Please see the preceding posts in our CalPERS Debunks Private Equity series:

• Executive Summary

• Investors Like CalPERS Rely on ILPA to Advance Their Cause, When It is Owned by Private Equity General Partners

Last week, we started analyzing a workshop on private equity held at CalPERS’ November board meeting. The staff’s intent was clearly not merely to educate the board, but far more important for CalPERS, to achieve two other goals: first, to persuade the public that private equity was a necessary component of CalPERS’ investment strategy; second, to demonstrate to the world that CalPERS understands private equity’s complexities and is therefore competent to participate in it.

In fact, a detached reading of the evidence and arguments presented leads to the exact opposite conclusion. This was most evident in CalPERS’ overriding argument for private equity: that it is necessary because it is the only type of investment that will beat CalPERS’ return targets, making it an essential component of the giant pension fund’s portfolio. As we will discuss in the next two posts, the evidence and arguments made in favor of private equity’s supposedly superior returns were at best weak and ridden with internal inconsistencies and at worst, relied on sleight of hand and an explicit preference for accounting tricks over economic realities.

We’ll begin with CalPERS’ star witness, Harvard Business School professor Joah Lerner, who participated via video conference. As you will soon see, Lerner indeed phoned it in, in more than one sense of the phrase. We’ve embedded his presentation at the end of this post.

Lerner opted for a mode of presentation which is common among academics who have been hired to support a position held by their client: They make a point of presenting enough negative information so as to preserve the appearance of objectivity, while still offering a preponderance of evidence supporting the client’s cause. However, in this instance, Lerner curiously fell well short of the mark, making a case for private equity that was so qualified and incoherent as to amount to an argument against it, and that can’t have been by design.

Why Most Academics Who “Research” Private Equity Should be Regarded With Considerable Skepticism

Chicago Business School professor Luigi Zingales, in a 2013 paper, Preventing Economists’ Capture, warned that economists were as susceptible to capture as regulators. He set forth the conditions that made capture likely:

While not all data economists use are proprietary, access to proprietary data provides a unique advantage in a highly competitive academic market. To obtain those data academic economists have to develop a reputation to treat their sources nicely. Hence, their incentives to cater to industry or to the political authority that controls the data are similar to those of the regulators. Second, outside of academia the natural audience of their work is either business people or the government officials applying some of that knowledge. The popularity and support among business people or the government gives credibility to a piece of research and the person who did it. Even if no researcher purposefully caters to business or the government, this selection will ensure that the most popular and successful researchers will be those who cater to business or the government. Finally, academic human capital is highly specific. Opportunities in consulting and careers outside of academia are not equally distributed. Economists who cater to business interests clearly have a larger set of opportunities.

Another, more subtle, source of bias arises from the publication process. In economics authors cannot do multiple submissions contemporaneously and manuscripts are subjected to many lengthy revisions. This extenuating process maximizes the power of the editor vis-à-vis the author. Thus, if a few editors are captured, this effect spreads out through the entire profession.

Scholarly work in private equity fits this pattern particularly well. The critical information, about performance of past funds, is kept by the general partners and shared only with friendly academics. And the general partner control of that data also means it is subject to cherry-picking. Even the supposedly better, less biased data sets like Burgiss, which consists of performance data provided by cooperating limited partners, has until very recently not been made available to academics who were critical of private equity.

Similarly, private equity pays lush consulting fees to its favored academics, separately providing a strong incentive to tout the party line. In my day in the early 1980s at Harvard Business School, the most senior members of the finance faculty made over five times as much in consulting fees as they did from their nominal day jobs at HBS. It’s hard to imagine the ratio of outside compensation to pay for working at the school is any lower now, and it is common knowledge that most faculty members at Harvard Business School are particularly aggressive about seeking outside work. Separately, one academic we know was told by a professor who has published regularly on private equity that our contact was foolish to adopt an adversarial posture to private equity, that they would find it difficult to get any funding for their research, while he was always well paid for his time.

Lerner’s conflict-of-interest problems were glaringly obvious yet went unaddressed in his presentation, to the point where a member of the public who is a CalPERS beneficiary felt compelled to raise the issue in his public comments. Unfortunately, this beneficiary was illegally denied the opportunity to confront Lerner himself about the issue, as Lerner signed off from his videoconference presentation as soon as he finished his portion of the program.

California law mandates that members of the public be allowed to raise issues on a public meeting agenda item before the body moves on to the next matter precisely so that such challenges can occur. However, the event was carefully orchestrated, in violation of state open meeting laws, to frustrate this important check and balance. We’ll discuss CalPERS’ flagrant violation of the Bagley-Keene Open Meeting Act at greater length in a future post.

This member of the public’s concerns about Lerner were stated clearly and judiciously:

David Sores**: What I wanted to bring up that I was concerned about, as I looked at what we were going forward with in the presentation, was Professor Lerner’s presentation in particular. And it’s not really fair to us or fair to him, I can’t question him and he can’t really defend himself, um, when I raise some questions about his background and qualifications because Mr. Eliopoulos does present the fact that he teaches at Harvard Business School.

But I know that also Professor Lerner is, and it just, this all came up on a simple Google search, he’s a [sic] advisor since 2009 for Grove Street Advisors, which is a major private equity firm. He’s listed also as an advisor at Caspian Private Equity as a strategic advisor, and I’m concerned that he may have a certain amount of conflict of interest, that is, I can’t ask him, but that his most of his income is coming from in fact the private equity industry. And I even look at his research institute and the tax filings for that research institute. His directors are essentially from the private equity industry and his funding comes from the private equity industry. And so I’m concerned that the presentation, obviously all the other presenters are investors in private equity and Professor Lerner is being sort of presented as independent, but he really isn’t. In fact, he’s the most conflicted presenter today.

And the concerns about the possibility of corruption are not theoretical. We’ve been told, in considerable detail, of a specific paper on private equity where the results were so implausible as to be clearly falsified.* We’ve also been told by a contact we regard as impeccable about a specific, well known academic in private equity that, “If you could reproduce any of his results, I would be astonished. But of course, all of his data sets are proprietary.” We hope to investigate this issue in greater depth next year.

Lerner’s Peculiar “Dare to be Great” Pitch to CalPERS About Private Equity

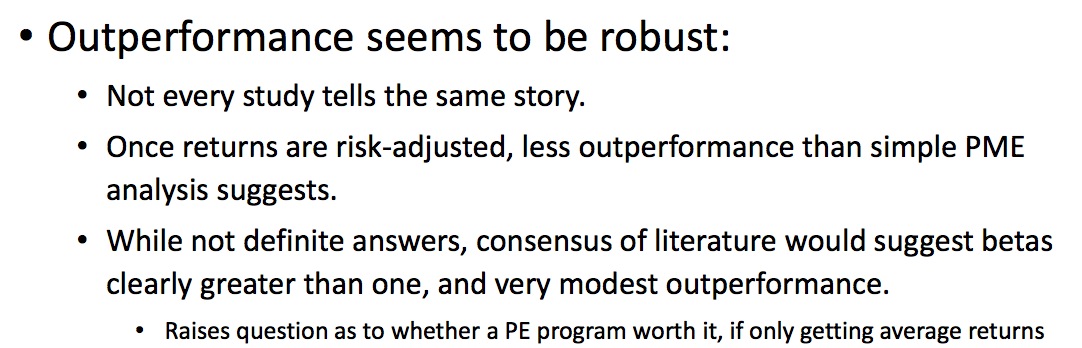

If you’d like to watch the entire presentation by Josh Lerner, it starts at 36:40 of the first part of the CalPERS’ video of the workshop. Even though Lerner tries to make a case for private equity outperformance, both in his slides and his talk he acknowledges that the evidence of strong private equity performance is qualified at best. As slide 25 concludes, in small type, “Raises question as to whether a PE program worth it, if only getting average returns,” and page 36 states:

• Data suggest that an “index fund” approach is likely to yield OK performance.

• But modest returns likely to result are unlikely to be worth the time and effort.

• Suggests that to be worthwhile, PE programs must have outperformance.

Keep in mind that North Carolina’s former chief investment officer, Andrew Silton, has said that CalPERS is such a large investor in private equity that it will inevitably be a de facto indexer:

Moreover at CalPERS’s immense scale, the best CalPERS can hope for is to build a portfolio of private equity funds that delivers market performance. In order to build a $30 billion private equity portfolio, CalPERS has to select so many managers and funds that it is virtually impossible to generate anything more than the market’s overall return for the asset class.

Yet one of the striking features of Lerner’s talk is its focus on how CalPERS can become a top quartile investor, when as we’ve been describing for some time, this is a fool’s errand. As we wrote in 2014:

Rather than question the logic of investing in private equity at all, everyone in the industry has convinced themselves that it is reasonable to believe that they can be the Warren Buffett of private equity. The investment consultants go through the shooting-fish-in-a-barrel exercise of convincing their institutional clients that each of them is prettier, smarter, and more charming than average, and therefore capable of achieving sparking results. Needless to say, flattery is an easy sell….

Fundamentally, this is an intellectually dishonest exercise, and diametrically opposed to the way many public pension funds construct other parts of their investment portfolios. With public equity in particular, it’s almost certain that a significant majority of U.S. pension fund assets are invested in index funds. That’s because pension funds have recognized that, collectively, they cannot do better than average, and that after paying active management fees, actively managed public equity portfolios typically perform worse than the market average.

So it’s not as if these investors are so clueless that they can’t grasp the point that all of them cannot achieve above average results, let alone significantly above average results. Instead, with private equity, there is a desperate desire to be in the asset class for reasons that probably reflect a combination of intellectual capture by the PE managers, political corruption in legislatures that control public fund board appointees, and the need to have a strategy that could conceivably solve the pension underfunding problem over time.

Even an MBA student who came to see the presentation could tell that the emperor had no clothes:

Pameis Morris**: My other comment is directed around, perhaps it can be addressed by the consultant from Wilshire. You know I know you can’t answer, but I’m wondering, left wondering how you advise your clients given that about half of them, in order to make significant returns in private equity, they have to beat the average. So if you are advising all these folks on private equity, I’m not sure how you would advise them all that they are all going to beat the average. I think what we saw in Dr. Lerner’s presentation was that on slide 32 that, if we can look at that as well, that you really do need to beat the average in order to claim superior returns in private equity. And I think to Mr. Jelincic’s point earlier, since we have perhaps less disclosure of funds that are underperforming, even perhaps this curve right here, you know, overestimates the returns that we’re getting in private equity.

Moreover, while there has been evidence of what in the literature is called “top quartile persistence,” meaning a fund that had been a top quartile performer was disproportionately likely to be a top performer again, even McKinsey has acknowledged, as Lerner also does (see slide 35), that the past is now much less likely to be a predictor of future performance.

And even in the hoary old days when top quartile performance appeared to exist, it was not realistically possible to achieve it. As we’ve pointed out previously, private equity general partners raise their next funds 4 to 5 years after their previous fund, when it is hard to tell reliably how well a fund will do (for instance, one fund that showed a near 80% IRR at fundraising time had an 11% IRR when all the money was finally paid out). One study found that 77% of the funds could claim to have the elusive top quartile performance.

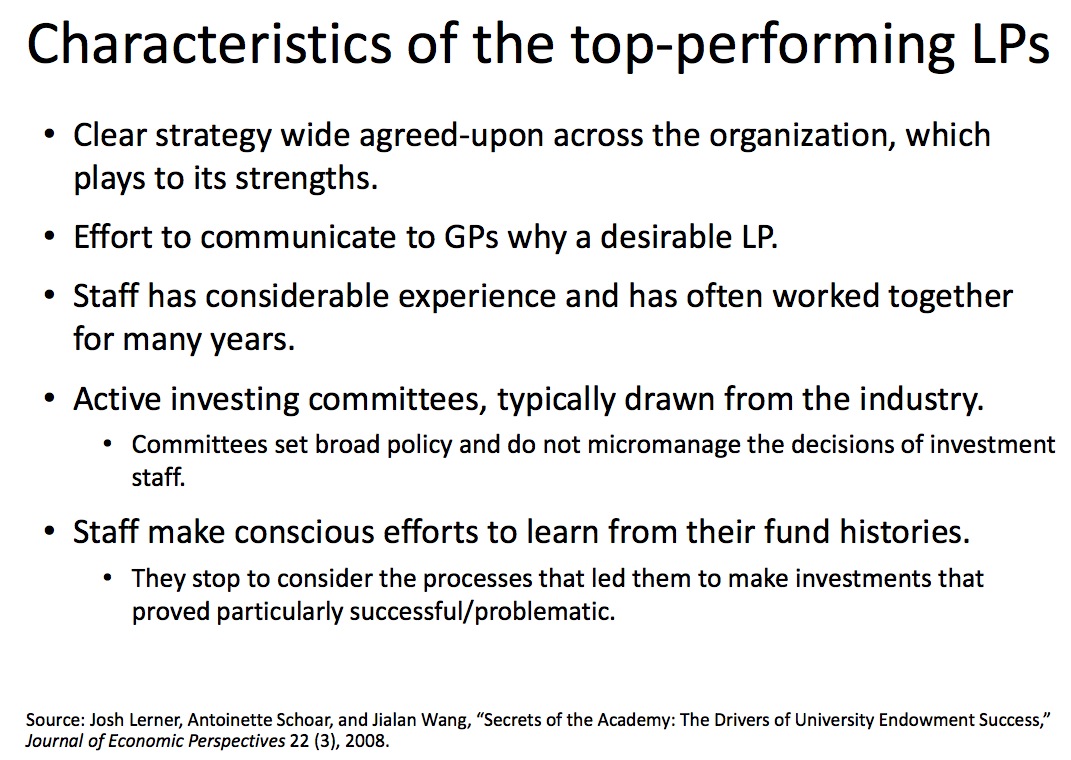

Lerner attempts to solve that problem by showing that foundations have more success than other investors in achieving superior results, and therefore they can serve as a model for how to beat the market. But that study was based on 1991 to 1998 data, which might as well be from the stone ages, and was also in the era where top quartile performance existed. Moreover, the magic foundation formula, even if it still worked (and Lerner acknowledges on p. 29 that it doesn’t), cannot be applied to a public pension fund:

I will confess to not having looked at how and when Lerner and his colleagues made this survey, but a 2007 paper he referenced in the preceding slide, “Smart Institutions, Foolish Choices: The Limited Partner Performance Puzzle,” Journal of Finance 62 (2), 2007, relied on 1991 to 1998 data, so the odds are high that this study also used information from the 1990s, a very different era.

In addition, it’s not obvious how CalPERS would achieve two elements of the not-at-all secret sauce that Lerner deems to be critical, that of minimizing employee turnover and having an active and expert investment committee. CalPERS is disadvantaged in recruiting staff by being located in Sacramento and having less cachet than a foundation, endowment, or fund of funds. It also would in most cases pay less than those competitors, which would make it ripe for poaching were CalPERS to find a way to be smarter about recruiting people who didn’t have the heavily-sought-after top tier undergraduate and grad school degrees, but nevertheless had the analytical and interpersonal skills to be good investors.

And the board problems are even more difficult to surmount. All of CalPERS’ board members sit on its Investment Committee. Six of the thirteen board members are elected from its membership. None of the current elected board members has investment experience, save JJ Jelincic, who is a CalPERS employee. And even then, his experience is not in private equity, and his status as a CaLPERS employee limits his role in governance (most importantly, he cannot participate in the review of the board’s lone direct report, CalPERS’ CEO Anne Stausboll). Three board members are appointed, two by the governor, one by the legislature. The four ex officio members — the Treasurer, the Controller, the director of the Department of Human Resources, and designee of the State Personnel Board — similarly do not have investment expertise. Thus the only way to up the board’s game would be via the appointees, and that runs the risk of private equity foxes getting into the CalPERS henhouse, unless (as did occur to a fair degree in the 1990s) some of the elected members take it upon themselves to educate themselves in private equity.

But an even bigger impediment now is Anne Stausboll’s power grab. As we’ve described at length in previous posts, she has gone to considerable lengths, and with great deal of success, to render the board weak and passive, which is exactly contrary to the sort of board needed for successful investment in private equity.

Lerner’s Rosy View of Private Equity Performance

Notice how Lerner’s claim in this slide (page 25) is not well supported by his bullet points that follow:

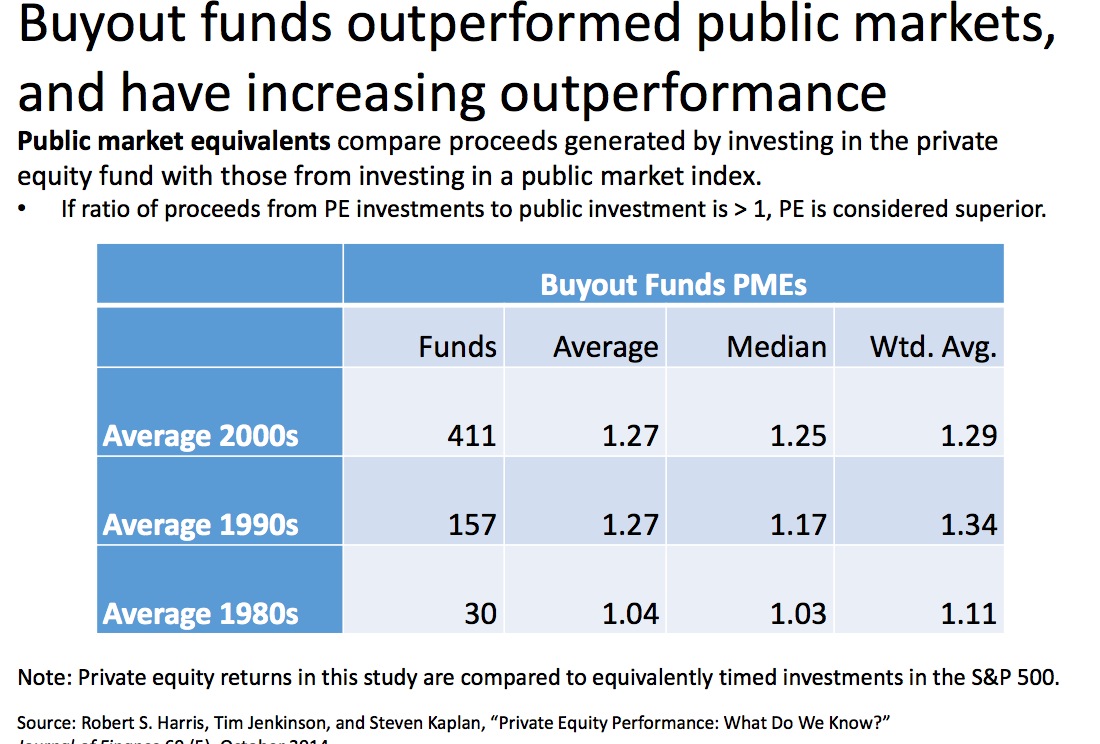

The “PME” that he refers to is “public market equivalent,” which is considered by academics and finance professionals to be a far better measure of returns that IRR.

Lerner’s case for private equity’s superior returns rests critically on this slide, page 23, which in turn is based on a single study, albeit a highly regarded one:

Astute readers will note that the benchmark used is the S&P 500, which is inappropriate and unduly flattering to private equity, since S&P 500 companies are vastly larger than private-equity owned firms. The S&P 500 index thus shows a lower return than smaller-cap stock indexes.

Rosemary Batt, the co-author of the highly esteemed book Private Equity at Work, was relegated to an illegal comment under California’s open meeting laws, well after Lerner’s presentation was over, blunting the impact of her remarks. She politely took issue with how Lerner read the Harris et al. study as well as another key paper he cited:

Professor Rosemary Batt: My name is Rosemary Batt. I’m a professor at Cornell University, and I’m on sabbatical at Berkeley, which is why I could come today.

My comments are based on a book which I have right here, um, which I just wrote on private equity, along with economist Eileen Appelbaum. And in that book, we summarize all of econometric evidence on private equity’s performance, including several of the papers that Professor Lerner cited today.

And so I want to talk a little more about the performance data and just expand on Professor Lerner’s excellent presentation.

The findings from that core Harris article that he mentioned are very important. He reported a 27% out-performance for private equity vintage funds in 2000s, which equals an annual excess return of about 2.4% if you assume a 10 year lifespan. To clarify, this finding is based almost entirely on estimates, if you look at the paper, so it’s not based on actual returns. The paper also reports returns on funds over three decades, and there the average annual excess drops to about about 2%, and the median is about 1.2%. So that’s in the Harris paper.

When the private equity funds are compared to the Russell 3000 and 2000, which cover the mid-sized companies that are comparable to private-equity-owned companies, private equity performance is worse, beating these indexes by between 1% and 1.5%.

So moreover, the pension funds, they generally require a premium of about 3% over the stock index in order to adjust for greater risk or illiquidity. None of the estimates in this important paper, porbably the most important paper recently, would warrant investment in private equity.

Two more points. Professor Lerner then refers to another really important paper by Robinson and Sensoy who report, they actually report performance based on real returns, so liquidated funds. And here they find that the average fund does outperform the stock market by 1 to 1.5%, depending upon the index.

The median fund, however, just matches the stock market, which means that 50% of the funds do not perform as well as the stock market. It is the top quartile funds that outperform both indexes by 3 or 4%.

So, if we put this together, then, Professor Lerner also points out this problem of persistence of performance. And the studies he refers to show that prior to 2000, the private equity firm with a top performing fund had about that 50% chance of being in the top performing funds in the follow-on fund. But since 2000, that probability has dropped to 22%, and that is less than would be expected if the distribution were random.

And so, in sum, I worry based on our review in which we’ve kind of turned the kind of technical papers into lay language, and that’s what we’ve tried to do in this book, um, you look across the studies and they really do not provide the kind of evidence to suggest that private equity beats the market in general, and especially if you take a risk-adjusted return into account. While the top quartile do beat the market, then the question is this persistence problem: it is no longer possible to use a private equity firm’s track records to predict funds that have the best chance of being top performers.

And there’s a longer discussion but it really does not have to do…. Yes, great staff really, really help, but they only have a certain amount of control. And if you think about, for example, the Texas utilities, KKR’s investment in a $48 billion deal that went down the tubes simply because they had an 80% debt and they could not foresee what was going to happen in the energy market, and that’s not within the control of the staff.

So thank you so much and I’m glad to provide an electronic copy of the material.

If you’ve read Private Equity at Work, one of its strongest features is how scrupulous it is in discussing academic work on private equity, and Batt gives her same characteristically careful reading here. It should come as no surprise that Appelbaum and Batt regularly found that the conclusions commonly attributed to widely-cited academic papers on private equity did not match up all that well with what a rigorous look at the paper’s data and methods actually showed.

As one academic said to me, Lerner’s presentation was of the type he was advised to make when he started researching private equity: point to the importance of top quartile performance, suggest that there are ways to achieve it, and drop hints as to how to be helpful (he highlighted the Lerner slide that mentioned the importance of expertise on the board: One remedy if you don’t possess it is to rent it, as in engage a consultant… such as a top academic).

The notion that CalPERS may well have received a prototypical presentation from Josh Lerner, even if it was updated to incorporate recent research, is consistent with the fact that private equity spends so much in fees that is it difficult to get independent advice. But the fact that CalPERS is so deeply captured that it does not even appear to recognize this impediment is even more troubling.

___

* This was from an academic with tenure and hence not a case of professional jealousy.

** My best guess as to the name based on the pronunciation.

How could you doubt the words of a Harvard economist? /s

http://www.boston.com/news/local/massachusetts/articles/2009/11/29/harvard_ignored_warnings_about_investments/

A real question is whether or not Harvard itself is willing to lend its imprimatur to Learner’s presentation. And if not, why not.

Sad that it takes a member of the hoi polloi to bring notice to simple and obvious conflicts

from the individual we will call David Sores (until he provides more info on sp.)

“But I know that also Professor Lerner is, and it just, this all came up on a simple Google search, he’s a [sic] advisor since 2009 for Grove Street Advisors, which is a major private equity firm. He’s listed also as an advisor at Caspian Private Equity as a strategic advisor, and I’m concerned that he may have a certain amount of conflict of interest, that is, I can’t ask him, but that his most of his income is coming from in fact the private equity industry. And I even look at his research institute and the tax filings for that research institute. His directors are essentially from the private equity industry and his funding comes from the private equity industry”

This is the independent reviewer! Revealed with an easy google search, and that in spite of how lame google searches have become…k

Harvard Business School…the word that pops into my head is “cloistered”

Rather than foaming at the mouth in my usual manner regarding that esteemed institution, I’ll pose a different angle, as our host is a product of HBS, how can we get Harvard to make more like her?

Calling the early ’80’s a more ethical time is a little difficult unless one compares them directly to the present day where corruption pays so well, and to a degree where the evidence of capture can simply be called up on google.

I notice on some of the “neighbor blogs” that there has been an increase in those haplessly decrying socialism. These same commenters, however, seem unable to grasp the hierarchical stack where a few powerful rich lord over a populace herded into a homogeneous mass is the basic description of communism. A sort of western style command/control scenario. This perplexes me. So in an effort to get better results for society from an esteemed institution such as HBS it may be necessary to nationalize Harvard in order to prevent Harvard from turning our country (let’s face it, they’re really engaging in a global power grab) into an uncompetitive monoculture benefitting those kings of the present who are trying to cement their standing as the lords and ladies of the new global government. Call me crazy, fine, but uber, air b’n’b et. al. have their greedy eyes on every loose dollar on the planet, and in the future world they have in mind for us you’l have your income managed by the IRS and MasterCard so that you can more efficiently be submissive to their needs…

this is relevant to the post I hope because PE is a vehicle by which public money is laundered into the pockets of the few connected insiders, something our gov’t claims to oppose in principle…

Sunday, April 22, 2012

Search for Positive PEU Contributions Doesn’t Slow Lerner

Apollo, Bershire, Carlyle, KKR, Clayton Dubilier and Thomas H. Lee Partners should be able provide data on thousands of PEU transactions. I expect they plan to pick and choose, submitting data on “winners” under Josh’s criteria. If PEU’s can game the political system, they have the wherewithal to distort academic research.

As for Josh Lerner, one doesn’t have to look far to find his love for PEU’s. Yet his new nonprofit claims to have no particular “point of view.”

The Private Capital Research Institute (PCRI) led by Harvard Business School Professor Josh Lerner, is seeking to address these disparities in knowledge by examining private capital transactions and institutions, seeking to understand their fundamental economic nature and impact. The PCRI is a not-for-profit corporation, to date solely funded by the Erwin Marion Kauffman Foundation; the Brookings-PCRI Private Capital Project has a number of generous donors, including the Association of Corporate Growth. The research is independent and focused on promoting an understanding of the Private Capital Industry, rather than advancing a particular point of view.

Of course Lerner has a point of view. It’s pro-PEU. Otherwise why would he get invited to speak at meetings of global economic tamperers this past decade. Take this talk from 2008:

Josh Lerner recently led an international team of scholars in a study of the economic impact of private equity for the World Economic Forum (WEF).

Josh knows how PEU money drives the WEF. Lerner co-heads the Brookings Private Capital Project. It’s aim? Research positive contributions of the industry. That means only putting their good stories in the database. That’s why fifteen PEU’s with thousands of companies isn’t nearly enough.

http://peureport.blogspot.com/search?q=lerner

Mr. Lerner meet Mr. Faust.