Yves here. Get a cup of coffee. This article is a big geeky at points by virtue of using a lot of acronyms. But be patient! It contains important information about the restructuring of the US workforce.

By William Lazonick, professor of economics at University of Massachusetts Lowell. Originally published at the Institute for New Economic Thinking website

How the U.S. New Economy Business Model has devalued science & engineering PhDs

This note comments on Eric Weinstein’s, “How and Why Government, Universities, and Industries Create Domestic Labor Shortages of Scientists and High-Tech Workers,” posted recently on INET’s website.

At the outset of his paper, Weinstein argues that:

Long term labor shortages do not happen naturally in market economies. That is not to say that they don’t exist. They are created when employers or government agencies tamper with the natural functioning of the wage mechanism.

The contention, written from the perspective of the late 1990s, is that in the first half of the 1990s an oversupply (“a glut”) of science and engineering (S&E) labor that depressed the wages of PhD scientists and engineers was primarily the result of the promotion of a government-university-industry (GUI) agenda, coordinated by the National Science Foundation under the leadership of Erich Bloch, head of the NSF from 1984 to 1990. Beginning in 1985, the NSF predicted a shortfall of 675,000 S&E personnel in the U.S. economy over the next two decades. According to a study by the NSF’s Policy Research and Analysis (PRA) division, quoted by Weinstein, salary data show that real PhD-level pay began to rise after 1982, moving from $52,000 to $64,000 in 1987 (measured in 1984 dollars). One set of salary projections show that real pay will reach $75,000 in 1996 and approach $100,000 shortly beyond the year 2000.

Weinstein argues that the GUI agenda (inspired by Reaganomics) sought to prevent these salary increases. He contends that the legislation that enabled this oversupply was the Immigration Act of 1990 that expanded the H-1B nonimmigrant visa program and instituted employment-based immigration preferences. Given that most of these foreigners came from lower-wage (Asian) nations, it is assumed that they were attracted to work in the United States by what for them were high wages, whereas Americans with S&E PhDs began to shun S&E careers as the salaries became less attractive.1

There is a lot missing from Weinstein’s perspective, which is also the perspective of demographer Michael Teitelbaum, who Weinstein cites extensively and who was at the Sloan Foundation from 1983 to 2013, rising to Vice-President in 2006. Weinstein and Teitelbaum view the salaries of scientists and engineers as being determined by supply and demand on the labor market (“the natural wage rate” and “the natural functioning of the labor market”). From this (neoclassical) perspective, they completely ignore the “marketization” of employment relations for S&E workers that occurred in the U.S. business sector from the mid-1980s as well as the concomitant “financialization” of the U.S. business corporation that remains, in my view, the most damaging economic problem facing the United States. This transformation of employment relations put out of work large numbers of PhD scientists and engineers who previously had secure employment and who enjoyed high incomes and benefits as well as creative corporate careers. The marketization of employment relations brought to an end of the norm of a career with one company (CWOC)—an employment norm that was pervasive in U.S. business corporations from the 1950s to the 1980s, but that has since disappeared. 2 The “financialization” of the corporation, manifested by massive distributions to shareholders in the forms of cash dividends and stock buybacks, undermined the opportunities for business-sector S&E careers.

The major cause of marketization was the rise of the “New Economy business model” (NEBM) in which high-tech startups, primarily in information-and-communication technology (ICT) and biotechnology, lured S&E personnel away from established companies, which offered CWOC under the “Old Economy business model” (OEBM). As startups with uncertain futures, the New Economy companies could not realistically offer CWOC, but instead enticed S&E personnel away from CWOC at Old Economy companies by offering these employees stock options on top of their salaries (which were typically lower than those at the Old Economy companies). The stock options could become extremely valuable if and when the startup did an initial public offering (IPO) or a merger-and-acquisition (M&A) deal with an established publicly-listed company.

The rise in S&E PhD salaries from 1982 to 1987, identified in the NSF study that Weinstein quotes, was the result of increased demand for S&E personnel by New Economy companies, with some of the increase taking the form of stock-based pay, which in the Census data drawn from tax returns is lumped in with salaries.3 Competing with companies for S&E personnel, the rise of the NEBM in turn put pressure on salaries at Old Economy companies as they tried to use CWOC to attract and retain S&E labor in the face of the stock-based alternative. By the last half of the 1980s, this New Economy competition for talent was eroding the learning capabilities of the corporate research labs that, in many cases from the early twentieth century, had been a characteristic feature of Old Economy companies in a wide range of knowledge-intensive industries. 4

The CWOC norm under OEBM had provided employment security and rising wages from years-of-service with the company and internal promotion of S&E personnel (significant proportions of whom in science- based companies had PhDs). As I show in my book Sustainable Prosperity in the New Economy?, the beginning of the end of CWOC was the transformation of IBM, the world’s leading computer company, from OEBM to NEBM from 1990 to 1994. In 1990, with 374,000 employees, IBM still bragged about its adherence to the CWOC norm (calling it “lifelong employment”), claiming that the company had not laid off anyone involuntarily since 1921. By 1994 IBM had 220,000 employees, and, with senior executives under CEO Louis Gerstner themselves getting fired for not laying off employees fast enough, CWOC was history. Over the course of the 1990s and into the 2000s, other major Old Economy companies followed IBM’s example, throwing out of work older employees, many of them highly educated and with accumulated experience that had previously been highly valued by the companies.

Already in the early 1990s, the marketization of employment relations was responsible for a precipitous decline of employment at the corporate research labs that had underpinned the twentieth-century growth of Old Economy high-tech companies, of which IBM was an exemplar. In 1993, a conference held at Harvard Business School decried the “end of an era” in industrial research, with papers from the conference appearing in a volume Engines of Innovation, published in 1996.5 In the introductory chapter, entitled “Technology’s Vanishing Wellspring,” conference organizers and volume editors Richard Rosenbloom and William Spencer argued that industrial research (as distinct from product development) of the type that had been carried out by corporate labs in the “golden era” of the post- World War II decades “expands the base of knowledge on which existing industries depend and generates new knowledge that leads to new technologies and the birth of new industries.” In the more competitive environment of the 1980s and 1990s, however, in the new industries of “biotechnology, exotic materials, and information products (and services based on them)”, Rosenbloom and Spencer observed that it was more difficult for companies “to keep new technologies fully proprietary”, and hence “research activities have been downsized, redirected, and restructured in recent years within most of the firms that once were among the largest sponsors of industrial research.” 6

There is little doubt that S&E PhDs were major victims of this transformation. But the problem that they, along with most other members of the U.S. labor force, have faced is not simply the marketization of employment relations. For reasons that I have fully described in my publications cited above, the transition from OEBM to NEBM was accompanied by the “financialization” of the U.S. business corporation as, from the last half of the 1980s, U.S. boardrooms and business schools embraced the ideology that, for the sake of superior economic performance, a business enterprise should be run to “maximize shareholder value” (MSV). Instead of retaining employees and reinvesting in their productive capabilities, as had been the case when CWOC had prevailed, MSV advocated and legitimized the downsizing of the company’s labor force and the distribution of corporate revenues to shareholders in the forms of both cash dividends and stock repurchases. 7

With the demise of CWOC, older employees were the most vulnerable, not only because they tended to have the highest salaries, but also because the shift from OEBM to NEBM was a shift from proprietary technology systems, in which employees with long years of experience were highly valued, to open technology systems that favored younger workers with the latest computer-related skills (often acquired by working at other companies). Under CWOC, older employees were more expensive not because of a “natural wage rate” that was the result of supply and demand on the S&E labor market, but because of the internal job ladders that are integral to a “retain-and-reinvest” resource-allocation regime. The salaries of S&E employees tended to increase with years of experience with the company, with a defined-benefit pension (based on years of service and highest salary levels) in retirement. These types of secure employment relations, and the high and rising pay levels associated with them, were the norm among established high-tech companies in the mid-1980s, but, as exemplified by IBM’s transformation, started to become undone in the early 1990s, and were virtually extinct a decade later, as Old Economy companies either made the transition to the NEBM, or disappeared.8 The culprit in the weakening in the demand for, and earnings of, S&E PhDs from the early 1990s was the demise of CWOC—a phenomenon that Weinstein (and Teitelbaum) entirely ignore.

With the rise of NEBM, companies wanted employees who were younger and cheaper, and that was the major reason why at the end of the 1980s the ICT industry pushed for an expansion of H-1B nonimmigrant visas and employment-based immigration visas. It is not at all clear that an influx of PhDs from foreign countries via these programs was undermining the earnings of S&E PhDs in the early 1990s. Most H-1B visa holders had Bachelor’s degrees when they entered the United States. At the same time, large numbers of non-immigrant visa holders entered the United States on student visas to do Master’s and PhD degrees, and then looked to employment on H-1B visas to enable them to stay in the United States for extended periods (up to seven years).9 It was in response to the availability of advanced- degree graduates of U.S. universities that in 2005 an additional 20,000 H-1B visas were added to the normal cap of 65,000. Without the influx of foreign students into U.S. S&E Master’s and PhD programs, many of these programs would not have survived. Through this route, the H-1B visa program has made

more foreign-born PhDs available to corporations for employment in the United States. But I posit that it has been the demise of OEBM and rise of the NEBM, not an increased supply of foreign-born PhDs, that has placed downward pressure on the career earnings of the most highly educated members of the U.S. labor force.

Besides giving employers access to an expanded supply of younger and cheaper high-tech labor in the United States, the H-1B visa along with the L-1 visa for people who had previously worked for the employer for at least one year outside the United States have another valuable attribute for employers: the person on the visa is immobile on the labor market—he or she can’t change jobs—whereas under NEBM the most valued high-tech workers are those who are highly mobile. This mobility of labor can boost the worker’s pay package but is highly problematic for a company that needs these employees to be engaged in the collective and cumulative learning processes that are the essence of generating competitive products. Under OEBM, CWOC was the central employment institution for college-educated workers precisely because of the need for collective and cumulative learning. But it was the rise of NEBM, not the Immigration Act of 1990, that undermined CWOC. The growing dominance of NEBM with its open systems architectures then led employers to make increased use of H-1 and L-1 visas in the 1980s, prompting them to get behind an expanded cap for H-1B visas in the Immigration Act of 1990. 10

Once OEBM was attacked by NEBM, with its offer of stock-based pay, these corporations became fertile territory for the adoption of the ideology that a company should be run to “maximize shareholder value” (MSV). This momentous transformation in U.S. corporate governance occurred from the late 1980s, legitimizing the transition from a “retain-and-reinvest” to a “downsize-and-distribute” corporate- governance regime. In the 1990s and beyond, this corporate-governance transformation laid waste to CWOC across corporate America, knowledge-intensive companies included. 11 With corporate research eroding as high-tech personnel responded to the lure of stock-based pay from NEBM companies— including not only startups but also those such as Intel, Microsoft, Oracle, Sun Microsystems, and Cisco Systems that during the 1990s grew to employ tens of thousands of people, most of them with stock- based pay—senior executives at the Old Economy high-tech companies began to see their company’s stock price as not only key to the size of their own stock-based pay packages but also as an instrument to compete for a broad-based of high-tech personnel. As exemplified by IBM in the 1990s and beyond, a company’s stock price could be raised by laying off expensive older workers and using the resultant “free” cash flow (as the purveyors of MSV called it) to do stock buybacks. 12

As I have documented in detail, over the past three decades this legalized looting of the U.S. business corporation has only gotten worse. As shown Table 1, driven by stock buybacks, net equity issues by U.S. nonfinancial corporations were, in 2015 dollars, minus $4.5 trillion over the decade 2006-2015. In 2016 net equity issues were minus $586 billion. Net equity issues are new stock issues by companies (in this case nonfinancial corporations) minus stock retired from the market as the result of stock repurchases and M&A deals. The massively negative numbers in recent decades are the result of stock buybacks. I have calculated net equity issues as a percent of GDP by decade to provide a measure of the value of buybacks done relative to the size of the U.S. economy. In both absolute inflation-adjusted dollars and as a percent of GDP, buybacks have become a prime mode of corporate resource allocation in the U.S. economy. Contrary to popular belief, in aggregate U.S. corporations fund the stock market, not vice versa. Note that almost all of the buybacks in the decade 1976-1985 occurred in 1984 and 1985 after in November 1982 the U.S. Securities and Exchange Commission adopted Rule 10b-18 that gave license to massive buybacks, in essence legalizing systemic stock-price manipulation and the looting of the U.S. business corporation.

Table 1: Net equity issues of nonfinancial corporations in the United States, 1946-2015, by decade, in 2015 dollars, and as a percent of GDP

| Decade | Net Equity Issues,

2015$ billions |

Net Equity Issues

as % of GDP |

| 1946-1955 | 143.2 | 0.56 |

| 1956-1965 | 110.9 | 0.30 |

| 1966-1975 | 316.0 | 0.58 |

| 1976-1985 | -290.9 | -0.40 |

| 1986-1995 | -1,002.5 | -1.00 |

| 1996-2005 | -1,524.4 | -1.09 |

| 2006-2015 | -4,466.6 | -2.65 |

Source: Board of Governors of the Federal Reserve System, Federal Reserve Statistical Release Z.1, “Financial Accounts of the United States: Flow of Funds, Balance Sheets, and Integrated Macroeconomic Accounts,” Table F-223: Corporate Equities, March 9, 2017, at https://www.federalreserve.gov/releases/z1/current/.

Over the years 2006-2015, the 459 companies in the S&P 500 Index in January 2016 that were publicly listed over the ten-year period expended $3.9 trillion on stock buybacks, representing 53.6 percent of net income, plus another 36.7 percent of net income on dividends. Much of the remaining 9.7 percent of profits was held abroad, sheltered from U.S. taxes. Mean buybacks for these 459 companies ranged from $291 million in 2009, when the stock markets had collapsed, to $1,205 million in 2007, when the stock market peaked before the Great Financial Crisis. In 2015, with the stock market booming, mean buybacks for these companies were $1,173 million. Meanwhile, dividends declined moderately in 2009, but over the period 2006-2015 they trended up in real terms.

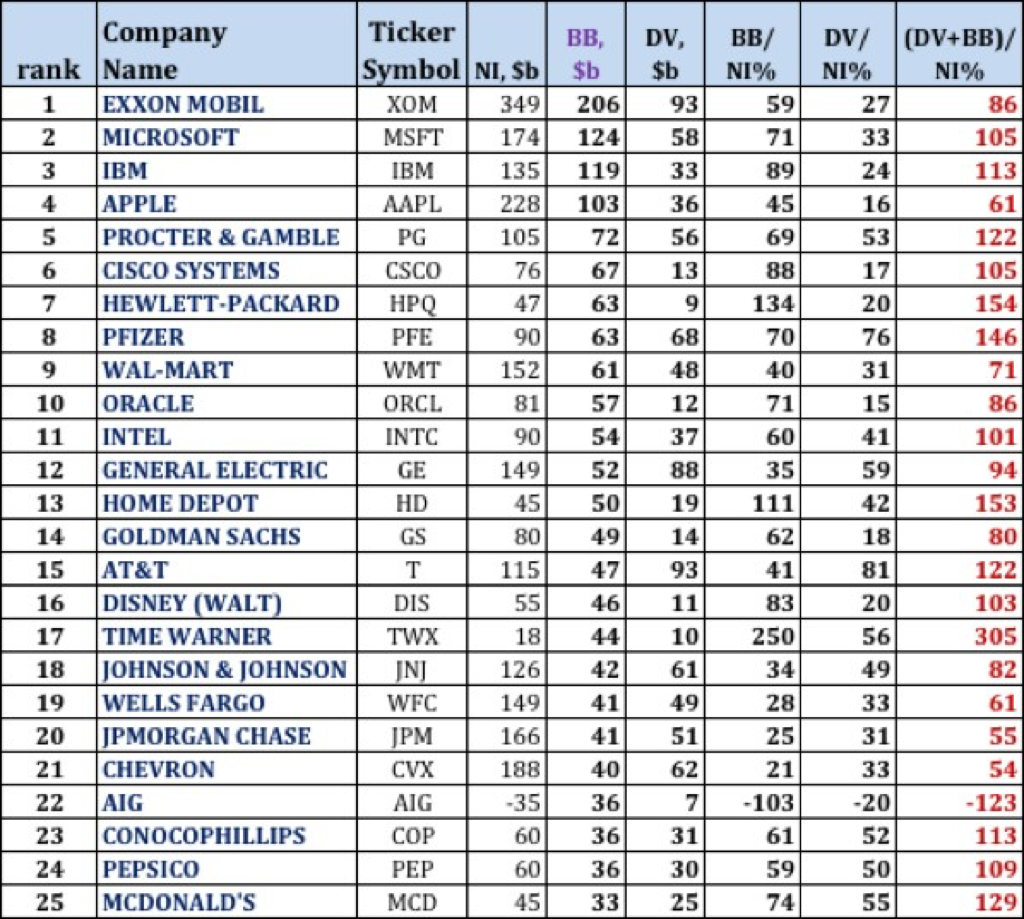

Among the largest repurchasers are America’s premier high-tech companies. Table 2 shows the top 25 repurchasers over the decade 2006-2015. Among the companies that one would expect to employ large numbers of S&E PhDs are Exxon Mobil, Microsoft, IBM, Apple, Cisco Systems, Hewlett Packard, Pfizer, Oracle, Intel, General Electric, Johnson & Johnson, Chevron, and ConocoPhillips. We do not know the historical numbers of S&E PhDs at these companies, but I hypothesize that numbers would be much higher than they are if the companies were not financialized. Many of America’s largest corporations

routinely distribute more than 100 percent of net income to shareholders, generating the extra cash by reducing cash reserves, selling off assets, taking on debt, or laying off employees.13 As I have shown, the only logical explanation for this buyback activity is that the stock-based pay that represents the vast majority of the remuneration of senior corporate executives incentivizes them to manipulate their companies’ stock prices, leaving most Americans worse off. 14

Table 2: The 25 largest stock repurchasers among U.S.-based corporations, 2006-2015, showing net income (NI) stock buybacks (BB), and cash dividends (DV)

Source: Calculated from data downloaded from Standard & Poor’s Compustat database.

The Weinstein-Teitelbaum focus on a GUI design to expand the supply of S&E PhDs ignores the transformations of corporate governance and employment relations that have decimated career employment for this group of workers over the past three decades. At the same time, the channeling of trillions of dollars of value created in U.S. nonfinancial corporations to the financial sector has opened up jobs on Wall Street that can provide quick income bonanzas for highly-educated members of the U.S. labor force, many of whom might have otherwise pursued S&E careers. Among the wealthiest of these Wall Street players are corporate predators—euphemistically known as “hedge-fund activists”—who have billions of dollars in assets under management with which they can attack companies to pump up their stock prices through the implementation of “downsize-and-distribute” allocation regimes and, even if it takes a few years, dump the stock for huge gains.15

In the case of Apple, we have shown how Carl Icahn used his wealth, visibility, hype, and influence to take $2 billion in stock-market gains by buying $3.6 billion of Apple shares in the summer of 2013 and selling them in the winter of 2016, even though he contributed absolutely nothing of any kind to Apple as a value-creating company.16 Apple CEO Tim Cook and his board (which includes former U.S. Vice President Al Gore) helped Icahn turn his accumulated fortune into an even bigger one by having Apple repurchase $45 billion in shares in 2014 and $36 billion in 2015—by far the two largest one-year stock buybacks of any company in history. Imagine the corporate research capabilities in which Apple could have invested, and the S&E PhDs the company could have employed, had it looked for productive ways to use even a fraction of the almost unimaginable sums that it wasted on buybacks.17 From 2011 through the first quarter of 2017, Apple spent $144 billion on buybacks and $51 billion on dividends under what it calls its “Capital Return” program. But the company is “returning” capital to shareholders who never gave the company anything in the first place; the only time in its history that Apple has ever raised funds on the public stock market was $97 million in its 1980 IPO. 18

A number of “hedge-fund activists”—Nelson Peltz of Trian, Daniel Loeb of Third Point, and William Ackman of Pershing Square are among the most prominent—have been able to put up one or two billion dollars to purchase small stakes in major high-tech companies, and, with the proxy votes of pension funds, mutual funds and endowments, have been able put pressure on companies, often by placing their representatives on the boards of directors, to implement “downsize-and-distribute” regimes for the sake of “maximizing shareholder value.”19 In the summer of 2013, Nelson Peltz’s Trian Fund Management bought DuPont stock worth $1.3 billion, representing 2.2% of shares outstanding. In May 2015 Peltz lost a proxy fight to put four of his nominees on the DuPont board, but in October 2015 DuPont CEO Ellen Kullman, who had opposed Peltz, resigned, and the new management began to implement Peltz’s plans to cut costs and hit financial targets, to be done in the context of a merger with Dow Chemical, which had fallen into the hands of another corporate predator Daniel Loeb. Meanwhile, in October 2015, Peltz bought 0.8 percent of the shares of General Electric (GE), and began to pressure another iconic high-tech company to cut costs and increase its stock price. GE was already a financialized company that had done $52 billion in buybacks in the decade 2006-2015 (see Table 2)—a massive amount of money for the purpose of manipulating its stock price. Undoubtedly responding to additional pressure from Peltz, during 2016, GE, with profits of $8.0 billion, paid out $8.5 billion in dividends and spent another $22.0 billion on buybacks. This financialization of U.S. high-tech corporations undermines, among other things, the employment of S&E PhDs.

We need research on this subject to quantify its impacts. I submit, however, that such a research agenda must focus on transformations of regimes of corporate governance and employment relations. Relying on the neoclassical economist’s notion of a “natural wage rate” determined by the interaction of supply and demand, Weinstein, a mathematician, and Teitelbaum, a demographer, missed the transformations in corporate governance and employment relations that marked the late 1980s and early 1990s—and beyond—and as result, in my view, failed to understand the changing fortunes of S&E PhDs in the marketized, globalized, and financialized New Economy. Given the dominance of what I have called “the myth of the market economy”20 in the thought processes of economists, Weinstein and Teitelbaum were by no means alone in erroneously focusing on supply and demand on the PhD labor market while failing to recognize the centrality of corporate governance and employment relations in determining the earnings and career prospects of S&E PhDs. It is time for new economic thinking on these critical questions.

Footnotes

1 The Weinstein paper appears to have been published prior to the adoption of the American Competitiveness and Workforce

2 William Lazonick, Sustainable Prosperity in the New Economy? Business Organization and High-Tech Employment in the United States, W. E. Upjohn Institute for Employment Research, 2009; ; William Lazonick, “The New Economy Business Model and the Crisis of US Capitalism,” Capitalism and Society, 4, 2, 2009: article 4; William Lazonick, Philip Moss, Hal Salzman, and Öner Tulum, “Skill Development and Sustainable Prosperity: Collective and Cumulative Careers versus Skill-Biased Technical Change,“ Institute for New Economic Thinking Working Group on the Political Economy of Distribution Working Paper No. 7, December 2014, at https://www.ineteconomics.org/ideas-papers/research-papers/skill-development-and-sustainable-prosperity-cumulative-and-collective-careers-versus-skill-biased-technical-change; William Lazonick, “Labor in the Twenty- First Century: The Top 0.1% and the Disappearing Middle Class,” in Christian E. Weller, ed., Inequality, Uncertainty, and Opportunity: The Varied and Growing Role of Finance in Labor Relations, Cornell University Press, 2015: 143-192.

3 Almost all gains from exercising employee stock options and the vesting of employee stock awards are taxed at the ordinary income-tax rate, not at the capital-gains tax rate, with taxes withheld by the employer at the time that options are exercised or awards vest. Hence these stock-based gains are reported as part of “wages, tips, other compensation” on IRS Form 1040.

4 Matt Hopkins and William Lazonick, “Who Invests in the High-Tech Knowledge Base?” Institute for New Economic Thinking Working Group on the Political Economy of Distribution Working Paper No. 6, September 2014 (revised December 2014) at www.ineteconomics.org/ideas-papers/research-papers/who-invests-in-the-high-tech-knowledge-base

5 Rosenbloom and Spencer, Engines of Innovation. Richard Rosenbloom was David Sarnoff Professor of Business Administration at Harvard Business School, while William Spencer was CEO of SEMATECH.

6 Ibid., pp. 2-3.

7 William Lazonick, “Profits Without Prosperity: Stock Buybacks Manipulate the Market and Leave Most Americans Worse Off,” Harvard Business Review, September 2014, 46-55; William Lazonick, “Stock Buybacks: From Retain-and-Reinvest to Downsize-and-Distribute,” Center for Effective Public Management, Brookings Institution, April 2015 at http://www.brookings.edu/research/papers/2015/04/17-stock-buybacks-lazonick.

8 Lazonick, Sustainable Prosperity, ch. 3. For an important case study that includes the fate of the once renowned Bell Labs, see William Lazonick and Edward March, “The Rise and Demise of Lucent Technologies,” Journal of Strategic Management Education, 7, 4, 2011.

9 Lazonick, Sustainable Prosperity, ch. 5.

10 Ibid., ch. 2. Note that the H-1 visa for workers in specialty occupations was renamed the H-1B visa in 1990 after the H-1A visa was created specifically for nurses.

11 Lazonick, “Stock Buybacks”; Lazonick, “Labor in the Twenty-First Century.”

12 Lazonick, “Profits Without Prosperity”; Lazonick, “Stock Buybacks.”

13 Lazonick, “Labor in the Twenty-First Century”: William Lazonick, “How Stock Buybacks Make Americans Vulnerable to Globalization,” Paper presented at the Workshop on Mega-Regionalism: New Challenges for Trade and Innovation, East-West Center, University of Hawaii, Honolulu, January 20-21, 2016, at http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2745387

14 Lazonick, “Profits Without Prosperity.”

15 Rachel Butt, “Here are some of the 10 biggest activist money managers and some of their most impressive bets,” Business Insider, June 17, 2016, at http://www.businessinsider.com/top-10-biggest-activist-investors-2016-6. Matt Hopkins, William Lazonick, and Jang-Sup Shin are engaged in research on the methods and gains of these predatory value extractors.

16 William Lazonick, Matt Hopkins, and Ken Jacobson, “What we learn about inequality from Carl Icahn’s $2 billion ‘no brainer,’” Institute for New Economic Thinking Ideas & Papers, June 6, 2016, at https://ineteconomics.org/ideas-papers/blog/what-we-learn-about-inequality-from-carl-icahns-2-billion-apple-no-brainer.

17 See William Lazonick, “What Apple should do with its massive piles of money,” Harvard Business Review Blog, October 20, 2014, at https://hbr.org/2014/10/what-apple-should-do-with-its-massive-piles-of-money

18 William Lazonick, “Numbers show Apple shareholders have already gotten plenty,” Harvard Business Review Blog, October 16, 2014, at https://hbr.org/2014/10/numbers-show-apple-shareholders-have-already-gotten-plenty

19 With Matt Hopkins and Jang-Sup Shin, I am involved in project on how the U. S. SEC has accommodated and even encouraged the corporate value extractors who call themselves “shareholder activists” or “hedge-fund activists.”

20 William Lazonick, Business Organization and the Myth of the Market Economy, Cambridge University Press, 1991

It was indeed a tough article to read to the end, but this nugget near the end was worth it:

“But the company is “returning” capital to shareholders who never gave the company anything in the first place; the only time in its history that Apple has ever raised funds on the public stock market was $97 million in its 1980 IPO.”

Wow!

As one who actually lived this process, I can tell you that the premise of this article must be basically true.

Back in the early ’90s I set out to fill in the gaps of my own computer science background (I’m actually an astrophysicist). And my classes were filled entirely by people from Asia, except for myself and one other Anglo. Job ads in the journals were already beginning to ask for PhD level CompSci with emphasis on, e.g., voice recognition, for a pay rate of $26K (1992 !). That was definitely appealing to the foreign students and unappealing to American STEM students.

During that period, the only job market for native PhD STEM students became the American Defense and Intelligence agencies, because they required security clearances and US Citizenship. I found myself driven in those directions too.

Now, after many years doing my own thing, I look around at the STEM marketplace and I am shocked to find large numbers of compatriots being pressured into the GIG Economy, and pay rates are appalling by former standards. There is a serious lack of expenditure on research and development today.

From another perspective this is just over investment in education. Technology for the most part is just increasing complexity and increasing complexity has diminishing returns. With energy becoming less available, we probably need a lot less complexity.

I was reading the article earlier at work and thought I would finish reading the comments

Relevant in many ways. Take intensive horticultural methods which could increase yields on agricultural products. Organic gardening (a garden is anything smaller than a field (about 40 acres)) can yield up tremendous amounts per square yard because the soil is tilled intensively and carefully. The organic content of the soil in commercial farming districts is very low as the methods used (particularly intensive nitrogen implants) destroy the Soil microorganisms thereby lessening the amount of nutrients available to vegetative methods in the roots. So by taking the technology level down (small equipment and lots of loving labor, lots of mulching a careful cohabitation of plants) the yields per acre can be in fact astronomical with organic methods.

Which is why/how several million suburbanites could grow enough food to make several million survival differences in several million suburban persons’ and/or families’ lives.

That’s still science applied a different way.

“American Defense”. hmmm, wonder if sending the jobs and know-how to China and India in the belief both will always be the US’s willing subcontractors is such a good idea (from a US national defense point of view).

I wouldn’t say that there is a lack of R&D — it just isn’t done in-house any more. Gone are the Bell Labs and the Xerox PARCs; welcome to the brave new world of university partnerships and non-profit R&D shops (most famous: the Southwest Research Institute).

Basically the rich are waging class war. That’s the problem no matter how you slice and dice this one.

This whole “New Economy” has been one big war on wages. I mean look at the collusion too between Google, Apple, and Intel to keep wages low.

https://www.wired.com/2015/01/apple-google-tech-giants-reach-415m-settlement-poaching-suit/

Considering how slap on the wrist this was, what incentive is there to not do it again? They know they can get away with this. Not to mention, this H1B and L1B program has become a way to keep wages low in the technology sector. In many sectors, there really isn’t a “shortage” of Americans. Oh and for all the talk of these companies being “innovative”, if they are prioritizing money on stock buybacks over R&D, that’s not really innovative as much as it is trying to boost salaries by capitalizing on the huge cash reserves they get for being the dominant companies in their sector. Same could be said about Exxon. Not much being spent on R&D means that they are more about rent seeking rather than innovation. Perhaps not yet as blatant as those patent trolls, which are little more than shell companies that sue other companies over patents, but that is their ideal business model.

I think that at the end of the day, even though many engineers in the tech companies are in the top 10% in terms of income percentile, their interests are closer aligned with working class people. The other issue is that I bet when many of these engineers turn into their 40s, they are going to witness first hand the very real age discrimination that exists in the technology industry.

Basically it comes down to, the rich are really greedy. The issue right now for the rich is that they are desperate to keep the looting from happening, while people are increasingly aware that the system is against them. Bernie Sanders got a lot of support in the Valley and while it is a very Democratic leaning area, I cannot imagine that Trump’s anti-H1B and L1B stance would have been opposed by the average employee. I think that the rich are not going to concede anything and that there needs to be some sort of solidarity union amongst all workers.

Patent trolls might fill a role by making patents valuable and encouraging inventors. If patent trolls are regulated, this has to be done in such a way so as not to weaken the patent system or to prohibit licensing, the means by which many inventors can get paid. We also need more private inventors and a good hard look at why the government should give away patent rights to university inventors. The Bayh Doyle act comes to mind.

Also, if R&D or funding for R&D start ups ( other than internet and some biotech) does not exist, to whom are inventors suppoed to sell or license inventions ? The real trolls are the hedge funds that pay for lawsuits against small business, inventors, and, entire countries. These are among the various schemes hedge funds use in order to extort money for the underfunded pensions and endowments for whom they work.

Is there a single person here who has worked on Wall Street (writ large) who can convince us that his job or his company had an overall positive effect on the US and/or world economy over five years, ten years, or twenty-five years?

I’ll go first: three investment banks under my belt and one was a giant fnancial and moral sucking machine called Citi. The other two were wannabe’s but certainly did not add value.

While “maximizing shareholder value” is the huge problem wrecking our economy, having watched the genesis of New Economic Paradigm through the experiences my wife and most of my friends going through the Silicon Valley start-up Tulip-mania from the mid-’80’s through the first decade of th e 2000’s, the author is hitting important points while over-simplifying and missing other equally important points, such as the role of the “Peace Dividend” in the collapse of aerospace and research funding, and the role of the Reagan and Clinton “tax reforms” in driving stock-based compensation systems.

Early on, the use of stock-based compensation drove down wage-based compensation and increased the role of financial speculators. Today, the speculators get the stock, but wages remain suppressed and only foreign workers will accept them. The author is correct: the causes are complicated, but the result drove down wages and job security for STEM workers.

I got my Ph.D. in biology in 2000. It was absolutely the worst decision in my life. In fact, it actually destroyed my life, reducing me to near homelessness and starvation because—GASP—-regular employers (like office jobs, retail etc.) will not hire Ph.D.s. There there is the lovely student debt that has grown exponentially, as my wages could not make the smallest dent. Convicted felons make more that I do. So to make a long story short, I started a small on-line business 9 years ago and got the FFFFF OUT of the rotten POS United States and moved to Ecuador, one of the most progressive countries in the world. I cannot believe how the US abuses its national treasures—is is truly a POS and I do not miss it for one day. I hope the US crashes and rots in hell.

Good for you! I wish I could do the same…that is, leave the country!

Out of curiosity: what happened to your student debt when you emigrated?

Considering Quito myself but I look at the weather forecast and it is RAIN RAIN all the time!! Any tips for those wishing to follow your direction? I’m in IT ( but not overly educated). What’s the job market like in Quito for Americans?

I empathize with the poster. The same thing happened in law.

I got a J.D. in 1998, thinking that it would open doors to a middle-class life. It has been nothing short of terrible. Many JD’s will not practice law; those who do will only practice for a short time before being replaced with a new law grad.

Applying, seeking an income, to a non-law job produces a range of disbelief to anger from employers that someone with a JD is applying to a nonlaw job. Reality is there are few law jobs for the multitudes of JDs.

The legal profession is broken. Law schools exist to support the former Supreme Court law clerks and Ivy League grads. Indebtedness of JD graduates is ignored.

It breaks my heart.

Its not just PhDs. I know several Engineers who advise their children to do something else. It’s just not worth the amount of effort that is required to be put into it and there is no future hope of a turn around. As bad as it is for graduates today, it’s only going to get worse.

They’re catching up with us arts and humanities majors.

Sad!

I am a civil engineer and one of my daughters is studying to become a structural engineer. I would not have advised her to go into engineering because of the problem with the H-1B visas.

But who am I to advise? Who can know the future? The world is just changing too fast now to really be able to advise our children on what careers to take. Besides, one of the advantages of studying engineering as you can work anywhere in the world.

I bought houses for each of my children and told them if they wanted to go to college they could trade the house in for the education. I personally think they should have considered keeping the house and working minimum wage jobs that they enjoy. But both of them are pursuing educations, my son to be history teacher!

I’m a high school teacher…on call, at least. If asked by a student about jobs, I will always suggest (if appropriate) a trade: plumber, electrician, mechanic etc. Not “sexy” but dependable & reasonably well remunerated.

Post WWII labor overplayed its hand by the 1970’s. Corporations and their decided they had had it. Corps and management proceeded to change the rules of the game on everything–courts, trade, taxation and regulation. These countermeasures have had disastrous long term consequences. Corporations now run the country in a fascist manner. Government capture has created myriad problems beyond financialization, only one tool in the corporate quiver. Oligopolies across most to all industries comes to mind. Rail, air, health insurance, banking, defense, telecom, entertainment….

But this paper is also lamenting a lack of business capex, which is directly correlated to public investment. When you decided to offshore manufacturing and fail to invest in infrastructure you get a double whammy that hits business capex. Increasing regulation and taxation on small and midsize companies has lead to consolidation. Approximately 5000 public companies have likely been consolidated. Sarbanes-Oxley added millions to compliance costs making it highly uneconomical to be a public company with less than $300 million in revenue. Dodd-Frank has created increases in cost for financial firms that had nothing to do with the crisis. In fact, the big banks have benefited enormously from implementation of this legislation.

For anyone else who was confused by the terminology, as I was briefly, capex = capital expenditure.

Not sure about the labor part overplaying their hand. They just wanted an even wage and productivity rise.

It is capital IMO that has overplayed its hand and the rise of neoliberal economics which has led to declines in public R&D spending. There isn’t anything like the Space Race anymore.

Frankly, labour underplayed its hand. At one point it had capital by the throat, and should have finished it off then. If peace is not an option, you should utterly and permanently destroy your enemy.

Labor did NOT overplay its hand after WW2 — Taft-Hartley was a HUGE smack-down to labor after the privations of the Depression followed by the war effort. The decent wages during the post-war period were part of a concerted effort to convince workers that they didn’t need unions and to be complacent.

Labor leadership certainly became corrupt from all the money sloshing around without global competition due to war devastation of Europe and Japan, the Cold War, and the death throes of colonialism, but this was not due to “overplaying” their hand.

Even Mark Blyth says labor overplayed its hand. See his comments on ‘the Lucas Critique’ beginning at 2:00.

https://www.youtube.com/watch?v=vSS4GCA__As

Blyth is wrong, Sluggeaux has got it right. Part of Blyth’s insight comes from a much deeper appreciation for history than other s. But he’s a poli sci guy, not a historian, so he misses the singular impact that Taft-Hartley, and for that matter, McCarthyism, had on the labor movement and alternatives to neocapitalism. Labor missed an opportunity, but only because they got thrown off the train between stations. If I was to put a date on it, I’d say 1944, specifically the DNC where Wallace was swapped out for Truman. Elections do matter.

Reply to cr@May 12, 2017 at 12:01 pm

The trends described in the post predate by decades the communist tyranny [/s] imposed by those bills.

The wholesale closing or offshoring of corporate research labs already started in the 1980s,

driven in part by corporate raiders like Milken, Pickens and Icahn.

IBM, GM, Kodak, Xerox, GE … they all had labs that provided jobs to STEM graduates

and a stream of discoveries and inventions to generate more jobs.

Now these are largely gone or substantially off-shored.

What has happened to corporate R&D shouldn’t be used as an excuse to make life easier

for the Wall Street culture largely responsible for it.

Yes, any burdens imposed by Sarbanes Oxley are the fault of numerous unethical business executives over recent decades, and not the fault of people in government.

When I was a student in IT, the shining stars at the firmament of industrial computer science and engineering R&D were Xerox PARC, DEC SRC, ATT Bell Labs and IBM Yorktown Heights.

They are gone or a shadow of their former selves.

William Lazonick, “Stock Buybacks: From Retain-and-Reinvest to Downsize-and-Distribute,” Center for Effective Public Management, Brookings Institution, April 2015 at http://www.brookings.edu/research/papers/2015/04/17-stock-buybacks-lazonick.

See Lazonick’s footnoted paper for many loving particulars. Especially note the details of how Rule 10b-18 offers no protection from abuse and (no news to NC readers) is a pillar of general corporate asset-stripping.

P. S. pages 10 and 11 of Lazonick’s pdf lay out Rule 10b-18 in full.

Thanks. Tremendous article!

Engineering long-term career arc has been an issue since at least my father’s generation (those born during WWI). Longer tenure (mid to late mid career) engineers were being eased out for young grads. When I was in a ChemE program in the 70s, advice was to follow the engineering degree with either law or a business degree because the odds of a long career doing engineering was not great. No one advised going for a PhD in engineering.

My father had a PhD in chemical engineering.

When I asked him why he got the degree, which didn’t seem necessary for someone who spent much of his career in industrial R&D, he said, “I’m like Mallory climbing Mount Everest. I got that degree because it is there.”

So, there you have it. My old man getting that degree because he wanted to. And because my mother was willing to support both of them while he worked on it.

To me, this is the money quote (literally):

“Many of America’s largest corporations routinely distribute more than 100 percent of net income to shareholders, generating the extra cash by reducing cash reserves, selling off assets, taking on debt, or laying off employees … the only logical explanation for this buyback activity is that the stock-based pay that represents the vast majority of the remuneration of senior corporate executives incentivizes them to manipulate their companies’ stock prices…”

This not only applies to the STEM sector, but nearly every large corp. in America. “Earnings quality” (i.e stock price) takes precedence over everything else leading to the crapification of products & services and devaluation of employees.

Thank gawd this type of thinking wasn’t around when Jonas Salk was working on the polio vaccine.

Which begs the question: what discoveries are we missing out on now because of this short sighted approach?

There’s probably not a discovery to be made that this economic system couldn’t turn to crap.

“In November 1982 the U.S. Securities and Exchange Commission adopted Rule 10b-18 that gave license to massive buybacks, in essence legalizing systemic stock-price manipulation and the looting of the U.S. business corporation.”

How can you have “looting” without lootees? The stockholders aren’t complaining. If any party is being disadvantaged by borrowing to fund stock buybacks, it’s existing bondholders. As David Swensen describes in an extended example in Pioneering Portfolio Management, managers compensated by stock options tend to treat corporate debt holders quite shabbily by piling on more debt, compromising the interest coverage ratio.

High tech companies use stock buybacks to offset their widespread granting of stock options which — absent Rule 10b-18 — would badly dilute existing stock holders over time.

Trying to paint the well-disclosed practice of stock buybacks as “looting” is histrionic ax grinding on Lazonick’s part. Over-leveraged companies are going to regret it in the next recession. But that’s a lamentable social phenomenon in a bubble-driven economy. Those who disagree with it are free to sell short over-leveraged stocks — perhaps a more meaningful way of expressing dissent than scribbling academic screeds.

And political dissenters are free to emigrate.

Well Jim, ponzi schemes work pretty well for those at the top. I suppose we shouldn’t worry about it until we start getting complaints..

Actually though, watching the train wreck that is the outlook for the youngest generation today, provides some grim amusement. For instance noting that the “bubble-driven” economy composed of companies desperate to prevent their stock becoming “badly diluted” by having fire sales on capitol and expertise that probably took their predecessors decades to build can really only have one outcome. Depression, misery, socialism. Maybe we skip the Mao route this time, maybe not.

Here’s some related “histrionics” of your channeling D.D…. an excerpt of a debate about “creative destruction” (emphasis mine) from 1991(context), chronologically, roughly following the tandem of Ronnie and Maggie.

Gregory Peck: “The Robber Barons of old at least left something tangible in their wake — a coal mine, a railroad, banks. THIS MAN LEAVES NOTHING. HE CREATES NOTHING. HE BUILDS NOTHING. HE RUNS NOTHING. And in his wake lies nothing but a blizzard of paper to cover the pain. Oh, if he said, “I know how to run your business better than you,” that would be something worth talking about. But he’s not saying that. He’s saying, “I’m going to kill you because at this particular moment in time, you’re worth more dead than alive.”

https://www.youtube.com/watch?v=xJRhrow3Jws

Danny Devito: “Let’s have the intelligence, let’s have the decency to sign the death certificate, collect the insurance, and invest in something with a future…”Ah, but we can’t,” goes the prayer. “We can’t because we have responsibility, a responsibility to our employees, to our community. What will happen to them?” I got two words for that: WHO CARES? Care about them? Why? They didn’t care about you. They sucked you dry. You have no responsibility to them. For the last ten years this company bled your money. Did this community ever say, “We know times are tough. We’ll lower taxes, reduce water and sewer.”

https://www.youtube.com/watch?v=62kxPyNZF3Q

In this statement: “managers compensated by stock options tend to treat corporate debt holders quite shabbily by piling on more debt, compromising the interest coverage ratio.” you suggest what might limit the corporate stock buyback trend might not be legislation but future bond buyers refusal to accept the corporation’s terms on new debt..

Perhaps there will be a requirement to preserve a debt/equity ratio within a range, perhaps a minimum interest coverage ratio will be required.

Perhaps a debt buyback provision will be triggered if more corporate stock is purchased.

Low interest rates make bond buyers more desperate for yield, so it seems unlikely this will happen near term.

A future bondholders’ revolt might put a damper on this corporate stock buyback trend before any legislation ever does.

IBM. Poster child of everything wrong at the executive-level and the shareholder-level.

Oho,

Yes, the IBM reference is interesting.The author gives an ordinal lead to IBM as a mover from the OEBM to NEBM. I ask myself if, from a mere one large corporation managing perspective, this was IBM’s 11th hour response to the by then devastating rise of its competitors like Apple & Microsoft. Also the irony that it did not help IBM at least in the midterm. So, IBM was the prime mover to initiate some aspects of a model change -change which every major player adhered to- in response to a new technological disadvantage vs. competitors, and in turned did not seem to do much for IBM in the immediate years. Although, if I recall well, IBM was immersed in many political battles and internal problems, legal and otherwise. Nevertheless, I doubt there was a historic inevitability on IBM’s ordinal force. Outstanding work by Lazonick

Let me quote a noted tech analyst on IBM :

“IBM is the poster child for shenanigans. Last month, IBM reported its 20th quarter in a row of declining year over year revenues….. a 13% drop in earnings, profit margins that declined in every business segment ( much worse than expected ), free cash flow that plummeted over 50% year over year and an earnings “beat” of 3 cents per share. How could this “beat” happen? ….. a negative tax rate of -23%…. This is why they pay the CEO Rometti the big bucks ( estimated at $50 to $65 million last year).”

And this is one of the Bluest of the Blue Chip companies in the world.

I read IBM spent a fortune at that time defending itself against monopolistic claims litigation. This was happening while Microsoft and Apple were clearly consolidating their oligopolistic empires. I read reports stating Oracle initial breakthroughs were taken from IBM’s research work.

Really fine piece, thanks.

Also, the quality of the readers’ comments is some of the highest I’ve seen in years of following NC

Not sure if anyone watches “Silicon Valley”, but here is a quote that seems fitting:

Season 2 – Bad Money

The midget billionaire was there to destroy not to create hence what do you need profit to accomplish that for?

With all the financialization the only products of S&P500 corporates are their stocks and they are recently very bad in selling that too having to borrow a cool $Trillions to buy stocks back or pay a bribes (dividends on supposedly growth stocks) to market mass concentrated monopolistic investors.

Just wanted to point out that there is one more link in the chain to be followed: the financiers would not have such an easy time playing Nero with our economy, if the banking sector were still properly constrained by a gold standard (=limited supply of printed credit), the risk of bank runs by outraged consumers, the Glass-Steagall separation of commercial from investment banking, personal rather than corporate punishment for fraud and abuse, antitrust enforcement, etc.

In addition, the rise of 401(k) based investing, in which workers are tax-incentivized to buy in to the corporate stock scheming, but lack the normal shareholder voice in corporate governance, has taken the chains off the looters as well.

It’s time to end the impunity. The government has been corrupted by the corporations, so only a populist uprising will produce reform. The uprising will require sacrifices of time, income, security. It will require boycotts of products that people like, but whose producers and vendors are evil. The products will not disappear while demand persists – but the producers and vendors must be brought to heel.

Consider the following inductees into the Corporate Hall of Shame:

Wells Fargo – customer abuse

United Airlines – customer abuse

UBER – employee abuse; legal system abuse

Mylan (Epi Pens) – Monopolistic price abuse

Hewlett Packard (spyware on laptops) – customer abuse

… pick an industry, you’ll find a Hall of Shame candidate. Hit them all in the wallet until they reform.

If we as consumers don’t exercise that power (hitting them in the wallet), nothing can be accomplished in terms of reigning in these crooks.

The impact on the Grads was secondary a byproduct of a larger agenda which included the transfer offshore and consolidation of “IP” of the entire American, EU and Asian industrial economies along with the withdrawl of capital, while at the same time intentionally sabotaging future innovations with the handicap of diversity.

Who got the loot and capital?

Usual suspects.

Go fly a kite

ISTR a guy named Ben Franklin, who flew a kite during a thunderstorm …

How is it not racketering for the numbers runners to gang up (so to speak) on a company so they can get their cut on the biz from sitting on their butts?

The quarterly growth demanded by the financiers reminds me of those movies where the mobster shakes down merchants monthly or weekly for their “protection.”

So it’s the financial sector taking everything over, and running it into the ground for short term profit. Greed is winning. So ubiquitous, so dreary, hopeless. We probably won’t survive our own short sightedness. Dragged back into the primordial ooze by our evolutionary heritage.

This is related to the Lasonick article:

“the returns to companies’ R&D spending have declined 65% over the past three decades.

Not coincidentally, this decline in companies’ research quotient or RQ (a metric I’ve developed that measures R&D productivity, or how much output they get for their innovation inputs) mimics the decline in U.S. GDP growth over the past 30 years.”

https://hbr.org/2017/03/is-rd-getting-harder-or-are-companies-just-getting-worse-at-it

Is R&D Getting Harder, or Are Companies Just Getting Worse At It?

Despite the importance of innovation to companies, as well as to the broader economy, despite the 250% rise in the number of scientists and engineers engaged in R&D, and despite all the experts dedicated to helping companies innovate, the money companies spend on R&D is producing fewer and fewer results. . .

So, a supply and demand problem?

When scientists and engineers come up with idiocy such as Juiceroo, the well of ideas appears empty.

No one got the memo from Milton, from way back in 1960, that individuals are now their own means of production and are capitalists, whether they like it or not.

Looked at that way, your employer is the enemy because the value you create within the company is stripped from you and transferred to the boss. All you get out of your effort is a declining paycheck while your boss get’s rich, sitting on his or her ass in an air conditioned office with extended lunch breaks, while the whip is snapping on the sweaty shop floor.

Your boss is a sadistic middle man, paying as little as possible for your labor, selling your output for as much as possible, keeping the difference, all the while enjoying treating you like crap.

It’s called experience!

Yves, another wonderfully great post.

But this is just another sliver of the overall pie. We are only out to gain for ourselves. Everyone, from the local garbage man to Icahn, human survival instincts will cause us to act to benefit ourselves first, without a care of future results.

Apple says “we could invest all that money in the next phone device. But that same investment could bankrupt us and all that money we had could go down the toilet. It’s better to suck up all the available money now, and if the ship sinks, at least the gold won’t go down with it”.

Said another way. “We could all be gone tomorrow. What matters is what happens today.” Who cares if I dump trash in the ocean. I don’t have to drink that water. And I have insulated myself from the effects from my ways so that I won’t ever have to realize the consequences.

It all comes back to accountability. If you aren’t held responsible for your actions, then you will continue to escalate the amount of looting and destruction that you can do.

Saw a number of what I call “H1-B” employment ads in the late 80’s – 90’s: they were looking for an EE/CS – masters degree person w/10 years exp in a technology that was 4 years old & the wage was ~$10K/year. Obviously no US citizen would apply for a crap job like that so ‘obviously’ the employer was ‘forced’ to look overseas for ‘suitable’ candidates.

I did Sr. Tech work in support of electronics manufacturing for 38 years but was forced into involuntary retirement when the electronics hardware mfg. industry left central TX in 2008, and I am bitter as hell…