By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

Minneapolis Fed President Neel Kashkari was the latest Fed official to claim in an essay – thus following in the time-honored footsteps of former Fed Chair Ben Bernanke – that “spotting bubbles is hard,” that the Fed cannot see them, and that if it could see them, it shouldn’t do anything to stop them because it had only “limited policy tools,” and because “the costs of making policy mistakes can be very high.”

But it’s OK to use these “limited policy tools” to inflate the greatest bubbles the world has ever seen and then preside over the damage they cause to the real economy before they even implode.

Neither Kashkari nor anyone else working at the Treasury Department in 2006 – when they were tasked by Secretary of the Treasury Hank Paulson to look for signs of trouble because they were “due for some form of crisis,” as he writes – could see any bubbles, not even the housing bubble although it was already beginning to deflate.

“It is really hard to spot bubbles with any confidence before they burst,” Kashkari writes, specifically naming stock prices and house prices. “Everyone can recognize a bubble after it bursts, and then many people convince themselves that they saw it on the way up.”

So here are some visual aids I put together for Kashkari and other Fed governors. It will help them “spot” the beautiful housing bubbles in the US – because bubbles really aren’t hard to recognize before they burst, if you want to recognize them.

What’s hard to predict accurately is when they’ll burst.

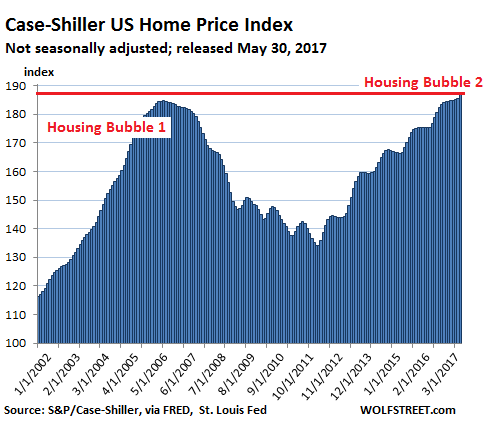

The S&P CoreLogic Case-Shiller National Home Price Index for March was released today. It jumped 7.7% year-over-year, far outpacing growth in household incomes. This has been the case for years. In fact, real household incomes are almost back where they were in 2006 (/sarc). So what could go wrong?

At 198.26, the index surpassed the peak of Housing Bubble 1 in May 2006 by 11% (data via FRED, St. Louis Fed):

Since everyone called it a housing bubble after it had imploded, even Kashkari, today’s phase in the wondrous market is Housing Bubble 2, no?

The other day, Zillow reported that the national median home value in April rose 7.3% year-over-year to $198,000. It too beat the peak of Housing Bubble 1 ($196,600) set in April 2007. “It only took a decade,” Zillow said.

The National Association of Realtors reported that the median price in April hit $246,100, which is 6.8% above the peak of Housing Bubble 1 ($230,400 in June 2006).

The Case-Shiller Index appears to have more stature at the Fed than Zillow or the NAR. So we’ll use it here in our visual aids for the Fed.

It is based on a rolling-three month average; hence, today’s release was for January, February, and March data. So it’s always behind. Instead of median prices, it uses “home price sales pairs,” for example, a house sold in 2011 and then again in 2017. Its algorithms adjust this price movement over the years and numerous other factors into a data point that becomes part of the index. The index was set at 100 for January 2000. So an index of 200 means prices have doubled in the past 17 years.

Housing is local. Therefore housing bubbles are local. But if enough of them come together at the same time, the housing bubble takes on national proportions. This is the phase, as the above chart shows, that the US has now reached: In some metros, prices are still below the peak; in other metros, prices are setting new records. Overall, prices have surpassed those of Housing Bubble 1.

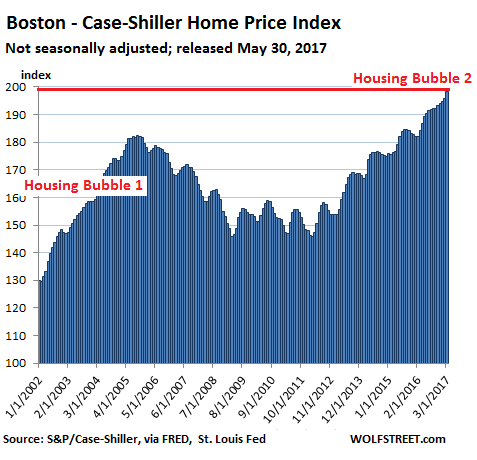

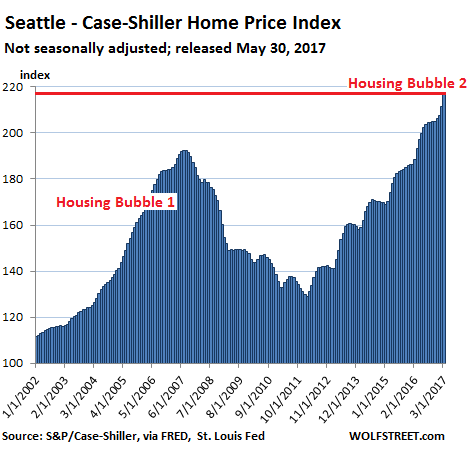

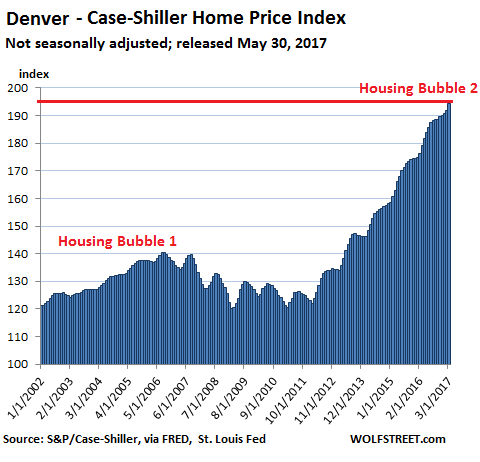

So dear Fed Governors, please have a look at some of the beautiful housing bubbles around the country. As you’ll see, they’re really not “hard to spot.”

This is the Boston metro, where the current home price index is now 9% above the peak of Housing Bubble 1 (Nov 2005):

Prices in the Seattle metro have surged even more, pushing the index 13% above the peak of Housing Bubble 1 (Jul 2007):

And here’s Denver’s house price bubble, where prices have soared a breath-taking 38% since the prior peak (Aug 2006):

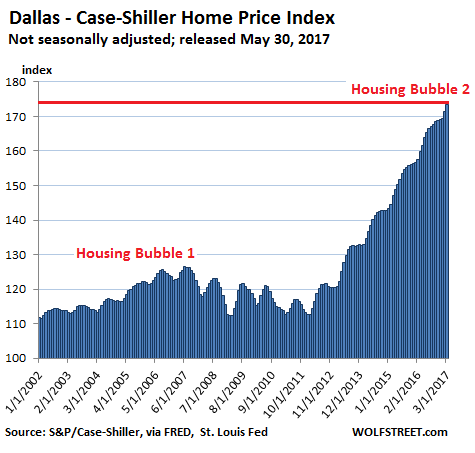

I know that folks in the Dallas-Fort Worth metro felt left out during Housing Bubble 1. I heard many complaints about that at the time. They also missed out on much of the house price crash.

But they sure know how to make up for things. Home prices have now surged by 37% since the last peak in June 2007:

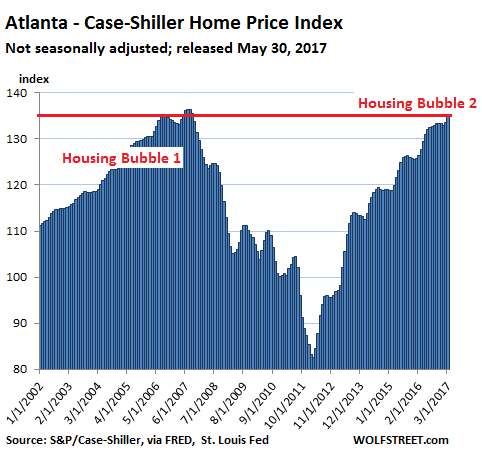

The Atlanta metro isn’t quite back to the peak of Housing Bubble 1, but it’s near-perfect V-shaped bubble recovery will soon hit it:

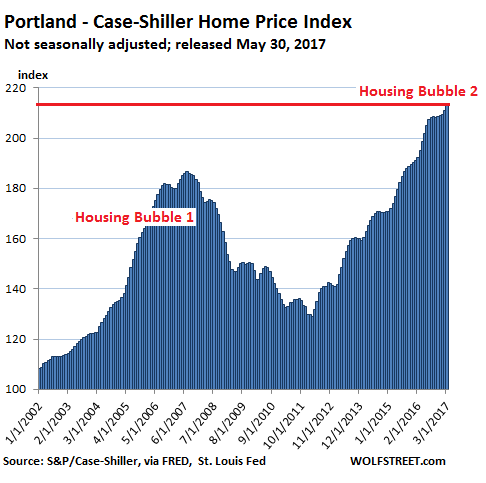

For the Portland house price bubble, the index is now 14% above the prior peak:

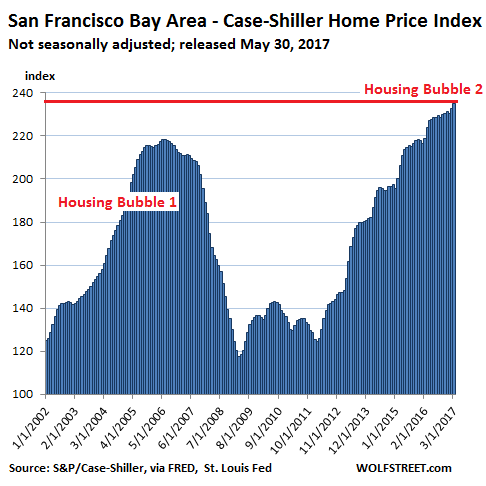

The Case-Shiller Index for San Francisco, which covers the five-county Bay Area, is now 7.7% higher than at the peak of Housing Bubble 1. However, in the city (and county) of San Francisco, the median home price has soared 47% above the prior peak (Nov. 2007). This is the chart for the five-county Bay Area house price bubble-crash-bubble:

The city of San Francisco is also the first city in this lineup where the median home price is now heading south on a year-over-year basis. During Housing Bust 1, the City was late to react. This time, it seems to be ahead of the pack.

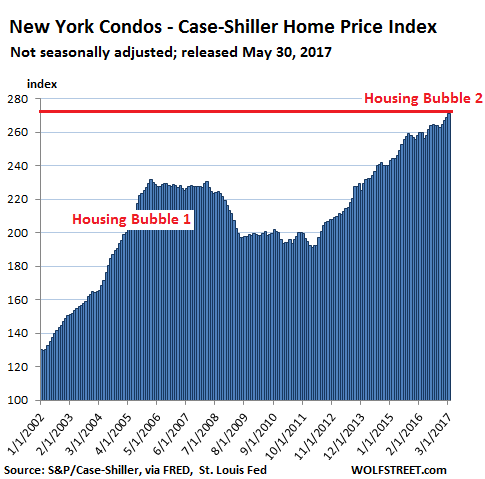

And the Case-Shiller index for the condo price bubble in New York City has soared 17% above the prior peak (Feb. 2006), with prices nearly tripling since 2000:

The local housing bubbles across the US blew up with spectacular consequences, all in their own time frames. Plenty of local home price bubbles are now coming together to form a national home price bubble. So it’s really not hard to spot them, Mr. Kashkari.

Sure, there has been some inflation – 17% since 2006, based on the Fed’s favorite core PCE measure. Home prices in some of the cities have already reached a new peak even after inflation. And besides, it’s not a housing bubble until it reaches the inflation-adjusted point where the prior one took down the financial system? Is that the point when Housing Bubble 2 begins, instead of ends? If so, what would Housing Bust 2 look like? A vision too ugly to behold.

What’s hard to predict is the moment when housing bubbles begin to deflate. With monetary policies still in easing mode, with the federal government subsidizing the housing market in numerous ways, and with homes having become a securitized asset class for global speculators, house price bubbles can inflate – as we have seen – far more than a rational human mind might think possible. But we do know that they will deflate.

In San Francisco, the signs and numbers are already lining up. Read… Will these 2 Forces Crush San Francisco’s Housing Bubble?

In my neighborhood, I am watching the Chinese Flipper House. Purchased in late 2015 by Chinese investors. A group of students (at least they look like students) has been living in the place while it was being fixed up.

It went on the market in December. Asking price was nearly three times the 2015 purchase price. There has been one modest price reduction, but the place still hasn’t sold.

All Chinese, regardless of age, look like math students. [it’s the squinty eyes]

Even the girls.

Showing your age Craazyman. They know how to make-up these days.

On a related note, Zillow is trying to bring AI to the real estate market.

https://therealdaily.com/editorials/artificial-intelligence-ai-real-estate-negating-monetizing-agents-experience/

What could go wrong?

Limited brain cells is what’s hampering the Fed.

I guess this go around rents are trying to keep up the housing price bubble. At least on the coasts.

Then new RE construction is somewhat subdued, so industry is not overbuilding themselves into a supply problem.

So all is well on that front. Except – imputed rents are still not moving, per the BLS data jockeys. That’s 40% weighting in the CPI…So the FED is missing their inflation target by a whisker or two…or they can’t see inflation because the numbers are faked?

It’s always something with the “tools”, not the monkeys that bang around with ’em.

What’s hampering the Fed is that they are actually in the “bubble-blowing business” – but need for the time being to pretend otherwise.

Hence, the ridiculous, nonsensical statements about the non-existence of bubbles, when they are practically everywhere.

My belief is that what’s hampering the Fed is that not enough little old ladies are sitting at the table for fleecing yet. There’s still money sitting on the sidelines.

To be fair, Kashkari said “It is really hard to spot bubbles with any confidence before they burst”. So he is not really saying there is no bubble, but he just cannot tell when, and make policy in correct timing before, a bubble bursts.

I do not think that is better, rather worse, since he is ok with bubbles and can see them, but does not care about the consequences. So he is seeing all these bubbles and just saying “oh well!”

But if it bursts, it’s no longer a bubble. The “before they burst” part is redundant.

Disagree. I can blow a soap bubble and know it is a bubble before it is burst.

The lifespan of the bubble is a matter of its’ properties; type of soap, ratio of water to soap, etc. Kashkari is essentially saying “I have no idea what this soap bubble is made of”.

Right. A bubble isn’t a bubble if it’s burst. He knows full well what a bubble is before it bursts, he just doesn’t want to look at it, which is what PKM II is saying.

They should call them pimples or zits. Something less attractive than bubbles, and containing ickiness.

Really, he’s saying that it’s preferable to have a bubble burst and all the associated pain with that, then it is to take a preemptive measure and end the economic frat house party early. He’s coming down squarely on the side of the TBTF players. who will just get bailed out again if the new housing bubble (or the auto loan bubble, or the college loan bubble, or the tech bubble, etc.) bursts. They have nothing to lose in that scenario, whereas being told they have to cool their heels could hurt potential returns. The plebs lose their houses, jobs, and retirement savings, well that’s their fault for not having the work ethic to get themselves a seat on the board

They still have to pretend that there is excessive regulation. There cannot be a bubble until everything is fully de-regulated and the kids can go totally wild again without any adult supervision. They are at least pretending to still be at the house now. trump and Mnuchin need some reason to eliminate Dodd-Frank in its entirety. The post-factual fact that there is no bubble and the financial sector is repressed by Communists should be good enough to spur the appropriate de-regulation.

Of course! No one wants to be blamed for crashing the economy!

If one sees a bubble, why not deploy a few pins?

Easy enough to spot a housing bubble – if a family earning the median income for a given housing market can’t qualify for a median-priced house, there’s a bubble. Same for median rents versus median salary.

What institutional incentive is there for ANY Fed official to “pop the bubble”.

If they are successful in seeing a late stage bubble and try to deflate it gradually, if they are successful it will be little noticed or appreciated.

If they are successful in bubble observation and call the world’s attention to it and the economy goes into a slump, they might get credit for spotting the bubble AND for causing the slump.

There is no percentage, other than bragging rights, of Fed officials pointing out a stock market/housing market bubble.

What might be interesting is a monthly graph of the volume of and total mortgage commitment to home purchases, over the last ten years, made by all Fed officials/higher level employees.

If Fed employees have pulled back from buying homes for personal consumption, then they might be quietly suggesting there is a bubble building in their regional markets.

Is this information available?

Amazon’s stock price briefly hit $1001.20 per share yesterday.

The trailing 12-mo. price-to-earnings ratio is 186.

No bubble here either. They will undoubtedly “grow into a more reasonable valuation”.

Bezos has already announced his plan to seed and procreate the galaxy with consumers.

It’s because Bezos knows investors, and Congress, are idiots. Also, he is relying heavily on verbal positive reinforcement of his Universal view.

He should apply for non-profit status.

He has already achieved non-prophet status.

The Fed can expand the quantity of money forever and the only problem is inflation IN SOME MADE-UP INDEX THAT THEY ALL AGREE ON. But if things that aren’t in that made-up index rise markedly, they just aren’t sure what to call it so they ignore it, or even worse, they say it’s good for us. I can’t believe that the citizenry of the USA are so stupid that they can’t see that inflation is…well…inflation. It’s either good, bad or benign. How can it be possible that inflation is good when they say so and not good when they say not. The plain truth is that the favored inflation index is controlled by restricting the money available to the masses who must purchase those goods to survive. Keep lowering their wages in real terms and keep subsidizing production of essential items and our magic (fraud) can continue. With respect to assets though, we find that one of the few things that economists get right:: when too much money is chasing too few goods, prices rise substantially. But be assured folks, that is not inflation and it is certainly not a “Bubble”. Why? Because those that are doing this to us say so. We are witnessing a colossal con which is nothing more than a sophisticated game of Three Card Monte, and it probably would not be that harmful were it not for the fact that our real estate (and therefore our abodes) are inflated beyond affordability and the price increases are not reflected in the made-up index. I am not surprised that the PPB are doing this, but I am astounded that we let them get away with it.

Goebbels, The Bigger The Better.

“When everything costs you more that’s a good thing, really, no, no, really, it means everything’s going great and we have the Ph.Ds to prove it” (gobbledegook follows, or should I say Goebbel-degook)

Try this instead:

https://mises.org/library/deflating-deflation-myth

The argument the article makes is that housing is in a bubble in some places? If so, what should be done?

If someone blew up the houses would that deflate the bubble? Maybe banks would do this as a new form of false flag.

Check out “blighted” housing demolitions by municipalities everywhere. No mention of seizing abandoned housing stock and restoring and repurposing it for homeless shelters or group homes. That would be Socialism. (Crosses fingers and toes while reciting a Hail Mary [in Latin] backwards.)

minor quibble….showing nominal values on the Y-axis only shows part of the picture.

Housing versus income = off the charts in most urban areas (and many rural areas as income is dropping faster than housing)

Bubble I (1995-2000) was all about stocks — specifically, TMT (Tech-Media-Telecom) stocks. Because the earnings-free tech stocks in the Nasdaq index reached such astronomical levels of valuation while parsecs of “dark fiber” were built out, it is also known as the Internet Bubble.

Bubble II (2002-2007) was a real estate and mortgage debt bubble. Real estate prices peaked in July 2006, according to the Case-Shiller index. But securitized mortgage debt in the form of CDOs, some featuring triple-A silk purse ratings magically conjured from subprime sows’ ears, went on to nearly blow up the European banking system along with the anencephalic US TBTF banks.

Despite Wolf Richter’s warning, it’s becoming more probable every day that Bubble III (2009-present) will feature a “twin peaks” simultaneous blowoff in stocks and property, fueled by the quintupling in central bank balance sheets after wave upon wave of QE (which is still underway in Japan and Europe).

True, QE did not produce much CPI inflation. Instead, it produced colossal asset price inflation, creating deci-billionaire Tech Lords such as Bezos and Brin and Zuckerberg who rule benevolently over their huddled masses of device-equipped consumer-depositors.

Obviously, this is a highly sustainable economic model. /sarc

But there is still further huge growth potential in monetizing US Intel and Surveillance business.

For instance, watching housing prices and other econ data is largely done gratis by amateurish, inefficient math geeks working off the gummint teat with little or no ideological direction – like supporting real world goals such as constraining inflation expectations and freeing up resources in Russia. [Siberia – specifically]

Not to mention the “War Is Growth Hypothesis” recently put forth by our Keynesian oriented think tanks. They indicate explosive GDP growth there, yet to be fully exploited.

This is all production done by US corporations, therefore goes straight to GDP, most productively.

> “War Is Growth Hypothesis”

It’s true for some! Just today on the tee vee was a military mind extolling the virtues of the F35 to be stationed at his base explaining, were’ in the gravy for three decades. Although they are stationed in such a way that if Canada were ever a threat, bombs away. Canada would be prudent to keep a few F18’s around just in case.

Bubble 1 was driven by large corporation spending up to 47% of their capital budget on IT for Y2K remediation. The prior average for IT was 6 to 8% the Capital Expense budget.

In 2001 corporations decided their Capital Expense for IT for the next few years was to be 0%.

And popped the bubble.

That doesn’t quite explain Pets.com which was more on par with the mania of the Tulip bubble.

Kashkari is a finance guy, and he only sees finance things. Things like asset classes.

In finance, rapidly expanding prices are really, truly, Wealth being created in the Market. It truly wasn’t a bubble unless all that wealth suddenly disappears.

Wolf remarked that housing is local. Sometimes that is true. Housing as people living in buildings is local. Housing as the buildings that people live in is local. Housing as an asset class is not local at all. And has nothing in particular to do with the financial state of people who live in buildings. (Although you would think it would. Availability of rental income to make for ROI is something finance people might be expected to notice. Still, exchange value is still value, I guess.)

Kashkari knows everything is fungible – money, debt, credit, assets, and especially toenail fungus.

The green kind. Generally, the yellow kind gets discounted by bankers, and only 95% of yellowish toenail fungus “face value” can be taken as an asset on the balance sheet.

It’s not that confusing – Krugman did a paper on it – but Mankiw sold all the textbooks. Unless you’re a shadow bank. Then there’s no reg because it’s dark* and you couldn’t read ’em, anyway..

Once you cross this Rubicon, all becomes clear.

* Bill Black mentions this. Said they always blame the power company during audit blackouts. A common event on Wall Street and also Caribbean branches, understandably. [they’re Island communists with no export products.]

“It truly wasn’t a bubble unless all that wealth suddenly disappears.” –

How true. The only problem is that when the wealth disappears, the debt doesn’t. As Mr. Haygood points out above, they fixed the problem last time by using public funds to blow another even larger bubble. I don’t think that history will repeat that aspect of fixing the fundamental balance sheet problem we have again. The problem with their thinking is that no asset is worth anything more than what you can sell it for and what you can sell something for can go up OR DOWN over time. To eliminate the problem one must factor in the risk that an asset won’t be what the market values it at today. We will once again see what we can actually sell assets for decrease significantly while the debt remains constant. Maybe I should have used the board game Monopoly as a metaphor instead of Three Card Monte. Really, can anyone here say with authority that Boardwalk and Park Place are not worth multiples of the Railroads? No bubble there. Oh but in Monopoly, when the assets are worthless, so is the debt.

FFS, the Fed creates the very bubbles it tries to prevent. Do you seriously think that the wealthy don’t love housing/market crashes? They make out, literally, like bandits. Its better not to even rise to the Feds bait. They know EXACTLY what they are doing, and why.

Warren Buffer’s company is sitting of a large pile of cash ($100 Billion?). One wonders why /s.

Which supports you points rather emphatically.

Indeed. They don’t make out like bandits on the pump and dump if they admit it’s a bubble. You don’t reel in the suckers, because if the average Joe has heard about the “gpod thing”, it’s the “pump” just before the dumb because they could never dump fast enough and do not have the same Insider Trading Information.

That last bubble floated on people actually thinking housing prices wouldn’t fall.

For a perspective. While in the EU monetary policy is more or less as accomodative as Fed’s, I don’t see such a large wave on investor-bougth houses in the EU although investors are driving price increases in some markets. In Spain, prices are climbing although they are still far below the bubble peak. In late years foreign investors have increased their share of house purchases from 8% at the begining of the century to about 12-14% in the last couple of years. British have traditionally been the most important investors and I don’t know yet if brexit is changing this. Chinese have increased their purchases but they are well below european investors in market share.

Anyway it seems to me that financialization in the US is too large and investors have a higher share in housing in the US than in other countries (Say Spain, I guess the UK is more similar to the US). My conclusion is that you cannot blame it all on interest rates and some other regulatory measures regarding real estate investors should help if one wishes to rein in Housing Bubble 2.0.

The problem is that nobody in charge wants to do it.

Had my east sf bay area home appraised in 2009 in case I had to sell to avoid foreclosure. Now, the appraised value has nearly doubled. If I sold it now I could realize enough to buy a house not here but possibly Fresno. No offense intended, Fresno Dan.

Our particular bubble is the result of being subsumed by silicon valley, some fifty miles away. My local cafe is now full of unconvivial techies staring at their respective screens. I used to have wonderful conversations with complete strangers in such places not to mention getting lucky now and then.

And, let me guess, those techie types are taking up space in the cafe because working at home is too isolating.

They now carry their splendid isolation around with them. I resent having my cafe space transformed into office space.

All I’ve got to say is Seattle is insane.

Small 684 sf house next door sold for $726,000.

That’s $1,061 per square foot! My own zip code average is about half that and seems quite mad to me.

On a somewhat related note, from my POV, was Mnuchin’s sophistic claim that “Glass-Steagall was about “conflicts” and not risk”, yet never seemed compelled to explain the conflicts in assigning risk or who/what assumes the ultimate risk. If these bubbles are blown with private debt and they really can’t “spot bubbles with any confidence before they burst”, when they do burst, why aren’t the claims on these debts written down to reflect the hot air? How is this a legitimate use of ‘deficit spending” and social general welfare not?

Kashkari’s views on Social Security and Medicare may provide some insights into how neoliberal austerity deludes itself through a language of “fiscal responsibility”.

http://www.washingtonpost.com/wp-dyn/content/article/2010/07/25/AR2010072502755.html

“Our leaders need to make the case for cutting entitlement spending by tapping into our shared beliefs of sacrifice and self-reliance.”-Kashkari

OMG – “our” shared beliefs. Does anyone here know a banker who showed sacrifice and self-reliance when the financial crisis hit. My god, have you no decency sir? These are the cave people Plato talked about.

Given the current ultra-low interest rates and excess liquidity then the prices might be close to being ‘correct’ so if the Fed claims that in current conditions there is not much of a bubble they might not be entirely wrong. However, that being said I’m not sure how long current conditions will continue…..

The Fed says there is no sign of a bubble because the Fed management wants to believe there is no sign of a bubble.

I’d bet a large sum that the suppressed worker bees in the fed do not agree with management.

That’s why we need industrial democracy. Checks and Balances on Management of large enterprises.

I’m in Western Sonoma County and the price increases have not been even, If you are selling a home that’s in good shape and it’s priced right you will get multiple offers and significantly more than you did last year.

If there’s a lot of work needed to update the home or just to repair things it will bring only a little more than last year.

Lots of cash buyers but they are looking for turnkey homes.

Great charts. I would like to see the same charts showing income levels, by comparison, and including a sample of rural areas, as well.

Of course, the inflated housing market has greatly increased rents, as well, having a YUUGE impact on my life.

I’m desperately trying to find a place to move to closer to the big city where I’m receiving my cancer treatments. Even most studio apts are well over half my rent, with utilities on top of that. Add to that the cost of going to a laundry mat, groceries, car insurance, phone/internet and I’m discovering I can’t really afford to survive.

The place I live is cheap but doesn’t even have a septic (no flush toilet–unsanitary) and the only source of heat is a homemade wood stove. Come winter, when I’ll be spending 5 days a week receiving radiation for 6 weeks, I won’t be here to keep it heated, nor will I be able to load the wood stove following numerous surgeries prior to that. I couldn’t afford to heat this entire place with electric (but will have to for the bathrm, at least, according to my landlord).

At 65 I’m trying to survive on my meager SS (leaving me far below poverty level) and that isn’t enough to rent a better, closer place, I’m discovering. And I live in a ‘poor’ state!

I contacted the local senior’s center as they have always offered rides to your appts, but was told their budget was just cut 40% so they no longer can. (My only vehicle already has 323,00 miles on it). There is no public transportation within over 100 miles of here.

I would qualify for section 8 housing, but that list is currently closed for applications in this state for any areas closer, with a waiting list already of 3 1/2 YEARS when it does reopen.

Having owned a home since I was 17 and now renting for the first time in my life, I owe it all to being stupid enough to enter Obummer’s HAMP project following illness and then the failure of my wholesale business.

My ranch the bank stole in CO was sold by Freddie Mac for a mere $65,000 (while I was current on my HAMP pymts on a $140,000 loan), yet is now worth $400,000.

I’m now beginning to ask myself why I’m bothering to even go through the treatments, since it’s becoming apparent I can’t really afford to live, anyway?

It’s hard to keep a positive attitude under my circumstances as my future still looks bleak even following recovery.

My disgust with recent (and current) regimes only grows daily. I realize the govt would prefer those nonproductive, older citizens such as myself just die, but currently, I remain too p*ssed off to oblige them. I’d much prefer to stick around and be a burr under their golden saddles, hoping to see the day they’re bucked off their high horses.

BTW, I’m handling the treatments extremely well, with exception of battling depression over my living conditions and severe allergies to the local juniper trees, forcing me to add allergy shots and nasal sprays to my chemo cocktails. The coming winter has me especially concerned, however, as well as my 30 yr old car. It seems if that dies while making 400 mile round trips over the next 6+ mths, so do I.

I guess my best hope is that Housing Bubble 2 happens SOON so that I may afford to move.

Ain’t America grand these days? /sarc

At least you’re still kicking. That makes a big difference, even medically.

My heart goes out to you; all any of us can do, I think, is wish you all the good luck in the world. And keep posting: we want to know you’re still with us.

Thank you.

Yes, I’m still kickin’–like a hog-tied mad mule!

I spent all day on the phone and may have finally found some section 8 housing a little closer to my treatments that could be available by Fall. (I never, ever thought I’d be in need of Section 8 housing!)

I plan to stick around to see the ‘fall of the empire’, so to speak. I desperately want to see someone like Bernie take over running this country.

Until then, I’ll remain a burr under the saddle of the elites as best I can, still signing petitions and calling govt entities to express my views.

My heartfelt sympathies to you. I expect the bubble to burst pretty soon. Nothing lasts forever.

” “Everyone can recognize a bubble after it bursts, and then many people convince themselves that they saw it on the way up.””

Dean Baker, and a tiny handful of other economists, both recognized the bubble before it burst and sounded the alarm

The profession’s failure to do so, on the whole, vitiates its validity.

The “limit” on their policy tools is their ideology. Nothing more.

you can’t spot something when you’re paid to create and ignore it in the first place.

Freedom and Liberty demand it.

Gentlereaders!

Mr Kashkari never said he couldn’t spot the bubbles, what he said was, “It is really hard to spot bubbles with any confidence before they burst.”

This is not about mere facts, this is a job for the Confidence Fairy!

Carlyle’s BDC Files for IPO: 100% Level 3 Assets

Seeking Alpha reported on the looming IPO of Carlyle affiliate TCG BDC, formerly Carlyle GMS Finance, Inc:

TCG BDC has a portfolio of 94 investments in 82 companies with total fair value of $1.39B. Total investment income last year was $111M. It will trade in the Nasdaq under the symbol “CGBD.” The IPO size is a placeholder amount of $100M.

The prospectus revealed all of TCG BDC’s assets are level 3.

Carlyle is coming off a brutal period in its hedge funds. Nearly all its hedge fund bets went sour. Surely, it’s time for their luck to turn. That or it’s time to dump pumped up assets onto unsuspecting investors.

Level 3— inputs to the valuation methodology are unobservable and significant to overall fair value measurement. The inputs into the determination of fair value require significant management judgment or estimation. Financial instruments that are included in this category generally include investments in privately-held entities, collateralized loan obligations, and certain over-the-counter derivatives where the fair value is based on unobservable inputs.

Carlyle took Carlyle Capital Corporation public in Amsterdam in July 2007. The highly leveraged fund declared bankruptcy in March 2008 when residential mortgage backed securities imploded.

Time will reveal if this IPO happens and at what price. This market is hungry for investment and yield. We will find out how hungry with Carlyle’s BDC.

http://peureport.blogspot.com/2017/05/carlyles-bdc-files-for-ipo-100-level-3.html

To be or not to be …Level 3?..hmmm….all the Fed does is worry about the average joe’s wages…what does that tell you?

I think I disagree with the graphs of this article.

1. Low quality lending is not rampant at this time. Although loans are getting a bit looser.

2. The ramp up in prices are certainly related to the low interest rate environment. These graphs don’t show this effect.

3. Remember the housing crash should be viewed as a mortgage lending crash first.

Yes, the article fails to argue instability at all. The 2002-7 bubble was based on low adjustable rates causing price inflation despite inability to meet higher rates. It was also unstable because securitized mortgages could not be foreclosed normally. I predicted that one at the beginning with little economic training, and it became steadily more obvious and unmentionable in polite company. I was amazed how long it took to burst, and amazed that regulators were so corrupt as to avoid preventive regulation, despite having much direct experience with federal corruption in other areas.

So what makes it unstable now? The rates are low, sending prices up, but are there bad credit risks, adjustable rates, securitization, and fraudulent documents?

I’ve no doubt there are still forged documents among other illegal activities.

Just think of how Wells Fargo got busted for opening various accts for customers without those customers even knowing, just to meet quotas.

I doubt the banks have really ‘cleaned up their act.’

It’s so much more profitable to ignore the laws and pay the fines when caught.

It will be interesting to see how the next year plays out. I’m under the impression a lot of the price run-up is foreign investment – people looking for a “safe” place to park their money as things get more unstable in their home countries. Will the USA still be considered “safe” after a year of erratic Trump administration behavior? Or will it be considered more safe because the foxes are now renting out the hen house?

When Housing goes up really fast then you can see a bubble but when it soars then crashes then rebounds over 15+ years it is just not the same.

Since 2002 based on Case Shiller average housing in the 20 markets rose 72.4%. When you take out the ups & downs that’s only an 3.6% annual increase. Inflation was 2.2% for the same period.

We have some regional markets that are in a bubble but housing in general has not really grown like it did in the early part of the millennium & a lot of the growth is do to the lack of building.

As usual Wolf is reading the wrong charts. Go over to CR and you’ll find the charts that show real prices, adjusted for inflation, and what’s more, that’s the fake inflation number, not the real one. The world inflated away the last bubble and financially repressed the savers: all is now well. Rich BRICsters need houses here. People are paying cash over asking in Cambridge Massachusetts, and they have been for decades.

All that needs to be done now, with employment getting tight, is to kick the velocity of money up, and another “70s decade” will make the prices of today seem like bargains.

In any event, readers who still think this man Wolf has something useful to say need only observe his advice from five years ago, and contemplate how much more money they might have had if they had never left the CR website and browsed over to “mr sky-is-falling” land.

The evidence shown here isn’t wholly convincing. For example, Robert Shiller publishes a real house price index, deflated by the CPI. It is not at a record high and he is not calling for a housing crash, at least on a nationwide scale. It has gone up, but it is much lower than in 2005.

If you don’t deflate an asset price by the general price level or by the income it generates, then you can claim everything is in bubble territory, simply because its price is much higher than it was 30 or 40 years ago. But a stock, for example, with a record high price might not be in a bubble if its earnings and dividends have risen persistently faster than its price.

I actually thought this article would focus on the stock market, where Shiller’s CAPE is approaching levels last seen early in the dot-com bubble.

I do think that Kashkari is an idiot – why would any Fed official mimic the Greenspan canard that bubbles can’t be spotted in advance? That is bullshit that ended in disaster in both 2001 and 2008. Greenspan has no credibility now, Shiller called the last two bubbles accurately with straightforward metrics.