By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

This could not have come at a more perfect time, with the Fed once again flip-flopping about raising rates. After appearing to wipe rate hikes off the table earlier this year, the Fed put them back on the table, perhaps as soon as June, according to the Fed minutes. A coterie of Fed heads was paraded in front of the media today and yesterday to make sure everyone got that point, pending further flip-flopping.

Drowned out by this hullabaloo, the Board of Governors of the Federal Reserve released its delinquency and charge-off data for all commercial banks in the first quarter – very sobering data.

So here a few nuggets.

Consumer loans and credit card loans have been hanging in there so far. Credit card delinquencies rose in the second half of 2015, but in Q1 2016, they ticked down a little. And mortgage delinquencies are low and falling. When home prices are soaring, no one defaults for long; you can sell the home and pay off your mortgage. Mortgage delinquencies rise after home prices have been falling for a while. They’re a lagging indicator.

But on the business side, delinquencies are spiking!

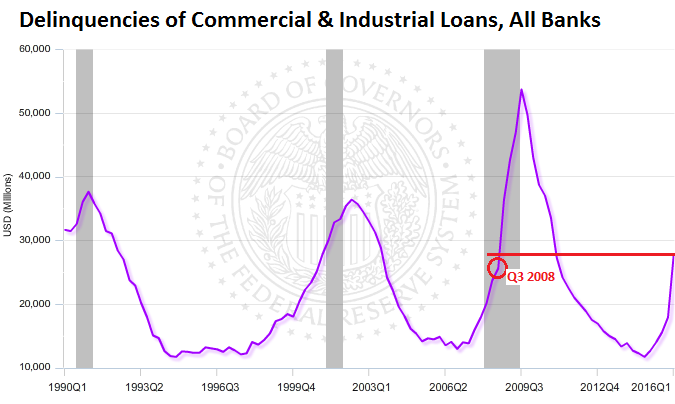

Delinquencies of commercial and industrial loans at all banks, after hitting a low point in Q4 2014 of $11.7 billion, have begun to balloon (they’re delinquent when they’re 30 days or more past due). Initially, this was due to the oil & gas fiasco, but increasingly it’s due to trouble in many other sectors, including retail.

Between Q4 2014 and Q1 2016, delinquencies spiked 137% to $27.8 billion. They’re halfway toward to the all-time peak during the Financial Crisis in Q3 2009 of $53.7 billion. And they’re higher than they’d been in Q3 2008, just as Lehman Brothers had its moment.

Note how, in this chart by the Board of Governors of the Fed, delinquencies of C&I loans start rising before recessions (shaded areas). I added the red marks to point out where we stand in relationship to the Lehman moment:

Business loan delinquencies are a leading indicator of big economic trouble. They begin to rise at the end of the credit cycle, on loans that were made in good times by over-eager loan officers with the encouragement of the Fed. But suddenly, the weight of this debt poses a major problem for borrowers whose sales, instead of soaring as projected during good times, may be shrinking, and whose expenses may be rising, and there’s no money left to service the loan.

The loan officer, feeling the hot breath of regulators on his neck, and seeing the Fed fiddle with the rate button, refuses to “extend and pretend,” as the time-honored banking practice is called of kicking the can down the road in good times.

If delinquencies are not cured within a specified time, they’re removed from the delinquency basket and dropped into the default basket. When defaults are not cured within a specified time, the bank deems a portion or all of the loan balance uncollectible and writes it off, therefore moving it out of the default basket into the write-off basket. That’s why the delinquency basket doesn’t get very large – loans don’t stay in it very long.

And farmers are having trouble.

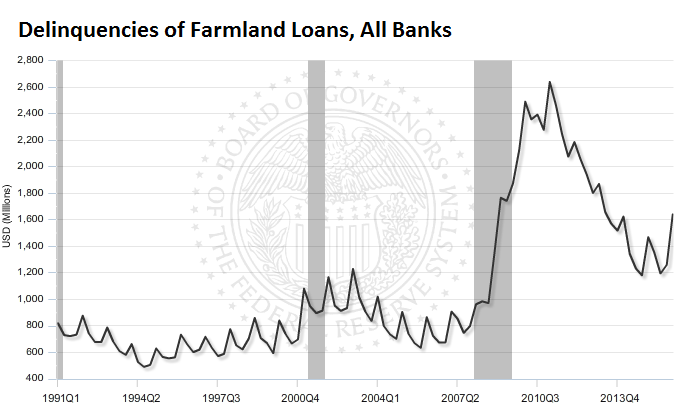

Slumping prices of agricultural commodities have done a job on farmers, many of whom are good-sized enterprises. Farmland is also owned by investors, including hedge funds, who’ve piled into it during the boom, powered by the meme that land prices would soar for all times because humans will always need food. Then they leased the land to growers.

Now there are reports that farmland, in Illinois for example, goes through auctions at prices that are 20% or even 30% below where they’d been a year ago. Land prices are adjusting to lower farm incomes, which are lower because commodity prices have plunged. (However, top farmland still fetches a good price.)

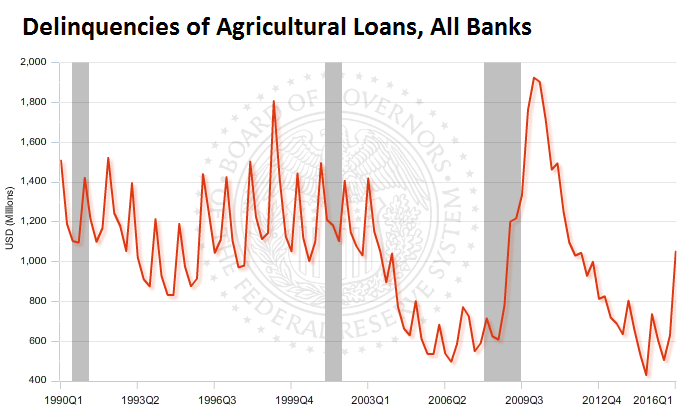

Now delinquencies of farmland loans and agricultural loans are sending serious warning signals. These delinquencies don’t hit the megabanks. They hit smaller specialized farm lenders.

Delinquencies of farmland loans jumped 37% from $1.19 billion in Q3 2015 to $1.64 billion in Q1 this year, the vast majority of it in the last quarter (chart by the Board of Governors of the Fed):

Delinquencies of agricultural loans spiked 108% in just two quarters to $1.05 billion in Q1. On the way up during the financial crisis, they’d shot past that level during Q1 2009:

Bad loans are made in good times — the oldest banking rule. “Good times” may not be a good economy, but one when rates are low and commercial loan officers are desperate to bring in some interest income. With a wink and a nod, they extend loans to businesses that look good for the moment. That has been the case ever since the Fed repressed interest rates during the Financial Crisis. A lot of bad loans were made during those “good times,” precisely as the Fed had encouraged them to do. And these loans are now coming home to roost.

One of the big indicators of the end of the “credit cycle” is the number of bankruptcies. During good times, so earlier in the credit cycle, companies borrow money. Lured by low interest rates and rosy-scenario rhetoric, they borrow even more. Then reality sets in. Read… US Commercial Bankruptcies Skyrocket

Deflation or inflation, that is the question. What will be the shape of the impending economic apocalypse, assuming that one is indeed impending? I can’t figure it out, so somebody please tell me so I can invest my meager savings where they will do the most good—for me.

The fundamental pressures are deflationary, but it’s quite hard to get deflation with a paper or electronic currency.

. . . invest my meager savings where they will do the most good—for me

I suggest hand tools and learn how to repair and maintain your own stuff. The dollar you don’t have to earn is way more valuable that the one you do.

:D been doing that my whole life…. gotta make some dollars tho in order to get the land too

Demand problems… no worries… income from leverage will make up for wages…

Disheveled Marsupial… oops middle class poof thingy….

Boom and Bust. Planned obsolescence. Highest rewards to those best adapted to lying and looting. Failing upward. The general population trapped in a self-indulged world of distraction. If a society could have a harmonic frequency that could be detected by it inhabitants, we would be hearing a dissonant screech.

The best phrase I have heard lately is- prepare to collapse in place. Simple. Easily communicated. While acknowledging the truly dire state we find ourselves in, leaves room for a positive interpretation.

Corporations have conquered the world, but they seem not to know what to do with it. What is that James Cagney movie?- Look Ma!!!! I’M on the TOP OF THE WORLD!!!!!

“Bad loans are made in good times”. As succinct a summary of Minsky’s Financial Instability Hypothesis as I’ve seen.

Well, duh! Nobody has any extra money after paying for basic services. I haven’t bought new clothes in five years; I shop at thrift stores instead. Latest find: a 2-piece jogging outfit with the $70 tag still attached for 99 cents. Secondly, Chinese stuff may have brought down prices, but they are made like crap, stop working, fall apart, etc.–so I buy as little as possible. And to get consumers to keep spending, every year the computer and electronics industries change the plugs and connectors so that perfectly good machinery will no longer “speak” to each other. I would go broke faster if I “updated” annually, so I just refuse to do it. Lastly, cable/satellite TV is such a rip-off, with so little actual news and so many damn ads, that I will probably decouple from it sometime this year and go straight internet. I feel sorry for retailers, because what’s happening isn’t their fault; it’s the greedy corporations.

Perhaps the propertarians (who put property/debt collection rights so far above human rights) are caching their survival hoards of “cash” off shore, as they also buy up more fancy shelters in gentrified areas, and as they prepare to escape and evade the consequences of where the extreme differential accumulations of wealth and power have been taking us.

Question: C&I loans are in Lehman territory, but not the housing or personal credit loans. Is C&I failure enough to crash the economy?

My uneducated assumption is that mortgage loans were the driver of the crash, C&I and personal credit followed. I have no idea of the % if each kind in the economy, so I don’t know how much danger we’re in.