By Wolfgang Keller, Director of the McGuire Center for International Economics and Professor at the University of Colorado-Boulder and Will Olney, Associate Professor of Economics, Williams College. Originally published at VoEU

Growing income inequality has been a hallmark of developed economies over the past few decades. Despite a large empirical literature exploring the determinants of this trend, to date few studies have explored the role of globalization. Using US data on executive compensation, this column argues that while firm size, technology, and poor governance have all contributed to the growth in top incomes, globalization is just as important in explaining the trend.

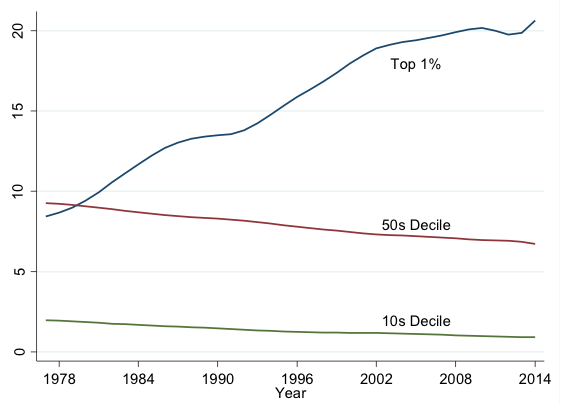

Growing inequality has been one of the most salient features of the US economy over the last 40 years. As depicted in Figure 1, nearly all of this growth in inequality is driven by the rapid increase in top incomes (Alvaredo et al. 2017, Piketty and Saez 2003). The share of income accruing to the top 1% of earners has risen from less than 10% in the 1970s to over 20% today. Despite important policy implications, the causes of this growth in top incomes remains an open and controversial question.

Figure 1 US income shares

Notes: Kernel-weighted local polynomial smoothed data from World Wealth and Income Database (WID).

Explanations

A variety of explanations for this rapid growth in top incomes have been proposed, including growing firm size (Gabaix and Landier 2008), new technology (Kaplan and Rauh 2013), the market for superstars (Rosen 1981), poor governance (Bertrand and Mullainathan 2001), and changes in top tax rates (Piketty et al. 2014). Despite the common perception that globalization has played a role in the growth of top incomes,1 there has been relatively little work studying this channel. Our recent paper aims to fill this gap (Keller and Olney 2017). Our findings complement recent research showing that rising import competition has adversely affected the low end of the income distribution (Autor et al. 2013, Pierce and Schott 2016). Given that the vast majority of income inequality is driven by growth in top incomes, focusing on exports and executive compensation seems especially relevant and important.

Globalization’s Impact

Broadly, there are two channels through which globalization could affect top incomes. First, market returns to executive talent may be rising with globalization. Globalization increases the market size of firms and may increase the difficulty of the executive’s job. Thus, as the importance of top superstar executive’s increase in the global economy, their compensation rises accordingly.

Second, globalization could affect top incomes for reasons unrelated to market returns to talent. The firm may be in an industry that happens to be expanding globally for reasons outside of the executive’s control, but the executive is nonetheless reaping the rewards of this fortunate turn of events. Alternatively, perhaps the sheer size and complexity of exporting firms enhance the opportunity for executives to disproportionately benefit in poor governance and rent-capture environments.

Evidence

Using a large dataset with detailed compensation information for US executives over the years 1993-2013, our results confirm that firm size, technology, and poor governance all have contributed to the growth in top incomes. Importantly we find that, qualitatively, exports are just as important at explaining the growth in executive compensation as the other more common explanations.

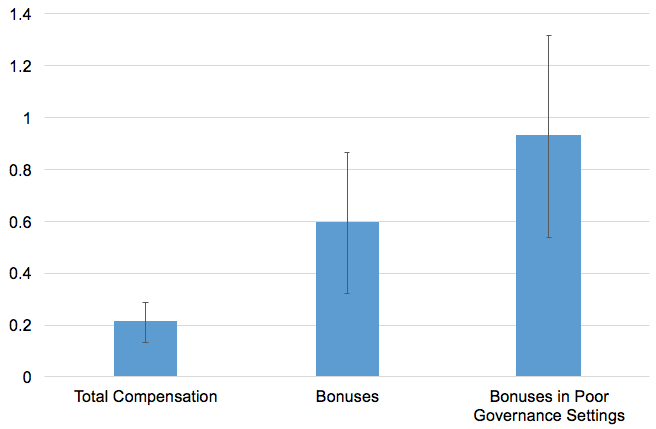

Does globalization’s impact on executive compensation reflect increasing market returns to talent and ability (which may be less objectionable) or non-market returns such as luck and rent-capture? To isolate the latter channel, we identify (using an instrumental variable approach) growth in exports that has nothing to do with the executive’s talent or actions. We find that a 10% export shock leads to a 2% increase in executive compensation (see Figure 2). The fact that exogenous export shocks significantly increase executive compensation provides evidence that globalization does indeed affect top incomes through non-market channels.

Additional results disentangle the luck and rent-capture channels. As illustrated in Figure 2, executive bonuses are more sensitive to export shocks than total compensation. Since bonuses are by nature relatively discretionary and conducive to rent-capture, this result not only reinforces the role of non-market channels but also suggests that rent-capture is important. Furthermore, we examine whether the impact of exogenous export shocks on executive bonuses is stronger in settings that are prone to rent-capture activities. Figure 2 shows that export shocks lead to an even larger increase in executive bonuses in poor governance environments characterised by insider board relationships. Thus, there is evidence that it hasn’t only been the ‘invisible hand’ of the market that has contributed to the increase in top US incomes.

Figure 2 Impact of globalization on executive compensation

Conclusions

Overall, our findings indicate that globalization has played a more central role in the rapid growth of executive compensation and US inequality than previously thought, and that rent-capture is an important part of this story. However, these findings should not be interpreted as a rationale for protectionist policies, since globalization has also generated large increases in standards of living. The key question for policymakers is to devise ways to address the distributional implications of globalization, such as those identified in this column, without compromising aggregate welfare gains.

See original post for references

Looks like there’s a missing end bold near the “Explanations” subhead.

Looks like ‘rent capture activities” needs some definitions.

Looks like compensation methods need to be looked at in terms of stock buy back and predatory finance.

Looks like taxes need to favor labor and productive capital and disfavor financial speculation to reverse a long term trend.

In my opinion, complexity in running a firm has nothing to do with it and, if if it did, then those running them were far from capable. One only need look at the great financial geniuses who ran the global economy off a cliff.

You need to talk to executive compensation consultants. Every public company board uses them. More complex firms most assuredly pay their CEOs more. That’s a bog standard recommendation. Not proposing that would be deviant and get the consultant fired since the factors that justify higher CEO pay also justify higher director pay.

Globalization = looting => that thing we call “executive compensation.” What are the Chief Looters being “compensated” for? A “job well done”? Seems to me it’s not compensation, as us mopes might understand it, but vastly and mostly just bezzle and looting, not even related to a twisted reading of the “rules of good corporate governance” which itself is a sick oxymoron… And what are “we” able, willing or in any position to do about it? To restore the balance in the Force?

Aren’t the “executive compensation consultants” part of the whole community of insiders & board members that create the infrastructure that can only lead to [overly] high CEO compensation?

It’s a whole “ecosystem” that creates a framework which can only lead to certain results. It’s like how Noam Chomsky described framing–if you have a certain frame size and you ppur marbles into it, you will only get a certain pyramid-type shape as the end result. The structure of the frame determines what the end result will look like.

Globalization is part of what makes up the “frame” structure (which is the authors’ thesis), but so is the structure of boards, insiders, and the executive compensation consultants. They are all insider beneficiaries, foxes in charge of their henhouse.

It’s recently occurred to me that one reason companies aren’t growing or hiring is their by now long standing dependence on consultants to tell them what it’s okay to do, while consultants almost by definition have no idea what to do because they are in the business of parroting politically correct cookie cutter advice for pay.

I arrived at this by looking up a former employer on Glassdoor, where many many employees indicated that the company is in decline because while certain particular changes need to happen, top management has been locked in an office with the consultants for years, none of them confer with employees at all, and the central issue never gets addressed.

This is just common sense. Outside consultants have no interest in helping even if they could because they’d be off the gravy train. So, yes, it’s a club that affirms the executive and consulting classes while rationalizing their extraction of money from the corporation.

There is also a strong link between executive compensation consultants and executive search consultants, aka headhunters. Most compensation studies are written by departments belonging to companies earning their profits from headhunting services, as compensation dpts are often just burning money. (And do not confuse these “studies” with anything close to academic, one just has to look at the sample sizes).

Given that most headhunters calculate their fees based on the 33%-rule, they are very interested indeed to raise the income expectations of managers. There are alternatives, by the way: for example, charging fixed fees, etc.

So, yes, headhunters are to executive compensation what rating agencies were to the financial crises.

“since globalization has also generated large increases in standards of living.”

I dunno…

Cmon, man — it’s all in how you select and delimit the metrics. Pick the right data set, and assumptioprojection = proved. The suckers can be schooled to believe pretty much anything. Dontcha know?

Japanese companies have had uneven but ridiculously expensive record of (being conned to) hiring “international” talent that never contributed to any sort of business result.

http://asia.nikkei.com/Business/Companies/SoftBank-ex-heir-Arora-received-record-93m

https://www.usatoday.com/story/money/cars/2015/07/01/top-toyota-executive-resigns/29551369/

There’s plenty of talent both domestic and international that would be effective at a fraction of the pay involved, although finding them is another matter.

Most so-called ” superstar” performers are beneficiaries of bull market cycles….

How about “long term erosion in morals and integrity” across the business world.

Also “childlike fantasy, delusion, hubris, unrestrained greed, narcissism, ethical corruption and bloviating academic enablement”

OK, there may be some overlap across those factors. Hard to untangle them in a regression.

Maybe “enfeebled sense of shame” could be an aggregation into one factor? You could also call it “cultural soul loss”.

maybe a one factor model can explain this one.

“Superstar executives” puh-leeze. Granted some people are better than others at organizing things and dealing with people, but really. I mean get a grip. Lunches, dinners and meetings? You don’t need genius for that. A bull market does the rest.

Gotta include sucking up, kicking down, and the other manifold skills at corporate infighting and manipulation and dissembling hinted at in popular teevee shows on corporate behavior like “Suits” and “The Sopranos…” Those gotta be worth something…

Yeah, not sure why this comes as such a revelation and is something that requires study by economists.

The way I look at it, it comes from the attributes you mentioned, using increased revenue stream (globalization being one way to increase said revenue stream) as a rather flimsy justification. As any revenue stream increases, those responsible for overseeing it feel entitled to an increased fraction of that revenue stream as compensation due to childlike fantasy, delusion, hubris, unrestrained greed, narcissism, ethical corruption and bloviating academic enablement. This despite the fact that they are often doing the same job requiring the same amount of actual work whether it’s a million or billion dollar company. I mean, one might (as a greedy real estate agent averse to actual work) flip a $200K house for a $10K profit, but who in their right mind would lower themselves to only making $10K on a $3 million mcmansion?

Funny though, when I was a bank teller (or whatever more important-sounding title they’ve given that job now in lieu of actually increasing the pay scale) my compensation did not increase commensurate with the dollar value of the transactions I was responsible for….