By John Helmer, the longest continuously serving foreign correspondent in Russia, and the only western journalist to direct his own bureau independent of single national or commercial ties. Helmer has also been a professor of political science, and an advisor to government heads in Greece, the United States, and Asia. He is the first and only member of a US presidential administration (Jimmy Carter) to establish himself in Russia. Originally published at Dances with Bears

The International Monetary Fund (IMF) has agreed on a scheme of war financing for Ukraine. For the first time, according to Fund sources, the IMF is not only violating its loan repayment conditions, but also the purposes and safeguards of the IMF’s original charter.

IMF lending is barred for a member state in civil war or at war with another member state, or for military purposes, according to Article I of the Fund’s 1944-45 Articles of Agreement. This provides “confidence to members by making the general resources of the Fund temporarily available to them under adequate safeguards, thus providing them with opportunity to correct maladjustments in their balance of payments without resorting to measures destructive of national or international prosperity.”

To deter Russian and other country directors from voting last week against the IMF’s loan, and releasing their reasons in public, the IMF board has offered Russia the possibility of, though not the commitment to repayment for Gazprom’s gas deliveries, and the $3 billion Russian state bond which falls due in December.

On March 11 the IMF board agreed to approve an Extended Loan Facility (EFF) for Ukraine for a total of 13.4 billion Special Drawing Rights (SDR), currently equivalent to $17.5 billion. Here are the IMF papers spelling out the details.

The first tranche agreed for payment amounts to $4.6 billion, and was paid on Friday. According to the IMF, another $4.6 billion may be released in three instalments later in the year – in June, September, and December. At the same time, the Ukrainian government is obliged to repay the IMF $840.1 million in past-due loan amounts and charges.

The Fund’s managing director Christine Lagarde (lead image) did not claim in her press release that this is new money. Instead, she said the IMF is making a “change in the IMF-supported program from Stand-By Arrangement [SBA] to Extended Arrangement under the EFF, which is consistent with the more protracted nature of Ukraine’s balance-of-payment needs.” Lagarde also claimed the loan’s purpose is to “support immediate economic stabilization in Ukraine and a set of deep and wide-ranging policy reforms aimed at restoring robust growth.”

Lagarde implied this money is not for continuing the war in the Donbass, but counts on the February ceasefire becoming a permanent armistice. The EFF loan, she said, “involves risks, notably those stemming from the conflict in the east of the country. I am heartened that the ceasefire agreed last month in Minsk seems to be largely holding for now.”

The loan papers don’t say the IMF will stop paying if it doesn’t. Instead, the Fund is saying it will supply cash so long as the war doesn’t exceed the present level of violence, and doesn’t break out of the line of contact towards Odessa in the south, Kharkov in the north, or Kiev. According to Thanos Arvanitis, a deputy director of the Fund’s European Department, “an essential assumption for the [EFF] program is the non-intensification of the conflict. So what we have assumed both for the macro framework and…the growth for 2015 and beyond, is that the ceasefire agreement holds, that the flare-ups that we have seen in recent periods do not repeat themselves and we think that with this the economy not affected directly by the conflict can start being delinked from the conflict.”

The EFF is scheduled for disbursement over four years, with repayment stretched out until 2028. It substitutes for the Stand-By Agreement (SBA), the first Ukrainian loan the IMF board agreed to in April of 2014, six weeks after the ouster of President Victor Yanukovich. That loan for 11 billion SDRs ($17.1 billion) was signed for a two-year term. Payout was suspended in October of 2014, after two tranches of $4.5 billion had been paid. Repayment had been scheduled until 2019.

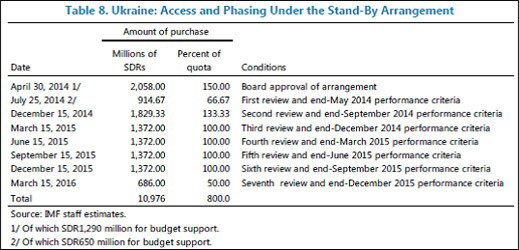

Here is the original schedule for the SBA:

Source: http://www.imf.org/external/pubs/ft/scr/2014/cr14106.pdf at page 80

Counting until last week, the IMF had refused to hand over $5 billion of last year’s loan. The IMF Staff Report, just released, claims this wasn’t money withheld because the Kiev government had failed to meet the borrowing conditions, spending limits, and performance targets, but simply because “the funds were not purchased” (page 33). That’s outcome, not explanation.

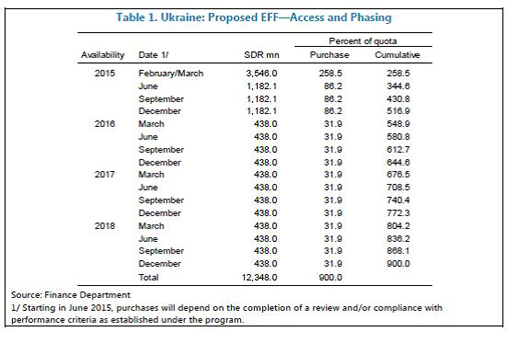

Here is the new EFF loan schedule:

Source: http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf

In the new IMF accounting, the Fund claims the EFF will provide $5.8 billion more than the abandoned SBA. In the old IMF accounting this is much less: subtracting the new EFF total from the old SBA total makes 1.372 billion SDRs, or $1.8 billion.

In practice, by extending loan disbursement from March 2016 until December 2018, and by handing out just $4.6 billion to start with, the IMF is cutting back on last year’s promised exposure to the government in Kiev. The board is also reserving the opportunity to cancel the loan a second time, and bring repayments forward. The first tranche is substantially less than the “front-loading” requested by the US minister of Ukrainian finance, Natalie Jaresko.

Take a magnifying glass to the tables titled “Ukraine Capacity to Repay Indicators” in last year’s SBA, and in this month’s EFF: it can be seen the newly scheduled repayments to the IMF are significantly larger from now until 2019 in the new scheme than they were in the old one, and of course they go on for much longer – another decade in fact. . For comparison, go to the SBA document, “Assessment of the Risks to the Fund and the Fund’s Liquidity Position”, page 10; for the EFF document, open this link, and go to the similarly titled document, page 13.

Take a magnifying glass to the tables titled “Ukraine Capacity to Repay Indicators” in last year’s SBA, and in this month’s EFF: it can be seen the newly scheduled repayments to the IMF are significantly larger from now until 2019 in the new scheme than they were in the old one, and of course they go on for much longer – another decade in fact. . For comparison, go to the SBA document, “Assessment of the Risks to the Fund and the Fund’s Liquidity Position”, page 10; for the EFF document, open this link, and go to the similarly titled document, page 13.

At the IMF Andrew Tweedie (below left) and Mark Flanagan (centre) are responsible for drafting this sleight of hand; Nikolai Gueorguiev (right), a former Bulgarian finance ministry official, has been in charge of negotiating the terms with the government in Kiev. In 2008 Flanagan was much more sceptical in his assessment of Ukrainian government accountability and capacity to repay much smaller liabilities than is plain today.

This trio is now making the IMF loan look less onerous for the Ukrainian economy by projecting faster recovery of GDP and exports than they thought was reasonable a year ago; and also by anticipating that other forms of debt relief, including grants, subsidies, and low-cost loans from the US and European Union will reduce the proportion of Ukrainian debt owed to the IMF.

This trio is now making the IMF loan look less onerous for the Ukrainian economy by projecting faster recovery of GDP and exports than they thought was reasonable a year ago; and also by anticipating that other forms of debt relief, including grants, subsidies, and low-cost loans from the US and European Union will reduce the proportion of Ukrainian debt owed to the IMF.

That’s guesswork. It didn’t work in 2014 — because of the war in the east. As Lagarde’s reference to the ceasefire implies, and the EFF papers now confirm, if the war continues, the government in Kiev will be unable to repay; the IMF board’s loan conditions will falter; and disbursement of the EFF cash will stop, just as the SBA cashflow did from last October. So what calculation is the IMF making of the military costs and the war’s impact on what the IMF is calling the Ukraine’s fiscal balance?

There are 163 pages in the dossier released by the IMF to demonstrate that the new loan to Ukraine meets the Fund’s charter, lending conditions, and criteria for repayment. The term “war” appears only once, referring to “war-induced supply shocks”; the terms “defence” and “army”, not at all. Referring to military spending by the government, the IMF dossier acknowledges the “risks to the outlook are exceptionally high and predominantly on the downside. Fighting in the East may resume and spread. This would unravel confidence, increase the direct loss of economic and export capacity while military spending may rise sharply.” This is an admission that the war is what the IMF charter labels “measures destructive of national or international prosperity.”

As for government expenditure, the IMF staff report claims “the budget continues to provide pensions to all pensioners who relocate from the ATO regions, but does not assume any fiscal revenue from or spending to the areas of active conflict in the East, except military spending which has been increased.” The IMF doesn’t say by how much, or to what value. The acronym ATO which the IMF staff uses stands for “anti-terrorism operation” – it is Kiev’s term (and justification) for the civil war.

Budget targets which the IMF has agreed with the government include “maintaining the nominal wage bill at 2014 level (except for military personnel)” and “as a result of these bold but necessary actions, and the optimization of staff in budgetary institutions, the wage bill of the budgetary sector (excluding the military) is maintained at the 2014 level.” Again, the IMF places military pensions and wages for active military personnel below the budget line.

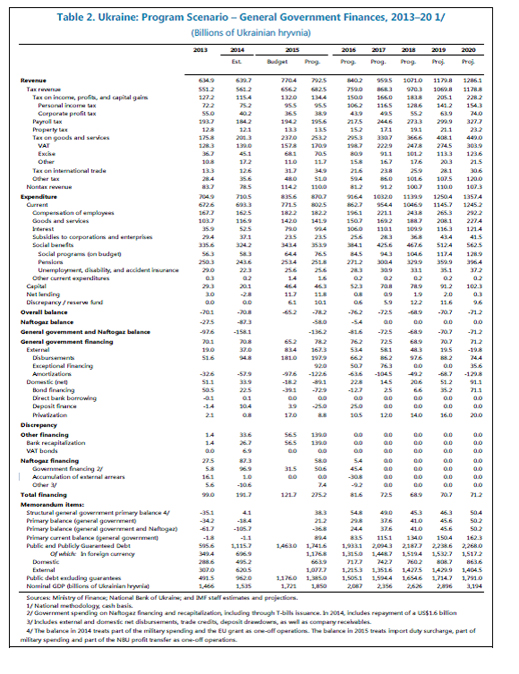

Then there is this table, which requires a magnifying glass:

Click to enlarge

Source: http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf at page 48

Look again at footnote 4: “The balance in 2014 treats part of the military spending and the EU grant as one-off operations. The balance in 2015 treats import duty surcharge, part of military spending and part of the NBU profit transfer as one-off operations.”

This reveals that past and future spending on the war and the rearmament programme President Petro Poroshenko announced last week are “one-offs”, below the budget line, and not counted by the IMF in the conditions it has set for the release of the scheduled instalments. Since budget funds are fungible, and since the Ukrainian government and Verkhovna Rada (parliament) have agreed to increase military spending substantially, the IMF was asked to say why it is contributing to the war risks by allowing EFF support for military budget outlays at the same time as it is concealing their magnitude in reporting to the IMF board.

Olga Stankova (right), the Fund’s spokesman on Ukraine, was asked to clarify the meaning of the EFF documents, and to say if the IMF has exempted military spending from conditionality and targeting, and is also keeping the value of that spending undisclosed. Stankova replied: “All military and security spending is included in the budget and relevant performance criteria under the program.”

Olga Stankova (right), the Fund’s spokesman on Ukraine, was asked to clarify the meaning of the EFF documents, and to say if the IMF has exempted military spending from conditionality and targeting, and is also keeping the value of that spending undisclosed. Stankova replied: “All military and security spending is included in the budget and relevant performance criteria under the program.”

This is evasive, sources close to the Fund board concede. Several country directorates at the Fund in Washington are known to have expressed their concerns to Lagarde. Press leaks from the French directorate have accused Lagarde and her staff of “whitewashing” the risks and costs of the war.

A Russian central banker who has served at the IMF comments: “the Fund should not place military spending below the line. But if you try to nail the Fund down on that, you would be wasting your time. The Fund has internationally-renowned expertise in doublespeak and hypocrisy. What the Fund is doing around Ukraine was at first laughable; now has become outrageous. No matter what, the Fund will keep financing the civil war in Donbass because the Americans want the fighting to continue and spread. Period.”

For the time being, the Russian Finance Ministry is not demurring. Finance Minister Anton Siluanov (right) followed Lagarde’s announcement of board approval for the EFF with this confirmation that Russia will contribute its share to the loan. “The [EFF] program will be financed via the IMF quota resources, and the funding from shareholder countries in the framework of their participation in the so-called New Borrowing arrangements. As such, the Russian Federation will participate in the funding in accordance with its obligations as a participant, and deliver the first tranche of the IMF program for Ukraine in the amount of $13.75 million dollars. The Bank of Russia will carry out the payment on 13 March 2015.”

For the time being, the Russian Finance Ministry is not demurring. Finance Minister Anton Siluanov (right) followed Lagarde’s announcement of board approval for the EFF with this confirmation that Russia will contribute its share to the loan. “The [EFF] program will be financed via the IMF quota resources, and the funding from shareholder countries in the framework of their participation in the so-called New Borrowing arrangements. As such, the Russian Federation will participate in the funding in accordance with its obligations as a participant, and deliver the first tranche of the IMF program for Ukraine in the amount of $13.75 million dollars. The Bank of Russia will carry out the payment on 13 March 2015.”

Although the Obama Administration claims it will not deliver lethal military equipment, it has been offering loans, repayment guarantees, and cash support for Ukrainian military agencies to buy it through third countries. Russian analysts call this a takeover by the Pentagon of the Ukrainian defence budget. Details of the line items totalling UAH 85 billion (about $4 billion) approved this month by the Verkhovna Rada can be read here.

International bankers say they cannot think of a precedent in which the treasury of a country at war finances a defeated opponent to renew the fight. Siluanov hints his reason is tactical. Moscow will not call a default of covenants in the December 2013 bond for $3 billion, he says, if Kiev agrees to exclude this debt from its restructuring of other bond obligations, and repays the Russian debt at maturity this coming December.

American advocates of Ukrainian repudiation of the Russian bond include George Soros, who made his pitch in January. Click to read. An analysis by Anna Gelpern (right) for the Peterson Institute of International Economics in Washington, argues that the UK should add to its sanctions on Russia by barring enforcement in the UK courts if Kiev refuses to redeem the Russian bond. The institute’s research on Ukraine is funded by the Dniepropetrovsk oligarch, Victor Pinchuk. “Ukraine would then have the option to walk away from this debt,” claims Gelpern, “without the usual legal and market consequences of repudiation. Such debt sanctions would reinforce the financial, energy, and trade sanctions under way, and by themselves would represent an appropriately targeted response to the conflict.”

American advocates of Ukrainian repudiation of the Russian bond include George Soros, who made his pitch in January. Click to read. An analysis by Anna Gelpern (right) for the Peterson Institute of International Economics in Washington, argues that the UK should add to its sanctions on Russia by barring enforcement in the UK courts if Kiev refuses to redeem the Russian bond. The institute’s research on Ukraine is funded by the Dniepropetrovsk oligarch, Victor Pinchuk. “Ukraine would then have the option to walk away from this debt,” claims Gelpern, “without the usual legal and market consequences of repudiation. Such debt sanctions would reinforce the financial, energy, and trade sanctions under way, and by themselves would represent an appropriately targeted response to the conflict.”

A year ago, Sergei Storchak, the deputy finance minister in charge of Russia’s participation in the IMF, acknowledged there was a risk of a Ukrainian default on the Russian bond. “We probably have risks, but not so big ones. It’s possible to begin with the fact that the debtor has a difficult financial situation, that it can’t return the money to us in two years [December 2015].” Storchak added that while the option existed for substituting one bond instrument for another, he was opposed to including Ukraine’s debt to Russia in a general restructuring. “This wouldn’t be right. I think that our bond demands won’t be part of the package. If we will decide, then it will be on a bilateral basis.”

Right now Storchak won’t say what the Kremlin will do if the Russian backing for the IMF loan doesn’t eventuate in bond redemption. A spokesman for Storchak (right) said Friday: “we have received many requests related to this subject. If we get the [official’s] answer, we will send it to you.” There has been none. A Russian finance ministry source denies that Storchak has gone soft on Lagarde. He concedes the IMF programme is a tactic the Finance Ministry has persuaded the Kremlin to accept in order to preserve the possibility of getting Gazprom and bond repayments out of the flow of funds the IMF is underwriting. Currently, the IMF estimates the outstanding Ukrainian debt to Gazprom through 2014 at $6.6 billion. For 2015 the IMF is projecting a Gazprom debt of $6 billion, dropping off slightly for two years, then rising to $6.1 billion in 2019 and again in 2020.

Right now Storchak won’t say what the Kremlin will do if the Russian backing for the IMF loan doesn’t eventuate in bond redemption. A spokesman for Storchak (right) said Friday: “we have received many requests related to this subject. If we get the [official’s] answer, we will send it to you.” There has been none. A Russian finance ministry source denies that Storchak has gone soft on Lagarde. He concedes the IMF programme is a tactic the Finance Ministry has persuaded the Kremlin to accept in order to preserve the possibility of getting Gazprom and bond repayments out of the flow of funds the IMF is underwriting. Currently, the IMF estimates the outstanding Ukrainian debt to Gazprom through 2014 at $6.6 billion. For 2015 the IMF is projecting a Gazprom debt of $6 billion, dropping off slightly for two years, then rising to $6.1 billion in 2019 and again in 2020.

“As for the Russia’s stance regarding the EFF,” a Moscow source close to the central bank says, “the disbursements under this program, paradoxically, create for Russia a slight chance of getting paid either for gas supplies or on the Eurobonds. The Ukrainians did not budget for the repayment on the bonds. Soros reportedly told them to renege on the ‘Russian bond’ at the first opportunity, and there are Ukrainian officials who no doubt want to do so, with relish.”

If the Russian bond stands a chance of repayment on time, the US bond investor Franklin Templeton has next to none, according to the EFF papers. It is likely to face an extension of maturity date, deferral of coupon payments, and a reduction of the principal to be redeemed (haircut). For the story of how Franklin Templeton’s California’s bond trader lobbied for a US Government guarantee that he would get $8.8 billion at maturity for bonds he paid $4 billion to acquire, read this.

The Franklin Templeton bond holdings appear to represent about half of the $17.3 billion in Ukrainian sovereign bonds outstanding. According to the IMF staff report, the “debt operation [haircut] would be guided by the following program objectives: (i) generate about US$15 billion in financing [that’s debt relief] during the program period; (ii) bring the public and publicly guaranteed debt/GDP ratio below 71 percent of GDP by 2020; and (iii) keep the budget’s gross financing needs at an average of 10 percent of GDP (maximum of 12 percent of GDP annually) in 2019–2025.”

Last week Lagarde tried obfuscating the haircut operation by claiming: “the Ukrainian government has taken actions toward consultations with the holders of their public sector debt with a view to improving medium-term sustainability.” The staff report concedes the Americans may want their war cake, and eat their bonds too. “Creditor participation in the debt operation may fall short of expectations. Creditors may balk at the terms being offered in the debt operation and holdouts may try to free ride. The negotiations may be protracted, particularly as some creditors have large positions in specific bond issues. At the same time, Ukraine’s continued capacity to service its debts would be contingent on a successful debt operation that ensured sufficient program financing and restored debt sustainability with high probability, and this should help encourage participation.”*

*http://www.imf.org/external/pubs/ft/scr/2015/cr1569.pdf (page 15)

Franklin Templeton has hired Blackstone Advisory Partners to fight the haircut and block a separate Russian bond deal. The advisory unit is headed by Martin Alderson Smith in New York (below, left). The Blackstone Group has avoided operating a regulated office in Moscow, engaging a consultant instead. Until last September that was Dmitry Kushaev (centre). Blackstone’s founder and chief executive, Stephen Schwarzman (right), is keeping his seat at the Russia Direct Investment Fund, a Kremlin investment vehicle, but he is shy about mentioning it.

Finance Minister Jaresko is showing embarrassment at providing favour for the Pentagon’s arms, but not for Franklin Templeton’s bonds. She told a creditor conference last week that the Russian government would not be paid off separately. “We invite the holders of the Russian bonds, as well as all of our other eurobonds to participate in this process on the basis of transparency, good faith and inter-creditor equity. ” If she and Franklin Templeton make common cause against the Russian bond, the Kremlin will have to rethink its backing for the IMF loan.

Finance Minister Jaresko is showing embarrassment at providing favour for the Pentagon’s arms, but not for Franklin Templeton’s bonds. She told a creditor conference last week that the Russian government would not be paid off separately. “We invite the holders of the Russian bonds, as well as all of our other eurobonds to participate in this process on the basis of transparency, good faith and inter-creditor equity. ” If she and Franklin Templeton make common cause against the Russian bond, the Kremlin will have to rethink its backing for the IMF loan.

“International bankers say they cannot think of a precedent in which the treasury of a country at war finances a defeated opponent to renew the fight. Siluanov hints his reason is tactical. Moscow will not call a default of covenants in the December 2013 bond for $3 billion, he says, if Kiev agrees to exclude this debt from its restructuring of other bond obligations, and repays the Russian debt at maturity this coming December.”

Amazing Russia would give it’s approval and fund IMF loan to Kiev (even if Russia’s share is a tiny $13 million). Also hard to believe Russia thinks this will also help in getting it’s $3 billion back.

On the other hand, maybe Russia is smart if it feels giving IMF loan to Kiev will help kill off Kiev govt sooner than otherwise since IMF loans make matters worse not better for those getting the loans. Yet that too is risky because those who come to power if the current freaks in Kiev are thrown out could be worse on all fronts.

I fail to see any way what so ever that Russia benefits from this even if it does get the 3 billion paid (which it won’t and Putin has been perfectly aware of what real intentions are before this). How much does it cost to rebuild a society from nuclear holocaust and how would that stack up against 3 billion?

Possibly Putin is simply being practical in a totally insane upside down inside out sort of way since he has no real means of shutting this escalation down. If all out war is inevitable, might as well get some money before you’re vaporized, along with everyone else, eh?

I get what the poster is saying. The IMF is going to antagonize the residents of Ukraine with it’s payback plans of the loan with austerity and as a result Ukrainians will want to realign themselves with Russia.

It’s kind of the idea that the US, is the US’s worst enemy.

Meanwhile Putin has made it clear that he is willing to use nukes if the situation in Ukraine escalates and it looks like his interests in Crimea will be threatened.

Our country is governed by reckless idiots who seem to think nothing about putting others at risk so they can profit.

It looks like we’re itching for WWIII

“Our country is governed by reckless idiots who seem to think nothing about putting others at risk so they can profit. It looks like we’re itching for WWIII.”

Yes. And when you read Paul Craig Roberts describing Ronald Reagan’s hand written note to the Soviets that he will always respect their honor and not expect them to do things fundamentally against their own interests and how Reagan sincerely believed in de-escalating nuclear war (true or not that is PCR take), you realize how far our current leaders have moved the goal posts and descended into insanity.

P.S. I worked the gamer event your daughter attended in Boston. It seemed a younger, sort of “hipster” crowd into video gaming

LOL She’d be appalled to be labeled a hipster. She is youngster though, just turned 21 this year. Three of my four are big into gaming and have been since primary school. I still remember the oldest begging for a Gameboy back in the mid 90s(He was a bit jealous that his sister got tickets to this event.) I think they had every single incarnation of a personal gaming system since then. *shrugs* I’ll have to admit I don’t really get the big technology draw.

Yippee WWIII !!! We’re all gonna die. Or do we go bankrupt first. I’ll go check the Death by Neo-liberalism website. They will know the order of things.

LOL and please lets us know what the site says. I might want to cancel some future plans and buy whiskey instead.

‘IMF lending is barred for a member state in civil war or at war with another member state, or for military purposes.’

Sure, just as the NATO treaty describes a defensive alliance, with no provision whatsoever for ‘out of area’ operations in non-member states (e.g., Kosovo, Afghanistan, etc.) No use suing for enforcement: as mere taxpayers and citizens, you and I have no standing.

Not only is the US constitution a dead letter, so are treaties. The rule of law disappeared about the same time cathode ray tubes did. Together, the iMFers and NATO (with indispensable help from the usual neocon suspects) are engineering a train wreck in Ukraine that may yet reach Iraqi proportions.

Is there still time for me to get in the kickstarter project with Lockheed and Boeing?

The IMF is nothing but an enforcement tool for finance – capitalist world-domination , and the collection agency for their global extortion rackets. WHY ? would anyone expect them to hold to their own rules? The bankers empire does not obey laws.

How about corruption-controls? IMF-personell at sites checking disbursements?

Corruption resides in the walls of society. It doesn´t disappear with one man fleeing the country.

Very strange indeed that people in Europe directly pays for the war without really knowing(as IMF-members)

When willl ms-media pick this up? Not to mention the violation of the IMF-charter! I guess Obama´s tight relations with Lagarde could be a key here.

I suppose the delectable Ms Lagarde will be looking for a new job soon. This throwing away of the rule book is a clear sign of the end game.

I think she would be better employed on the catwalk as a model for older womens’ fashions. There is something about her that makes men look.