didn’t have a mortgage. I have very limited personal contact with borrowers, and I can name an additional five cases where the bank refused to take regular borrower payments or insurance settlement payments after a fire and initiated a foreclosure. If I can name 25 (and a lit search would probably turn up well more than the roughly 20 I recall), it’s clear this number is way too low. Foreclosure attorneys are even more derisive of the totals shown.

But the Goldberg “the decision was made not to find harm” is an important reminder. The table and the methodology is a mere ruse. With no idea of who was hurt and how badly, the giving out of money was a dart-throwing exercise that needed to be made to look legitimate. So the way to dress that up was to find an arbitrary metric from within the servicer, since the testimony last week revealed the independent consultants, who were the ones who allegedly did whatever investigation was done, weren’t involved in the process. And they just did a time cutoff as Goldberg indicates. If you were far enough along (oh and military, the banks are really afraid of being hauled before the Veterans Affairs Committee, so those borrowers were much more likely to get a decent payout), you might win the lotto of being slotted in a higher-payout category.

In case you think I’m exaggerating how completely bogus the payout numbers are, consider this testimony from the GAO:

Mr. Evans, GAO: It is. And I think that’s a good place for me to assert that any information based on the IFR at this point should be deemed incomplete, and the data does not allow us to render any conclusions about error rates at a particular servicer or make comparisons across servicers, despite what’s been reported in the press. They were at different degrees of completion, across the servicers, variations in the type of files that were reviewed varied, and also even if it were complete, depending on the sampling methods used, it’s possible that this information would still have limits. So it’s impossible to draw any inferences about the data, because they’re not representative.

And that’s before you get to the fact that the reviews also failed to consider some types of borrower harm. We found that in our whistleblower reports from Bank of America, that there were certain types of systematic abuses, such as hitting borrowers with fees accumulated during a bankruptcy (impermissible under Federal law) and forced place insurance that were omitted. And it appears that the folks doing the statistical track of the review didn’t look at servicer notes, which would make it impossible for them to understand how homeowners were jerked around:

Ms. Goldberg, NFHA: I would add one thing, which is that one concern we had all along with the methodology was the potential problem that the files themselves would not be enough to understand the problems that borrowers experienced. So, for example, one of the most common problems that borrowers encountered was servicers losing their documents and having to resubmit them over and over and over again. Or borrowers being told the wrong information. “You have to stop making payments before we can consider you for a loan modification.” You know, things along those lines. And it’s not clear that anybody examining just the files would be able to tease out that kind of information and understand those kinds of errors, and in order to do that what’s really necessary is for whoever’s doing the review to be talking, at least in selected cases, to homeowners themselves or to the advisers who work with them, housing counselors or attorneys.

Menendez and Merkley probed other issues as well. One was that the non-cash portion of the settlement was structured so that servicers would get the same credit for short sales and deed in lieus of foreclosure as they would for principal reductions. Yet principal reductions are more work for the servicer but produce better outcomes, both for the investor as well as the borrower, since he’d keep his home that way. But why should the bank-friendly OCC and Fed try to make banks work for their settlement credits?

Another way the banks are certain to game the settlement is (as they’ve been doing in the national settlement) is to focus their non-$ relief efforts on bigger mortgages, since it will take them fewer loans to meet their goal (the work is the same regardless of the mortgage size). That means the soft credits will go to better-off borrowers and communities, when it was lower-income communities and minority borrowers who suffered the most systematic mortgage abuses. Deborah Goldberg pressed for getting granular information as to exactly what kind of relief was going where, say by Census sub-tract.

Even worse, the computation of the credits are easily abused:

Sen. Merkley: Thank you very much, Mr. Chairman. I wanted to continue on this same issue. In your testimony, Miss Goldberg, on page 10, you note that on a loan with an unpaid balance of $500,000, a loan modification that provides any amount of principal reduction, be that $1,000 or $10,000 or $100,000, yields $500,000 worth of credit for the servicers. It’s hard for anyone apart from this process to truly believe that if you do a $1,000 reduction you get $500,000 of credit, yet are you saying absolutely that’s the way it works?

Ms. Goldberg, NFHA: That’s what it says in the settlement. I have to say, Senator, that when I first read the settlement I didn’t pick that up because it was so hard for me to believe it could be structured that way as well, but in fact that is the wording of the settlement…

Sen. Merkley: Okay. Well, I’d just to point out that the roughly 6 billion of small, in soft money that’s in the settlement, at that 500 to 1 rate, that is reduced down to 12 million dollars. Six billion goes to 12 million dollars. That’s a vast difference. Now you’ve pointed out, Miss Goldberg, that this creates a pure incentive to do reductions on large loans. Now, I live in a working-class neighborhood, three-bedroom ranch houses. There are no $500,000 mortgages where I live because there’s no $500,000 houses. So your point in your testimony is that working-class communities, and certainly communities of color, are essentially – there’s an incentive to kind of bypass them. Why would the Fed and the OCC agree to a structure that allows a 500 to 1 or more – for that matter, it could have been $1 under the argument you’re making rather than $1000. Why would they agree to such a fictitious form of accounting and a structure that incentivizes the bypassing of working Americans in this whole process?

Ms. Goldberg, NFHA: I think that’s an excellent question, Senator Merkley. I’m afraid I can’t answer it. It would be a good question to ask them to explain.

Sen. Merkley: Has anyone at the OCC or Fed explained, given a rational explanation, of what they were possibly thinking?

Ms. Goldberg, NFHA: At one point I heard one person say that they believed that this structure accurately reflected the value of the assistance that the borrower received. That’s the only explanation that I’ve heard, and it’s not one that I find credible.

Recall that the settlement does not require that the soft dollar relief go to the 4.3 million people that were in the target universe for the settlement. It can go to anyone. Do you think the servicers among them would find it hard to dredge up 12,000 borrowers with mortgages of $500,000 or more to give them a $1,000 break? This is why it is critical to get a breakout of the amount of relief, not just in terms of credit but actual action taken and how that was translated into credit, and where the recipients of particular types of credit are located. I’ve always regarded the non-hard dollar portion of settlements as a joke, since they reward things that the bank either would have done anyhow or can do for virtually no cost. This 500 to 1 example makes clear what a fiction these provisions are.

While it is better to have the widespread criticism of the IFR confirmed in an official setting, this exposure will not do anything for wronged borrowers. And one of the frustrations of these hearings is watching the major actors, the OCC and Promontory in particular, being treated as if they acted in good faith. The IFR was intended from the outset to be another stealth rescue operation, this one to legitimate bank PR that nothing bad had happened to borrowers aside from occasional, inconsequential mistakes.

Sadly, these hearings look like the regulatory analogue to the Rodney Dangerfield joke: Steal $1000 from the convenience store and you go to jail for ten years. Steal $100 million and you appear before Congress and get called bad names for ten minutes.

The only way for these hearings to have some impact is for the responsible parties to suffer meaningful consequences for their bad actions. Legislation like the bill proposed by Maxine Waters to put more curbs on the consultants performing regulatory work is critically important. But far more essential is to shut down the OCC. It has demonstrated that it is a hopelessly bank-cronyistic organization. The incoming Comptroller of the Currency, Tom Curry, has performed badly in the settlement negotiations, which took place on his watch. It is time to recognize that the OCC is beyond redemption. Even though a first go at shutting down the OCC is likely to fail, this sort of effort would put the agency on notice that future misconduct puts its survival at risk. If we can’t take on too big to fail banks, maybe the alternative is to take out their most important enablers, starting with a not too big to fail regulator like the OCC.

the foreclosure fraud remediation checks bounced:

Mortgage Relief Checks Go Out, Only to Bounce – When the bank account is running dry and the mortgage payment is coming due, the phrase “insufficient funds” is the last thing you want to hear. Now imagine hearing those two words when trying to cash a long-awaited check from the same bank that foreclosed on you. Many struggling homeowners got exactly that this week when they lined up to take their cut of a $3.6 billion settlement with the nation’s largest banks — lenders accused of wrongful evictions and other abuses. It is unclear how many of the 1.4 million homeowners who were mailed the first round of payments covered under the foreclosure settlement have had problems with their checks. But housing advocates from California to New York and even regulators say that in recent days frustrated homeowners have bombarded them with complaints and questions. The mishap is just the latest setback to troubled homeowners. It took more than two years to resolve a federal investigation into the foreclosure abuses. Even after the settlement in January, the checks were delayed for weeks.

Did you not bother to read the post? That’s covered in the second paragraph.

no, yves, i hadnt read your post before i posted that link; it was something i found early this morning while checking my reader & came here first to see if there was an appropriate post to contribute that story to…

obviously, it was completely redundant…

It’s hard to read posts like this without halfway through becoming so angry that one has to get up and walk around. Then when coming back a person has to force oneself to pick up where you left off knowing that you’re likely to get pissed off all over again.

Anyone have a clue what will happen w/GMAC? They’re not a part of the settlement & are still in the Independent Review process…but we received a letter from Rust asking for our patience…We know GMAC filed bankruptcy so they wouldn’t have to pay, but I think they still have to pay out on the foreclosures. Sure wish there was a way for all of us to be compensated enough to just “start over.”

The criminality of our system is blatant and open to full view. It seems as if the People have been drugged — turned to zombies that no longer care about themselves or their lot. Apparently, we’re content to sit on the porch and watch the barn burn to the ground. I wonder what type or quantity of pain it will take for the citizenry to rouse to their own common defense.

We’re roused, alright. Seen the pitchforks and torches across social network sights, in comments here and elsewhere, in your local attorney’s law firm? Only need a statutory cause of action to extend the limits on lawsuits?

Thanks for the reference at the end to the pattycakes treatment that OCC keeps getting from these legislators (including Levin the round with JPMorgan). As long as that continues, the whole exercise, while illuminating, will remain in the “shocked, shocked” category, which will suit the Obama folks just fine. It begins to look suspiciously like another part of the PR effort if abuses are uncovered and then nothing substantive is done about them or even proposed.

Thanks for keeping this in the spotlight at a time when so many would like to see it just go away.

The part I found most incredible was gleaned from the written testimony of Mr. Holland of Rust Consulting (apologies in advance if already covered here at NC, I do miss a few posts here and there). The settlement agreement with the lenders was reached without the OCC and FRB having the numbers of borrowers harmed or types of harm they suffered. Instead, the servicers were given the framework with possible categories of harm, for them to fill out the number of borrowers they found in each category. Then the regulators, based on those numbers supplied by the servicers, determined compensation for each category such that the total relief would equal the amount agreed to in the settlement.

Would that be called making the data align with the figures? Can we deduct our own personal debits to align with our account balances?

Lucy you will not believe what has happened. Is there an email where I can contact you?

Here’s one I just created today.

foreclosure lulu at yahoo dot com

Remove all spaces.

There’s not much I wouldn’t believe anymore, but I hope it’s unbelievable in a good way, like they’re dropping the suit against you and reimbursing you for your trouble. Hey, we can always hope.

Ugly revelations to say the least. It’s maddening.

Two phrases come to mind describing OCC and “servicer” behavior here: Passive aggressiveness and criminal behavior.

What a country we live in.

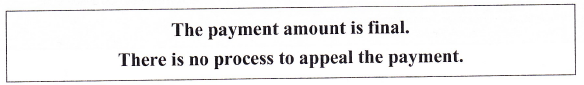

Thank you so much for taking the time to cover this story relentlessly and in-depth. No other traditional media outlet has done so. You give me hope that this debacle will at least be exposed. As we speak check recipients are agonizing over the piddling amounts they are receiving with nowhere to turn. Some have clearly been tossed into the wrong category merely to reduce their payout. Rust Consulting customer service is a sham set up to read scripted answers to two questions and the letter containing checks clearly states the settlement amount is final. Not to mention the fact that checks are bouncing. The contempt with which these victims are being treated is a disgrace.

And now the checks are bouncing. Because? They hate you. You’re a little person and a loser. You deserve what you get. The sociopaths want you to suffer and think it’s all funny. The normals, if any, hate you becuse you put them in the wrong and they have to spend energy in denisl, so they restore ego damage by kicking you That’s why. On the bright side, at least there’s a reason. Oh, and “no appeal” is a way of saying TINA. it’s important to say that at all times. Garcon! More champagne!

I am afraid to ask what TINA means…

There Is No Alternative……..

It has been announced that the checks are now good. They also announced that the account would remain funded for two years. I don’t know why if the last checks are going out in July and are void after 90 days. Maybe Rust forgot that part…….. or thought it made for good PR and hoped others wouldn’t notice the contradiction.

I cashed the check yesterday and checked my account this morning to see if it was posted. It did. I figured after hearing all the stories about rubber checks I’d wait a few days.

This whole experience from the start in 2009 was a revelation in the Obama administrations saying one thing while not putting any effort in following up to what you have said or in most cases just not sticking to the truth. I believe the proper short phrase is lying.

While I sat at my computer and phone three years ago filling out forms and gathering information for Wells Fargo. I kept hearing stories about forms getting lost and applicants being denied a modification for a variety of reasons.

I tried for a modification three different times and was denied each time. I could not understand that after failing the first test that there was a make up. I failed the test the second time and was allowed to take a third test. My thought was what’s going on here? I don’t think you can even do three make ups at an on line university.Still I was being told to keep applying.

This whole time I’m reasoning that I don’t think Obama knows what’s going on with these so called loan modifications. Obama knew well what was going on and his plan was to keep the banks exposure to a minimum while touting that he was going help people stay in their homes. The whole time that this has transpired it’s now pretty obvious to see that protecting the banks was the main goal.

One of the decisions that I’m glad that I made was that I didn’t do a short sale. Fuck you Wells Fargo! The value on our condo has decreased by 80k and you don’t want to give me a loan modification but instead want me to sell this place for you. I’ll pay cash for that flat screen from now on and you can shove those wage slave credit ratings up your you know what. You can sell this place yourself!

All in all I’m glad we gave it up. The value dropped another 20k and the builder declared bankruptcy while we were in foreclosure thus sending up the association fees. We were the sixth family in a seventy-two unit development to be foreclosed on.

Is it fair for the remaining residents that live in the complex? No it’s not. The 225,000 condo that we paid for sold for 130,00. Those condo’s are all under water today thanks to the TBTF banks. You can argue whose fault it is mine or the bank’s. However one thing that should be recognized is that because of the enormity of the situation help was needed to stabilize the American economy. Who gets the help? Main street or Wall Street.

If Obama would have gave monetary relief to the homeowners like he claimed he was doing instead of the banks then this whole fiasco would not be in it’s fourth year.

Mad, I just wish President Obama administration would have given some of that money congress gave to the bank to bail them out, to the homeowners who was fraudlent jerked by the bank, instead of creating an independent foreclosure review. It was the greedy bank that cause home owners to be in this horrible sideration. Bank stopped loaning money to business to produce and pay employee, people started to get lead off. Some could not pay their mortgages or buy a car to get to work, because banks started to go broke. Government bail them out. Now they don’t want to help the home owner.

So now, just to recap. Summers, Greenspan and Paulson forced the resignation of Brooksley Born when she insisted on regulating derivatives (which miraculously still go unregulated in Dodd Frank). The SEC was promptly turned into a croupier and in 2008 the entire system collapsed from “over leveraging”. Derivatives were not punished. On the contrary, they were rewarded and continue unabated to this day. Causing absurdities like the OCC’s IFR.

you always do that recap thingy so well…thanks STO

(they’re nice to attach to family emails, insert into quick conversations etc’ ))

Yes, she does, and there are so many great opportunities for such choice recaps.

I heard another recently. If a terrorist kills a few people, then nothing will stand in the way of preventing another occurrence, including infringing on all kinds of our constitutional rights. Warrantless searches, waiving habeas corpeus, torture, assassinations, collateral civilian casualties, along with no-fly and other lists of suspected terrorists, all rubber-stamped with the approval of Congress.

But if 30,000 people each year die from gun deaths, Congress will refuse to take action, refuse to even pass a background check to determine prior felonies (using same guns), for fear of the creation of a list of known gun owners, despite provision making such list a punishable felony and support of background checks by an unprecedented 90% of their constituents. The 30,000 deaths each year are something we must accept to prevent the remote possibility of one more, of many that already exist, government list of citizens.

Logically, the reasoning on the gun vote and the IFR scam and many other actions make no sense. They make perfect sense however if one accepts that our lawmakers and regulators are owned by special interests. We have the best laws that money can buy. However, the only thing money can’t do is to vote. How long before the citizenry wakes up and votes them all out of office?

“We have the best laws that money can buy. However, the only thing money can’t do is to vote. How long before the citizenry wakes up and votes them all out of office?”

We have to get this: the problem is systemic. It is not about individuals.

It really doesn’t matter who “votes” nor which individuals are “elected.” The system trumps all, and it is rotten to the core.

We will be stuck with this corrupt corporate state until we change the system.

The problem with this is all true politics are local. We all believe that congress is corrupt, but our gal/guy is not. We need to choose congress like we get picked for jury duty. “Damn, got to serve the next month in congress”

And today, DeMarco!!!

http://www.banking.senate.gov/public/index.cfm?FuseAction=Hearings.LiveStream&Hearing_id=fd3ae73f-db37-41b6-b69c-48e6faa6ab0d

White House Said Near Decision on Leader of Fannie Mae Regulator

http://www.bloomberg.com/news/2013-04-18/white-house-said-near-decision-on-leader-of-fannie-mae-regulator.html

Tues., April 23rd 10:00 AM – 12:00 PM :

“The Consumer Financial Protection Bureau’s Semi-Annual Report to Congress”

(Related ??????)

But what can we do? I am so disgusted and mad mainly because we were victims of the Bank’s (Wells Fargo, the Biggest of the Bad) foreclosure abuses and illegal taking of our home. We fought, and had evidence of all the criminal practices they supposedly were in trouble for: fraudulent docum,ents, robosigning, losing documents, juggling us between numerous department reps, and forgery. But we still were ignored by the Court system. Now, it is obvious no restitution which could be deemed acceptable will ever be forthcoming, and do you think I don’t want to protest this whole fiasco and raise holy Hell? Of course I do! If I could start a revolution and bombard the gates I would, but I can’t. What can we do? We are just the “people”, not rich enough, powerful enough, or evil enough to be noticed or matter. I am so pissed off and frustrated there isn’t a word in the dictionary to define how much I HATE the people who are letting this happen and allowing the banks to just walk away unscathed. But what can we do about it? Nothing.

I received a $300.00 check on a property that has never had a mortgage or foreclosure!!! My foreclosed property…Independent Foreclosure Review has no record of it & the review form that they sent me on the property that I filed …they CAN”T FIND that either!!! My server: Wells Fargo told me yesterday …6 phone calls later..that they gave IFR the correct address.!! They said the harm amount was IFR’s doing too!!!! Wells Fargo said they would submit a statement that they made no mistake …but IFR DID !!! Right now IFR told me to keep the check on the wrong property!! I have a lawyer waiting to take action if I don’t get compensated for my foreclosed property!!! I had assistance from the Attorney General’s Office, my lawyer, & the Dept. of Justice!!! If IFR send me a lousy $amount…I am going A-Wall !!!!! IFR claims they are going to call me Mon. They are truly giving me the run around!!! I am going to wait..I wrote a letter to the VP- Mr. Parks of Rust; I contacted Congresswoman Waters, I emailed Sen. Warren, & I called the Consumer Financial Bureau & made a complaint. And out of all this drama…they gave a check that was no good until Wednesday!!!!!! Unbelieveable!!!!!

I was in the same situation as you. I was turned down for modification twice and the third time they “lost” the documents. I got my check, I was put in the category of Modification request received but no decision made. This is bull that we can not appeal the payment. Does anyone know of anything we can do if we were paid out from the wrong category?

I cashed the check yesterday and checked my account this morning to see if it was posted. It did. I figured after hearing all the stories about rubber checks I’d wait a few days.

This whole experience from the start in 2009 was a revelation in the Obama administrations saying one thing while not putting any effort in following up to what you have said or in most cases just not sticking to the truth. I believe the proper short phrase is lying.

While I sat at my computer and phone three years ago filling out forms and gathering information for the TBTF bank. I kept hearing stories about forms getting lost and applicants being denied a modification for a variety of reasons.

I tried for a modification three different times and was denied each time. I could not understand that after failing the first test that there was a make up. I failed the test the second time and was allowed to take a third test. My thought was what’s going on here? I don’t think you can even do three make ups at an on line university.Still I was being told to keep applying.

This whole time I’m reasoning that I don’t think Obama knows what’s going on with these so called loan modifications. Obama knew well what was going on and his plan was to keep the banks exposure to a minimum while touting that he was going help people stay in their homes. The whole time that this has transpired it’s now pretty obvious to see that protecting the banks was the main goal.

One of the decisions that I’m glad that I made was that I didn’t do a short sale. Screw you Bank! The value on our condo has decreased by 80k and you don’t want to give me a loan modification but instead want me to sell this place for you. I’ll pay cash for that flat screen from now on and you can shove those wage slave credit ratings up your you know what. You can sell this place yourself!

All in all I’m glad we gave it up. The value dropped another 20k and the builder declared bankruptcy while we were in foreclosure thus sending up the association fees. We were the sixth family in a seventy-two unit development to be foreclosed on.

Is it fair for the remaining residents that live in the complex? No it’s not. The 225,000 condo that we paid for sold for 130,00. Those condo’s are all under water today thanks to the TBTF banks. You can argue whose fault it is mine or the bank’s. However one thing that should be recognized is that because of the enormity of the situation help was needed to stabilize the American economy. Who gets the help? Main street or Wall Street.

If Obama would have gave monetary relief to the homeowners like he claimed he was doing instead of the banks then this whole fiasco would not be in it’s fourth year.

Who pays the monitor and the OCC? Do we, the taxpayer pay for the banks protection. They won’t go to jail but at least they need to be shut down and fired on the spot. Shocking how the banks get credit. I thought they might get 10 cents per dollar relief granted – not the other way around! It all didn’t seem to add up. If the banks really paid 25 billion in punishment how could they have so much higher earnings compared to the last three years. We should all sign petitions to shut down the OCC and fire the monitor!

Why won’t they go to jail? I believe crimes were committed and are still being committed and courts can deal with them. They’re not, but they can and should have been, and I’m not writing them off. They can wake up. After a while even they will realize they need to wake up. That we are all in the same boat and what goes around comes around and they can do something. Is their world any better now that Aaron Swartz is dead and skating TBTF has bankrupted the planet and we see justice as a joke? No. They look like silly mimes to me with painted woe faces and hands climbing invisible walls. “Oh no, we can’t get through!” Yes you can. Quit being silly. Do your job.

Just seems sensible to me.

The last few days have had more and more ugly revelations emerge about the botched OCC and Fed Independent Foreclosure Review settlement

It wasn’t botched. It proceeded exactly as it was designed to.

No matter how often you explain this to the left, it’s utterly incapable of understanding it. Things work exactly as they are designed to. Otherwise bright people can’t fathom this, and they are the rule on the left, not the exception.

No, this was botched. I have consistently said, from when it was announced back in 2011, that the IFR was intended to be a coverup. It was botched because it has become a visible, costly mess and damaged the credibility of the banks’ best friend, the OCC. The OCC is actually talking about getting the power to sanction consultants to head off legislative action against it, such as transferring its most important operations out or even shuttering it. Maxine Waters is pushing for legislation which would make it much harder for consultants to provide ridiculous bank-ass-covering reports without consequences. These would be long-term impediments for the banks.

This seems like a telling moment from the hearing:

Thank you for your relentless coverage of the IFR and the fraud that it is.

I agree with Cletus, the average American does seem to be content to sit on the porch and watch the barn (country) burn to the ground. Millions of people have been negatively impacted by the housing/foreclosure crisis. Instead of dog and pony shows we need pitchforks and firebrands.

As Yves pointed out, the checks are only good for 90 days. Why? My guess is that millions of these checks went to the address of the foreclosed property. In most cases, the homeowner has long since moved and the time for the USPS to forward mail (6 months) has long since passed. If the check makes it to the correct/new address – and that’s a big if – the 90 days will be up.

And what about the huge pile of return checks at Rust Consulting? I’m sure someone will advise us it was “too big to mail.”

With regard to how the OCC’s operations are funded, from their website:

The OCC does not receive appropriations from Congress. Instead, the OCC’s operations are funded primarily by assessments on national banks and federal savings associations. National banks and federal thrifts pay for their examinations, and they pay for the OCC’s processing of their corporate applications. The OCC also receives revenue from its investment income, primarily from U.S. Treasury securities.

So the regulatory system we have in place is no better than the system everyone is outraged by, whereby banks pay consultants to provide them the answers they want. Our regulatory system provides for a similar arrangement between the banks and their regulators. With such an arrangement, why would staffers at the OCC not bend over backwards to be quite accommodating to their “client banks” who pay their salaries and cushy retirement plans, rather than ruffle feathers and jeopardize same?

Talk about a need for structural reform. Let’s start with the way we regulate in this country.

on a side note:

http://www.glassdoor.com/Reviews/Office-of-the-Comptroller-of-the-Currency-Reviews-E40139.htm

“Excellent place to work, especially for Finance/Accounting grads”

Current Assistant National Bank Examiner in Lubbock, TX – Reviewed Feb 16, 2013

Pros – Decent salary, excellent benefits, working environment, travel rewards and incentives. You get federal employee discounts on a plethora of goods and services, and you get 10 paid federal holidays per year. The OCC is a non-appropriated federal agency, so it is not subject to federal pay/hiring freezes.

Cons – It’s still public sector work, so you won’t get rich. However, you will be very comfortable. Travel can get tedious at times.

“The OCC is a non-appropriated federal agency, so it is not subject to federal pay/hiring freezes.”

:- |

Under ‘incentives’ in pros: great career stepping stone to lucrative position in private sector

The problem is regulators funded by Congressional appropriations don’t work any better. The SEC was a competent and feared regulator when I was on Wall Street in the early 1980s. Ditto the FDA.

I don’t know the path of the FDA’s decay., but I can tell you for sure that the SEC’s ruin was engineered by various Presidents (weak, industry friendly appointments as chairman) and Congress (threatening basically industry friendly regulators when they’d get tough minded on selective issues with budget cuts. Joe Lieberman, Senator from Hedigstan, was the lead actor here).

I certainly hope that members of Congress at least follow-up by asking what proportion of settlement checks were actually cashed. Yves presents good circumstantial evidence that the banks have now resorted to discouraging people from cashing the checks. I suspect any questions along these lines, regarding what proportion of checks were cashed, will be met with initial stonewalling. “We don’t know. Our systems aren’t set up to track that.” If someone like Warren persists, a shockingly low number will eventually be offered. But nothing will be done about it, which the banks already know.

In the interest of providing a little more data to your amazing coverage of this issue: I just received a check from Rust Consulting for $3000. My foreclosure was completed. I did not make a claim that HSBC made mistakes with my servicing.

I surmised that, as you said above, the checks must have just fallen into general categories.

I have read all of your posts about foreclosure issues. It seems to me that perhaps the banks and Promontory discovered quite a bit in their brief review. Perhaps they found that their servicing was worse then they originally assumed. Then, getting the outrageous bill from Promontory for the review, someone(s) high up convinced their peers at all of the other banks that they had better cut their losses and just payout to everyone and be done with it.

The shame is that people who suffered real crimes at the hands of the servicers are not being appropriately compensated.

I do feel however, that the vast majority of people who were foreclosed upon, had lost their livelihood due to the economic depression that these banks caused. In this case, a check for $3000 is a very welcome drop in the bucket. I personally am in the construction industry and have been earning under $20k a year for the past 5 years. Contrary to propaganda, construction has not come back, and an income drop from $100K to $20K a year, will not cover mortgage payments. Once your savings are gone, you accept foreclosure. ($3000 will pay a few months rent!)

What I got from watching part of this hearing (before switching it off in disgust) is these “regulators” are really “chair warmers”. No one in these positions keeps their jobs by making demands (or making waves). It’s go-along to get-along throughout government. We would be much better off to just eliminate all the regulatory agencies and instead publish the home addresses of all the executive management of the companies being regulated. Then let the chips fall where they may. I’ll bet this would be much more effective and of course, cost the taxpayers much less.

I am glad to hear that some fellow readers are getting checks, however small and inadequate.

I still don’t even know if we qualify for a check, but I believe not as our servicer was not part of the agreement. Tant pis. I don’t care.

What would have made a real difference in the lives of people who lost their homes? Simply this: a small sum in the form of a credit for a new down payment and a “mulligan” in the credit score department based on “factors beyond anyone’s control.” Speaking as someone who went through a year of misery trying to hold on, then two years of unhappy, expensive rentership, and finally (six months ago) bought a new, smaller, cheaper home, I can say THIS has saved my family, my sanity, my marriage. We have fixed expenses again and can save for the future! Hallelujah!

Good people have gone through the wringer and nothing was learned. The former could be forgiven, but not the latter. Please, fellow readers, if it is possible and you get a 4-5-or 6 figure check, put it aside for a down payment. This may be the only cure for our particular brand of heartbreak. Peace out.

why would you ever encourage someone to take out a mortgage with these idiots?

Unfortunately, the borrower has no say in the matter. The bank that makes the mortgage loan can transfer/sell the loan and the servicer for the new mortgage holder steps in.

This happened to me after I closed on my house in January. The bank that originated my mortgage sold it and 6 weeks later I got a letter that Wells Fargo was now servicing my mortgage. It didn’t take long before Wells sent me a letter asking for proof of insurance, claiming they had no evidence I had insurance — even though the policy was fully paid at the closing. Long story short, 9 days after my broker faxed (they don’t do e-mail) a copy of my insurance declaration Well’s computers still say I don’t have insurance. I’m waiting to see if they dare charge me for force placed insurance.

Please keep us posted

Dolley,,

People have to live somewhere, don’t they? I mean, the state frowns on raising your kids in a pup tent. At the end of the day, you are much better off owning than renting provided that interst rates are low and you pay a fair price (and have a steady income).

Jiggering with rates can’t fix the problem with pricing if you bought 5-10 years ago.

However, you are right to point out that servicers have not been reprimanded or reformed. Huge problem. Our loan will not be sold, but not everyone is so lucky.

this melt down is in waves and they’re getting closer together

example…

youth unemployment squeezing elders

young educated squeezing ‘overpaid’ middle age

corps merging & outsourcing

all equals fresh waves of mortgage delinquencies

i wouldn’t sign their dotted lines at this time…

Ah, but what if the world doesn’t end? It probably won’t, by the way. Muddling through is the human condition.

Let me tell you what it really means to deleverage and come out the other side. When we moved into a rental our housing expenses were cut in half. Not bad, but not great. When we bought again our expenses are about the same as renting, but about 60% goes to principal and repaying a 401k loan for the down payment. On top of that, another 20% is tax write off on interst and RE taxes. In reality then, we are saving two-thirds on living expenses. Try that while squatting or renting. The only way to fix our problems is to buy again. I’m sorry the water is dirty and. Shark infested. Jump anyway.

the world won’t end…but its changing faster than many are prepared for

i’ll never stop jumping…im just watching for less blood in the water

im happy for you and wish you and yours good fortune in all your endeavors

Totally agree with AbyNormal.

No way in hell I’m jumping in the dirty, shark infested waters again.

Buying or renting? Depends a lot on individual circumstances, like level of job security and how long one plans to stay in the same home. Markets also play a role, too. For example, renting my home would cost more than a 30 year PITI mortgage payment, and that’s not taking tax advantages into consideration. Being at the mercy of a landlord is not always pleasant either. I’m not concerned about issues with breaks in chain of title clouding title. It’s abundantly clear that the decision has been made to protect the banks on that front. That protection will be thus transferred along to the homeowner.

For me, the final determining factor though is wanting the security of being free of rent and mortgage payments when I reach retirement age. I have no pension or employer 401K contributions funding my retirement, and SS is on the chopping block. With rent on a 1 BR apt in a low-cost region of the country costing half of the average SS check, how many folks will be able to afford to pay rent?

Finally, I bought in 2007, specifically avoiding what I saw as Florida’s way overpriced market, where I was living at the time, for an area that saw little in the way of a bubble. By the time I learned of all these problems, it was already a done deal. I’m sure I would feel differently had my home been stolen from me despite remaining current on my payments, but my servicer has never given me grief, and was excellent when they did a low-cost refinance at a competitive lower rate even though I was unemployed and thus didn’t qualify for a conforming mortgage (Jan 2010, before HARP or any other mandates, but was 80% LTV……. and in return, they got a clean set of loan docs). My loan is now proudly owned by US taxpayers via Fannie Mae.

What’s the OCC’s budget? Sounds like a good candidate for deficit reduction.

I haven’t seen anyone else post about this so hear I go. I sent my paperwork in for the IFR before the first deadline. I corresponded with them all the way up until December 27, 2012, when they called and asked for some additional documentation. At the end of February I called in to verify they had received my documenation – and my address had been changed. Apparently, Rust consulting, updated addresses from the National Address Change Register or something along those lines. I informed Rust that it was the incorrect address and that they had the right one on file – I had not moved since we started this.

All of the websites, the OCC, The Federal Reserve Board, all of the news releases – state to call Rust Consulting to update your contact information. THIS CANNOT BE DONE! They will not update your information over the phone, I was asked to submit a letter with my reference number the “old” address and state my new address. I submitted a letter, 4 times. Rust can confirm that they have received the letters, they can even tell me what the correct address is, but they WILL NOT change it. I am now being told that I need a form that they will mail me to change my address. I have been waiting since March 11th for the form. Oh but it really doesn’t matter if I get it or not, because whatever address they had on file as of March 1st – is the address they will mail payment to. In my case the wrong address – even they for 2 years they had the correct one and they know it is wrong. I was advised to go to the post office and ask for an address change or contact them at the end of May to start the re-issue request. They are really working hard reading from their scripts, refusing to help anyone who calls and not doing what their website states by updating contact info…

Omg, I am having the exact same problem! I spent $15 on a certified, tracked letter with my new address information, the letter was received on April 3… When I called on April 8th and 11th my address had not been changed. Rust consulting does not know what the hell they are doing, they can not even update our contact information. I had to go through the postal service and submitt another change of address, online, thankfully that only takes 3 days to process… WE have to do something about this whole mess…at first I thought everyone cash their checks and then close their accounts, I still think that’s a good idea for those that can do it, but I think we should use these forms to organize a meeting. First, with those in the same city and state, then everyone in the state, then all together! I’m ready to fight this system….I’m in my early 30s and I refuse to live in this corrupt country and I am ready to do something about it!

I posted comments about this situation yesterday and again today.

I too had updated the OCC and the IFR with my new address. Long before Rust sent their postcards.

I called Rust after I read the postcards were mailed to verify my address. They still had my old address and advised me to send my new address in writing. They received my letter but refuse to change the address! The rep yesterday advised me to send the change of address again. This sounds like a repeat of all the “lost” mod paperwork hell the servicers put millions through.

We need to keep the pressure up on Rust. Keep sharing your stories. Contact media outlets. Keep coming back to NC to share/update your stories.

This is bullshit. And like millions of others, I’ve had it!

I’m having the same issue with trying to change my address on file at Rust. I was told to write at letter, which I did. I called back 2 weeks later to verify that they had changed it…They hadn’t…I was then told that they would have to send a form for me to fill out…Why wouldn’t they have sent that form out automatically? Besides the Rust website says to call for address updates…What the heck are they doing?…jerking people around again?…BTW, I’m still waiting for the address change form…hmmm. I think someone should be over-seeing what is going on at Rust. The settlement payments seam like they are being handled the same way modifications/foreclosures were handled…obviously very poorly…what a shame. Shame on all those banks!!

Those of you with change of address problems with Rust, post complaints to CFPB. If they get enough of them, perhaps they will put some pressure on Rust.

I have filed formal complaints with both the OCC and FRB, in addition to calling both of their customer service hotlines. I have also sent several senators emails including Senator Warren and Senator Menedez.

Good choice — Menendez was the one questioning VP David Holland of Rust at the hearing about how Rust was doing its job.

Holland’s opening statement is p. 8-9 of the transcript, Menendez questioning him is p. 29-30, and his written statement is here:

http://www.banking.senate.gov/public/index.cfm?FuseAction=Hearings.Testimony&Hearing_ID=6aac2b90-e6ee-4c5c-b6a0-526ab27c70d2&Witness_ID=4e48df0e-045c-432f-8caa-8d2c9d632fcc

@Julia- I am having the exact same problem.

Yes, very frustrating. On top of that the address they decided should be mine, is a business. The USPS will not allow me to put a forward on for an individual from a business address. I have call the OCC, The Federal Reserve Board, Rust Consulting’s main office, the IFR hotline, even my state Attorney Generals office.

I would call the business, explain your predicament, and ask them to please hold any letters they receive for you and leave your number to notify you to come pick it up. Then, if they do, buy them a box of chocolates or some other gift to show your appreciation.

Ditto for others who are in similar predicaments. My experience, after moving frequently much of my life, has been that USPS will deliver all mail to an address irregardless of addressee, once the 6 months of a ‘change of address’ expires. I’m still getting mail for the previous 3 addressees, after buying this home in 2007. If I were contacted, I’d be happy to hold somebody’s mail. I’m sure most people will.

Cons on top of scams on top of thefts. It isn’t just this settlement. This is the way our modern world works, and why it will crash and burn.

A theft wrapped in a con inside a scam.

Not sure if this was asked in last week’s hearing, but it certainly wasn’t covered in this one:

If the IFRs could not be completed for the banks included in this “settlement” for various reasons, why were EverBank/EverHome Mortgage Company, Financial Freedom (OneWest), GMAC Mortgage, and IndyMac Mortgage Services (OneWest) allowed to opt out of this and continue the “reviews” for their customers?

You would think that the review processes, or lack thereof, would be the same across the board.

No, it wasn’t covered in the hearing last week. AmericanBankers did a piece covering some of the likely reasons. Included were that they were smaller servicers so may have been closer to completion, by mid-summer, and that privately owned One West had received at least partial indemnification for some of the past liability they might bear when it was purchased from the FDIC.

http://www.americanbanker.com/issues/178_19/two-banks-foreclosure-reviews-grind-on-after-giants-give-up-1056224-1.html

Article is behind paywall but may get free 2 week registration

I know IndyMac went down and maybe Financial Freedom (One West), but GMAC is/was not a small time servicer. They were one of the big 5 in the NMS last year – though not for anyone who has/had a Fannie or Freddie mortgage. I’ve been trying to get news about them in regards to this fiasco, but to no avail. It doesn’t seem like anyone is reporting on these servicers and why they got to opt out when their review processes had to be just as bad and needing to be covered up just as much as the others. I didn’t expect to see the MSM covering it, but thought some of the blogs like NC or FDL (or wherever Dave Dayen is hanging his hat) would have something.

Posted too soon! Got right in on that site and had forgotten about GMAC/ResCap’s bankruptcy last year. That’s the reason given for why they weren’t included since the trustee would have to give authorization for the deal. But the article is from January and surely someone would know if that had been requested by now.

this independant foreclosure review process has been a big disappointment the borrowers are the only ones getting the short end of the stick in this fiasco of crap. rust consulting was a joke from way back when sending out phony settlement checks they should have just sent the checks straight from the federal reserve they did not need a middle man to deliver the checks and how much are they getting paid?is it out of the settlement money that the borrowers are suppose to get,the occ is another joke just sitting back letting the banks do what they want, and the national mortgage settlement is just resting not sending their part of the money at all? what is going on these are two completely different settlements yet national mortgage settlement has not updated their web-site at all it still says febuary 2013 this is april they are stalling and it’s pathetic they don’t want to find harm they want to hold on to the money themselves and disperse it the way that they see fit ,not fairly like they should be doing.Obama bailed out the banks and they still did not help any one keep their homes.now again 25 billion dollars squabbled into different programs but not given to the victims of fradulent foreclosure practices fairly.It has to be a way to fight this i say a seperate web-site made up so everyone can form a large number or petition of people to file our own civl action lawsuit NO MATTER HOW LONG IT TAKES IT MIGHT NOT TAKE AS LONG AS YOU THINK!!!!! it can be done and geoffrey fieger good lawyer!!!!! just might be the one i will find out .Stay tuned for further info.

I’am with you own this one. where is Geoffrey Fieger office located in what state and city.

There is a petition out to sign ….. everyone go sign it… here’s the link!

https://petitions.whitehouse.gov/petition/re-evaluate-independent-foreclosure-review-and-review-occ-and-federal-reserves-role/KpNg8Hzn

I would like to know when the next wave of checks will be mailed out and since the servicers were wrong the foreclosure should be removed from all of our credit report so that we all can start a new life.

I am a honorably retired servicemember. A veteran of Afghanistan and I have to ask, what did I defend? The right for American citizens to be thrown out oftheir homes for paying their mortgage? The right for big banks to perform illegal operations that resulted in our citizens losing their homes? Or was it so that everyone (including Senators, Representatives and Congressman) could merely talk about the travisty of it all. Did I fight for the freedom of banks to take homes away from my fellow servicemembers while they were fighting for freedom? What exactly is this all about. So what that good questions are asked and the sub committee “hammered” them with words. Words do not provide a safe place to sleep for those that lost their homes. Niether does $300 for the paperwork showing they were only at a certain point during 2009 or 2010 not what was actually occuring on the ground. Really folks! WHAT DID I DEFEND????? Please someone tell me because the last 10 years have made me wonder what benefit came from my military service. I see the rich getting richer and talking a lot and the poor struggling even more. Thats right, I said nothing about a middle class, those lines are blurred to uncertainty if one even exists. I do not regret 1 day of my service but I have to ask the moral question, what did I defend? All seems backwards when servicemembers and hard working families are removed (some forcibly) from their homes (most due to illegal practices)and it’s ok to send them a check that bounces (adding even more stress and insult)for $300 to $800 to %80 of them. Those not directly affected stand by and watch and agree with words its wrong yet no real action is ever taken. Why? too hard, too complicated. So is a firefight in fallujah yet many have stood behind those all to real bullets. Will someone in our government stand behind this one and make things right based on facts? Take the time to make these banks make things right for these families. Pay them what they actually took from them and don’t let the banks do it again and guess what, I’m going to boldly suggest the economy will improve somewhat. I don’t want to think my service contibuted to the fleecing of my neighbors, my friends, or even a total stranger but it’s hard. Is there that much of a disconnect in our society that we would allow this to happen and not handle it with the appropriate amount of effort and action? I am proud to have in a small way defended each and every American Citizen, not so much so for big business and corporations that take advantage of their power. Capt. D (Retired)

Oh yeah, by the way, anything over $600 is most likely taxable. Can I claim my loss of equity against the taxable gain? I would get a fantastic refund! Probably not legal for a law abiding citizen though.

Capt. D

Your words are strong and true, as a fellow Veteran I understand where you come from. Please if your time allows copy and forward your comment to every elected official from your local level all the way up as well as all media outlets you can think of. I have spent the last two years working in my community and state trying to make a difference for those affected by this foreclosure fiasco and I will spend whatever more time it takes. Do not let your words fade away on this page.

I will Vince. I will even cc some media in hopes it brings to light some truth about what the Backbone of America is actually going through. The Backbone being it’s citizens who built and maintain this great and keep it from imploding by their shear will and tenacity against all odds.

katcandu – “WHAT DID I DEFEND?????”:

Sgt. Shamar Thomas at Occupy Wall St., October 2011 – “There is no honor in this! There is no honor in this!”

Yves, Bloomberg has a somewhat bizarre and very thorough article on Well’s hiring of Notre Dame Coach Holtz to cheer lead the realtors at a conference in San Francisco into giving Wells more business. And the piece speaks to Well’s increasing difficulty in originating loans and the bank’s future vis a vis the loans. Even some rather dire scaremongering from one analyst. Having been screwed by Wells on two loans, I find this delicious.

http://bloom.bg/ZyWzOb

I have not got a check yet what does that mean did Rust send out smaller checks first and larger coming later. Based on the schedule I should get 6,000

Did you get your 6k yet? You were probably in the same category as me. You made three successful 3 payments? We thought that we were in that category too! Our check was for only 2k. Good luck!

Tammy the bank Mortgage department had it’s lawyers to file a foreclosure on me and it was not my fault. The bank credited my monthly payments then kick them out of the system. They have the nerve to tell me it was a computer error. That their computer have been kicking borrows payments out of the system and also kicking them out of their trial modication. Well they better fire that computer and hire a real person. I wonder what my check will look like.

Quite an interesting fiasco posting and the comments here are quite revealing.

Top to bottom, stem to stern……it’s rotten.

There are plenty of good people left I think but the incentives, disincentives, rule of law and inheritance of our current society need to be revisited and refocused to support the majority instead of a small minority of humans.

What about the 2 out of the 13 servicers Goldman Sachs & Morgan Stanley?? It says they will receive payments in the near future and gives no time or date but just in the near future. Why are they the last 2 servicers to mail out payments to borrowers? Is their payment bigger than the rest or equal???

That number is now 890, with 300 votes for a class action suit! Getting close enough in numbers to actually start a serious discussion on finding a lawyer etc. Here is the poll, please register and vote! http://foreclosurevictims.freeforums.org/class-action-lawsuit-yay-or-nay-t94.html

Very simple. Take the bounced check and get a criminal warrant issued by your State Attorney directly to Rust Consulting’s CEO?

I have not received a check yet. I anticipate getting 300.00. But I am holding out for a major error as this whole group of Rat B@stards might just mess it up and give me 5000.00. I mean they did so many of you wrong, I could see me benefitting from a mistake on their end (kind of like what they gave me in my end) May God Bless you all, He/She blesses me everyday! Pray for Boston/Waco Area.

Maybe congress should have at least passed the gun legislation. (there are some very unhappy people in here) lol

Iam still defending my foreclosure pro se from 2009 after 9 modification requests to wells fargo does any one know if they are still in that status if they will use this settlement admission of wrong doing as a basis to dismiss the foreclosure with pregaduce or to seek punitive damages

I have been searching for information for the last week or so, hoping to get an idea as to when to expect my check. I spoke with Rust Consulting yesterday and after being bounced around I was told that my check has not been as of yet. Of course, they could not tell me the amount or an idea as to when that could possible happen. It is very frustrating.

We fought wells Fargo for three years, then finally lost our house. They put us through the nightmare of three modifications (constantly restarted due to “lost paperwork”) and then a forbearance, where they again “lost” our papers even though their own people told us the computer showed they had it. The house was eventually auctioned. According to the table, we were entitled to 50k. They gave us FIVE HUNDRED DOLLARS. For years of suffering, our credit shot and having our house sold from under us with five children. and apparently there is nothing we can do. We just bend over and take it.

Abby, that sounds so wrong. How could any bank sale a home and the parents have five children. Instead of them taking the time to found the paper work, they prefer to sale a family home to someone else. The banks better stop doing this to people. there could be another financially tumbling of the banks. who will give the banks tarf money to bail them out next time around, because it is coming. They’re treating borrowers so wrong.

Ok I hope this helps some people however I just got off the phone with a supervisor of the customer service department of rust and I was informed that another wave of checks were mailed out today and another wave will be mailed out next Friday. The supervisor could not inform me if the waves were based off of the amount or the servicer. But she could tell me it was not alphabetical. She was able to tell me when I could expect mine. I hope that helps someone with this mess.

I am one who submitted a request for an IFR (I only received my forms after several days of e-mails and a conference call with the assistant director of enforcement at the OCC early last year)and I received my check this past Tuesday, for $2000. I haven’t cashed it and I have no intentions to do so-more likely I will burn it for all to see on a YouTube video during which time I will introduce approx. 30-35 fraudulently produced assignments of deed of trust and or mortgages that were produced by one bank in particular in its ongoing attempts to steal peoples homes that it did not own.

I have been in this fight for 7 years and I have survived 3 modification denials, 5 foreclosure attempts and most recently the filing of fraudulent and forged documents submitted by the banks attorneys for record with the local clerk and recorders office. And, I’m not in default and the bank has never owned my original note, I’m in possesion of that document.

By my calculations, using the matrix of payments put out by the OCC I was entitled to at least $49,700 from the settlement, minus the $2,000 received that leaves a balance of $47,700 for which I intend to submit a bill to the FED and the OCC. There are a few billion dollars hanging out in the soft-dollar side of this settlement that they can draw on to settle up. With a multiplication factor of 500:1 Bank of America shouldn’t complain because they will get a credit of $23,850,000.

The OCC and the FED have stipulated to the fact that I was harmed or at least that I deserved to be compensated for certain action of my servicer, all of which are within the payment matrix and nowhere can I find where it says that I can only be compensated for one of several of those acts. It must simply be an oversight by those who prepared the list, of course it was because it was the same people who caused me that harm numerous times and in numerous ways.

It was the OCC and the FED that came up with this amended consent decree so it ony seems right that I send them my request for payment under the terms of that Consent Decree to them and then proceed in whatever legal arena that becomes necessary in order to collect.

I’ve become quite proficent in matters of the law and the courts over the last 7 years, just ask Bank of America why my Note is no longer enforceable and my Deed of Trust has been exstinguished and I have told them several times that they can kiss me where the Sun doth seldom shine but have yet to garner a response from those thieving bas*@#*&.

All we have and all we will have comes from what we do for ourselves and all those waiting for someone or something to make all of this right will still be waiting when they lay you to rest. Man up and stand up or shut up and lay down.

I also received a check for 2K. It was accompanied by the statement that I am free to pursue further restitution.

Have you read the original “Remediation Framework”? It’s at http://www.federalreserve.gov/consumerinfo/independent-foreclosure-review.htm

It includes correcting credit reports and rescinding completed foreclosures and approving “lost” modification loan applications. This is the remedy I need as I face eviction.

I admire you for what I read about your situation and how you’ve continued to stand up. Any thoughts you might have on how to exercise this “right” to seek further justice are greatly appreciated.

Cheri don’t give up. I have been going thru this for 4 years, and I will not give up. Their are programs out their to help you. Try legal Aid, Hope, The hardest hit program in your state.

Cheri try: flhardesthithelp.org or flhardesthit.org

This program is really good.

I have one Qestion to ask you before you burn that check, can Cheri if she don’t mind me asking you, can she have that check instead of you burning it.

Thank you.

@DanTheGray If it’s truly worth the check to you (I myself would think twice) we could certainly make that video go viral.

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make

your point. You clearly know what youre talking about, why

throw away your intelligence on just posting videos to

your weblog when you could be giving us something informative to read?

Again…I received a $300.00 check via Wells Fargo on a property that has NEVER had a mortgage or foreclosure!!!! This harm amount is correct…there was no litagation..because there WAS NO MORTGAGE !!!! The Foreclosed property that I lost…IFR has no record of it!!! On yesterday 6 phone calls later…Wells Fargo said that IFR made the mistake & the harm value was all of the Independent Foreclosure Reviews doing!!!!The bank is willing to write a statement that they gave IFR the correct file! IFR told me to keep the check! I told them I’m not cashing the check. I want my compensation for my foreclosed property; my harm was $50,000.00 according to the tier; I have my lawyer on standby; and the errors again that I constantly dealt with in my foreclosure showed up in my settlement!!! I truly can’t believe this!! The IFR was suppose to FIND ERRORS and they end up committing ERRORS!!!!! what kind of bull crap is this?????????????

You are so right! They have victimized us again. Is there any way to protest or demand corrections? I can’t find a lawyer who’s familiar enough with the IFR. Even the servicer’s attorney admitted in an email that he was not aware of an IFR. Right then, I felt safe because I believed the intended remedy would become reality and I could laugh in his face. OMG – I am so tired but I must save my home of 21+ yrs. I’m a senior citizen and am afraid I’ll end up homeless if I give any more money to lawyers who don’t know what they’re doing. Please help guide me in the right direction.

The original Remediation Framework was fair. You can download it from http://www.federalreserve.gov/consumerinfo/independent-foreclosure-review.htm

The Agreement, which replaced the Framework, has only harmed us even further. How can we fight for what is right? The original Framework was based on some sense of law, no? Therefore, we should have legal recourse to gain the fair remedy.

It seems the local lawyers know not much about the IFR.

i am another victim of wells fargo, those mother f**kers!!!! excuse my language!!!! they do nothing but scam everybody. my home went to auction after several attempts to modify and they actually rescinded the foreclosure and didn’t even notify me. i had to find out through a water bill from the city that i owned the home still. well i go inside the home and sure enough they never maintained the home. well guess what, i have 8 inched of water that has created mold to in entire basement and is now going up into the first floor of the house….i have been fighting with them since jan 16, 2013. i told them that they have to pay for the repairs and then i will think about modifying the loan. i don’t know what to do. the emotions along are all coming back…i cant believe this….oh yea they also verbally told me that a 27k check was in the mail for the wrong doing back on Jan 30, 2013 come to find out they sent the investor my check, then they told me that they should have never said anything to me about this money. i wonder if i have a legal case to fight for this money??? all i wanted was to pay my mortgage each month, however if they weren’t still charging me 8.3% interest each month then i would be glad to pay…..one other thing to note…..they have billed me since the auction that took place in July 2012 to date for the mortgage payment….i haven’t even lived in the home. they kicked me out. i am going to retain a lawyer in the upcoming weeks to get whatever i can get at this point…just to prove these fu***rs wrong…………wells fargo……………….GO F**K yourself

Tv you go get them. If your mortgage company is not the original holder of the mortgage they may not have the originated paper works. Many don’t know but banks and mortgage companies needs to have a paper trail. If they tell you to send them a copy of your closing, don’t do it because 9 out of 9 if they’re asking you to send in a copy of your closing contract they don’t probably have their paper work or owner of the property that you own. I learn that from my lawyer. If the property you own is still in your name and the new person that purchase the property then they probably don’t have the title to it. Get yourself a good good cheap lawyer, many of them are fighting for clients these days. Good luck.

Received a check for $2,000 last week. It’s now apparent that we were place in the wrong category. Should have been in the category “servicer failed to convert borrower to a permanent modification after 3 successful payments under a written trial-period.” I have documented proof that we were offered a “trial period” modification plus 6 cancelled checks for 6 successful payments (made in good faith) under modification program. Long story short, were never offered a permanent modification and our check should have been for $6,000 instead of 2k. Dupped again by Chase! We kept our end of the deal by making this payments. “Daniel” from Chase said all we had to 3 successful payments and it would be permanent. Does anybody know of a lawyer or lawsuit that could deal with Chase? To be honest, I would have been ok if they would have just put us in the right category and paid the 6k. They are still being deceptive!

it’s so sad the banks win again!!!!!

Tammy if you live in florida look up matt weidner law he is an expert and has a website and blog even if not in florida check him out he really is on top of these jackxxx banks I get his daily email alerts

Tammy also go to 4closurefraud.org

The people have gone through one of roughest times n America next to great depression. Our country needs to reestablish these homeowners in to a home. They need to develop a loan for people gone through this loss and hel erase/repair the credit mark. It is like a ealing process for people and for the economy. It needs not to take 4 years to develop and all other programs are flawed to some degree. Itis about caringfor the people. If the peope have successful home loan therefore the real estate,building market will be back on track. The settlement should be round one of benefits. It would not hurt to have insurance products mandatory on new loans-such as if you loose your job..your payment is picked up for 6 months to year,ill or someone dies the payment is covered.Its about designing a financial product that would not put millions f people in danger and not distroy our housing market. Come on law makers…if I can think up a product to protect people..surely you can do much better!

Jenny the Fed should’ve given the money to the home owners and small business folks. Those are the people that keep America going. I think that if the money was giving to home owners at lease two thirds of it towards of paying off the mortgage. If someone owes $300 on their mortgage the fed should offer the banks $200 to pay off the borrow home. If the banks don”t want to accept the payoff than the feds whick is the America people can refuse to capitalize them with more tarf money. The feds shouldn’t have only given the bank money to stablize the ecomoney, but they should’ve give the home buyers money to stablize their profit in their home.