A new Financial Times story helps quantify the degree to which AirBnB is ripping off members of the public generally to the benefit of its suppliers and customers.

A significant source of AirBnB’s price advantage in the UK is tax gaming. Commercial properties pay a higher rate of tax than residential. Similarly, AirBnB hosts skirt charging VAT, since the tax applies only on businesses with more than £83,000 in annual revenue. VAT is applicable only to AirBnB’s booking and service charges.

Airbnb says one of the key benefits of what it calls “home sharing” is to reduce costs for travellers and to help hosts earn extra income. But hoteliers complain they face unfair competition, as a result of tax differences and gaps in regulatory enforcement of everything from hygiene to disabled access and fire safety….

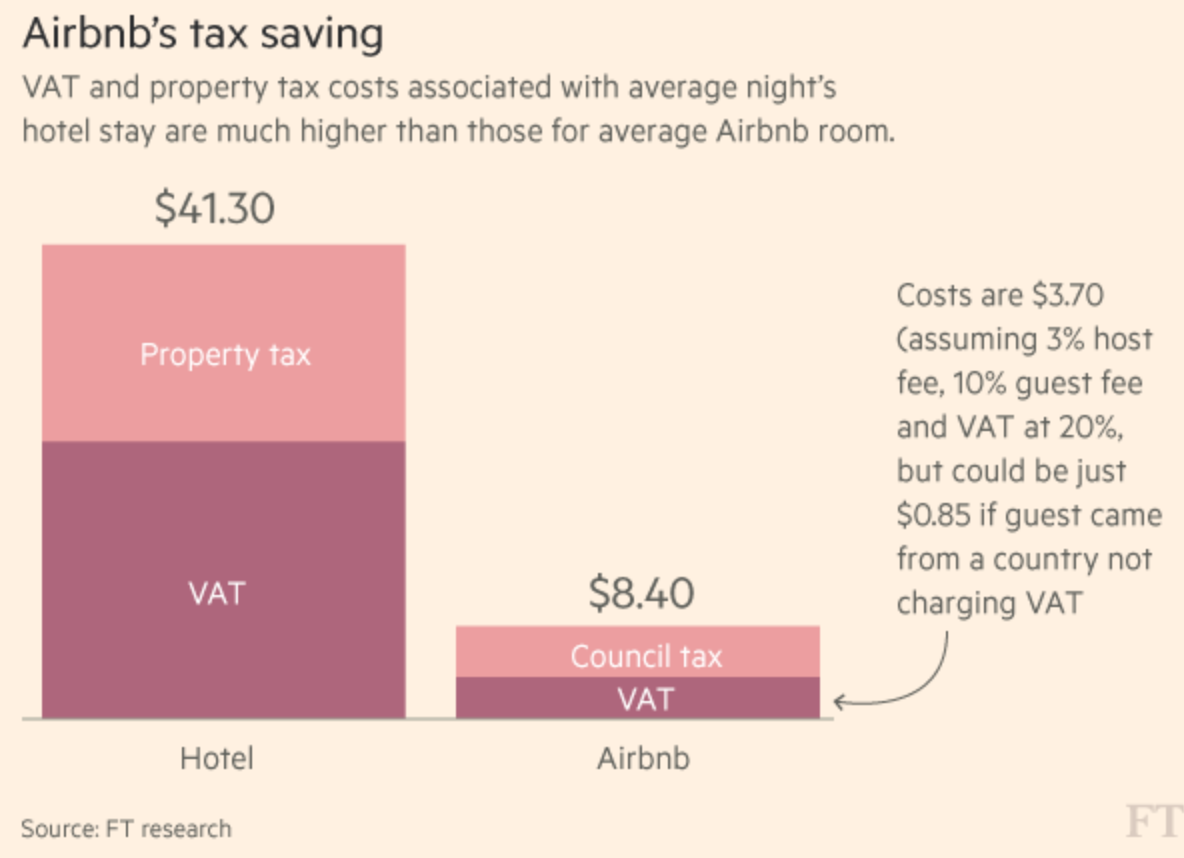

VAT and property taxes account for up to 17 per cent of the price of a typical London hotel room after the recovery of VAT paid on costs….

These VAT and property tax differences can add up to roughly third of the extra cost of using a London hotel. On average, guests paid $220 a night for a hotel room in 2015 before VAT, while Airbnb hosts received $142, according to the Hotelschool report, which was calculated in dollars. After taking account of hotel room VAT and Airbnb fees (assuming a 10 per cent guest fee and a 3 per cent host fee, plus VAT) the prices were $264 for the hotel room and $164 for Airbnb. The tax differences are worth tens of millions of pounds, based on FT calculations that assume Airbnb’s London bookings were about $600m in 2016.

AirBnB tried disputing this analysis by arguing that individuals renting out a spare room weren’t comparable to hotels. But it’s spurious to say that most AirBnB hosts are in that category. Over half the London listings are for the entire apartment. Moreover, per the pink paper:

Airbnb is now directly targeting the business travel market, with hosts able to advertise themselves as “business travel ready” if their property meets certain requirements, such as offering WiFi and a 24-hour check-in.

Even though AirBnB has been making concessions to local governments and is collecting hotel and occupancy in more and more communities, but AirBnB users seldom pay the same charges as hotel operators. And the Financial Times analysis shows how much AirBnB depends on tax arbitrage in one of its biggest markets. And that’s before you get to the fact, as a tax maven pointed out, that AirBnB hosts in the US are likely to be under-reporting income.

While the Financial Times couldn’t quantify the impact, another beef is that AirBnB renters don’t have to meet safety standards:

But consumer protection is another emerging issue. David Weston, chairman of the Bed and Breakfast Association, criticises Airbnb for not ensuring compliance with fire regulations. “I think the public assumes some sort of checking if you are booking with a big global brand,” he adds.

By contrast, members of his association with as few as three letting bedrooms have been required to install fully wired fire alarms and fire doors. “We have had instances of people having to spend thousands of pounds,” he says. “It is extremely galling to find that fast-growing competitors are not complying with anything.”

All AirBnB could offer in the way of response was a handwave.

The ability of AirBnB to operate at all is proof of the success of neoliberal indoctrination. Most communities have strict zoning laws. Renting out your home, even on a part-time basis, is a commercial activity. Most localities ignore violations of that distinction for businesses that don’t generate traffic, such as a bookkeeper or web designer working from their home. But one of the reasons for this distinction was to preserve the integrity of residential communities and keep transients out. But it seems that nothing is to stand in the way of rental extraction in the name of the sharing economy…even when the sharing consists of pilfering from the very communities that cut businesses like AirBnB slack that they do not deserve.

AirBnB is ripping off members of the public generally.

Assumes taxes thus collected are used for the general public good. Questionable assumption, it seems that many local taxes, fines, etc; are used more and more for the benefit od oligarchy (that own hotels, homes in nicer neighborhoods that may have owner councils restricting outsiders from accessing areas, etc).

Are fire alarms for 3 room B&B for the public good, if homes don’t require them, or are they for the benefit of the oligarchy that owns the approved local supplier(s)? Not all such regulations are what they appear to be.

Problematic is the avoidance of zoning restrictions, which may possibly put more stress on resources, and that users may abuse resources because they don’t need to deal with moral and social pressures that a long term resident would be subjected to.

I’m no fan of Uber, AirB&B, etc; mostly as they collect a rent for providing very little value beyond what should be a easily copyied market place (except for patent protection). That they can exist profitably may also be an indication that the other side of the coin should be looked at just as carefully. And lets look again at that patent protection.

> Are fire alarms for 3 room B&B for the public good, if homes don’t require them, or are they for the benefit of the oligarchy that owns the approved local supplier(s)? Not all such regulations are what they appear to be.

Could be both. Local code enforcement has its issues. But health and safety regulation, including fire regulations, embody hard-fought victories. I don’t see a good reason to throw them away because Silicon Valley glibertarians want to make a quick buck breaking the law.

In the area where I live (~8M people), there is a fire alarm every 15 minutes. There are very good reasons to have such regulations.

Interesting that the first comment runs standard neoliberal tropes, including the usual attack on taxes.

Taxes are the price of civilization. I live in a high-tax city because it is expensive to run places that have high densities. Taxes are high on hotels because it is an easy way to shift costs from locals to transients, in particular price insensitive business travelers who are the heavy users of high priced hotels.

And most hotels are not owned by “oligarchs”. Lordie. They are public companies. If you own any stock index funds or REITs, you are an oligarch by your definition.

And your oligarchy argument is factually false. If you actually knew anything about local property taxes, they are higher in areas that have better school systems. As Elizabeth Warren explained long-form in her book The Two Income Trap, that led to competition to be in those communities, creating large premiums, particularly as the neoliberal experiment, which you seem to favor, led to a reduction in the already on average so-so quality of public education, as well as greater variability.

Need I point out that the most corrupt states in the US, namely Louisiana and Mississippi, have low taxes?

I’m a big fan of higher taxes, and of high taxes on business travellers, but in the rush to tax business travellers they priced out a lot of casual travel to see friends and family. If AirBnB can stick to it’s original model of letting someone rent out their extra room, or their apartment while they are out of town, and cut down on people renting/buying places for the sole purpose of renting on airBnB than it will be doing a valuable service. Otherwise, it is just working to raise housing prices for low income people.

What percentage of stocks do you think are owned by oligarchs vs non-oligarchs? I think it’s a bit of a joke to claim public ownership does much to make companies more benevolent.

Considering the lower 50% have essentially no wealth or investments (they own only 0.5% of stocks, bonds and mutual funds) and the top 1% own 50%, I think Yves’ point stands.

And 85% of stock market gains go to 15% of people

I never said it made them benevolent.

I am disputing the bizarre claim that reducing local tax revenues and driving up local rental prices is somehow a blow for the little guy v. “oligarchs”.

Retirement accounts hold 37% of stocks. That means IRAs, 401 (k)s, and pension plans like CalPERS. Insurance companies are another big holder that isn’t an oligarch, along with foundations and endowments.

http://www.businessinsider.com/who-actually-owns-the-stock-market-2016-5

Yves, the UK is Monetarily Sovereign. It creates its sovereign currency, the British Pound, each time it spends. Monetarily Sovereign governments do not need or use tax dollars for anything.

In contrast, London, is monetarily non-sovereign. It does need and use taxes for spending.

If you wish to understand the differences between Monetary Sovereignty and monetary non-sovereignty, click here.

While monetary sovereignty sounds nice, it is still a fact, that if you get way too many currency units chasing finite, scarce goods and services, you will get hyperinflation. And hyperinflation is just a different way of going bankrupt, you can still write checks, just no one will accept them.

Creating currency “out of thin air” and pumping it to the real economy is always inflationary, simple matter of supply and demand.

In the end, it makes little difference, one can either tax population visibly, by taking away some of the hard earned currency of the people, or stealthily inflate away their purchasing power. Either way, the real goods and services that government buys are not made out of thin air.

@Julian – Creating currency “out of thin air” is how it’s always done in a Monetarily Sovereign nation like the US or the UK. As long as the economy is not at full employment then the additional spending will elicit additional supply to meet the demand. Neither the US nor the UK is anywhere near full employment. They are both suffering from different degrees of austerity and both economies would improve with additional spending by the national government.

If an economy is at full employment then additional spending (by the government or the non-government sectors) can create modest inflation, which is easily controlled through interest rate adjustments or additional taxes.

Hyperinflation is never caused by “money printing”; money printing is a response to hyperinflation. Both the Weimar and Zimbabwe hyperinflation was caused by a collapse in the productive capacity of those countries.

You don’t realize it yet but inflation is well on its way thanks to the Fed’s ZIRP. Just wait a few years and you’ll know.

@oh – Inflation and hyperinflation are two very different things.

I’m very skeptical of any prediction of inflation (or hyperinflation) to come sometime in a “few years.” We’ve been “wait[ing] a few years” to see the inflation many economists predicted due to high Federal deficit spending, but it hasn’t appeared.

What exactly is the mechanism that you see leading to inflation at some indeterminate future date?

ZIRP adds less money to the economy, because the govt is a net payer of interest to savers, including retiree pensions. ZIRP = austerity.

ZIRP was believed to be inflationary, on purpose by the Fed, in terms of re-inflating housing prices. But ZIRP was carried out at the moment of economic & financial collapse of the housing market, meaning few home buyers were seeking or receiving loans to purchase or refinance property that was already “underwater”. What economic benefit or inflation could result from the Fed cutting prices on a commodity — credit — that few people could acquire?

And who could acquire cheap credit? Corporations, including Finance, for stock buybacks, which used to be considered illegal insider trading before deregulation.

The argument is that by ZIRP, the Fed is “artificially” cutting interest rates, but the Fed Funds/Prime interest rate has no “natural” level. It is set by Fed fiat.

The Fed cannot control the overall volume of money in circulation, contrary to Friedman. That is the result of decisions of borrowers + banks, and by Fiscal policy to a lesser degree. The Fed has the power to target or control the price — interest rate — of money precisely. The idea of “artificial” rates has no basis in fact because there is no “natural”.

Or rather, since banks create deposits which create reserves, the “natural” rate falls to zero, reflecting the infinite supply of bank credit and the minimal administrative cost in creating a loan deposit. The role of the Fed is to manipulate reserve levels to prop up rates above zero, not push rates down. Any time the rate is above ZIRP, that could be called “artificial”.

“local property taxes, …are higher in areas that have better school systems.”

Yes, we live in one such area.

There are exceptions. We fled San Francisco which has very high property values, high taxes, rents and AirB&B usage.

The public schools there are abysmal and it is a very corrupt city.

‘I live in a high-tax city because it is expensive to run places that have high densities.’

If anything, it should be quite the opposite, as density allows services to be furnished very efficiently.

For example, salaries tax in dense Hong Kong, the Manhattan of Asia, goes up to 17% … compared to over 50% (city/state/federal) in the Big Apple.

More accurate to say that “it is expensive to run places that have a big welfare state.”

Even though I pay a fair amount in city and state taxes, the largest chunk of my taxes is Federal. City and State taxes in NYC are NOT 50%, you have to put that large portion Federal in there. And just for the record similar to the whole federal tax system where more tax monies are spent in areas where there are less taxes – see Louisiana and Mississippi versus NY and California, more of the state taxes raised in New York City go to upstate NY.

We have more kids, more transportation, more roads, more police and fire and more libraries (although like the schools there is less and less of them). Unlike various areas, we also have garbage and recycling pick up regularly. We also provide more services for the elderly, and yes the homeless.

So gotta disagree with you, Jim. I’ve lived in small towns, rural areas, and even small cities. Most of them during the period when the common good was not the dirty word it now is. None of them remotely provided the same level of available services for their residents. Most of my local taxes are well spent.

Its generally accepted in the academic literature that higher density urban areas are cheaper to service than lower density areas. In terms of transport, there is no question but that the amount of road per person is much lower in dense urban areas than in low density suburbs, and good public transport is far cheaper to provide when you have higher densities. Forcing people to have 2 cars per family and drive everywhere is a hidden cost imposed on individuals in low density cities over high density cities.

Its harder to calculate with other services – for example, low density areas can push the price of water and sewage onto individuals (everyone having a well and septic tank), while that can’t be done in dense cities for obvious reasons in addition to imposing private transport costs. There is also a huge difference in costs depending on whether an area is growing or not. Infrastructurally mature areas (i.e. long established cities) are much cheaper to run than cities undergrowing rapid growth, or rapid population losses, for obvious but different reasons. And a lot depends on whether the government owns land banks or not – land costs can become a major problem in providing everything from schools to roads in high growth/high income cities.

Its most accurate to say perhaps that the cheapest areas to run for supplying public services are areas where the density of population matches the existing infrastructure, and where the population structure (not just absolute numbers) is relatively stable.

You are missing the point. Cities provide more services. Small towns don’t provide public transportation. They don’t provide anywhere near as much in the way of policing. They don’t support museums. They don’t plow the streets quickly if at all in the event of snowstorms. They don’t regulate rents or have a special housing court (and even a rent hotline). They don’t have 311, where you can get advice on what city agency to contact and make complaints and get a complaint tracking number.

With respect, Yves, that was exactly my point! Sorry if I didn’t express it very clearly.

As I said above, in low density areas people frequently have no option but to run 2 cars, have their own septic tank, etc., etc. I agree that there are a lot of hidden services from living in high density areas which frequently (not always) balances out the generally higher cost of accommodation. My personal annual commuting costs are my 20 euro a year bike scheme card and some shoe leather.

I’d imagine it depends on what the service is. NYC is going to require a lot more public schools than a rural town with the same area but only 10K people. But the rural town may require a mile of road to connect two homes whereas in NYC thousands of people might live on the same mile long strip.

Anyway, it’s pretty clear that many of the Silicon Valley billionaires are getting that rich by avoiding billions in taxes. I read somewhere, maybe here, a back of the envelope calculation of how much in state taxes Amazon has avoided paying and it was surprisingly similar to Bezos’ approximate net worth.

And yet some still wonder why infrastructure is crumbling…

I don’t see how property taxes enter into this discussion either way. Presumably AirBnB hosts’ property assessments and taxes don’t change due to their rental gig, nor do their hotel competitors’. I don’t think adding fire doors and upgrading fire alarms would change assessments, and airbnb guests are probably not making use of the local schools or most of the resources in any substantially increased way over the inhabitants, since they can only occupy existing capacity.

Commercial property is generally taxed at a higher rate than residential. Usually, hotels have specific taxes based on occupancy in addition to VAT or sales tax.

The rationale is that transients like business travelers are obviously motivated to be in the area, and are willing to pay. It’s something of the time honored tradition of soaking the out-of-towners, though in a lot of cases there are are specific costs like convention centers and tourist related amenities that are being recovered as well.

“Taxes are the price of civilization” – somewhat true, though to be honest, its very very hard to see where and how your taxes are being spent. For example, in Evanston I paid something along the lines of 20% extra for liquor as part of an ‘alcohol tax’. Not exactly sure what that money was being used for, but absolutely sure that the city didn’t need the money – it’s arbitrary. The breweries are already paying for manufacturing licensing, just like the storefront is paying for a distribution license, and you’re paying a sales tax. So in actuality, what we have in America is obscene levels of regulation & fees/taxes on every level (the people, the businesses, the goods) which has slowly been crippling the waning entrepreneur spirit in America. This is why just the idea of taxation rubs many people the wrong way.

With Uber and AirBnB, we have come to a crossroads. These companies use the mystifying (at least for lawyers/politicians) layer of software to essentially circumvent any of the fees associated with actually running a business in taxying & renting respectively. So the question is: do you relax fees/regulation for the taxi and hotel companies? Or do you force these “App” companies to start paying the same fees and regulations as the industry? Either way, what’s pretty certain is that the end users will be affected negatively, and will either have to pay higher fees for the service (like we’ve seen with Uber drivers, which take the brunt of the insurance fees) or be forced to pay extra taxes.

Not actually the case in London where boroughs such as Wandsworth and Westminster have the lowest property taxes (council tax) in the country.

The question of whether they are used for the public good is entirely separate from that of whether they are fairly imposed. If the law says paying overnight visitors are supposed to pay a hotel tax, that should apply to all such visitors. When people come to town and don’t pay hotel tax, they are using local amenities without paying for them, which is unfair both to other visitors who do pay the tax and to residents who will get fewer services if revenues are lower.

Good for you what now. Maybe the guy renting out rooms is putting his kids in private school. Maybe the tourist is spending his money in restaurants that suit his needs. The poor cronies may have to solicit their incorruptible politicians outside Louisiana and Mississippi and ask for a tax break. Nothing worse than competition for the free market

“Free market” is an intellectually incoherent idea. When people start falling back on that, they don’t have an argument. Markets function only when there are laws and regulations and courts to enforce them, all of which are provided by government.

And what does sending kids to school have to do with it? I have no children yet I pay property taxes. Taxes are the price of civilization.

Acting like a hotel but evading the taxes that local jurisdictions require hotels to pay isn’t “free market,” it’s ripping off taxpayers. So I take it you also approve of businesses that cook their books and keep the sales tax they charged customers for themselves if it allows them to send a kid to private school?

The “free market” means things are free for shysters like AirBmB.

Interesting idea that the UK tax authorities are ignoring someone gaming the system: they squeeze their money from wherever they can – unless the target has some political protection and even that is usually very limited.

Interestingly at least one UK government department, the Department for International Development (DFID), requires that their staff find inexpensive accomodation when travelling on business (which is fair enough as long as it is safe and clean), but I had understood them to be encouraging the use of AirBnB… wonder if that might change?

They are not just free riding on local taxpayers, they are also free-riding on neighbours. I’m on the board of management for my apartment building and any short term lettings – whether through AirBNB or more conventional ways – significantly increases security and other costs for running the building. Even a simple thing like having to clean up after someone leaves their recycling bags in the wrong place because they don’t know the building rules costs money and time to deal with.

Totally. AirBnB in multi-unit buildings creates a whole other layer of problems. Just last week in my building someone had a “friend” over who got caught testing doorknobs on another floor. The doorman almost got fired over it.

Wehn your housing stick is build on a wood frame, you have this problem

When it is brick or cinder block, there are fewer fires.

An exterior brick wall should is 13″ thick. Why is why home in the UK have decent width windowsills. (All the easier for jumping from into the arms of the rescuers, my dear).

can someone please kill the Orwellian PR greenwashing that AirBnb is “sharing”?

The bulk of landlords on AirBnb are professional, full-time, jitney hotel operators—-not Auntie Mabel letting out her spare bedroom to lodgers.

As much as I have little sympathy for Marriott, Hilton, Hyatt/Pritzkers, AirBnB isn’t the champion of the little people either.

The U.K. is Monetarily Sovereign. This means the UK creates its own sovereign currency, the British Pound ad hoc, each time it pays a bill.

Unlike London, for instance, the UK does neither needs nor uses tax dollars. Even if all UK tax collections fell to zero, the UK could continue spending, forever.

Therefore, AirBnb’s failure to pay UK taxes does not cost UK taxpayers anything. In fact, it leaves more money in the private sector, and stimulates the UK economy.

The rich want you to believe that taxes are necessary, so they have an excuse to cut services to the middle classes and the poor. But, UK taxes do nothing to help the government spend, and simply are recessive money-taking by the government.

Read Monetary Sovereignty to understand the full picture of the “Big Lie” (the lie that UK taxes fund UK spending.)

By the way, this is why the UK was wise not to adopt the euro.

To the extent that removing rental housing from the market for the purpose of putting it on AirBnB drives rents higher, there is a clear and unambiguous cost to local taxpayers. Taxing AirBnBs at rates commensurate with other hotels would reduce the incentive to do so, putting more units back on the market for actual residents in dense and competitive areas like London. Likewise, the reality of monetary sovereignty would seem to matter little so long as a significant part of the political establishment is committed to cutting social services, and happy to leap on any revenue shortfalls as an excuse.

Long Live Schumpeter and capitalism as the process of creative destruction. Complain if you wish to about AirBnb, cry about the tax advantages of Airbnb rentiers may enjoy, but many casual travelers such as myself will seek out BnB accomodations before hotels/motels, and not just b/c it is usually cheaper to do so.

For example, to visit my sister in rural OH this xmas holiday, I had to seek out accommodations. Both hotels and Bnbs were considered. There wan’t a hotel inside of 20 miles. But there was a wonderful BnB five miles away. A 1908 Sears Roebuck mail-order catalog home in fact, complete with a 6 course breakfast. Pricewise, the Bnb made more cents as well. You won’t hear a complaint from me.

One business outcompeting others due to tax advantages would probably not have been considered by Schumpeter as “creative destruction,” but rather as “uncreative destruction.”

Yes, let’s all game the system and use tricks to avoid paying taxes, who needs taxes to fund any public services anyway, it’s every man for himself in capitalist Heaven! Just call your pal with a truck and a hose next time there’s a fire in your neighborhood.

I have a great law firm for you to contact, to manage your personal affairs so you don’t have to worry about any of those stupid taxes:

http://www.mossfon.com/

“The bulk of landlords on AirBnb are professional, full-time, jitney hotel operators—-not Auntie Mabel letting out her spare bedroom to lodgers.”

This is bullshit.

I’ve used Airbnb repeatedly over the past 6 years and every time (San Diego, SLC, Northshore New Orleans area) the unit has been a room or section of a single family residence in which the family resides. The experience has been good every time and the “landlords” have been exactly what they are supposed to be: live-in owners making a little sporadic money off under-utilized space.

You professionals who live your lives in the western world’s over-priced, over-crowded, stunningly corrupt megacities have a warped understanding of who uses this service. Airbnb is not, obviously a “champion of the little people”. It is a Silicon Valley bro corp, and it is run with all the breezy disregard for norms that we’ve come to expect from those smooth, haughty white boys. However across most of North America, Airbnb serves the demographic it claims to be there for. For years it has (grudgingly) works with cities (i.e. Portland) that require it to charge room tax and similar fees.

The problem in Manhattan and inner London is not that some booking service caters to the interests of owner-operators; it’s that your entire communities are rife with grasping white collar criminals. Most notably, your real estate industries are thick with creeps who operate with impunity on many levels. Anyone who doesn’t know this needs to read up on a few of Manhattan’s better known landlord-tenant disputes. Most make “Chinatown” look like an episode from “Little Home on the Prairie”.

Sorry, the only AirBnB operators I know are pros with multiple properties. And most of my sample is people living outside Manhattan.

The plural of anecdote is not data.

And I don’t know what you are talking about re Manhattan. We have very tough rental regulations and our housing court is not pro-landlord. Yes, you do read horror stories upon occasion about slumlords, but this is a city of 8 million people. If you call 311 and report a lack of heat or water, the city acts pronto. You see far worse abuses on a routine basis in the single family home rental market by Blackstone.

Likewise, surely?

See the article for more comprehensive data: “Over half the London listings are for the entire apartment.”

Yves,

This is one of the only times that I have ever disagreed with you so vehemently.

I know three friends who use airBnB to actually make their mortgage payment.

1) Divorcee woman who was left for a younger woman. No alimony, no child support and a large mortgage. She chose to keep her kids stable and in the same school rather than upending their life. She rents out her basement to make her mortgage payment.

2) Woman who is disabled, unable to work due to Lyme disease also uses her basement as a way to make ends meet.

3) Man who uses 2 extra rooms as rentals bnb rather than allow the bank to take his home in foreclosure.

None of these people could *make it* in Seattle without this extra bnb income.

So is the drama they find themselves in a bind because of decades of pure ideologically driven social agenda or is more of the same used to offset aforementioned effects a desirable solution.

disheveled…. its like watching people baste each other…. or Temple Grandin works on behavioral modification…. cattle don’t mind being lead… in the short term… even tho the long term is catastrophic…

Yves, you are – as far as I remember after 3 decades away – totally right about the power of city landlords. I didn’t mean to claim they have free rein. They get away with far less than they would like, and far less than their equivalents can here in flyover Nevada. However the power dynamics of property rental in major urban centers like Manhattan are dauntingly unpleasant. Owners and managers suck damaging amounts of income out of people who are trying to make a modest living, and tempt them into all kinds of subletting games to make ends meet.

Legal landlords & property managers are only part of the issue. Many urban, multi-unit Airbnb operators are a step down from owners. But, none of them are representative of the people who use the service nationwide.

I strongly believe that the problems with booking services like Airbnb in major cities are more a function of the corruption and stress in those locales than of the flaws in the services. They works OK for people who live in less elevated parts of the world. Even in Seattle, Salt Lake City and New Orleans. And Houston. I forgot to mention my good stay in 2014 in the oil corridor west of the city center, over towards Katy. An Airbnb room let me stay near enough to where I had to work that week to avoid the rapey rental car fees for a toll road pass.

Maybe they need to be banned from some urban centers. I just know that they are not detrimental to economic and social life in less stressed, less densely populated locations. Particularly not when municipalities work with them to levy going-rate room taxes. The rat bastards who run Uber are another story however.

Gezzz…. that frictionless Capitalism [Gates] where even absentee ownership is a dim memory… where an app allows VoM across the books just to burnish equity valuations… which then in turn is used to leverage political and social systems…..

disheveled…. creative destruction – ???? – yeah black holes are too…. too bad about all that information loss tho’….

As an erstwhile small inn owner (Borrego Valley Inn, 2006-2015), I have been incensed by the unmitigated and cynical gall of AirBNB and its ilk (Uber, particularly) in flat-out breaking longstanding laws as the core of their business models. The “sharing economy” figleaf is nothing but a ruse, a camoflage for blatant lawbreaking.

The thinking appears to be “fuck the rubes — we have better lawyers, shills, lobbyists and whores (eg., David Plouffe) than they can ever afford, so effing eff them to effing hell for effing ever, amen.” I hate, hate, hate the fact that they have, so far, prevailed. My only solace is the thought that, slowly, ever so slowly, the forces of right and good will catch up with these mfuckers and tie them up with their own arguments. For this, I pray…

X1000!!

In my condo highrise in Vancouver, Canada, AirBnB is proving to be a problem. We have several commercial operators buying condos and using our residential building as their unregulated hotel. They flagrantly violate our condo bylaws and we’ve already had security issues arise. Now our condo corp might also have the expense of going to court to try to put a stop to it, since the commercial operators completely ignore our condo council.

I don’t really get the VAT argument as it seems to depend entirely on the size of the operation. If I understand correctly any large enough Airbnb host would need to pay VAT same as any small enough Hotel would not be subject to VAT. Second, most of the comparison hinges on UK tax code – why are private properties not subject to any property tax etc. Third, if I understand correctly here some average absolute contribution per night is compared (and not relative tax) which would produce similar results if we just compare cheap hotels with expensive ones.

I do think that airbnb does skirt some restrictions which needs to be addressed by stricter regulations for hosts. But the tax argument does not convince me.