Yves here. Steve Roth argues that high concentrations of wealth are bad for pretty much everyone except the super rich themselves. We’ve argued that they would benefit from having their lucre reduced, since levels of inequality pose a cost on longevity, even among the top rich. Highly unequal societies have shallow social bond, and even those who are doing well much spend at the level that their friends, or risk being excluded. For instance, the very well off live in certain communities, engage in mutual back-scratching by giving to various charities, have catered parties for each other. And they also worry about their personal safety, as the building of safe rooms and well stocked bunkers in

By Steve Roth, the publisher of Evonomics. He is a Seattle-based serial entrepreneur, and a student of economics and evolution. He blogs at Asymptosis, Angry Bear, and Seeking Alpha. Follow him on Twitter: @asymptosis. Originally published at Evonomics

Remember Smaug the dragon, in The Hobbit? He hoarded up a vast pile of wealth, and then he just hung out in his cave, sitting on it (with occasional forays to further pillage and immolate the local populace).

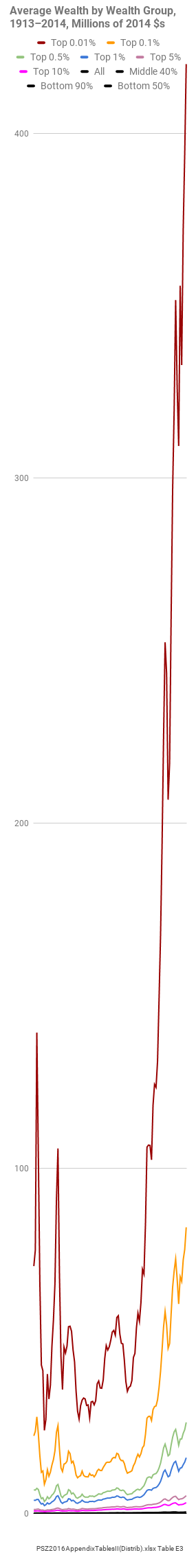

That’s what you should think of when you consider the mind-boggling hoards of wealth that the very rich have amassed in America over the last forty years. The picture at right only shows the very tippy-top of the scale. In 1976 the richest people had $35 million each (in 2014 dollars). In 2014 they had $420 million each — a twelvefold increase. You can be sure it’s gotten even more extreme since then.

.

These people could spend $20 million every year and they’d still just keep getting richer, forever, even if they did absolutely nothing except choose some index funds, watch their balances grow, and shop for a new yacht for their eight-year-old.

These people could spend $20 million every year and they’d still just keep getting richer, forever, even if they did absolutely nothing except choose some index funds, watch their balances grow, and shop for a new yacht for their eight-year-old.

If you’re thinking that they “deserve” all that wealth, and all that income just for owning stuff, because they’re “makers,” think again: between 50% and 70% of U.S. household wealth is “earned” the old-fashioned way (cue John Houseman voice): it’s inherited.

The bottom 90% of Americans aren’t even visible on this chart — and it’s a very tall chart. The scale of wealth inequality in America today makes our crazy levels of income inequality (which have also expanded vastly) look like a Marxist utopia.

American households’ total wealth is about $95 trillion. That’s more than three-quarters of a million dollars for every American household. But roughly 50% of households have zero or negative wealth.

Now of course you don’t expect 20-year-olds to have much or any wealth; there will always be households with none. But still, the environment for young households trying to build a comfortable and secure nest egg — the American dream? — has gotten wildly competitive and hostile over recent decades. (If we had a sovereign wealth fund, everyone would have a wealth share from birth.)

But here’s what’s even more egregious: that concentrated wealth is strangling our economy, our economic growth, our national prosperity. Wealth concentration drives a vicious, downward cycle, throttling the very engine of wealth creation itself.

Because: people with lots of money don’t spend it. They just sit on it, like Smaug in his cave. The more money you have, the less of it you spend every year. If you have $10,000, you might spend it this year. If you have $10 million, you’re not gonna. If you have $1,000, you’re at least somewhat likely to spend it this month.

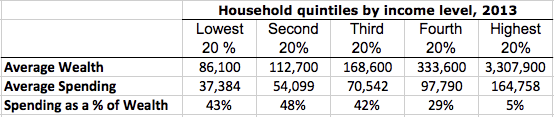

Here’s one picture of what that looks like (data sources):

These broad quintile averages obviously don’t put across the realities of the very poor and the very rich; each quintile spans 25 million households. But the picture is clear. The bottom quintiles turn over 40% or 50% of their wealth every year. The richest quintile turns over 5%. For a given amount of wealth, wider wealth dispersion means more spending. It’s arithmetic.

Now go back to those top-.01% households. They have about $5 trillion between them. Imagine that they had half that much instead (the suffering), and the rest was spread out among all American households — about $20,000 each.

Assume that all those lower-quintile households spend about 40% of their wealth every year. They each get to spend an extra $8,000, and enjoy the results. Sounds nice. And it’s spending that simply won’t happen with concentrated wealth. The money will just sit there.

Now obviously just transferring $2.5 trillion dollars, one time, is not going to achieve this imagined nirvana. Nor is it bloody well likely to happen. That example is just to illustrate the arithmetic. Absent some serious changes in our wildly skewed income distribution (plus capital gains, the overwhelmingly dominant mechanism of wealth accumulation, which don’t count as “income”), that wealth would just get sucked back up to the very rich, like it has, increasingly, for the past forty years — and really, the past several thousand years.

If wealth is consistently more widely dispersed — like it was after WW II — the extra spending that results causes more production. (Why, exactly, do you think producers produce things?) And production produces a surplus — value in, more value out. It’s the ultimate engine of wealth creation. In this little example, we’re talking a trillion dollars a year in additional spending and production. GDP would be 5.5% higher.

If you want to claim that the extra spending would just raise prices, consider the last 20 years. Or the last three decades, in Japan. And if you think concentrated wealth causes better investment and greater wealth accumulation, ask yourself: what economic theory says that $95 trillion in concentrated wealth will result in more or better investment than $95 trillion in broadly dispersed wealth? Our financial system is supposed to intermediateall that, right?

Or ask yourself: would Apple be as successful as it is if its business model was based on selling eight-million-dollar diamond-encrusted iPhones? Broad prosperity is what made Apple, Apple. Concentrated wealth distorts producers’ incentives, so they produce, for instance, a million-dollar Maserati instead of forty (40) $25,000 Toyotas — because that’s what the people with the money are buying. Which delivers more prosperity and well-being?

This little envelope calc is describing a far more prosperous, comfortable, and secure society — far richer and and one hopes far more peaceful than the one we’re facing under wildly concentrated wealth. With the possible exception of a few very rich multi-generational dynasties, everyone’s grandchildren will be far better off 50 years from now if wealth is more widely dispersed. And over that half century, hundreds of millions, even billions of people will live far richer, better lives.

Why wouldn’t we want that? Why wouldn’t we do that? (We know the answer: rich people hate the idea — even those who aren’t all that rich but foolishly buy into the whole trickle-down fantasy. And the rich people…have the power.)

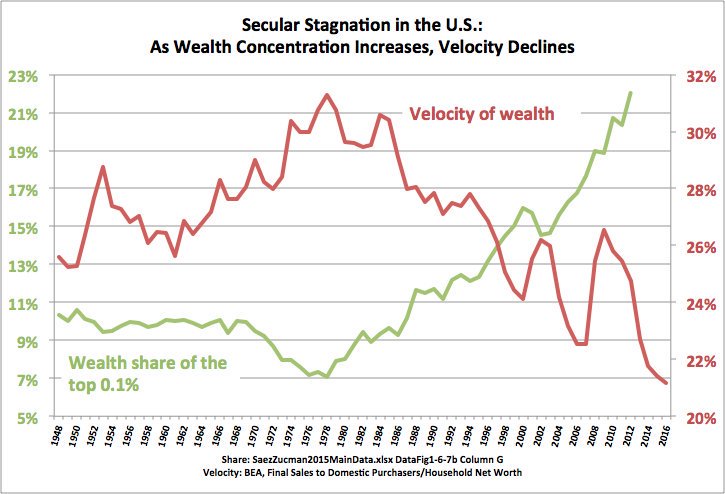

By contrast to that possibility, here’s what things look like over the last seven decades:

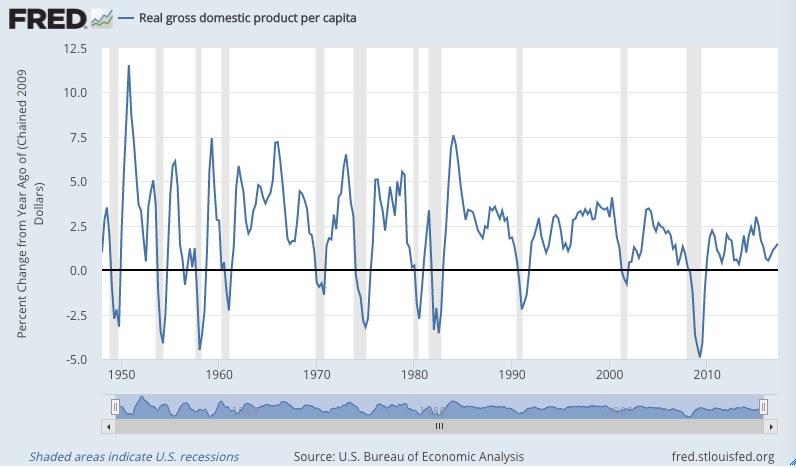

Here are the results — growth in inflation-adjusted GDP per capita:

The last time economic growth broke 5% was in 1984. And the decline continues.

So how do we get there, given that we’ve mostly failed to do so for millennia? Start with a tax system that actually is progressive, like we had, briefly, during the postwar heyday of rampant and widespread American growth and prosperity. And greatly expand the social platform and springboard that gives tens of millions more Americans a place to stand, where they can move the world.

All of this dweebish arithmetic, of course, doesn’t put across the real crux of the thing: power. Money is power. So it is, so it has been, and so it shall be in our lifetimes and our children’s lifetimes (world without end, amen). This is especially true for minorities, who have been so thoroughly screwed by our recent Great Whatever. Money is the power to walk away from a shitty job. To hire fancy lawyers and lobbyists, maybe even buy yourself a politician or two. If we want minorities to have power, they need to have money.

Add to that dignity, and respect, which is deserved by every child born: sadly but truly, they are delivered to those who have money. You can bemoan that reality, but in the meantime, let’s concentrate on the money.

If you want to create a workers’ utopia, a better world for all, seize the wealth and income.

You appear to be missing a chart at the top. There’s no referent for this: “The picture at right only shows the very tippy-top of the scale. In 1976 the richest people had $35 million each…”

Say as a counterfactual, that rather than spend the 20K, people used it to pay off their debts. So money would be extracted from the wealthy would basically go to other wealthy people, it would be a transfer. It would in some cases take money from wealthy high net worth individuals and put it in the hands of financial institutions.

A debt jubilee would be an alternative for having these types of transfers. But, even in those circumstances, I am concerned about the assets of pension funds, University endowments, etc footing the bill as opposed to the actual financial institutions.

I’m sure if you put enough experts in a room, they could create a system to create a means of equitable financial transfer. It would be impossible to do it in secret of course, as anyone rich enough to have those types of assets would also be powerful enough to obstruct the process endlessly and ruin the lives of any proponents as well as possibly usurp any government legitimately elected for redistributive purposes.

I guess you could go after international tax evasion, it would be more politically palpable, as a penalty. Or turn repatriation taxes into a helicopter fund rather than government coffers, corporations haven’t really been paying their fair share for quite a while now. I thought that tax recycling from carbon taxes to the poor and vulnerable might also have merit.

Regardless, the how is much more difficult than the why or what for.

It actually doesn’t really matter if a low- or middle income household chooses to spend a $20,000 windfall or use it to pay off debt: paying off $20,000 in debt frees up the money that would have been used to pay off the debt otherwise – and that’s the same $20,000 now available for spending, plus the interest that would have been paid, so it can mean as much as $25-30K of extra spending money in case of a higher interest loan.

Suggesting a slight improvement (link)

Awesome screen name ;-)

And, given the impact of stress on telomeres, that is a particularly brilliant screen name at NC 8^}

Thank you.

On most days, I consider the screen name gobsmackingly pretentious, so much so that it should be treated as a stern warning to those that would dare create a screen name after uncorking bottle #3.

AAAAAAAHHH! (Screams real loud) I’d call it an eximious moniker…

Two questions:

1. Does this supplant “gobsmack”?

2. Has Lambert approved the usage?

1. Just applause for your moniker.

2. We’ll find out.

“If we had a sovereign wealth fund, everyone would have a wealth share from birth.”

Quite so. America’s closest proxy to a sovereign wealth fund is Social Security, designed in 1935. Unlike Norway’s trillion-dollar sovereign wealth fund which holds 60% stocks, 35% bonds and 5% property, Social Security is 100% invested in low-yielding, non-marketable Treasuries.

Forcing wage earners to hand over 15.3% of their lifetime gross income to be invested at 2% nominal return (i.e., zero percent real return) is a motor of inequality that systematically strips the working poor of the capital gains in equities and businesses which fuel great fortunes.

It doesn’t have to be this way. But in the weaponized, tertiary stage of the two-party system, with a brewing state and local pension crisis on its hands, innovation in social benefits is dead. The zombified, 20%-funded corpse of Social Security marches on toward total exhaustion of its trust fund (zero percent funding) in 2035, according to its own trustees.

It’s a sovereign no-wealth fund.

@Haygood – misrepresenting the status of the Social Security system yet again, I see. It is not, nor was it ever, a funded plan. It’s a pay as you go plan which due to baby boom demographics and post-WW2 prosperity, accumulated a surplus over the past 60 years which will unwind over the next 20 years until it is again a purely pay as you go plan.

I do agree that the surplus has been poorly invested – your example of Norway as a counter is poor, however- since most of the funds in the Norwegian sovereign wealth fund are from oil proceeds. A better example is Canada’s CPP fund, which is invested partially in Canadian enterprises, mostly publicly traded. Returns are higher and the long-term health of the plan is better than SSI’s. However, I’m concerned that if a similar system were implemented in the USA, the corruption of the US federal apparatus would result in the misappropriation of SSI fund assets rather than honest and prudent stewardship.

Thank you for pointing that out.

Love your comments Haygood, but that isn’t how SS works. People may be paid out today based on what they paid in, but if they paid in themselves with 1975 dollars, they are being paid out today in the 2017 dollars someone else paid in.

I do agree there could be some improvements but I don’t think investing in markets is the way to go either. In the US, being a sovereign nation in charge of its own currency and knowing that collected taxes don’t fund government liabilities, we could simply determine what a reasonable standard of living is for any given year and pay out that much per retired person without anybody paying into the system at all.

Ellis Winningham has suggested that we stop emphasizing the bit about taxes don’t fund spending.

https://www.facebook.com/RealProgressive/photos/a.1485444788451613.1073741826.1485438831785542/1891706231158798/?type=3&theater

Collected taxes do control inflation, among other things. A solution that would work under the current economic circumstances of low demand and low investment might not always work when conditions change. Don’t be so cavalier about suggesting permanent policies that are appropriate for temporary conditions.

Time to go back to the old man himself: https://www.ssa.gov/history/Gulick.html

And withstanding the politics I suspect if any economics are at play it’s the economics that have been espoused by Michael Hudson which is that low men on the totem pole are taxed so that their surplus isn’t sent to the banks to drive up asset prices (home mortgages). Of course, it seems like the US has capitulated on that thinking – wealth effect is the new normal.

So sure, let’s give the little people their money back. So they can pledge it all to the banks and drive up housing prices even more so. Or if not on homes, then on cars, etc. Wake me up when the banks want their customers to save their money for a rainy day.

Perhaps I am mistaken, but I thought they were taxed so the super-rich could use said economic surplus to drive up their financial assets.

Maybe if that surplus (lovely economics notion) was put into a state or local or Postal bank, the looting/piling-up aspect could be avoided?

What is the psychology, the teleology, or other -ology of a wealth hoarder?

What is the endgame for someone with billions aspiring to trillions?

Will they buy up countries?

Will they relocate to friendlier confines, or become citizens of the(ir) world?

What of their offspring?

Will all the money in the world save some precious few from environmental degradations or civilizational collapse, and if so, where?

Is there some double-secret probation PE project to colonize the moon, or Mars?

After a while or two, what becomes of Masters of the Universe?

Where are the Johnsons of the Universe?

It would seem that the goal is dynasties that rule the world.

The endgame: “richest man in the grave yard”

there is no other alternative that I am aware of.

Wealth hoarding is easy to understand. I make way more than I spend. I could buy mazzeratis with the excess, but where is the value in that? I could buy that stuff, but largely I don’t want to because the stuff designed to soak the rich generally tends to be engineered away from the reliability of a good old Toyota Corolla or Mazda 3. I just don’t need the hassle. The take home lesson is not that the hoarders are necessarily evil, just very, very overpaid.

Where is the good in it? Let us suppose that our preferred good is environmental virtue, rather than wealth equality, fairness or justice. If we want the most people in the world to live frugally and consume less, then deprive them of disposable income. It isn’t nice or fair, that is for sure! However, what we really can ill afford is to have the entire world burning resources like Americans. I won’t say that I think we should run the world this way, but it does seem to be what we are doing, doesn’t it? We must look for silver linings.

They get to shape the world as they want. This is what Bill gates is doing to public eduction (to, not for); this is what the Koch brothers are doing to politics; Eli Broad, etc., etc.

Not, just billionaires, but plutocrats and megalomaniacs, too!

I agree. The hoard of wealth allows them to shape the world as they like. There needs to be a serious scientific research into what effect such hoarding and power has on these people.

The psychology is simple: they want (all of us want) to increase the gap between them and the layer below, and to decrease the gap between them and the layer above. Thank you Rodger Malcolm Mitchell for the concise concept.

While I’m sure there’s a strong connection between wealth (and income) concentration and economic growth (the OECD I think found a correlation from international comparisons) this is sort of an underconsumptionist argument and I think it’s very incomplete in explaining the slower post-Reagan ‘n’ Thatcher growth.

The other change was the abandonment of Keynesian demand management with the goal of full employment. That was a matter of government demand first of all, stimulating economic growth (via private demand too), not so much about more equal distribution getting growth. Though, high employment would tend to keep up the incomes of the poor by allowing them to earn through work and scrabble less for welfare benefits, so I’m pretty sure it would be good for flattening the distribution too (higher working class incomes allowing higher savings).

https://www.globalresearch.ca/study-congress-literally-doesnt-care-what-you-think/5466723

Princeton University study: Public opinion has “near-zero” impact on U.S. law.

Gilens & Page found that the number of Americans for or against any idea has no impact on the likelihood that Congress will make it law.

“The preferences of the average American appear to have only a miniscule, near-zero, statistically non-significant impact upon public policy.”

One thing that does have an influence? MONEY. While the opinions of the bottom 90% of income earners in America have a “statistically non-significant impact,” Economic elites, business interests, and people who can afford lobbyists still carry major influence.

================================================

I would disagree that one thing that influences congress is money…..there are 3 THINGS – MONEY, MO’ MONEY, AND LOTS MO MONEY!

miniscule, near-zero, statistically non-significant impact upon public policy.”

Uh, I think he really means NONE, nada, zilch, 0, nuthin’ ….and I’m being optimistic – I think most congressmen vote against their constituents interests out of sheer spite and sociopathic behavior.

I agree with you and thank you for the link.

Concentrated Money’s toxicity to our democracy and Liberty swamp out all other considerations. I wonder why the author of this post and other similar past posts so often spend much time on the “dweebish arithmetic” only tailing their discussion with:

“All of this dweebish arithmetic, of course, doesn’t put across the real crux of the thing: power. Money is power.”

Discussion and argumentation over the matter too often gets bogged down in contentions about the “dweebish arithmetic” and its lesser implications while the “crux of the thing” is lost behind the resulting clouds of smoke.

Yet people seem to have an instinctive respect for power, though most often it is a result of luck or privilege. Has anyone considered taxing wealth as we do currently until death, then taxing everything above a fixed amount (adjusted for inflation).

I realize that inheritance takes many forms, including the passing on of businesses to offspring, perhaps giving them a well-paid titular position at the family firm, with no real responsibilities. There’s always ways to game the system.

It would seem taxing inherited wealth would limit inherited privilege, which would move us closer to a meritocracy.

Like this:

https://www.theguardian.com/us-news/2017/jun/26/koch-network-piggy-banks-closed-republicans-healthcare-tax-reform

Shouldn’t SEX fit in there as well …

‘Like a hand in glove’ … the Blue Velvet way !

And can’t we just name everyone in CONgree ‘Frank’ and be done with the pretense ?

‘And Now a Free CONgressional oxygen (?) Mask with every Lobbist purchase !’

Many thanks, Yves.

Much of the problem is caused by its relative invisibility, the pretence (at least in the US) that all have a shot at the American Dream and can make it if they wish, and the MSM collaboration with the rich and powerful, including the number of hacks married to financial services magnates and their acolytes.

I worked at the UK’s best known private bank for a couple of years in the late 1990s and was staggered by the amount of inherited and hidden wealth the bank serviced (even in Northern Ireland). I worked on projects to buy Swiss private banks, both sold in the last couple of years, and grow the assets. There’s a French saying that one lives well by living in a discrete, if not hidden, manner.

On a related note, I visited a beautiful chateau in Pauillac last Thursday. It’s owned by a well known and influential insurer. Apart from using the chateau for marketing their financial products and wines, the senior managers at the firm use the premises, pretending to be and trying to keep up with 1%ers.

Amazingly well done! It cogently supports a point that I have been promoting for years with substantial resistance from ‘centrist’ economists: instead of relying exclusively on debt to fund economic stimulus, we should be taxing the wealthy to fund it.

For general jollies you should look over the info on the top 400 “earners” that the IRS provides.

Some high points:

2014 average income $317,818,000 (about a million and a half per working day)

In constant 1990 dollars the average income in 1992 was $17 million, in 2014 it has risen to $70 million.

2014 tax rate 23.13%

You have to guess how much of their income they can hide in tax havens.

If that data is from IRS, it would only show the portion which they DIDN’T hide in tax havens, right?

It only could include what they declared, making the real dollar amounts even more stratospheric.

Of course, they only have that massive income because they work 2000 times as hard and are 2000 times as smart as the rest of us! /s

Looked at the data another way, take some zeros off. Making $17,000 in 92, should be around $70,000 in 2014, I wish.

When I was in business, I knew scads of people that were feverishly working on acquiring giant pile of money #6, to stick on top of giant pile of money #5 and so on. They really weren’t ‘see me-dig me’ types either, and could have called it quits after earning the 1st giant pile.

The word ‘enough’ was not in their vernacular, though.

Thank you.

Not only are the rich different from us, they also speak a different language.

I am working in Paris this and next week and enjoying how frustrated the Macron hangers-on are getting about the reluctance of their compatriots to embrace the concept of being a “start up nation” and the überisation” of France. The English terms are used as the language of Molière is bastardised by neo-liberals.

Re working on piles of money: Strikes me that the same behavioral tic might be at work within the bowels of the Blob — the CIA guys know how to destabilize and raise chaos, so that’s what they do, move on from one horror to a larger and more compendious one — that’s where the rewards in promotions and corruption opportunities and whatever attaboys the CIA spooks get off on come from. Same with the military/industrial thing — double down on what you know, in search of “global full spectrum dominance” or the spend-the-last-dollar weapon system to out-weapon-system all other weapon systems. Interoperably, of course.

Okay, who has the budget for an animation of this?! Because I know a good animator (not me, FWIW).

This concept needs to be viewed by everyone who doesn’t watch FOX, and by a few who do.

Over, and over, and over. Until it sinks in.

All dragons are like that, like the one in the Monty Python movie.

Why?

From a dragon’s perspective, it lives a long life and so, maybe it needs all that wealth.

Similarly, for a billionaire desiring immortality, he/she needs young blood constantly, fresh organic fruits and vegetables everyday and a stress-free life (in a hurricane-free island). Vast wealth makes that possible.

It’s interesting about the greed of dragons. The dragon in the final section of “Beowulf” guards a hoard of treasure, and subsequent writers have copied that. I wonder what the source of that mythological theme was?

I only know that Joseph Campbell mentioned it.

The image of a powerful elite sitting on piles of accumulated wealth is a theme that persists throughout the ages because of its truth. An argument could be made that wealth accumulation is an integral part of the human condition, a consequence derived from the necessity to survive in a hostile environment. The mere fact of survival opens a pathway to power. Those that seize opportunity in controlling a surplus, can continue the accumulation.

How does one exercise power? For the benefit of oneself or the larger community?

How does one handle the certainty of death? Fearlessly or as a coward?

How does one deal with the complexities of the world? With intelligence and forethought or as a simpleton?

We, human beings, need stories to make sense of our place in the Universe. Will the accepted narratives be informative, cautionary tales ensuring our survival or just entertainments that serve only to deaden the awareness of approaching and inevitable doom?

It seems the health of a society depends on what choices are made.

Smaug stole his wealth from the dwarves in the mountain and their home as well. Still a fitting analogy.

And Smaug had a vastly elevated opinion of himself.

One wonders if the analogy holds, to the extent that rubbing his engrossed belly on the piles of gold and jewels and all produced a weak spot in the armor, into which some intrepid hero could fire an arrow made of ancient iron…

Supply side economics was always a scam, a lie. Giving those with the most more was never going to stimulate investment to create millions of jobs and prosperity for everyone else, moreover, that was never really the point.

No one invests if there is no demand. Our American economy and our economic policies have devolved into looting. The rich do not share and they do not create new wealth, they take from others. Increasingly the use their control of government to do the taking for them, tax cuts after tax cuts, loophole after loophole, and avoiding punishment for crime after crime. The rich have become parasites on our nation’s economy, and they are draining the economic security of our entire population to feed their greed and their lust for power.

There has been a class war in America since Reagan. Those who dared to call it out were, of course, labeled nut jobs. But here we are. Millions must lose their access to health care and tens of thousands must be caused to die so the rich can get more. Secure retirements, our so called golden years, must be destroyed so the rich can have more. Our children and their children must never have things as well as their parents so the rich can have more.

Conservative economics, supply side economics, has always been a lie created by the rich and those who serve them for the benefit of the rich and those that serve them. Economics ceased being a science, if it ever was one, the instant supply side economics took over and dominated that profession.

Conservative economics is based on belief; it is a cult, or it is an accepted lie, but it is not real and never was going to be real. But as long as it remains the basis of our tax code the rich will continue to get richer and everyone else will experience the continued declines in opportunity and economic advancement the rest of the nation has experienced for more than a generation.

And Laffer’s napkin. Worth the paper it’s printed on.

Notice how this goes back to the unwind of the pre-fiat money supply in the 1970s. Once all your money was credits, and it paid to save them. But once all your money was debits, it paid to spend them. Simple common sense. The 70s were the transition period. We are 35 years past that … been fully debit money all that time. But chickens come home to roost eventually. The US has been able to live beyond its means for most of my lifetime, but only because “there is no other choice” for the rest of the world, but to fund that excess. Until recently.

Interesting how the wording has changed on U.S. banknotes…

Presently on FRN notes it states:

“This Note Is Legal Tender For All Debts Public And Private”

On 1950 series FRN notes it stated:

“This Note Is Legal Tender For All Debts Public And Private, And Is

Redeemable In Lawful Money At The United States Treasury, Or Any Federal Reserve Bank”

I believe this to be bogus. Gotta source?

Sounds like a Ron Paul-ism

My error. He is correct. 1950 series included 5$ bills and above, they will surely still give me 5 ones for a five.

One lesson after the Asian Financial Crisis in the 1990’s for China has been this: The Chinese have to work much harder to make American consumers happy, so China can earn enough money to defend herself in any future crisis.

“Your American wish spells our command in Mandarin.”

“Fiat Money” and ““there is no other choice” for the rest of the world, but to fund that excess” are two ideas that have no connection at all. Otherwise Zimbabwe would be rich.

Money is an artificial construct. Tying it to gold is like claiming your viginity can only be exchanged for (insert actor/actress name here). Then that doesn’t happen, so you decide you’ll do (insert local sports hero)… then that won’t do so you eventually (family blog) somebody who happens to be available and not horrifying.

How many times, under the gold standard, did we arbitrarily change the exchange rate? it should have been called the always-change rate.

Not advocating a return to a gold standard. It had its problems. The problem is un-restrained corrupt politics, that encourages buying votes from either end of the socio-economic hierarchy. Gold was a convenient way to keep the politicians semi-honest … domestically until 1933, internationally until 1971. Platinum would have worked as well, even Bitcoin … as long as it is something that politicians can’t freely print (electronically today, even easier than Bureau of Engraving & Printing).

I am currently reading Philip Pilkington’s book, ‘The Reformation in Economics’, which has an interesting factoid attributed to a 2014 paper by Steven Cynamon & Barry Fazzani. Apparently, in the US national accounts payments by Medicare and Medicaid are counted as income to households.

As a Brit my knowledge of US healthcare is strictly limited but, as I understand it, these schemes are for the elderly and poor – both groups with below average incomes – so Medicare and Medicaid payments could flatter recorded income at the bottom of the scale in which case inequality would be even worse than the statistics suggest.

Even a quick look at history, politics, and economics (even modern pseudo-economics) shows how inequality destroys a society. It happens over and over. I really do not understand why anyone could believe differently. But then as hinted in the post, the wealthy spend vast amounts of money on propaganda, which creates, and maintains, this whacked belief that unending accumulation and concentration of wealth is a good thing.

A wealth cult. Nice.

They don’t need to spend vast amounts of money. Lobbyists have about the best payback of any investment.

Smaug was sitting on a finite resource where in our case congress is hording an infinite resource. We don’t have to tax first before we pressure congress to spend for public purpose. Although we do need to tax for equity among other things.

MMT conference is live streaming starting 8:30 Saturday.

Thank you for the heads-up on the conference – must be this one: http://www.mmtconference.org/

Plus, just think of the health benefits in stemming the dangerous effects of Affluenza which is a serious illness that needs to be addressed in this country. From famous cases like Martin Skereli and the Trumps, to mortgage scammers and war profiteers. We need to, as a nation, help save those at risk of affluenza by tightly regulating and monitoring access to excessive wealth and power.

This disease can easily spread through the transfer of money between hands so we need to better control the distribution of money – whether from parental heredity or shady VC’s and lobbyists – so no one person is infected with excessive affluence which is the leading cause of affluenza.

Please, let’s work to eradicate Affluenza once and for all. Our nation’s wealthy and privileged need us.

The ultra-rich like practicing philanthropy because:

1. They get to decide where the cheque goes

2. They get to let everyone know where the cheque went, and bask in the kudos

and, hey, it’s cynical, but it’s better than sitting on it.

While this solution doesn’t address #1., what someone should do is try to convince these people that, aside from the actual benefits described in this piece, paying a lot o’ tax and ostentatiously disclosing how much they contributed and, by the way, here’s all the nice good things that this enormous tax contribution could pay for, is a PR slam dunk and will make them beloved.

The ultra-rich like practicing philanthropy because: its a mega tax write-off; aka tax avoidance.

For every dollar donated to charity by a wealthy individual, everyone else effectively chips in 40 to 50 cents. When the mega-rich tax bills go down, we pick up the slack to pay for public services such as infrastructure, research, and defense. Add insult to injury, the everyday janes and joes are the no-invites to the mega-rich narcissists grandiose parties celebrating their generous fabulousness. Once again, we’re left with the tab for the hoarders of wealth.

To quote the queen of mean- Leona Hemsley, “We don’t pay taxes; only the little people pay taxes”

Only if the mega rich pay 40-50% tax rate. Largely they don’t, because you don’t get that rich working with your own two hands. It is capital gains. Long term capital gains are taxed at a much lower rate, so the public contribution to gifts by the .1% or the .01% is much lower than the 1%.

There is a BIG difference between the 1% (doctors, lawyers, engineers) who are taxed in accordance with how people think they should be at a 52% marginal tax rate, and the 1% of the 1% (investors) who pay Warren buffet tax rates closer to 20% or less. Smash down just those people and you will have accomplished your goal.

Don’t forget that charity scams are also a way of laundering money and peddling influence, you get a tax write off and you get to still utilize the money in a power broker move. Point of example The Clinton Foundation.

Near the end of his book Inequality: What Everyone Needs to Know, James Galbraith points out that in a war, the more egalitarian nation is more likely to win. There are exceptions, especially when the two sides have a major power imbalance, but in general his point seems valid.

“The Vietnam War” series by Ken Burns is quietly making this point, pointing out the corruption of the South Vietnam government. In the early 60s after a pivotal battle, it dawned on some of the American advisors that the Viet Cong and NVA were able to have an entire battalion of soldiers traipsing around the countryside in supposedly friendly territory and “nobody knew”. I am sure the peasants knew, but they weren’t going to say a peep.

Similarly, in the battle of Hue in 68, they Viet Cong and NVA were able to infiltrate an entire division along with all of their equipment and supplies over months and “nobody knew”. The same thing occurred to the French in Dien Bien Phu in the late 50s.

It is hard to win a war if the population doesn’t want to fight for the government and ruling class.

Hernando Cortes conquered the Aztec empire with little over 500 men. Give a ruthless killer, equipped with advanced military technology, a little civil unrest and defeat becomes possible. The resulting rule is just not long lasting, only the brutality remains.

It seems the fundamental difference in society is if the ruling elite are supported by the population or the degree to which the population is subjugated. Violence or cooperation. It is an endless swing back and forth.

It was only five hundred against millions, and the technology levels were not that different.

The massive deaths from the new diseases helped a lot. The Aztecs’ Flower Wars also helped the Spanish. When the ruling empire creates artificial wars to get the massive number of human sacrifices that its ruling elites say are necessary, that also creates extreme hatred.

There was always a strain of human sacrifice, or even more personal sacrifice. For example the Maya would created bleeding wounds in very painful ways sometimes involving their reproductive organs. Nothing fatal just extremely uncomfortable.

Western and Eastern civilizations also had, and still does to some degree, a tradition of religious sacrifices. However, instead of having real human sacrifices only in extreme, or at least fairly rare circumstances, in ancient times, and gradually making sacrifices of animals, or even goods, the rule, and don’t think those sacrifices did not hurt as giving up some prized bull, or sheep, was often painful. Such animals were a source of wealth and food in societies living close to the edge of survival. Even for modern societies, a goat for a poor family can be expensive.

Anyways, Latin American civilizations were more demanding in their sacrificial traditions. It was not the proctice that was the problem as most societies had similar traditions. It was that the Aztecs took the practice up to eleven instead of the eight of other Americans, or the two of the other societies. So when the Spanish arrived, they had very ready allies.

Also the Aztec elites would use their own lower classes, especially whoever broke whatever laws were made. Don’t paid the rent, have your heart ripped out. We need a child sacrifice. Hey, your child will do!

The shame of it really was that the Aztecs apparently had a debate over whether to be an empire, and if so, what kind of empire. The moderates lost, which created the enemies that destroyed them a few generations later.

Inequality is a consequence of an economics that is designed in the interests of economic liberalism.

In the interests of economic liberalism how can we leave bankers free to do what they want?

Neoclassical economics that doesn’t look at private debt.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

1929 and 2008 suddenly stick out like sore thumbs.

They used this economics in the 1920s as well, its private debt blind spot caused the same problem.

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.53.09.png

Thatcher shows neo-liberalism works, no one notices it runs on debt.

The real estate and financial speculation ponzi scheme that is the UK economy.

In the interests of economic liberalism how can we leave rentier interests free to do what they want?

Neoclassical economics that doesn’t distinguish between “earned” and “unearned” income.

We have to battle some very powerful groups to put things right.

Finance and real estate.

Richard Werner has been looking at this since Japan 1989, when he was around for the financial crisis in Japan.

He has looked at how sensible bank lending into economy produces stable, low inequality, successful economies. The Asian Tigers, in their glory days, and Germany are examples.

The US and UK are the opposite where only 20% of bank lending goes into productive investment; they are very unequal and run big trade deficits.

https://www.youtube.com/watch?v=EC0G7pY4wRE&t=3s

It’s been this way for a long time. Bob Hope’s old joke: “Banks exist to lend money to people who can prove they don’t need it.”

Anyone have a reference on how banking and finance worked in Soviet style economies? Both at the macro level and the consumer level. Were they in effect applying MMT? I am very interested in that. I believe the Soviet ruble was convertible to gold, possibly until the end?

Outis, perhaps – can you help with anything?

And regarding consumer debt and credit, there were no-interest savings pools, and there were definitely loans to buy housing guaranteed by automatically deducted income by a virtually guaranteed job (no downpayment I believe), and the supply and the market was very tightly controlled by the state of course – but it resulted in 80-90% homeownership levels by the 1980ies… – all things that are almost never discussed anywhere that I can come across easily but there may have been something to learn there.

I haven’t read it yet, but a book came out just this year focusing on some of the things you are interested in.

On the connection with MMT, I don’t know of much from MMT advocates (readers?) discussing the relationship between their ideas and what took place in the Soviet Union. In this post from 2011, Bill Mitchell suggested that the modern Chinese government is applying a certain MMT-esque policy flexibility. This is of course modern China, so not exactly what you are asking about.

Thank you so much – the book definitely seems relevant. Good material.

The Ruble on an exchange basis in the west was in theory worth around $1.50 from the 60’s to the 80’s, but in practice worth a fraction of that. It was the same story for all currencies behind the iron curtain.

Perhaps the Ruble was convertible to gold-but only on Venus, ha!

I remember only 1 Soviet retail import in the USA during the Cold War, Stolychnaya vodka, so they weren’t exactly killing it on the export front~

Now in terms of value, most everything in the USSR hardly cost anything in terms of Kopeks & Rubles, that is if you could find something for sale.

Here’s a family story about the value of eastern bloc money:

My father was sentenced to death in absentia by the communist government in Czechoslovakia in the late 40’s, his crime being leaving the country. Kinda Kafka-ish if you ask me.

He couldn’t go back for a long time until the smoke cleared, and around 1973 my mom and he went first to Vienna and then to Prague, and in the banks in Vienna, you could buy Czech Korunas for about 1/3rd of the official exchange rate in Czechoslovakia, and my dad being in the stock business, knew an arbitrage opportunity when he saw one, so they loaded up, and when they got to Prague, my mom told my aunt about what they’d brought in, and according to my mom, my aunt had a hissy fit, and told her how dangerous it was what they did, and advised her to stick the bankroll in her vagina, the one place they wouldn’t look if the secret police frisked her, hopefully!

Well, it didn’t matter what the exchange rate was, as the stores were full of empty-aside from lead crystal objects, which is beautifully useless, and how much does anybody really need?

That was the first of many dozens of trips to the old country that my parents embarked on, and they never brought in cheap Korunas again, why bother?

Now, on the flipside of the trade, my mom told me she was constantly pestered by locals that cottoned on to her being a Yankee capitalist, that wanted to do a deal to get her dollars, as there was a store called Tusek or something like that, where you could buy all kinds of stuff.

There is also an issue of priorities. The words of a certain homeless prophet come to mind: “Beware all forms of greed, for one’s life does not consist of one’s possessions.”

To what degree can one simplify one’s own needs and address the issue from the demand-side of the equation?

To which degree do you have to simplify is the current question. The young are:

https://www.federalreserve.gov/econresdata/notes/feds-notes/2016/the-young-and-the-carless-the-demographics-of-new-vehicle-purchases-20160624.html

https://www.washingtonpost.com/opinions/millennials-arent-buying-homes–good-for-them/2016/08/22/818793be-68a4-11e6-ba32-5a4bf5aad4fa_story.html?utm_term=.b199d19681ab

But I don’t see how this alone will break the grip of the guys on the RHS of that graph above.

The worst part isn’t just that the dragons hoard gold. The larger problem is that many middle class strivers seem to be worshipping these golden dragons. So much fawning over the supposed genius of wealthy parasites.

“Because: people with lots of money don’t spend it.”

That’s not true, they spend all of it front running the needs and wants of the have-nots, which is the mechanism for this undamped acceleration in inequality.

I say this because your oversimplification will lead a republican or wealthy individual to say you are wrong it is all invested back into the economy, which is true!

But the point to be made is the manner in which it is deployed ends up being rent seeking in the very end whether by actual rents, interest, or corporate profits, which is not nice even if it is legal. All is fair in love war and getting rich as they say, but we should call them on it.

“front running the needs and wants of the have-nots” – could you elaborate on this phrase?

I think what is meant is that when the very wealthy “invest” in the country, it is in buying up housing, for instance, or privatized utilities, or other assets that ORDINARY PEOPLE need access to. That’s the front-running part: they know our needs and seek to own and control them … and to gouge us to further enrich themselves, in a vicious cycle of economic hideousness that the rich call “investments in the economy.” See, for instance, how the wealthy (via hedge funds, etc) purchased all the illegally and otherwise foreclosed homes, jacked up the rent, and encouraged Wall Street Journal reporters to tell us it’s all poor people’s fault.

If some wealthy sh#thead like Bezos or Buffet or Black Rock is allowed to buy the U.S. post office some day (which many elites still push), do you think a single, solitary stamp will be under $5? They have shareholders, you know! And a multi-million dollar salaried CEO to pay! Catch my drift?

Bottom line, it’s a game. And it’s rigged, start to finish.

Purchasing Van Goghs at elevated prices makes lots of jobs for the little people.

I think the big key is that somehow we have penalized actual work by taxing it far more than unearned income (just the term alone should be a warning to people about ethics and morality). Capital gains and dividends should be taxed at the same rate as ordinary income from wages and salaries. Doing this and eliminating many of the deductions, credits, and subsidies would allow the income rate on a dollar of income to drop which would save the typical wage and salary earner some big bucks.

We then need either an estate tax or an aggressive end of life accounting where undeclared capital gains are taxed before being passed down to heirs. The American Dream does contain the desire for people to be able to make their own fortune and to improve the lot of their children. To those ends, I don’t begrudge people founding companies etc. the ability to retain much of their capital gains in their lifetimes, but their children do not have the right to simply inherit massive wealth without a reasonable level of taxation. I think the current levels of estate tax exemption are quite fair in that small business owners and private farms can largely pass those businesses down to their families, but theoretically billionaires would have to pay significant tax. The trust laws should be tightened up so that estates and trusts are forced to spend down quickly for the very wealthy.

The American Dream is really about making it big yourself, not just winning the birthright lottery. So we should celebrate people who actually create businesses and make wealth. But their heirs should also have to re-earn that massive wealth.

“Separate an individual from society, and give him an island or a continent to possess, and he cannot acquire personal property. He cannot be rich. So inseparably are the means connected with the end, in all cases, that where the former do not exist the latter cannot be obtained. All accumulation, therefore, of personal property, beyond what a man’s own hands produce, is derived to him by living in society; and he owes on every principle of justice, of gratitude, and of civilization, a part of that accumulation back again to society from whence the whole came.

The superstitious awe, the enslaving reverence, that formerly surrounded affluence, is passing away in all countries, and leaving the possessor of property to the convulsion of accidents. When wealth and splendor, instead of fascinating the multitude, excite emotions of disgust; when, instead of drawing forth admiration, it is beheld as an insult upon wretchedness; when the ostentatious appearance it makes serves to call the right of it in question, the case of property becomes critical, and it is only in a system of justice that the possessor can contemplate security.

To remove the danger, it is necessary to remove the antipathies, and this can only be done by making property productive of a national blessing, extending to every individual. When the riches of one man above another shall increase the national fund in the same proportion; when its, shall be seen that the prosperity of that fund depends on the prosperity of individuals; when the more riches a man acquires, the better it shall be for the general mass; it is often that antipathies will cease, and property be placed on the permanent basis or national interest and protection.” Agrarian Justice, 1795. Thomas Paine

Thank you. I just teared up a little.

Paine was so far ahead of his time, or, were the times surrounding him that retrograde? That we must make recourse to the writings of a two hundred years gone political philosopher to address the injustices of the present day says myriads about the stagnation at the heart of todays’ ‘elites.’

In Book V of The Laws, by Plato, Jowett translation, there’s this:

So in Plato’s formulation, nobody could own more than four times the basic amount of wealth that everyone is entitled to.

From the secular stagnation graph, it appears the system is nearly working to perfection: The Great Recession, unlike the 1970s doldrums or the tech bubble pop in 2000, barely affected the rate of wealth concentration by the 0.1%.

We can thank Bernanke and the Fed for that. Their focus on preserving assets values allowed many people to remain wealthy. If the free market had actually been allowed to work, we would likely have a much more equal society today, although it would be poorer. The big failures were the lack of prosecution and the selective bailouts by the Fed, Treasury, and Congress that penalized the middle class and rewarded the wealthy asset owners.

And they can do it by scaring the middle class. What do *I*, a person that owns a single roof to keep over his head, care if all house values including mine drop by 10%? I can still (ignoring the real estate parasites) follow my career by selling my house and buying another.

But they have them conned into thinking their house is an “investment”, your “asset”, and it therefore needs to act like such.

You “own” your house? Like I “own” mine? What I “own” is being allowed to inhabit the place, 2 br 1 ba evacuation zone D 19 feet above datum sea level, to maintain and improve it, put on a new roof, all that, but only as long as I keep paying $$$$$ month to the lender who holds the note, and mortgages the debt I signed up for. Oh, and pay a pretty penny for insurance and “the costs of civilization.” On a 30-year mortgage, which has 25 years to run. And I am over 70, with small chance of either being able to physically and possibly financially sustain my wife and myself in this house, or have a chance of holding a “mortgage burning,” https://en.m.wikipedia.org/wiki/Mortgage_burning (One small virtue is that the mortgage — so far — is serviced and the note held by my credit union and not sliced, diced and “tranches,” though the credit union has been merged into one of the larger Financial Beasts so who knows how long that will last.) People talk of home “ownership” as some kind of “right.” Several posters here can attest how easily the wealthy and powerful can kick them out of their “homes,” with no recourse. As I say repeatedly, “there are no rights without enforceable remedies.”

“Home ownership” is an oxymoron from the git-go. But we mopes do what we can to “survive and prosper” as best we can…

Too bad I am not as perspicacious as some who post here and in the trading blogs and conservative spaces, who have “trading skills” and are able to surf the waves of the “market ocean” right up onto the beach… Lightens THEIR survival struggle, but there’s a loser in every trade, and even they are “exposed to risk” that does not even touch the wealthy/powerful… It’s my own fault for not “investing more wisely,” I guess, and not being born with wealth or with the kind of brain function that perceives beta intuitively…

The argument reminds me of something my grandfather said. He was a small grocer, but he dabbled in agriculture (owned some farms), stocks (mostly fizzles) and real estate (so-so). He also was a board member for a large bank in his city. He told me that the problem during the Great Depression wasn’t a lack of money. He said there was lots of money, but it was in the possession of the wealthy, and the wealthy wouldn’t spend it. The problem was compounded by deflation, which made the money more valuable with each passing day.

As a small businessman, his success depended on the average Joe to have money in his pocket and be willing to spend it on groceries and sundries. There weren’t enough millionaires to keep his grocery in business, as they ate about the same amount of food as the middle class and working poor. Different food and better quality food, certainly, but not significantly more food. The profit margin on steak was about the same as on hamburger or sliced baloney.

Great comment and info, Phil. Thank you. His experience is ours today.

Nobody’s interested in changing this. Estimates of participation in IRA savings, for instance, show that barely 1/4 of workers contribute in a given year. Plenty of opportunity to organize the little guy to build countervailing wealth. Zero interest.

Call me when people are willing to break taboos.

If you are being paid a less than living wage {i.e. all your wages go to essentials to just survive) how are you going to put money in a 401k? It is amazing that the old saying “an honest day’s work for an honest day’s pay” has disappeared from our vernacular.

Fortune Magazine states 42.4% of the work force earns less than $15 an hour. Add in the unemployed and is it any shock that only 1/4 of the workers are able to put money away for retirement.

…but, but, it’s their OWN fault for not investing wisely and adapting to the Market supplely and flexibly and all that, isn’t it?

I used to work at the most exclusive country club in San Diego County. Back in the mid 1980’s our management had to institute a 15% tip charge right onto the food/drink bill just to keep waitstaff. We were losing all of our best servers because some of the richest people in the U.S. who own homes here in this exclusive north county community were too cheap to leave tips for us.

The richest people in the U.S. who own homes here in this exclusive north county community intentionally rip off the waitstaff and leave zero tips for us. (fixed it for ya)

Its a feature, not a bug

You don’t get rich by spending it!

Investing in making cronies and having them acquire power has been able to massively increase wealth.

Unknown in the USA of course……

Total information awareness, 1033 program, patriot act,citizens united….these have no relationship to the increasing disparity of wealth and power in the USA.

US Census Bureau just reported in 2016 middle-class household income had reached the highest level ever recorded. Median household income was $59,039. But for anyone who took Business Statistics knows that median is a point located on the scale somewhere close to the middle. But they don’t mention how high the total highest household income is. When you have .01%-1.0% households getting huge increases in income each year, it makes sense that scale’s median point would be higher.

No. It doesn’t matter at all what the 1% earn. It can be $1 more than median or $1 trillion more than median. The median income is the income of that one guy at the exact 50% mark, forget everyone else.

The wealth of the top 1% strongly impacts the average income, not the median.

Have you done the math on your statement?

This brings up another problem. “Median Household Income”. Where are all the inflation-adjusted comparisons of SALARIES, between 60’s/70’s and present day? A ‘days work for a days pay’ comparison?

While this may be useful for looking at what resources are available to a family unit, it says nothing about the labor time or effort needed to acquire the income.

Show me a figure for median WAGE for one person, as opposed to multiple earners. I have not found it, despite looking. Certainly not in the overwhelming state-by-state, county-by county, breakdowns which household income have been analyzed.

When I was growing up, it was rare indeed to find two parents with full-time jobs. The only ones I can recall, having reflected at length, were one academic couple, where both were profs, and probably had a quite large store of wealth. But they had 7 children!

Poverty is the problem, not the rich. The rich spend or invest, creating opportunity. They are greedy, often. But that is not the cause of poverty.

Lack of long term thinking is deliberately fostered. So is urbanization and for decades, suburbanization. Deliberately pointless spending enriches some at the expense of many. Less CONditioning, more thinking?

The chattering classes in the USA are disappointing.

Past research data points to a cumulative, long-term effect of poverty on cognition (Karelis, 2007, Shonkoff, Deborah, 2000) while childhood poverty has been correlated with hindered brain development and a reduction in cognitive capacity amongst adults who experienced childhood poverty (Evans et al, 2009).

Previous research on people living in long-term poverty (Shah et al, 2012, others) have shown fairly conclusively that lack of financial means forces poor decision-making — such as choosing to purchase cheaper, less healthy foods, or, to forgo purchasing a necessary medication due to cost, thus increasing poor health. This much seems clear, if not self-evident.

But new research by a team of psychologists and economists from Harvard, Princeton, and the University of British Columbia, has found that it is not simply the lack of money that forces poor people to make “poor” decisions, rather, that poverty itself depletes cognitive resources, and specifically, one resource in particular: cognitive control.

According to the researchers — who combined results from two complimentary studies — poverty “directly impedes cognitive functioning.” PlanetSave: How poverty impairs mental functioning and promotes risky decision making.

An entirely different reality exists for the nation’s wealthiest minors, evidenced by social media accounts that flaunt their lifestyles. Naturally, a child born into a high-income earning family has easy access to luxurious resources. Yet this environment has set them up with an unfair advantage compared to low-income children, as wealthy kids without fiscal responsibility are likely to stay wealthy at about the same rate as poor kids who work hard are likely to stay poor. Newsweek: Why the rich stay rich and the poor stay poor.

The problem is not ‘Insanely Concentrated Wealth’ – as the author himself acknowledged that has always been with us. It’s Insanely Concentrated Business Power, otherwise known as Crony Capitalism. The Robber Barons of 100-125 years ago, the Hedge Private Equity players today, behind the smoke screen of ‘maximizing shareholder value. ‘

Awesome post! Thank you! Great discussion, all!

Raising (back from the dead) American labor union density is the singular key. Seems the big blockade against progressive states starting the ball rolling — by for instance making union busting a felony — is the universal presumption that federal preemption bars almost any labor law action by states; even actions simply supporting federal law (which works with minimum wage for example). Which is the extreme way the courts have portrayed what the NLRA(a) intends for generations now.

Cut the Gordian knot of fed preemption — per simple, unquestioned right to organize — by remembering that a First Amendment protected right is involved in same:

If a state or local legislature passes a law that makes exercising freedom of association (e.g., organize a labor union) possible where it would not be possible otherwise, then, Congressional preemption of labor law falls to the First Amendment.

As presentable a new path back as it is simply true. Republicans will have no place to hide.

The bottom 2 quintiles explain the higher murder rates (Chicago et. al.). And it’s correctable. Secular strangulation is none other than declining savings velocity (not demographics, not robots or AI).

Velocity has fallen since 1981 (ever since the plateau in commercial bank deposit financialization, viz., the widespread introduction of ATS, NOW, and MMDA account classifications). Velocity falls when a higher percentage of an increasing volume of money becomes interest bearing, or saved and held within the framework of the payment’s system. It’s simple commercial banks don’t loan out savings (at least from the standpoint of the system, i.e., macro-economics (remember: loans + investments = deposits?). This is the source of the pervasive error that characterizes the Keynesian economics – the Gurley-Shaw thesis. See Bankrupt u Bernanke:

There are 2 things you don’t mess with: a man’s meal and his paycheck. Bankrupt u Bernanke violated both sacraments.

Ben Bernanke in his book “The Courage to Act”: “Money is fungible. One dollar is like any other”.

(1) “I adapted this general idea to show how, by affecting banks’ loanable funds, monetary policy could influence the supply of intermediated credit” (Bernanke and Blinder, 1988).”

(2) “For example, although banks and other intermediaries no longer depend exclusively on insured deposits for funding, non-deposit sources of funding are likely to be relatively more expensive than deposits”

(3) “The first channel worked through the banking system…By developing expertise in gathering relevant information, as well as by maintaining ongoing relationships with customers, banks and similar intermediaries develop “informational capital.”

(4) “that the failure of financial institutions in the Great Depression increased the cost of financial intermediation and thus hurt borrowers” (Bernanke [1983b]).

Keynesian economists have finally achieved their objective: that there is no difference between money and liquid assets.

Apologies for pontificating here: imo we, rich and poor alike, are too mentally lazy to have real power so we settle for money and shiney things. If power is the goal and we enslave the economy to serve the value of money just to maintain power, then we need good industrial/eco/social policy – as in laws and regulations – in order to have any meaning. Because power without social purpose is useless. It’s circular at best. It’s an oxymoron. I think real power comes from knowing what you want and turning your back on all the distractions. Someone mentioned “Vietnam” above – that’s the kind of determination we need. A social mobilization to end a war. Maybe global warming will give us the courage of our convictions again. Maybe.

Didn`t notice anyone mentioning Wagner`s Ring Cycle: the ultimate story of dragons and hoards of loot. Fafner offs his brother and gets all the gold, then goes to sleep on it until Siegfried guts him, bathes in his blood, and becomes almost invincible. Thence follows a tale of vast tragic expanse. You could if so inclined watch several versions of the Ring on Youtube. The rich attend the opera (or music drama if you will) but they seem not to learn anything from it. Too busy counting their loot in their heads to listen to it? They see at the end the Gods entering Valhalla and I suppose think that’s where it’s at, ignoring that it is the Twilight of the Gods, their ending, their defeat, their Gotterdamerung. Is it true for this “End of History” neoliberal fairytale as well?

You have just discovered why Great Britain established death duties (estate taxs) as a swingingly huge tax on inherited wealth at the BEGINNING of the 20th century.

Congratulations, USAins, those who don’t know their history, and the reasons behind the historic events, (Which appears to be the US body civic) are condemned to repeat it.

This is not a slag off to NC. It is a slag off to those who believe “estate taxes” an unfair burden.

Good News:Estate taxes are a unfair burden. On the idle rich, the parasites of society who are forced to go to work.

Can you believe Zuckem-drys’s kids, or Bozo’s offspring, or the Swinging Gates will do something great?

If you do, I’m accepting bets!

Suck ’em dry! Ha! It took me a little while to figure it out. Good one!

I am a math wonk, but not as familiar with economics as i obviously should be. I AM, however, a big fan of good visualizations.

Up-thread someone was pleading for a good animator of economic factors. It seems that Hans Rosling would have been your man. Here is one of several videos he has produced that are just about perfect:

https://www.youtube.com/watch?v=jbkSRLYSojo

His Gapminder Foundation continues his work. Perhaps the author here should reach out.

I wonder how many of you grew up in an economic regime which was prosperous? Would you recognize it? Obviously, GDP and even per capita GDP is as useless a measure as, say, the Dow and a lot of comments here are about monetary flows & stocks, the distorting effects of wealth on policy & politics, etc, all of which are valid, but what is “prosperity?” It’s a question I asked myself a few years back and as far as I can tell, nobody seems to get it, though Phil in Kansas City and Denis Drew danced near it. The answer I found, matters. A lot. I grew up in prosperity and this is what I remember: middle-skilled workers (not business owners, not managers, but line employees) were able to acquire wealth (which for the most part was their home purchase) just on the wages of a single household earner. What’s more, they were able to largely consolidate that purchase before retirement. Lower skilled workers had a fairly easy time moving up into the ranks of the middle-skilled quickly because there was an abundance of opportunity and people didn’t need to take on tens of thousands of dollars in debt just to get into decent job path. Real estate was an investment hedge, not the hot market it is today and it’s why manufacturing matters. This to me is the bare minimum needed to define prosperity and honestly, it was a product of the destruction of our competition overseas, though regulation, large amounts of government spending (with the tax rates to support this) and especially a strong labor movement obviously played their parts. Has anybody any idea how we get back to this situation without destroying the industrial plants of foreign competitors? Because I’m not seeing it and this should give everyone pause.

I grew up in a golden age, 2/3rds of the world had neutered themselves vis a vis communism or ravages of war, and there was never a whiff of a chance of me being in the military, and as you wrote, you only needed one person working to support a family.

We’ll simply never see the likes of it again, everybody else wants what we had, and are willing to work harder, longer and cheaper to get there.

I think the last generation was the youngest Boomers, or maybe as late as ~1975, and since then it’s been slowly decaying economically. So fifty years since the economic regime was broadly healthy.

That’s a long time.