By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Here’s another data point on the Canadian housing bubble, how immense it really is, and how utterly crucial wild housing speculation has become to the Canadian economy.

Housing starts surged to 253,720 units in March seasonally adjusted, the highest since September 2007, according to Canada Mortgage & Housing Corp. Of them, 161,000 were multi-family starts of condos and rental units in urban areas. In Toronto, one of the hot beds of Canada’s house price bubble, housing starts jumped by 16,600 units, all of them condos and apartments, defying any expectation of a slowdown.

Housing starts are an indication of construction activity, a powerful additive to the local economy with large secondary effects. Housing construction gets fired up by the promise of ever skyrocketing housing prices, and thus big payoffs for developers, lenders, real estate agents, and the entire industry.

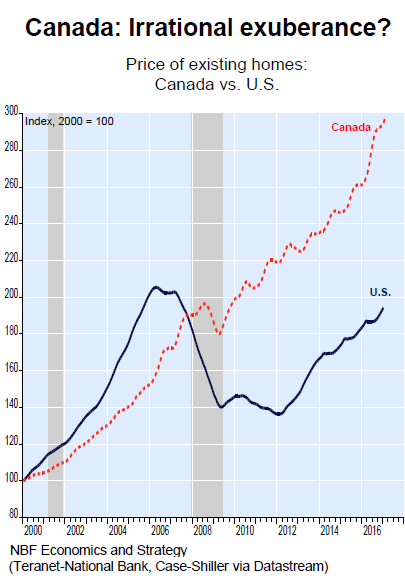

National home price data covers up the real drama in certain cities, particularly Vancouver (British Columbia) and Toronto (Ontario), but it does show by how much Canadian housing prices have overshot the already lofty US housing prices.

The chart below by Stéfane Marion, Chief Economist at Economics and Strategy, National Bank of Canada, compares US home prices per the Case-Shiller 20-City index to Canadian home prices per the Teranet-National Bank 26-market index. Both indices are based on similar methodologies of comparing pairs of sales of the same home over time. The shaded areas denote recessions in Canada. Note that during the housing crisis in the US, there was only a blip in Canada’s housing market:

Marion added in his note today:

Home price inflation has become THE hot topic of discussion in Canada. Surging prices are no longer confined to greater Toronto and Vancouver. As today’s Hot Chart shows, we estimate that close to 55% of regional markets in Canada are reporting price inflation of at least 10%.

This record proportion is very similar to that observed in the United States in 2005 at the peak of the market.

When 55% of the market is on fire, the use of interest rates to cool things down is justifiable. The Bank of Canada must change its narrative and abandon its easing bias as soon as this week.

He was referring to the Bank of Canada’s meeting this Wednesday.

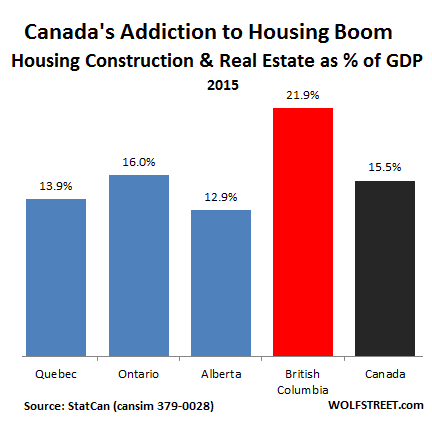

How important is real estate and housing construction to the Canadian economy? Hugely important! It accounts for an ever larger proportion of the Canadian economy. For all of Canada, according to data by Statistics Canada, housing construction and real estate activities combined account for 15.5% of GDP, up from 14.7% in 2011.

This chart shows housing construction and real estate activities in the largest four provinces as percent of the province’s GDP in 2015, and for Canada overall. StatCan data for 2016 are not yet available. Note British Columbia: 22% of its economy is based on residential construction and real estate activities – due to Canada’s number one housing hot-bed Vancouver:

This is why neither the Bank of Canada nor the governments at the provincial and federal levels are eager to step on the brakes. BC tried with its housing transfer tax aimed at foreign non-resident investors. After it was instituted last summer, it temporarily froze up the market, with sellers and buyers too far apart, and transactions plunged.

By December, only four months after the transfer tax was implemented, the prospects for 22% of the provincial economy heading into a sharp decline or even a major bust motivated the BC government to step back on the accelerator to prolong the speculation – with an ingenious trick.

The province began offering a subsidy to first-time homebuyers: an interest free loan for a down payment of up to $37,500 to match the buyer’s own down payment. It was an effort to allow buyers to get around the down-payment requirements set by the federal government designed to curb wild housing speculation.

It seems the BC government has figured something out: if anything curbs this housing speculation, on which the province is so dependent, the overall economy is going to tank.

Canadian cities are desperately dependent on property taxes for their budgets. Toronto, for example, is facing major budget strains. In February, city councilors approved a 3.3% increase in the residential property tax and they raised the municipal land transfer tax. Under the new budget, property taxes would provide 38% of the revenues, and the land transfer tax 7%, for a total of 45% of the C$10.5 billion in tax revenues for this fiscal year. In other words, the city will extract a record C$4.7 billion from property owners to delay falling into a fiscal and financial sinkhole.

That kind of tax extraction is bearable for property owners only as long as the value of their property soars year after year. Once that value declines, owning this property becomes a massive liability.

This is why the housing bubble and the accompanying crazy housing speculation must be maintained and further inflated, no matter what. It has become an addictive drug for the Canadian economy. Average household indebtedness is among the highest in the world. Many households are carrying little or no debt. But many others are suffocating under a mountain of debt, and a sharp decline in house prices would wreak havoc among them.

The entire economy – including government revenues and thereby the services offered by these governments – depends on wild property speculation. And everyone is praying that it can somehow be maintained.

So are these prices based on fundamentals? You gotta be kidding. Read… Toronto House Price Bubble Goes Nuts

The Australian economy is likewise dependent on a massive housing bubble playing out in the two largest cities, Sydney and Melbourne, with mean prices rising 16% and 14% respectively over the last year. There are signs and plenty of warnings from learned commentators that a deflation isn’t far away.

I’m a bit surprised there’s no mention of overseas investors in the Wolf piece, as I understand they have played a big role on the demand side in Canada, as they certainly have here.

And, in other news today, Moody’s says house price increases in NZ ‘closely resemble’ those in Spain, Ireland and the US on the eve of their housing market crashes.

We would like to thank the Aussie banks for their generous funding.

Australian banks are part of a much larger financial consortium.

And, conversely, the Aussie branches of Aussie banks are probably safe from NZ contagion. NZ Reserve Bank open-bank-resolution rules means the NZ branches will stay solvent by bailing in bondholders and depositors. This has been tested in Cyprus and will work well.

Thank you, Skippy.

You are right about that.

I worked on prudential and resolution matters from 2008 – 12 with the London Branches of the big Aussie banks and UK subsidiaries of NAB (Clydesdale and Yorkshire Banks) and wondered what was on their balance sheets and what attention APRA paid to what went on overseas.

Australia seems quite relevant. Wasn’t a similar scheme for “first time buyers” implemented there a few years ago?

What practical consequences turned out to be?

The “First Home Owners Grant” was introduced here in 2000, to offset the impact of the 10% GST (Goods and Services Tax – a value added tax) introduced in the same year. Initially it was about 7000 AUD (~5000 USD) and was subsequently doubled, then further increased, although the exact amount varies from state to state, and it’s available only to buyers of homes under a certain value.

I don’t think it’s had a great effect in driving up house prices, especially because it’s such a small fraction of the median Sydney house price of 1,123,991 AUD as at the end of 2016. First home buyers have been largely priced out of the larger city markets by competition from established owners, and domestic and foreign investors, the latter mainly from China. If anything, the ridiculous inflation of house prices has been driving up the grant.

For domestic investors, the attraction of minimally taxed capital gains in a bubble market are irresistible, and they get tax breaks on losses when interest on mortgages exceeds rental income. For Chinese investors it’s a safe refuge for capital and often part of a strategy to get permanent residency. There’s recently been talk of reducing or eliminating the investor tax breaks, but the neocon Turnbull government doesn’t want to upset its base by doing so. Chinese crackdowns on capital flight have also cooled the pressure from overseas investors.

Ahh…. Post Plaza blues….

disheveled… so much for screwing with traditional banking to allow capital dictating flows whilst banks seek yield in C/RE

Ding ding ding we have a winner, everyone always cites the denominator as the problem not the numerator. But whether it’s “Dollars / house” or “Dollars / pizza” the fact is that our central bank geniuses have completely obliterated the quality of the product they are supposedly such careful stewards of. It’s 3 A.M. and that smug delusional grandmother troll Yellen keeps adding gallon after gallon of vodka to the punchbowl. Then has the unmitigated gall to show up and give speeches about how great things are.

Thing is that the Fed is just a vassal that got filled up with ideologues, along with some international alphabetic institutions.

That history is well worn around here….

Thank you, Yves.

It sounds like the UK, too. The former colonies have learnt well.

One can see why Carney was hired by the British government.

Speaking of Carney, he gets / takes the credit for steering the Canadian financial system through the crisis. It’s never mentioned how Carney, along with the former finance minister Ralph Goodale, put pressure on OSFI head Julie Dixon, later at the ECB, to loosen bank regulations, so that Canadian banks could increase their US sub-prime related activities. Dixon pushed back and had to cite OSFI’s statutory independence to thwart their special pleading / lobbying for the banks. Behind every good man…

Canada operates a “twin peaks” approach to supervision. The (central) Bank of Canada ensures financial stability and acts as the lender of last resort. The Office for the Supervision of Financial Institutions regulates firms from prudential and conduct perspectives. This is similar to Australia has and what the UK had for the first dozen years of this century.

Correct me if I’m wrong, but didn’t Canada have a neoliberal prime minister before the last election. That could explain what is going on.

Thank you, Jackie.

Canuckistan did and still does.

We did, Stephen Harper – Conservative party (kinder, gentler Republicans) and we do now, Justin Trudeau – Liberal party (kinder, gentler Democrats). As far as those two parties are concerned, we pretty much have the same one party as the US, just a little more socialist on the left and no religious right (at least not a particularly powerful one). The kinder, gentler part is due to our healthcare system, regulated national banks, good public education system, and the fact that the MIC hasn’t totally taken over our economy.

I don’t kid myself though, the Neoliberals are alive and kicking here, the banks are currently facing consumer fraud accusations, housing bubble, Justin just did some major cheering for Trump’s Syria missile launching escapade, biased MSM, etc. We may have some things right but I fear for the future.

Hell, our third party, the NDP (more left, socialist than Liberals), had a chance leading up to the last election (we were pretty tired of Harper’s gang by then) and blew it by embracing austerity and budget balancing. Sigh. I’ve voted NDP my entire life – pointlessly because I live in a majority Conservative area. I voted strategically for the Liberals that year out of sheer disgust with the NDP. The Liberals won in my riding. And now we have Justin’s “sunny ways” – somehow cheering on Trump’s embrace of continuous war doesn’t strike me as particularly sunny.

I wouldn’t call the Liberal Party kinder or gentler. Corruption is corruption and all our career MPs are corrupt. I don’t think one can describe the liberal ones as being half pregnant.

What’s kinder and gentler is our universal health care system. It cushions the neo-liberal blows for 99% of the population. A cushion Americans do not have. The problem is that the 1% run the country – a colonial outpost of the Amerikaner Reich – and that 1% does not need universal health care. Consequently we’ve had a 20 year assault on the system, including a 2 decade doctors shortage. Make sure the system doesn’t work properly and you have an excuse to reform it – which means get rid of it. This process began with those kind and gentle Liberals led by Chretien. What Harper’s – call me Conservative – Reform Party did was small scale compared to the damage done in the 1990s.

Now we are set up for a housing collapse and an economic collapse, which Klein would point out will be the 1%’s excuse to really move against the health care system. At least we’ve a pop star PM to cushion us through that blow.

Klein would have pointed it out if he were still alive.

Naomi Klein – Shock Doctrine…sorry about that

I was only thinking of the Liberals vs. the Democrats and probably over simplifying for our USian friends. Totally agree about the corruption, etc. Kindness and gentleness nowhere near where I’d like it to be.

I’ve heard it said by Canadians that the good news is that Canada thankfully is often 10 years behind the cultural/social trends of the US. That’s also the bad news.

Also, I live in US semi-rural flyover country, economically stagnant at best. Real estate here has only budged up a small bit since 2007 and nowhere close to any bubble levels. I would imagine such areas also exist in Canada. Would that be the maritimes or portions of the prairie provinces?

I’m a Maritimer…and the common wisdom here is that we’ve been in a recession since 1873. (That’s when P.E.I. joined Confederation and messed everything up!) The benefit is no wild-mood-swings. All the being said, the new normal here is to borrow and borrow more. When you’re finished, borrow again. So while our home prices may not be the kicker, once Toronto and Vancouver plunge it will be the new regulations/interest rates that will punish our maritime utopia.

Fox Blew, I identify with your first sentence.

Our small province (population 753,914 approx.) is so far in debt that it will never get out. It all started with Orimulsion that cost the province quite a bit of money. We do not have the population density that would provide the taxes needed to run the province, which has a surfeit of elderly people, but as far as I know, we do not have a housing bubble. But a bubble elsewhere will probably affect us.

Our provincial government tries really hard to get businesses going which results in money being thrown at them and then the businesses collapsing. Our latest money has been thrown to Sears which may become bankrupt at any time.

But I wouldn’t choose live anywhere else in Canada!

You Maritimers certainly live in a beautiful part of the world. I spent 6 days in NB and NS a few years ago (didn’t make it to PEI, took one look at that long bridge at the end of a long drive and decided against it) en route to Newfoundland and Labrador with some camping at Cape Breton NP thrown in. Having spent much of my life in Louisiana it was interesting to see so many of the same Acadian surnames in places like Chetecamp–Boudreaux, Bergeron, LeBlanc, etc.

Glad you enjoyed your visit to the Maritimes. The Acadians have an interesting relationship with Louisiana because of their expulsion from our area (bad bit of history that). It is interesting to see how they adapted to Louisiana.

We spent 10 years in the Annapolis Valley. In 2004 the World Acadian Congress held it’s Acadian Reunion at Grand Pre, the shipping point for many of those expelled, including the mythical Evangeline. I wrote a story about the reunion for a program for the nearby city of Windsor’s Sam Slick Days. The next Acadian Reunion will be in Louisiana in 2019 (they occur every five years).

Nothing to do with Harper; what the article does not mention at all is the money pouring in from China (and some other places). At least in Vancouver, the housing market appreciation started around 1998, when HK was about to be transferred to China. It has never stopped – except for the 2008-2009 hick-up. After BC instituted the foreign buyer tax, a lot of the money went to Toronto. It is possible that such buyers will eventually adjust to the tax and/or learn o get around it (somehow). The article paints housing situation in Canada in a uniform manner – but there are regional differences. The bubble is mainly in Van and Toronto – but Van resembles San Francisco a lot – a beautiful place, with very limited supply of land (it is boxed in by water and mountains). Toronto is the main economic centre of the country. Canada is seen as a stable place and fairly welcoming of immigrants (except when it comes to providing them with jobs). Also, property taxes may constitute a large part of municipal budgets, but they are generally much lower than in the US. Additionally, a lot of the new construction is condos – which has made older condo units lose value. What appreciates mostly is the land (thus, detached houses). Not saying that the current dynamics of the C. housing market are sustainable long-term – but it is a bit more complicated than the article paints.

> That could explain what is going on.

That explains nothing. They have all been neoliberals for as far back as Mulroney.

What does explain it, is ‘marginal buyer’ and they are the Chinese elite, paying in cash and just like China has tens of millions of unoccupied concrete stores of wealth, the houses bought in Vancouver and Toronto sit empty.

This past weekend the Globe and Mail had a big two page spread about the Toronto housing market and touched this subject, explaining that is was racist to single out foreign Chinese buyers. That’s a diversion. It’s class based. The foreign Chinese buyers are not the slaves working on Apple’s Iphone assembly line for 85 cents an hour.

Wolf is right about the “authorities” not shutting the insanity down. They personally profit from it.

The weekend’s articles had a section titled “What can governments do to cool the housing market?”.

The federal government.

1 Create a national housing strategy to coordinate with the provinces and municipalities on issues of housing affordability, going beyond the existing strategy on social housing for low income earners.

More study is needed, to employ a whole slew of bureaucrats to fumble around and waste millions not addressing any problems.

2 Raise the portion of profits subject to capital gains tax on sales of non-principle residences to deter speculation and flipping.

The Chinese buyers are not speculators and flippers. They are money launderers.

3 Increase the first-time home-buyer RRSP (Registered Retirement Savings Plan) deduction above the $25,000 limit, allowing people to withdraw more to fund the down payment on their first home. Also, allow “inter-generational” transfers” under the plan, giving parents an efficient way to help with down payments.

Seriously delusional. Moar debt is the answer to competing with Chinese buyers.

4 Remove the GST (Gouge and Screw Tax) paid on municipal development taxes – a tax on a tax, according to the Canadian Home Builders Association – to make home buying affordable.

Yes, the federal government puts a sales tax on a municipal fee.

The suggestions for the Ontario Government

Impose a speculation tax on people who flip houses within a short period, perhaps within two or four years of purchase. The tax could apply to all homes or be limited to non-principle residences

Money launderers will pay any tax to clean their loot

Introduce a tax on foreign buyers who buy residential homes in the GTA (Greater Toronto Area), similar to the 15 percent tax imposed in British Columbia.

Money launderers will pay any tax to clean their loot.

Develop a progressive property tax for foreign owners, requiring people who own homes but do not live or work in Canada to pay an annual property-tax surcharge.

Do I need to repeat myself?

Prohibit foreigners from buying resale homes, except under limited circumstances, to curb speculation, but allow them to buy newly built homes to encourage investment in new housing stock

Hair splitting rules making. More study is needed.

Expand rent-control rules to cover more homes, helping to moderate rent increases for people who cannot buy.

. . . people who cannot buy. That would be just about every wage earner in Toronto.

Give municipalities a break from high-density development requirements to improve the supply of detached, single family homes, while also encouraging more innovative housing solutions. Target infrastructure such as transit to places where it is most needed

Moneta’s hair is on fire.

The suggestions for Toronto and other municipalities.

Impose a vacancy tax on homes left unoccupied by the owners, which would be collected by municipalities but would require provincial approval to implement. Vancouver is introducing a vacancy tax this year, set at 1 per cent of the assessed value of the home. It relies on the homeowner to declare whether a house is occupied or not.

Knock knock, anyone home?

Reduce development charges to make new homes more affordable. Development charges are paid by a builder to the local municipality to fund infrastructure costs such as roads and transit, and builders pass along the costs to new home buyers.

So, a provincial suggestion is to restrict foreign buyers to new homes, and a municipal suggestion is to lower the development charges to new home buyers. Why not eliminate all municipal charges, as the roads won’t be needed to run in front of empty houses.

Fast-track zoning approvals for residential development and streamline other approval times for all stages of projects to help get more housing units constructed.

Let’s say every one of these policies were implemented, would it really make a difference? All this talk is about meeting increased demand without looking at where demand is coming from.

From one of the articles:”The house is sold, but nobody’s home”

“Are you building for people or are you building for investment?” he asks. “Who are you trying to house?”

Mr Yan, a third generation Vancouverite of Chinese descent, faced criticism two years ago when his study of land-title data in three affluent Vancouver neighborhoods, found two thirds of recent buyers had non-anglicized names and thus , he concluded, were new immigrants.

Critics called his methodology racist, but Mr Yan acknowledged he could only deduce that buyers were purchasing with money from mainland China because those dependent on the local job market could not afford the multimillion-dollar homes he studied.

In Toronto’s red hot real estate market, recently sold houses sit empty because offshore speculators are often looking for a place to park their money and don’t want the headache of finding and managing tenants, said John Pasalis, president of Realosophy Realty Inc.

Like the stock market, GTA real estate has become a commodity to be traded, he said.

“Rather than putting it in the stock market, they’ve just been buying houses. It’s like the new gold bars, you know what I mean?”.

See how insane it really is? Lots of talk about tax this or tax that, change a few rules here and of course the obligatory years of study required to get the rules just right. All doomed to failure, when a simple rule would stop this insanity in a heartbeat.

Require all foreign buyers of Canadian homes to submit their tax returns for the last five years to establish that incoming money is legitimate.

When government is to blame for the bubble the one certainty is that no government action shall fix the problem.

How about another simple rule: stop central bank manipulation and let the market decide interest rates. Or how about a fixed interest rate of, say, 5%. Then let everyone plan their lives accordingly around it.

Visited Toronto to catch up with family. Found that the largest employment among new immigrants that were visible in their churches, social organs, etc was real estate related, not just brokerage, but more often helping in money laundry, arranging marriages of convenience, etc. There is a large amount of money still in the process of being cleaned up for use in Canada, and neither the Federal Governments nor the provincial governments seem half concerned to rain on the parade. Too many oligarchy in the 3 main party are all busy making hay, even when they expect the bubble to eventually pop. My expectation is the bubble has a long way to go based on what prices are in China, but I could be wrong.

IDontKnow, on what do you base your oligarchy of the three parties? So far, we do not live under an oligarchy as the people elected appear to represent the people and are doing a good job trying to provide Canada with representative governance. So far our government is not dependent on billionaires and millionaires.

Who are the oligarchs you refer to who run the country?

Waste of typing on the deaf, blind but not mute. Start here, and see if you can educate yourself. I won’t be back here to see how you did. Too much low hanging fruit to fight this battle.

http://www.theglobeandmail.com/news/politics/canada-violating-international-law-with-saudi-arms-sale-expert/article29640135/

LEGAL GAMBLING

The gloom is fading from the real estate situation. More nibbles during the last few weeks

than for the last three years. If January brings us

good rains, this next year will open the door to

the sunshine—a case of rain bringing the sun.

It is to be hoped, however, that there will

never be another boom. The crash of the boom

of 1923 was due to the same causes that wrecked

the Wall street stock market. People sold what

they did not own. They made a payment down

in the hope of getting the property off their hands

before it began to burn. Real estate fell into the

hands of sharp-shooting gamblers who had no interest in land.

To them it was just a pile of blue

chips on a roulette wheel.

Harry Carr, in Los Angeles Times. 1929

Rinse and repeat for every country till it all comes crashing down.

It was a relief to see the chart where Canada’s way off in the stratosphere, with the US about to repeat the bubble peak. Mission accomplished, Fed! /s

How much do you want to bet that the banks will be bailed out this time too, and austerity imposed on the people because of supposed short falls in funds due to rescuing the poor banksters.

Naturally. These people do know what they are doing. The reason Canada exists is to have a central authority to plunder on behalf of the banks. They’ve been doing it for 150 years. With the economic collapse the big five banks will be saved – I expect a bail-in, not a bail out – and the credit unions will go under. Thus the cartel eliminates all competition.

On what do you base your prediction, EoinW?

Basically on my opinion. Maybe also based on the government making bail-ins legal. Why would they do that if they didn’t plan to use them? Also based on history.

I fear we shall disagree on principle because you believe Canada has representative government while I believe the only people represented by our governments are the special interest groups of the 1%.

I think it’s a reasonable extrapolation from what we’ve seen in the EU, combined with the deficit hysteria that’s been encouraged in the populace. “Bailouts” are unpopular because they’re used as an excuse to cut social spending. Citizens won’t look on future ones with favor. That leaves “bailins”, which have terrible side effects. Money is a creation of the human imagination, so let’s just mark up the computers with whatever is required and put the offenders in jail. Debt forgiveness will prevent damage to the real economy, which is shaky at best. (No, you can’t have inflation with wages going nowhere. That’s something else, called poverty.)

I moved to the GTA last year from the US. It has exactly the same feel as DC 11 years ago. Same litany of excuses from the locals about how there will be no crash…foreign buyers, Toronto is a International city, no subprime mortgages here (aka no subprime people like the states), stricter standards for lending, etc. Dunno when it’ll end, but it’s eerily familiar…

There has been fraud in the real estate business and there is speculation as well. Things will not end well for the home owner. I’m not sure that the banks are doing anything fraudulent, but who knows for sure?

Economist Dean Baker called the USA housing bubble when the equivalent rent of purchasing a US home was much higher than simply renting one.

To justify the high purchasing prices, a buyer would be banking on future price appreciation on an asset that currently could not be rented out to pay its carrying costs.

Do we have this figure for the Canadian market?

The population of Canada (35.16 million, 2013) is about the same population as California (38.8 million, 2014)

It is as if the great white north CA is following in the USA CA’s housing bubble footsteps.

Our housing bubble is not based on banks making money from selling derivatives in sub-prime mortgages. We have our own way of creating bubbles, thank you very much!

It looks like the Canadian index diverged significantly from the US index after 2007. From then the Canadian market outpaced the US market by (an eyeballed) ~50%. Looks crazy but keep in mind that the CAD has fallen 30% relative to the USD during the same time, and the Canadian housing market didn’t crash like the US market did through 2008. Still in alarm bell territory though.

Interesting to see: http://www.tradingeconomics.com/canada/households-debt-to-gdp

Canadian household debt is roughly 100% of GDP now. Just before the Great Recession, U.S. household debt was more than double that (it’s receded to slightly less)

But…by Steve Keen’s estimate, the Canucks aren’t in danger…yet.

Coincidentally, Michael Hudson comments on Vancouver’s housing bubble here.

Toronto had a brutal real estate crash in the last eighties and early nineties. I’d be interested to see the comparison chart above if its start point was, say, 1980.