By Raúl Ilargi Meijer, editor-in-chief of The Automatic Earth. Originally published at Automatic Earth

It’s been a while since we posted an article by our friend Euan Mearns, who was active at The Oil Drum at the same time Nicole and I were. Is it really 11 years ago that started, and almost 9 since we left? You know the drill: we ‘departed’ because they didn’t want us to cover finance, which we said was the more immediate crisis, yada yada. Euan stayed on for longer, and the once unequalled Oil Drum is no more.

On one of our long tours, which were based around Nicole’s brilliant public speaking engagements, we went to see Euan in Scotland, he teaches at Aberdeen University. I think it was 2011?! An honor. Anyway, always a friend.

And there’s ono-one I can think of who’d be better at explaining the Peak Oil Paradox in today’s context. So here’s a good friend of the Automatic Earth, Euan Mearns:

Euan Mearns: Back in the mid-noughties the peak oil meme gained significant traction in part due to The Oil Drum blog where I played a prominent role. Sharply rising oil price, OPEC spare capacity falling below 2 Mbpd and the decline of the North Sea were definite signs of scarcity and many believed that peak oil was at hand and the world as we knew it was about to end. Forecasts of oil production crashing in the coming months were ten a penny. And yet between 2008, when the oil price peaked, and 2015, global crude+condensate+NGL (C+C+NGL) production has risen by 8.85 Mbpd to 91.67 Mbpd. That is by over 10%. Peak oilers need to admit they were wrong then. Or were they?

Introduction

It is useful to begin with a look at what peak oil was all about. This definition from Wikipedia is as good as any:

Peak oil, an event based on M. King Hubbert’s theory, is the point in time when the maximum rate of extraction of petroleum is reached, after which it is expected to enter terminal decline. Peak oil theory is based on the observed rise, peak, fall, and depletion of aggregate production rate in oil fields over time.

Those who engaged in the debate can be divided into two broad classes of individual: 1) those who wanted to try and understand oil resources, reserves, production and depletion rates based on a myriad of data sets and analysis techniques with a view to predicting when peak oil may occur and 2) those who speculated about the consequences of peak oil upon society. Such speculation normally warned of dire consequences of a world running short of transport fuel and affordable energy leading to resource wars and general mayhem. And none of this ever came to pass unless we want to link mayhem in Iraq*, Syria, Yemen, Sudan and Nigeria to high food prices and hence peak oil. In which case we may also want to link the European migrant crisis and Brexit to the same.

[* One needs to recall that GWI was precipitated over Kuwait stealing oil from Iraq, from a shared field on the Kuwait-Iraq border, leading to the Iraqi invasion of 1991.]

The peak oil debate on The Oil Drum was a lightning conductor for doomers of every flavour – peak oil doom (broadened to resource depletion doom), economic doom and environmental doom being the three main courses on the menu. The discussion was eventually hijacked by Greens and Green thinkers, who, not content with waiting for doomsday to happen, set about manufacturing arguments and data to hasten the day. For example, fossil fuel scarcity has morphed into stranded fossil fuel reserves that cannot be burned because of the CO2 produced, accompanied by recommendations to divest fossil fuel companies from public portfolios. Somewhat surprisingly, these ideas have gained traction in The United Nations, The European Union and Academia.

It is not my intention to dig too deeply into the past. Firmly belonging to the group of data analysts, in this post I want to take a look at two different data sets to explore where peak oil stands today. Is it dead and buried forever, or is it lurking in the shadows, waiting to derail the global economy again?

The USA and Hubbert’s Peak

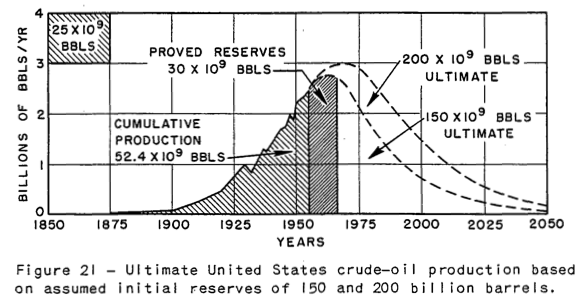

The USA once was the poster child of peak oil. The Peak Oil theory was first formulated there by M. King Hubbert who in 1956 famously forecast that US production would peak around 1970 and thereafter enter an era of never-ending decline (Figure 1). Hubbert’s original paper is well worth a read.

Figure 1 From Hubbert’s 1956 paper shows the peak and fall in US production for ultimate recovery of 150 and 200 billion barrels. The 200 billion barrel model shows a peak of 8.2 Mbpd around 1970 that proved to be uncannily accurate.

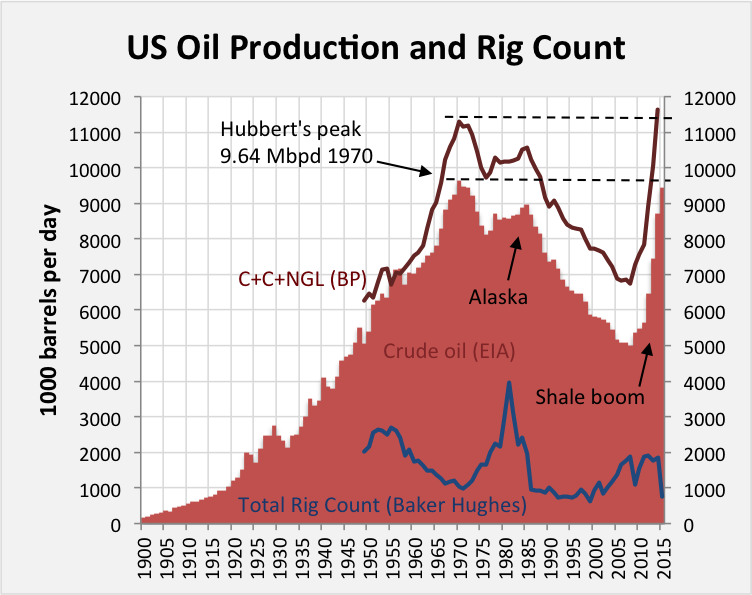

Looking to Figure 2 we see that Hubbert’s prediction almost came true. US production did indeed peak in 1970 at 9.64 Mbpd while Hubbert’s forecast was a little lower at 8.2 Mbpd. The post-peak decline was interrupted by the discovery of oil on the N slope of Alaska and opening of the Aleyska pipeline in 1977 that was not considered in Hubbert’s work. Herein lies one of the key weaknesses of using Hubbert’s methodology. One needs to take into account known unknowns. We know for sure that unexpected discoveries and unexpected technology developments will occur, it’s just we don’t know, what, when and how big.

Figure 2 In red, US crude oil production from the EIA shows progressive growth from 1900 to 1970. The oil industry believed this growth would continue forever and was somewhat aghast when M. King Hubbert warned the party may end in 1970 which it duly did. The discovery of oil in Alaska created a shoulder on the decline curve. But apart from that, Hubbert’s forecast remained good until 2008 when the shale drillers and frackers went to work. Hubbert’s 1970 peak was matched by crude oil in 2015 and exceeded by C+C+NGL that same year.

Following the secondary Alaska peak of 8.97 Mbpd (crude oil) in 1985, production continued to decline and reached a low of 5 Mbpd (crude oil) in 2008. But since then, the rest is history. The shale drillers and frackers went to work producing an astonishing turnaround that most peak oil commentators, including me, would never have dreamt was possible.

Before going on to contemplate the consequences of the shale revolution, I want to dwell for a moment on the production and drilling activity in the period 1955 to 1990. 1955 to 1970 we see that total rigs* declined from 2683 to 1027. At the same time crude oil production grew from 6.8 to 9.6 Mbpd. It was in 1956 that Hubbert made his forecast and in the years that followed, US production grew by 41% while drilling rigs declined by 62%. No wonder the industry scoffed at Hubbert.

[* Note that Baker Hughes’ archive pre-1987 does not break out oil and gas rigs from the total.]

But then post 1970, as production went into reverse, the drilling industry went into top gear, with operational rigs rising sharply to a peak of 3974 in 1981. But to no avail, production in the contiguous 48 states (excluding Alaska) continued to plunge no matter how hard the oil and its drilling industry tried to avert it. Hubbert must surely have been proven right, and his methodology must surely be applicable not only to the US but to the World stage?

The oil price crash of 1981 put paid to the drilling frenzy with rig count returning to the sub-1000 unit baseline where it would remain until the turn of the century. The bear market in oil ended in 1998 and by the year 2000, the US drilling industry went back to work, drilling conventional vertical wells at first but with horizontal drilling of shale kicking in around 2004/05. Production would turn around in 2009.

Those who would speak out against peak oil in the mid-noughties, like Daniel Yergin and Mike Lynch, would argue that high price would result in greater drilling activity and technical innovation that would drive production to whatever level society demanded. They would also point out that new oil provinces would be found, allowing the resource base to grow. And they too must surely have been proved to be correct.

But there is a sting in the tail of this success story since drilling and producing from shale is expensive, it is dependent upon high price to succeed. But over-production of LTO has led to the price collapse, starving the shale drilling industry of cash flow and ability to borrow, leading to widespread bankruptcy. In fact informed commentators like Art Berman and Rune Likvernhave long maintained that the shale industry has never turned a profit and has survived via a rising mountain of never ending debt. Economists will argue, however, that improved technology and efficiency will reduce costs and make shale competitive with other sources of oil and energy. We shall see.

Herein lies a serious conundrum for the oil industry and OECD economies. They may be able to run on shale oil (and gas) for a while at least, but the industry cannot function properly within current market conditions. Either prices need to be set at a level where a profit can be made, or production capped to protect price and market share. This of course would stifle innovation and is not likely to happen until there are queues at gas stations.

2008-2015 Winners and Losers

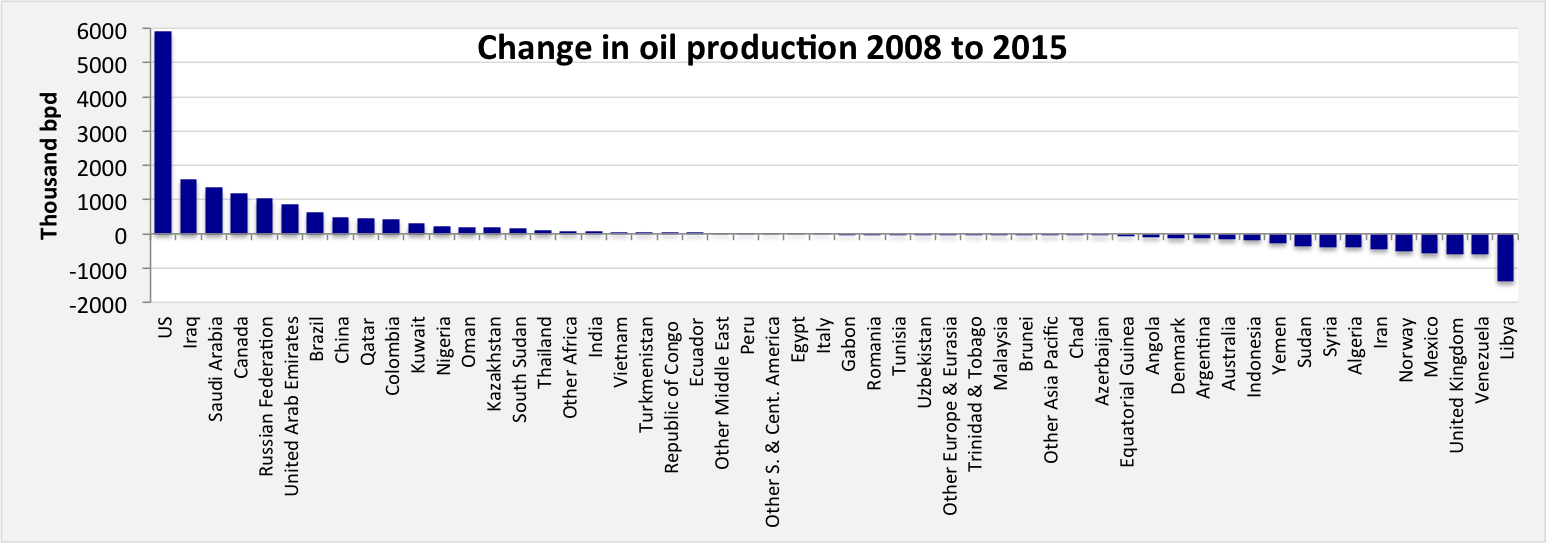

BP report oil production data for 54 countries / areas including 5 “other” categories that make up the balance of small producers in any region. I have deducted 2008 production (barrels per day) from 2015 production and sorted the data on the size of this difference. The data are plotted in Figure 3.

Figure 3 The oil production winners to the left and losers to the right, 2008 to 2015. The USA is the clear winner while Libya is the clear loser. About half of the countries show very little change. Click chart for a large readable version.

What we see is that production increased in 27 countries and decreased in the other 27 countries. One thing we can say is that despite prolonged record-high oil price, production still fell in half of the world’s producing countries. We can also see that in about half of these countries any rise or fall was barely significant and it is only in a handful of countries at either end of the spectrum where significant gains and losses were registered. Let’s take a closer look at these.

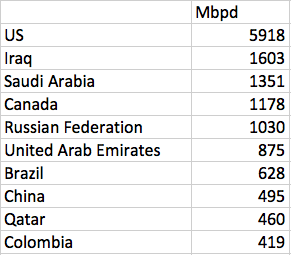

Figure 4 The top ten winners, 2008 to 2015.

The first thing to observe from Figure 4 is that the USA and Canada combined contributed 7.096 Mbpd of the 8.852 Mbpd gain 2008-2015. That is to say that unconventional light tight oil (LTO) production from the USA and LTO plus tar sands production from Canada make up 80% of the global gain in oil production (C+C+NGL). Iraq returning to market in the aftermath of the 2003 war makes up 18%. In other words expensive unconventional oil + Iraq makes up virtually all of the gains although concise allocation of gains and losses is rather more complex than that. Saudi Arabia, Russia, The UAE, Brazil, China, Qatar and Colombia have all registered real gains (5.258 Mbpd) that have been partly cancelled by production losses elsewhere.

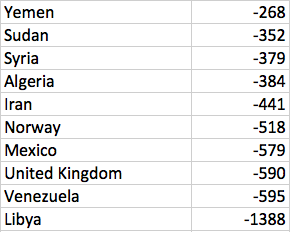

Figure 5 The top ten losers, 2008 to 2015.

Looking to the losers (Figure 5) we see that Libya, Iran, Syria, Sudan and Yemen contribute 2.828 Mbpd of lost production that may be attributed to war, civil unrest or sanctions. I am not going to include Venezuela and Algeria with this group and will instead attribute declines in these countries (0.979 Mbpd) to natural reservoir depletion, although a slow down in OECD technical assistance in these countries may have exacerbated this situation. That leaves the UK, Mexico and Norway as the three large OECD producers that register a significant decline (1.687 Mbpd) attributed to natural declines in mature offshore provinces. Let me try to summarise these trends in a balance sheet:

Figure 6 The winner and loser balance sheet.

We see that these 20 countries account for 8.463 Mbpd net gain compared with the global figure of 8.85 Mbpd. We are capturing the bulk of the data and the main trends. In summary:

- Unconventional LTO and tar sands + 7.096 Mbpd

- Net conventional gains + 2.592 Mbpd

- Net conflict losses -1.225 Mbpd

The sobering point here for the oil industry and society to grasp is that during 8 years when the oil price was mainly over $100/bbl, only 2.592 Mbpd of conventional production was added. That is about 3.1%. Global conventional oil production was all but static. And the question to ask now is what will happen in the aftermath of the oil price crash?

One lesson from recent history is that the oil industry and oil production had substantial momentum. It is nearly two years since the price crash, and while global production is now falling slowly it remains in surplus compared with demand. This has given the industry plenty time to cut staff, drilling activity and to delay or cancel projects that depend upon high price. In a post-mature province like the North Sea, the current crisis will also hasten decommissioning. It seems highly likely that momentum on the down leg will be replaced by inertia on the up leg with a diminished industry unwilling to jump back on the band wagon when price finally climbs back towards $100 / bbl, which it surely will do one day in the not too distant future.

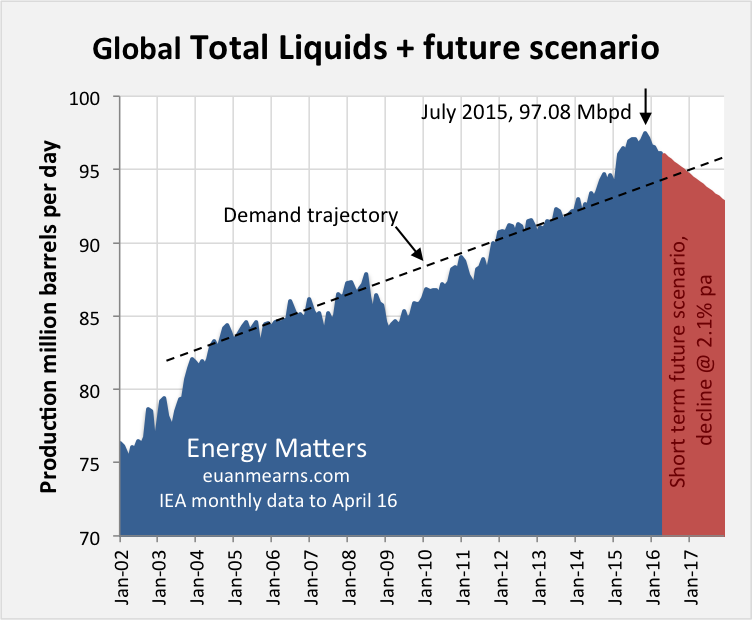

For many years I pinned my colours to peak oil occurring in the window 2012±3 years. Noting that the near-term peak was 97.08 Mbpd on July 15 2015 it is time to dust off that opinion (Figure 7). The decline since the July 2015 peak is of the order 2% per annum (excluding the Fort McMurray impact). It seems reasonable to presume that this decline may continue for another two years, or even longer. That would leave global production at around 92 Mbpd mid 2018. It is nigh impossible to predict what will happen, especially in a world over run by political and economic uncertainty. Another major spike in oil price seems plausible and this could perhaps destabilise certain economies, banks and currencies. Should this occur, another price collapse will follow, and it’s not clear that production will ever recover to the July 2015 peak. Much will depend upon the future of the US shale industry and whether or not drilling for shale oil and gas gains traction in other countries.

Figure 7 The chart shows in blue global total liquids production (C+C+NGL+refinery gains+biofuels) according to the Energy Information Agency (EIA). The near term peak was 97.08 Mbpd in July 2015. The decline since then, excluding the Fort McMurray wild fire impact, is of the order 2% per annum. In the current low price environment, it is difficult to see anything arresting this decline before the end of next year. In fact, decline may accelerate and go on beyond the end of 2017. The dashed line shows the demand trajectory and scheduled balancing of supply and demand by the end of this year. By the end of next year the supply deficit could be of the order 3 Mbpd which on an annualised basis would result in a stock draw of 1.1 billion barrels. But remember, forecasts are ten a penny

Concluding Thoughts

- M. King Hubbert’s forecast for US oil production and the methodology it was based on has been proven to be sound when applied to conventional oil pools in the USA. When decline takes hold in any basin or province, it is extremely difficult to reverse even with a period of sustained high price and the best seismic imaging and drilling technology in the world.

- On this basis we can surmise that global conventional oil production will peak one day with unpredictable consequences for the global economy and humanity. It is just possible that the near term peak in production of 97.08 Mbpd in July 2015 may turn out to be the all-time high.

- Economists who argued that scarcity would lead to higher price that in turn would lead to higher drilling activity and innovation have also been proven to be correct. Much will depend upon Man’s ability to continue to innovate and to reduce the cost of drilling for LTO in order to turn a profit at today’s price levels. If the shale industry is unable to turn a profit then it will surely perish without State intervention in the market.

- But from 2008 to 2015, oil production actually fell in 27 of 54 countries despite record high price. Thus, while peak oil critics have been proven right in North America they have been proven wrong in half of the World’s producing countries.

- Should the shale industry perish, then it becomes highly likely that Mankind will face severe liquid fuel shortages in the years ahead. The future will then depend upon substitution and our ability to innovate within other areas of the energy sector.

Related reading:

From Rune Likvern:

The Bakken LTO extraction in Retrospect and a Forecast of Near Future Developments

Bakken(ND) Light Tight Oil Update with Sep 15 NDIC Data

From Enno Peters:

Peak Oilers vs Houston Oilers: so far, Houston is winning.

Only way to know for sure what comes next is to ask the self-taught energy expert Alan Greenspan, who is infallibly wrong.

Greenspan, our Economic equivalent to https://en.wikipedia.org/wiki/Douglas_Corrigan

Thanks for that link! Fits right in with a common Irish solution to an Irish problem: It’s better to ask for forgiveness than to ask permission.

This attitude continues till this day. It leads to all kinds of end runs around local planning / development legislation, then filing for “permission to retain”.

Well, we can’t really burn all of our current reserves if we are to stay in safe temperature levels anyway, so. I hope shale doesn’t gain any traction.

My preference would be to use the current relative cost savings in oil and fund work to advance solar.

One of the things making discussion difficult is illustrated again in this article. Figure 1 is ‘crude oil’ (C), Figure 2 is ‘crude oil + condensate + Natural Gas Liquids’ (C+C+NGL), Figure 3 – we don’t know, and Figure 7 adds ‘refinery gains plus biofuels’.

So we can keep the illusion production is ever-growing.

This is the must read comment here and also why I really should stop paying attention to these sorts of essays.

Peak oil was handled in good twenty-first century managerial style by redefining what “oil” meant.

I’m curious, Iraq is now at 1603 Mbpd, what happens when the destroy/reconstruct project moves along in Libya and the majors start pumping there again? Seems like there’s room for some geoplitical can kicking, but in the sense of peak oil, it seems expensive to get it but tptb can’t get on without it’s economic knock on’s, the MIC being good for GDP, so what shows up as a profit Increasing gdp through war and intentional meddling is in reality a cost for oil not reflected in the price. As the post states there are many factors involved and not a few of them involve uncertainty.

About the 3rd conclusion. That oil scarcity will produce a rise in prices, and will in turn spur new innovations leading to new production being “proven correct.” Actually, the is flat out wrong.

While new technology has increased production, it hasn’t increased supply in equal proportion. Nor has it found a way to circumvent the basic law of conversations of mas an energy. At some point, we will run out of oil products to extract – and there is no technological innovation that can produce oil from the either.

This is typified by the shale development. It’s more expensive because it demands more energy to extract these resources. This means a greater proportion of oil being produced has to be retained in order to continue to power the extraction process and refinement. At some point, the shale deposits may actually consume more oil than it produces, becoming an energy sink. What is worse is the way the markets are set up not only ignores this fact, but may still turn a profit on it, so long as the oil being produced can be sold at a lower price than when the same oil is to be consumed later at a higher price.

The First Law of Thermodynamics (conservation of mass/energy) is indeed the ultimate reason for “peak oil”, as well as peak all other extractive resource gathering. What we currently have is a situation much like Ali Baba’s cave after the 40 thieves had that unfortunate industrial accident: we don’t have an accurate inventory of the remaining fossil fuel hidden in the Earth – but we do know that nobody’s putting in more, and it’s getting harder to find.

Another interesting idea is that prices may fall as supply dwindles, due to lack of demand. At some point, people won’t be able to afford to keep their cars fueled due to high prices, lowering demand. When enough people give up their cars because they can’t keep them fueled, the gas station network will collapse, further driving down demand. Eventually, the fossil fuel industry won’t be able to keep the pipelines and refineries going, and the whole thing will collapse. The question, of course, is when.

This goes back to the magic cave: until one has fully explored the cave, one could never be sure that a narrow side-passage might open up into another treasure room. For oil, we can be pretty sure that all the oil under dry land has been found – but there still seems to be reserves hidden under the oceans. How much, how deep, and how expensive in money and energy to pull it out and burn it is another question.

Hubbert was a remarkable and prescient individual. See Mason Inman’s recent biography of him which is very well done. Remember that he made his famous prediction about Peak Oil in the mid 1950’s. Much has happened since then but the basic thrust of the prediction still stands. The nuance which has become clear in recent years is that the source of our prosperity is the huge energy surplus from conventional oil fields. That surplus, after all of the exploration and production energy requirements have been met, is what makes the other sectors of the economy possible. All of the new sources of liquid fuels: tar sands, LTO (fracking), polar, deep water, and biofuels all produce considerably smaller surpluses (in some cases none) leaving the rest of society wondering where the prosperity went. That’s why counting barrels has become a misleading metric to gauge the state of our energy supply. With something like corn ethanol it takes almost as much energy to produce it as you get out of it. So you are not allowed to count both the fuel inputs and the fuel outputs both as production. You are double counting.

This double counting gives the illusion that there is plenty of oil and and therefore the Peak Oil concept is flawed. But it effectively steals energy and therefore prosperity from the rest of the economy. That is why we have the uneasy feeling that we are just not as well off as we used to be. The energy surpluses are declining. The oil will never run out, but rational incentives to find and produce it will run out and we are now in a slow process of realizing this.

Ethanol to me is one of the biggest wastes of energy, and food(!) that I can think of. Not only does the manufacture produce little net energy, but I have consistently found in the vehicles that I own that ethanol fuels produce a reduction in gas mileage equal to or greater than the percentage mixed in.

On a hunch, while camping I filled my wife’s little Honda up with clear gas, 92 octane, no ethanol at a boat marina. I ended up getting 44mpg on the drive home, almost 20% more than I would expect for highway driving. Nothing scientific here of course, but those are my results.

Actually, your methods may not be scientific, but it is a scientific fact that ethanol has less energy density than a similar amount of gasoline. You get only 69% of the energy from an equivalent amount of ethanol that you’d get from gasoline. Which means, of course, that you have to burn approximately 30% more to go the same distance. Ethanol had, contrary to its advocates’ claims, nothing to do with “Energy Independence” or “going Green”, but with subsidizing the agricultural and coal interests (during the Bush administration a new coal-fired processing plant was coming online every two weeks to change food into fuel, whereas the same people calling for energy independence were soon (and successfully) lobbying Congress to allow the export of the fracked oil that was supposed to help us attain that Independence).

Interested readers can search, “triangle of doom oil” for one explanation of how peak oil affects economy and finance. In my view, this analysis is playing out now. All predictions that the rising price of oil will increase and spur new discovery of cheap oil are in error. In fact, the “glut” of oil is not a glut; rather it’s an indication of spreading debt and insolvency driving down demand.

Demand destruction is also caused by competing technologies such as wind, solar, as well as some energy efficiency seen recently in led lighting and better refrigeration tech.

Euan’s antipathy to environmentalists and skepticism about climate change unfortunately mars an otherwise worthwhile post.

One of the lessons from the unfolding of the peak oil story over the last decade or so, that Euan doesn’t really address, is the reality that global oil production is one complex, adaptive system effecting and being effected by numerous other complex, adaptive systems. The obvious is the global economy and energy demand. But there’s also the huge impact of post Great Recession low interest rates on the financialization of shale drilling. The so-called shale revolution was as much about cash infusion and the pressure on drillers to meet production targets as it was about high oil prices and technological advances. Deborah (Rogers) Lawrence did fantastic work early on showing these connections: http://shalebubble.org/wall-street/.

Another lesson is that predictions are a fool’s game — both specific predictions about when global production would peak and predictions about the socio-economic fallout of such a peak. And getting these numbers and dates right doesn’t matter unless you’re in the industry or betting in the markets. What really matters is the societal impacts and how we can best mitigate and respond to the realities of peak oil.

I still believe there’s high probability of certain outcomes (price swings; demand destruction; declines in net energy) — particularly if you think in terms of decades rather than years or months — and certainties of other things, the most obvious being that “peak oil” is not a theory, it’s an inevitability (like with any non-renewable resources).

Something went wrong in some editing step here?

>Either prices need to be set at a level where a profit can be made, or production capped to protect price and market share. This of course would stifle innovation and is not likely to happen until there are queues at gas stations.

Nobody is going to cap production if there are queues at the gas stations? Unless he is talking about queues of tanker trucks trying to sell their cargo?

Interesting post. Thanks for sharing.

Back when The Oil Drum was a thing I used to read a counter site called Peak Oil Debunked. The author’s thrust was that the peak oilers were mostly “talking their book” and the important thing they ignored, and that the above post seems to ignore, is that there is also “peak demand.” Back when Hubbert made his prediction the average car got about 12 mpg. Now fleet averages are much much higher. And if my neighbors would stop driving those bus size SUVs everywhere they would be much higher still. Plus there’s the fact that many young people now don’t even own a car or view it as socially mandatory. Of course the rest of the world outside the US is using a lot more oil than in the fifties, and in high gas tax countries they are already driving tiny cars. Still, given the huge share of world oil consumption that the US represents there’s probably quite a bit of elastic in that demand.

These people are just doomers who want their preconceived ideas about some doom scenario to come true. Hardly any of them do any decent analysis.

The onus is on you to give examples and not just handwave. The fact is that what is happening with energy is consistent with Jacques Tainter’s theory of the collapse of complex societies: that as they become more complex, their energy needs rise. Over time they exhaust or greatly exceed the capacity of cheap energy sources and start using successively more costly and difficult to obtain ones. Shale gas is more costly than petroleum. And all greenhouse gas-causeing sources of energy, even at their current prices, are artificially underpriced by virtue of not including the cost of the environmental damage, which is a huge externality. So tell me what is wrong with the overall picture?

Let’s take it a step further and try to integrate this understanding into a civil and economic rationale that’s sustainable. Rather than the inevitable decay and dissolution that our current growth-dependant systems are leading us towards, we just might be able to develop a positive plan for the future.

I’d start with the premise that all of our social institutions are too big and complex to survive anymore, like the dinosaurs were, and need to be shrunk down.

Have you spent any time looking at the projections/analysis of oil cornucopians?

Like “peak horses” in the past?

LOL! yea! OMG Peak horses, we are all going to die!!

The whole “it’s peak demand, fool, not peak oil!” argument is so fatuous — as though higher prices or constraints wouldn’t impact demand.

The following is a re-post of one of my diaries from FDL 2010;

So, my questions are these;

Are we doomed to keep repeating this history of Big Oil making us look like idiots by suddenly ‘discovering ‘new’ deposits in our own backyard?

Has Big Oil always secretly ensured America’s energy independence by controlling not only the oil deposits under our own soil but the rest of the world’s as well?

I suspect the answer to both questions is yes.

You may well ask, if there is so much oil in the Gulf of Mexico, why all the fracking?

Why risk polluting our precious water resources and spend all that money on wells that don’t pay for themselves?

You could also ask who’s making big profits off financing those wells?

Europeans with colonial mindsets are those that understand the subaltern position of the colonized, the natural resources of the colonies are to be depleted first before ever even thinking of touching the fatherland. It is analogous to not dipping into the capital. The capital being the resources within the sovereign territory of your nation. Let the colonies suffer the consequences of mining, drilling etc. Only when, if ever, does the capital ever get used, it will be well past the point of exhausting the subaltern nations. Exhaust one neo-colonial trading partner and move onto the next. While there are some domestic political concerns about why bother going to war for oil over there when we have it right here, the ever expanding need for more markets for more profits is enough to drive foreign policy into dirty little wars, as long as we don’t start the really big one. The UN Permanent Security Council are the nations who have agreed not to war with each over over any lesser, subalterns.

From what I hear rumored, ‘they’ have gotten it into ‘their’ heads that the really big one, needn’t be so really big after all.

Come to think of it, didn’t the Bush clan buy up a whole bunch of Bolivia recently?

I worry that people are misunderstanding my comment.

I am not denying we are impacted by peak oil, or that peak oil is a legitimate concern.

What I’m pointing out is that the true nature of our reliance on oil and the underlying realities of the oil ‘business’ is shrouded in a fog of misinformation, whose purpose is to stymie any consideration of policy changes that could impact Big Oil’s profits.

Big Oil, and by extension the MICC, have perpetrated a myth based on an impenetrable web of deceit within which we flounder in our efforts to fix the very real environmental and political problems that face us.

IOW, we might be able to solve our energy problems going forward, or our economic inequality, or our environmental emergencies, but that would require facing the fact that none of our government’s policies are what we think they are.

Contrary to what anyone says, the MICC is not ‘spreading democracy and freedom’, they are not making us safe at home, and they are not being starved for resources.

Contrary to what anyone says, Big Oil is not busy trying to ‘Make America Energy Independent’.

So, peak oil is an important issue to consider, but how can we calculate the size of the problem, and the possible remedies if we’re relying on phony, or incomplete data provided by an industry, and a government for that matter, that has a historic commitment to hiding the facts in service to the global hegemony of the empire?

And as far as that goes, how can we hope to make political headway in the face of an electorate whose ‘opinions’ are so heavily polluted by all this deceit?

I think there is much more to add that increases uncertainty. In the demand side, there is lot of room to reduce oil consumption, in the US and in all OECD countries. There is plenty of energy consumtion that could be removed without much impact. The incentives to live with less oil consumption could be increased and it is a matter of politics, so uncertain. In the supply side the alternatives are, like oil extraction techniques, subject to innovative improvements that migth make them more competitive in all energy areas (thermal, electrical, transport).

I can write with some confidence in electricity/heating consumption. I am installing systems that monitor consumption of electricity/heating as well as wellness factors (temperature/humidity), in houses, commercial estate and factories. What we find in many cases is that there is a lot of room to reduce energy consumption without compromising factory output or wellness, just changing some behaviours and with minor changes in building isolation or energy efficiency of the machinery or appliances.

Such overconsumption is in fact a buffer against the doomsday scenarios. In my opinion the buffering capacity is so large that oil production disruptions should be of political origin, not technical, to be really disruptive. Hubbert’s depletion curves are not that sloppy giving us time to react.

We just spend too much energy!

Either prices need to be set at a level where a profit can be made, or production capped to protect price and market share

Which assumes no nationalization or “production by diktat” of the kind that took place in Germany in the 1930s. [Essentially, much of the economy remained in private hands but the state ended up directing production and investment and even setting profit margins in some cases in order to, basically, plow everything into a rapid rearmament. To wit, it was the state that “encouraged” private industry to invest and rapidly expand synthfuel production, including via personal intimidation, which private industry would almost certainly not have done otherwise, at least nowhere near to the same degree.]

In other words, let us say the doom and gloom scenario happens. I personally happen to think – partly from experience – that all such scenarios tend to unfold over much longer time horizons than anybody anticipates, in part because in the interim all the players involved are doing something to run out the string – but whatever. Let us even say this scenario occurs tomorrow at the stroke of midnight (it’s all Cinderella’s fault).

Do you seriously believe there would not be outright nationalization or nationalization-by-coercion taking place in oil producing countries?

Do you seriously believe that a given (large) state would not take resources out of other areas to plow into “unprofitable” production in order to sustain the status quo – which is all any given elite ever cares about (since they’re already elites, hence fat and happy, hence why change anything except make them even fatter and happier)?

I mean, yes – pre-crisis you’ll still have market mechanisms engaged. Past history and common sense, however, suggest that these mechanisms go out the window when existential threats arise and are recognized as such by the elite, prior rhetoric and actual letter of the law notwithstanding. [To wit, the 2008-2009 bail-outs. What market mechanisms?]

The real question is NOT if/when we hit peak oil. It is whether climate change is going to fry the planet before we get there, at peak oil.

All the evidence suggest that we get the fried planet before any meaningful decline in production/demand/consumption of oil.

Unless of course there is a relatively sudden global policy initiative…but there is about zero evidence of that happening as well–in despite all of the existing evidence that it really need to happen, like yesterday.

Thus, all this debate amount to just a bunch of hand waving.

Viva la paz…

Agreed. With the hundreds of millions to billions of dollars in new capital projects rolling down the line for LPG and heavy oil processing, I’m sure the industry will fight like hell to keep them from being frozen.

And the problems will only get worse as the industry continues down the path of processing ever dirtier crude and larger fractions get cooked down to petcoke to be burned in China (and wherever else that doesn’t mind) and is actually dirtier than coal.

I’m not sure how this ends well.

Good analysis. It’s nice to see some of the past & future unknowns acknowledged.

We’re still not taking advantage of known non-oil technology. For just one example I think of the remarkable innovative work Win Keech has done, implementing a range of older systems (Edison battery), Nathan Stubblefield’s technologies (using the Earth’s below-the-surface energy field and entraining energy flows), new form of wind energy (RidgeBlade), and that’s only the “boring” tip of the iceberg about what he has accomplished and shared. He, like others, flies mostly beneath the radar–perhaps because of his past experience in the conventional entrepreneurial world. (Keech invented the chip & pin security systems now widespread in much of the world. He took his technology even further–but doesn’t talk about it much.)

Depending on peoples’ interest in outside-the-box thinking by folks like Keech, predicting future oil production will eventually become moot.

Surely it’s best if we find better ways that enable us to leave resources in the ground to avoid extraction–regardless of one’s attitude towards climate change and what causes it.

in regards to rigs vs output, it would pay to take a look at the most recent EIA Drilling Productivity Report, and note that the new well production per well is still rising in all US shale plays…

http://www.eia.gov/petroleum/drilling/#tabs-summary-1

as a peakoiler myself a half dozen years ago who did not pin my colors to the theory, i’ve walked back my concern about the possibilty..sure, oil is finite, but i dont see that being a problem in the next 20 years…

The repercussions of peak oil have been a big problem for the last 10. You think it is going to magically stop? How?

Cheap nuclear can be used to produce cheap hydrogen or liquid fuels. If pursued rationally, not for the Military Industrial Complex. Can be done safely and cost effectively with small, air cooled, fail-safe modules.

At that point oil will be almost exclusively used as a feedstock for long-chain chemical manufacturing.

Greatly improves global security, as one of China’s primary fears driving its South China Sea policy is keeping the petro-tanker traffic flowing.

No need for analysis. It boils down to this: we cannot have infinite growth on a finite planet. Resources become scarce and environmental degradation accelerates. Human civilization is a heat engine and we are finished because the climate moderating system has been pushed beyond numerous tipping points. Now the SHTF.

Once again,

1) Efficiency. GDP is decoupling from energy consumption. It’s taking fewer units of energy to produce each unit of growth because we’re learning to do more with less.

2) Substitutability. There’s no mention of how this might be holding oil prices down. Solar power gets 10-20% cheaper every year. Is this happening with the old fossil fuel technologies? No. They’re moving in the opposite direction. These curves have already started crossing. In many places it’s cheaper to build new solar plants than fossil fuel power generators. Storage is the only large nut left to crack. Utility-scale batteries are improving fast and automotive batteries aren’t far behind.

It’s so exhausting reading energy economists who gloss over these two important factors in energy economics.

“GDP is decoupling from energy consumption.”

No. It. Isn’t.

If you are talking about “relative” decoupling, that has almost always been the case. If you are talking about “absolute” decoupling, it has almost never happened. Absolute decoupling is where energy consumption declines while GDP increases. Relative decoupling is where energy consumption increases at a slower rate than GDP.

“It’s so exhausting reading energy economists who gloss over these two important factors in energy economics.”

True that!

Check out this economist called erik reinert(norwegian) who talks about switching from activities of diminishing returns to increasing returns. I am not able to find it right now because of a lack of time, but IIRC he mentions that solar energy provides for increasing returns. Here’s a decent introduction to his ideas – http://www.theglobalist.com/energy-security-beware-false-comfort/

“Diminishing returns of extraction make economics a dismal science (also in terms of sustainability), while increasing returns give cause for optimism. This taps the virtually unlimited sources of natural energy around us and relies on the inexhaustible capacity we have for innovation.

Antonio Serra would not be surprised. He would only wonder why it took us so long to work out this elementary feature of energy systems and how the real sources of energy security are to be found in manufacturing rather than resource extraction.”

You are parrotting the scientifically illiterate bullshit of all economist –all brands included–

http://cassandralegacy.blogspot.ca/2016/07/some-reflections-on-twilight-of-oil-age.html

Looking at the oil production chart, I wonder if anyone has charted that in terms of end user available energy. Tight oil being “expensive” to produce means that it requires more energy to produce, which in turn means that an increasing share of the addition oil production is intermediate output and not final consumption petroleum.

If it costs me 10 barrels to produce 105 barrels of oil then I’m worse off than if I had I produced 100 barrels of oil but it only cost me 4 barrels to do so. It’s not only what you get that counts but what it cost to get it.

There is no peak oil conundrum. The theory suggested that as oil supplies dried out, the price and production would enter in an extended period of volatility as higher prices drove new expensive technologies, (shale?) while excess production would drive price slumps (current?). The one thing his theory didn’t factor in was climate change, and its imperative for the environment, which is driving solar and alternative energy adoption. I’m not seeing any conundrum at all.

What I am seeing is a major oil producer – Saudi Arabia – which has realised that it is indeed sitting on a potentially vast supply of stranded assets as alternative fuels start to gain traction, and is doing its best to sell them off at any price before the reality sinks in around the globe.

The only thing worse than running out of oil is not running out of oil.

I wonder about two other political dominoes on the sidelines:

Domino 1. Oil isn’t just an energy commodity but plays a role as a backer of petrodollar currency. Does anyone have a feel for what happens to $ as a currency if oil prices go up and supply goes down? Will oil come to play a role like gold as it becomes scarce? At the end of the day, this could be the main driver for keeping oil production at higher-than-necessary levels, by maintaining mass consumption and discouraging energy substitution. I imagine the financial adaptation will be revolutionary.

Domino 2. There’s a subsequent question of what happens when and if alternative sources or supply scarcity do manage to reduce production substantially. Then the original motive for using oil kicks in. That would be, for example, Churchill’s use of oil in the British Navy that led to the formation of Anglo-Persian oil company, and the German development of synthetic fuel. The role of fuel in military operations is irreplacable: specifically, oil’s is the cheap, high-energy-per-mass power sources. I don’t see F-22’s doing aerobatics at airshows running on batteries. The scramble is going to be especially bloody if and when access to oil falls to a level where it is perceived that military operations might be threatened.

Most oil production is used for transportation Most transportation relies on some form of internal combustion engine. This bothers me in that this is one of the least efficient machines humans have ever contrived.

Most people fail to realize that most vehicles carry an on-board machine whose sole purpose is to keep their motors from burning up from its own wasted energy. That is the reason for the cooling system.

By contrast electric motors are now in excess of 90% efficient. This is the reason you never see more than some minor cooling fins needed even for fairly large electric motors. Think of how many moving parts comprise your internal combustion engine,… pistons, rods, pumps, valves, etc. The electric motor has ONE… the rotor. One commentator on a sailing site I visited renamed it the “infernal combustion engine”.

The only reason the internal combustion engine won out over electric motors when cars were first being developed over a hundred years ago was the lack of a good electrical storage device. Since then we developed manned flight, put a man on the moon, released energy that we didn’t know even existed by converting mass directly into energy (still in the process of making that safely usable) but we still haven’t come up with a way to efficiently store electrons. My guess is that we haven’t really put enough resources into it.

With good inexpensive electrical storage devices, sustainable energy, solar and wind, would become much more viable. The old conservative argument “Well its not windy all the time” will become worthless.

We need a Manhattan project for electrical energy storage When such devises become available the need and demand for petroleum collapses as efficient electric vehicles quickly dominate the market.and CO2 production falls dramatically within a decade.

Sorry but my tractor, rototiller, and truck motors have all been problems this summer and I grow frustrated with the stupidity we’ve been saddled with. I have to leave now to rebuild a carburetor.

But no oil, no petrodollars! Hmm, maybe we could reach a compromise: develop a renewable electrical grid to supply power to cars, tractors, rototillers ad trucks, and to keep consumption up, convert everyone to Zoroastrianism so we’ll all have a lot of oil lamps that burn lotsa little fires. Been done before.