Lambert here: Sounds like a capital strike, to me, but what would I know?

By Aqib Aslam, Economist, Research Department, IMF, Samya Beidas-Strom, Senior Economist, Research Department, IMF, Daniel Leigh, Economist in the Research Department, IMF, Seok Gil Park, Economist in the Research Department, IMF, and Hui Tong, Economist in the Research Department, IMF. Originally published at VoxEU.

The debate continues on why businesses aren’t investing more in machinery, equipment, and plants. In advanced economies, business investment – the largest component of private investment – has contracted much more since the global financial crisis than after historical recessions. There are worrying signs that this has contributed to the erosion of long-term economic growth.

Getting the diagnosis right is critical for devising policies to encourage firms to invest more. If low investment is mainly a symptom of a weak economic environment – with firms responding to weak sales as some suggest1 – then calls for expanding overall economic activity could be justified.2 If, on the other hand, if special impediments are mainly to blame, – such as policy uncertainty or financial sector weaknesses, as others suggest (European Investment Bank 2013, and Buti and Mohl 2014, for example), – then these must be removed before investment can rise.

Weak Economic Activity Key Factor

Our analysis in chapter 4 of the IMF’s April 2015 World Economic Outlook suggests that the weak economic environment is the overriding factor holding back business investment.

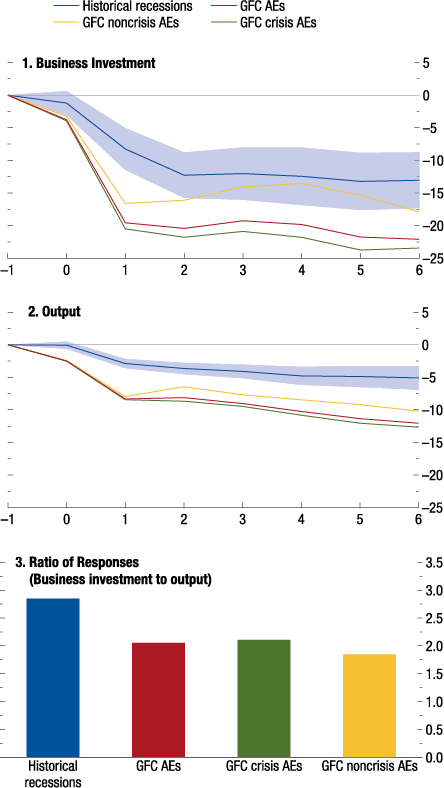

Investment contracted more severely following the global financial crisis than in historical recessions, but the contraction in output was also much more severe (Figure 1). The joint behavior of business investment and output has therefore not been unusual. The relative response of investment was, overall, two to three times greater than that of output in previous recessions, and this relative response was similar in the current context. If anything, investment dipped slightly less relative to the output contraction than in previous recessions.

Figure 1. Real business investment and output relative to forecasts: Historical recessions versus Global Financial Crisis (Percent deviation from forecasts in the year of recession, unless noted otherwise; years on x-axis, unless noted otherwise)

Sources: Consensus Economics; Haver Analytics; national authorities; and IMF staff

estimates.

Note: For historical recessions, t = 0 is the year of recession. Deviations from historical recessions (1990–2002) are relative to spring forecasts in the year of the recession. Recessions are as identified in Claessens, Kose, and Terrones 2012. For the global financial crisis (GFC), t = 0 is 2008. Deviations are relative to precrisis (spring 2007) forecasts. Shaded areas denote 90 percent confidence intervals. Panels 1 and 2 present data for the advanced economies (AEs). GFC crisis and noncrisis advanced economies are as identified in Laeven and Valencia 2012.

At the same time, the endogenous nature of investment and output – that is, the simultaneous feedback from output to investment and then back to output – complicates the interpretation of these results. To correct for this endogeneity, we use an instrumental variables approach and estimate the historical relationship between investment and output based on macroeconomic fluctuations not triggered by a contraction in business investment. Our instruments are changes in fiscal policy motivated primarily by the desire to reduce the budget deficit and not by a response to the current or prospective state of the economy (Devries and others,et al 2011). We use the results to predict the contraction in investment that would have been expected to occur after 2007 based on the observed contraction in output. We then compare the predicted decline in investment after 2007 with the actual decline in investment.

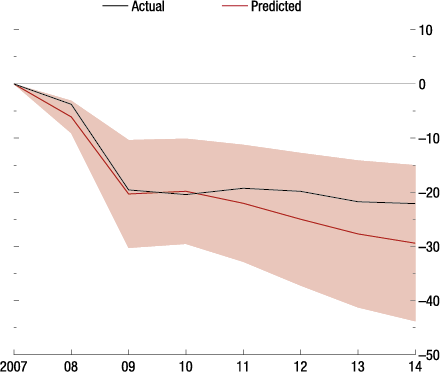

Based on this estimated historical investment-output relation, business investment has deviated little from what could be expected given the weakness in economic activity (Figure 2). In other words, firms have reacted to weak sales – both current and prospective – by reducing capital spending. Indeed, in surveys, businesses typically report lack of customer demand as the dominant challenge they face.

Figure 2. Real business investment in advanced economies: Actual and predicted based on economic activity (Percent deviation of investment from spring 2007 forecasts)

Sources: Consensus Economics; Haver Analytics; national authorities; and IMF staff estimates.

Note: Prediction based on historical investment-output relation and postcrisis decline in output relative to precrisis forecasts. Shaded areas denote 90 percent confidence intervals.

Factors Beyond Output

Beyond this general pattern, we find a few cases of investment weakness that go beyond what can be explained by output – particularly in Eurozone countries with high borrowing spreads during the 2010-2011 sovereign debt crisis. After controlling for financial constraints and policy uncertainty, the degree of unexplained investment weakness declines for these economies, suggesting a role for these factors beyond the weakness in output. At the same time, identifying the effect of these factors is challenging based on macroeconomic data, particularly given the limited number of observations for each country since the crisis.

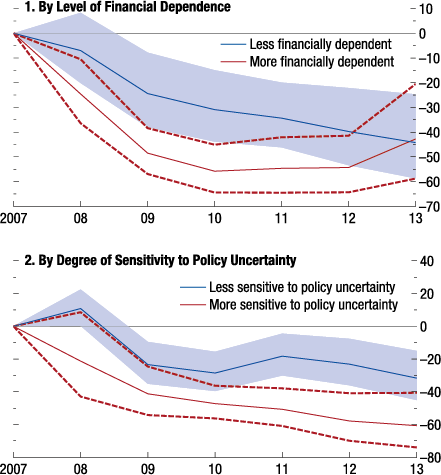

Confirmation of these additional factors at play comes from our analysis of investment decisions by different types of firms. Investment by firms in sectors that rely more on external funds (such as machinery producers) has fallen more since the crisis than investment by other types of firms. And firms whose stock prices typically respond more to measures of aggregate uncertainty have cut back more on investment – even after the role of weak sales is accounted for. This suggests that, given the irreversible and lumpy nature of some investment projects, uncertainty has played a role in discouraging business investment.

Figure 3 provides a simple illustration of this finding by reporting the evolution of investment for publically-listed firms in the highest 25% and the lowest 25% of the external dependence distribution for all advanced economies since 2007. By 2009 investment had dropped by 50% (relative to the forecast) among firms in more financially dependent sectors – about twice as much as for those in less financially dependent sectors. In the case of policy uncertainty, investment had dropped by about 50% by 2011, relative to the forecast, in sectors more sensitive to uncertainty – more than twice as much as in less sensitive sectors.

Figure 3. Firm investment since the Crisis, by firm type (Percent; impulse responses based on local projection method)

Sources: Thomson Reuters Worldscope; and IMF staff calculations. Note: Less (more) financially dependent and less (more) sensitive firms are those in the lowest (highest) 25 percent of the external dependence and news-based sensitivity distributions, respectively, as described in the chapter. Shaded areas (less dependent/sensitive) and dashed lines (more dependent/sensitive) denote 90 percent confidence intervals. Sample includes all advanced economies except

Policies to Boost Investment

We conclude that a comprehensive policy effort to expand output is needed to sustainably raise private investment. Fiscal and monetary policies can encourage firms to invest, although such policies are unlikely to fully return restore investment fully to precrisis trends. More public infrastructure investment could also spur demand in the short term, raise supply in the medium term, and thus ‘crowd in’ private investment where conditions are right. And structural reforms, – such as those to strengthen labor force participation, – could improve the outlook for potential output and thus encourage private investment. Finally, to the extent that financial constraints hold back private investment, there is also a role for policies aimed at relieving crisis-related financial constraints, including through tackling debt overhang and cleaning up bank balance sheets.

References

Buti, M and P Mohl (2014), “Lacklustre Investment in the Eurozone: Is There a Puzzle?”, VoxEU.org.

Chinn, M (2011) “Investment Behavior and Policy Implications”, Econbrowser: Analysis of Current Economic Conditions and Policy (blog).

Devries, P, J Guajardo, D Leigh, and A Pescatori (2011) “A New Action-Based Dataset of Fiscal Consolidation in OECD Countries”, IMF Working Paper 11/128, International Monetary Fund, Washington.

European Investment Bank (2013), Investment and Investment Finance in Europe, Luxembourg.

Krugman, P (2011), “Explaining Business Investment.” The New York Times, 3 December.

Lewis, S, N Pain, J Strasky, and F Mankyna (2014), “Investment Gaps after the Crisis”, Economics Department Working Paper 1168, Organisation for Economic Co-operation and Development, Paris.

Footnotes

1 See Chinn (2011) and Krugman (2011) for example.

2 Lewis and others (2014) find that, although it has been a major factor, low output growth since the crisis cannot fully account for the weak investment weakness in some of the major advanced economies.

The reason why there has been a dearth of investment is that even before the financial crisis there was huge overcapacity in quite a few big industries. Car industry, steel industry, construction industry etc etc.

The average pigeon-holed analyst might want to branch out and verify that with some industry-analysts, shouldn’t be too difficult.

As for this little gem:

“And structural reforms, – such as those to strengthen labor force participation, – could improve the outlook for potential output and thus encourage private investment.”

A lot of investment is solely done to reduce the number of employees (cut cost of wages) -> those kind of investments actually weakens (lowers) labour force participation (-> reduces demand -> reduces need for investment). Should be a well known phenomenon or?

& I’m guessing that the ‘structural reforms’ is not about reducing the share capital gets, it is about reducing wages. Or is increased share of profits to workers (incentivise work) actually a structural reform that ‘serious’ analysts consider?

Yep, I’m really curious if someone offers a differing viewpoint.

It is simply assumed to be true in these kinds of analyses that we need more – whatever exactly more is.

+ about 7 billion

Yes, Jesper, Washunate – for instance the article says:

“Getting the diagnosis right is critical for devising policies to encourage firms to invest more.”

For why would we want to do this, directly? Obsession on private investment-led growth & government tinkering to achieve it is a disorder Minsky diagnosed decades ago. It is old/bastard Keynesianism, not Keynes, not MMT and essentially based on inverting causes and effects. Robust private investment should be an effect and augmenter (“crowding-in” as above) of good policies, of strong demand, high consumption and full employment – not a clumsy tool used to initially “stimulate” them by a circuitous route.

Businesses are in business to make money. Use that fact, understand why the business/capitalist class as a whole can go on “capital strike” sabotaging the economy as a whole, even hurting many individual businesses, not only mere humans. But thinking that one can persuade or incentivize businesses to not prioritize money-making is crazy. Dean Baker noted that private investment was surprisingly high – not on strike – in the USA since the crisis and Aslam et al agree: ” If anything, investment dipped slightly less relative to the output contraction than in previous recessions.”

A lot of investment is solely done to reduce the number of employees (cut cost of wages) -> those kind of investments actually weakens (lowers) labour force participation (-> reduces demand -> reduces need for investment). Should be a well known phenomenon or?

It is, these issues, problems around technological unemployment were noted as early as the 18th century – a key modern concept is the “Domar effect” which John Cornwall succinctly explains: “The basic idea of the ‘Domar effect’ was the dual role of investment whereby net investment determined demand and output through the multiplier and increased productive capacity or supply by adding to the capital stock.” The ‘Ceiling’ & the ‘Domar Effect as Stabilizers

Though I fear cracking the egg here, in Capitalism, machinery has, and I think always will, increase(d) productivity and marginalize labor at the expense of energy resources (so long as they hold out). In that vein, how big of a “technical/creative” class can we create and sustain? One graphic designer for 20 workers at a print shop. One automation technician for 100 line jobs. The population is not getting any smaller and we are still relying on employment to deliver sustenance to the majority. Forget guaranteed employment, how about no employment? We seem to be developing all the tools for a quasi-utopia we just don’t put them toward that end.

Therein is the long term problem. Our system is designed for continued growth so that the younger workers support the older. This is unsustainable long term with shareholders demanding ever increasing profitability. Somebody has to pay for the old people and business is unwilling to do so any longer.

Also, that one graphic designer no longer lives in the US. He/she lives somewhere in India or Asia and makes a fraction of what a US based graphic designer makes. I’ve heard plenty of the elite pontificating that we peons need to learn to do with less, but guess who supports all the world economies? The peons. When the peons have less to spend, business has fewer customers and doesn’t need equipment or need to add labor.

Frankly, I don’t see a way out. I only see the question of how do I continue to keep a roof over my head until I draw a last breath. There is no fixing this system, there is only surviving it somewhat intact and healthy for as long as possible.

Same thoughts here.

I keep thinking there must be a way to mobilize a localized group of people to create new cooperative ventures. It just seems like an enormous amount of valuable human capital is going to waste and not being used to its fullest potential.

A new deal that taps into and puts much needed human capital to work ultimately investing in the infrastructure of the local community.

There’s got to be a way to tap that energy without relying on Washington.

” In other words, firms have reacted to weak sales – both current and prospective – by reducing capital spending. Indeed, in surveys, businesses typically report lack of customer demand as the dominant challenge they face. ”

This isn’t new news. Quarterly surveys in CEO magazine going back to the dotcom crash have regularly reported that “lack of demand” was a common concern , usually the top-rated concern.

We have these euphemisms – like “savings glut” and “elevated demand for safe assets” – which in reality are merely cover for the fact that rich corps and individuals have more money than they know what to do with , both in the US and across the globe. “Hoarding” is a more honest term.

There are literally trillions in budget-neutral stimulus funds out there for the taking , but even the ardent secular- stagnationists like Summers won’t dare suggest going after it. Someday , a decade or so from now , we’ll have to again endure the torture of listening to economists rationalize how and why they “missed it” , as when they missed the real estate debt bomb. This time they’ll explain how they missed the fact that extreme inequality was the primary cause of our lost decades , because they relied too much on representative agent models , or some such excuse. One way or another , they’ll cover their asses.

Investment where? FDI into China and Hong Kong looks pretty healthy. Just because the money isn’t going into the US or other “developed” economies doesn’t mean it isn’t there.

“FDI in China…has increased considerably in the last decade, reaching $59.1 billion in the first six months of 2012, making China the largest recipient of foreign direct investment and topping the United States which had $57.4 billion of FDI.[11] In 2013 the FDI flow into China was $64.1 billion, resulting in a 34.7% market share of FDI into the Asia-Pacific region…”

http://en.wikipedia.org/wiki/Foreign_direct_investment#China

Also see: http://unctad.org/en/PublicationsLibrary/webdiaeia2015d1_en.pdf

“Preliminary estimates [for 2014] show that FDI flows to developed countries as a whole dropped by 14% to an estimated US$511 billion. FDI flows to the United States fell to an estimated US$86 billion − almost a third

of their 2013 level…”

evil has run out of countries to abuse (aka das kapital stryke)

my perpetual happiness comes from laughing at the darkness since the tears and whimpers you hear from the watchmen and the gargoyles in the berfrei are from having reached the end of the road of the easy arbitrage money.

since the US (via Ike and JFk) began enforcing the Atlantic Charter (LendLease annex) or at least tried to, by, as Malcolm might have said, “every means necessary” (including use of what we now call the deep state and other creative “election” strategies), the former in power nobles have taken their toys elsewhere, attempting to resist their “subjects” refusal to submit by removing capital to new and improved “islands of rentier paradise” starting in monaco with onasis and expanding to the bermuda, panama, liberia, and then onto panama, singapore, HK, Gibraltar, Grand Cayman, and on and on…

Although in theory, the former colonists gave up their hold on the electoral process, the release of economic control was never really implemented. Between the Commonwealth and the CFA in former french territories, europe in many ways has never really given up control of its dominion, with both the French and the British holding way too much sway in international matters by manipulation of voting via proxies in the UN and the IMF. With the economic tentacles of spain still holding some sway in the americas, perhaps the enemy was never really the russians after all…

but after running around the globe, moving money and making compromises which most moral breathing sentient beings might find disturbing, the ? former ? nobles have run out of places to run and hide from taxation and responsibility…china was the last parade…and now that it has played out…what now…certainly there is not now nor has ever been enough of interest in keeping capital in place other than to insure just enough money between borrowings and tax payments, to keep bullets in the rifles to insure enforcement impressions. Money has never been backed by gold…its been backed by guns and power and the impression of value in exchange for value from needs or wants(luxury or impressioned memes).

so stasis begins as most of the victims have not the interest nor the drive to work on alternative scenarios. At least soros, charlie M and dr k spend 100 hours a week working on evil…the average schmoe is not going to put in the hard work to create another road and destiny…

basel 2 turned american treasuries into gold…in april/may of 2007 the battle of cov-lite led to stasis in the markets when KKR started waxing about how the age of darkness…i mean, private equity…was upon us and cov-lite was going to rule via prime brokerage (off book / shadow economy) operations…

but I am hopeful…success from open greed leads to change…and opportunity for the average schmoe…

Investment by companies is governed by demand. With low demand in the marketplace, companies are taking advantage of low interest rates by buying back stock instead of investing in more output. With low interest rates, banks are finding other ways to make money rather than lending to companies. Until there is more demand from the consumer, who is saddled with debt and has not seen appreciable wage increases since the late 1970’s, this trend will continue. Higher real wages for workers (who never shared the productivity gains in the first place) would put more money in hands of more people. The higher propensity to consume (the 99% versus the 1%) would raise demand and spur companies to increase output by investing in more capital and labor. At the same time, incentivizing banks to going back to what they used to do, (i.e. loaning to companies that are growing instead of financialization and speculation) would create more jobs and a more vibrant economy.

Thank you for a thoughtful and well-written comment, R Seckler. The hit to consumer demand from the enormous economic damage caused by the individuals behind the abject, failed Neoliberal economic policies is reflected in a broad range of economic and financial data. Consumer Metrics Institute charts show absolute U.S. consumer demand continuing to run well below 2005 levels:

http://www.consumerindexes.com/

That they and their failed economic and political ideology continue to drive the policy bus after the 2007-09 financial collapse and what has subsequently occurred globally (See TPP agreement, for current example) beggars belief.

I notice that the article continues to tip the hat to “debt overhang” (and austerity).

The willful failure to understand labor = people = customers is a continuing illness among economists.

The article poses the issue concerning why business firms aren’t deciding to invest more in capital in machinery, equipment, and plants, and then proceeds to discuss the issue without making reference to the financial criteria that real businesses use. Of course the business purpose of investing in machinery, equipment, and plants, is to enable to a business firm to produce its inventory (for the sake of the profit the firm will gain upon selling the inventory), but a firm will not decide to produce inventory when it can earn a higher return on the financial resources invested in the firm by procuring its inventory from a vendor outside the firm. In short, the “make/buy” decision is the fundamental management problem facing every business that markets manufactured goods, and the solution to that problem can change from day to day, as an uncertain and therefore risky economic outlook, regulatory environment, or “business climate” will change from day to day.

This explains why the stimulation of demand for final goods in an economy may not stimulate demand for investment in machinery, equipment, and plants to manufacture those goods in that particular economy. Depending on managements assessment of risks arising from factors external to the firm, production in one’s firm may not make as much financial sense as procurement from a vendor, and procurement from a vendor in one’s own economy may not make as much sense as procurement from a vendor located half a world away.

Of course, there is also no guarantee that the proceeds from the sale of manufactured goods will be reinvested to obtain more inventory to sell to generate even more proceeds. Some firms will face incentives to do that some of the time; other firms will face incentives to distribute the proceeds to investors.

If you want to understand why business firms aren’t deciding to invest more in machinery, equipment, and plant, then studying the financial criteria that drive decisions in firms may be more rewarding that studying macroeconomic data. But there’s a catch. Answers to survey questions may not be very revealing. Firms compete with each other, and competition creates pressures to keep business plans and financial projections secret.

I think you have hit on a key idea. Given that firms serve customers they will invest in productive capacity if the demand rises other things equal. Of course other things are likely never equal. There are competing solutions to increase capacity, including, as you suggest, outsourcing to a country half a world away. And we do not know with any certainty what real capacity in any specific industry really is.

Interest rates are at historic lows. So I conclude low rates are not critical to investment. And corporations have trillions tucked away in rainy day funds. Investment will occur when business sees a clear return on investment, not withstanding the level of interest rates. And sending bakers out to loan money won’t help if there is no demand for it.

I also suspect businesses are always looking for more business. Increases in profits are what capitalism is all about. If they do not grow they risk being bought out by someone else. Buying back ones stock can marginally improve earnings per share and enrich oneself via increased bonus but it will not keep the wolf from the door. So we may have a problem with demand visible in low wages and too many unemployed. Sounds like we need Uncle Sam to do something. Fat chance of that.

I think Marko is correct. Perhaps an overismplification, but it really does look like unbridled greed has resulted in money hoarding at the top. As the 1% hoard more and more money, the only direction for an economy to go in is deflationary. They certainly are not going to invest unless that investment gives back more than they put in, hence their propensity for asset stripping.

I work in a support capacity for a “privately held investment LLC”

I sat in on a meeting a few years ago that illustrated the mindset.

Subject was whether the company was going to invest/partner in an expansion of an existing business. The company’s decision was “no”. Because the “rate of return” did not justify the risk to their money.

What rate of return/ROI were they looking for? 8-10% minimum

And that ladies and gentleman is why the economy sucks.

The only was to get 8-10% return in this economy is to either cut your own profit/return, or screw your employees by cutting their pay and benefits.

Good luck with the wretched refuse getting more money. My position is such that I am directly responsible for the safety and well being of the owners, their families, and their multi-million dollar piece of transportation equipment. Yet when discussions about getting my pay up to industry average are concerned, it’s “if you don’t like it, pack your S##t and go”

If they are totally willing to tell me to go pound sand, you can imagine what it’s going to be like for the great unwashed to get a pay raise.

And you do that job why, again? Feeds you and your family an ever shrinking “chained crap pet instant”?. Lots of bits of history about what happens when the slaves revolt. One wonders if the ” security staff” discipline-in-ranks will hold, without more carrots being provided…

I personally had “a problem with authority” as a volunteer in th old green-fatigues US Army, so did a lot of KP and guard duty and other punishments. Trick for KP was get up extra early to grab the less bvad duties. Like caring for the officers mess area. Constant complaints about the taste of the coffee, despite clean urns, just arrogance and cheap coffee. After a fumigation there were lots of dying roaches and silverfish swept up from under the baseboard radiators. These got added to the coffee urns and apparently actually improved the flavor so much that the mess sergeant got praise from the CO. Who also started treating our Headquarters Company to lots of oarade performance s on weekends, he likes to see us march and faint in the Texas sun and liked to pull lots of inspections. His payroll file got sent to Africa, his personnel file went to Alaska, and the Mickey Mouse treatment of the Troops ended. This was in the day of paper-only records, but…

Who the heck are you to ‘dis someone reporting from the field? I think your personal rebuke to Steve in Flyover is uncalled-for.

What that a rebuke? I had trouble being able to tell. :)

My end of the big picture just has a bunch of chickens who are just now coming home to roost, thanks to years of underinvestment and screwing the wretched refuse. Now the PTB are complaining about not being able to find “qualified people”

(“Qualified people” = people willing to work long, irregular hours at high stress, public safety positions for table scraps.

Have had several cold calls from businesses since January 1. As usual, everyone wants experienced, trained people who will work for 1985 pay scales. Their business plan is based on screwing the help, and pocketing the difference.

Does this mean pay for the refuse will rise? Nope. They will just have the certification authorities lower the standards, so the pool of “qualified” people gets bigger.

One thing Ive learned is that management doesnt care whats really going on, as long as they have a piece of paper from someone saying its good, so when the SHTF, the lawyers have coverage.

“One thing I’ve learned is that management doesn’t care whats really going on, as long as they have a piece of paper from someone saying its good, so when the SHTF, the lawyers have coverage.”

Years ago, the company I worked at was getting ISO-9000x quality certification, as it was required by some of our customers.

The auditors came in, looked around, and gave management a list of things to do to improve product quality (really process quality, which is not quite the same thing, but that’s another story). They required some moderate changes before they would certify.

What did management do?

They fired the auditors and hired a second company that cashed their check and certified them with no changes required.

Later, the company closed down the entire department of electronic engineering at that site, but the quality control staff were kept. All of the actual electrical engineers either lost their jobs (like me) or were forced to move to another time zone. The paper-pushers stayed employed.

I am no longer employed as an engineer. The USA does not want engineers, it wants paper pushers.

I have a crazy theory:

The big bosses who run the firms don’t really care whether their firm makes more profits, as long as it makes enough profit. It’s the guys below them who want to get promoted who worry over scrounging out more profits. The big bosses have it made and they don’t want to take any unnecessary risks — and why should they? The large supply of zero interest money provides a very nice way to pull the value out of their firm and put it in their pockets and in the pockets of their friends and allies on the corporate board. They just buy back their firm’s stock and drive the price up. With that kind of money, they can even “play” the market a little — after all — no one is really looking at insider trading if the insider is a corporation — and even if they were — it’s easy enough to create the appearance of up-and-up trading. If they hollow out their firm enough, it offers some protection against raiders buying the firm out from under them and putting a top end on their good thing. If the free money came be obtained based on “book value” of their firms, and they have a “good” relationship with the appraisers the big bosses can keep a large treasure chest of cash to use for buying up “competitors” or building a conglomerate.

I don’t know enough to go any further with this crazy theory or tweak it for errors and omissions. Given the degree of consolidation of markets and firms, I don’t believe there is much competition in the “market.” Also, I believe it may be most illuminating to study the men and women who control our firms and determine what motivates their actions. I believe the notion these people are all about the firm’s bottom line and maximizing profits and growth is an overly simplified idealization of their motivations which best fits the theories economists create.

Nothing crazy about your theory. See James Galbraith’s The Predator State, and before that, Thorstein Veblen.

I started “Predator State” but got sidetracked from it — I think I started my reading binge on Murakami’s novels. I read “The Theory of Business Enterprise” but so long ago all I remember are vague impressions. Thanks for your reading suggestion. I will definitely re-start Predator State, read and re-read some Veblen.

I’m glad you think my theory isn’t too crazy. With the kids gone and since being laid off I don’t get out as much as I should and worry about growing a little odd in these, my later years.

I am slowly coming to the conclusion that economic theory works nicely to describe the workings of an ideal firm in a perfect market place … but sociology provides a better description for economics and how things work in the real world. Macro economics may be all right for explaining some things but the theory definitely needs an overhaul.

what a great little thread this was

“Please don’t put me to bed so early!”

pleads this little thread.

When trading paper makes more profit than production of goods, why bother producing? It’s a real hassle making stuff, all kinds of externalities that could interrupt the process and take a piece of the pie. With all the Fed asset purchase programs, profit from pushing paper became a sure thing.

Again, why would anyone produce when money is free and consumers are destroyed?

This is Veblen’s distinction between industry and business, I think. PE is “all business.”

Not just “Bernanke Bucks”, but the tax code too: http://davidstockmanscontracorner.com/money-printing-and-the-bane-of-financial-engineering-how-the-biggest-lbo-in-history-blew-up/

The more you learn about these structures, the greater the disgust. What’s that old saying about how the fish rots from the head down?

It would be interesting to compare the relative impact of private equity ownership in recessions over time. Debt was once used to build production facilities with new machinery. Now it funds PEU dividends and special distributions. Increased interest expense and annual management fees suck up money formerly available for new plant and equipment. Just a thought. Getting the data would be a bear as PEUs don’t like to share.

Many excellent comments here. Let me try a slightly different angle.

Investing in a real competitive business is difficult, risky, and generally gives only modest profits after a long period of work. Think: running an airline, or an automobile manufacturing company.

But what if the government gave you unlimited money at basically zero percent interest, and you could play financial games, and get bailed out if you made a mistake, and make enormous profits up front with no risk, and no skill other than bribing the right people? Yes to low investment being due to low demand, but perhaps some of it is psychological: the elites are losing interest in ‘real’ investing because playing games with corrupt finance is so much easier.

In classical China there were stories of the emperors being shown examples of advanced western technologies, and having no interest in them. But why should they? The emperors simply owned everything outright, they had no need to compete in a market, no need to do the hard work of building a new industry, when all you could want is just handed to you by right of ownership…

With banks acquiring more and more sovereign debt, and the Neoliberal dogma that investors must always be bailed out (in contrast to capitalism, where bad investments must lose money), we could be moving to a more feudal system where an elite simply owns everything and that’s that. And feudal societies are never very big on investing, I think…

You have to look at the larger picture . In the US , investment in housing is considered capex. In fact , investment in housing is long term durable consumption. All the trophy housing in California placed end to end doesn’t create value .

Controlled for cost of living, population size , and GDP, capex in the United States – and I suspect the developed world – has been falling since 1970. Not by coincidence , we have exported / outsourced to Asia much of our manufacturing. If our elites get their way, the next step in to export many services. There is no reason why much accounting, legal, and clerical services can be exported just as much data processing has.

Of course this means very low/no growth in the developed world, but if you are strategically placed, some will profit tremendously.

Why invest in any real projects? If the TPP TIPP becomes the law of the planet then the mega corps will be too busy suing local/state/sovereign nations for their unfulfilled corporate profits. Why go to all that extra trouble in making real investments when imaginary ones can make you more with less effort?

The big boys have more than enough production capacity and so have no incentive to add any. Plenty of disincentive, actually. They can see the weak demand projections, so it makes far more sense to put money into financial investments, including buying back their own stock. The smaller players, on the other hand, don’t have the money to spend. For them, financing requires collateralizing not just any equipment purchased, but everything else as well, including A/R. Finance some new equipment, take out a couple of lines of credit, and every asset the company has is cross-collateralized and over-secured beyond the ability to get any more financing. The insolvency problem hasn’t exactly gone away over the last eight years, especially since the only “solutions” that have come down the pike have been for illiquidity.