Please see the preceding posts in our CalPERS Debunks Private Equity series:

• Executive Summary

• Investors Like CalPERS Rely on ILPA to Advance Their Cause, When It is Owned by Private Equity General Partners

• Harvard Professor Josh Lerner Gave Weak and Internally Contradictory Plug for Private Equity at CalPERS Workshop

• CalPERS Used Sleight of Hand, Accounting Tricks, to Make False “There is No Alternative” Claim for Private Equity

The CalPERS November private equity workshop contained so many misleading and even flat out untrue statements that it would tax reader patience to go through them all and unpack why the remarks were off base. Nevertheless, over the next few posts, we’ll focus on some of the most important of these canards, both in the context of the workshop and regular statements CalPERS’ staff have made about private equity investing.

We’ll focus on two related ones today, since they are based on the deeply flawed limited partner belief, carefully nurtured by the general partners, that being their “partner” actually means that the investors are anything more than a meal ticket to the private equity general partners.

As we’ve been digging deeper into the private equity industry, and using the CalPERS November private equity workshop as another vantage point, one of the most striking elements is the severity of intellectual capture. Even though there is very little in the way of a revolving door between investors like CalPERS and private equity funds, there is nevertheless a remarkable amount of internalization of what amounts to general partner propaganda by the limited partners.

For instance, shortly after so-called “carry fees” came under increased scrutiny as the result of CalPERS’ embarrassing admission earlier this year that it had no idea what it was paying, quite suddenly a few investors such as CalSTRS, as well as the industry organs like Private Equity International, started trying to distance themselves from the term “carry fees” as if it were tainted, and started trying to rebrand it as a profit share (the IRS does call it a “profits interest” but I’ve not seen that deployed as the new term of art). The fact that investors were rushing to defend the general partners on the question of how much money the GPs were making and why hadn’t the investors been more inquisitive about that, since it was coming out of their returns, illustrated how much investors see themselves as joined at the hip with the general partners.

In reality, not only are the general partners wildly successful at exploiting the investors at every turn, many of the general partners are using the profits they’ve earned on the backs of public pension funds to campaign to end them. So the general partners are as much their friend as is the farmer the friend of the turkey he is fattening for Thanksgiving. And the turkey actually has better grounds for trusting the farmer, since every day prior to his slaughter, he has been fed and cared for.

By contrast, as we pointed out yesterday:

The very investors who amassed their wealth on the back of public pension funds often reinvest their lucre in a frontal attack on those very institutions. For instance, from yesterday’s New York Times (hat tip DO):

Mr. [Kenneth] Griffin and a small group of rich supporters — not just from Chicago, but also from New York City and Los Angeles, southern Florida and Texas — have poured tens of millions of dollars into the state, a concentration of political money without precedent in Illinois history.

Their wealth has forcefully shifted the state’s balance of power. Last year, the families helped elect as governor Bruce Rauner, a Griffin friend and former private equity executive from the Chicago suburbs, who estimates his own fortune at more than $500 million. Now they are rallying behind Mr. Rauner’s agenda: to cut spending and overhaul the state’s pension system, impose term limits and weaken public employee unions.

In other words, public pension funds are naively signing their death warrants, and that the pay packages of state employees who have not yet retired, out of their deeply misguided, utterly unwarranted loyalty to the private equity industry.

The “Alignment of Interests” and “Skin in the Game” Canards

If you listen to the CalPERS’ monthly Investment Committee meetings, you’ll hear both the Chief Investment Officer Ted Eliopoulos and the head of private equity, Réal Desrochers, regularly tell the board about how they work to achieve “alignment of interests” between CalPERS and the general partners.

These reassurances are hollow.* We’ve explained at some length about how the features that CalPERS officers have touted as being to CalPERS’ benefit don’t work that way that they claim they do. For instance, Desrochers told the CalPERS board that his staff required investors to have “skin in the game” and that the fees were designed so that the general partners and CalPERS has the same incentives.

CalPERS staff has to be willfully blind to believe that. As we wrote in Senior Private Equity Officers at CalPERS Do Not Understand How They Guarantee That Private Equity General Partners Get Rich:

Not only has he [Desrochers] misrepresented the extent and rigor of CalPERS’ private equity due diligence, which in and of itself should be a firing offense for someone so senior, but he is also completely wrong about how private equity firms make money. Once you get past the smallest firms, they do get rich on management fees alone. And CalPERS, by virtue of its size, invests almost entirely in mid-sized and larger funds.

One former private equity partner laughed at the notion that industry members were only getting by from management fees and needed to work hard to get rich: “The LPs [limited partners] lost that battle long ago.” He said that the heads of some firms make close to $100 million annually before “carry fees,” including firms that manage funds in which CalPERS holds investments.

Eileen Appelbaum and Rosemary Batt, in their landmark study Private Equity at Work, similarly found that the overwhelming majority of private equity income came from fees not at risk, as in the management fees and the other fees and expenses that they extract from the portfolio companies that they own. From p.52 of the original print edition:

Despite changes in fee structure, management fees are still a major source of income for PE general partners. The pay packets of GPs, not including their share of carried interest, are quite high. Average senior GP pay in 2011 was nearly $1.4 million and ranged as high as $5 million. For a less experienced junior GP, average salary in 2011 was $270,268 and ranged up to $750,000.

Andrew Mettnick and Ayako Yasuda found that “close to two-thirds of total revenues [of the PE firm] derive from fixed-revenue components, and about one-third from the variable-revenue components.” That is, in their study, management and other fees provided two-thirds of the income earned by a fund’s general partner. Carried interest accounts for about one-third.

Yet we saw the same type of misrepresentation made again in the workshop. For instance, page 72 of the slideshow states, “Management fees intended to cover operating expenses of a fund,” when that’s been widely discussed as false in practice (see the widely-read 2112 Kauffman Foundation report, We Have Met the Enemy and He is Us as an example**).

Another important nail in the coffin of this “alignment of interests” fantasy came in the public comments section of the CalPERS workshop. It’s so important, and in some ways so obvious, that I am kicking myself for not having noticed it before.

The issue is that the large public companies like KKR and Blackstone that invest in private equity don’t have “partners” risking their own money. Their top brass are employees who get salaries and bonuses. Moreover, their shareholder reports allow you to see the role that carried interest played in their total comp, and it’s not all that significant.***

Thus the “skin in the game” model doesn’t even remotely apply to them. Their economic arrangement is even more “heads I win, tails you lose” than for the rest of the industry, which is saying a lot.

From the public comments section of the workshop:

Don Ochoa:**** In looking through the presentation I’m struck that there is no mention, in any of the slides, that four of your largest PE managers, who collectively manage close to 40% of CalPERS’ PE commitments, are publicly traded companies.

The fact that Blackstone, KKR, Apollo and Carlyle are publicly-traded brings into question CalPERS’ assertion that it can successfully align its interests with these PE managers.

Despite CalPERS’ belief that these executives and founders are motivated by their pursuit of carried interest in the funds, the reality is much different. By examining SEC 10-K annual reports, it easy to see that increasing dividend, payouts and stock appreciation, and not carried interests, are the overwhelmingly predominant income sources for these private equity executives.

For example, looking at Stephen Schwartzman’s compensation, he’s the CEO of Blackstone, from 2012 to 2014 we see that in that period he made approximately $1.1 billion dollars in dividend income. I will take a second to let that number sink in for a bit.

For that same period he only made $116 million in carried interest. In other words, carried interest represented less than 10% of the total cash income that Mr. Schwartzman received from 2012 to 2014.

For Mr. Kravis and Mr. Roberts, co-CEOs of KKR, carried interest represented approximately 36% of their cash income during the same period. Their noncarried interest income was $238 million and approximately $780 million for Mr. Black of Apollo. Again, these amounts do not include carried interest that they earned over and above these figures. Also, these numbers do not include earnings from their investments in their own funds.

Putting aside the astronomical sums of money that these CEOs have collected over a three year period, primarily at the expense of public pensions funds like CalPERS, the important point is that most of the income of these publicly traded companies is generated from fees you pay regardless of whether the funds you invest in are profitable, including management fees and portfolio company fees.

It is important for you to recognize that Wall Street analysts who cover the stock of these PE firms praise them for maximizing this recurring fee income and give them relatively no credit for earning profits from carried interest, because such profits are unpredictable and uneven. The perspective of these analysts has a large impact on the stock price of these publicly-traded private equity firms, so the fact that the analysts disfavor carried interest as a source of profits has a huge impact on how the firms structure their business.

Again, it’s a little disappointing that your outside experts failed to point out this fundamental reality, and I am glad to have the opportunity to share this with you.

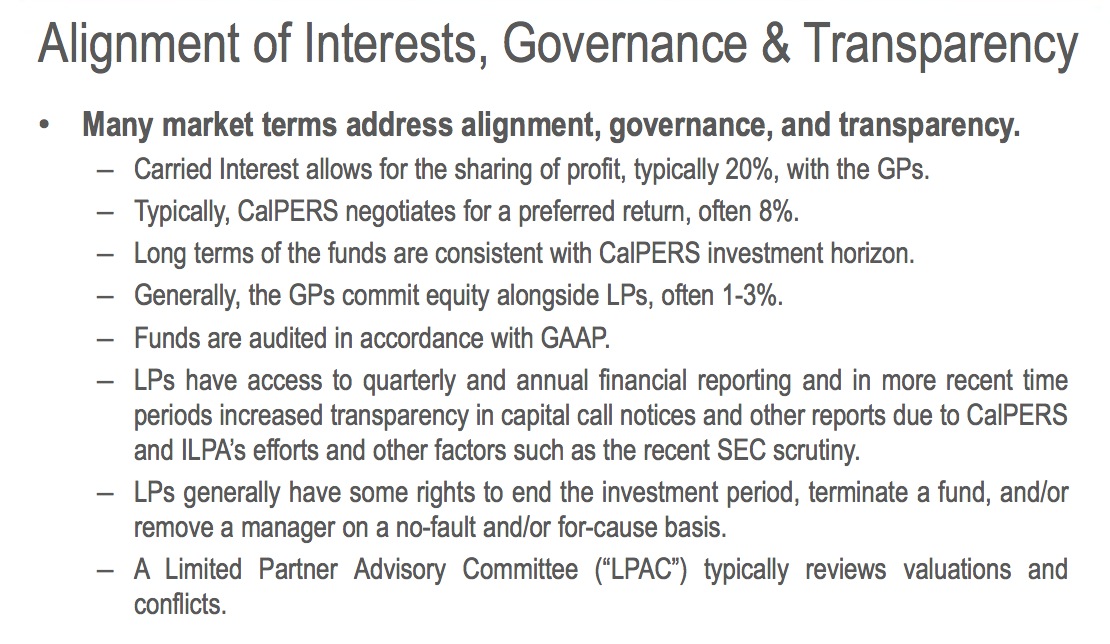

We’ll continue with the “alignment of interest” fairy tale. Although we singled out the presentation by a CalPERS in-house attorney, Marte Castanos, on legal issues as generally good, we take issue with some of his discussion of “alignment of interests.” In fairness, Castanos may have felt hemmed in by positions repeatedly taken by Eliopoulos, Desrochers, and other private equity staffers in previous board meetings. From his section of the talk:

We’ll address some points on the slide briefly:

The hurdle rate/preferred return is widely misunderstood. In simplified terms, for most funds, as CalPERS’ carry fee disclosure totals confirmed, the preferred return is set up so that once that prototypical 8% profit level is attained, the general partners are entitled to a “catch up” so that the effect is that he will have earned his 20% on the entire profits, and not the profits in excess of 8%.

The GPs generally commit 1% equity or less. Particularly for the large funds that CalPERS favors, most of the general partner capital committment comes in the form of waived management fees. That means, perversely, that the general partners are permitted to credit part of their excessive management fees paid by the limited partners (excessive because they are only supposed to cover operating costs and therefor should have been negotiated down long ago) as if it was an actual hard dollar contribution of their own money.

While fund audits are indeed prepared in conformity with GAAP, they are well known among accountants to be lightweight compared to public company audits.

The standards for preparing portfolio company financial statements are disturbingly low. Portfolio company financial reports for many, and likely most, private equity managers, are prepared with a software package from a company called iLevel Solutions that allows the reports to be manipulated and do not provide an audit trial for changes made. We discussed this issue at length in 2013 in Why You Should Not Trust the Financials of Private Equity Owned Companies. From that post:

The key issue is that PE firms want their investors and the SEC to believe that their iLevel database has been constructed in a tamper-resistant fashion, which is always a central design goal of accounting software systems. If an accounting system allows people to change entries after the fact, that system is absolutely, utterly worthless. But that’s what iLevel explicitly allows to occur because, rather than extracting the data directly, it requires portfolio company employees to re-enter information into iLevel from their general ledger accounting system. Moreover, iLevel presents as one of its advantages that “key stakeholders” can “verify and approve the data.” That’s code for “tamper with.”

Pray tell, how often has CalPERS asked its prospective private equity managers whether they use iLevel Solutions software to prepare the financial reports of portfolio companies?

Limited partner rights to stop investing, terminate funds and fire managers are empty. There is a big collective action problem here, particularly in light of how desperate most investors are to curry favors with general partners. That is compounded by a pervasive fear about standing up to a general partner (the belief is that not only will that general partner retaliate but others would take similar measures if they saw any commonality of interest with the general partner being challenged), save in an extreme case such as Madoff-level stealing (and in instances like that, the horse has not just left the barn but is already in the next county).

The last bullet point, on the role of the limited partner advisory committees, is so important as to merit stand-alone treatment. This was a topic I had intended to present to the board in the public comments section of the workshop had our time not been curtailed in violation of the Bagley-Keene Open Meeting Act (the topic of a future post).

The Utter Powerlessness of Limited Partner Advisory Committees

Former SEC examination chief Andrew Bowden singled out limited partnership post-investment supervision as particularly weak in his famed 2014 “sunshine speech” (emphasis original): “…investor oversight is generally much more lax after closing.”

Yet when CalPERS CIO Ted Eliopoulos mentions limited partner advisory committees, one of the few post-closing supervision channels, you can hear him crank up the warmth in his voice. It’s as if he wants to make clear to the board that these groups are a big deal and the board should respect the special role that CalPERS enjoys by participating in them.

Sadly, the presentation failed to address how little power private equity limited partner advisory committees actually have.

First, the general partner selects who sits on the advisory committee. Needless to say, they almost always ensure that a majority of the committee consists of friends and allies. For example, the funds of funds sponsored by the big investment banks are significantly over-represented among advisory committee members. This is the case because general partners collectively pay investment banks billions in fees, which makes it almost impossible for the funds of funds to vote against general partner interests.

Second, the purview of the Advisory Committee is quite limited, typically to approving conflicts of interest and, sometimes, portfolio company valuations. But, even then, the deck is stacked against investors like CalPERS. The limited partnership agreements that we’ve published, like Blackstone’s, show that the advisory committee needs to go through a very cumbersome process to object to valuations. And, in the case of Blackstone, the issue ultimately ends up arbitrated by the New York Stock Exchange, where it is safe to assume that Blackstone has many friends.

Third, the existence of the advisory committee can actually work against the limited partners as a whole by providing a pretense of LP governance that is ultimately a sham. For instance, as was discussed in CalPERS’ investment committee meeting in October, Blackstone was engaged in an abuse called “termination of monitoring fees” which basically means charging monitoring fees to portfolio companies after the deal was sold. As JJ Jelincic pointed out then, Blackstone had notified the dozen or so members of the advisory committee about this practice, while hundreds of other investors were left in the dark. Yet apparently none of the advisory committee members did anything about it. Had the limited partners as a whole been informed, the odds of opposition would have been greater.

Finally, there are well-known stories in the limited partner community of the rare instances where a limited partner representative asked tough questions at an advisory committee meeting and, before he even got back to his office, his boss had received a call demanding that the individual never be sent to another advisory committee meeting.

As a result of these power dynamics, there is an underlying reality that, for the vast majority of limited partners, participating on advisory committees means little more than an excuse for a trip to New York or London, a nice meal, and socializing with other limited partners and the general partner. It’s a mistake to view it as anything more.

And on a higher level, it’s disheartening to see how easily limited partners like CalPERS are bought. Back in the old days, the line was that the price of a $100 million commitment was a steak dinner. But even worse, limited partners have become textbook examples of what Jane Hamsher called the veal pen in the political sphere. As she wrote in 2009:

Someone asked me over the weekend to be more explicit about what the term “veal pen” means:

The veal crate is a wooden restraining device that is the veal calf’s permanent home. It is so small (22″ x 54″) that the calves cannot turn around or even lie down and stretch and is the ultimate in high-profit, confinement animal agriculture. Designed to prevent movement (exercise), the crate does its job of atrophying the calves’ muscles, thus producing tender “gourmet” veal.

About 14 weeks after their birth, the calves are slaughtered. The quality of this “food,” laden with chemicals, lacking in fiber and other nutrients, diseased and processed, is another matter. The real issue is the calves’ experience. During their brief lives, they never see the sun or touch the Earth. They never see or taste the grass. Their anemic bodies crave proper sustenance. Their muscles ache for freedom and exercise. They long for maternal care. They are kept in darkness except to be fed two to three times a day for 20 minutes.

Soon after the election, the Administration began corralling the big liberal DC interest groups into a variety of organizations and communication networks through which they telegraphed their wishes — into a virtual veal pen….

And so the groups in the DC veal pen stay silent. The leadership gets gets bought off by cocktail parties at the White House while the interests of their members gets sold out. How many have openly pushed back against the Administration on Don’t Ask, Don’t Tell or DOMA? Well, not many. Most tried to satisfy their LGBT members by outsourcing activism to other organizations, or proving their bona fides by getting involved in the Prop 8 battle that is not directly toxic to the White House. It’s a chickenshit sidestep that betrays the interests of their members in the interest of personal gain, which they justify with feeble self-serving palliatives about the importance of “maintaining a seat at the table.”

The analogy is uncomfortably exact as far as limited partners like CalPERS are concerned, who perceive their freedom of movement to be tightly circumscribed.

We’ve seen how closely limited partner choice of words and talking points hew to those of general partners, which suggests rapt attentiveness to messaging in industry conferences and mouthpieces, similar to the communication networks that Hamsher describes. Similarly, the interests of the staff handling private equity investments are divorced from those of their beneficiaries. Top executives at private equity investors are often well paid, particularly when they have the likes of Robert Klaunser setting up lucrative special pension plans for them. Even the modestly remunerated investors at least get the perk of going to general partner dog and pony shows and industry conferences in glamorous locations.

And in another parallel to the Washington veal pen, the opposition has been outsourced, as we’ve pointed out, to the Institutional Limited Partnership Association, an organization designed to be toothless because virtually all of its funding comes from the general partners.

Ultimately, the pension fund beneficiaries are being sold out, by virtue of the refusal to consider alternatives to private equity, and the fact, as we stressed at the top of this post, that some of the private equity winnings are being plowed into a campaign to tear down public pension funds.

The worst is that unlike the inhabitants of the Washington DC veal pen, who were disciplined by having the Administration cut the funding of groups who’d stepped out of line by leaning on major institutional sponsors, CalPERS and other major institutional investors have far more power and latitude than they’ve been conditioned to think they have. We’ll discuss that issue at length in the last post in our series.

___

* That’s aside from the fact that every time Eliopoulos goes into his “alignment of interests” patter, it comes off as if he’s telling children a favorite bedtime story.

** Remember that Kauffman invested solely in venture capital funds, which are vastly smaller on average than the funds CalPERS invests in, so this issue is far more acute for CalPERS than Kauffman, yet even Kauffman flagged it as noteworthy.

*** Admittedly that also reflects the fact that Blackstone above all has become a broad-based asset management firm, albeit with a heavy focus on alternative investments. But KKR is close to a private equity pure play and Apollo is skewed towards private equity. And as Mr. Ochoa points out, the leaders of all these firms are heavily involved in the private equity business.

**** Investment Committee Chairman Henry Jones seemed to make a point of mangling the names of speakers in the public comments section, with the most striking example calling Professor Rosemary Batt “Rosemary Butt.”

Bernie Sanders: The business of Wall Street is fraud and greed.

In reality, not only are the general partners wildly successful at exploiting the investors at every turn, many of the general partners are using the profits they’ve earned on the backs of public pension funds to campaign to end them. . . .

After that, who will be Pirate Equity’s next victim? Will all employees be required to start a 401K, so that instead of being looted collectively they can be looted individually?

Who knows what lurks in the dark corners of the PE industry.

It seems that we’re at an inflection point with these various tales regarding he divide between “us” and “them”.

As with the trade agreements there comes a time where the elite must interface with the commons in the form of some regulator or board of directors. They’ve obviously built the aforementioned “veal pen” and are 100% accustomed to “winning” but obviously any oversight would reveal that they’re not really winning, they’re cheating and stealing from grandmas which, however much that feeds the alpha in private among thieves, it doesn’t have the same burnish down at the corner coffee shop. In both cases(trade deals, pension management) the public are fools who deserve to be exploited but we have this pesky transparency requirement that needs to be squelched at least or made toothless at best. That proves the effectiveness of the transparency requirements, thanks yves for shining the light. As Prof. Black notes, all we need to do is enforce the laws already on the books and support people like jj jelencic

As mentioned in an “into the ether” post on Dec. 1 “CalPERS sleight of hand,” CalPERS PE consultant didn’t even cite volatility in a slide show presentation a few months ago. Now CalPERS speaks of expected PE volatility of 25% and realized PE volatility of 19%.

It would be interesting to know the source of these volatility numbers: from a generic industry index, or from CalPERS’ actual portfolio?

If the latter, it would nice to see more detail. Owing to the complications introduced by capital calls and distributions (meaning that the amount invested is not constant), PE fund volatility is calculated from an NAV series using a “chained modified Dietz formula.” EVCA (European Venture Capital Association) even recommends applying “statistical unsmoothing techniques” to counter the appraisal value effect. Since assumptions would be invoked in unsmoothing, we need to see these calculations.

If, on the other hand, the “19% realized volatility” is just a generic number from the State Street GX Private Equity index or equivalent, then it is not an accurate reflection of CalPERS’ realized volatility.

Show us the math!

Sounds like the farmer has convinced the turkeys that they are farmers, too!

Thanks for these great posts. Other pension funds may learn something.

Farmer to turkeys: “Pay no attention to what the ducks and horses are telling you. They aren’t farmers. “

” Investment Committee Chairman Henry Jones seemed to make a point of mangling the names of speakers in the public comments section, with the most striking example calling Professor Rosemary Batt “Rosemary Butt”

No, he just really has difficulty with the english language, watch any board meeting

How many people have the last name “Butt”? Please tell me how someone pronounces a name spelled “Batt” as “Butt”? It would be easier to see this as innocent were it not for that.

And your alternate explanation is not terribly encouraging given the importance of the role of the Investment Committee.

“Yet when CalPERS CIO Ted Eliopoulos mentions limited partner advisory committees, one of the few post-closing supervision channels, you can hear him crank up the warmth in his voice. It’s as if he wants to make clear to the board that these groups are a big deal and the board should respect the special role that CalPERS enjoys by participating in them”

Six months ago CIO Ted had no clue what a limited partner advisory committee or ILPA is. That odd vocal tone is his newfound PE expertise being patronizingly vocalized to the lowly board.

After viewing the workshop, I believe we’ve been had.

http://www.bloombergview.com/articles/2015-11-25/calpers-fees-and-culture-consultants

In this blog, Calpers fees are seen quite possibly too high. Further down the blog, Vanguard Financial is being charge with a fraudulent design to avoid taxes in its mutual fund structure, where the investors own the management company and management company prices at cost, without profit margins. This is cooperative economics 101 for a consumer owned cooperative that cut out the commodification process by reducing the costs of having to make a profit. The investors make the profit by having a higher return than if they went to a money manager that they did not own, and paid whatever the agreed upon fees would be, presumably including a profit margin of some amount.

But a disgruntled employee has contacted the IRS and other state authorities making an argument that this all a tax dodge. The alleged whistle blower got a judge to agree that Vanguard is “artificially” charging lower fees than it should if it charged market rate fees in the rest of the industry. Interestingly enough, other writers are pointing to a Vanguard effect, that is a body blow to Wall St by causing $Billions to move to from fee charging money managers to passive management index funds, reducing Wall St income take by over $16Billion.

So Calpers looks the other way while high fees are charged, and there is no investigation, mean while, in California, a reported criminal investigation is being initiated into Vanguards pricing practices. The Neo-Liberal TINA ideology seems to demand that profits must be charged in pricing or else you are “artificially” lowering your prices in some unfair, anti-competitive manner!!! This crazy theory is being swallowed by some NY state judges and now, possibly CA as well. Can someone make some sense out of this nonsense?

——————————————————————————————-

http://mobile.philly.com/beta?wss=/philly/business&id=359776471

Danon alleges that the Malvern-based company has violated federal and state tax law by undercharging its mutual funds for professional services. Vanguard has said this “at-cost” pricing lets it charge customers low fees.

Danon, backed by tax experts he hired as consultants, says federal law requires affiliated companies to charge one another “market” prices, generating profits and tax obligations, which he says Vanguard wrongly avoided. He also accuses Vanguard of moving money to a reserve that is not taxed or shared with customers.

Vanguard has said it complies with the law.

Thanks for another great post in this series, including emphasizing that GP staff get most of their compensation from salary.

Your repeating other crucial points is appreciated.

Regarding the GP’s supposed skin-in-the-game (i.e., when they’re not management fees transformed magically/illegally into tax-reducing capital gains), aren’t GP-sourced monies mostly leveraged (borrowed)? I’ve read that one of the basic rules of the wealthy is to never take a risk with your own money. Perhaps someone who knows can confirm if this is indeed the case regarding any funds put into the pot by GPs.