By Eric Tymoigne. Originally published at New Economic Perspectives

Central Bank Balance Sheet and Immediate Implications

The previous post reviewed basic balance-sheet mechanics. This post begins to apply them to the Federal Reserve System (Fed).

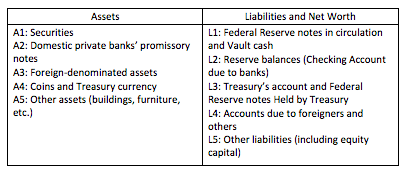

Balance Sheet of the Federal Reserve System

For analytical purpose, the balance sheet of the Fed can be presented as follows:

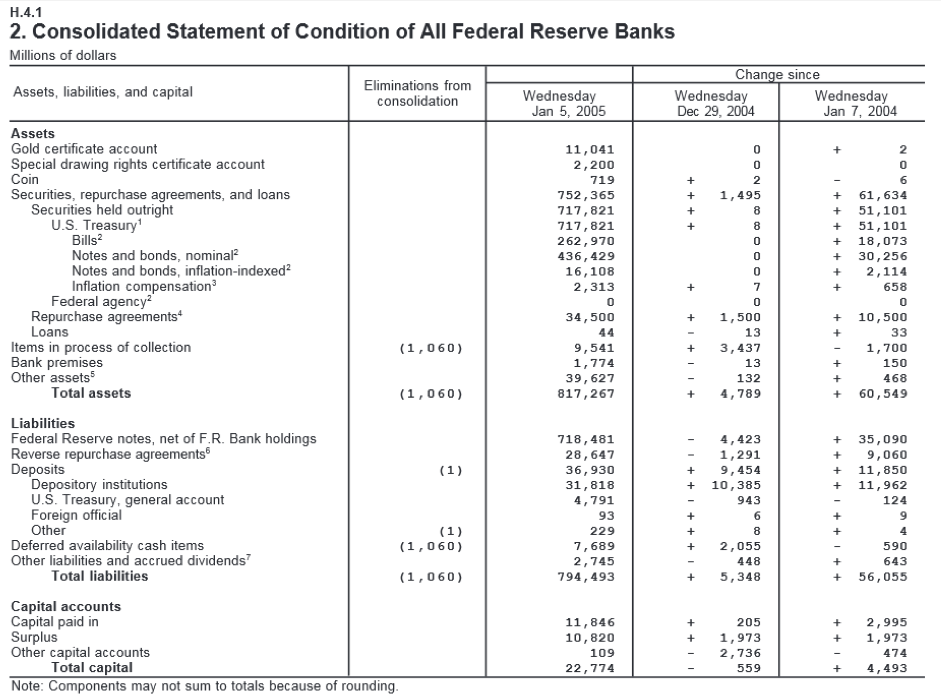

Below is the actual balance sheet of the Federal Reserve System prior to the recent crisis (from Board of Governors’ series H4.1, Factors Affecting Reserve Balances). It sums the assets, liabilities, and capital of all twelve Federal Reserve Banks and consolidates them (i.e. removes what Fed banks owe to each other). The main asset was Treasury securities that amounted to about $718 billion in January 2005.

The main liability was outstanding Federal Reserve notes (FRNs) issued (i.e. held outside the twelve Fed banks’ vaults) that amounted to $718 billion in January 2005. This line in the balance sheet includes all FRNs issued regardless who owns them, which is different from L1 in the balance sheet above. Indeed, for analytical purpose, economists like to measure the amount of FRNs “in circulation,” that is FRNs held outside the Federal Reserve banks, the U.S. Treasury and private banks (i.e. “vault cash”). A distant second liability was reserve balances that amounted to $31 billion.

Capital consists mostly of the annual net income of the Fed (“surplus” line) and the shares that banks must buy when becoming members of the Federal Reserve System (the “capital paid in” line). These shares are not tradable, cannot be pledged (i.e. banks cannot use them as collateral or cannot be discounted), do not provide a voting right to banks, and pay an annual dividend representing 6% of net income.

Any left-over net income is transferred to the U.S. Treasury and the Secretary of the Treasury can use the funds only for two purposes: to increase Treasury’s gold stock or to reduce outstanding amount of treasuries (aka “public debt”) (For detail see Section 7 of Federal Reserve Act).

Four Important Points

- Point 1: The Federal Reserve notes are a liability of the Fed.

One immediately notes that the central bank does not own any dollar or a bank account in USD, i.e. there are no domestic monetary instruments on its asset side besides a few Treasury currency (United States notes, etc.) and some coins (Fed buys all new coins from U.S. mint at face value and releases them as needed; it acts as coin wholesaler for the Treasury). Gold certificate account (first line under assets) are just electronic entries to record the safe keeping of some of the gold stock owned by the U.S. Treasury (The fed does not own any gold). The fed does own some foreign monetary instruments (SDR accounts, accounts are foreign central banks, foreign currency).

What the U.S. population considers “money”, the Federal Reserve notes (FRNs), is recorded as a liability on the balance sheet of the fed. FRNs are a specific security issued by the Fed and the Fed owes the holders of the FRNs. We will study what is owed later but the point at the moment is that what we, the public, consider money is a debt of the Federal Reserve.

- Point 2: The Fed does not earn any money in USD

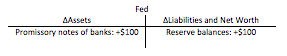

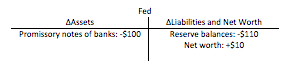

When the Fed receives a net income in USD it is not receiving any money/cash flow, i.e. its asset side is not going up. What goes up is net worth. How does that occur? Suppose that banks request an advance of funds of $100 repayable the next day with a 10% interest. Today the following is recorded:

The fed just typed an entry on each side of its balance sheet, one to record the crediting of reserve balances and one to record the fed is now a creditor of private banks by holding a claim (“promissory note”) on banks.

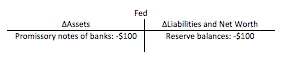

The next day banks must pay back $100 and an additional $10. The full repayment of the principal (i.e. outstanding amount due) leads to:

What about the $10 payment? It leads to an additional decrease in reserve balances and the offsetting operation is an increase in net worth at the Fed (and of course a decrease in net worth at private banks)

These two T-accounts are normally consolidated into one:

Here we go! The fed records an income gain!

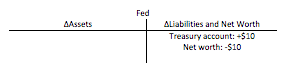

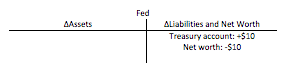

How does it transfer that to the Treasury? Easy! A Fed employee types the following on a keyboard:

The transfer of funds between accounts is just about keeping scores by changing amounts recorded on the liability side. Banks lost 10 points, Treasury gained 10 points.

- Point 3: The Fed does not lend reserves and does not rely on the taxpayers

If you go back to the official balance sheet of Fed you will note a line “loan” on the asset side and you will often hear and read—even in Fed documents—that the Fed lends reserves to banks. You will also notice that in the balance sheet of the Fed I made, there is no “loan” but instead there is “A2: Domestic private banks’ promissory notes.”

Throughout this blog I will not the use the words “loan” “lender” “borrower” “lending” “borrowing” when analyzing banks (private or Fed) and their operations. Banks don’t lend money, and customer don’t borrow money from banks. Words like “advance” “creditor” “debtor” are more appropriate words to describe what goes on in banking operations.

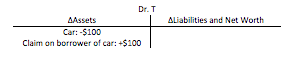

The word “lend” (and so “borrow”) is really a misnomer that has the potential of confusing—and actually does confuse—people about what banks do. “Lending” means giving up an asset temporarily: “I lend you my car for a few days” is represented as follows in terms of a balance sheet:

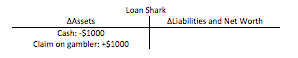

Alternatively, if someone goes to see a loan shark for his gambling habits and borrow $1000 cash, then the balance sheet of the loan shark changes as follows

The loan shark loses cash temporarily—it does lend cash—and if the gambler doesn’t repay quickly with hefty interest, the loan shark comes with a baseball bat and breaks his legs (or worse!).

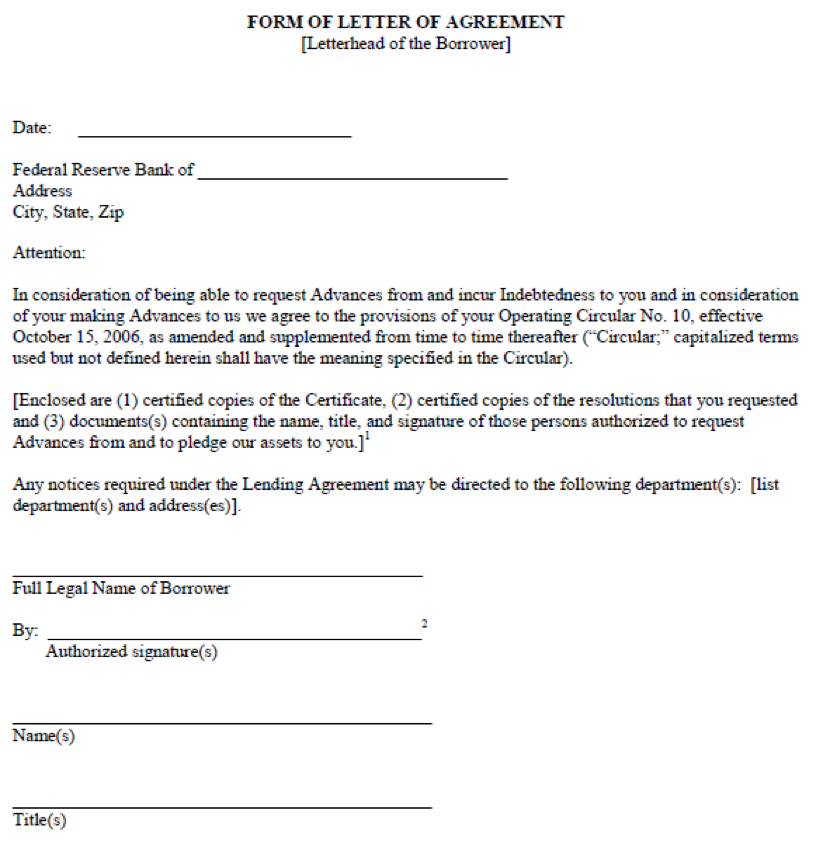

“To lend” is really not a proper verb to explain what the fed does because reserve balances and FRNs are not asset of the Fed, they are a liability of the Fed. As shown in point 2, when the fed provides reserve balances to banks, the fed gives to banks its own promissory note (reserve balances) and banks give to the Fed their own promissory notes. What the fed does is swap/exchange promissory notes with banks. This is one way for banks to obtain reserves balances, banks could also sell something to the Fed as we will see later. We will see later why banks are so interested in the Fed promissory note. Here what the banks’ promissory note looks like (here)

In this legal document (and others attached to it), a bank recognizes that it is indebted to the Fed because the Fed provided an advance of funds (i.e. credited the bank’s reserve balance). Now the bank promises to comply with the terms of the contract (that details time table for repayment, interest, collateral requirements, covenants, what happens in case of default, etc.). The Fed keeps a copy of this document in its vault, it is an asset for the Fed (A2 in our balance sheet) because the bank made a legal promise to the Fed so it can force the bank to comply with the demands of the promise.

The main point is that, when the Fed provides funds to banks, the Fed is not give up something it had first to acquire. The Fed does not use “tax payers’ money” (or anybody else’s money) as we often heard during the 2008 financial crisis (especially when large emergency advances had to be provided to many financial institutions). When the Fed provides/advances funds to banks, it just credits accounts of banks by keystroking amounts. As we will see later, the same logic applies to private banks.

- Point 4: Banks can’t do anything with reserve balances unless they are dealing with other Fed account holders

One may also note that nobody in the U.S. population has a bank account at the Federal Reserve. Only domestic banks, foreign central banks, and other specific institutions (such as the IMF and some Government Sponsored Enterprises) have an account at the Fed. When banks use their account at the Fed (aka the “reserve balances”) to make (or receive) a payment, the only other institutions that can receive the funds (or make a payment to banks) are those that also hold an account at the Fed. Banks cannot use their reserve balances to buy something from an economic unit that does not have an account at the Fed because funds can’t be transferred. Similarly, you and I cannot make electronic payments to a person who does not hold a bank account.

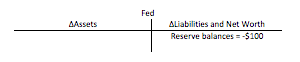

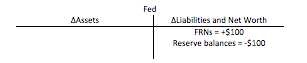

This is what happens when banks spend $100 from their reserve balances:

Now this T-account is incomplete because it is missing the offsetting operations. What are the possibilities? Below are three of them:

1. Banks ask for FRNs to put in their vault

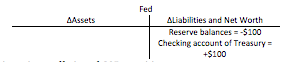

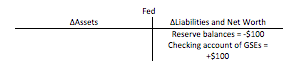

2. Banks settle taxes (theirs or that of the US population)

3. Banks participate in an offering of GSE securities

You may think of other ways to transfer the $100 on the liability side of the fed. Once again, the fed is basically keeping scores by transferring funds among account holders and keeping a tab.

The main point is that banks cannot buy anything with reserve balances from anyone in the domestic economy except from each other and other Fed account holders. Banks as a whole cannot use reserve balances to acquire any security issued by the private sector or any goods and services. More reserves does not provide banks more purchasing power in the domestic economy to buy existing bonds, stocks, houses, etc.

If banks wanted buy something from someone in the domestic economy with Fed currency, they would have to get more vault cash first (case 1 above). We will see that banks do not operate that way to make payments. Nor do banks lend cash (they are not the loan shark of point 2).

Can the Fed Go Bankrupt?

No the fed cannot “run out of dollars” because it is the issuer of the dollar (again, it does not lend any scarce asset it has). The Fed could have a negative net worth and still be able to operate normally and meet all its creditors’ demands.

The main role of net worth in a private balance sheet is to protect the creditors (the holders of the liabilities). Think of the house example in the first blog. The house was funded by $80k of funds obtained from a bank and $20k down. If the mortgagor defaults, the bank can foreclose and sell the house. With a net worth of 20k, the home price can fall by 20% before the bank is unable to recover the funds advanced to the mortgagors. If the down-payment had been 0% (and mortgage was $100k), when the bank forecloses it does not have any financial buffer against a fall in house price.

For the Fed, this is financially irrelevant (although politically it may raise some eyebrows in Congress). It can meet all payments due denominated in USD at any time, no matter how big they are.

That is it for today! We will use most of this in the next blogs to study how monetary policy works. Next blog will continue to study the central bank by focusing on the “monetary base”.

“One may also note that nobody in the U.S. population has a bank account at the Federal Reserve. Only domestic banks, foreign central banks, and other specific institutions (such as the IMF and some Government Sponsored Enterprises) have an account at the Fed. When banks use their account at the Fed (aka the “reserve balances”) to make (or receive) a payment, the only other institutions that can receive the funds (or make a payment to banks) are those that also hold an account at the Fed. Banks cannot use their reserve balances to buy something from an economic unit that does not have an account at the Fed because funds can’t be transferred. Similarly, you and I cannot make electronic payments to a person who does not hold a bank account.” Eric Tymoigne [bold added]

And this is precisely the problem; the economy must work through the commercial banks instead of being able to deal peer-to-peer with each other (and the commercial banks too, if desired) as would be the case if all could have (risk-free, by nature) accounts at the Federal Reserve. Thus the commercial banks must be coddled so the check clearing system does not fail.

There may have been an excuse in the past for allowing only commercial banks and a few others to have accounts at the central bank because of technological limitations but that excuse no longer exists.

Nice article and I hope Bernie Sanders reads it because one might think that Bernie thinks that commercial banks loan “out”* their reserves when that is currently impossible because genuine borrowers would have to have an account at the central bank too.

* eg. to a “borrower” at a commercial bank.

Sorry the shadow sector is manifold the commercial and much more opaque, that’s not to say their not intertwined.

Yes, the shadow banks must work through the commercial banks (like we all must do, currently) so accounts at a shadow bank have two failure points re the payment system:

a) The shadow bank may have insufficient funds (aka commercial bank credit/deposits) in its commercial bank account to satisfy demand for deposit withdrawals.

b) The shadow bank’s commercial bank may have insufficient funds (aka reserves) in its central bank account to satisfy demand for deposit withdrawals.

With accounts at the central bank for all then the distinction between shadow banks and commercial banks would disappear leaving only a) as a failure point, a significant improvement.

“leaving only a) as a failure point, a significant improvement.”

Except a) would now read “The

shadownow commercial bank equivalent may have insufficient funds (akacommercial bank credit/depositsreserves) in itscommercialcentral bank account to satisfy demand for deposit withdrawals.”The shadow sector is more leveraged and rehypocated than the traditional sector, did I mention unregulated again?????

Once shadow banks have accounts at the central bank then, if they run into liquidity problems, they can:

a) borrow from or sell assets to individual accounts at the central bank, eg. at the Federal Reserve.

b) borrow from or sell assets to business accounts at the central bank.

c) borrow from or sell assets to commercial bank accounts at the central bank.

d) borrow from or sell assets to other accounts at the central bank, excluding the monetary sovereign.

e) if deemed necessary, “borrow” from the central bank itself at penalty rates with the central bank debt being senior to all other debt or no deal.

If e) then the interest collected* should be distributed pro rata to all other accounts at the central bank since it was their purchasing power that was lent, albeit involuntarily.

*If the loan defaults then the proceeds of the bankruptcy should likewise be distributed pro rata to all other accounts at the central bank.

No account without regulation and ending derivatives super senior status, tho that would not make it shadow anymore.

Well, I don’t see that individual or non-financial business or non-financial organization accounts at the central bank would require much regulation – of the account holders that is. OTOH, the central bank should not be able to show favoritism to accounts or to a class of accounts such as commercial bank accounts.

Btw, I haven’t been able to determine how much the FDIC insures in total but it was close to $4.29 trillion in 2008. Assuming that only 10% of those deposits fled (because of the abolition of government-provided deposit insurance) to risk-free (but non-interest paying) accounts at the Federal Reserve and that the commercial banks were no longer awash in reserves* then that’s $429,000,000,000 that could potentially be metered out equally to American citizens via their (if necessary, created for them) accounts at the Federal Reserve to provide the necessary reserves for the transfer of those deposits. Of course, the distribution of new fiat and the abolition of deposit insurance would have to be carefully planned and coordinated with each other and with the sale of private assets by the Federal Reserves. Ideally, the commercial banks would to borrow the needed reserves from individual accounts at the Fed (via uninsured certificates of deposit) but if deemed necessary the Fed itself could provide the new reserves at penalty rates and then distribute the interest to individual accounts.

Bottom line is that individual accounts at the Fed plus a careful abolition of deposit insurance would allow a vast amount of private debt relief without disadvantaging non-debtors or destroying the banks.

*because of the coordinated sale of private assets by the Federal Reserve

Correction:

“Ideally, the commercial banks would have to borrow the needed reserves from individual accounts “

“OTOH, the central bank should not be able to show favoritism to accounts or to a class of accounts such as commercial bank accounts.”

Except all fiat distributions should be to individual accounts ONLY lest some get paid two or more times via their ownership of a business or membership in an organization that has an account at the central bank.

Well, so much for hasty speaking:

More precisely, gifts of new fiat from the monetary sovereign (eg. from the US Treasury account at the Fed) should go to individual accounts at the central bank (but to only 1 per individual) ONLY to avoid multiple gifts (actually restitution for legalized theft, if one thinks about it) to an individual.

However, if it is deemed necessary that the central bank should involuntarily borrow the purchasing power of all account holders at the central bank by “lending” to the private sector then the central bank should distribute the interest received pro rata to ALL other (other than the “borrower”) accounts at the central bank.

Banks as a whole cannot use reserve balances to purchase assets.

But the Federal Reserve took Mortgage Backed Securities as collateral.

If the Federal Reserve can take bad securities from the banks does that essentially mean the banks are receiving free money?

Would they not be operating without risk?

I am not commenting as an expert. I am hoping to learn something.

It only took government guaranteed mortgages as collateral, so they were most assuredly not “bad collateral”.

In their just-released 4th quarter report, Hoisington Management points out that ex-Fed Governor Kevin Warsh has joined econ nobelist Michael Spence in attacking the economic basis of QE. They state:

Thus the substandard investment in real assets which produce long-term growth, in favor of financial assets that produce only vulnerable bubbles.

Hoisington concludes that the Fed’s rate hikes will reduce M2 growth, lower the velocity of money, and depress prices, perhaps sending Treasury yields to fresh record lows.

Lovely, just lovely. Possibly the Federal Reserve bank cartel has sh*t the bed so badly this time, that we can finally put these PhD fortune-tellers out of business — or least relocate them to seedy strip malls next to tattoo parlors and title loan shops to ply their shady trade.

“or least relocate them to seedy strip malls next to tattoo parlors and title loan shops to ply their shady trade.” Jim Haygood

With inherently risk-free Federal Reserve accounts for all and the end of government-provided deposit insurance for commercial bank accounts, then all remaining deposits at the commercial banks would be, by definition, at-risk, not necessarily liquid INVESTMENTS, no?

So inherently risk-free Federal Reserve accounts for all (including businesses) would allow the investment banks to become commercial banks.

But with the end of government-provided deposit insurance then ALL banks would be investment banks by definition, yes?

And thus we would finally be free of commercial bank tyranny since they would all have been reduced to investment banks and not a privileged cartel of gatekeepers to the nation’s fiat.

Adding that the abolition of government-provided deposit insurance will or at least should* require new fiat balances at the Federal Reserve (aka “reserves” in the case of commercial banks) and that’s where the trillion dollar coins and Steve Keen’s “A Modern Jubilee” come in. Let the commercial banks have to borrow those needed reserves from the US population and not get them via cheap loans from, or overpriced asset sales to, the Fed. “One hand washes the other”, comes to mind.

*So the Fed should sell private assets to sop up the reserves it has lavished on the banks via QE.

Well, first the Fed could sell their $4.5 trillion of Treasury and MBS stock. That would take care of the Treasury yield “problem”.

Next, with record excess reserves, what’s the problem with reducing M2 – if no one is using it??

Then, velocity of money is a demand problem. If they gave us some, we would be happy to make it zoom around. I know I would.

Hoisington is full of crap!

Hoisington definitely are biased to bond bullishness, always and forever.

That said, their forecast of lower Treasury yields almost certainly will be realized if the economy slides into recession.

If this period is just a “groaf pause,” one could still anticipate Treasury yields remaining about the same. All that the Fed’s rate hikes at the short end will accomplish is to flatten the yield curve. Ultimately that will tip the economy into its next recession, later if not sooner.

Pre QE, the Fed balance sheet was $1 trillion. That provided enough liquidity for the economy up thru 2008. It’s now $4.5T. Anything to do with yields is all the Fed’s own making at this point.

If they wanted long yields up, or a rising yield curve, it’s a piece of cake. Just sell some friggin bonds off their balance sheet. In fact, they are still doing the opposite – they are buying longish bonds to replace maturing bonds on their balance sheet – in order to keep their balance sheet the same! While paying banks interest on reserves – but I don’t get any passed thru to me yet!!!!!

“While paying banks interest on reserves – but I don’t get any passed thru to me yet!!!!!” craazyboy

I guess your value (and the value of the rest of us) to the payment system is not yet fully appreciated, ie. what value is a liquid payment system when the population is afraid to spend?

Are they afraid to spend or they don’t have any money –OH! OH, I mean FEDERAL RESERVE NOTES, to spend????? (or is that more accurately stated as they lack the means at effecting a transfer of various promissory instruments on sundry reserve bank accounts)?

The story is, and I believe it, is that the non-rich are afraid to consume and therefore the rich are afraid to invest. Likewise the banks are afraid to create additional deposits (aka “bank lending”).

It’s the end of the line for commercial banking as we know it, is my hope. We’ve had growth, yes, but at the expense of potential consumers.

Whocouldanode?

“is that the non-rich are afraid to consume “

Or can’t, as you point out, since their own purchasing power was, in many cases, used to disemploy them via automation and outsourcing.

The non rich are “afraid to spend”?

Say what?

You imagine that they have money to spend?

Only the commercial banks get to handle real money with any convenience.

The rest of us must make do with mere claims (aka commercial bank liabilities aka deposits at commercial banks) to real money or with “stone knives and bearskins”, physical cash and the mattress or safety deposit box.

But your point is well taken, see my comment above yours.

Pre crisis, the Fed balance sheet was $400 billion.

“Well, first the Fed could sell their $4.5 trillion of Treasury and MBS stock.” craazyboy

Yes to the later and no to the former since interest paying sovereign debt is welfare proportional to wealth rather than welfare proportional to need.

“If they gave us some [money], we would be happy to make it zoom around. I know I would.” craazyboy

And now they should know how to without:

a) disadvantaging non-debtors.

b) requiring a ban on new deposit creation.

“We believe the novel, long-term use of extraordinary monetary policy systematically biases decision-makers toward financial assets and away from real assets.”

I believe, (and there is a group of us from an old LTG forum) that this and all the deregulation plus all the “financial engineering” was done intentionally in an attempt to enrich the population. This was done with the belief that in order to overcome any constraints and have a future of floating cars, cities, and off world travel all we need to do is make everyone rich. In other words the solution to a future where everything is always becoming more expensive, aka reality. is to simply remove the monetary system/wealth from any real finite world connection. The concept of money being attached to anything tangible is so 20th century. Before you say it, yes everyone is rich but don’t worry the rich would have still been richier.

The only failure is in their ability to spread it around. The housing bubble almost did it. The tech bubble looked very exciting there for a while.

Bottom line is that we live on a finite planet with finite resources and we are beginning to but up against it. This absolute, undeniable fact by definition means if we attempt growth everything becomes ever more expensive. The alternative is everyone becomes evermore poorer, having less and less and start to die off.

Which policy do you propose?

“butt up”; not “but up”

“Bottom line is that we live on a finite planet with finite resources and we are beginning to but up against it. This absolute, undeniable fact by definition means if we attempt growth everything becomes ever more expensive. The alternative is everyone becomes evermore poorer, having less and less and start to die off.”

There can be growth with less use of material, space and energy, eg. computers.

The problem is unjust distribution of wealth and that can be traced, at least partially, to privileges for commercial banks and, by extension, for the most so-called creditworthy, which always includes the rich.

Depressing food prices would be a fine outcome, but I’m not holding my breath.

There is an error in the 3rd T-account in Point 2. It is a copy of the fifth T-account. The fifth one is correct, but the third one should not be the same as the 5th. I believe the third one should be:

Reserve balances -10

Net Worth + 10

overall, very nice exposition!

Can the Fed take bad securities as collateral?

If they can is this not the same as giving free money for the banks to gamble with?

No, they only take high quality collateral for QE, basically Treasuries and government guaranteed mortgage bonds.

For collateralized lending facilities, they do take lower quality stuff but the haircuts are really high. So you can only borrow a lot less than the face amount.

” but the haircuts are really high. “ Yves Smith

That’s nice to know. So draining reserves should not be a problem when it’s time to handout the new fiat to individual accounts at the Fed.

It’s still the Fed’s choice, I believe. There are the “Maiden Lanes”, made up of mostly Bear Stearns drek.

We didn’t want to throw the seniors under the bus. Of course the question arises, which sense of the word seniors are we alluding to ?

True, dat, but that was not part of QE or discount window lending. The Maiden Lane was for Bear, the second two for AIG.

Can’t run out of dollars = Can’t be subject to acute liquidity shortage

Not quite the same as can’t go bankrupt, very close but not the same.

Change the law and no entity need ever go bankrupt, what else is new….

If the Fed can always meet its financial obligations to creditors as those obligations come due, then it is indeed true that the Fed can’t go bankrupt in the only practically meaningful sense of the word. And it can always meet its obligations, but issuing more of its own debt, the federal reserve notes which then become the money that satisfies those obligations. That’s just my way of paraphrasing what Eric Tymoigne said.

The ability to issue one’s own debt, when everyone else is legally obliged to accept that debt as money, is the ultimate asset.

The Fed’s net worth is zero! All I see in the balance sheet at the top are assets and liabilities.

It’s an oddly formatted balance sheet. But Total Capital is the net worth obtained by subtracting assets from liabilities.

In its current version, “Other liabilities and capital” of $46.948 billion amounts to just over one (1) percent of assets.

http://www.federalreserve.gov/releases/h41/Current/

That is, knowing that a big chunk of its liabilities is unredeemable, the Fed is leveraged out the wazoo, on its long day’s journey into the dark night of infinite leverage with negative capital.

At less than 100 to 1, assets compared to balance sheet size, is as close to zero as you can get without actually touching it.

That lever could snap at the $40 billion fulcrum, and take the rest of the world with it.

It’s not that a “big chunk” of the Fed’s liabilities are unredeemable, but rather that all of its liabilities that are unredeemable. $718 billion of liabiilties are Federal Reserve Notes. These are redeemable only in Federal Reserve Notes. You can present old ones and the Fed will gladly give you new ones in redemption. The balance of its other liabilities can also be redeemed in federal reserve notes. The debits and credits to its accounts will always balance.

If you are worried that a big chunk of the Fed’s assets are unredeemable, don’t be. The Fed has no need and no plans to redeem those assets, and it doesn’t ever need to–because it can always generate the federal reserve notes it needs to meet its obligations without ever needing to sell any of its assets, if it, or Congress, or the President, doesn’t want those assets sold.

The Fed has a special IBM mainframe that’s worth an infinite amount of money.

So what do people make of this BoE article?

http://bankunderground.co.uk/2015/06/30/banks-are-not-intermediaries-of-loanable-funds-and-why-this-matters/

Essentially stating that commercial banks lend simply by creating an asset and liability then extending credit, with no practical bounds during a boom period as all banks are lending which become other banks’ deposits.

Where do reserves come into play here?

“Where do reserves come into play here?” ben

Taxes to the monetary sovereign drain reserves from the accounts of commercial banks at the central bank. Thus during a boom, when incomes increase, new reserves are needed to pay the additional tax revenues to the monetary sovereign.

That’s one reason.

…. as all banks are lending which then become other bank’s deposits. … Where do reserves come into play here?”

I believe the answer is, the commercial banks’ reserve accounts at the Federal Reserve Banks are the accounts that are adjusted to settle transactions between the commercial banks that are lending and receiving those deposits.

Thank you! I have never, ever understood this. It has been an opaque process to me.

This is why I read NC.

OK, these fake songs are getting annoying, but this is so true and I can’t help it, it’s how my head works . . .

Magic Bus

Every day I was confused (Too much, Magic Bus)

Rode the bus with the money blues (Too much, Magic Bus)

Now I get it, I just sit and smile (Too much, Magic Bus)

Poor house is only another mile (Too much, Magic Bus)

Thank you, driver, for getting me there (Too much, Magic Bus)

You’ll be a banker, have no fear (Too much, Magic Bus)

I don’t want to cause no fuss (Too much, Magic Bus)

But can I drive the Magic Bus? (Too much, Magic Bus)

Nooooooooo!

I don’t care how much I pay (Too much, Magic Bus)

I’ll just make it anyway (Too much, Magic Bus)

I want it, I want it, I want it, I want it … (You can’t have it!)

Just wanna drive it the other way

See my worth go up each day

‘Cause I can drive it another way

Magic Bus, Magic Bus, Magic Bus …

I said, now I’ve got my Magic Bus (Too much, Magic Bus)

I said, now I’ve got my Magic Bus (Too much, Magic Bus)

I drive my net worth up each day (Too much, Magic Bus)

Each time I drive a different way (Too much, Magic Bus)

I want it, i want it, I want it, I want it …

Every day you’ll see the dust (Too much, Magic Bus)

Where I drive the Magic Bus (Too much, Magic Bus)

and dats why we love u, in a non-sexual way of course.

“Ya can’t have it!”

Yep, but wait till we wrest at least SOME of those [currently] insured deposits away if, as V. Hugo said, “Nothing is more powerful that an idea whose time has come “