Yves here. While the impetus for Steve Keen’s post is the ECB’s latest pretense that it can and is doing something to combat deflation, he provides an excellent and short debunking of two widespread misconceptions about money and banking. The first myth is the money multiplier and the second is that reserves are the basis for bank lending.

You’ve just made your morning coffee, and look up in horror as you realise that the gas burner has set your kitchen ablaze. So you take decisive action: you pour your coffee on the floor.

Such is the real impact of the European Central Bank’s latest attempt to revive the European economy, which cut rates a whopping 0.1 per cent (from 0.15 per cent to 0.05 per cent), and increased the negative interest rate imposed on bank reserve deposits from a huge -0.1 per cent to a gargantuan -0.2 per cent.

Forgive my sarcasm. But the mystery that should occur to everyone — and it probably does to most people who haven’t been given a £9000 lobotomy (as Aditya Chakrabortty recently described an economics degree) — is why an economist might think that such apparently trivial measures would have any impact on the disaster that is the eurozone economy.

Ah, but an economist can tell you why. It’s because of the ‘money multiplier’! This potent force will turn that allegorical puddle into a proverbial sea that will drown the flame of 25 per cent-plus unemployment in southern Europe.

The fable theory goes like this. Banks lend by taking money deposited by one customer (say €100), hanging on to a certain fraction of it (say 10 per cent, which is €10), which they add to their reserve assets. They then lend the rest (€90) out to another customer. That customer then spends that €90, and the people who get it put that in their own banks, who also hang on to 10 per cent (€9), and lend out the rest (€81). The process repeats indefinitely, at the end of which time the initial deposit of €100 has been turned into €1000 of new money and new spending along the way.

Seen from this viewpoint, the cause of the European crisis is obvious: banks aren’t doing their bit and lending on as much of their depositors’ funds as they could. Rather than hanging on to 10 per cent and lending out 90 per cent, they’re hanging on to say 25 per cent and lending out only 75 per cent. The consequences are less money, less spending, and more unemployment.

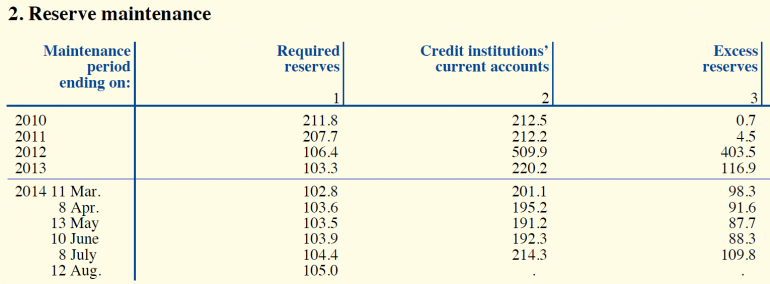

The evidence here is the amount of reserves that private banks are holding in excess of the amount they’re required to hold by law (see the third column in Figure 1).

Excess reserves were at trivial levels before the crisis (as small as €700 million), but shot up to more than €400 billion during the crisis. They’ve since fallen back, but are still more than 100 times as large as they were previously.

Figure 1: Private bank reserves in the eurozone

If only these excess reserves could be mobilised, just think of the economic activity they could generate! The required reserve ratio in the eurozone is just 1 per cent, which means private banks are required to hang on to just €1 in every €100 deposited. That means €110bn of excess reserves could generate as much as €10 trillion of new money — enough to blast the euro economy out of its doldrums.

But banks aren’t doing their bit. Instead, they’re just sitting on depositors’ funds and not lending them on, probably because they lack confidence to lend because they’re afraid their borrowers won’t be able to repay their debts.

So let’s prod these lazy banks to lend, by making it expensive to just sit on these funds. Let’s charge them to hang on to excess reserves. We tried a 0.1 per cent charge, and that wasn’t enough. Let’s double it!

There’s just one problem with this theory, in addition to the fact that a 0.2 per cent negative interest rate will cost the banks a mere €200m per year, which is chicken feed. It’s all bollocks, because banks can’t and don’t lend out reserves, and reserves don’t control how much they lend. To understand why, you’re going to have to suffer through some accounting.

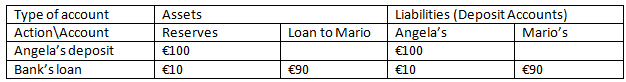

When a bank customer deposits cash at a bank, the bank records the payment as both an asset and a liability. The cash itself is an asset, but because you as a depositor can demand that the bank give the money back to you at any time, it is also a liability of the bank to you. Figure 2 shows how Deutsche Bank would record the transaction if a random depositor — let’s call her Angela — deposits €100 with it:

Figure 2: Angela makes a deposit

Notice that Deutsche Bank’s assets and liabilities both rise by the same amount. This is a basic accounting rule: all transactions must be balanced, otherwise you haven’t recorded the transactions properly. I’m showing this here by making a positive on both sides of the ledger: assets go up and so do liabilities. (I use a different sign convention in my Minsky software, for technical reasons.)

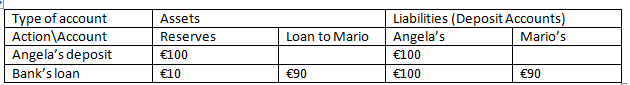

What if Deutsche Bank then tries to use Angela’s cash deposit to make a cash loan of €90 to Mario, which is what the ‘money multiplier’ model says banks do? If I stick to that accounting rule, then the model implies that the next stage of the process looks like Figure 3: the bank has ‘hung on’ to €10 of Angela’s deposit and lent out €90 to Mario.

Figure 3: The ‘money multiplier’ model of a bank making a loan

But there’s are two problems. Firstly, no money has been created: it’s just been shifted from Angela to Mario. Secondly, no one’s told Angela that her account has gone down by €90. In fact, this isn’t supposed to happen, according to the ‘money multiplier’ model: her account is supposed to still have €100 in it.

So what if we write that down here? Then we get the picture shown in Figure 4, which to borrow a phrase from a sometime correspondent of mine, is “all wrong”, because the row doesn’t balance. There’s €100 in assets but €190 in liabilities.

Figure 4: The uncorrected second stage in the ‘money multiplier’ model

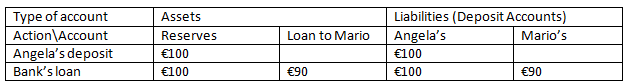

The correct story is shown in Figure 5. The bank just makes the loan to Mario by crediting his deposit account with €90 and showing the same amount as a loan in its assets. Its reserves don’t change, and they (and Angela’s deposit) are irrelevant to the operation.

Figure 5: The correct model of lending

I’ll say that again, this time quoting the Bank of England:

As with the relationship between deposits and loans, the relationship between reserves and loans typically operates in the reverse way to that described in some economics textbooks. Banks first decide how much to lend depending on the profitable lending opportunities available to them … It is these lending decisions that determine how many bank deposits are created by the banking system. The amount of bank deposits in turn influences how much central bank money banks want to hold in reserve …, which is then, in normal times, supplied on demand by the Bank of England.

To summarise the Bank of England — and to repeat myself — reserves are irrelevant to bank lending. They only exist so that one bank can settle its accounts with another, and banks keep these accounts as low as they can manage. So charging private banks a trivial interest rate on their trivial reserve accounts is about as effective at stimulating an economy as pouring your coffee on the floor is at stopping a kitchen fire. If this is the best that the ECB can manage, then Great Depression levels of unemployment in Europe will persist.

I’m not sure I understand this example. If Angela’s deposit into her bank account goes straight into reserves, and Mario’s loan is credited into his account with the bank, shouldn’t “Reserves” in the last figure be 190? Why is Angela’s account “reserves”, but not Mario’s? I understand that Keen’s overarching MMT point, but it’s clearly not the case that deposits = reserves, and this seems to be a confused way of making the point that loans are created by banks without reference to deposits/reserves.

Angela’s cash, deposited at the commercial bank, is a component of that bank’s “reserves” (the other component is the commercial bank’s deposits at the central bank).

Reserves are a liability of the central bank.

But the loan that the commercial bank granted to Mario is definitely not a liability of the central bank.

Thus, it can’t be part of “reserves”.

Keen’s accounting is correct: the bank now has 100 in reserves and 90 in loans, on the asset side of its balance sheet.

We do have some insight in negative interest rates…. the Danes tried it for a few years and caused the banks to absorb the losses because they refused to pass the costs onto the account holders.

Folks are hopefully beginning to see we here in the EU have a lot incompetence at many levels and not just with the ECB.

In some way we must become concordant with our ideologies. We lament constantly that the spoliation of natural resources will result in a human and planetary catastrophe. But economists and politicians and the public in general want growth, that is more spoliation, more pollution, more congestion. Austerity is the way towards some sort of ‘balance”. That austerity takes the form of economic phenomena, is just the manifestation of the importance of money which is the language between values. Austerity is a necessity but like all necessities it appears to be a drag.

Forced downshifting without any sort of stability and coordination while others absorb and consume the surplus produced and enjoy exhuberance is not the way to do it.

Is like asking third world countries to stop developing because “there aren’t enough resources”, we need a proper system of check and balances and redistribution to make it as fair as possible.

Except that growth is required to make payments on debt that can not be repaid in a normal sense. So the borrower borrows more to pay for what they consumed yesterday. This includes government and corporate borrowing. Steve Keen has computer models that show how this system crashes. I think he calls it Minsky. Also Chris Martenson has a video program called the Crash Course that also shows how exponential growth can not work in a finite system and how then end result is a total CRASH of the system.

Secondly there is a belief in the Capitalistic system that a corporation is either growing or dying. Which is true when it has more debt and expenses and promises than it can actually pay out of current revenues.

And YES to stabilize the earth so that mankind can survive in the future we need to stop the destruction of the environment and quit taking more from the seas and land than can be reasonably replaced by natural systems, YET that means not only austerity but a reduction in resource extraction and populations. Which is exactly the opposite of what corporations and governments need to do to survive their unsustainable inverted debt pyramids.

Interest is paid by turnover. It isn’t necessary to borrow more for the purpose of servicing the loan.

You may not need new money for interest to be paid, but you do need an increase in the velocity of money.

It is when your revenues are dropping or at best not growing. Especially when the debt is not used for value added productive activities but for bonuses and stock repurchasing.

That’s on a microeconomic level; in aggregate no, unless turnover has dropped precipitously.

Not on aggregate level when you take into account the “frictions” and leakages of the system (that is savings).

My layman understanding of the power of the multiplier is that the banker is able to make multiple loans with the same money, and then pick and choose whose debt to call in and who gets a free ride, or what debts get written off. “Money for nuthin'” if your buddy is a banker.

Please adjust my understanding if it is insufficient.

Banks don’t loan out the money that gets deposited by customers, when they loan the mark up somebody’s account. They create the money that is loaned rather than loaning the same money out repeatedly.

From another Layman’s perspective, all you really need to know is that Fed is utterly incompetent. They have little if any real control over the loans banks make into the real economy. Banks need qualified borrowers of suitable risk before they will loan out money. No matter how much gasoline the Fed pours on the fire, the amount of loans made into the real economy (and thus the velocity of money) will see little benefit. The Feds destruction of the “real” economy is why the velocity of money has been declining. The protection racket for the upper echelon of society has the nasty side-effect of obliterating the disposable income of a vast segment of the population.

If you want to understand the Fed’s gross incompetence, take a look at the non seasonally adjusted mortgage purchase application index (DOWN 12 percent year over year), and likely to get worse with this week’s rise in the 10-Year Treasury yields.

http://confoundedinterest.wordpress.com/2014/09/12/yellens-bad-hair-week-treasury-10y-yields-rise-almost-30-basis-points-since-august-28th/

Ex Nihilo Nihil Fit

Wake up!

As with the relationship between deposits and loans, the relationship between reserves and loans typically operates in the reverse way to that described in some economics textbooks

Why are those incorrect “economics textbooks” being used, and what is the point of teaching economics from those textbooks?

When a bank makes a loan, is it in essence a counterfeiter? This post makes the case that the answer is yes.

Can a bank lend itself counterfeited money and use that money to speculate in the equity markets?

The purpose of teaching from the incorrect textbooks is to promote the neoliberal program by keeping people ignorant of the power of fiat money, used wisely, to provide for the general welfare and prosperity of ALL citizens. Also, economists, especially the academics, don’t want to admit that they have been horribly wrong about so much for so long. Fortunately, there is a student-led movement to change the way economics is taught so that a wider range of economic theories, including heterodox theories, is presented.

In essence the economists are the useful idiots of Wall Street and the City of London.

In essence, economic theory is stuck thinking in terms of commodity (gold, jade, coral, etc) money.

Many of their theories hold up (to some degree at least, their marginal utility is a mess of hot air for instance) as long as the money is just another market commodity. But ever since Nixon nixed the USD’s convertibility, the world has been running on fiat.

A layman learns about Naked Economics:

http://www.bing.com/videos/search?q=american+dream+video+youtube&FORM=VIRE8#view=detail&mid=23390F4375F916E8E6B923390F4375F916E8E6B9

Except that they are not, because they have a license to operate as a bank.

And no, it can’t lend to itself. Two banks can however lend to each other.

This is basically what has been going on in the housing market for instance.

Bank 1 loans to the builder, bank 2 loans to buyer 1 enough to cover the builders loans and a bit of profit, that pays the builder, that pays bank 1. Then bank 1 loans buyer 2 enough to cover buyer 1 plus profit. And so the hot potato ponzi scheme gets under way.

One of the recent books that addresses economics as a cult and its teachings is:

Sack the Economists… and disband their departments by Geoff Davies

http://sacktheeconomists.com/

Thanks. Here is a sentiment dear to my heart and an excerpt from the introduction.

Well, I think it’s clear we can’t be too subtle. We need to speak in plain English, to everyone, and get straight to the point. Economists don’t know what they’re talking about. We should remove economists from positions of power and influence. Get them out of treasuries, central banks, media, universities, where ever they spread their baleful ignorance.

Economists don’t know how businesses work, they don’t know how financial markets work, they can’t begin to do elementary accounting, they don’t know where money comes from nor how banks work, they think private debt has no effect on the economy, their favourite theory is a laughably irrelevant abstraction and they never learnt that mathematics on its own is not science. They ignore well-known evidence that clearly contradicts their theories.

A great start is to fire every economist at every central bank. Having been taught garbage theories from “incorrect economics textbooks” makes them hazardous to our wealth.

Bank loans are not counterfeiting and they cannot make loans to themselves. Thry can secure financing from another bank.

After thinking about it, my apologies to actual counterfeiters. They actually work for their money, unlike banks.

Counterfeiters need the right paper and ink, a high end printing press, a space to operate, actual economic inputs to “create” money. The banks need to do nothing other than hit enter on a keyboard or screen to “create” money.

. . . they cannot make loans to themselves.

What prevents the banks from making loans to themselves? The law? We have seen repeatedly that banks couldn’t care less about law, unless someone is robbing them or misses a payment, then the law is sacrosanct.

They can secure financing from another bank.

Can two banks loan each other money to speculate in the equities market?

Counterfeiting is not an apt description of what the banks do. A counterfeit piece of money is made to look like the real thing, but if you hand it to a bank and they figure out it is counterfeit, then it is worth nothing.

With loans, the bank isn’t handing you a fake anything. They just tell you that if you spend the money they gave you, they will provide non-counterfeit money to cover your spending. And they always back up their promise. If they run out of non-counterfeit money, the fed will supply some to make up for what is missing.

The beauty of all of this is that most people don’t even want an actual non-counterfeit bill. They are perfectly happy to take the word of the bank that if they write a check on their account, all other banks will honor it. If the bank on which you write the check doesn’t have enough reserves with the fed to honor that check, the fed just changes the figures in the ledger to say that the bank does have the money. The fed may also make an entry in the ledger to say that the bank borrowed this money from the fed.

If people want to buy more than the economy can produce with all this created money, then prices rise because there is “too much money chasing too few goods”. Then it all balances out again. However, if people are satisfied to let this excess money sit in their bank accounts, then there is no excess demand. There may even be too little demand, if too much money sits in bank accounts without being spent. Then you get either no inflation or you get deflation. And it all miraculously balances out again.

And the problem with the current regime is that there is already more debt in the system than can be repaid. Plus the money that the FED created to *stabilize* the system has gone into speculation rather than lending to the consumer. This money caused the costs to the consumer to go up as it has fueled the unregulated greed in health care, insurance, energy and food production. So the consumer has less actual disposable income while those with access to the FED’s largess have more. Thus the system is again on the verge of instability and collapse.

So there has been to much money chasing the things that consumers need driving up their value and the cost to the consumers while there has been to little money actually in circulation. http://research.stlouisfed.org/fred2/series/M2V

Funny thing is that it can be repaid, just not all at once.

That is really the problem. If banks, rather than calling for all loans to be repaid right freaking now, would allow for loans to be paid down slower, there would be no crisis.

Hell, some banks seems to have looked the other way at missing payments because they know this.

“Funny thing is that it can be repaid, just not all at once.”

There’s a long history that suggests that this is not so.

The “magic of compound interest”, i.e., the myth of exponential exigencies. Austerity is the political restructuring of the social order, not an “economics” solution.

“A common denominator runs throughout recorded history: a rising proportion of debts cannot be paid. Adam Smith remarked that no government ever had repaid its debt, and today the same can be said of the overall volume of private-sector debt. One way or another, there will be defaults — unless debts are paid in an illusory fashion, simply by adding the interest charges onto the debt balance until the sums finally grow to so fictitious a magnitude that the illusion of viability has to be dropped.”

-Hudson, Michael,THE BUBBLE AND BEYOND

Here’s a link that may help put this reality in context;

http://www.usdebtclock.org/

Why hasn’t ‘austerity’ changed these trends?

At Smith’s time, the world was still largely commodity money. Hoard the commodity and the economy comes to a screeching halt.

The trick about repaying debt is that the turnover in the economy must happen faster than the interest rate pumps up the overall debt.

For this to happen, first and foremost people must be spending rather than hoarding.

The 2007/2008 recession happened because people stopped spending and started hoarding. Banks in particular by calling for loans to be paid “now” rather than over time.

This is pretty much the economic equivalent of a blood clot. and ended up causing a economic heart attack.

Problem is that at least in Europe, the central banks and politicians then tried to heal this heart attack by leeches and blood letting…

“too much money chasing too few goods”.

The problem I see with this simplistic ‘descriptor’ is proportionality or probably more precisely DIS-proportionality. Why don’t wages and salaries keep up or get some of that “too much money”?

“And it all miraculously balances out again.”

From my POV, this reads like a euphemism for “the rich get richer and the poor get poorer”. Seems like after every “re-balancing”, there’s a “new normal” social order and a larger number of “outcasts”.

The missing element from the discussion is the banks all want to get rid of their excess negative-interest-rate reserves (or in the case of the U.S. banks, negative “real-rate” reserves), and so they attempt to do so by buying financial assets from other banks with the excess reserves, spiraling financial asset prices ever higher in a perverted game of musical chairs, and pauperizing the middle class in the process. The only ways the excess reserves ever go away are 1) the central banks reverse policy and sell securities back to the banks, absorbing the reserves as payment, but likely crashing securities prices in the process, 2) depositors demand physical cash for their deposits (bank vault cash is part of bank reserves), though this only happens in a bank run scenario, or 3) banks make so many new loans that the excess reserves are now required reserves, though with so much bad debt already in existence banks have no interest today in adding to the pile, and even if they did the result would be massive inflation in whatever the borrowers were chasing. And not one person in ten thousand, and not one “economist” in 100, has a clue as to how the aspirations of the middle class to lead a better life are circling the drain due to both the ignorance and the criminality of the central banks and their commercial bank puppetmasters.

You can lead a horse to water but you can’t make him drink. Understanding the mechanics of how private banks make loans aside, as you load up the system with private debt both borrowers and lenders become more wary of taking on debt that both know can never be repaid. As the era of juicing demand with private debt draws to a close, we are about to see just how dysfunctional and impotent private banking is.

These tables are far from clear.

In table #5, it looks like there are €200 of reserves. Obviously, that is not the case. So how are we to interpret the “Bank’s loan” row? Plainly, it is not a sum, as the “Loan to Mario” column indicates. Things still don’t add up, I am afraid.

I hate these explanations of the multiplier effect. Because implied in all the blabber is a concept that it can go on forever. So very nutty. Keen isn’t doing this, I’m not criticizing him. I love the guy. But I’m criticizing the whole fantasy of money and the way it works. If this theory of a multiplier effect were ever to survive it would have to come back down to earth in equal measure – that is, not by “austerity” which just fucks the poor, but by a really cool “divider effect” whereby all that hubris (aka money) is given back to the source (people), which can then be tapped once again to juice up the whole silly thing. We live in such a half-baked world it’s a miracle we have survived this long.

Correct: according to the money multiplier banking systems without reserve requirements would have infinite reserves on hand which clearly is not the case.

sure it is. if you look beyond earth to the whole galaxy and other galaxies — and what a shocker that must have been for Professor Hubble back in the day, when he first realized, and people think Pascal had it bad? ha! — and out to the edges of the universe, whatever that means, the “edge” another mental disorder, “the edge”, then there are infinite reserves, in theory. But getting people to agree to work together to employ those states of potential, that’s another problem. The so-called “reserves” don’t even exist until they’re “observed” through cooperative transactions. So the infinity is in the capacity for observation through cooperation around some collective goal, and not in any a-prior state of being. It’s not Newtonian and never was, but that won’t stop them . . . QED from Magonia

Do economists know they’re peddling trash or are they true believers?

As a general thing they are true believers.

just read Krugman. He is a believer… For the most part I read that almost all western universities teach this brand of magical thinking and so the corporations and the government hire the PHDs from these magical thinking producers and we have what we have. The math doesn’t work, the models don’t work but the faithful still believe.

Thank you for this post and especially for the link to the BoE paper on money creation. As a layman one of the questions I had in reading this piece is why the US government needs a Fed/Primary Dealer network for its debt securities? My assumption is that it is primarily an interest rate management mechanism. But is it also an artifact of a bygone era?

I read this article carefully. I understand it, now. But the ideas are so slippery that I know I will have to come back and read it again. I keep trying to visualize the process so that it sticks permanently in my brain!

I’m a little late to this party, but this is bizarre double entry bookkeeping. When the bank makes a loan to Mario, the cash reserve account goes down 90. If the BoE gives the bank 90 more cash reserves, that’s fine. But that’s the government creating more reserves, not the bank.

***

The real transaction would look more like this:

Debit loans receivable 90 (an asset that goes up). Credit cash reserves 90 (an asset that goes down).

Here’s the key: there is no change to the amount of assets and liabilities. All that has changed is the nature of the assets. 100 cash reserves has been transformed into 10 cash and 90 receivables. If Mario is able to pay back the 90 plus some accounting profit, the bank makes money and continues its activities. If Mario is unable to do that, then the bank loses money and must cover those losses from other profitable activities. If the bank makes lots of bad bets, it goes out of business.

Or gets bailed out by the government who wants those bad bets to be made. If that happens, it’s not the bank making the money. It is the government making the money.

The entire point of double entry bookkeeping is that things must always balance. A bank can’t just create more reserves; it has to get them from somewhere, either private actors or the government.

http://www.quickmba.com/accounting/fin/double-entry/

washunate, I think you are correct, an equation must balance and leaving the original deposit balance unchanged after the loan is provided contradicts that, thus I dispute the accounting maths, which calls the whole basis of the article into question; however if the maths is ‘correct’ then the banks are 100% committing legalised fraud for every loan they provide and makes the reserve requirement a completely farcical illusion.

I think the currency and currency-like debt volume flow problem is caused by:

* Banks realising that that a lot of their ‘reserves’ are actually reducing in value, in real terms, especially state bonds, and may end up effectively worth-less, so could make the bank insolvent and/or bankrupt.

* Potential depositors are less likely to save fiat currency with banks because they have less currency free or the banks offer uncompetitive savings rates now!

* Banks trusting other Banks less to unwind inter-bank lending, even with central bank intermediation.

* Banks being more cautious about lending criteria, because they know that default (aka bankruptcy) is more likely for most people and businesses now.

* Some potential borrowers not even wanting to risk borrow at the interest rates banks are charging.

* Banks think they can make more gains by speculation than by providing loans to the public and businesses.

I think that fractional bank lending with compounding interest is at least mostly legalised fraud unless they have to compensate for the cost of spending by the borrower incurring the bank fractional reserve debt liabilities with other banks; in that is the case, some of the fraud moves to the fictional fractional reserve loans by the other banks to the loan bank.

I can accept that bank lending depends on each bank’s whole balance sheet, cost of funds and economic expectations and not on the level of statutory reserves. But surely, the high level of excess reserves must be a measure something: mostly I suspect it is a response to regulatory pressure to increase the level of capital in their balance sheet. Rather than issue new shares on unfavourable terms, the banks choose to shrink their lending.

We can either have safer banks, or banks which maximize GDP growth, but the ECB cannot have both at the present time. If Europe wants both growth and safe banks, the best chance is infrastructure investment that aims not only to provide jobs during the building phase but also genuinely to improve national productivity for a long time.

No, the Fed started paying interest on reserves. Keeping reserves idle is now a way to earn a meager return that is 100% safe.

And banks don’t need to carry loans on their balance sheets to lend. They securitize real estate loans, auto loans, student loans, car loans, and credit card receivables, and leveraged (private equity takeover related) loans. Who needs a balance sheet to lend? It’s just a place to park loans until you sell them into securities markets.

Not sure I understood your reply: we are looking at why Euro bank reserves went up in 2012 and have not fallen back to 2010 (i.e. early post-crisis) levels. I don’t believe that the explanation is that Euro banks were securitizing more in 2012 than in 2014. But suppose the bank has credit card receivables yielding 17%, that is a whole lot more than what the ECB pays; if they can securitize at 3% with a capped recourse, they can lock in a trading profit. But that 3% that they are giving up to investors is still decently more than negative rates. Fear is one possibility, but why should they be more fearful in 2014 than 2010/11 i.e. during the first Greek Government crisis? Banks are clearly doing something other than maximizing their profits here: I suspect they are following instructions to beautify their balance sheets, but this means that Europe is missing a non-bank, non-governmental source of new investment. The ECB can help by buying up existing portfolios of long term nonbank investors. But that on its own is not a sufficient cause of new enterprise.

What textbooks do is to take it that Mario had borrowed the $90 not to leave it in Deustch bank, but to spend it. The balance sheet then shows reserves failing by $90 along with deposits. How can reserves be irrelevant then?