Lambert here: Some damned foolish thing in the Balkans….

By Silvia Merler, an Affiliate Fellow at Bruegel. Originally publishd at Bruegel

It’s been a tense week in Bulgaria. Two bank runs occurred last week, with depositors withdrawing the equivalent of 10% and 20% of the assets held by two important national banks. An emergency line of 3.3bn Bulgarian levs (€1.7bn) was approved by the European Commission on Monday, and tensions in the country seem to have eased since then. The modalities and motives of this mini financial crisis are not entirely clear yet, but it seems to be deeply rooted in a long-standing domestic business and political feud.

It all started last week. After a run by depositors, the Bulgarian National Bank took control of the country’s fourth lender, Corporate Commercial Bank (KTB). The operations were frozen, the directors suspended and the bank put under special administration, in the attempt to stop what the Central Bank described as “an attempt to destabilise the state through an organised attack against Bulgarian banks”.

Two days later, the bank has been nationalised, but it was not enough. Tensions spilled over from KTB to First Investment Bank (FiB), an even bigger domestic bank. According to the Financial Times, depositors withdrew 800m lev (about $556m) on Friday from First Investment Bank, and funds appear to have been moved to the foreign-owned banks in the country.

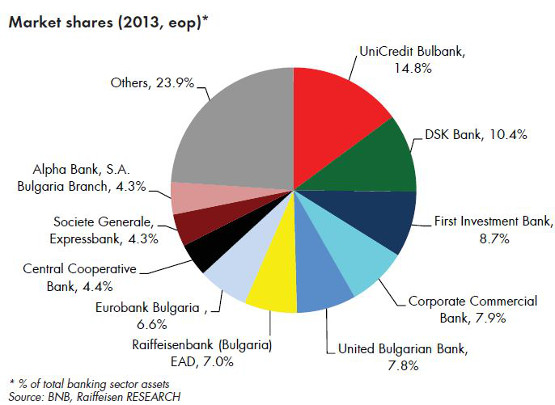

The Bulgarian banking system is in fact dominated by foreign lenders, especially Italian Unicredit, Hungarian DSK, Austrian Raiffeisen (figure 1).

Source: Wall Street Journal

The worsening of this situation triggered the introduction of a set of emergency measures by the Central Bank and the approval by the European Commission of a 3.3 billion levs (€ 1.7bn) credit line to ensure the necessary liquidity support to the banks. Sources quoted by the FT suggest that 1.3 Lev have already been raised on Monday through a special bond issue, mainly covered by foreign banks.

In its press release, the Commission stressed that that Bulgaria’s banking system is: “well capitalised and has high levels of liquidity compared to its peers in other member states”. So how and why were these two banks exposed to a run?

Concerning the “how”, the Bulgarian run is interesting because it basically shows how a bank run could look like in the tech and social networking era. Both the government and the central bank have in fact claimed that the run was ignited by a “cyber attack”, for which six people have already been arrested.

According to the Bulgarian National Security Agency (see here, for a reporting in English), an investment company that “built a network of associated companies for marketing services” that was used to diffuse panic by means of an alert, uncomfortably titled “Information Bulletin of on the Risk of Deposits in Bulgarian Banks”. The “bulletin” claimed – Bloomberg reports – KTB was undergoing a liquidity shortage. The message apparently also said that the government deposit guarantee fund was under-capitalised to meet possible repayments, that banks could go bankrupt and that the peg of the currency with the euro could be broken.

Allegedly, the alert was diffused by text, email and even Facebook messages, thus ensuring a very widespread outreach. In a country that in 1997 underwent a very serious banking crisis featuring all these characteristics – whose memory is still fresh – this was enough to spur panic.

Concerning the why, the story is extremely complicated. Different interests prevail according to different versions, making it quite difficult to reach a clear conclusion, but it certainly seems to have little to do with economics and a lot to do with politics.

KTB bank – the first to all in trouble last week – is the ultimate hotspot where business feuds, personal issues, corruption, political uncertainty, tensions with Russia and pressures from Bruxelles all come together into an explosive mix. KTB bank is known to have very strong and complex political connection. According to the Financial Times, 30% of KTB is controlled by Oman and a 10% by the Russian bank VTB. The largest shareholder owning a larger than 50% stake (which, incidentally, will be written off as a consequence of the state recapitalisation) is Tsvetan Vassilev, linked to the ruling party. Several sources, including New York Times and Financial Times attribute the bank run to the unfolding of a complicated “feud” between Tsvetan Vassilev and Delyan Peevski, another controversial prominent Bulgarian businessman owner of a media empire as well as Member of the Parliament.

The two fellows’ businesses appear to share a number of connections. The tycoon’s empire is in fact reportedly built on loans approved by the now-troubled KTB bank itself. At the same time, the successful expansion of KTB bank is partly due to the fact that the bank was able to attract an extremely large amount of deposits from state-controlled companies, offering at the same time exceptionally high interest rates on retail deposits.

This “business model” had caught government’s attention last year already, leading to a strong regulatory reaction. In May 2013, in fact, a law was approved according to which those companies in which the government had a stake of more than 50 per cent should diversify the allocation of their deposits, with a maximum of 25 per cent per bank.

Bulgarian news reports Prime Minister Marin Raykov as saying that in 2013 54 per cent of state-owned companies’ deposits were held by one bank. While Raykov declined to name the financial institution, the Sofia Globe argues that the most likely guess – and one widely made by Bulgarian media – is Corporate Commercial Bank (KTB).

Several analysts’ and news reports attribute the bank run and last week mini-crisis to the unfolding of a latent war between Peevski and Vassilev. In particular, the trigger of the crisis at KTB (controlled by Vassilev) has possibly been the withdrawal of a large amount of money by Peevski.

According to this version of the story, the money would have been moved exactly to FIB, which would have later come under pressure when allies of Vassilev retaliated by spreading rumours about its solidity. While these can be considered speculations, the relationship between the two businessmen is certainly not good now, and they repeatedly accused each other of various wrongdoings.

On top of the internal feud, the run comes at the end of a period during which political uncertainty has been mounting in Bulgaria. This is partly due to the fact that Bulgaria – which is a major transit route for Russian gas – has been caught in the crossfire between Russia and Europe over the country’s participation in South Stream.

The Prime Minister announced his resignation and the country will most likely see anticipated elections, while Standard & Poor’s cut Bulgaria’s sovereign rating to triple-B minus, citing political instability as the main concern. Such nervous and precarious political environment, coupled with the fact that Bulgaria is one of the countries most affected by corruption, offers little protections against the unfolding of business and political feuds like the one that appears to have been behind the bank run of last week.

Luckily, contagion seems to have been stopped before turning these embers could ignite a more serious fire.

This particular story rhymes quite a bit with what happened in Iceland. The feud between David Oddsson and Jon Asgeir Johannesson, the self dealing, the lure of high interest rates, etc. I’m curious to see how this plays out.

Bulgaria is Exhibit A on what is wrong with the EU project. One cannot write about Bulgaria without discussing the criminal state. It has had a long history of high level corruption. Rather than have Bulgaria clean up its act before joining the EU, national leaders like from Germany saw the despot country as a market to exploit. Germany exports Audi’s to the Bulgarian mafia like selling Bosch machine tools back home.

Our EU mercantilist nationalist leaders are losing their global influence because of their greedy, self-centered ways. Projecting global soft power via Mercedes or Renault just won’t hold up.

Despot country is rather hyperbolic. I agree with everything else you wrote.

Perhaps both Vassilev and Peevski are innocent of causing the run. Maybe they are convenient pawns exploited by a bigger ‘Invisible Hand’ in an attempt to deliberately destabilize Bulgaria. Why? To stop South Stream going ahead.

No need to assume obscure machinations; rather, it is a symptom of a banking system that is extremely fragile and goes into a tailspin at the slightest shock.

Apart from Bulgaria, have a look at what has been happening the last few months in Portugal with the group Espírito Santo: regulatory authorities in Portugal, Luxembourg and Angola have been uncovering huge holes in that financial group — a 1.3 B€ non-declared debt, then a hole ranging from 5.7 to 6.5 B$ in Angola, then a further 1.2 B€ hole in Portugal. After a series of similar problems with other banks, the Portuguese authorities have only 6 B€ left in their financial emergency fund…

In Austria, all major banks are writing off assets by the billions, and publishing huge losses. The exposure of Bank Austria and Raiffeisen in Ukraine, Erste in Romania and Hungary, and Volksbank in Romania and Russia will prove expensive for their shareholders — and probably for the Austrian taxpayers as well, like happened with Hypo Alpe Adria because of its dubious business in the Balkans (the bank was basically taken over by the Austrian State).

The European banking system is cracking again, and this is starting in smaller countries.

Got any links on that material? (I’m honestly not sure there has to a larger goal — for example, the south stream — here, other than looting. There are just so many crooks working at cross purposes I’m not sure there has to be an over-arching narrative. Rather like a rugby scrum, except without an actual rugby game, if you see what I mean.)

“And we are here as on a darkling plain Swept with confused alarms of struggle and flight, Where ignorant armies clash by night.”

Don’t pay taxes.

Tell your regime to go and PRINT rupees for its requirements/extravagance.

I have to agree with Yonatan’s suspicion as well.

This is about the South Stream.

This has very little to do with South Stream, rather it is a fight between two rival factions of the oligarcho-political mafia which has ran the country since 1990. Peevski is an MP for the ethnic Turk Movement for Rights and Freedom (MRF) and a media oligarch, Vassilev is a banker connected to the ruling Socialist Party (which is socialist in the way Milton Friedman was). The Socialist Party is the direct descendant of the Communist Party, and the MRF was created by the communists as a way to control the sizable ethnic Turk minority post-communism – it’s founder Ahmed Dogan was exposed as an agent for the feared communist State Security. Most other parties are more or less creatures of the communist secret services, whose basic aim was to ensure that the transition to “democracy” and “market economy” would not end the nomenclatura’s stranglehold on power and the wealth resulting from the corrupt exercise of that power. So for the past 24 years MRF has played a kingmaker in BG politics, as it has been needed as coalition partner in order to be able to form a government. When ot no longer sees a benefit from a given coalition it withdraws from it, bringing down the government in the process.

So history repeats itself again. The crisis was sparked in June of last year when the Socialists nominated Peevski to head one of the internal security organs, which sparked massive protests. His nomination was withdrawn, but we are now seeing the fallout of that kerfuffle. The protests did not end but continued through the entire year, making the coalition of the Socialists, MRF, and the ultra nationalist Ataka party untenable (only in Bulgaria would the nationalist and an ethnic minority form a coalition, anything goes to be in power). As the coalition has fallen apart, its oligarchs have began to fight for position, and this is basically what we are seeing now, with the added Balkan way of doing things: they have each accused the other of hiring hit men.

As far as the South Stream goes, at most we will see some subcontractors being replaced with others as the GERB party which will likely win the “elections” buys off MRF’s favor and gives some firms connected to MRF juicy parts of the pie. Yes, the breakdown accelerated after McCain’s mission to Bulgaria as MRF saw the socialists as incompetents whose missteps were threatening the South Stream gravy train, but make no mistake, the project will go on despite the Americans, there is too much money at stake and the Americans bring nothing to replace that money.

I forwarded this story on to Richard Smith, who studies “associated companies for marketing services,” and such like, and he said the spammers were these guys.

Dunno if these guys and their connections will help people dope out “the real story,” assuming there is one, but FWIW.

I have been catching up on what has been happening there. I can’t find the reports in English just yet, but several respected independent papers are reporting this weekend that on June 27-29 the former PM Boyko Borissov of GERB and representatives of the ethnic Turk MRF party, together with the Borissov-appointed governor of the Bulgarian National Bank, insisted that the Parliament declare a bank holiday beginning Monday, June 30, and invite the IMF in. This despite the insistence of private banks that they are well-capitalized and can weather a run, and that a bank holiday was a terrible idea that would only worsen the crisis. Only after a threat by the private banks to open as usual on Monday and go public about the political machinations of the GERB and MRF parties was the idea for a bank holiday and IMF involvement dropped, and the € 1.7bn credit line approved. On Monday the banks opened as normal and confidence was restored. So this was basically an attempt for a coup d’etat by Borissov and MRF, whose plan was to form an expert government in the wake of the bank holiday crisis rather than to wait for early elections in September or October. For those interested, this info is from http://www.capital.bg/biznes/finansi/2014/07/04/2337495_na_kosum_ot_izkustvena_katastrofa/ and http://www.banker.bg/?Channel=3&Category=77&Article=499412. It wouldn’t surprise me if the people linked to the bank run turn out to have ties to either GERB or MRF, but in Bulgaria such things are hardly ever investigated by the corrupt judiciary and it is unlikely to ever find out on whose behalf they acted.

It is interesting that in mid-June Borissov spent a week in Washngton, DC meeting with various NGOs, think thanks, and Congress critters, so who knows if this was his or theirs harebrained idea. Borissov, like any other notable BG politician, has extensive ties to organised crime in BG. Some of these ties have been discussed in diplomatic cables published by Wikileaks (http://wlcentral.org/node/1810). It appears Borissov may be switching his allegiances from his Russian to his American handlers, but one thing to keep in mind about organized political crime families in BG is that they have ties with both the West and the East, always jokeing for the most profitable position. Borissov is particularly good at this game.