By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

China never had an actual economic model or growth model. It simply printed an obscene amount of money, especially after 2008, and used it to build factories, 30-story see-through apartment blocks and highways into nowhere cities, without giving much if any thought to where this would lead when their formerly rich western customers had less to spend on its ever increasing amount of ever more useless products, or when its workers would stop spending ever more on apartments as investments, or when no more roads and bridges were needed because nowhere was already in plain sight. Or all of the above. It was ‘to infinity and beyond’ from the start, but that’s a line from a kids’ fantasy story, not a 5-year plan or an economic model.

Going into its 10-day, 3,000 delegates National People’s Congress opening on Friday, China was facing -and very much still is- two major and interconnected problems. Both are problems that the country has never faced before -not a minor point to make. The first is a giant debt load, one that could easily be as high as $40 trillion, or 350% of GDP, once one includes the shadow banking system (watch the shadows!). The second is the Communist Party’s -economic- credibility.

The debt problem is impossible to solve without very far-reaching restructurings of both the debt itself and of the entire Chinese economy. There appears to be a problem within the problem, however: the Party neither looks prepared to truly tackle the debt nor does it seem to know how.

As for the credibility issue, the very fact that a 5-year plan will be unveiled is the perfect in-a-nutshell illustration of what’s ailing Beijing. Not only does it hark back to communist days of old, not exactly a confidence booster, but trying to look 5 years ahead in today’s global economy is in itself not credible. It forces the Party to make statements nobody in their right mind will believe. And to compound the issue, that is something the leadership doesn’t really seem to take seriously. President Xi Jinping, more than anything else, looks like a man in the tradition of ‘what I say is true because I say so”.

That may have worked for a long time inside the country, but the desire to be part of the global economy means the ‘because I say so’ attitude is now being questioned by people Xi can neither bully nor bend into submission. Something he doesn’t seem to have clued into yet. Surrounded as he will be over these ten days by people who’ll say Yes at any appropriate and inappropriate instance, and laugh at anything he says that might be construed as a joke, Xi won’t come out any the wiser. He’d probably be better off spending those days with someone like Kyle Bass, but he’s not doing that.

Everybody, including most NPC delegates, knows that China’s grossly overleveraged, overproducing and overcapacitated economy needs another round of mass layoffs. Some initial numbers relating to job losses have been ‘leaked’ prior to the Congress. First, it was 1.8 million jobs cut in the coal and steel sectors, and a few days later that became 6 million. But that can only possibly be just a start.

It’s all in the numbers. China has something in the order of a billion workers, give or take 100 million or so. Even with the largest mass migration in human history, in which 100s of millions moved from the countryside to the cities, there are still an estimated 300 million people working in agriculture. That’s the entire US population. It’s also 30% of the Chinese workforce. In the US just 2 or 3% work in farming.

But that still leaves 700 million Chinese in other jobs. Many of these jobs were ‘invented’ in the past 20 years, as China’s ‘miracle growth’ transformed it first into the world’s no. 1 trinket producer, then into a kind of powerhouse that built highways to nowhere cities, and today a powerhouse with a fast plummeting global consumer base.

Many millions of Chinese workers produce things that can’t be sold. This is by no means confined to just coal and steel. The sharply dropping Chinese import and export numbers, as well as the purchasing indices, tell a bleak story. It’s evident that China must re-invent itself. And while that may be exactly what it claims it’s doing, the -alleged- transition to a service- and/or consumer economy may sound good, but its practical success is far from guaranteed.

Transforming a factory worker into a service sector employee is not a matter of flicking a switch. Repeating this 10 million times over, or 20 or 30 million, is a nightmare in an economy that is seeing its growth rates plummet while at the same time needing to deleverage its debt levels.

What are all these people going to do that produces actual economic value? And what will be the character of the companies they produce this value at? China is still dominated by state-owned enterprises, with workers relying on the faith that Beijing will always make everything right that goes wrong.

Losing that faith may have far-reaching consequences. At the same time, China cannot get the international economic status it so desperately seeks if so many de facto work for the government.

Though most tend to forget this, China was in a similar situation not so long ago:

In the late 1990s, China drastically restructured its state-owned enterprises, privatizing some and shutting down others. The result: from 1995 to 2002, over 40 million jobs in the state sector were cut, along with nearly 30 million jobs lost in the manufacturing, mining, and utilities sectors.

Although many of these workers were able to pick up jobs in the newly-growing private sector, the societal and cultural shift entailed in the restricting should not be underestimated. Prior to that wave of reforms, state sector employees (the vast majority of China’s workforce) enjoyed the benefits of an “iron rice bowl,” absolute job security along with social benefits (such as healthcare and pensions) provided by the state.

70 million – unproductive- jobs cut in 7 years. An average 10 million per year. A problem the country ‘solved’ by throwing tens of trillions (in US dollars) into overleveraged overproduction at exports-driven manufacturing enterprises. And by moving hundreds of millions of people into the cities that housed the enterprises.

15 years later, many of these newly created jobs have in their turn become unproductive. And the country may have to start the same process all over again. With probably tens of millions more jobs to replace. Question is, how will it fare this time around? Will people accept it as obediently as 15 years ago?

The reforms of the 1990s resulted in massive lay-offs. Overnight, tens of millions of workers lost their “iron rice bowls.” There were people who didn’t want to accept it, even those who actively resisted, but the government ruled with an iron fist and eventually the reforms went through. Even today, some of these people have grown old on the edge of poverty. On a certain level, we sacrificed them in exchange for huge reforms to the economic system.

But before wondering about civil obedience, let’s ask again: what are all these people going to do that produces actual economic value? Service economy? Consumer economy? There is no move available this time into another giant and overleveraged export industry. They’re at the end of the -debt- line.

Those people that had some money have lost a lot -and will lose much more- in equities and housing markets. Moreover, the government’s attempts to make them feel more secure about their old age would take decades to convince the people. So those who have something to save will do just that. So.. what consumer economy?

Service economy? Much of that in China is in financial services. Which has no future. So what else is there? How about the US model of burger flippers? That looks like a winner…

See, here’s a depiction of Chinese debt:

It looks like subprime derivatives on steroids: China hopes to bundle together billions of dollars worth of non-performing loans and eventually sell them to global investors Such a massive securitisation programme would represent the latest tactic in China’s campaign to lift one of the biggest shadows cast over its slowing economy -a debt pile that is as big as 230% of GDP. It would whittle back debts at Chinese banks and move some of the risk outside the domestic financial system.

According to official figures, such debts at the banks have reached Rmb1.27tn ($194bn), while analysts estimate the real number is likely to be many times higher. Chinese media has reported that the regulator has granted a total of Rmb50bn for the first wave of products. Demand for the scheme, however, is expected to be significantly more modest than supply. “How many global investors have been interested in the traditional [bad debt in China]?” asked one Hong Kong-based investor with experience buying distressed debt in Asia. “Not many.. is a more complicated version of this going to change that soon? No.”

This’ll be great, as great as the western approach to drowning in debt. Mind you, the Chinese haven’t even started talking about ‘recovery’ like we have, they’re still thinking -or propagandizing- that they’re on an ever upward trail. Well, they’re not. One of the early notes coming out of the People’s Congress was this: “China Says Will Keep Yuan Basically Stable Against Basket Of Currencies ..”

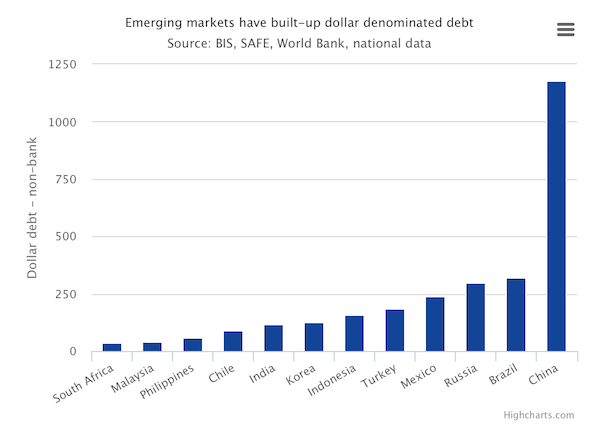

That’s not happening. They know it, we know it, and Kyle Bass knows it. Perhaps once the Congress is over, they’ll come clean? Hard to say. What’s certain is that global markets WILL force a substantial re-adjustment of the yuan, and there’s nothing Xi or the entire Communist Party can do to prevent it. And then, after a 30% readjustment, take another look at that dollar-denominated debt!

And they’ll have to cut many millions of jobs, and try to ‘pacify’ the newly unemployed, and deleverage the insane debt levels they’ve created, and find a way to explain to their people where it all went so wrong.

China no longer lives in a kids’ fantasy Toy Story.

The Chinese should be doing what we should be doing: taxing the rich, both to pay off the debt and to fund public services for the poor. Austerity for the billionaires, not the people. A key part of this would be to shut down their shadow banking system.

There is no combination of rich people nor tax rate that would come anywhere near making a dent in the amount of public debt. You could make paupers of all of them and just end up with more paupers than you started with.

Yes but most of those billionares are the party or are descended from members of it, and most of the shadow banking is dealing in local government debt. In effect doing that would mean taxing themselves. While our own government has ugly cronyism there you are talking about the president literally bankrupting his own kids.

It would also mean doing something that they have never really done: have taxes. Since so much is nominally state owned they don’t have a large and complex tax system that could be turned to this. They have shown a willingness to make such things out of thin air so they might but it could not be done without some ugly pain in some way.

I’m not sure I buy the notion which this article pushes that all recent Chinese growth has been a mirage. There are plenty of roads to nowhere and empty cities, but I don’t think there has been anywhere near the level of malinvestment that we saw in, for example, Japan in the 1980’s. And while Chinese debt levels are very high, so is growth (still), so again, I think the use of those comparative figures are a little misleading. When you read writers such as Michael Pettis, its clear I think that while the Chinese situation is very serious, it is still not yet out of control – sharp intelligent measures can ensure a soft landing and more sustainable (albeit much lower) growth. There can be little doubt that the CCP is fully aware of the issues, the key question is whether they choose the right options (the recent choice of yet another fiscal expansion indicates they are on the wrong track), and whether they new oligarchy has become just too strong to prevent the necessary measures.

The main obstacle to reform is local government – it is obvious that the government knows there has to be a large-scale shut down of excess capacity all over the country, but much of this capacity is owned by regional government and it has been a gravy train for a very large number of apparatchiks and their families (its amazing how many female millionaires and billionaires in China just happen to be married to senior local officials). The solution would appear to be obvious – generous financial settlements to workers and their families and relocation packages to more prosperous coastal cities (maybe using all those empty apartments). But it is one thing to say that, another to implement it.

I’m not convinced either that the Yuan has to devalue. The CCP still has other options within the ‘impossible trinity’, and I think devaluation is of the three, the least attractive option. It is far more likely that they would impose strict capital controls to prevent it happening, and raise domestic interest rates if necessary. The Chinese are well aware of the weakness of the world economy, so they must be aware that a devaluation will cause more harm than good to their own economy, and not least, it would be devastating for their immediate neighbours, who have become very important for their own expansionist policies.

Well, it is automatic earth we were are talking about here. They have been peddling doomsday scenarios since 2008,as far as I remember, and hardly anything they predict has happened.

China’s analysis needs to be inline with proper economic theory and political analysis. For example, this article doesn’t really explain to the average reader what does it mean to have apparently such a large debt(in dollar denomination) for a country like China. How is the debt divided between public and private and who owns what,etc etc.Just putting together some facts and not connecting them in a proper manner is just bad writing. I dont know why NC still pays attention to Automatic Earth. I hope Yves can explain it here.

Also,imho, this is a good opportunity for China to lead by example. China is probably the only place in the world right now that has the chance to use its unique political structure to turn its ship faster and better than other recession mired countries and lead by example.

Yes – its too easy to be a bear about China without acknowledging the real progress made and the qualities of the leadership. I strongly suspect that China will fail to spring out of the middle income trap, and they are in a very dangerous position right now, but they have not run out of options yet.

I’m not really sure though that they can act as an example. They already proved fiscal stimulus was the right way to go after 2008, but the rest of the world managed to ignore that lesson while simultaneously reaping the advantage (Germany and Japan in particular benefited enormously). What China needs now is deep structural reform, but structural reform is always particular to each country and each situation. Unfortunately I think they are falling prey to supply side illusions rather than taking a more holistic view of how they can turn the supertanker around without losing half the crew.

unique political structure to turn its ship faster and better

…those ‘bundles’ will make for unique bamboo shoot nail jobs!

http://www.bloomberg.com/quote/CNMS2YOY:IND

of course there’s nothing like Debt to Prove Strength in Politicians…

Most Gracious of You for the AM Belly Laff

I disagree that none of it has come to pass. Pushing unending growth while totally ignoring externalities or the real underlying value of the work done is insane, but this can be maintained for a long time. TAE documents the build-up of negative side effects of this paradigm, which I’ve found valuable. These include robbing savers through low interest rates, impoverishing various countries (PIIGS) due to structural Euro problems and corruption, the use of natural resources mainly to enrich a few people and provide jobs rather than to build things of enduring social value, and the results of killing and toxifying the biophysical environment.

They do get hand-wavy on a lot of nuts-and-bolts financial issues. They get that the cultural narratives of growth can be maintained while still shifting the burden of change to the poor, or by not accounting for environmental costs, or forgiving debts, or not enforcing laws. The authors aren’t great resources in my opinion for the nuts and bolts of all these and forecasting how long they can continue, but there is wisdom in seeing the forest for the trees – TAE’s documentation of the rapidly compounding negative side effects of civilized decisions has lead to some useful insights for me.

Side question: Does anyone know of good books describing ways countries have dealt with too-high population levels? I know the nuclear-weapon issue makes war riskier, but at some point, the soil will simply not maintain the population growth anymore, and I’m curious to know what options the policy-makers are considering in their deepest secret chambers, where they can openly discuss any option, no matter how saddening we’d find it.

It depends on what you mean by ‘high population levels’. A population is only ‘high’ relative to the available resources. Jared Diamonds book ‘Guns, Germs and Steel’ looked at a few societies which have successfully avoided catastrophe, mostly by reducing resource use. There is evidence, for example, that Pacific Islanders on small islands sometimes deliberately killed all their pigs and took on a piscetarian lifestyle in order to stave off a collapse of their islands infrastructure. Of course sometimes they ate each other to achieve the same ends.

The Chinese example of one child policy of course was one example. The peoples of the Tibetan plateau have long had a series of cultural adaptions which reduce population levels – monasteries are a good way of reducing the number of children produced. Its been speculated that the hindu prohibition on eating beef was a reaction to overpopulation. I believe its also been speculated that Aztec human sacrifice came about similarly. There is plenty of historical evidence that the British empire at least implicitly saw the Irish potato famine (in addition to Indian famines) as a method of reducing a problem population. They didn’t deliberately create the famines, but they didn’t stop them either.

The lesson from history and anthropology is that the correct response to overpopulation are cultural adaptions to reduce resource use in the short run, and encourage smaller families in the long run. Its that simple.

And China is to end their one child policy.

Will it reduce female infanticide? Will we see a return of uxorialocal marriages?

I think the rate of female infanticide was always exaggerated – it was a very local issue, but the western media liked it as a story.

China has undergone very profound social changes the last few decades I think few older traditions will have survived, except in rural areas. The one great benefit though of relieving the one child policy is taking away the enormous, suffocating pressure on the parents and single children. The combination of a strong tradition of the child (especially the son) to take care of the family, with the absence of sibling has produced what I think is an emotionally crippled generation. The child is, quite literally, all that stands between many parents and starvation. China desperately needs a proper social welfare system in order to release that pressure on people.

I found this at Wiki:

The core problem with female children in a Chinese context is not a simple one of misogyny. Within Chinese culture it is the responsibility of the oldest son (and his wife) to look after the parents. Young women were expected to go into marriage with a dowry.

Therefore, in particular in rural and more traditional rural areas, the single child policy raised a terrifying prospect for poorer people of only having a girl – raising her, saving for her dowry, and then see her leave to look after her in-laws, with nobody to look after them. The gender imbalance arising from selective abortion and (very occasionally) abandonment and infanticide was an inevitable consequence, and the CCP moved quickly when it realised the problem. However, it was left with a negative legacy of a ‘blip’ of excess males in certain regions. The major gender imbalance in cities such as Shanghai now, however, is mostly due to migration issues.

Its got to be said though that there was always a problem of child abandonment and infanticide in poor areas of China, the single child policy just focused attention on it.

LTPB,

The one-child policy was without doubt the sane thing to do – China still can attain what India never will.

Actually that situation was preceded by another series of job losses at state enterprises in the 1980s, and it was this series that helped feed the riots that occurred in the cities other than Beijing during and right after the Tiananmen incident. Both of those situations were harder and easier than what the CCP faces today.

Harder in that those workers who lost jobs didn’t have a family farm or other private safety net to fall back on. They all came from state enterprises which employed whole families, and which provided everything from medical care to schooling for the children. These people had no idea how to survive without the state supporting them, and in the end that’s what the state did, it gave them just enough to survive on, barely, and a time table with cuts, to motivate them. That and the bayonet kept order. The easy part was it would only cost RMB 80 per head to keep a family from starvation in those pre-inflationary days.

This time it is much easier because most of the people being fired came from the country-side and have farms to fall back on. Also they usually came to these nasty jobs, with the intent to only work until they had save enough money to enlarge their farm, build a nicer house, or start their own enterprise. The layoff’s are prematurely putting an end to some plans which may mean they will have to either reduce their schemes for using the money they hoped to save. It’s been interesting to see what the really young factory workers have done in their home towns after returning from Shenzhen. Many have opened restaurants, coffee shops, etc to meet the demands of their fellow returnees, who’ve seen a bit of the world and want more than a iron bowl of rice. The downside today is the extreme cost of living makes falling off the economic miracle extremely hard if those investments in the home towns fail. Survival now costs in the thousands of RMB per head. More over few will stay content and off the streets if all they can get is that sort of welfare. In the 80s/90s, the rich were not that rich, they were very discrete, and were not party members. This is no longer the case.

Hence, Xi’s not taking any chances. Part of island building South China Seas is preparing the ground work for a cause to start a war with the USA, if it should be necessary, to justify using full force to suppress mass scale domestic riots. Even a cold war, with the excuse to hunt down 3rd roaders may just do the trick. The CCP too is well aware that patriotism is the last resort of scoundrels. They even don’t have to “win” the war by western standards, just not lose it too badly.

– And then, after a 30% readjustment, take another look at that dollar-denominated debt!

“To say that the dollar will continue its globalization and integration is a misunderstanding. As a rising great power, One Belt, One Road is the initial stage of China globalization.” – Qiao Liang

China is viewing the next ten years in existential terms. That’s how long they think they have to get several billion people dependent on China before a shooting war starts. By setting those dependencies, the shooting war may be avoided. But only if the dependencies on the dollar have been severely weakened.

For those who missed a relevant conversation:

nakedcapitalism.com/2016/03/china-continues-to-focus-on-growth-not-reform.html#comment-2559831

It seems then, the struggle is to make those dependent on the dollar depend on China, in order to avoid a shooting war.

But it’s possible that the struggle itself could lead to, precipitate (sooner than otherwise), a shooting war as well.

It looks like China is setting up infrastructure westards for material transfers. BRICS bank & Shanghai Cooperation Organization provide economic / political infrastructure. But currency imbalances and the financial specifics are why I come here, there are devilish details. The TPP looks like a real line in the sand, with time favoring China. And what about all those U.S. bonds I hear ‘China’ has? Who controls those, and what can they lever?

It’s all in the time frame. Liang said that they don’t think the U.S. will start a shooting war for ten years, and that is their implementation time.

That apparently was the thinking, i.e., attempt to keep a low enough profile to avoid a war (as in avoid provoking the US) until the attempt to wage it at all became a form of MAD due to the complexity and scope of integration of the global economy that decade hence – as well as having a fully operational alternative global systems infrastructure up and running just in case ‘ten years’ turned out to be much shorter, whether (or perhaps because) the US hits a wall first or the US acts sooner to prevent Chinese success – which is what I sense has happened here. What did China come away with from the G20? Why should it again do the heaviest lifting, even as the US raises interest rates? How was it the PBOC had to come out and confess, essentially, that the huge moves in currency and other markets had been caused by its efforts to suck and blow at the same time – draw down its reserves, send them into a whirly-gig of old-fashioned internal money shuffling until out the other end pops replacement of the reserves along with the other benefits? That statement immediately ended what had been the start of a meaningful correction. And now all the various stimuli?

I think China has been somewhat humbled by this – and that is very closely tied, I think, to the clearly hostile US position, from TPP through to a new set of military bases all ringing China (and Russia) to already by the time of the ‘Asia Pivot’ being Officially painted as the ‘inevitable’ enemy.

China’s adventure in capitalism (albeit more state-managed than the Anglo-American varieties) is at end stage. And that leaves….

Become consumption based. And eschow imports. Aside from oil what would the Chinese care about exchange rates with a nearly closed, export rich, economy (manufacturer to the world)?

Cleaning up their pollution will create whole new Chinese industries.

And we need accurate numbers of sovereign debt vs private sector debt. The central government can always monetize all government, local and central, debt.

Government debt is money held in interest bearing accounts. Monetizing just means setting interest rates to zero.

I wonder if there are any examples of zero interest rate to examine……

Their exports depend on raw material imports, like ores, timber, copper, oil, plastics…

And their central government should just give money directly to the people, instead of monetizing corrupt government, local and central, debt – a lot of that money went to support mansion purchases in the West.

It´s the DEBT stupid

Do you know this man Immanuel Wallerstein here in NYC brilliant is from his blog incredible writer and clear like you

When “white-collar” positions were eliminated or reduced in number, they were indeed replaced by new “white-collar” positions. When, however, today, “white-collar” positions disappear, where is the container of new jobs to be created? And if they cannot be located, the overall effect is to diminish severely effective demand.

Effective demand however is the sine qua non of capitalism as an historical system. Without effective demand, there can be no capital accumulation. This is the reality that seems to be creeping in. There is no surprise then that concern is being expressed. It is not likely however that the “timid” attempts to deal with this new reality can in fact make a difference. The structural crisis of our system is in full bloom. The big question is not how to repair the system but with what to replace it.

I do appreciate these international posts.

china plans to buy, bundle and securitize zillions in non-performing loans? and sell them to international investors along with as many credit default swap contracts… so this will make chinese banks balance sheets good again and offset capital flight… what if they held an auction and nobody came?

Goldman Sacks will show up for the post auction sale. Keep an eye out for a new securitized product – prolly “Gold Brics” or some such name. AAA rated and a little yield too!

Soylent bonds?

Well, the PBOC could just follow existing global practice and buy enough itself to flip to others and off-load the lot of them. Is it possible they are just introducing diced derivatives as a market into China and these are the ‘loss-leaders;? Foreign Central Banks, maybe, would buy them? I would imagine it depends very much on the qualities of particular SOE’s as to whether whole operations could be sliced and diced and sprinkled around to the worthy.

Good review of the massive dilemma facing perhaps the biggest exemplar of the results of decades-long national-economic-can-kicking … just one quibble:

let’s ask again: what are all these people going to do that produces actual economic value?

Eh, if you are producing gadgets, gizmos or widgets for which there is no demand, you are producing ‘unsaleable goods’, not ‘economic value’. Retail-level Bridges to Nowhere, if you will.