Yves here. This is a comparatively cheery reading on China, and I hope Vernengo is correct. Some reasons for concern, however, include:

The possibility of the knock-on effects in Asia of the Chinese slowdown leading to a full-blown currency war (witness Japanese move to negative rates, which had a much bigger impact on the price of the yen than it will on domestic activity)

The risk of a contagion vector from the Chinese economy to a systemically important financial institution. HSBC is the most obvious candidate

The impact of a sudden decline in Chinese flight capital. The Chinese are attempting to get tough on capital controls, and it’s not certain how effective they will be. But some of the money exodus has fallen as investors are feeling much less flush du to stock market losses. This is probably not enough to have a major impact globally, but it could cause a lot of hurt selectively. Vulerable spots are Australia, Canadian and potentially San Francisco real estate, since the latter is also being affected by the air starting to leave a big tech bubble.

The odds that China will escalate its provocation in the South China Sea to gin up patriotic support for the government as it is firing employees state-owned enterprises as it shuts and rationalizes them (witness the announcement that 400,000 coal workers are to lose their jobs)

By Mathias Vernengo, Professor of Economics at Bucknell University. Originally published at Naked Keynesianism

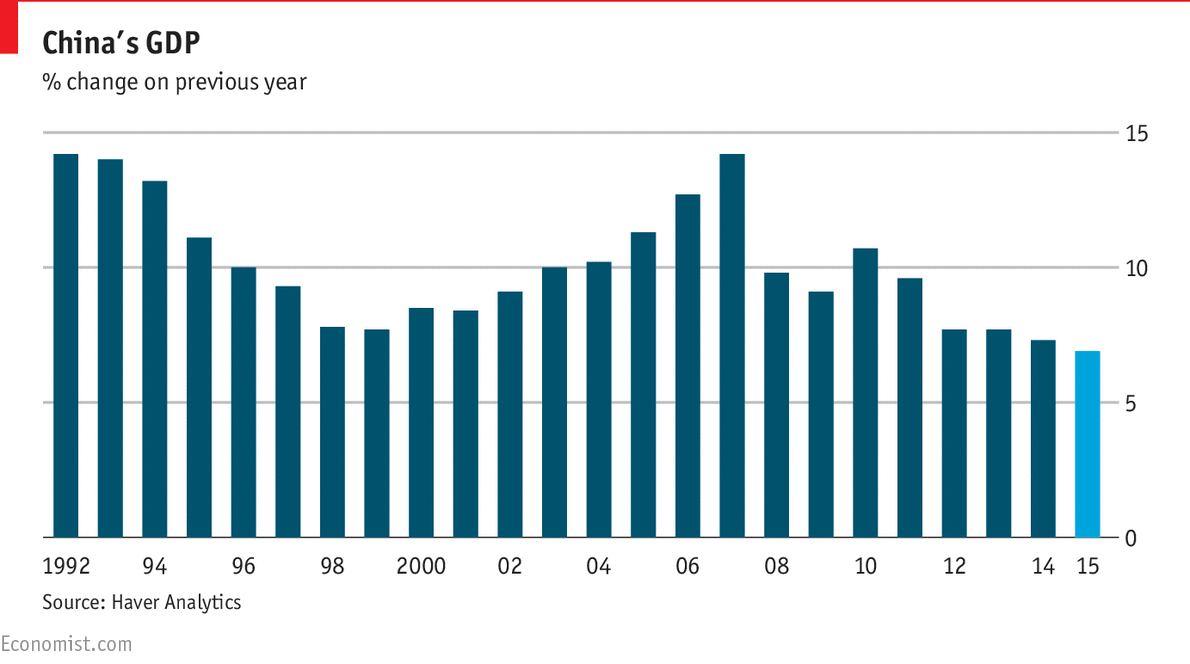

The Conference Board argues that Chinese official data should be taken with some skepticism. Nothing new there. They have adopted a new measure, which suggests that implies “Chinese economic growth at a more realistic 3.7 percent” for the recent past. In this scenario, interestingly enough, “it’s likely that the bulk of China’s slowdown has already taken place since 2011, even if unapparent in official statistics.” So the picture is probably worse than the official one (from The Economist)

So China will grow at about 4% and has already been growing at that pace for a while, if one believes the Conference Board (in the official data above one might think there is more space for a slowdown, but clearly it has gone already down too). The big questions are whether this will continue, and what would be the impact for the global economy.

Arguably the slowdown is the result of the transition from an export-led development strategy to a domestic, consumption centered economy, compounded by the problems of an unregulated banking sector, the infamous shadow banks. Note, however, that most problems are associated to domestic demand, and debt in domestic currency. China still has current account surpluses and huge external reserves, even if the latter have decreased. So the problems of a typical developing country, which cannot grow given the external constraint are inexistent. Also, it is true that some firms have debts in dollars, and the depreciation of the yuan poses problems, but again the People’s Bank of China has enough dollars that rescuing and absorbing the costs of exchange rate risk should be a minor issue. This is not to say that a further slowdown is impossible, but if it continues it should be counted as a policy mistake, not a structural constraint.

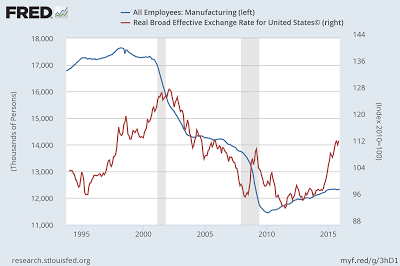

On the effects on the world economy my impression is that there is also a great deal of exaggeration. China is the second largest economy in the world, for sure, and has become central for the global economy in many ways. But it’s role in the global economic problems has been overstated. In Brazil, for example, the Chinese slowdown played virtually no role, as I discussedhere. In the US the usual complaint is that the depreciation of the yuan is behind deindustrialization, and that the Chinese crisis, that has led to a more depreciated currency, is hurting the manufacturing recovery in the country. I am skeptical of the argument. The figure below shows manufacturing employment and a broad trade weighted exchange rate for the US.

As it can be seen the decrease in manufacturing jobs, which started in the early 2000s (before that it was more or less constant; see discussion here) is connected to the entry of China in the World Trade Organization (WTO). But the collapse of manufacturing jobs went hand in hand with a depreciation of the dollar. And some of the, admittedly slow and small, recovery since the 2008 recession has gone with an appreciation of the dollar. This indicates that Free Trade Agreements (FTAs) and the WTO play a more important role than exchange rates.

China is important, but the notion that it will derail the US recovery seems incredibly hyperbolic. My bet is the US will continue its slow recovery, and the Fed will increase interest rates at an even slower pace than they suggested, as the last meeting indicated.

I think its worth bearing in mind Michael Pettis’s warning that economists always underestimate the strength and rate of major economic expansions of economies and the consequent downturns. Just as nobody seriously predicted in the 1990’s that China could maintain a double digit growth rate for a quarter of a century, the mainstream of economists (excepting development economists) tend to underestimate just how hard it is to escape the middle income trap and how rapid a reverse can take place (just look at the histories of Argentina and Brazil).

From being a Chinese bear for quite a few years, and being entirely wrong about it, I do think that the most likely outcome now is that China will continue to recover and grow for a couple of years, before slowly, almost imperceptibly slipping into a long term deflationary period of very low growth. Quite simply, they are too late to make the sort of transition South Korea successfully pulled off from the Asian model of growth (i.e. export and investment led) to a more balanced growth. The transition is occurring but its too slow, the economy is too fundamentally imbalanced, and changing demographics will make it harder in the future to make that change. However, the Government does seem to have enough tools at hand to prevent an uncontrolled slip into recession.

But as Yves suggests, there are plenty of black swans floating out there that could derail the Chinese system. Given the opaqueness of the banking system, the possibility of an unexpected collapse somewhere (possibly because of endemic fraud) is relatively high. Capital flight could overwhelm even the huge reserves China has built up. Something I repeatedly see, which most commentators tend to overlook, is just how many wealthy Chinese are on a hair trigger to leave at the sign of trouble. They don’t buy properties in SF and London as investments, they buy them as escape hatches. So the potential for a self-confirming panic is, I think, far higher than most anticipate. Historically, China has a repeated pattern of great strides forward, and rapid retrenchments into itself. Nobody is more aware of this than the Chinese themselves.

But its correct I think that the US is relatively insulated from potential problems. I suspect Europe is more vulnerable, as so many of its companies are dependent on Chinese (and broader Asian) sales, from luxury goods to machine plant. And of course the route in commodities is having all sorts of negative impacts in South America and elsewhere – and it could get worse.

“But its correct I think that the US is relatively insulated from potential problems……”

I wonder how insulated the US is considering the fact that the major purchasing segment of the US population has pulled back for various reasons (mainly lack of discretionary income)?

I don’t really know enough about the topic. I think its fair to say that while a major recession in China would not seriously impact on the US in terms of exports, there are all sorts of indirect links which could be more important, especially via South America and Australia, which would both be hit very badly. I think the biggest impact would be via oil and other commodity prices – a major collapse in demand from China would push these even lower, which could be devastating for many US banks and other investors.

For decades, China’s primary concern has been keeping everyone busy, and everything else (health, safety, water, air, soil, communities, finance, etc.) could go hang. I don’t see that policy changing any time soon given the number of present examples (and the number of examples in China’s own history) of what happens when a significant part of the population is idle.

I’ve opined similar to anyone who would slow down enough by the roadside to listen since early 2015. China is not much of an end consumer putting aside VW’s, luxury handbags and raw commodities. Sure, Australia is going to get it in the teeth from iron ore prices but after 20 years of overblown good times, refusing to diversify beyond a hole in the ground and their own housing market, maybe they need that dependency whisked away from them.

Looking at the chart, NAFTA in the mid 90’s was the beginning of the end to manufacturing in this country

It and other free trade agreements that both political parties voted for has and continue to gut the middle class.

Which is the reason Sanders and Trump are ahead in the polls.

Sounds simple, but true

I thought the Movable Feast started in the 70’s, depending on where you sat at the table. For me Schenectady N.Y. GE/Alco.

Here in the Great Lakes region, too.

Some of us referred to it as the Japanese Invasion. I remember seeing some Times, Newsweek and Biz Week magazine covers on the subject.

But then it became the Asian Export Model and Asian Tigers, so it was hard to keep track….

Auto employment and UAW membership peaked in 1979. The recessions of 79 and 81-82 cut that about in half. It wasn’t until 1984 that it became clear that most of the jobs lost were not coming back. But that was mostly because of lower cost/higher quality Japanese imports. The outsourcing, first to Mexico, didn’t really get cranked up til mid-80s. (Low Canadian dollar did prompt movement of work to Canada in early 80’s, which led to break up of “international” UAW.)Then NAFTA opened the floodgates.

Would you want China’s pollution problems instead?

We started the dismantling in the 60s when we effectively stopped training the skilled trades required for a real manufacturing economy. By the time Reagan took office, we were short on just about everything (machinists, tool and die, pattern makers, top-level plumbers/electricians/welders, etc.). NAFTA was just the last nail in the coffin.

The Conference Board? When has The Conference Board EVER been right about the Chinese economy? For that matter, when has ANY Western agency or medium ever been right about the Chinese economy? Ever?

Since I visited China in 1967 I’ve read thousands of articles like the one above. Not a single one turned out to be right. Not for lack of persistence: The Economist has predicted 56 ‘hard landings’ for China in the past 30 years. None happened but The Economist persists to this day in foreseeing doom for China. Nobody, to my knowledge, has cancelled their subscriptions despite the obvious worthlessness of The Economist’s economics.

There are several reasons for this bizarre social phenomenon. Here are some:

1. Nobody’s interested in China’s economy. They’re interested in its demise, obviously, but not in the thing itself. The thing itself was designed 45 years ago by extremely smart Keynesian Marxists for a unique culture to achieve unique goals. Their economy is not like ours. Their ‘banks’ are not like our banks, even though they’re the largest, most profitable corporations on earth. Here’s a useful introduction to the structure of China’s economy: http://www.cfsgam.com.au/au/insto/Insights/How_investment_transformed_China/.

2. Bad news is good news. Our media lead with bad ‘news’ of China’s economy 100% of the time. We’re conditioned, in other words, not to see the real elephant in the room. “Look! Over there! An imaginary cloud on China’s horizon!” Forty years of that have shaped our expectations.

3. Racism.

4. Laziness. It takes a minute to pull up the World Bank’s Debt to GDP ratios for every country on earth. China’s 209% and 7% acceleration is exemplary, the US’ 290% and 2% growth and Japan’s 390% and 0% growth? Not so much. The readers of our mendacious media will never learn these simple truths.

Here’s an antidote to the nonsense in our media: China’s real economy, PPP adjusted, will be $23 trillion by the end of this year. The US’s will be $18T. This prediction – certainly true enough to be publicly defended – will draw howls of outrage (and, usually, insults) from Western readers. It can’t be happening! But it is and, while we console one another with nonsense about China, the Chinese are happily eating our lunch.

4 pct growth for China sounds about right because that is where high growth economies such as Korea or tAiwan settled after crossing their own Lewis points. And the economic footprint of the Chinese state is larger than in the average EM, which gives the government more scope to stabilize the economy, if necessary through direct intervention. Also, the impact of the Chinese slowdown on global markets could be stronger than on growth in OECD countries China is redistributing income from commodity exporters to importers. Exporters were a big sourc of demand for financial assets in developed markets. With lower commodities prices , the foreign bid is much weaker and sovereign wealth funds have to liquidate assets to fund public deficits. That’s happening just when Mr Market is having doubts on the extent of global central banks puts. Not good for valuations. In terms of global growth by contrast, China was a big contributor but relied on a large current account surplus to do so i.e. It was a user as well as a supplier of global demand. And the CNY is no global currency so the global impact of the diseased Chinese financial system is likely limited. For sure big, domestic driven economies like the US are much less exposed than small open economies like Australia or the average EM. But the panic over a Chinese crisis seems overdone: it seems to have as much to do with Mr Market going from euphoria to despondency as with reality of the ground.

Nah, Taiwan and Korea are puny countries that had more U.S. money thrown at it to fight Communism. China has some mild (U.S.) posturing, but…most of all, China is huge, the artificial advantages E. Asia used with the West’s blessing will not be enough to motor China to Taiwan levels…ever.

Incidentally, Raul Castro They Younger, seems to be trying duplicate the “china model,” but he’s in for a dud surprise. Cuba has a higher cost of living/standard of living compared to China and the Narco Miami folk don’t have as much capital as the Chinese diaspora/colonialists. skc

I live in China, and it’s not China’s economy that has me worried financially, though the political stability does worry me in another way. It’s the American banking sector and it’s exposure to oil, natural gas, US real estate, etc. that has me getting set for a long cold economic winter.

Michael Pettis’ most recent blog entry discusses this at length.

Yes, his latest and very long blog entry is excellent (as always with Pettis). Really required reading for anyone interested in where China is going, although you do have to read a little between the lines to see the contempt he has for most academic economic models – rightly so.

This article was of limited value to me in terms of increasing understanding the factors underlying what is occurring in China, elsewhere in East Asia, global commodity and energy markets, and US manufacturing.

I have found articles posted here in the past like that by Michael Pettis in September regarding a probable path of China’s slowdown to be very helpful. Also, studies of the interrelationships between China’s current account surpluses, debt-fueled overcapacity and malinvestment issues; PBC monetary and government regulatory policies; demand indicators like the Baltic Dry Index; global commodities and energy prices; prices of global supply chain stocks; and an ongoing effort to understand various feedback loops between China, Japan, the US, EU, oil exporters, and market makers can be informative in terms of the probable depth and duration of the slowdown. China also has long-term environmental, demographic and corruption issues that affect policy-making. So do we all.

What about rural China ? And also, what about rural India ? Anybody here wiling to look at these part of stories ? Climate change included.

One interesting point raised by Michael Pettis, who has contributed to NC before, is that politically it may be easier for the Chinese government, faced with an inevitable rise in unemployment, to send poor workers back to the land rather than disappoint the educated middle classes. In all the growth in China the lives of rural dwellers hasn’t really improved that much – the whole emphasis of policy has been about moving people to the cities.

First they’ll have to tear down the empty cities they built on the farmland and then rehabilitate the farmland. So I guess there is a lot of work for everyone.

Doesn’t debt deflation coincide with an appreciating currency? I’m confused because China has been exporting deflation, both debt and dumping and the dumping has de-industrialized us. So how did the collapse of manufacturing jobs here lead to depreciation of the dollar when the dollar is sky high? I don’t agree that the dollar has appreciated because our manufacturing has improved a tiny bit just recently, very recently, and that this somehow indicates that free trade agreements are a better stimulus and more important for the dollar than tweaking exchange rates, aka race to the bottom. It is more likely that we’ve been down so long it looks like up and also that we stepped in early and often with zirp and QE and we were the real exporters of deflation to EMs. But whatever. I don’t see free trade agreements having anything to do with manufacturing improving. Or anything improving.

China – baby policy…

Hearsay

We are all limited by false assumptions. When your hear something, it goes into that prism as a reflection of the prism, which is why hearsay is invalid, no matter what authority tells you otherwise. An economy ultimately relying upon the kidnapping of children to enforce their indenturement in its mythology isn’t going to work; it’s not a negotiation.

We have people in this country who believe that the stories of Adam, Jesus, and the US Constitution are simultaneously true, which cannot be the case and none can be verified. And their leaders pretend to believe in the ‘truth’ only to the extent their own self-obsessed prejudices are confirmed. The Founding Fathers Narrative was respect for the beliefs of others, and the result is the opposite, surprise.

Science is the theory of testing theories and discarding them when they are proven false, by scientific vote, which simply creates more problems in the context of an elastic economy. You cannot prove that unicorns do not exist. Because a group of scientist votes to believe in a theory doesn’t make it true. And most importantly, every moment you spend defining the past, which cannot be verified, the future is passing you by.

What matters is the process creating the symptoms. Printing money on the back of so-indentured children to study the past as a means to project the future, busy work, can only be an abject failure. No matter how you organize a government – of, by and for hearsay, it cannot work, except as a counterweight. The best possible outcome is rounding up the usual suspects and letting them go.

Convicting the individual behavior, a symptom, for the ills of society, the behavior of a system, always in denial, is ludicrous, yet that’s the system, and the jury, peers and population will all nod in agreement, as they were trained to do, somehow expecting not to become subject eventually to a system run by psychopaths, for sociopaths. Like any contract, government is made to be broken, and exists only so long as it is useful, as a counterweight.

You are certainly welcome to meet with 350 million people, or 7 billion, and legislate parenting, only to be determined by the electoral college of a few, but you are going to have the outcome of a meeting. And in the end, all that busy work is going to be flushed down the toilet, regardless of theory.

If you begin with the opposite of what you are told by any group, and reserve judgment, you are far more likely to reach the truth, which is neither black nor white. I chose not to become a doctor because modern medicine is a sad joke, and sadder yet is those so addicted. Obamacare isn’t consuming everything in its path by accident.

If you learn anything as a parent, you learn that your children will always find a hole in your theories. You are responsible, yet you are not an authority. Welcome to life, which will not yield to definition.

Adopt any government you like, but teaching the subject as anything other than a theory is DOA. None can survive mathematics, and mathematics cannot survive literature, itself a story. Life is the story you build with nature as the arbiter, no matter where you go in the universe.

No matter where you go in this world, at what time, you are going to run into people who want you to dig ditches with a hammer and wash dishes with no soap, while they pay themselves in a debt to nature to talk sh- about each other. No matter what hair-brained scheme, it’s always the same frequency, background noise. Save yourself some money on LSD and just spin around in a circle until you fall down.

If you want children to respect you, and you do if you want a functioning economy, don’t present a lie as the truth. Just tell them that government is a theory in progress, probably wrong, but it’s all you got. A little balance and moderation goes a very long way, and that little pattern matcher looking at you for guidance isn’t burdened by your false assumptions.

Single people and single people pretending to be married, voting on how parents are going to raise their children, cannot form an economy, because they have no future. That’s markets and that’s marketing – of, by and for armchair economists, studying entrails and playing the part of God, trying to make chicken soup out of chicken sh-. That much Putin knows, from experience.

Attack Grace all you like; she’s built for the purpose. There are people who talk and people who do. The majority aligns itself with the former and is dependent on the latter, and spends all its time convincing itself otherwise. That’s History, of financial engineering – hearsay.

If GDP measures consumption, and it does, and ‘earnings’ is a function of GDP over time, and it is, because that is how the US Constitution is structured, what is the data-driven Fed worth, for recycling securities in a ponzi, to maintain the returns to feudal monopolies?

Thanks for this great comment.

A tangent, related to your final comment which mentions consumption–I have a knee-jerk reaction whenever “consumption” is mentioned, because it’s never defined, just left hanging as one of those supposedly beneficial things for an economy–one of those assumptions, as you so well described. Never any discussion about what kind of consumption, and whether it’s consumption that regenerates our ecosystem and society, or consumption that will create further damage. When ever people talk about consumption or spending (including government spending) as if it’s some monolithic thing, I feel like a haze is being pulled over peoples’ eyes, no matter how ostensibly “progressive” the recommended economic prescription under discussion.

“China won’t derail the US economic recovery” — what recovery? We are getting set for another recession. Economic indicators for domestic and international trade such as rail freight, the Baltic Dry index (which measures the amount of freight moving over the sea), etc are all crashing.

I think the pollution is why they had to pull the plug on the heavy heavy industry because the air was or maybe has killed everybody….another study out today. The plastic crap is still at walmart .Of course there is so much inventory,…….who knows we might hit China on that front. Our economy is so down we wont waste money on junk from China anymore.

China is now the workshop of the world.

China’s problems clearly illustrate the lack of global demand.

China manufactures its products from imported raw materials from other emerging economies, so these in turn suffer from the lack of global demand for China’s finished goods.

Global commodity prices and the Baltic Dry Index are at record lows illustrating this collapse in demand.

“There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning.” Warren Buffett

The 1% went to war on the 99% (aka the global consumer), very silly really.

Before they win, everyone loses.

Capitalism is like Siamese twins at war with each other.

The 1% and 99% always fighting each other to get more, but if either side win they destroy each other.

The 1% were in the ascendency in the 1920s and blew it up with a Wall Street Crash in 1929.

The 99% were in the ascendency in the 1970s and blew it up with constant strikes making individual nations uncompetitive.

The 1% are in the ascendency again and have already caused another Wall Street Crash (2008) plunging the world into a global recession that seems without end.

The 1% haven’t worked out that they have gone to war against the consumers that buy their products and services.

Obviously this was all spotted by Marx a long time ago, but he had never seen the results of the 99% in power (Pol Pot’s Cambodia, Stalin’s Russia, Mao’s China, etc …). He came from a wealthy family and was only too aware of the greed, self-interest and hypocrisy in his own class. It doesn’t seem to matter which ideology you try and follow the psychopaths always end up in the positions of power.

Capitalism is an endless fight between the two sides, but neither side can win, to do so destroys

themselves.

A more balanced approach is needed but the very thing that makes Capitalism work, self-interest and greed, ensures neither side is ever happy with their lot and always wants more.

(Latest update – The demise of the Western consumer has affected demand for Chinese products and their Keynesian infrastructure investment has run out of money due to the length of the downturn in the West.

The lack of demand for Chinese products and the end of its Keynesian, debt fuelled stop gap has fed back into global commodity prices.

This is affecting commodity producers in Latin America and Africa.

Spain and Portugal are massively invested in Latin America and the losses are starting to mount.

The vicious circle is now complete and can only spin faster and faster until the global consumer gets some money to spend.)

Francis Fukuyama in 1992 said it was “the end of history” and Capitalism had been the only successful economic system to stand the test of time.

Even then work was well under way to turn it upside down.

40 years ago most economists and almost everyone else believed the economy was demand driven and the system naturally trickled up.

Now most economists and almost everyone else believes the economy is supply driven and the system naturally trickles down.

Economics has been turned upside down in the last 40 years.

Which way is up?

Is today’s economics upside-down?

In the 1960s and 1970s we had some of the lowest levels of inequality in history.

The new upside-down economics is driving inequality.

Today’s ideal is unregulated, trickledown Capitalism.

We had un-regulated, trickledown Capitalism in the UK in the 19th Century.

We know what it looks like.

1) Those at the top were very wealthy

2) Those lower down lived in grinding poverty, paid just enough to keep them alive to work with as little time off as possible.

3) Slavery

4) Child Labour

Immense wealth at the top with nothing trickling down, just like today.

This is what Capitalism maximized for profit looks like.

Labour costs are reduced to the absolute minimum to maximise profit.

(The majority got a larger slice of the pie through organised Labour movements.)

The beginnings of regulation to deal with the wealthy UK businessman seeking to maximise profit, the abolition of slavery and child labour.

Where regulation is lax today?

Apple factories with suicide nets in China.

The modern business person chases around the world to find the poorest nation with the laxest regulations so they can exploit these people in the same way they used to exploit the citizens of their own nations two hundred years ago.

Labour costs are reduced to the absolute minimum to maximise profit.

A leopard never changes its spots.

Capitalism in its natural state does not create much demand.

Capitalism in its natural state sucks everything up to the top.

With the old economics, where demand is seen as the driver, reasonable wages are required to keep the economy going.

In those days the US consumer was seen as the engine of the global economy.

The new economics is wiping out the middle class in the US, they are irrelevant.

Should we be looking to get that old successful economics back again before global demand is totally destroyed?

I understand a cluster of big US and European Hedge Funds and others are running up giant bets against the Yuan, which is pissing off Chinese authorities no end. For several reasons, China’s ‘fire-power’ isn’t everything it’s chipped to be: they’ve burned through about a trillion dollars, and have to keep one and a half trillion segregated for other uses, so they’re half-way through their buffers in the better part of a year.

Quick thought: Russia and China have purportedly started settlement in yuan or rubles for oil shipped to China.

this from early this morning:

http://www.theguardian.com/world/2016/feb/01/nearly-a-million-scammed-in-chinese-online-ponzi-scheme

it’s probably just the tip of the ice berg and there’s a lot more investment that will prove to have been wasted. when the true extent of the problem is brought to light, the damage will have been enormous