Yves here. The updates in this MacroBusiness report are consistent with our reading on the arm-wrestling between Matteo Renzi versus the ECB and other Eurocrats. Short version: since early this year, Renzi has been trying to get what has widely been described as a “bail out” for sick Italian banks, of which there are many. The term “bail out” makes Renzi’s plan seem more generous than it is, since he is not proposing to prop up diseased banks, but to have them spin out their bad assets into a “bad bank”. This is similar to the approach used in the US savings & loan crisis and in Sweden’s widely praised early 1990s bank rescues. A good bank/ bad bank approach leave the cleaned up banks considerably smaller. Some banks may have so many bad loans that there is no or pretty much no “good bank” left, so you can expect this approach to lead to some consolidation too. I have to confess that am not clear as to how Renzi proposes to change the operations of the “good banks” that needed state intervention to survive.

It would seem to make eminent good sense to give Renzi the waivers he needs to rescue the banks since:

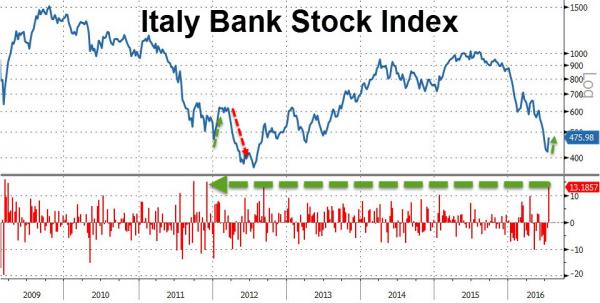

If Italian banks start falling over, the dominoes will quickly reach Deutsche Bank

As the article below points out (and we’ve stressed earlier), if Renzi is forced to do bail-ins, small Italian savers will take a big hit. Many were fraudulently sold subordinated bonds and told they were the same as deposits. That’s not true, since they will be next in line after bank equity to be wiped out in a bail-in. Any meaningful losses to these small savers would both further damage Italy’s already weak economy, and boost the Five Star movement, which already has good odds of winning in elections this fall. Five Star has promised a referendum on exiting the Eurozone. The UK leaving the EU would be very damaging economically but it’s remotely possible that it might not be a total disaster. By contrast, Italy leaving the Eurozone would be cataclysmic.

So with the stakes so high, one would think the ECB and Eurocrats would relent, since they have a perfectly good face-saving excuse for retreating from their barmy bail-in scheme: with Brexit in play, banks are already looking wobbly, and the new bail-in rules allow for rescues under extraordinary circumstances. But Renzi tried that argument, as well as another escape hatch, public interest, and was told “Nein” both times.

Why are the European banking regulators being so self-destructive? Part of the answer may be prejudice against periphery countries. But as David Llewellyn-Smith indicates, again consistent with what other analysts have sad, the authorities are wedded to the newly-nstituted bank regulations, even though banking experts all deem the bail-in procedures to be guaranteed to produce runs and shake confidence. While bail-ins would be a useful tool in a regulator’s arsenal, the bail-in rules are “one size fits all,” making them unsuitable for real-world use.

This situation is disturbingly analogous to Lehman. After the Bear Stearns rescue, there was such a strong political backlash that the Bush Administration decided it was not doing that again. Moreover, it was obvious from the media that they were not going to relent. Yet Dick Fuld nevertheless convinced himself that Lehman would get government help if he could not find a moneybags to save Lehman. That led him to blow up the one deal he could have had, an investment by the Korean Development Bank in a Lehman “good bank”. Fuld regarded it as unacceptable to have to wind down the bad parts of Lehman.

Oh, and in a telling bit of history…the successor to Creditanstalt is over 96% owned by Unicredit, Italy’s biggest bank.

While the politics are different, we again have political imperatives trumping real-world consequences. And here, the downside is more obvious than it was with Lehman.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

From the AFR:

Platinum, the Sydney-based global value investor, is defying the bearish mood and buying more European bank stocks after its positions in banks accounted for almost half of the fund manager’s losses so far this year.

The Platinum Unhedged Fund’s latest report shows that its value fell 10 per cent in 2015-16 compared with a 1 per cent fall for global equities. Platinum is not alone; many Australian fund managers who invest globally have seen returns hurt by the Brexit vote through falling positions in European bank stocks such as Lloyds Banking Group, including at PM Capital and Magellan among others.

…What is unusual is Platinum’s willingness to buy more

…”The banks’ share prices are factoring in fear of further political risk, namely, a full break-up of the European Union. The impact of recency bias plays a big role here. As we have just seen, a large country making a shock exit, suddenly the probability of further exits feels significantly heightened,” the fund manager told clients. “But we need to take into account that the European governments will react and concessions will be made.”

I am sure that Platinum is joking when it says that European banks are priced for a “full break-up of the European Union”. They have fallen a long way, however, and that rather amusing statement does not mean that it is wrong about Europe giving ground on Italy, from Bloomie:

It may seem like there are many different ways this critical situation can pan out, but all bar one would be fatal for the euro zone. The only option is to bail out the banks without “bailing in” investors.

Of course the banks will be rescued. This column has previously outlined how Italian banks will be saved precisely because the alternative is the collapse of the Italian economy, which would likely precipitate the breakup of the euro.

So the crunch decision is whether bond investors share some of the cost of that bailout. Since January, the EU has legislated that investors must be bailed in, and bail-ins have happened elsewhere, e.g. 54% haircut for senior creditors of Heta Asset Resolution in Austria.

Surely the EU can’t blatantly break its own new rules just for Italy? That would set a bad precedent, completely undermine its authority, create large moral hazard within the euro zone, and weaken the euro.

But it can. And it most likely will. Because the alternative is much scarier. In Italy, too much of the subordinated bank debt is owned by private individuals. If they’re made to pay for this, then Italy’s constitutional referendum in October will fail, resulting in Prime Minister Renzi resigning and the collapse of the government.

Italy will be in crisis, and anti-EU sentiment will gain a significant boost at a time when the euroskeptic Five-Star Movement has already become the most popular party. Again, the euro zone will be in serious jeopardy.

So there’s really only one path to be followed: the one that doesn’t threaten to break up the euro zone. The Italian banks will be bailed out and investors will not be bailed in.

This will be a boost to global equities and positive- yielding bonds, yet another boon for emerging markets. It will be less good for the euro, which is trading within 1% of its 18-month high versus a trade-weighted index.

That is probably too black and white and a partial bail-in is more likely with a distinction made between small and large bond holders. So, to that extent, Platinum is probably right.

Except that that is not the real problem. This is, from The Telegraph:

The bondholders’ losses risk harming the government’s reputation at a delicate moment.

Prime Minister Matteo Renzi is already facing a close-fought referendum over a planned constitutional reform. If he loses the vote, it could mean the end of his government, and polls indicate that the eurosceptic Five Star party, headed by Beppe Grillo, could perform well in a general election, spreading further political instability through the European Union.

Italian pragmatists argue the cost of a government-backed bailout would be worth paying, to avoid financial instability. Yet the equation is not that simple.

The EU insists bondholders have to bear the cost of the recapitalisation, sparing taxpayers and forcing investors to think about the risks they are taking, to help stop future crises at banks and in governments’ finances.

Officials at the Eurogroup and European Central Bank are digging in their heels – they do not want the past five years of financial reforms undermined immediately by Italy.

Such a result would sap their own authority and open the door to similar state-backed deals in Portugal, which is also suffering from bad bank loans.

Still, even a bailout would bring political risks to Mr Renzi.

Lorenzo Codogno, former director- general of the Treasury Department at the Italian economy ministry, says there is a risk that a bail-in of retail investors could be politically toxic, even if a conversion of debt into equity, could be a “gift” for many bondholders who now have illiquid subordinated debt.

“The risk is clearly that it is not taken well by the electorate, affecting political support for the PM,” says Codogno, the current chief economist of LC Macro Advisors.

Does Platinum understand Italian politics so deeply (making it pretty unique) that it knows how this is going to play with the polity amid BREXIT, French attacks, a rising Five Star Movement, as well as the likelihood that any European bailout concession will very likely come with reform conditions that will do great harm to growth before anything improves? Platinum clearly did not see BREXIT coming so why would it be any better on Italy? The blood is up in Europe, this is not just a numbers game anymore.

Perhaps holding on at this juncture makes sense given Platinum’s losses but buying more?

How extensively has this ‘bail in” story been reported in Italy itself? Based on the threat of ‘bail-in’ one would expect individuals to move their money from bonds to deposits–even if there were penalties for doing so.

“Life savings” losses by maybe 150k-250k small depositors who were misled into buying subordinated bonds (“just as safe as deposits” … not) and wound up “bailing-in” four failed regional banks have received front-page treatment intermittently for several months throughout Italy in both newspapers and national TV, not least due to at least two suicides explicitly attributed in writing by the decedents to the fraud to which they fell victim. The government is working on remediation, but it’s slow going and not yet a done deal AFAIK (don’t follow it real closely).

At the moment, I think most depositers still think Renzi will somehow work things out with the Eurogroup. However, if MPS (Monte dei Paschi di Siena, the world’s oldest bank), which is probably most at risk, winds up with its similarly-misled small depositers bailing it in, I’d expect an immediate stampede.

Unlike the US and many other European countries, Italian families have a strong saving tradition, and many families (probably most of the top 2/3, economically) have substantial investments (i.e., a few 100,000s Euros) in government, bank, and corporate bonds. In the days of the Italian Lira, this was the traditional way for small savers to defend against (and even profit from) Italy’s steady inflation. The old system worked … banks were secure, savings were reasonably well-adjusted for cost of living increases, and Italian exporters remained successful. The Euro’s inflexibility + GFC totally changed the game, but I think many small Italian savers have yet to adjust their trust in the formerly community bank on the corner, long since absorbed into some larger banking group.

In the old days, the system really did protect their interests. Now it’s every investor for himself, and most of the affected savers are NOT sophisticated investors. They still buy what their neighbor who’s behind the counter at the local bank branch recommends. It’s taken ’em a long time to grok the extent to which the current generation of bank executives corrupted their customer-facing staff with carefully designed and extremely self-serving incentives.

BillC: Good summary, at least in the sense of how I read the situation. The “regional” banks you mention include the Banca Etruria case, which has been highly visible, with demonstrations by bilked depositors.

The irony of the Monte dei Paschi di Siena is that it started as a pawn shop. Maybe the international banking system is heading back to its origins.

The savings rates by Italians are famous–although maybe not in the U.S., where savings is just so nineteenth century. Italians save a large proportion of their income. Also, my Italian friends all seem to own many pieces of property. After Zia Letizia of Padova dies, everyone inherits an apartment or two and, maybe, a piece of land. So Italians and their assets differ from Americans and their assets (which seem mainly to be ownership of credit cards these days).

I am highly skeptical of referring to the Movimento Cinque Stelle as Euroskeptic. Sure, Grillo, in his extensive ramblings, has criticized the euro as a currency. But the grillini, who fight rather fiercely among themselves, are a populist and center-left movement. So Italy now has two large center-left parties, the Democratic Party (which was modeled after and suffers from some of the same decadence as the U.S. Democratic Party) and the 5 Stars, who are an odd combination of civil libertarians, reformists, scholars of Laputa, anti-corruption crusaders, and Grillo cultists. Grillo’s great service is that he destroyed Berlusconi and Forza Italia. Italy is highly odd in having no viable center-right. And the rightist parties, such as the Lega Nord, which is populist-fantasy-right, are all at sea. But can Grillo either get a new deal for Italy in the EU or lead Italy out of the EU? No. Impossibile.

As was seen in Greece, small businesses can have funds in flight that greatly exceed the deposit limit. Protecting individuals who lose their jobs due to small business employer failure will not be enough to stabilize the situation. Any plan that hopes to protect the Italian economy will need to avoid both small business and individual bail-ins.

However the EU is now much weaker due to the Brexit vote. Every EU concession given to Italy is now a powerful signal that the EU will give concessions to the UK later. After all, they are not “rules” if they are not for everyone.

Why is Sweden always only cited as an example of a bank resolution. There it was I believe only one large bank that was taken over and that bank already had a share of government ownership. Wasn’t the bank reform in Norway at the same time more rigorous?

I’m with you… the term ‘bailout’ is misleading. Penn Square Bank and Continental Illinois were not ‘bailed out’, but rather liquidated and their assets sold to healthy banks. It appears Renzi is trying a similar, sensible approach. This will end very badly if they don’t act quickly.

The Five Star Party has never been seriously euro sceptic. Its voters are. The party is not.

Lately it’s leaving its ambiguous stance on the euro and the EU and has lined up with the neoliberal TINA.

If you understand the euro, you want to leave. And if you want to leave the last thing you would do is go for a consultative referendum.

If something was fraudulently sold then prosecute the fraud. Why should the general public re-imburse the victims of this kind of fraud but not other frauds? Why should this kind of fraud not be prosecuted?

If a “bailout” occurs I am sure it will be given a technical, euphemistic term. But where does the money printing come from? The Fed through US banks? Goldman Sachs to the rescue!

During a week of anti-austerity protests in Spain a popular banner was:

“Unconditional bailouts for bankers and austerity for the people”

The populists are not going to be happy with more bailouts.

Perhaps the EU has picked up on the mood of the masses with its bail-in proposals.

If there is no money for the people, there should be no money for the bankers.

After Brexit they will be worried.

Catch 22

Can someone help me with this: the Europeans seem obsessed with who’s going to pay. Meanwhile across the pond the Fed basically does an asset swap from private banks to the fed with some added liquidity and we are – relatively speaking – “off to the races.”

What confuses me is this site’s knowing glances towards MMT and then a piece like the above which seems to suggest that there’s something substantial to the claim that there’s “no free lunch / someone has to “pay””

Blending economics and politics as it should be blended MMT’s whole point – to my mind – is this: scolding someone on their deathbed is obviously pointless. Do we want a future or not?

The problem with MMT applied to the EU is that the EU is not a political union and the ECB controls the money creation centrally on behalf of very different and separate political Economies, EU member states. The Germans dictate the policy but it works against the southern countries so Italian Banks and its central Bank are hide bound by a central european money issuer with conflicting political customer/client states of which Germany is the dominant and very much first economically amongst political equals.The MMT model simply does not fit the political dynamic of the EU.

How does this comment relate to the post? And separately, we’ve repeatedly acknowledged that MMT describes the operation of fiat currency issuers, which means countries that control their own currencies. That means the US but not states like Kansas, and not countries in the Eurozone.

We have a rule that comments to posts are to be on topic. I let your comment through only to give yo this message. If you post another off-topic comment, I will not approve it.