In our coverage of the Greek government’s efforts to end austerity and negotiate a debt restructuring and a shift to pro-growth policies, we’ve stressed how unlikely the ruling coalition was to succeed. That meant it has been frustrating for readers to see the new government make unforced errors and reduce its already low odds of success. But even worse is the specter of Syriza now taking steps to wring money out of a long-sufffering population in order to make payments to creditors. As reader Ned Ludd wrote:

I think the majority of Syriza was always amendable to being the new PASOK. The path to power, of course, required pretending that a Syriza-led government would be fundamentally different (and to the left of) PASOK.

Since the end goal was always a deal with the Troika, though, PASOK would have gotten a better deal than Varoufakis ever could. “If you can’t bite, better not show your teeth.” ~ Yiddish Proverb.

As we discussed yesterday, would the old mainstream coalition have dared to pilfer pension funds, local government deposits, and university surplus cash, particularly when the odds are high that the government will soon be forced to capitulate or default?

Nevertheless, some readers have been unhappy that we have not been harsher critics of the creditors. It is a mystery to us why the Troika is willing to risk turning Greece into a failed state to a make a point about the cost of defying its authority. And we’ve chronicled over the years how austerity policies have failed.

However, the Greek government has exposed how deeply wedded not only the Eurocrats, but also the governments that have been forced to wear the austerity hairshirt are to economic faith healing. The Latvian government actually believes its program is a success, when that “success” was achieved through a 14% decline in the population as the youngest and most energetic departed, leaving Latvia with an aging populatoin. And as we and other commentators observed years ago, the contractionary policies inflicted on the periphery countries would eventually infect the core, and that is starting to occur as deflation takes hold in Europe.

A new paper by Dutch economist Servaas Storm znd C.W.M. Naastepad, embedded at the end of this post, does a deft job of shredding the two key beliefs that underlie austerity policies: that government profligacy and insufficiently competitive labor markets caused the crisis, so the remedy is to crack down on government spending and wage rates.

In contrast to most economic papers, this one is not just well documented but also well written. The authors give themselves license to decry these intellectually bankrupt policies. The abstract:

The Eurozone crisis has been wrongly interpreted as either a crisis of fiscal profligacy or of deteriorating unit-labour cost competitiveness (caused by rigid labour markets), or a combination of both. Based on these diagnoses, crisis-countries have been treated with the bitter medicines of fiscal austerity, drastic wage reductions, and far-reaching labour market deregulation—all in the expectation that these would restore cost competitiveness and revive growth (through exports), while at the same time allowing for fiscal consolidation and private-sector debt deleveraging. The medicines did not work and almost killed the patients. The problem lies with the diagnoses: the real cause of the Eurozone crisis resides in unsustainable private sector debt leverage, which was aided and abetted by the liberalization of (integrating) European financial markets and a “global banking glut”.

The raw numbers show how badly the orthodox policies have performed. European GDP has yet to reach its precrisis level, and the average unemployment level is 12%, and the social costs are high as well:

The crisis is creating an even more polarized society in which the poorest have to fight for access to basic items such as critical medicines, have to queue up for the soup kitchens and are ever more often homeless. The crisis has turned the Southern Eurozone into a depressing world of closing of possibilities, hopes and dreams, a dark world of heightened inequalities, high unemployment, pay cuts, rising in-work poverty, and people going hungry, hunting for food through garbage cans—as there is no (longer a) welfare state to fall back upon.

As Storm and Naastepad debunk what they depict as the central myths of the Eurozone crisis. The first is that the meltdown was the direct result of the famed “profligacy” of nation-states, and was thus always a sovereign crisis. As Naked Capitalism readers know well, the sovereign debt crisis was the result of the banking system implosion. Governments were hit with a collapse in tax revenues as GDP fell and higher levels of spending as payments under social safety net programs like unemployment insurance rose. In addition, governments also bore the cost of bank bailouts, and in some countries, notably Ireland, they were particularly costly.

As the paper shows, government debt to GDP ratios in the eight years preceding the crisis actually fell by an average of 6%. And most of the periphery countries were among the ones who had improved debt to GDP ratios: Italy’s fell by 7%, Ireland’s by 8% and Spain’s by as much as 27%. Even supposed wastrel Greece saw its debt to GDP ratio rise by 4%, lower than the 5% increase posted by France and Germany. Greek debt traded at spreads as low as 30 basis points over Germany’s in 2007.

The authors show that there was indeed a runup in debt before the crisis, namely, private debt and in particular, the debt of financial corporations:

Growing private-sector debts dwarf the changes in sovereign debts—particularly so in the crisis countries. In Greece, household indebtedness rose by 32 percentage points, corporate indebtedness by 13 percentage points, and financial sector indebtedness by 41 percentage points—trivializing the 4-percentage point increase in public debt. Spain experienced a massive increase in the debts of non-financial corporations (of 78 percentage points during 2000-07), of banks (of 74 percentage points) as well as households (of 34 percentage points)—all participants in Spain’s massive property bubble—in a period when sovereign indebtedness was sharply reduced. Undeniably, the Eurozone crisis was triggered by a gigantic unsustainable increase in indebtedness—but why would one single out trifling increases in sovereign debts as the main factor, while neglecting the significant growth in private indebtedness?

For the statistically-minded, the paper has several analyses that lend further support for this argument. Storm and Naastepad point out that the IMF has ‘fessed up that fiscal multipliers are typically higher than one, meaning a cut in government spending results in an even greater fall in GDP, making the debt level even worse. The authors stress that the IMF estimates are conservative, so the damage of misguided austerity policies is likely to be greater than they indicate.

The second big myth is that inefficient labor markets (meaning too well paid and pampered workers) were another primary cause of the crisis. This belief is why European authorities become outraged at Greece’s plans to raise the minimum wage and strengthen labor bargaining rights.

Storm and Naastepad contend that orthodox thinkers naively equate low labor costs with greater competitiveness, when labor is only one factor in costs, and cost is far from the only aspect of competitiveness:

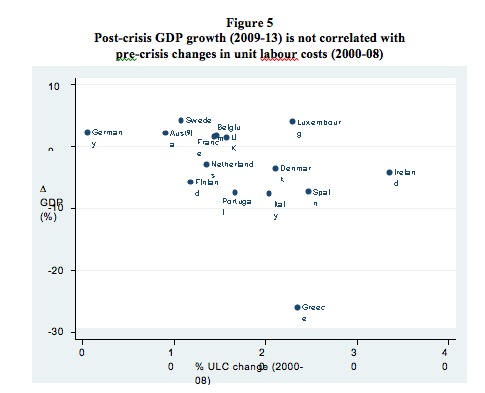

The problem with the “labour cost competitiveness” explanation is not that the data—as given in Figure 5—prove Mr. Bini Smaghi wrong, as there is no statistically significant correlation between pre-crisis increases in unit labour costs (ULC) and post-crisis growth performance for Europe and the Eurozone. The problem is a much deeper one as it concerns a leap of logic, a misleading use of the term “competitiveness” which philosophers would label equivocation, by which the—broad—concept of “competitiveness” is reduced, with remarkable sleight of hand, to competitiveness in terms of only relative unit-labour costs (or RULC). This is no trivial issue, as, firstly, it is no secret that economics lacks an agreed definition and measure of “international competitiveness” (Wyplosz 2013; Storm and Naastepad 2015a), and, secondly, often-used competitiveness indicators, such as RULC and/or current account imbalances, are known to be weak predictors of future export and import performance….. Instead, we (and others) find that

1. most goods & services imported into the Eurozone are “non-competing” imports used as intermediate inputs in manufacturing or for consumption—hence imports depend almost completely on domestic income (see also Bussière et al. 2011).

2. export performance by Eurozone members is overwhelmingly determined by world income growth (see also European Commission 2010; Danninger and Joutz 2007; Schröder 2015). Countries (such as Germany) exporting to fast-growing markets (such as China) experienced rapid export growth, whereas countries (such as Greece, Italy and Portugal) catering to slowly-growing markets had much lower export growth (ECB 2009).3. Eurozone current account imbalances are not statistically significantly affected by changes in RULC (see also Gaulier and Vicard 2012; Diaz Sanchez and Varoudakis 2013; Gabrisch and Staehr 2014).

Wage costs don’t matter that much, in other words…However, all this does not mean that “competitiveness” is unimportant. It is non-price or technological competitiveness which matters—not price or cost competitiveness

The misguided fixation on labor costs (which are visible and easy to measure, while an assessment of technological competitiveness isn’t readily relegated to a spreadsheet) leads to bad policy:

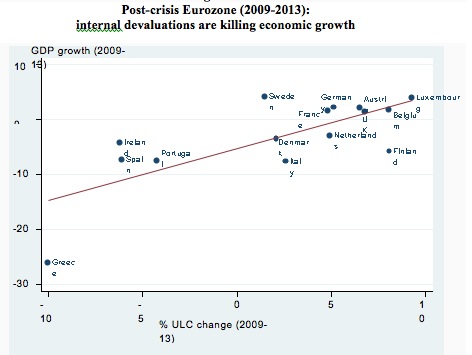

Cutting wages (internal devaluation) and deregulating labour markets undermines a country’s competitiveness and stall export growth; combined with fiscal austerity this policy cocktail is lethal.

Here are some of the negative competitive consequences of pushing to reduce wage rates and lower labor bargaining power:

Moreover, in more flexible labour markets, firms will invest less in workers’ firm-specific human capital and this hurts productivity as well (Lee and McCann 2011; Kleinknecht et al. 2013). Labour market deregulation may affect productivity through its impact on worker motivation and effort, as it erodes social capital and trust in the labour relation (Storm and Naastepad 2012). Likewise, lower wages and more flexible labour slow down the process of capital deepening, enable inefficient firms to stay in the market and discourage structural change. Finally, lower wage and demand growth reduce the pace at which older vintages of capital stock are being scrapped and new equipment, embodying the latest more productive technologies, is being installed. Taken together, lower wage growth gets reflected in lower labour productivity growth and weaker export performance (for reviews of the evidence, see Storm and Naastepad 2012; Kleinknecht, Naastepad, Storm & Vergeer 2013).

Post-crisis policies have strengthened Germany’s position relative to the periphery; the authors treat that as a terrible mistake; one has to wonder whether it is actually a feature:

This brings us to the real problem of the Eurozone: the widening differentials in labour productivity and technological capabilities between members of the Eurozone. Productive asymmetries have increased within the Eurozone after monetary union. In the pre-crisis years, Germany managed to strengthen its production structure, but the Eurozone periphery lost ground—both their manufacturing activities and export bases became relatively more narrow and technologically stagnant

Germany’s rising trade surplus, now at over 7% of GDP, is widely regarded as unsustainable, particularly since Germany refuses to continue financing its trade partners.

It’s been remarkable to see how long Europe has been able to keep a broken economic model going well beyond its sell-by date. How long they can keep this up is still very much open to question. However, Storm’s and Naastepad’s paper is an important addition to a now robust literature on the contractions and failures of Europe’s post-crisis economic policies. When the day of reckoning finally arrives, no on in authority can claim they were not warned.

You know, the “push the cost of labour down” meme is just extremely dumb – or, more likely, the direct result of “increase profits no matter what”, and cost of labour is the easiest (even though not the most important) way of doing so.

The best book I ever read on Industrial Revolution, and why it started in the UK had a very simple premise. It wasn’t the IP protection, protestantism, or (directly) democracy vs. autocracy. It was a simple fact that in the UK cost of labour was high, so it made sense to invest in innovations and use capital to get things done. In France (not to mention Asia) the cost of labour was very low, so why invest capital into risky ventures when you could get the same profit via hiring cheapo workers?

Driving down cost of labour is a very short-sighted policy in the age of cheap capital.

This is not new policy. It goes back to the founding of industrial capitalism:

Slavery was funded by banks in London and New York and investors in both capitals grew rich. Productivity increases were generated by simply whipping the slaves to produce more cotton. From 1830-1860 as cotton profits soared, overseers demanded that their slaves work faster and faster, and for longer and longer hours. After the war, despite increased capital investment, it took decades to get back to the same level of profitability, because naturally, without constant whipping and outright torture, workers just don’t work as fast or as hard as the do when they fear being strapped on the whipping machine. So, the “best” (as in most profitable) labor is slave labor, or in the absence of actual slavery, an international capital flight to areas of depressed wages. Hence “free trade agreements” that favor capital over labor or the environment.

The only limits to these policies have been worker revolts, economic chaos of the Great Depression, the rise of Nazism and Fascism leading to global war. For a few decades after WWII, the elites had institutional memory of the total collapse of pre-war civilization as a sobering reminder that there are limits. But, now they’ve forgotten every lesson from the past, and are on a trajectory of ever increasing cruelty and blind profit seeking, free from all constraints and unconcerned about the inevitable consequences of their actions. The words “blow-back” are not in their vocabulary and they are immune to reason and blind to history.

Wow. You and the post above. I now have a few new phrases to mulch my brain. “Capital deepening” – “We don’t have a definition of international competition”- labor costs are a “misleading term of competitiveness” – and the bedrock point (for me) that as an economy naturally grown everything in it should grow – nobody should offshore labor to get an advantage but should instead innovate. Our debt is entirely a debt of a lack of innovation. As in environmental restoration and etc. There will always be a demand for satisfying needs and better solutions. My new favorite quote is Yves’ (killing labor to profit) as “economic faith healing.” So now we have mismanaged our “success” to the extent that we have an epidemic, or an economic plague – dead in the water. And we are trying to manage our way out of it after having caused it by making lotsa bad decisions; after having killed our inspiration to solve problems. I’d rather see it this way: The future is bright – we have so many problems to solve now that we are in business for at least a century.

“It is a mystery to us why the Troika is willing to risk turning Greece into a failed state to a make a point about the cost of defying its authority.”

I think Noam Chomsky pointed out that the severe inequalities in Brazil had historically hampered its economic growth. It raises the question: Why would elites pursue policies that kept people impoverished, when these policies actually hurt their country’s economic growth?

Making people poor and desperate – through debt peonage, or by turning countries into failed states – appears to have become the modus operandi of the modern elite to further accumulate power over their subjects; regardless of the health of the overall economies.

Because there are really few enlightened autocrats around (hence why democracy wins the contest of Cinderella’s ugly sisters). It’s people’s inborn bias to look at short-term gains rather than long-term, and it take a non-trivial amount of willpower, intelligence etc. to overcome it. Loot-and-run on the other hand is a well proved strategy.

Of note that four years of undergraduate study and 3 years of post graduate work barely scratches the surface of the “non-trivial amount of willpower, intelligence etc. to overcome it” for the vast majority of our dear business leaders. On the contrary, such education, particularly from the aristocratic dispensaries of American education seem to cement the view point that short term gains – not simply irrespective of, but frequently measured as valuable and flattering (or differentiating) based on the human cost – are all that matters.

Think of it. Three years of post graduate work can be condensed into three words: Loot and run… though it’s true the devil is in the detail.

A fundamental problem with our economic system is that capitalism favors hoarders who have an insatiable desire for capital/power, and these successful capitalists use their accumulated power as a wrecking ball to destroy any competing power centers and democratic institutions.

Under a democratic economic system – through workplace democracy or other forms of coöperatives – there is no real mechanism for individuals, or a small elite, to accumulate control of numerous different organizations.

I’d not be betting on “democratic economic system”. The reality is that people are imperfect, and any system that does not recognize it and does not build safeguards (that usually require other people to pay attention and do stuff proactively) will be subverted.

In fact, the best working systems tend to be subverted the easiest, because the opposition can always say ” why do we need this? We haven’t had a problem with it for years…”. It’s a paradox of a good rule. If it works, you don’t notice it. If you don’t notice it, you (or someone else) start think you may not need it.

You could say that you need to be paranoid to have a working system (to suspect everyone of trying to subvert it), but if the paranoia works, and no-one subverts the system for decades, it’s really hard to be both mentally healthy and keep the required levels of paranoia.

From where I sit, unless elites recognize the danger – which historically they never did, well, one could argue for Glorious Revolution in the England as one – we’re in for another upheaval ala French revolution etc. The problem with that is that revolutions never end up the way they were intended..

Capitalism in the age of scarcity.

This is what happens when the aristos believe in wealth as a zero sum game.

Why would elites pursue policies that kept people impoverished, when these policies actually hurt their country’s economic growth?

Iron Law of Institutions–elites are more concerned with maintaining/enhancing their own place within the system than with the overall health of the system generally. To quote Varys from Game of Thrones: “He would burn down the entire realm if it meant he could be king of the ashes.”

Under merchantilism … you grow by exports, just as the British Empire did … and you enforce imports by your trading partners by colonialism … and in the case of the French Empire in N Africa … by repossessing a country driven to bankruptcy by predatory loans provided by the ultimate colonizer.

The line between capitalism and merchantilism aka Adam Smith, is a fine one. Supposedly by following a growth strategy rather than a zero sum strategy. But that can only happen when growth is still possible … and in the case of export titans China and Germany … that limit may have been reached, globally.

Thus the return to 19th century foreign policies of internal predatory loans and external imperialism. Welcome to the Sino-Germanic Raj.

Doesn’t the relunctance of the Germans to make concessions to Greece reflect their fear that Spain, Portugal, etc. would then demand similar concessions?

Also it is likely that the Germans secretly wish that Greece would go away but don’t want to be blamed for the breakup. Greece and Germany is a marriage made in hell.

The Western allies of Europe did this shit to Germany post WWI, utterly wrecking the country and being DIRECTLY responsible for the rise of Hitler and his NAZIs. Europe obviously enjoyed that so ,uch they want a repeat.

i think Juncker, Merkel and others see that don’t they? Otherwise they would have cut the rope and let Greece fall to the abyss.

i think there’s a small error in there. should it not be “and not cause of” rather than “and not caused by”?

As Naked Capitalism readers know well, the sovereign debt crisis was the result of,

and not caused by, the banking system implosion.Breathtaking:

“As we discussed yesterday, would the old mainstream coalition have dared to pilfer pension funds, local government deposits, and university surplus cash, particularly when the odds are high that the government will soon be forced to capitulate or default?” So we are also talking about moral collapse of the so-called liberals. In the USA, we have the Grand Bargain, for the same reasons, which would be austerity, confiscation, and hierarchy, and a president conducting foreign policy as video-game drone surprises.

And thanks:

The reference to Marat / Sade brings up all kinds of ramifications. I saw it about three years ago, done by a tiny theater company. Yet it requires a cast of twenty or so, which in these cash-strapped times, means that most theaters won’t touch it. They’d rather do something pseudo-august and Sondheimian. Yet the play, which is now almost 50 years old, I believe, is still revolutionary. Revolutionary in its thought–about history, ethics, and the efficacy of action. Revolutionary in its staging.

I wonder why the mass of people cannot through simple moral calculations figure out that for instance – wearing a flash suit doesn’t make someone a trustworthy person, but then I think of Ted Bundy & ” Idiocracy ” the latter I watched the other night, which I thought was very funny, but ludricous because the elites as in pre 20th century Britain & elsewhere will always be well educated even if everyone else isn’t. Most people I have come across on my travels would jump at the chance of being powerful & or rich, & even when given a little bit of power, it often makes people worse – maybe that’s the problem in the a world with millions of potential Hitler’s whose third reich’s are usually only family units – Greed isn’t reserved only for the rich & it seems to very common & supported by consumerism, materialism & our warped capitalism.

I grew up on good guys & bad guys – Robin Hood / Sherrif of Nottingham – George Bailey / Potter – Scrooge & countless others, with easily identifiable baddies who are generally greedy bullies, so why can’t most people seem to recognise the same in real life ? Or as men tend to invent God in their own image, maybe many also see these strutting powerful VIP’s as a reflection of the hero they themselves would like to be & as we know despising stereotyped unter-menschen ( while not realising you are also one ) is common almost everywhere.

Hitler & his chosen odd bod master race cronies were perhaps very unfortunate to have actually, to a large extent been punished for their crimes, & it took me sometime to realise this isn’t normally the case & that there are many out there who are potentially as bad. The best I can do in this nicotine deprived rant is to imagine these scumbags, sometime in the future like Queen Elizabeth 1 ( who signed something like 38.000 death warrants ) slowly dying in a stinking sick bed in a room absent of love, surrounded by flunkies wishing she would get on with it, while she lay there wondering if there was any judgement & then saying, as some reports stated, something like ” I would give up all my possessions & power for just one more minute of life “.

Incidentally during those times poor people could attack their oppressors with curses, which were taken very seriously by the recipients who tried there best to avoid receiving those ‘ A plague on all your houses ‘ sort of things. So in that spirit I wish the Troika a plague on all their houses & the unlikely event that these constructions should somehow only fall on them.

re: your article’s title.

Nice “Marat/Sade” reference, and very apt.

The recent explosion in European Sovereign bond rates is unprecedented and tells me that sell by date may have arrived. Despite ECB QE swamping the bond markets with liquidity, bond market investors are in a panic about the prospects of the building blocks of the union. Perversely, these higher rates are supporting the Euro, the developed world’s most endangered currency. Something bad is about to happen as the level of denial has reached “Don’t worry, we’ve got this” proportions.

I don’t understand why Greece hasn’t yet introduced Euro substitutes like Tax Anticipation Notes or the electronic money Varoufakis was bragging about. By now, they’ve had time, and it would a) improve the economy by increasing money b) improve their bargaining position by giving them options, *and* c) let them scrape together more money to pay off Troika bills. It’s a win-win-win for them, why aren’t they doing it?

Fair Economist….wouldn’t that require a plan of some kind?

I wonder what ‘teeth’ Ned Ludd thinks PASOK (polling at 3.5-5% for the last 2 years) has shown at any point in the crisis? And in the face of their non-performance on what basis does he assert that PASOK (and presumably ND) would do better now? PASOK handed Greece over to the IMF without informing or debating this move in parliament, and announced it to the nation after the fact. PASOK folded from the first stages of the crisis allowing Merkel & Sarkozy to falsely define both the nature of the crisis and prescribe its solution, the 340 bn “loan” to Greece. PASOK refused to hire sovereign default lawyers and also withdrew the promise of a referendum under EU pressure. PASOK allowed itself to be replaced by a ‘technocratic’ government led by the ex-vice director of the ECB despite having a parliamentary majority. There was literally no fight back or resistance.

As for not taking funds from the people, PASOK – (not Troika) – imposed the emergency property tax and, while doubling income tax, rolled back the minimum taxable rate to zero, so that even a minimum wage of 430EUR/month was taxed. Indeed, homeless people were deemed to owe the government c. 350 EUR per year based on the cost of minimum survival! As for not taking funds from the state, PASOK/ND happily haircut by 51% all private bond holders, including greek citizens, in PSI-1 2012; and Venizelos personally went to the Bank of Greece after hours on the same day to haircut 51% (without warning) all university, hospital, pension and other state funds. Allow me to point out that these were not bonds; technically this was fraud.

On day one following the 2012 election that brought the coalition PASOK/ND government to power, Venizelos personally co-signed an illegal public tender (illegal in EU terms since there was no competition) awarding Siemens the biggest commission in Greece at the time: the extension of the Athens and Thessaloniki metros. By a strange coincidence, the profit to Siemens exactly equals the penalties the German court decreed should be paid to Greece for Siemens’ corruption. The Troika’s fingers are all over that move: nevertheless Venizelos never showed an ounce of resistance.

In June last year Venizelos was informed that a bailiff would serve him papers on a prosecution of corruption and unconstitutionality. In the case of MPs, these papers are served in parliament. That afternoon the coalition government hastily announced the end of the winter session, 3 weeks early. The next day Venizelos and Samaras met and through a prime ministerial decree signed a law giving Venizelos, Samaras, Papademos and Papandreaou lifetime immunity from prosecution for decisions made between 2009-2014.

Where in all this miserable acquiescence does Ned Ludd’s find proof of PASOK’s ‘teeth’? On what basis does he state that they would fight, let alone negotiate (!), and in his own words “better”? In the eyes of the Greek people such an assertion is hilarious to put it mildly. As for SYRIZA wanting to be PASOK, no party in Greece wants to be tainted by PASOK association. PASOK is toxic. Even exPASOK mayors and governors run now as Independents.

That’s what Ned was saying: if SYRIZA couldn’t bite, better to not make the threat. PASOK has teeth; as in the liberal US, they’re directed down instead of up.

Excellent article, again.

Good round up and good paper at the end.

I find it very difficult to understand how anyone, or any group, with common sense can / could so massively apply, in the economic sphere, such a disastrous ‘recipe’ as a ‘cure’ for ills that aren’t that severe. Well, cult-members do go way off the rails in a sort of collective hysteria (space aliens, purification rituals, ruinous and harmful sacrifice, down to collective suicide, etc.); but the ‘cult’ situation as traditionally described can’t be applied to such a large and varied consensus.

I don’t believe economics is any kind of rigorous Science (whatever acceptation of the term one gloms on..) it should be part of Social Antrhopology, or Social Psychology.. to exaggerate a tad.

So one is left with Economics (aka one bastardized version of Econ 101) as a Religion. I can’t quite swallow that, in the sense that I can’t argue for it to my own satisfaction.

So I conclude that other motives are in play. These deal with, on a personal level, sadism (as in title, persecution, etc.), on a group level with international geo-politics and war.

That is, when forced to choose between the stupidity/incompetence/cult-craziness interpretation and a somewhat calculated scheme that is obscured, I prefer the latter.

SYRIZA as currently constituted might make a good PASOK, but SYRIZA is not homogeneous. Maybe the portions of SYRIZA which don’t want to be PASOK should form their own party, then.

If by “PASOK” you mean the long abandoned centre left space, maybe. In relation to the program SYRIZA is fighting for right as merely sensible / moderate and what was considered normal in Europe in the 1980s.

However PASOK itself is finished, and its pathetic hangers-on are right wing law’n’order neolibs serving oligarch interests exclusively.

Meanwhile SYRIZA’s non-homogeneity is a breath of fresh air in the Greek reality. It promotes open debate and ends 40 years of cynical bloc-voting / ping-pong changes of government.

I can’t help wondering how much “more flexible labour markets” would improve the international competitiveness of countries like Greece no matter how low that ‘flexibility’ drove living standards. How much “capital deepening” does a country with little to export really need? How does such a country obtain the income it needs to participate in the global economy and obtain products it’s size or other circumstances would prohibit it from producing at competitive or even affordable prices?

“flexible labour markets” have been capitalism’s cheap trick (along with raiding the commons) for most if not all its history. But you can’t buy low and sell high to machines. So even in countries that might benefit from “capital deepening”, where are the workers displaced by the process going to get the money to buy the commodities increasingly produced without their labor?

Varoufakis raises this issue at least indirectly in his book The Global Minotaur with his discussion of the need for a replacement for the Global Surplus Recycling Mechanism (GSRM) US and European ‘financial engineers’ destroyed with their “financial weapons of mass destruction” in 2008. But I find myself wondering if finding a new GSRM isn’t just putting a Band-Aid on a potentially life-threatening wound. Like the British and the Americans before them Germany’s financial elite appears to have found no better use for the money they made through “capital deepening” and “labour market flexibility” than sending it beyond their borders in search of yet more money.

The Troika’s “They borrowed the money” stance reflects a lack of vision about what to do with Germany’s economic success. At a more fundamental level it shows that, like the British and Americans before them, Germany’s financial elite lacks an understanding of the foundation and sources of wealth in an industrial civilization. Chastened by defeat in two world wars, it no longer sends its monetized industrial surpluses beyond its borders in the form of Panzer divisions. Instead it sends an army Eurobank accountants to subdue the nations it has conquered with its money.

The erosion of “social capital” now occurring in those countries will soon spread to the Fatherland (if it hasn’t already?) just as it did in the Britain and the US. Obsessed as they were with Empire and hegemony, Britain and the US decided to let, ironically, ‘communists’ fight beyond their borders the class wars and general social progress to which they had been losing ground, focusing instead on acquiring the world’s wealth with their money or when that didn’t work, their guns.

It remains to be seen whether the leaders of China still understand the sources of wealth and power in an industrial civilization – and at an appropriately chosen moment will demonstrate that power to a Western civilization blinded and impoverished by its love of money.

“The persecution and assassination of the people of Greece” by the Troika (Pretty Bold statement- shouldn’t it read The persecution and assassination of the people of Greece by the Greeks).

The people of Greece sought funding without pain and bought into Syriza promises. This “mandate” enbolded Tsipras to slow roll negotiations and not address some requested “reforms”. It appears that the Troika was willing to alter some reform demands on a dollar cost basis. Save moneys here and you get to spend moneys somewhere else. The demand for “reform” is a forced request to structurally change the Greek system which is embedded with graft, corruption, cronyism, cartelism, nonpayment of taxes, bribes, etc. It does not mean that that the lower sections of society are being forced to suffer, that is the result and Syriza should shoulder a lot of blame (along with elites and Parliament). For example, let us say that there are 25,000 government jobs that are bloat placed onto the system by patronage. If you release 25,000 inefficient jobs @ 30,000 euro per job that is a 750,000,000 euro saving (not inclusive of pension cost savings/unemployment costs). That saving will buy a lot of social benefit. If you look at Greece as a capital venture, Greece seems to have cooked books before entry. Greek Inc. “went public” on an IPO and got it’s first leg of funding. After a period of time, the market discovers that Greek Inc. has wasted massive amounts of money, didn’t pay their taxes, has significant job redundancies, has bloated wages due to nepotism/patronage, has special perks, management has funneled money to offshore accounts and the company is profitless. The venture capitalists order a set of reforms and in return Greek Inc. gets additional funding. After an additional amount of time, reforms are not initiated and Greek Inc is in a death spiral. IMO the solution has to come from Greek Inc. and placing significant blame for “odious” debt, the austerity hairshirt or “asphxiation” is a dodge. During the reign of Syriza, there has been a massive default in governing. As they rob society of liquidity (constitutional???) and default on their own bills… there is no reform. The elite want status quo and Syriza wants to the lead the government. The problem is that the venture capitalists don’t want to fund a company that essentially should go BK (failed state). One has to question the lack of “reforms” on Greece’s part. What has Syriza proposed in the way of growth that could be partially funded by the Trokia or grants? What has Greece done in the way of positive reform? Why are the same reforms being proposed time and time again…. the answer is because they have not been adequately addressed. I am not opposed to Greece delaying privatization nor am I opposed to retaining “valid” pensions. It is obvious that money should be funneled to the needy, homeless and hungry. The question is, would you lend money to Greek Inc.? What would be one of your loan contingencies and what do you want in return?

SYRIZA bears none of the blame for 40 years of graft and civil service appointments since it didn’t enter parliament until 2004.

Since you haven’t checked any facts you might be interested to know that the Greek civil service is 17%, one of the lowest in the EU. The current median salary for civil servants is 8,500 EUR pa. Meanwhile, geographically – 1200 inhabited islands, 80% of the landmass alpine mountain ranges – Greece has a structural need for more public service infrastructure than most countries. Just think of Douanes / harbour masters / coast guard…hospitals, schools.

You obviously have no intention of visiting such a disgusting country as the Greece you describe: given that there are no medical facilities on the islands post-Troika (due to those civil service job cuts you applaud & insist on) this is a wise choice.

Syriza does deserve blame, just not 40 years of it. I do check facts and read Greek papers but it is difficult for me to document all sources for the amount of data input. Where did you get your facts? Greek civil service is 17% of what? What is your definition of civil service? Does it include all government? Federal only? What is the average (not median) salary? RE: Syrzia: When first installed as the new government, Syrzia wanted to raise the minimum wage from 650 euros to 840 euros. Why and with what money? Who is paying? This was a legislative initiative that essentially slapped the Troika across the face. Great for local consumption but moronic when you haven’t received a bailout yet. If you look at the latest numbers for job creation and business creation in Greece, the numbers are significantly downtrending. Job creation is import and maintaining jobs is also important. I understand that 50-60 construction projects are currently not being funded by the government. Many of the projects also receive EU moneys (which could demand repayments). In addition to construction projects, Syrzia is not funding a vast amount of third party billings and other professional salaries. As Syrzia goes into a a deep hole with past due debts, many people WITH jobs are not getting paid. Essentially it is destroying a productive part of the economy. RE Civil Service: It is my understanding that Greece expanded government jobs massively over the last 10 years. Not a bad idea if someone else pays for it but costly if you have to pay for it yourself. I am not opposed to civil service jobs per se, I am opposed to inefficiency and cushy/bogus jobs that are unproductive and come from a system of spoils. RE infrastructure: I am all for any infrastructure project that makes sense and employs Greeks. RE trip to Greece: Greece is not a disgusting country. It is a country with social and structural problems that have to be recognized. I personally hope the Troika realizes it’s past and current mistakes and sets Greece free. No constraints + a program for growth and social assistance. This would enable Greece to face reality. If the government through it’s 51% ownership of DEH wants to give a 6 euro daily stipend to the electrical union + guarantees for no layoffs for ANY economic reason… so be it. In my mind it is the poor and hungry who should have the 6 euro stipend.

If the government wants to acquire (steal in my opinion) public/municipal reserves…so be it. If the PM and the FM want to conduct interview after interview and attend seminars while the country is in crisis…so be it. If Greece is “free”, Greeks will hopefully become responsible and embrace structural change. Not for the current populace but for future generations.

Wist: The problem is that the particular “structural reforms”, the austerity proposed and enacted by the Eurocrats make Greece’s or any other country’s debts less payable, not more payable. Therefore, the Eurocracy doesn’t care about the debt per se. It is not about the debt, but about eternal debt-peonage.

The austerity “reforms” are like a boss saying to an “employee” who overspent at the company store: “You must reform your ways! Here’s a sledgehammer. Break your own legs and I’ll let you keep your position as my slave.”

I appreciate the response and I understand the thought. No country nor person should be subject to debt peonage. I think “reforms” have to have more definition and “austerity” as a term needs to be banished. The parties involved need to determine what has equity and what doesn’t. Under “labor reform”, it is my understanding that the Troika wants the Greek government and businesses to have broader abilities to layoff employees. This seems to be an issue that Syriza opposes. If worker rights to protect against retaliation, sexual discrimination, bogus firings and replacement by patronage etc. etc. are legislated…I don’t see the problem. The reality of the matter is that society has to pay the bill every time that a cartel gains a special exclusion or preferential treatment and every time a government employee secures a bribe. Does a hair salon employee or a trombone player deserve to retire at an early age due to having a “hazardous” job occupation? Is that equitable for society? Not really. Greece is stuck in a structural mess that has developed for decades. The elites, politicians and cartels are sucking the lifeblood out of Greece. The “little guy” fights to protect what stake he has in the system and sees the upper end stealing their enlarged share. For the most part he acknowledges bribery/corruption and goes with the flow. This is why in Greece you have what is described as the 40-40-20 tax system for personal/real property. You pay a bribe of 40%, get a reduction in the tax bill that equates to a 40% saving and 20% goes to the government. I don’t disagree with many of the Troika’s suggested reforms. I do disagree with the Troika in that they haven’t offered a host of growth programs, infrastructure grants and joint venture proposals to enhance growth. With the Greek government I see too much posturing, little leadership expertise, little or no addressing of important issues (ie. tax collection), poor negotiating technique, bluster, extremely poor governance, terrible economic policies, etc… Given the polarizing of positions and the amount of finger pointing; it is likely that this whole saga ends very poorly with the possibility of tanks in the street.

Greece should depend on and be controlled by the rapacious theories and activities of venture capitalists?

Really?

…epic fail, your comment…

Yep, that is exactly what I said…word for word. Couldn’t get anything past your steel-trap mind.

My comment: None…you caught me and my rapacious theories have been exposed. Good job Vox. I will try and avoid any epic fails in the future.

Barbara Tuchman’s The March of Folly, makes clear to me that economics make no difference to world leaders who will aim for power over economic sanity. You can not figure out what these people do, because it simply doesn’t make any sense except as if they are attempting to destroy a nation. It was the same for Napoleon. He preferred giving up for France great lands in North America so he could loot and destroy the freedoms won by the Haitians. The C.S.A. wanted more slavery in all of North America, and couldn’t function without it as they gambled with the mortgages on lives homegrown.

England lost all of North America because they could not imagine the Colonies fighting back. So it has been, and so it will be.

Or rather, to the elites power is economic sanity, and vice versa.

The money holders are simply incapable of writing down their bad debt since that means the loss of wealth and power; the lowering of their status. They will pillage the periphery until they are forced to stop or there is nothing left to loot.

What does the Troika see as the end of this little drama? How does this end? Do they actually have any idea beyond ‘Pay me!’

I think the end looks like Dachau and Auschwitz and Buchenwald…

For perspective on the local government and pension fund issue, see Graph of the day: Greek government deposits. As Knibbe and the link therein note, Portugal & Ireland in the Eurozone and Hungary, Bolivia, Poland and the UK outside have acted similarly, to little notice.

That’s easy: “the Institutions” would like to see Greece repay the debt. Sell state assets, reduce pension payments, fire civil servants, etc. The more interesting question is: what does the Greece government see as the end of this little drama?

I see two main possibilities:

For Syriza, both #1 and #2 mean:

These outcomes could’ve been predicted when the initial talks all-but failed. Syriza had not prepared for a showdown with the Troika. Despite warnings to the contrary, Syriza leadership had staked everything on the hope that the Troika would listen to reason and would act more like responsible statesmen than creditors. The result was billions of euro of capital fled during the showdown which threatened the banking system. The Troika took full advantage of this to humiliate Syriza by insisting that bailout funds be withheld (Syriza was deemed untrustworthy) and that Syriza join the farce that they had previously denounced (‘partnering’ with “the Institutions”). Syriza pretended that this was progress – but no reform program that they presented to “the Institutions” has been sufficient. The withheld bailout funds (predictably) remained withheld and the crisis deepened with every payment.

The alternative to the “community organizer” approach that Syriza chose was a powerful socialist/populist approach that would challenge TPTB. While the former seeks to find common ground with TPTB, it generally ends in devious schemes to betray the people. Many on the left were hoping that Greece would lead the charge against neoliberalism and would’ve rallied to Greece’s side if they had chosen to do so.

Neoliberal austerity is a political tool as much as it is economic. It denies people resources to fight back. Initially, an unsuspecting, and too trusting people accepts ‘belt tightening’ (based on deceitful statements of why it is necessary) but it is unclear if that ‘tightening’ will ever end. TPTB position, that the beatings will continue until moral improves belies their real intent: a war of attrition on the middle class.

=

=

=

H O P

Meant as reply to Berial.

See my follow-up comment at the next day’s links: Making Sense of Greece.

Many, many thanks to Yves for presenting and highlighting this piece. Two aspects, that of Syriza’s response to the crisis and that of the banks’ indebtedness passed on to the people, arouse in me two trains of thought.

The first is that even as Syriza falls short of its ideals, nevertheless, the ideals have been presented (as they were when youth rallied so nobly to the first Obama campaign.) So, in both cases, it seems to me the tactics came as a double-edged sword for the duplicy-practitioners: they raised expectations, then failed to live up to them. It’s a glass half full or half empty situation, and I’m going with half full. (By that measure, every well documented failure of the regime in question, as presented here, solidifies those rallying against it, said rally having been nurtured by the promises, kept or not. If it works for those advocating terrorism, that terror breeds terror, so too it must work with respect to ideals.)

Okay, my second brain melt is this: I’ve been reading “The Hunchback of Notre Dame” (not finished yet) and finding the parallels, which Hugo would agree with I think, since he does suppose that all history is cyclical. He’s looking back to Paris of the late 15th century from an age delirious with excitement over the printed, not just written, word, which he calls the new architecture of a new age.

We now have the new architecture of the computer, primarily allied with financial power the way the printed word was allied with ideas, the old, physical architecture with religion. Yet, that alliance with financial power isn’t a natural one; it is being challenged by an alliance with popular power.

It would seem there can only be three slices of the apple. Just as in the archetype Paris there were three divisions – the cité, the university, and the town itself. Just as in the Constitution of the United States, nothing is said in favor of corporations, plenty about the government and plenty about the people, and plenty about the common welfare.

(The concept of architectural changes is very appealing, since ‘economy’ goes to the root meaning ‘home building’ – the same root term used by the Septaguint authors to describe how Eve was formed from Adam.)

Sorry, should be ‘duplicity-practitioners’, second paragraph.

“Economic faith healing” seems a clever critique, however I think “neoliberal medieval blood-letting” is a more apt one. Faith can actually help heal.

No one here talks about the inevitable here: the moment New Democracy comes back to power. Here is some possible thinking:

(a) When New Democracy comes back to power, mass emigration of the young ensues, dwarfing the Irish Potato famine of the 1840s.

(b) This emigration suits New Democracy just fine…it wasn’t their demographic anyways…

(c) Thirty to 40 years later, Greece has a population of about 425, with the ECB owning all of the assets after asset stripping is complete.

(d) Once the last Greek dies off, the ECB owns assets without any pesky voters, and opens up a tax haven within the EU to rival Singapore and Dubai. Land values instantly shoot up, and the young re-immigrate to the Former Republic of Greece, however, prior to this the ECB sets the voting age at 50 and up.

(e) Capital floods in, creating a European Singapore.

(f) ECB repeats this model in the former republics of Italy, Spain, and Portugal.

(g) The new model is more econmically efficient and investor friendly than the northern European states, so those countries (if not already depopulated) collapse; residents move to Southern Europe, since it is where all of the Germans and Brits wanted to live anyways.

(h) ECB repeats the model in Northern Europe, completing its takeover of Europe and the transition away from democracy for good.