The Wall Street Journal gave us yet another a taste of the World According to Corporate America.

Companies are unhappy that employees are dipping into their 401(k)s, although they’ve managed to devise one of those agency-free words, “leakage,” to the process.

Why are they upset? Because lower savings means their employees will want (as in need) to stay wage slaves longer. Can’t have that, dammit. Need to clear those cobwebs out so as to make room for young, frisky workers.

American companies are trying to stop employees from raiding their 401(k)s, in an attempt to ensure that older workers can afford to retire and make room for younger, less-expensive hires….

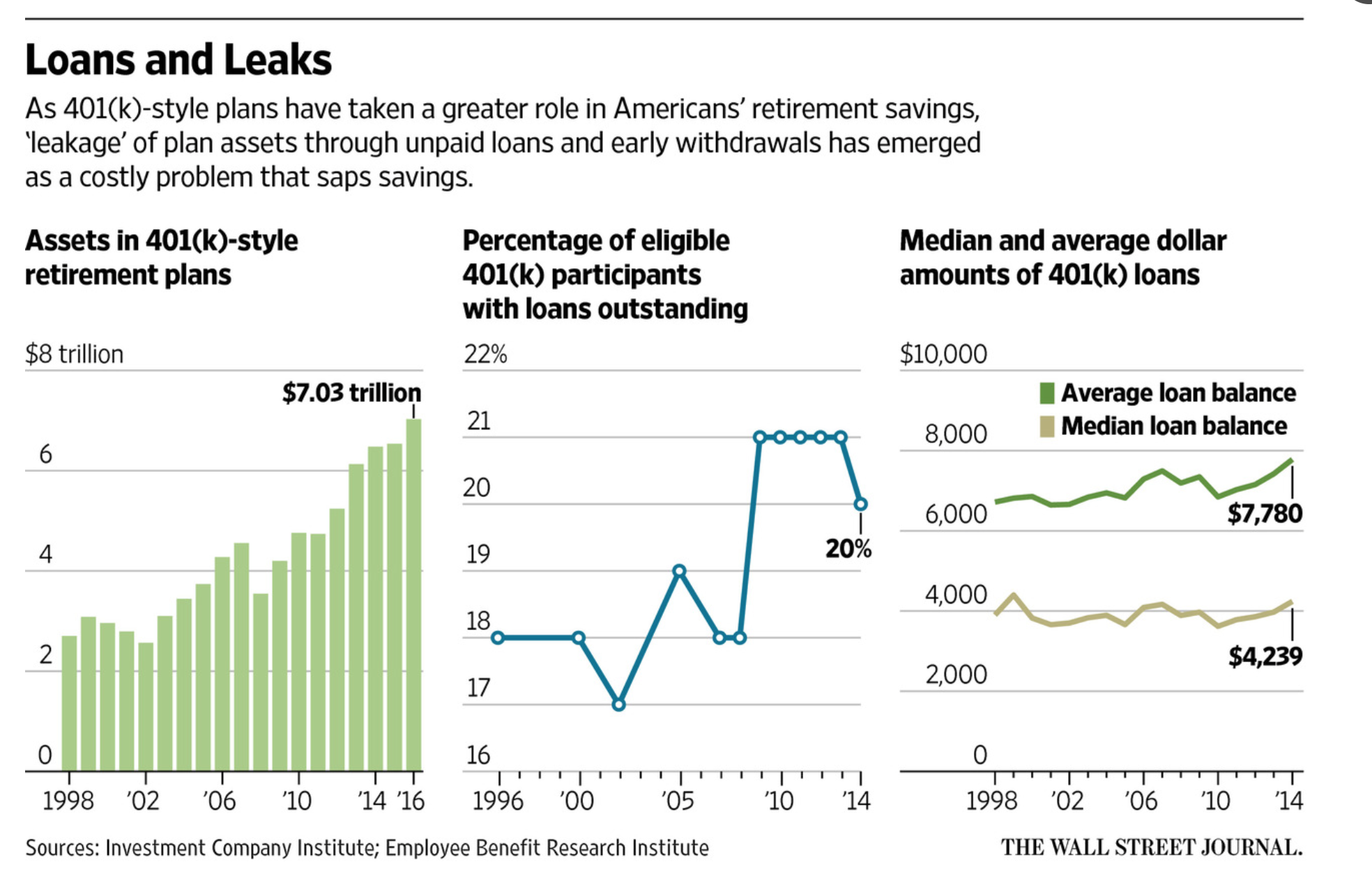

Tapping or pocketing retirement funds early, known in the industry as leakage, threatens to reduce the wealth in U.S. retirement accounts by about 25% when the lost annual savings are compounded over 30 years, according to an analysis by economists at Boston College’s Center for Retirement Research.

Now let’s get real. First, 401(k) were never designed to be a primary retirement vehicle. They were a supplemental retirement savings account for people who had defined benefit plans, as the Journal ‘fessed up in January:

Herbert Whitehouse was one of the first in the U.S. to suggest workers use a 401(k). His hope in 1981 was that the retirement-savings plan would supplement a company pension that guaranteed payouts for life.

And the promoters admitted 401(k)s were not well-suited to serving as primary retirement vehicles:

Many early backers of the 401(k) now say they have regrets about how their creation turned out despite its emergence as the dominant way most Americans save. Some say it wasn’t designed to be a primary retirement tool and acknowledge they used forecasts that were too optimistic to sell the plan in its early days.

Others say the proliferation of 401(k) plans has exposed workers to big drops in the stock market and high fees from Wall Street money managers while making it easier for companies to shed guaranteed retiree payouts.

“The great lie is that the 401(k) was capable of replacing the old system of pensions,” says former American Society of Pension Actuaries head Gerald Facciani, who helped turn back a 1986 Reagan administration push to kill the 401(k). “It was oversold.”

But even with their shortcomings, why are workers dipping into the closest thing they have to a pension? While moralists with stable, well-ordered lives like to finger-wag at spendthrifts, and that is no doubt the cause in some cases. The Journal’s sources paint the picture that some of these withdrawals are due to not understanding the true costs, and some employers like Home Depot have implemented “Don’t touch that dial” programs that have had some success in reducing borrowing against 401(k)s, which in its case has helped reduce the amount of borrowings by 17%. While that is progress of sorts, the modest level of reduction is an indirect confirmation that most of these withdrawals are driven by real needs, particularly in light of the fact that most American have almost no emergency savings (While 401(k)s do allow for hardship withdrawals, such as for preventing foreclosures and medical expenses, the Journal notes, ” ….the employee must demonstrate an ‘immediate and heavy financial need,’ according to the Internal Revenue Service.”).

A more employee-friendly approach, adopted by Redner’s Markets, is to let workers make low-cost borrowings instead. But how about plain old better wages, or alternatively, a more concerted effort to crack down on the monopolies and oligopolies that are successfully squeezing American laborers?

The article also laments that 30% to 40% cash out their 401(k)s when they change jobs, which means they pay taxes and fees and presumably spend the dough. The wee problem with this argument, while true, is again it may reflect cold financial realities: in some cases, the need to pay moving and costs related to getting housing in a new location (transaction costs on homes eat considerably into equity). And some of those people may roll over their money into an IRA; they have 60 days to do so.

Wall Street Journal reader Marc Jones got down to the real issues:

Oh heck, lets make this easy. At age eighty, it is the oven for you. I mean, everybody knows once you reach fifty, you are just becoming an bigger burden and you represent nothing more than an impediment to those younger than you.

The whole 401k structure was a scam to strip older workers of deferred compensation. It allowed the corporate sector to cut pay without anyone noticing. It brought a huge new source of revenue into financial institutions and all those political contributions were as sweet as candy to the parliamentary strumpets.

But, those oldsters are still a problem. They hang on and they have the audacity to vote! Ovens! That’s the answer! Ovens!

The methods may not be quite so obvious as mass roastings but as Lambert has been saying for a while, one of the tenets of neoliberalism is “Die sooner!” So in a perverse way, it’s encouraging to see even Journal readers starting to figure that out.

Soylent Green is people!

Some people raid their 401k because they believe that in the future, the government will say …”Because the Social Security will be insolvent if we give social security benefits to all, we decided that those people who have 401k will not be eligible for Social Security income anymore.” The government imports all these poor people from other countries and they make them eligible for lifetime of Social Security benefits in our expense. No more.

Well said

Got a smidgen of evidence for your assertions, like about “the government importing all those foreign people”? Hmmm? Or just punching down because it feels so good? And of course it appears the there’s money to be created to pay for decent living for pretty much all of us, if “the govt” and the oligarchs wanted to.

Since American companies are run by the greediest psychopaths on the planet, the real reason for the objection to 401K withdrawals might as well be that selling overpriced stawks and using the cash to pay bills, reduces the opportunity of the chief corporate psychopaths to cash out on their stawk options.

It’s personal. How dare a peasant beat a corporate bigwig by cashing out early, and reduce the bigwig’s monetary takings by even a penny.

Tapping or pocketing retirement funds early, known in the industry as leakage, threatens to reduce the wealth in U.S. retirement accounts by about 25% when the lost annual savings are compounded over 30 years, according to an analysis by economists at Boston College’s Center for Retirement Research.

That’s 25% less available funds that Wall Street can steal from customers. Starve the beast? How do we cut them off from the teat of the FED?

Bernie Sanders: The business of Wall Street is fraud and greed.

precisely. If I had a 401K, I would not be trusting those jackals with my money. My ex lost pretty much everything after he had contributed for 12+ years.

Re: “… American companies are run by the greediest psychopaths on the planet…”

I have a quibble with this point of view. Greed takes many forms, and greed for power is just as motivating as greed for wealth. So I’m of the opinion that corporate psychopaths have plenty of company in the halls of government, particularly in the National Security arena. These people have shown that killing hundreds of thousands and destroying the lives of millions more is not enough to satisfy their lust for power and control. Oh no, not nearly enough. The beast you speak of must eat every day.

As far as cutting off Wall Street from the teat of the Fed, this is a virtual impossibility. Wall Street, the Fed, and the Federal Government, and particularly the National Security State, are all just different faces of the same entity. It would be like trying to separate the front and the back of a dollar bill. You can’t do it without destroying the whole thing.

And if I was Marc Jones, I wouldn’t be crying “ovens” too loud. It’s happened before, and by people who may not have been all that much further along the psychopath curve than the ones we are dealing with now.

I remember an interview of Jack Welsh by Cramer on Mad Money where he said, and I’m paraphrasing, ‘sure, means test me up the wazoo for my meager social security checks, and take them away, if you must’, and then got all beady eyed and continued ‘but leave my big pile alone’.

Sure, greed takes many forms, but greed for power is something I don’t understand well. It’s human nature to resent being bossed around, so when someone seeks power to boss someone else around, they are seeking something that were it aimed at themselves they would object.

By the time career military people get to the top ranks, it would be surprising if they weren’t psychotic. Their whole working lives have been dedicated to the jawb of killing. That can twist anyone’s mind.

“Do unto others as you would have them do unto you.”

Hahahahahahshaha….

I have friends who are just past their mid-30s and borrowed against their 401k to make a house purchase. A promotion lead to a desire for a bigger home in a nicer town (i.e. schools) and when they sold their current house a combination of real estate transaction fees and being slightly underwater on mortgage (I thought housing prices always went up!?) meant the only place they could go for excess savings was their retirement accounts. Now that’s something I would never do, but I understand the motivation. And from their perspective, things are still on the upswing in terms of their age and career expected earnings.

I have another colleague who has been at our large company long enough to still have a pension plan, while our U.K. colleagues are still in a union. Instead of wondering why our older colleagues have it so good with regards to benefits and time off, they just joke about the days of a pension being gone and make with the old man cracks.

“Companies are worried about their employees retirement prospects”

Gotta love the language. Maybe they should pay their employees more … if you actually believe that’s what companies are concerned about … but seriously this is why I don’t read the news anymore. The ongoing casual lies are embedded within a broader tapestry of falsehood.

They can’t pay more… they need to maximize their eps or stock price for the big pension plans who own them.

The irony is that they need to minimize the pay of their workers to maximize the pensions of workers not necessarily in their firm.

Well they could just make contributions to the 401ks for employees themselves without even requiring the employee to put anything in (without requiring matching). Some companies do do this. Probably better than just paying them more if they are really worried about their retirement funds, because if they just paid them more there’s a good chance it wouldn’t go to retirement. I’m not opposed to more pay, just realistic about how much might go to retirement. A pension of course is better but small companies aren’t going to manage that financially even if they wanted to.

Even of the boomers I bet many of them don’t have pensions. Why? They didn’t work for government or fortune 500s, and it was probably never that many people with lifetime at careers at small companies that got pensions. But much of the employment is small businesses.

“The great lie is that the 401(k) was capable of replacing the old system of pensions,”

No kidding. There are so many great lies with 401(k)’s, the biggest being that it is now expected that people should be able to save enough for their own retirement if they would only assume some personal responsibility.

But the math has never worked. According to Reaganomics, personal responsibility is the solution to retirement needs, medical costs, education costs, child care costs, unemployment, etc. No one has ever been able to produce a household budget for a family in the lower half of income that would ever come remotely close to fulfilling the conservative’s fantasy of personal responsibility. It. Can’t. Be. Done.

The great lie that is the 401(k) and Reaganomics serves the same purpose as so many other conservative lies: it allows more money to flow to Wall Street and the richest Americans. It also is used to justify tax cuts for the rich and cuts in social programs. It is about the greed of the few against the living standards of the rest of our society.

The 401(k) was intended to be a supplemental income to a pension, but those pensions no longer exist and are never coming back. In the face of what has happened, particularly the graft Wall Street and financial managers have imposed on 401(k)’s and other retirement investments, what is needed is a much more muscular Social Security system for retirement.

Does anyone know what percentage of boomers (or even older boomers) have pensions? I’m guessing it’s not all that high (even if it’s 50%, that means half would be relying on SS and other savings etc.).

To find your answer, find out how many police and school teachers and politicians you have in your country. They are the only ones who have $100k pensions.

Look at the CalPERS stuff they they cover here, if you think that’s a problem isolated to California public employees you are deeply mistaken.

Every pension fund will end up looted, because that’s what they are there for. How are retirees are going to be move in with their kids, when their kids already live with them?

Start hoarding used sheet metal, it will be the new gold when the shanty town movement really gets going. It will really help you stretch your $340 dollars a month from the https://en.wikipedia.org/wiki/Pension_Benefit_Guaranty_Corporation

It’s a good reaon to increase SSI, as Bernie and friends say; lock it up so the plutocrat thieves won’t plunder it first!

So if all benefited from well funded DB plan wouldn’t the economy be smaller from less spending and markets even more overvalued?

Oh no, the economy would have been smaller so there would have been less money to save…

My head hurts thinking about all those what ifs!

It just seems to me that the cost of living for the vast majority will always equal disposable income because there is alway someone out there younger, willing to work longer hours, willing to take a pay cut or pay extra for a house. Arbitrage rules.

Asking everyone to save for 30 years of retirement is a farce and sure to fail. And we are currently witnessing its failure. There are just too many variables.

All it takes is for someone out there to plan using a life expectancy of 80 while another with the same income uses 95. This gives them way more cash flow during their working years to increase the price of everything screwing up the plans of those using more conservative assumptions.

And this is just one variable…

And if every American saved for retirement owning part of the equity index, wouldn’t that be approaching communism?

Interesting that capitalists would have thought up such a pension system. Lol!

Pension funds own about 1/6th of equities as it is.

Since companies don’t care if you survive after you leave them and I bet in many of these big box stores newbies and old timers probably earn about the same amount 10-15/hr. What is the real reason they want to stop leakage? That 25% drop in gambling money & earnings for fund managers.

I am guilty moved on to new job and cashed it out. I didn’t put any money in, don’t care and don’t see this as a real way to ?retire.

After 2008 it seems like 401ks are just a place to dump garbage. What do I know, I am young & dumb.

Older workers = higher health care expenses and higher matching contributions.

Question:

So my spouse has changed jobs 4 times in the last 5 years. Each time we have to cash out the old 401k and deposit it in the new one. Some times this rollover was done by direct wire transfer from old to new, but one time they sent us a check, which we signed over to the new 401k account. Are these somehow being counted as “cashing out”? We though these are really rollovers? Just curious…

is there a reason you aren’t just depositing it in an IRA when she leaves?

If you move monies from one 401k into another, or transfer it into a rollover IRA it is not considered as a taxable event, I.e., you did not cash out.

The Wall Street crooks through the governments they own have convinced the majority of the people that 401(k)s are good because of (1) tax deferral and (2) company contributions. Americans are obsessed with paying lower taxes that they let the Wall Street Banksters get their claws on their savings. The laws dictate that only the banksters/brokers can keep and handle your savings. Each trade results in a commission. Add to this mix the myriad of so called financial consultants who churn the account for their own benefit. When Wall Street crashes, Good Bye!

Exactly! And they dump sub prime this and that in there. No fiduciary obligation=garbage.

BIL (high-level TV executive mostly unemployed for two years) withdrew his entire 401k without understanding the tax consequences. April 15 a very large number is due to the Feds. Oops.

Over the years, I have been astonished at how little many executives understand about finance, taxes, and business. I have always wondered what they actually do in their cocooned meetings. Generally speaking, those meetings result in hilarious memos re-organizing people that don’t appear to have anything to do with the normal business while cutting costs that are essential to executing the business.

So it is not a surprise to me that a high-level executive would be unaware that a 401k is tax-deferred, not tax-exempt. He probably also thinks that a hedge fund is guaranteed to outperform the S&P 500 and has already moved his money into one, which means he will have less money to pay his taxes with.

Borrowing against your 401k is only an issue if you are saving in it at a low rate. The really big issue with 401ks is that companies generally do not put much in matching funds in – typically far less than their old pension fund contributions would be. Instead, those funds have been going to pay for exorbitant healthcare insurance plans in the vastly over-priced US healthcare system.

I have borrowed against my 401ks over the years. However, I also save at a pretty high rate, generally at the highest rate that the company permits. So I get the tax savings (been in some of the highest tax brackets for over 20 years and live in a high income tax state, so about 35% or so tax deferral) while building an asset base.

Occasionally, something comes up that needs some cash, so I take a loan against the 401k (generally the value is less than a year’s worth of contributions) and set up a schedule to pay it back over a couple of years. Some years the interest rate on the loan (that you are paying to yourself) is higher than the portfolio returns and other years it is lower. In the end, I have come out ahead because I am not trying to save those chunks of money after tax in a bank savings account that pays little or not interest.

I’m curious: If you pay the interest on the 401k loan with already-taxed money, is that interest taxed again upon withdrawal from the 401k?

Yes it is a 35% tax savings, even if not in the highest bracket. Say in the 25% fed bracket (income of $37,950 to $91,900). Then California income taxes for that income can come to nearly 10%.

You almost never want to roll your 401k into a new employers plan. Shift it to your own IRA.

When you roll to your employer’s plan you lose flexibility and can even put your pre-existing funds at risk in certain cases.

Mostly true, but it depends. If the new 410k has good, low cost investment options that one wishes to utilize then it’s probably fine. That said, many 401k accounts tend to have higher costs for equivalent funds than one can get in a rollover IRA. Buyer gots to do their research.

No, he’s correct. 401(k)s have TONS of hidden fees. You can’t get disclosure of the full fees. You are guaranteed to have lower fees and more choices at Vanguard.

Not just the corporation investing in equities or stock buybacks, or workers investing in equities, but also the corporations turn themselves into finance/insurance businesses (Westinghouse, etc.) It’s funny that they can’t see how they have defeated themselves – and they are blaming leakage when spending the money is the antidote to stagnation as the system now works. It’s hard to imagine that the corporations want to retire the old workers to make room for new – I don’t believe that for a second because they’ll gladly retire 4 olds and hire 1new. It’s “flexibility” they are looking for.

If they want people to retire earlier maybe they could lower the age at which social security pays out.