By Ann Pettifor, a Director of Policy Research in Macroeconomics (PRIME), Honorary Research Fellow at the Political Economy Research Centre at City University (CITYPERC) and a fellow of the New Economics Foundation, London. Originally published at PRIME Economics

What is deflation? What has caused inflation to fall? And why is there no such thing as ‘good deflation’?

Introduction

On Monday the Office of National Statistics (ONS) announced that inflation at 0.5% was lower than the 1% rise that had been predicted by the Bank of England as recently as November. And it was lower than the prediction of most economists who believed prices would rise by to 0.7%.

We at PRIME are not surprised, as we have tracked Britain’s disinflation (falling prices) for some time. And we warned as far back as 2003, and again in 2006, 2010, and e.g. in October, 2014 of the threat of global debt-deflation. Because policy-makers lack the tools to correct a deflationary spiral, the prospect of deflation is frightening.

We therefore find ourselves at odds with the British Chancellor, George Osborne who announced that the fall in inflation to 0.5% was “welcome news”; with the Bundesbank President, Jens Weidmann, who argued recently that “an inflation rate that for a few months lies below zero, for me, doesn’t represent deflation”; and finally with the Financial Times which ran the following headline on the news of Britain’s low inflation rate: ‘Good deflation’ seen as spur to growth”. (Note: this headline appeared in the paper edition of 14 January, 2015, and not in the digital edition.)

For ordinary consumers, workers, farmers and for the owners of firms and shops – especially those with debts – there is no such thing as “good deflation”.

What is Deflation?

Deflation occurs when prices (not necessarily all prices, but the average price level) fall below the costs of production – i.e. when prices become negative. So in a deflationary environment producers will sell a good or service at below the level of profitability or below the cost of making that product. They will do this just simply to get products off the shelves and out of the warehouse – before prices fall even further.

Deflating prices may appeal to the consumer, and may boost consumption in the short-term, but they are associated with savage costs that will quickly catch up with British and European, and potentially even American consumers.

The reason is as follows: if producers or retailers sell their wares below cost, then they will invariably make a loss on those sales. Their business will become less profitable. The sensible response when a firm is not able to price its goods to make a profit, or to cover costs, is to produce less of what it is unprofitable. In other words: to shrink productive activity. This is done by cutting production, trimming wages and inevitably, laying off staff. Thus the fall in prices, leads to a fall in profits, which leads to falls in wages and to a rise in unemployment. Unemployment means that workers lack disposable income, and find it harder to buy products and services on offer. As a result producers sell even fewer of their already low- priced products or services. Bankruptcies and unemployment rise, while wages and prices fall further, and so the deflationary spiral takes hold.

Furthermore, the price indices managed by government –in particular the Consumer Price Index (CPI – are used to fix wages in private and public sector wage negotiations. Benefits received by disabled people and pensioners increase (or decrease) in line with CPI inflation. So when the CPI falls, be sure wages and benefits will fall too. (And with a political consensus in the British Parliament promising savage spending cuts in the next Parliament, pensions and other benefits will have to be cut in line with the falling level of CPI, if the proposed extreme spending targets are to be met.)

For Whom is Deflation Good?

Deflation is good for those on fixed incomes, as these will rise in real terms as prices fall.

Deflation is good for creditors/money-lenders or the rentier class. This is because while prices can fall below zero, interest rates cannot. So while wages or incomes may fall below zero, interest rates (at what is known as the ‘zero-bound’) will rise relative to these falls. If prices fall below zero, say to minus 2% but the interest rate remains at plus 2%, then the real rate of interest rises to 4% in a deflationary environment.

And while prices, wages and incomes can fall below zero, debts remain fixed, and in relation to falling wages and incomes – rise in value.

This is why creditors encourage, and even pressure politicians and policy-makers (central bankers and officials) to apply deflationary policies – because deflationary policies protect and even increase the value of their most important asset – debt.

To repeat: whereas inflation erodes the value of debt, deflation increases the real value of debt.

So in a deflationary environment, creditors (effortlessly) grow richer as the value of debts owed to them rises (until their debtors default); and debtors with falling incomes find their debts become unpayable.

Keynes once wrote that:

“Deflation…involves a transference of wealth from the rest of the community to the rentier class and to all holders of titles to money; just as inflation involves the opposite. In particular it involves a transference from all borrowers, that is to say from traders, manufacturers, and farmers, to lenders, from the active to the inactive…Modern business, being carried on largely with borrowed money, must necessarily be brought to a standstill by such a process.” [1]

So no, Chancellor, 0.5% inflation is not “welcome news”.

What Causes Deflation?

In an economy that has high and still rising levels of private debt – owed by individuals, households, SMEs, big companies, banks and other financial institutions – deflation can be caused by borrowers paying down debts. If there is a crisis, as in 2007-9; and if prices, profits and incomes are falling, debtors become wary, and begin to use available income to pay off their debts. This deleveraging of debt, if combined with falling real incomes (as in the UK and much of the Eurozone) causes deflation, because it contracts the amount of money in the economy that can be used to purchase goods and services. As producers and suppliers compete to attract sales from penny-pinching debtors, they lower prices. We see this happening in the supermarket sector, where cut-price stores are out-competing mid-range stores – a cut-throat process aimed at luring in shoppers, but that may leave very few standing.

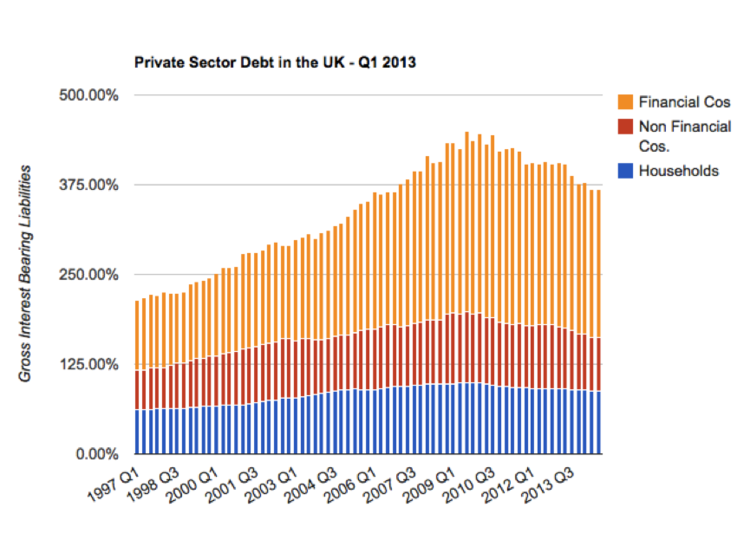

Britain’s private sector has very high levels of debt as the chart below shows – amounting to almost 370% of national income, or GDP.

Source: UK Private Debt Levels, Qtr 3, 2014 by Neil Wilson, http://www.3spoken.co.uk/

Britain’s debtors have been trying to de-leverage (pay down or re-schedule) their debts since the crisis, as the chart shows. However this de-leveraging has not gone far and over the last few months consumers have increased their borrowing, especially on credit cards.

Britain’s consumers, but most importantly big British companies and financial institutions have therefore, a vast burden, or overhang, of debt. These vast private debts – at three times our national income – have constrained or contracted economic activity. This is because debt acts as a drag on spending or investment, as we all know from personal experience. Furthermore, because British banks are still far from healthy, and because the economy is so anaemic, bank lending has contracted. So both the debt overhang, and the contraction in bank lending has helped to shrink the money supply. With deflation, this debt overhang will rise and become an unpayable burden for both financial institutions, corporates, households and individuals.

To compound this state of affairs, the British government decided in 2010 that it would further contract economic activity, by introducing austerity – and cutting back on government investment and spending.

This causality was implied, if not fully acknowledged by the governor of the Bank of England, Mark Carney in a speech to the TUC in October, 2010. He argued correctly that austerity squeezed profits and contracted incomes.

“Profits have been squeezed almost as much as labour costs. Employees have seen their real incomes reduced……..”

He pointed out that wages fell by an unprecedented 10% after the crisis. “To find such a fall in the past, you would have to look back to the early 1920s” Carney reminded delegates.

The contraction in incomes, investment, spending and lending by both private and public sectors is the major cause of falling prices.

A sensible government would have recognized that the private debt burden constrained private investment and spending after the crisis, and would have substituted for that, with government investment and spending. A sensible government would have financed this spending by borrowing at very low rates from their own central bank – the Bank of England – effectively a department of government. As every £ of expenditure, whether public or private, is income for somebody else, government investment would have generated incomes and profits and these in turn would have generated tax revenues, meaning that the investment and spending would have paid for itself.

A sensible government might have noticed that, after the crisis, the banks acted bizarrely (largely because their balance sheets were in a mess). Rather than lending into the economy bankers were, for some years, borrowing from the real economy, as deposits exceeded loans.

This helped contract the money supply in both the UK and the Eurozone.

Governments in both the UK and the Eurozone compounded this contraction of both the money supply and economic activity, by contracting public sector activity. They hoped that fiscal contraction could be balanced by monetary expansion (i.e.QE). This was not to be, and monetary expansion as the Bank of England has admitted served only to enrich the already-rich.

These hugely damaging policies were loudly cheered on, or supported, by mainstream economists, by e.g. the UK’s Institute for Fiscal Studies, by the Office for Budget Responsibility and even by social democratic opposition parties.

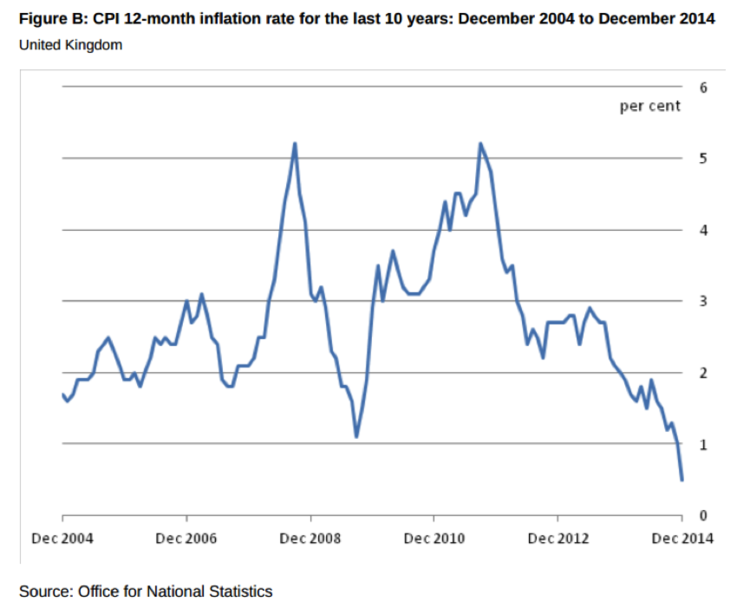

A direct consequence of this double whammy of private and public contraction of UK investment and spending was the fall in prices from 2011 – as clearly demonstrated in the ONS chart below.

These falls in prices can be directly correlated with the onset of the Great Recession and the Coalition government’s determination in 2010 to reverse the stimulus and weak recovery put in place by the Labour government after 2008.

Indeed the impact of the Chancellor’s policies on prices was almost immediate, as the chart shows.

What of the 1920s?

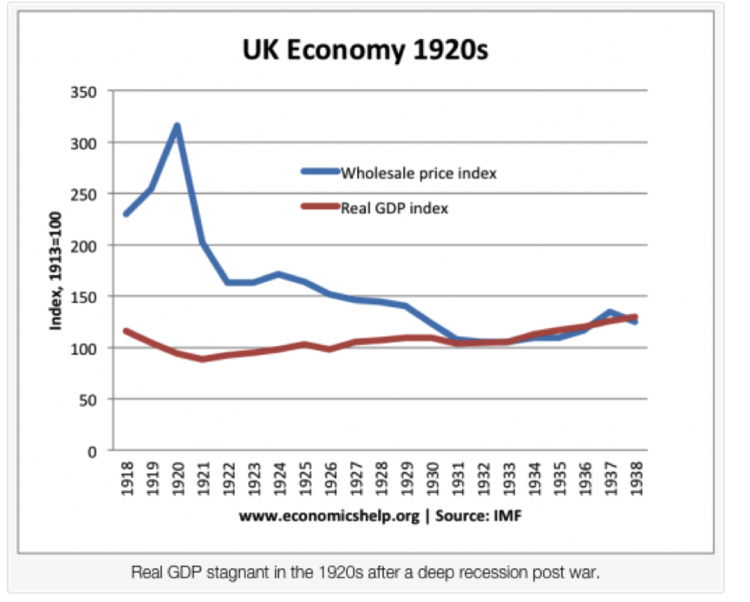

The causes of deflation and falls in wages in the 1920s were not different from the causes of deflation today.

As Britons stage dramatic events to commemorate the tragedy of millions of lives lost during the First World War, we would do well to recollect that soldiers who survived the “trenches of death” returned to a country that would not provide employment. Then as now, the government imposed deflationary ‘austerity’ policies based on orthodox economic theory, wedded to that ‘barbaric relic’ the gold standard. As now, so then: austerity contracted investment and incomes, and lowered profits. Banks stopped lending, and the money supply shrunk further. This led directly to deflation, when prices fell precipitously after the short post-war boom. See the chart below:

Source: UK Economy in the 1920s, by Tejvan Pettinger. http://www.economicshelp.org/blog/5948/economics/uk-economy-in-the-1920s/

The result was a dramatic rise in unemployment for heroic British soldiers returning from a destructive war. Unemployment in 1921 reached its highest level – 11.5% – since records had begun; averaged 14% between 1921 and 1938, and never fell below 9.5%.

Although few of us alive today have lived through a deflationary era, the horror of that period ought to be fresh enough for the experience to be alive in the memories of the public authorities and of academics.

Sadly, these well-known facts about the deflationary ‘20s, have been forgotten, and lessons have not been learned. Or perhaps it is just that those who benefit from deflation – the rentier class – have once again reasserted themselves in the realm of public policy and public debate.

The 1920s era of deflation and high unemployment came about as a result of the very same austerity policies being vigorously re-applied today by ‘neoclassical’ or monetarist economists and politicians across the Eurozone and in the UK.

In his remarks at the launch of the November inflation report the governor of the Bank of England said:

“A spectre is now haunting Europe – the spectre of economic stagnation, with growth disappointing again and confidence falling back……”

That spectre – which may well presage an era as economically and politically dangerous as that of the 1920s and 30s – is a little late in haunting the policy-makers that have brought us to this deplorable state of affairs. The awful truth about deflation is that the public authorities have almost no policy tools for reversing it. Interest rates cannot fall lower than they are today; and with weak demand for goods and services, and as debtors choose to save rather than spend, monetary policy (or Quantitative Easing) – can do little to stimulate real activity.

So no, Chancellor, 0.5% inflation is not “welcome news”.

End.

[1] Keynes, 1930, Chapter XXXV ‘Problems of International Management’ – II. The Gold Standard (Vol II).

Sorry, but I am losing you in the 2nd paragraph already because I don’t think the definition that deflation equals selling below cost is true, either as a proper definition or a description of current reality.

What if cost of production falls, as is the case with a lot of technology these days (and even some other goods where technology allows production cost to decrease) ? Last time I looked, profitability of typical product manufacturers (not oil/commodities of course) was still pretty decent.

Huh?

1. The evidence ex the Walmart effect, which did help productivity greatly in the 1990s, is that “technology” has not improved profits.

2. What has improved profits is labor-squeezing. Profits have been at a record high % of GPD in the US. That hurts demand, since in a consumer-driven economy like the US, squeezing labor is ultimately squeezing your own revenues. And that feed into the deflationary spiral underway due to debt deleveraging.

Um?

I think the original poster has a valid observation in regard to the author’s definitions of deflation. For example:

I’m not aware of any instances of deflation so bad that producers essentially paid you to take the product… And then this point:

The business will not just become less profitable, they not be profitable at all!

And this:

Once again, I can’t think of any examples of negative prices for goods and services… And there are several real examples of negative interest rates recently, at least at a central bank level (Sweden and Switzerland)

Overall, I agree that the situation we are in now is partially due to the squeezing of labor. The question is how to convince corporations to distribute more of their profits to employees. More government spending would probably ease the suffering for labor in this regard in the short term, but how do we address this issue in the long term?

I suggest you expand your horizons. Japan has had borderline deflation over its now lost two decades. The US experienced bouts of deflation during its Long Depression of the late 19th century. And farmers were selling their goods below their costs. That was the basis for farmers pushing for the end of the gold standard. William Jennings Bryan’s famous “cross of gold” speech came out of that movement.

Europe has registered negative inflation recently. See this January 2015 Telegraph article:

Germany succumbs to Europe’s deflationary crisis

Deflation is destructive because it conditions consumers to hold out for cheaper prices, since they know the trend of prices is for them to fall. Europe has not yet fallen into persistent deflation but it is awfully close. The remedy the officials are using, that of negative interest rates to make it unattractive for consumers to save rather than spend, isn’t one I endorse. I do agree that more government spending is the remedy.

Sometimes I think I wouldn’t mind a “lost decade” or two if the result is like Japan’s, the standard of living (purchasing power) and unemployment levels have held up pretty well. Go for a visit and look around…clearly falling prices of goods has not destroyed the society. The Japanese did not “decide to hold out for lower prices” when it came to paying rent, buying food, buying healthcare, buying gasoline, they may have delayed the purchase of that new washing machine and guess what? They were right, they got it at a lower price.

My comment was primarily in regard to the way deflation was defined by the author of the piece, not in regard to it’s existence; I’m not trying to be pedantic when I point out that a statement like “prices can fall below zero” doesn’t make logical sense (I would say, at a minimum, there’s a lower bound of zero), and doesn’t support the other points in the rest of the article. I’m quite aware that deflation exists and that it is not good for the average citizen.

In any case, I love NC, and read it every day – just felt some of the assertions made were a bit out characters for the usual quality I read here.

There is a misunderstanding here.

Comments do not deny the existence of deflation or its effects, they question the definition of deflation proposed by Ann Pettifor — and so do I.

I never saw that definition of deflation before.

Deflation is usually defined as a general decrease in the level of prices (the contrary of inflation), i.e. a negative variation of prices, not prices “becoming negative” — which literally means that customers get paid to acquire goods and services.

Further, prices can fall below the costs of production and still remain positive: e.g. cost of production 90, selling price 85, loss 5, but the price is still greater than zero, not negative.

All in all, good points in the article about the consequences of deflation, but extremely sloppy definitional basis.

I did not take the definition to mean that prices went negative in the sense that producers paid consumers to take their stuff. Only that “below zero” means below the producer’s costs. I don’t see how anyone gets “negative prices” out of Yves statement.

Then we are not talking about prices, but about margins.

Using the proper terminology is essential — sloppy vocabulary often leads to sloppy arguments.

The internet is actually driving down profits and profit margins.

Look at Amazon, Jeff Bezos gets rich but Amazon generates no profit.

It competes on price and drives down profit margins.

The internet allows direct comparison of price in the comfort of your own home driving prices and profit margins down.

Technology destroying profit.

Equity’s are profit [money] for Amazon which in turn fuel borrowing – raising of capital, tho I wait till consumption of fixed capital starts to cause dramas and exacerbated by hyper efficiency.

Bezos is engaged in predatory pricing and should have been put out of business long ago if we had any sort of anti-trust enforcement. Amazon sells below its cost in books. It’s clearly trying to put competitors out of business. That has nothing to do with the Internet. It’s easy to gain market share if you are willing to sell your product so cheaply that you lose money. Go look at Amazon’s financials. It loses money but is cash flow positive because it gets paid before it pays suppliers. That models works only if you keep growing or at least don’t suffer a decline in revenues.

Doesn’t the chart “UK Economy 1920s” demonstrate Mondo’s point? The wholesale price index does occasionally drop below the Real GDP Index. But isn’t this supposed to be the whole point of capitalist competition – bringing prices down to the cost of production? Then there is J.K. Galbraith’s “The New Industrial State” and his argument that economies of scale have long since resulted in oligopolies with managed prices in the most important sectors of the economy.

What seems to be amiss here is the idea that the only reason to produce something is to make a profit. What about basic human needs like lodging, food, health care and education? What about social needs like the development of alternative energy sources to (take your choice): avoid supporting Middle Eastern despots whose long term ambitions diverge radically from your nation’s leaders’ (sic) goal of global hegemony and/or the necessity of taking sides in millennia’s old religious conflicts; avoid cooking the earth?

Unless and until economists and the rest of us get beyond the belief the only purpose of life is to pile up more money, ‘we’ are doomed. I suggest as a starting place understanding the world we inhabit and the requirements for keeping it habitable. As for economists:

Frederick Soddy, WEALTH, VIRTUAL WEALTH AND DEBT, 2nd edition, p. 102

This isn’t really a true statement. And it brings up a recurring issue I have with the left side of the political spectrum, who seem to believe production costs basically equal prices. They don’t. I set a price based on the income of my target customers, how much competition there is (and what their price points are), and the number of bells and whistles my product/service has compared to others. My profit margin may be 50%, or 15% or even over 100%, depending on the market and the product/service. Or I may be trying to build market share and push out some competitors, so selling at a lower selling with less (or negative) profit is part of a long-term business strategy. If I reduce my profit margin from 40% to 30%, it’s not necessarily “below the level of profitability” and clearly not below the level of costs.

My usual rant is that we should be shifting the tax burden from workers and consumers to taxes on landlords and producers by reducing/eliminating payroll, VAT and sales taxes and using instead taxes on rents (interest, dividends and capital gains too) of the largest wealth holders, and taxes on the business receipts of large companies. The usual refrain I hear in response is that “higher taxes on rent incomes will mean higher rent prices,” which is false. A landlord generally sets a rent price based on the highest amount someone in the area can afford. Costs have little to do with the rent price. The building may be owned 100% without any mortgage and the operating costs may be low, but if people in the area can pay $4,000 a month for an apartment, that is what the rent is. I look forward to a world where more people understand that costs and prices are very different.

The presupposition that “free” markets determine prices depends on there being “free” markets.

Robert – I think you missed the point.

In a debt-deflation cycle, a business may be forced to sell inventory for less than production costs to obtain cash to service its debt – this is what the author is speaking to. Once the business has eliminated surplus stocks, then it will be forced to cut wages to maintain its cash flow — which is primarily determined by interest it pays on debt. This cuts demand since workers have less cash and since most industries are impacted in the debt-deflation. The business may then be forced to sell assets at fire-sale prices (at a loss) to further service its debt. More worker layoffs follow – less demand – a downward spiral. This is discussed in depth by Jack Rasmus in his book “Epic Recession”.

Agreed, that was a really bizarre definition of deflation.

Apologies, this is only at best tangentially relevant to the original piece above but it is, I think, worth noting. In the Credit Card industry (I’m talking about the UK here, like the article, but I suspect this is the case in other markets too) disinflation / deflation — call it what you will — is leading to some bizarre behaviour amongst the card issuers.

While there has been some recent credit expansion, that has largely come to an end. Basically flat real incomes can only support a finite level of consumer indebtedness. So the total amount of credit card balances outstanding and credit card receivables is either static or starting to fall. Card issuers make their money in one of three ways which I’ll list out here. The list is in historic levels of contribution to card issuer profits:

a) Interest charged to card holders on outstanding balances

b) Income from “junk” fees

c) An income stream from fee sharing of securitisations of credit card receivables

But with ZIRP and disin/deflation, spreads are thin between the cost of capital and amount which borrowers are willing to pay. Net interest margins of 2 – 3% are all that can be obtained — and all that is justifiable in a world of ZIRP. There’s little to be done on the costs side of the P&L because there are simply no low hanging fruit left to pick there. Every cost reducing trick in the book has been tried at least twice and it’s well past “blood out of turnip” point.

In the UK at least, the worst excesses of junk fees have been regulated out of the business. There is a shady hinterland between prime and sub prime (mainstream card issuers and those customers who are left with no choice but to go to payday lenders) in the form of “just above sub prime” where certain niche card issuers push the limits of what they can charge on outstanding balances and what fee gouging they can get away with. But this is a niche area and those card issuers have to stay under the radar to avoid too many referrals to the regulators. So for the big card issuers, it’s not worth the bother of trying to pussyfoot around the regulators in the hope of getting a bit of the old “wild west” action from junk fees and product design tripwires.

This leaves income from securitisation. Securitisation isn’t a bad thing per se. Some investors need a steady supply of fixed income assets so it is preferential to not hold this type of asset on bank balance sheets because it is more useful to other asset holders. If it is more useful to other asset holders than it is the card issuer, then the asset is worth more to the other asset holders than it is the card issuer so it makes sense to sell it on. And the card issuer earns a fee from the securitisation.

But this is where the bizarre behaviour has crept in. Card issuers are increasingly writing barley profitable new business simply to earn some securitisation fee income. It’s all about the churn. This can only go so long because, in the absence of a growing level of credit card debt (due to all the disinflation or deflation — people may be dumb or desperate but they’re not, ultimately that stupid to not realise that taking on debt in an era of falling prices and falling or at best static incomes is not a good idea) simply churning the same pool of credit card debt around is value-destructive to the entire industry. But in a new version of “while the music is playing, you have to dance”, no card issuer wants to be the one loosing out. Not just yet, anyway.

The risk this time isn’t through dismal asset quality coming back to bite the unsuspecting investor on the bum if they’re unlucky enough to be the last one in the game of risk pass-the-parcel. Lending standards are sort-of reasonable and the real drekky stuff doesn’t get to sit on the mainstream lenders’ books or get into their securitisations. The risk is actually more pernicious — an industry which is dysfunctional and possibly even not viable in the long term.

The traditional “fixes” won’t work. These used to happen in the form of consolidation and mergers or reducing credit quality. But because there’s preciously little extra efficiency to be eked out through fewer, bigger institutions — and even, perversely, an argument that bigger institutions tend to become less efficient, not more, I’ve certainly seen that in my TBTF — that one is off the table. Besides, the industry is pretty consolidated right now. And no-one is going to make huge reductions in credit quality because, while memories in finance are quick to fade, they’re not that quick. Crappy FICO credit card lending is, as I mentioned just now, confined to some specialist institutions which have to stay small and nimble. So there’s evidence there of progress, of a sort, compared to the events which led up to the GFC. But unless we get a chain reaction of rising real incomes, rising levels of consumer indebtedness and rising net interest margin, the credit card industry too will hit the zero bound. It won’t collapse in a heap, but it won’t be anything other than anaemically profitable in a best-case scenario. That’s part of the problem — there’s no mechanism to trigger creative destruction.

Too early and way too dramatic to say it’s emblematic of a “crisis of capitalism”, but — in the disinflationary or deflationary environment our wonderful UK government seems intent on maintaining — it certainly gives a very good impression of a zombie having to start to feed on its own body parts.

It’s a return to that old chestnut, beggar thy neighbor. UK banks can’t make money on UK customers, so the magic thinking goes, we’ll make money off of someone else. But, as Isaac Asimov said once in another context, it’s like standing under a tree in a rain shower imagining that when that one soaks through you’ll just run under another tree. Every nation on Earth today is waiting around for some other nation to increase wages and thereby demand so that they can make money off of those new customers. But no one is willing to pull the trigger. China was supposed to in its transition to a more service-oriented economy leaning on the national market rather than global exports. But that’s not happening. The game plan now seems to be keeping the 1% rich by servicing the 7% who have money. I have great doubts it will work.

Monetary Politboro genius thought process: “I know, we’ll make our country richer by making our citizens poorer”. A devaluation is a devaluation, period, DE = opposite or lesser, VALUE. Recall when we join the “race to the bottom” on wages just what the bottom looks like: I read one account of a factory in China where workers showed up and did not even want to be paid, they wanted the free company lunch and to sleep on the dry and protected floor of the factory. The Koch Brothers and Jeff Bezos and Tim Cook may think that is Nirvana for America but I’m not so sure we should take their word for it.

“No mechanism to trigger creative destruction” in a deeply indebted, deflationary and interconnected economy which has reached the limits of inflation and has nowhere to go. They can’t really destroy an inflationary economy either. Creative destruction is a limited, local thing, not really a doomsday device. The best solution is a mechanism that doesn’t let things inflate or deflate in the first place. Ann Pettifor says “policy makers lack the tools to correct a deflationary spiral” – but that’s by choice. It almost makes me think that inflation/deflation is itself the little engine we worship the most.

reached the limits of inflation because if it went on forever it would devalue the currency… so not understanding the value of the currency is the thing that is causing the mess in the first place… and currencies can be valued however we choose because they are all fiat… and blablablah.

between deflation and inflation you can’t win. even stagflation. that’s bad too. what about disinflation? it depends on the “dis” and the “inflation”. almost anything with “flation” in the word is a matter of some considerable controversy. “Conflation” is even bad. Even words with “ation” without the f and the l can be controversial. “Inhalation” is good, unless it’s smoke. Blowing smoke isn’t good, but you have to inhale first. This is a very complicated topic. The other thing they use that can be good or bad is numbers. 3 and 5 for example. Or 9. You can add them or subtract them. negative numbers are deflation. Decreasing positive numbers are disinflation. Increasing positive numbers are inflation. Sometimes differnt things have the same numbers and sometimes each thing has it’s own number. There can be hundreds or thousands of things too. That gets complicated. Numbers you can’t measure are not numbers, until you measure them or just say “this is 8” or example when somebody else could have said 7 or 9 or 5. 3 is probably too low for an “8 estimate”. When you do they’re no longer what they were. Now they’re numbers. But that’s all they are.

I stop reading when they don’t know the difference between positive numbers and negative numbers. Or that there is usually 10% between price and fully burdened cost, or 25%-40% between price and direct cost. Or that there is a higher power that guarantees corporations the right to increase profits 10% year, every year, and anything else we call deflation. Or that mismanagement is monetary deflation. Or they are unaware that the first thing taught in MBA school is that “there is no relationship between price and cost”. This means a good bidness person works on cost reductions even if they are able to raise prices. Then there is the concept of “average prices”. These seem to be very different than both what we pay for things and what our cost of living is – so this makes the whole thing seem quite arbitrary.

It’s small beer but, I loved the governor of the Bank of England giving a homage to Marx; “A spectre is haunting Europe.”

beer is good. Even 8 is good, if you’re young. I remember nights of 12 or 13. Sometimes I puked the next day but surprisingly rarely. Usually it was just pain. Gotta love Bernie takein it to the Wall Street Banks in their house. hahahaha. some things aren’t complicated because they exist before and after numbers. The numbers are just there for the convenience of rapid thinking.

Yay beer!

However, when it comes to bong juice, spirits are the way to go. A hand made wax bubbler, cheap vodka for a filtering agent, and one of those portable medical oxygen tanks for the shotgun blast and you’re ready for some serious ‘melting personality syndrome.’

All of the above is for the convenience of dilatory thinking. Indeed, can one posit negative thinking? Is clinical depression the analogue of the square root of negative 1?

More importantly, given the above, what is the localized effect of the ZIRP? I’m certainly casting around for what is apparently now a chimera, gainful employment. All I see now are offers for anti-gainful employment. Who wants a job where you have to show up six days a week for four hours a day for close to minimum wage? I can see the return of those “Employee Dormitories” our parents were familiar with in the Long Ago.

Anything above 12, and I have to take off my shoes. What I need is one of those ‘hip’ cartoons with dancing numbers and lots of question marks flying about.

Yves,

You are so great, but I find when it comes to the “inflation” thing it seems you are just as stuck on bad data, and non empirical evidence as standard economics. If the empirical record does not show deflation to be “bad” then it isn’t. If the assumptions regarding inflation and human behavior have never been tested, and when measured seem wrong you really have to question this. You’ve debunked so much, well it’s time to spend some time on this topic. When you start thinking it through, much of the current problems have to do with our fixation on inflation and inflation targeting. The Bis has done some wonderful papers on this subject, that are long PDF’s. Evidence does not support in any way that standard view.

Have you been to Japan lately ? Try that for what happens to an economy after 20 years of deflation. It’s not that Japan is not actually a pleasant enough society to be a part of (it is), but it has — economically speaking — entered the Twilight Zone in terms of the deflation-induced distortions which have to be constantly navigated around by government, business and joe public.

We can’t begin any discussion without mentioning first how the Japanese government is doing this weirdly awful kabuki of non-monetisation-monetising the deficit. Everyone knows this is what is happening but because monetisation is a no-no, you can’t mention the “M” word in polite company. But the only option for Japan to end the deflationary spiral is monetisation so that, in practice, is exactly what it is doing. As it can’t acknowledge it, though (not least because it would open Japan up to charges of currency manipulation, of all things) everyone has to exist in this economic version of The Matrix where once in a while you can see the true underlying reality but then it all shimmers and you get the presentation layer back intact again and that’s when everyone then carries on like they are seeing what they are supposed to be seeing. But this is a peculiar version of The Matrix because, subliminally, everyone knows the underlying reality and acts accordingly which has people in a perpetual state of waiting for the shoe to drop. This strangles any confidence fairies at birth.

For business, the cost of — real terms — capital is hideous. So investment is stunted. Even if the cost of capital was to somehow fall (and there’s no mechanism for that to happen in a zero-bound economy), under ZIRP (why ZIRP ? doh ! because deflation !) there’s still — yes, still — this overhang of delinquent assets which don’t get written off because there’s no real push to pay off the principle, the interest is negligible and there’s no inflation to eat away at the outstanding debts.

For consumers / everyone else, the velocity of money is on the floor so credit is scarce (and that’s if people wanted to borrow in the first place, as mentioned in the original piece, deflation kills demand which kills borrowing). Try to borrow some money in Japan. If you’re not in a small coterie of stably employed, male, early middle aged borrowers, you’ll face loan-shark rates. Why wouldn’t you ? — if you have no realisable assets (real estate too is bumping along the bottom at best), a static income (that’s the deflation at work, again) and little employment security (jobs for life disappeared along with the bubble era) you’re a pretty yucky credit risk for a lending institution to take on. And because of that high cost of capital (because — have you guessed what it is yet ? yes, deflation) any loan losses are especially painful for the lender.

“Bad” doesn’t even begin to cover it.

There’s loads of documentation covering Japan’s battle with deflation and the deleterious effects it has had and continues to have. And how tricky it now is for Japan to escape. Try a few internet searches, it’s not hard to come by.

Ah, another bugaboo. Economists always measure deflation from Peak Bubble. Real estate prices in the stratosphere and industrial overcapacity built to export all the products the entire world buys.

The problem is “deflation”. Not Peak Bubble. hahahaha

Yes, there’s not anything particularly problematic about deflation, all things being equal. Trouble is, “things” never are “equal”. It’s only ever okay on one of those “imagine an island where…” scenarios which only an economist can come up with.

Of course. They couldn’t find anyone to pay the price of the Japanese Imperial Gardens, which they claimed was worth the entire state of CA. Then if you invest capital to supply 100% of the world’s products and the world finally decides they won’t let you do that, debt certainly becomes a problem.

Japan’s problem is that it’s lunch has been eaten by China and Korea, This is not a “monetary phenomenon”.

The US is getting away with it by exporting dollars and wars. The US can export its problems, Japan cannot.

The price in the US is massive asset inflation and consequent inequality.

This deflation wolf is a scare that is always drummed up by financial types to get their bidding done – you know, create a crisis to take advantage of it. Ask Bennie how he got the chairman’s job.

– deflation increases the real value of debt.

*ding*ding*ding*ding*ding*ding*ding!!!

In both excluded-volume entropy, and exclusion-zone water, there is an internal area of high order, which is balanced by increased disorder outside of that zone. In the water case, the ordered area has more electrons, having stripped the protons of their charges.

The point being, you get change in time by virtue of there being a gradient. And if one side of the equation cannot fall below zero, you can still generate movement by submerging the other side below that baseline.

Or if you are a CEO, you can sell corporate debt to make stock buybacks and increase this years bonus. Then when the biz cycle downturn inevitably comes, take your golden parachute and the next CEO dude can deal with “deflation increasing the value of the debt”, which you had previously increased and stuck some in your bank account. It’s easy to get rich, when you know how.

But don’t feel sorry for the next CEO – they reset the bonus plan for him – and then it’s off to “growth” from the now deflated stock price. ‘Course layoffs come during this process – which is why the Imperialist Capitalist Pigs invented this scary propaganda story about deflation for us.

There’s a story in Links today about black holes farting off enormous clouds of hot gases…

I dunno, just seemed relevant.

Accountants call it “one time charges”. The entire S&P500 does it at the same time.(each recession) It’s another mystery of the universe.

That’s it! For “one time” dt = 0, and nothing changes! Well, dynamically. The charge separation is permanent and the black hole more massive.

Important to note, the black hole is not emitting anything. The apparent expansion and heating up is from self-interested individuals falling even faster and then getting blown away from the center of mass.

That sounds like an opportunity to use Stokes’ Theorem! Those don’t come up often in the peanut gallery. You gotta hop on it!

Thank you, sir. Please note, tho, that finance has inverted Stokes by providing for an infinite number of derivatives, inverting the antiderivatives through the use of imaginary numbers.

Would that make the CEO a Hodge star operator with an aim of a handout – ????? – in flat space…. making it canonical and thus sacred….

Skippy…. Derivatives ain’t that just another word for misogynistic…. us boys know what were doing – !!!!!!

deflation increases the real value of debt (depends).

even if the case, then periodic bouts of deflation help to keep debt levels in line.with gdp, (which is good)

example: income 100, goes to 90, prices drop 20% debt 20%

normal I have 80 dollars excess spending

post deflation

90 dollars income leaves 70 spending, but that 70 now buys 20% more equals 84 dollars worth of goods I can buy in prior money. My real income has gone up.

As far as I can tell deflation is only really a problem in an over leveraged system (supported by empirical data). So the fixation of all these years on maintaining inflation has allowed the leverage buildup, leaving much of the current problem

Plus all inflation is not the same, (wage inflation vs scarcity inflation). ditto with deflation. TFP, productivity increases should be deflationary. Not bad.

I want to pull my hair out when analysis doesn’t look into things in depth

I’m no expert by any means, but no mention of a debt jubilee?

If you were an expert you’d realize that violates “sanctity of contracts”.

That’s how the looters got their bonuses during the Big Bailout, they had contracts to get the money even though the money came right from the Fed and not the market.

The contracts didn’t say where the money had to come from. Just that it had to come. So technically it wasn’t a violation of the contract! See how it works. :)

Devil’s advocate:

Osborne’s (obviously fallacious) argument seems to be that the current deflation is caused by crude prices being halved. (I say fallacious, because aggregate demand was miserable before crude dropped). But I do wonder if there could be a grain of truth in the pile of manure being pushed by Herr Osborne: we saw what the price of oil skyrocketing did to inflation in the 70s. What is the effect of it dropping now? To the degree that a noxious aspect of prices (oil) is being decreased, shouldn’t this ideally lead to prices that more accurately reflect supply/demand and remove rentiers from the supply chain?

In other words, what if Osborne is saying (he isn’t):

deflation due to oil prices dropping = good

deflation due to decreased agg. demand = bad

Meanwhile, Pettifor has only addressed issue (2), aggregate demand, and rightly so, because deflation is a sign of a sick economy, and she makes a point that needs to be said in a climate where inflation hypochondriacs dominate the central banks and the media. But I’m not sure she’s addressing the chancellor’s argument.

[RG then takes a prolonged bath to wash off the stench of having defended Osborne]

Why is NC publishing an article by Ann from PRIME that was written a year ago this month without noting this?

I neglected to mention that the graph on UK household debt produced by Neil Wilson, which goes up to Q1 of 2013, is not included in this “extract”.

prices only changed 0.5% since then. what difference does it make?

Even next year, right about now, you could still publish it — probably.

If there’s deflation between now and then it can only go up in value (publishing wise).

Interesting read. Deflation is healthy because it leads to real price discovery – but in our current environment price discovery is a no-no. Hence deflation being bad. Flation of any type doesn’t seem to matter when the price of gas drops which should lower costs at the supermarket due to lower delivery costs, but those prices don’t drop (?!). Food costs are still rising. Saw a 3%-5% rise in prices at the discount grocery store yesterday (employee owned). Gas stations around here are pricing their gas as if oil were above $50 barrel! The invisible hand of government? No inflation naturally occurring so that also must be propped up? Just curious wth is going on.

Rent extraction. Get it while the getting is good.

How does deflation lead to real price discovery? Deflation is a surefire sign of depressed aggregate demand. What I assume you mean by “real prices” is prices as determined by supply and demand (ceterus paribus). So by having deflation you are not getting closer to what supply/demand actually is, rather you are just toying with one of the variables: demand.

Furthermore, your comment could be read as “deflation is healthy because now we know what ‘real prices’ are. Sure, we now have massive unemployment and decreased real wages as a result, but who cares because now we get to know what the idealistic prices of goods should be.”

I’m no expert, but if inflation is healthy, deflation is healthy in the long run for markets also. There has to be balance. The markets are telling us that but we’re fighting it every step of the way. How is that good?

At 2% inflation how long will the value of the dollar last? It’s lost about 95% of it’s value over the last 100 years. Is the goal to make it worthless through inflation? Just asking

Inflation is necessary because economies (are supposed to) grow. You are effectively saying that growing and contracting are both healthy. Furthermore, as the article noted, a deflationary environment causes consumers to postpone consumption. An inflationary environment does the opposite. If you’ll pardon the analogy, inflation and deflation are not two types of opposite ingredients that are needed in balance to make a tasty economic soup. Rather they are one single, necessary ingredient, and the inflation must be positive, not negative.

Secondly, the dollar will “last” as long as there is demand for it, regardless of how many zeros are on the bill. The fact that more dollars are necessary to buy goods now than in 1971 is irrelevant so long as salaries keep pace (they have gone down, even with minimal inflation). What erodes real value is when you need to work more hours to buy the same products. That happens when the labour market is weak because no one is hiring because of deflation. See Spain: 23% employment and no inflation.

Also, I’m not saying “deflation is healthy because now we know what ‘real prices’ are”. Deflation is a step in price discovery when markets are propped up. Deflation can “lead” to asset price discovery is all I’m saying. Sorry if the terminology wasn’t concise. No expert, just curious.

It’s not a matter of terminology, and I’m no expert either (in fact I’m hoping some of the smart people here will jump in).

Still, I can’t make sense of your “price discovery” point. In theory, prices are established by supply and demand. You can modify prices by modifying either supply or demand. Market distortions are created by speculation, subsidies, central economic planning etc., all of which distort supply and demand. Deflation does not necessarily affect those distortions, thus giving a “clearer view” of what the price should be; rather it affects the market itself, by decreasing one of the variables: demand.

I think when we have inflation, it’s good to deflate it.

And when we have deflation, it’s also a good time for inflating.

Always aim for the middle ground. Always look for Goldilocks.

‘Deflation is good for creditors/money-lenders or the rentier class.’

This was accepted as axiomatic in the 19th century. But in 1910, rentiers made their peace at Jekyll Island with an inflationary, quasi-public central bank which backstopped them against crises.

In turn, rentiers shifted from being lenders to being non-recourse borrowers and leveraged speculators. This is what private equity is all about.

The post-Seventies era of goods disinflation coupled with asset inflation has let 10,000 billionaires bloom. ZIRP and QE were their rocket fuel.

I love this comment and will need to re-read it several times, people forget the denominator in all of these “analyses”. So we think $140 oil going to $40 oil just has to do with the numerator (a barrel and whether there’s demand for it) when actually it has just as much to do with the denominator: “per USD” in all its hyper-leveraged and re-hypothecated glory.

In Japan they have the furrea kippu, a currency denominated in hours of elder care, a relatively stable measure of value over time. When you’re young you earn them, when you get older and it’s your turn you spend them.

Income disparity started in the 70s when it became detached from productivity, as such, please illuminate how that had anything to do with the fed. In fact I seem to recall the monetarists [quantity theory] cracked a fat about hyper inflation boogie men compounded with John Birch Society et al wing nuts, which proceeded the roll back of progressive indavidual taxation and paved the way for billionaires – squillionaires – multi/transnationals e.g. corporatists [sovereign stripe] in establishing oligarchy and plutocracy.

“post-Seventies era of goods disinflation” gezz beaver I thought that was how supply side worked, you pay lower or stagnate wages [loss of PPP] and off set it by exporting all the profit drag and import cheaper shit…. presto billionaires multiplier…

Skippy…. ask these good Americans – awaiting thingy…

I’d add to this a point raised by Larry Summers in a presentation on the productivity decline of recent decades that he gave at the Peterson Institute (I know – two wrongs seldom make a right but Summers was discussing a technical point on macroeconomics, so no neoliberal boosterism was evident). Summers cited research that suggested that part of the question of why productivity has not been increasing may be a mismeasurement of underlying inflation, which he said may be overstated by as much as 1.5%.

Summers cited this by way of explaining that productivity may have been higher than believed BUT HE IGNORED THE IMPLICATION FOR THE CURRENT GLOBAL ECONOMIC SITUATION COMPLETELY! If Summers is correct then the Western countries have been experiencing deflation for the last eight years. In addition, the Fed’s target of 2% inflation should actually be closer to 4%. I was astounded that no one in the Q&A (led by Adam Posen) followed up on this point. Here is the URL

https://youtu.be/iqNYVP-ly1k

P

Maybe to really understand how dangerous debt-deflation is you need to be Irving Fisher.

1. 1929: “Stocks have reached a permanently high plateau”.

2. 1929-1930: Financially wiped out in the Great Crash.

Thinks …

3. 1933: Debt deflation theory of depressions.

“So in a deflationary environment producers will sell a good or service at below the level of profitability or below the cost of making that product.”

WTF?

No one in Japan is making a profit?

Deflation does not necessarily postpone consumption. This is obvious.

I cannot defer feeding or housing myself. That’s almost 80% of my expenditure.

The lower down the income scale, the less deferrable is most of the consumption.

Inflation is NOT something anyone should want. Nor necessarily deflation, for that matter. What we want is a rise in real earning and purchasing power across the whole population. But for environmental reasons, do we want infinitely rising consumption? Is there ever such a thing as enough?

Do we need everyone to be flogged back to work by the monetary overseers’ desired level of inflation?

The best solution for debt-delfation is not monetary inflation, but the cancellation of debts and proper rationalization/reduction of the financial services sector.

Mellon wanted to liquidate various categories of activity, but all the activities he wanted liquidated happened to be actually producing real goods and services. But if we adapted Mellon’s sentiment to our own needs, it would actually sound pretty good: “Liquidate subprime, liquidate share buybacks, liquidate CEO stock options, etc. etc.”

To summarize:

Deflate first !

Then reflate !

Never inflate !