Yves here. As much as Ilargi’s post has merit, I get a bit bothered by the exercise of trying to make sweeping statements about capitalism in the present day, since capitalism takes many form.

As readers know, we also are not fans of a universal basic income. First, if it were high enough to provide even for a subsistence living, it would be massively inflationary. That means it would at best be a stipend that would wind up subsidizing businesses, since it would allow them to pay lower wages. It would also be used to cut/end existing targeted programs, which are often far more generous to populations with specific needs. Second, it would reduce recipients to being mere consumers, held in contempt by supposedly more productive people. That also means, like the Speenhamland system, it would be at risk of being ended abruptly and displacing people who had long been largely or entirely out of the workforce and would not be able to find sufficient employment.

Finally, to answer whether a basic income is part of a capitalist system, Michal Kalecki’s 1943 Essay on Politics and Ideology already predicted it as inevitable if businessmen, as he anticipated, would oppose full employment policies. As he wrote:

IV

1. What will be the practical outcome of the opposition to a policy of full employment by government spending in a capitalist democracy? We shall try to answer this question on the basis of the analysis of the reasons for this opposition given in section II. We argued there that we may expect the opposition of the leaders of industry on three planes: (i) opposition on principle to government spending based on a budget deficit; (ii) opposition to this spending being directed either towards public investment — which may foreshadow the intrusion of the state into the new spheres of economic activity — or towards subsidizing mass consumption; (iii) opposition to maintaining full employment and not merely preventing deep and prolonged slumps….

2. In current discussions of these problems there emerges time and again the conception of counteracting the slump by stimulating private investment. This may be done by lowering the rate of interest, by the reduction of income tax, or by subsidizing private investment directly in this or another form. That such a scheme should be attractive to business is not surprising. The entrepreneur remains the medium through which the intervention is conducted. If he does not feel confidence in the political situation, he will not be bribed into investment. And the intervention does not involve the government either in ‘playing with’ (public) investment or ‘wasting money’ on subsidizing consumption.

It may be shown, however, that the stimulation of private investment does not provide an adequate method for preventing mass unemployment. There are two alternatives to be considered here. (i) The rate of interest or income tax (or both) is reduced sharply in the slump and increased in the boom. In this case, both the period and the amplitude of the business cycle will be reduced, but employment not only in the slump but even in the boom may be far from full, i.e. the average unemployment may be considerable, although its fluctuations will be less marked. (ii) The rate of interest or income tax is reduced in a slump but not increased in the subsequent boom. In this case the boom will last longer, but it must end in a new slump: one reduction in the rate of interest or income tax does not, of course, eliminate the forces which cause cyclical fluctuations in a capitalist economy. In the new slump it will be necessary to reduce the rate of interest or income tax again and so on. Thus in the not too remote future, the rate of interest would have to be negative and income tax would have to be replaced by an income subsidy. The same would arise if it were attempted to maintain full employment by stimulating private investment: the rate of interest and income tax would have to be reduced continuously.

By Raúl Ilargi Meijer, editor at Automatic Earth. Originally published at Automatic Earth

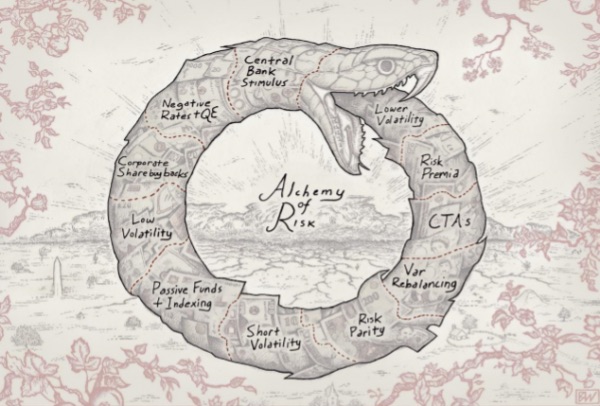

New Zealand’s new prime minister Jacinda Ardern calls capitalism a blatant failure. Former Greek finance minister Yanis Varoufakis says capitalism is ‘merely’ coming to an end because it is making itself obsolete. Mathematics professor Bruce Boghosian claims that without redistribution of wealth, our market economy would not be stable, because wealth always tends to concentrate. The people at Artemis Capital Management write that the stock market has begun self-cannibalizing like a snake eating its tail, and the only reason we’re not in a recession already is ‘financial alchemy’.

At the very least we can say that the system is under pressure. But what system is that? It would be nice to have a clearcut definition of capitalism, but alas, there are many, about as many as there are different forms of it. That doesn’t make this any easier. Americans call many European economies ‘socialist’, which seems to mean they are not capitalist. But Scandinavian countries don’t function like the Soviet Union either.

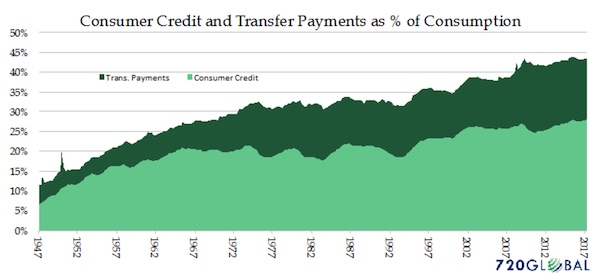

And if you see how much money is involved in transfer payments to citizens in the US, the supposed bastion of free market capitalism, it’s tempting to conclude the system has already failed. But even with transfer payments, inequality is at record levels. That would seem to confirm Boghosian’s statement that “even if a society does redistribute wealth, if it’s too small an amount, “a partial oligarchy will result..” So what then?

Varoufakis and others want a “universal basic dividend”, or “universal basic income”. Would that be the end of capitalism as we know it? Or is it just a -perhaps more extreme- form of ‘state capitalism’? Varoufakis deems it inevitable because technology will eradicate so many jobs from societies that people won’t be able to make money from work. Personally, I’ve long thought that the pending large-scale demise of pensions systems will lead to some form of UBI.

37-year-young Jacinda Ardern is very clear in her assessment of New Zealand’s form of capitalism. If you’ve got the worst homelessness in the developed world, you have a broken system. If the system fails the people, it’s no good. Other people might argue that capitalism never promised to take care of everyone. Or rather, not through state interference. Labour’s Ardern has her view:

New Zealand’s New Prime Minister Brands Capitalism A ‘Blatant Failure’

[Jacinda] Ardern, has pledged her government will increase the minimum wage, write child poverty reduction targets into law, and build thousands of affordable homes. In her first full interview since becoming prime minister-elect, she told current affairs programme The Nation that capitalism had “failed our people”. “If you have hundreds of thousands of children living in homes without enough to survive, that’s a blatant failure,” she said. [..] “When you have a market economy, it all comes down to whether or not you acknowledge where the market has failed and where intervention is required. Has it failed our people in recent times? Yes. How can you claim you’ve been successful when you have growth roughly 3%, but you’ve got the worst homelessness in the developed world?”

So to which extent should a state interfere in markets, and in society at large? There are obviously wide ideological divides when it comes to answering that one. Does that mean there is no answer possible at all? Perhaps not. Perhaps the answer lies in the fact that the system is predestined to fail, as Boghosian’s mathematical models suggest: “Our work refutes the idea that free markets, by virtually leaving people up to their own devices, will be fair..”

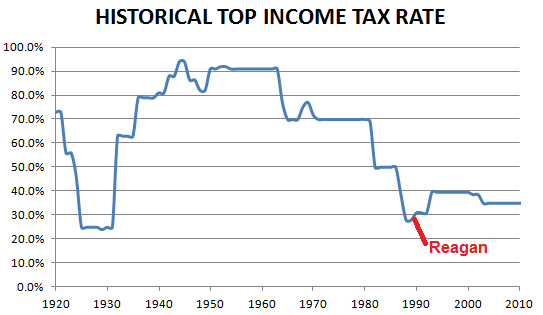

That doesn’t necessarily demand a lot of interference, we could ‘simply’ write the rules of the game in such a way that the ‘natural tendency’ towards wealth concentration is blocked. An example is the history of the top US income tax rate. Arguably, the nation was doing a lot better under Eisenhower and Kennedy, with a top rate of 91%, than it is today. If you put a few rules like that in play, perhaps including Varoufakis’ idea of a ‘common welfare fund’, maybe the state doesn’t have to interfere much otherwise.

One of the main underlying claims of capitalism, and of macroeconomics in general, is that markets -and societies- will sort themselves out if left alone. Bruce Boghosian says this is not true, and that he has the math to prove it. The entire notion of markets tending towards a ‘supply-demand equilibrium’ is nonsense, he says (echoing Minsky, Steve Keen et al). Trickle-down economics is a figment of the imagination, while trickle up-economics flourishes.

This refutes much of what our economic systems are based on, which would appear to indicate that we need an urgent revision of these systems. Unless we would agree that Darwin-on-Steroids is a good idea. We don’t and won’t, because it would mean Stephen Foster’s “frail forms fainting at the door” all over the place. A market ideology that causes widespread misery has no future.

Seven years ago, the combined wealth of 388 billionaires equaled that of the poorest half of humanity , according to Oxfam International. This past January the equation was even more unbalanced: it took only eight billionaires, marking an unmistakable march toward increased concentration of wealth. Today that number has been reduced to five billionaires.

Trying to understand such growing inequality is usually the purview of economists, but Bruce Boghosian, a professor of mathematics, thinks he has found another explanation—and a warning. Using a mathematical model devised to mimic a simplified version of the free market, he and colleagues are finding that, without redistribution, wealth becomes increasingly more concentrated, and inequality grows until almost all assets are held by an extremely small percent of people.

“Our work refutes the idea that free markets, by virtually leaving people up to their own devices, will be fair,” he said. “Our model, which is able to explain the form of the actual wealth distribution with remarkable accuracy, also shows that free markets cannot be stable without redistribution mechanisms. The reality is precisely the opposite of what so-called ‘market fundamentalists’ would have us believe.”

While economists use math for their models, they seek to show that an economy governed by supply and demand will result in a steady state or equilibrium, while Boghosian’s efforts “don’t try to engineer a supply-demand equilibrium, and we don’t find one,” he said. [..] The model tracks the data with remarkable accuracy, he said. He and his team will soon publish a paper on how it relates to U.S. wealth data from 1989 to 2013.

“We have also begun to apply it to wealth data from the ECB, and so far it seems to work very well for certain European countries as well,” he said [..] It turns out that when agents do well in early transactions, the odds are so increasingly stacked in their favor that—without redistribution from taxes or other wealth-transfer mechanisms—they will get more money, and keep accruing wealth inevitably.

“Without redistribution of wealth, our market economy would not be stable,” said Boghosian. “One person would run away with all the wealth, and it would keep going until it came to complete oligarchy.” And even if a society does redistribute wealth, if it’s too small an amount, “a partial oligarchy will result,” Boghosian said.

If markets and societies cannot survive under current rules, theories and ideologies, what do we do? The Artemis guys strongly suggest we stop the practice of excessive stock buybacks- even if they’re the only thing propping up the whole market system. Because they’re leading us straight into a recession. Because they’re making that recession a lot worse.

Volatility and the Alchemy of Risk

The Ouroboros, a Greek word meaning ‘tail devourer’, is the ancient symbol of a snake consuming its own body in perfect symmetry. The imagery of the Ouroboros evokes the infinite nature of creation from destruction. The sign appears across cultures and is an important icon in the esoteric tradition of Alchemy. Egyptian mystics first derived the symbol from a real phenomenon in nature. In extreme heat a snake, unable to self-regulate its body temperature,will experience an out-of-control spike in its metabolism. In a state of mania, the snake is unable to differentiate its own tail from its prey,and will attack itself, self-cannibalizing until it perishes. In nature and markets, when randomness self-organizes into too perfect symmetry, order becomes the source of chaos.

The Ouroboros is a metaphor for the financial alchemy driving the modern Bear Market in Fear. Volatility across asset classes is at multi-generational lows. A dangerous feedback loop now exists between ultra-low interest rates, debt expansion, asset volatility, and financial engineering that allocates risk based on that volatility. In this self-reflexive loop volatility can reinforce itself both lower and higher. In a market where stocks and bonds are both overvalued, financial alchemy is the only way to feed our global hunger for yield, until it kills the very system it is nourishing.

[..] At the head of the Great Snake of Risk is unprecedented monetary policy. Since 2009 Global Central Banks have pumped in $15 trillion in stimulus creating an imbalance in the investment demand for and supply of quality assets. Long term government bond yields are now the lowest levels in the history of human civilization dating back to 1285. As of this summer there was $9.5 trillion worth of negative yielding debt globally. Last month Austria issued a 100-year bond with a coupon of only 2.1%(6) that will lose close to half its value if interest rates rise 1% or more. The global demand for yield is now unmatched in human history. None of this makes sense outside a framework of financial repression.

Amid this mania for investment, the stock market has begun self-cannibalizing… literally. Since 2009, US companies have spent a record $3.8 trillion on share buy-backs financed by historic levels of debt issuance. Share buybacks are a form of financial alchemy that uses balance sheet leverage to reduce liquidity generating the illusion of growth. A shocking +40% of the earning-per-share growth and +30% of the stock market gains since 2009 are from share buy-backs. Absent this financial engineering we would already be in an earnings recession.

Any strategy that systematically buys declines in markets is mathematically shorting volatility. To this effect, the trillions of dollars spent on share buybacks are equivalent to a giant short volatility position that enhances mean reversion. Every decline in markets is aggressively bought by the market itself, further lowing volatility. Stock price valuations are now at levels which in the past have preceded depressions including 1928, 1999, and 2007. The role of active investors is to find value, but when all asset classes are overvalued, the only way to survive is by using financial engineering to short volatility in some form.

Yanis Varoufakis doesn’t so much argue that capitalism has already failed, he says it is bound to fail in the near future. Because new technology, including artificial intelligence, will destroy too many jobs for society to continue to function intact. That is already happening, in that we both produce and consume Google’s ‘products’, but we get none of the profits. An example:

Google’s Plan To Revolutionise Cities Is A Takeover In All But Name

Alphabet’s weapons are impressive. Cheap, modular buildings to be assembled quickly; sensors monitoring air quality and building conditions; adaptive traffic lights prioritising pedestrians and cyclists; parking systems directing cars to available slots. Not to mention delivery robots, advanced energy grids, automated waste sorting, and, of course, ubiquitous self-driving cars. Alphabet essentially wants to be the default platform for other municipal services. Cities, it says, have always been platforms; now they are simply going digital.

“The world’s great cities are all hubs of growth and innovation because they leveraged platforms put in place by visionary leaders,” states the proposal. “Rome had aqueducts, London the Underground, Manhattan the street grid.” Toronto, led by its own visionary leaders, will have Alphabet. Amid all this platformaphoria, one could easily forget that the street grid is not typically the property of a private entity, capable of excluding some and indulging others. Would we want Trump Inc to own it? Probably not. So why hurry to give its digital equivalent to Alphabet?

Google aims at taking over our entire communities, and claims this will be to our benefit. We let the new technology companies expand far and wide, to a large extent because our ‘leaders’ don’t understand what is happening any better than we do. But that is not a good thing, for many different reasons. It’ll be very hard to whistle them back later, both because of the wealth they’re building, and because of the intensifying links they have to government, including -or especially- the intelligence community.

Capitalism Is Ending Because It Has Made Itself Obsolete

Former Greek finance minister Yanis Varoufakis has claimed capitalism is coming to an end because it is making itself obsolete. The former economics professor told an audience at University College London that the rise of giant technology corporations and artificial intelligence will cause the current economic system to undermine itself.

Mr Varoufakis [..] said companies such as Google and Facebook, for the first time ever, are having their capital bought and produced by consumers. “Firstly the technologies were funded by some government grant; secondly every time you search for something on Google, you contribute to Google’s capital,” he said. “And who gets the returns from capital? Google, not you. “So now there is no doubt capital is being socially produced, and the returns are being privatised. This with artificial intelligence is going to be the end of capitalism.”

Warning Karl Marx “will have his revenge ”, the 56-year-old said for the first time since capitalism started, new technology “is going to destroy a lot more jobs than it creates”. He added: “Capitalism is going to undermine capitalism , because they are producing all these technologies that will make corporations and the private means of production obsolete. “And then what happens? I have no idea.”

Describing the present economic situation as “unsustainable” and fearing the rise of “toxic nationalism”, Mr Varoufakis said governments needed to prepare for post-capitalism by introducing redistributive wealth policies. He suggested one effective policy would be for 10% of all future issue of shares to be put into a “common welfare fund” owned by the people. Out of this a “universal basic dividend” could be paid to every citizen.

Has capitalism failed already, as Jacinda Ardern claims, or will that happen only in the future, as Varoufakis says? It may be a moot question once the system and the markets start collapsing. That they will, and must, is not a question but a certainty, even a mathematical one. Whatever your ideology, that is not a good thing. And the current ideology has caused this, that much is clear.

If the remaining wealth is not divided better than it is today, those who have gathered most of it will also find themselves in non-functioning societies and communities. Unless perhaps you’re George W. and have property in Paraguay.

But even then. We’re eating our tails.

It’s not as if I didn’t think about the 1%’er interface between me and hepatitis A when I was down in San Diego last week. Our world’s walk in different circles, except when I had to urgently use a fast food restaurant’s bathroom, and our germs met if only in passing.

The 1%’ers on the other side of the spectrum on Wall*Street had for so long included me in their fraudulent schemes-along with everybody else, as unwilling accomplices of their chicanery, which spread so far as to allow us to stomach lies from all quarters-as business as usual, not business as unusual.

Infection inflections

My long post got ate. Gosh Darn it.

So

Bullet Points

Guaranteed work not income.

Most people want work not check.

Plenty of not being done or done poorly by machines to cut payroll.

Also awful products and service.

Monopoly everything so customers screwed. And my blue jeans suck, and no longer made in America.

Numbers of written laws including Constitution ignored or interpreted into worthlessness.

Corruption, corruption, and corruption distorts and destroys any economic system we choose.

The state will probably use (illegal) violence and Stasi levels of spying, repression, and interference only with bonus modern technology to prevent changes.

not sure if this will work for you but I’ve had some success hitting the back button in the event of an eaten comment, then scrolling to the bottom of the comment page and yours may be there at the bottom but once retrieved you need to make significant changes to your comment or the moderation algo will id you as a spammer, which will increase odds of further moderations

Thanks, it can be frustrating.

financialization (much of it criminal) has made it impossible for an industrious person to earn a secure living.

as it appears that these criminal activities will not be prosecuted, housing, healthcare and education costs will remain beyond the reach of at least 60% of americans.

this is not their fault. a basic universal income, if sufficient, will rectify this.

if we truly had ‘capitalism’ then i could see how ubi would be a problem. we don’t though. it’s not capitalism if equifax or tepco or kobe steel are considered viable. it’s not capitalism if you have dozens of six-figure administrators at every university and health insurer.

optimally, we’d eliminate rent-seeking and predatory behavior. since that’s not going to happen, ubi seems like the only path forward.

financialization (much of it criminal) has made it impossible for an industrious person to earn a secure living.

Yeah. Concisely put.

..as some of us succinctly have noted, 2001, “financial services” hovered 2-3 % of U.S. economy…today, that number has been observed at 16-22%…(post 2007 Wall Street “control accounting frauds”..)

(anyone with lucid characterization of stats, please do…)

Thank you for pulling that out of the essay.

good points, and recalls to me a commentor from a few weeks back who claimed that we should fear medicare for all because it would put all those insurance employees in a bad spot. That said I prefer jobs guarantee but doubt our leaders have the foresight to enact such a thing, or a ubi for that matter

There is already a class of Americans whose entire lives are funded by government largess, or to say it another way they are already receiving a Guaranteed Basic Income. As a simple matter of fairness I believe that every man, woman, and child within the US should have access to the same Basic Guaranteed Income.

In the trailer park where my mother still lives the majority of residents are receiving food stamps (free food from the government). I have a hard time trying to wrap my head around the fact fact that these people are getting food for literally doing nothing while I’ve disqualified myself from such a great benefit by working and planning ahead. Maybe if these people wouldn’t get their food aid cut the moment they got up to work, they’d actually want to go work? If free money for nothing every month is a bit much, how about just free food for nothing for everyone then? I think it could work.

The Kraft corporation gets 1/6th of its revenue from SNAP,Walmart 18%, I can’t recall the bank that makes a tidy sum from administering the cards.

So it also helps people who have worked hard and planned for the future.

IIRC the bank is Chase. Jamie Dimon is a welfare queen.

I hear permutations of this argument fairly regularly, and will allow that it may well have merit.

But…I worked for the Treasury Department post-crisis. The same Treasury Department that handed $25 billion of public assistance to LIBOR-rigging, document-falsifying megabanks.

In terms of priority setting, if we really care about preventing government fraud, waste and abuse, it seems to me that we should breathe down the necks of people getting $25 billion of government handouts before we worry about people getting $250 a month. For one thing, I doubt the people getting $250 a month are shipping any of it to the Cayman Islands.

Not only that – but, connecting this to MMT, the government issuing interest-paying bonds is in effect a gigantic subsidy to the private sector, see link with Bill Mitchell’s interview below.

https://www.youtube.com/watch?v=YnyDRwSqp2E

So arguing about foodstamps… I don’t think the answer is there. I think instead of a guaranteed UBI we should have guaranteed levels of housing, work, healthcare, education and other essentials all supported by interest free money but not necessarily via money giveaway. I don’t hear anyone talking about that.

A UBI in the form of money only will achieve nothing except fast and sure inflation which will negate its value very quickly and put us back to square one.

You are not responding to what I said. I suggested that everyone should get guaranteed basic food assistance for fairness’ sake and you went off on some strange tangent. What’s going on?

…rabid scapegoating of victims – diversion from Wall Street control accounting frauds has been perpetrated since 2007…teachers, schools, social security, medicare, unions, the poor (welfare recipients), immigrants, and last week, NY TImes, new tech; Facebook, Amazon, Apple, Microsoft, etc…

that round robin has continued unabated ever since…

“free money for nothing”. It’s not free money for nothing. Bread and circuses ensure that the Patricians sleep soundly in their villas without fear of having their throats slit in the middle of the night. The seven richest counties in the US are all just outside Washington DC. That is where the majority of government largesse goes. That is real “free money for nothing”; not the chump change of the trailer park denizens whom you seem to envy so much.

So the corrupt upper classes are corrupting the lower classes to hang on to power for a few more years. That worked well for the Romans.

By the way, if I envied trailer park denizens I’d still be living in a trailer park. I simply want to make the system more fair for everyone so that everyone has more psychological motivation to work hard and support the system.

I’m willing to compromise though. The American Revolution started with the idea of “no taxation without representation”. Just so the tax payers who are funding welfare programs can feel like they’re getting something worthwhile for the extra effort they’re putting in, how about we institute a policy of “no representation without taxation”? Only net tax payers will be allowed to vote under it. This should short-circuit the buying votes with bread and circusses downward spiral that eventually crashed the Roman Empire. What do you think?

Instead of a free food policy, I would support something akin to food stamps for every person in the US under the following conditions:

#1. It has to be pre-processed non-prepared food. Fruits, vegetables, maybe some dairy and meats would qualify under extremely stringent conditions.

#2. It is grown locally. I know for some of the population that would be impossible.

I agree with you. A legitimate food aid program would be along the lines of exactly what you said, and I would fully support. Additionally I’d even be willing to supply people with free training, seeds, plants, and gardening tools for those motivated enough to grow thier own food. Maybe we could arrange a cash payment program for those who use less food than they are allotted thanks to their gardening efforts.

What we have now is just unfair corporate welfare and should be ended immediately.

You are correct.. every person in the military, every politician, every government contractor is already suckling at the government teet. If they actually went and got jobs in the outside world they would be making much less money. Why should we as a society be throwing money down the hole of the military when this country hasn’t been attacked by a foreign government entity since 12/7/1941? Why should we paying Senators $225,000 per year when they can go out and compete on our glorious free market for a job? Why should we be supporting government contractors for jobs that the government has gotten done previously??

I don’t disagree with you there either. As I learned in ethics 101 however, two wrongs don’t make a right. Welfare should be distributed in an even-handed manner to everyone or no one. The system we have now of selectively dishing out benifts to particular groups is a recipe for corruption and social decay. As evidence I’d have you look at the groups who have been traditionally receiving benefits in America and compare their group situations today vs. when these programs started. For any measure you care to look at receiving free money from the government has been an unmitigated disaster for them. Ironically enough anyone who makes the case that a guaranteed basic income for everyone would be an awful idea can look at these groups as evidence of how their predictions have already been born out in reality. Free government aid is a great way to destroy people if that’s your aim.

There is already a class of Americans whose entire lives are funded by government largess . . .

The military class.

I have no Calvinist impulse to work. Most of the jobs in this society fall into one of three categories:

1) Do actual harm;

2) Do no good;

3) Do some good, but can easily be done by a machine.

Right now, a large proportion of jobs exist only to keep people busy and “out of trouble.” No thanks.

Is there much necessary and important work not being done? Absolutely, but a Capitalist system will never allocate resources to nurture the old and young, restore the environment or create the beautiful or challenging. We’ll have to rely on our own impulses for those things.

But we have to eat, and as long as we are under the thumb of Capitalism, UBI is the only way to keep things halfway humane.

I hate to tell you, a UBI will make you even more vulnerable to the whims of the powerful than being a wage slave. You act as if it would be a right. It will never be. It could be cut or restricted at any time. And it will be stigmatized.

Shush…. don’t tell them about the modern proponents [econnomists] musings, the need to diminish voting rights [democracy], because under a UBI they [econnomists] fear they [unwashed] would just vote for money thingy….

disheveled…. get some of that freedom ™ thingy…. sigh…

Those doing well by effectively getting a UBI, like in finance and pharma, think it’s fabulous. But Yves is right, people getting UBI will be considered scum and treated as so.

Well said.

Read 1984 – Understand Prole.

A boot on the face of humanity, forever?

Money is power, prestige, and ego verifying. I guess the monied believe in its permanent acquisition, just like raw power is for the ruling Class in 1984. The same end result too. In 1984 they were more honest, whereas the real world elites seem to create excuses.

I agree. Most jobs fall into the category of “adult daycare.” In my experience, the higher I climbed on the career ladder and the more money I made, the more pointless the “work” I did. Roofing houses in the summer heat was grueling, but you ended up with a house with a new roof. I make many times what I made doing that actual work now, to send some emails and change numbers in an excel spreadsheet. Most modern work is a farce.

I would support a universal jobs gaurantee rather than ubi IF the jobs were real work cleaning trash out of our oceans, rebuilding our infrastructure, educating our children, and stuff like that. If a universal jobs gaurantee just means everyone gets sent to adult daycare, a ubi looks preferable.

“Most jobs fall into the category of “adult daycare.””

Heh. When you’re a kid, you spend your weekdays in school wasting time,* and then you go home and have your parents do your chores for you: laundry, cooking, cleaning, home maintenance etc.

When you grow up, you spend your weekdays at a corporate job wasting time (no asterisk required, hopefully), and then you go home and spend some of your wages to hire strangers to play mommy and daddy for you: drop your clothes off at the laundromat, eat out or takeout, a cleaning lady, a shrink’s shoulder to cry on, a superintendent/plumber/repairman/etc. But now you get to call yourself a real, independent adult.

*There’s a reason why kids can be homeschooled for two hours a day and achieve the same test results as kids who go to school for seven to eight hours plus commute and homework.

and then even if the work itself is of some minimal worth, it’s often done under abusive conditions. But work guarantee jobs will be less abusive? That *might* be … but honestly I think a lot of it has to do with power, power corrupts, it takes people who may already have a hidden mean streak and turns them outright sadistic if they are given power as bosses over other human beings. Not everyone of course, but it really does do that to a decent number of personalities.

Honestly, I have contempt for your attitude. You think you have a right to exist and be served by others? Seriously? I feel sorry for your mother. She must have waited on you hand and foot.

Animals have to hunt or find places where they can graze and not be unduly at risk of being eaten by predators. They usually have to move about seasonally, sometimes very long distances (see bird and whale migrations). Subsistence farming or being a hunter gatherer is hard and unsafe unless you happen to be a hunter-gatherer in places with lots of edible plants and a good variety of them too (that’s generally not far from the equator).

But here we live in a world with electricity, indoor plumbing, winter heat as the norm, air conditioning, grocery stored, and cars (and that’s before we get to entertainment and chocolate) and you resent what work you have to do?

And that means you also hold in contempt people who do work you consider to be beneath you, like garbage collectors, janitors, orderlies in hospitals, service staff in restaurants, the list goes on….

Since we’re not close to UBI or JG, why can’t we just talk about reducing work hours?

I agree, however the problem is a lot of jobs these days don’t pay much. However more options to take part-time work, more vacation time etc. all that has been worked out by almost every industrial country in the world except the U.S.. It’s not difficult.

Capitalism is neither dead nor dying. Like a virus, it mutates and takes on new forms. Adam Smith recognized its revolutionary nature. Marx predicted its transformation from industrial capitalism into financial capitalism. The life force of Capitalism is the profit motive. Capitalism will transform itself into whatever form it takes to make a profit. It might be a neoliberal state takeover, where the state is subjugated to the demands of Capitalism. It might be a fascistic state where Fascism subjugates Capitalism to the service of the State. It might be a Scandanavian-style social democracy. You get the picture.

The outcome will vary on each country’s particular social-political-economic genetics. I would bet on a very unpleasant outcome for the USA. Then you have to add resource depletion, environmental degradation, climate change and conflict into the mix. Things will get worse. Much, much worse. I fear the ending is already scripted as countries continue down their paths of dependencies. The war for the World Island is the ultimate scene in this play. Spoiler: the planet dies.

There are outcomes we share and outcomes we don’t share. On the ones we share, economics and politics are inseparable. Democratic republics are unstable … you can only buy votes with the other guy’s money for so long … and that includes exploitation of non-citizens inside and outside your borders. Ultimately a predatory state is produced. See Roman history. Too keep up appearances, war is ultimately required, because three-walnut-shells and a pea, only works for so long.

What’s surely missing in this article are the words “compund interest”. Without including the dynamics of debts (aka other peoples’ savings) growing exponentially you can’t come up with a good understanding of how the system actually works, and why wealth tends to concentrate.

Both the basic income and the tech-scare of ” robots will destroy our jobs” are ideologically neoliberal victories.

No, the problem is not robots or tech stealing our jobs. The problem is that financial sector is strangling the real economy and sucking the blood out of it.

A universal basic income then, is not a solution. What’s the point of giving money away to people if this money will be sucked right away by the financiers and bankers colluding with monopolies, real estate and healtchare?

Varoufakis logic is misleading and unhelpful. He is either ignorant or a useful dummie.

Somebody is not reading their Minsky. Stability is unstable.

I missed that and the “free markets” bit. There is no such thing as “free markets”. Anyone who says that needs their mouth washed out with soap. Markets require rules and enforcements to exist. Impersonal trading is highly unnatural by historical standards and requires formal and informal enforcement to last for any length of time.

…rabid scapegoating of victims – diversion from Wall Street control accounting frauds has been perpetrated since 2007…teachers, schools, social security, medicare, unions, the poor (welfare – food stamp recipients), immigrants, and last week, NY TImes, new tech; Facebook, Amazon, Apple, Microsoft, etc…

that round robin has continued unabated ever since…

..some of us have daily challenged scapegoaters since 2007 to “follow the $$$$” to prove said illogic…none have ever done so. Brooksley Born defined Wall Street control accounting frauds at $690. trillion…

Capitalism and what are called capitalists: like the meme in “The Highlander,” “In the end, there can be only one.” That “one” kills off all the others, and takes their stuff.

All the best competition systems are run cooperatively to re-set so that play can continue and continue to be rewarding. Think sports leagues where seasons end and the least successful team gets first pick of new players.

Even if you are playing Monopoly, once someone has won you re-set the board and start from scratch. How fun would it be to play a game once and declare a winner for life? How fun would it be if the winner in each round gets to start the next game with their winnings? (And by ‘how fun’ I mean how likely are people to be interested in continued participation?)

If you want a system to benefit from competition, you need a framework of re-sets to keep it going.

…or, a totally corrupt sense of self:

“Neoliberalism sees competition as the defining characteristic of human relations. It redefines citizens as consumers, whose democratic choices are best exercised by buying and selling, a process that rewards merit and punishes inefficiency. It maintains that “the market” delivers benefits that could never be achieved by planning.

Attempts to limit competition are treated as inimical to liberty. Tax and regulation should be minimised, public services should be privatised. The organisation of labour and collective bargaining by trade unions are portrayed as market distortions that impede the formation of a natural hierarchy of winners and losers. Inequality is recast as virtuous: a reward for utility and a generator of wealth, which trickles down to enrich everyone. Efforts to create a more equal society are both counterproductive and morally corrosive. The market ensures that everyone gets what they deserve.”

(George Monbiot):

https://www.theguardian.com/books/2016/apr/15/neoliberalism-ideology-problem-george-monbiot

but let’s do delineate history of: “The term neoliberalism was coined at a meeting in Paris in 1938. Among the delegates were two men who came to define the ideology, Ludwig von Mises and Friedrich Hayek. Both exiles from Austria, they saw social democracy, exemplified by Franklin Roosevelt’s New Deal and the gradual development of Britain’s welfare state, as manifestations of a collectivism that occupied the same spectrum as nazism and communism.

In The Road to Serfdom, published in 1944, Hayek argued that government planning, by crushing individualism, would lead inexorably to totalitarian control. Like Mises’s book Bureaucracy, The Road to Serfdom was widely read. It came to the attention of some very wealthy people, who saw in the philosophy an opportunity to free themselves from regulation and tax. When, in 1947, Hayek founded the first organisation that would spread the doctrine of neoliberalism – the Mont Pelerin Society – it was supported financially by millionaires and their foundations.

The movement’s rich backers funded a series of thinktanks which would refine and promote the ideology. Among them were the American Enterprise Institute, the Heritage Foundation, the Cato Institute, the Institute of Economic Affairs, the Centre for Policy Studies and the Adam Smith Institute.”

An Occupy Wall Street, strict anarchist, unwilling to take a hierarchical position, was recommending “Jubilee”. I had to look it up suspecting that I didn’t grasp the context. It turns out to be the same as debt write offs for everyone completely every 50 years, and to an extent every 7.

Apparently Jesus spoke in favor of the Jubilee write down in his home town three weeks before being arrested & tried & crucified.

Sounds like the anarchist, famous enough that he was written about, was wise in not wanting to be more famous.

Barry is then correct and the write off is the same as the reset for the game of capitalism. The US Treasury would have to simply buy all the debt of all the individuals who will never otherwise live a day that is not listed in someone’s account as debt.

Creditors will want for these debts 100 percent as Hedge funds need their parasitical blood from all veins of the body.

It would certainly be a test of MMT.

Is there really an alternative to UBI given that a jobs guarantee will very likely be rendered unviable by AI wiping out large swathes of current jobs while making the creation of new ones a challenging undertaking. If given a hypothetical choice between a job and a guaranteed UBI, most people would choose a job I believe, except that’s unlikely to be the real choice if the soul crushing drudgery that currently passes for “jobs” is anything to go by (someone has to create the jobs under a jobs guarantee scheme and my suspicion is that such grudgingly created jobs are likely to be far worse than the crappified drudgery we have currently). The real choice is thus likely to play out as drudgery vs guaranteed UBI. While “earning your keep and not suckling on the government tit” might indeed be satisfying thoughts to take to bed at night, I still suspect the indentured serfs who currently fill their days with soul crushing, imagination deadening “jobs” would jump at the prospect of a UBI, if only to allow their minds to recover from the years of abuse masquerading as work, and to reflect on their next steps.

As for Capitalism, it might have started off as an exercise in social darwinism but it seems to be morphing into an exercise in Malthusian disaster engineering. Governments must intervene without their policy wiggle room being dictated by the “markets” because history has demonstrated that the markets only give a nod of approval to those governments who leave the status quo intact (listened to the midterm budget speech by our finance minister here in South Africa yesterday and it was patently clear that his was a speech designed to appease the “markets”, or he was reading from the speech left in he bottom drawer by his “market friendly” predecessor, but alas, the markets were still jittery “that he didn’t go far enough in assuring investors and ratings agencies that SA is on the right track” and the rand proceeded to lose value against the dollar).

To be clear, i’m not advocating for a UBI, i’m engaging the issue by extrapolating forward from where we are today vis a vis what type of jobs are currently available to people down on their luck (and this cohort is increasingly including even people with university degrees as “down on your luck” now stretches beyond those living in abject poverty to take in those who, all things being equal, would ordinarily refer to themselves as “middle class) and what type of employment opportunities might be available under a jobs guarantee scheme.

There is more than enough work to be had for everyone changing to a sustainable energy system. Building and retrofitting buildings to be more energy efficient. If by some miracle we can’t find enough things that need doing with a job guarantee than it is time to shorten the work week. There is no way in hell there won’t be a ton of social stigma attached to people on an UBI.

Problem solving.

1) Understand the problem

2) Find a solution

First, understand the problem.

They used mickey mouse, neoclassical economics for globalisation and sowed the seeds of its own destruction.

It had been used in the 1920s and had exactly the same problem; it doesn’t look at private debt. The 1920s roared with debt based consumption and speculation before tipping over into the debt deflation of the Great Depression.

Financial liberalisation was rolled out globally and economies started blowing up in the late 1980s, early 1990s, e.g. Japan, UK, Australia, Canada and Scandinavia. Richard Werner was in Japan at the time and wondered what had gone wrong and he put some effort in to work it out.

Productive lending goes into business and industry and gives a good return in GDP.

Unproductive lending goes into real estate and financial speculation and it doesn’t give a good return in GDP.

Excessive unproductive lending into the economy leads to financial instability and crises.

As unproductive lending doesn’t give a good return in GDP, the debt-to-GDP ratio shows unproductive lending building up in the economy.

Financial stability in 15 mins.

https://www.youtube.com/watch?v=EC0G7pY4wRE&t=3s

The mainstream just ploughed on with their mickey mouse economics that doesn’t look at private debt.

US:

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.52.41.png

1929 and 2008 stick out like sore thumbs.

UK:

https://cdn.opendemocracy.net/neweconomics/wp-content/uploads/sites/5/2017/04/Screen-Shot-2017-04-21-at-13.53.09.png

The unsustainable real estate and financial speculation economy makes itself apparent.

You can’t raise rates that much because there has been no real deleveraging, the problem has been postponed not solved. The US is the same situation now as it was before the Great Depression; there are the same levels of unproductive lending within the economy.

The UK is pretty much the same, its economic model was unsustainable and ran on debt and debt is still dragging the economy down, it’s just like Japan after 1989.

“Surviving in the Intellectually Bankrupt Monetary Policy Environment” Richard Koo

https://www.youtube.com/watch?v=8YTyJzmiHGk

Here’s more data to prove it, Europe and the US turned Japanese after 2008 and the Central Banker’s QE isn’t doing anything now.

That’s the problem.

Moving on, step 2, find a solution.

Now we understand we have just repeated the 1920s, had the Wall Street crash and moved into another global recession.

Let’s think.

Keynes’s ideas were a solution to the problems of the Great Depression, but we forgot why he did, what he did.

They tried running an economy on debt in the 1920s.

The 1920s roared with debt based consumption and speculation until it all tipped over into the debt deflation of the Great Depression.

No one realised the problems that were building up in the economy as they used an economics that doesn’t look at private debt, neoclassical economics.

Keynes looked at the problems of the debt based economy and came up with redistribution through taxation to keep the system running in a sustainable way.

The cost of living = housing costs + healthcare costs + student loan costs + food + other costs of living

Disposable income = wages – (taxes + the cost of living)

High taxation funded a low cost economy with subsidised housing, healthcare, education and other services to give more disposable income.

Keynesian ideas went wrong in the 1970s and everyone had forgotten the problem of the debt based economy that he originally solved.

Rinse and repeat.

1920s/2000s – high inequality, high banker pay, low regulation, low taxes for the wealthy, robber barons (CEOs), reckless bankers, globalisation phase

1929/2008 – Wall Street crash

1930s/2010s – Global recession, currency wars, rising nationalism and extremism

Well here we are again.

Some Keynesian ideas should kick start things while we rebuild economics from the work of the classical economists who worked with the raw material of small state, unregulated capitalism and saw all its problems. It’s really not that good, never has been or will be.

Neoclassical economists corrupted their work by hiding the difference between earned and unearned income in the late 19th, early 20th century.

You have to go back this far to build up on an uncorrupted base.

Capitalism started with a parasitic oligarchy, called the aristocracy.

The classical economists could see they maintained themselves through unearned income and started looking at solutions to move from here to a successful capitalist society.

We are back to square one.

Capitalism isn’t dying, it’s dead . It started to die as soon as someone realised it wasn’t a good idea to have children as young as seven working all day in a coal mine ( 1842 ). The new paradigm whatever it is begins as follows : there are approx 7 billion of us humans alive and we all have to eat, shelter, clothe ourselves and have some fun. It was ever thus. What we have to do is figure out how we are going to co-exist .

In IZA Policy Paper No. 133, Sept. 2017 , ‘Basic income and a public job offer’ we argue that only this combination deals with the problems raised by Yves and others which apply to either policy alone, replaces failing targeted welfare, and and offers an alternative to growing under- and non-standard employment, and threats from automation.

onlyone mention of ‘monpoly’ and that’s in the comments. caoitalism denied when monopoies/oligopolies bought DC and the Dems.

slap a bank asset tax on every dollar of assets (or deposits) over X (like 400 billion). break up the vertically integrated media/telecoms. break off search from google and microsoft.

also would help if Dems stopped sending the likes like Schumer and Feinstein to the Senate. not holding my breath

Great comments here today. Thanks everyone. I appreciate Yves’ opener to the article. I disagree with the “jobs give people’s lives meaning” argument, which I tend to see. However, I do agree with the other points being made in favor of a jobs guarantee versus a universal basic income (though I wouldn’t turn away “free” money).

What is “work” as opposed to interacting with your environment? What is a “job;” time spent doing something you are “ordered to do?” If capitalism is dying or just morphing into new directions it is important to think about what it has mandated in terms of daily life. Definitions are important because they force us to think about very basic concepts.

If the activity was meant to be fun, it wouldn’t be called work.

Yes, I know people who enjoy their “work” but for many people I think the above applies.

ETA: Eclair below makes a good point about distinguishing between jobs and work.

I don’t know is doing your dishes fun? Probably not. But neither is it work. Work we do for ourselves is not wage labor.

Find out what you like to do, and you will never “work” a day in your life.

Someone famous and smarter than me.

what does that even mean, even if you love the work bad bosses or coworkers might make your life miserable just the same.

Rarely does anyone address the underlying reality that vicious sociopaths will end up gaming any system anyone comes up with. These “systems” are just window dressing for the wind down of 500 years of civilization.

Ultimately we will end up living in gigantic favelas. Sometimes the overlords will amuse themselves by sending packs of wild trained pit bulls into a quarter and watching the mayhem. Or maybe kidnapping women and children and doing unspeakable things with them. The darkest whisperings of people you deride as ‘conspiracy kooks’ are the barest hint of the world’s future. Or maybe the oil runs out and it’s “The Road” meets 6th century Europe. Either way, it’s gonna be a rough ride.

I though I was cynical and gloomy. I see where you are coming from as I tend towards it, but it is not that bad. Civilizations do collapse, ours is in a mess, there is real evil happening, and we should do wholesale criminal prosecutions, but even our Beloved Ruling Class is not composed of Acolytes of a Dark, and Evil, Religion demanding human blood to commit foul sacrifices for chuckles and profit. Greed, stupidity, thoughtlessness, emptiness of soul, even cluelessness can explain most of what is happening.

We’ve sacrificed honor and morals for profits, a faustian bargain.

Yes. Now Hollywood get to tell a new morality tale. No fondling the merchandise.

We’re talking about ‘jobs,’ but we have not mentioned ‘work.’ I think the the two differ.

Under late-stage capitalism, a ‘job’ is something we do only to make money; we have no control over where we do it, how we do it, or how much we are reimbursed for doing it. Our job does not make us a better person or improve our community. It may actually harm us and the people and the environment. We can do our job for 60 hours per week and still not make enough cash to pay for food, shelter, clothing and taxes. A job is something we must endure. Only the truly fortunate have a job they love.

‘Work,’ OTOH, should involve actions that enhance our community and make it a better place. It may involve teaching the young, caring for the old, growing and preserving food, making clothing, building shelters, entertaining with music and story-telling and performances. It may involve dispute resolution among neighbors or persuading unruly ones that their actions do not benefit the community.

Every human, with the few exceptions of the very young and the very sick, can work. They simply have to feel that the work they do is valued. This is where capitalism fails. We have attached great value to predatory and destructive work and to the jobs that this work spawns. So, a cook in a fast food restaurant who feeds a hundred people is deemed almost worthless. While a banker who moves money around and facilitates mountain-top removal and the building of pipelines and oil-rigs and sweat-shop factories and chemical plants is lauded as the most productive member of our society.

Thank you! So, the problem seems to me to be how do we opt for work and not jobs. If our basic needs for food (stamps?), shelter (land trusts?) and health care (free) then maybe we can actually begin to do work, which needs to be defined as ‘doing’ under our control not as directed by some (paternalistic) overlord. In other words, work is the allocation of OUR time to collaborate with others for the common good. IF we don’t control our time then we control nothing.

UBI as expressed popularly in the US seems to have ‘morphed’ into a hi-techie proposed welfare system – a far remove from its origins with Gorz who proposed it decades ago (More, Paine, etc. prior) or Guy Standing who brings it up-to-date. I wish Standing’s arguments for it were available for discussion here.

I just wanted to link to a great podcast (The Partially Examined Life) that covered some of these ideas from Frithjof Bergmann and his ideas of New Work.

You could say that capitalism died in the 2008 crisis, in the 1929 crisis, or in one of the many crashes of the late 19th century. But it just changed form and was reborn. What died were the people who suffered stunted or lives — we are the mortals. But a social system can just stop operation, then begin again (remember zombie banks?). It is only “late capitalism” if we end it, otherwise it is just the latest capitalism.

The 1929 financial crisis was akin to our Civil War in complexity, compared to what went down a decade ago.

The problem can best be summed up with this one statement. “Other people might argue that capitalism never promised to take care of everyone.” What logical being would support such an idea? If our system of money and earnings only benefits a few it would seem this, is capitalism dying, dead or even worthwhile?, would be an endless problem and discussion. It would, then, seem that capitalism was never alive but entered the world stillborn to a mother in denial. It appeals to the greed factor that all good cons are built on. We built a world predicated on everyone having money but designed the rules to make that impossible. Seems self destructive and an argument for continuing idiocy that ends in one person running off with it all while the rest of the world suffers.

People who support such an idea believe that capitalism, when left alone, rewards those who deserve rewarding and this will cause everyone to behave such that they get rewarded. Anyone who isn’t ‘taken care of’ in free market capitalism is by definition undeserving. And undeserving people should not be allowed to burden us righteous folks by expecting us to do anything to ease their suffering (which will just hinder their ability to get the message about market discipline).

… this whole system of ‘market discipline’ of course depends on ‘markets’ working the way capitalists claim, which they do not.

Indeed, our modern day monadologists:

Philosophical conclusions

This theory leads to:

1. Idealism, since it denies things in themselves (besides

monadsmarkets) and multiplies them in different points of view.MonadsMarkets are “perpetual living mirrors of the universe.”2. Metaphysical optimism, through the principle of sufficient reason, developed as follows:

a) Everything exists according to a reason (by the axiom “Nothing arises from nothing”);

b) Everything which exists has a sufficient reason to exist;

c) Everything which exists is better than anything nonexistent (by the first point: since it is more rational, it also has more reality), and, consequently, it is the best possible being in the best of all possible worlds (by the axiom: “That which contains more reality is better than that which contains less reality”).

I think a post-acashalyptic world would be kind of interesting, especially here in the USA where nobody ever learned how to dicker on things, aside from buying a car or a house.

Markets have two modes of operation:

1) Price discovery

2) Bigger fool mode where everyone rides the bubble for capital gains

You may remember hearing about mode two in Tulip Mania; it’s as old as the hills.

Everyone knows about mode two and it’s what the real estate market thrives on.

Everyone likes mode two because you can earn money doing nothing with mode two. You just sit on your behind and the asset goes up in price. You must make sure you are not the biggest fool that gets caught carrying the can at the end.

Making money doing nothing is the best part of capitalism; you can’t get rid of it as the other alternative is that rather unpleasant hard work stuff. You just need to believe you are far too smart to be the biggest fool who gets caught carrying the can at the end and everyone is far too smart to be the biggest fool who gets left carrying the can at the end.

Wall Street’s investment banks did turn out to be the biggest fools in 2008, but they wouldn’t let a little think like experience stand in the way of doing it again.

Things haven’t been the same since 2008.

You can’t ignore mode 2.

+1

Most financial bubbles object of desire is frankly, something stupid like tulip bulbs, silver, tin, baseball cards, Ferraris, etc.

The housing bubble is a different cat, in that it’s a basic human need.

That is why real estate is the best game in town and the global neo-liberal favourite for bubble blowing.

The bankers can shift loads of their debt products (mortgages) inflating a nations housing stock until it all blows up.

Hopefully, TBTF will catch the fallout and the bonuses are all banked anyway.

Capitalism was always only symbolic in this oxymoron world. The idea of Ecosocialism or Ecocapitalism is a contradiction in terms (for example). Because both capitalism and socialism operate on synthetic theorie of profit and productive growth, aka exploitation, translated via markets and exchange into an economic symbol: currency. Currency itself, even tho’ it is a first-class mirage, then operates as the driver of the economy; the economy itself then becomes based on the currency. The only way out of this circular self perpetuating mess is to change the idea of currency. For starters we should not use currencies as both a medium of exchange and a store of value because those uses are at odds. Economies are throttle because free moving currencies spent by deficit devalue themselves Minsky style. But if currencies were not used as a store of value beyond their usefulness as timely exchange tokens, economies could be more stable and the environment would be less exploited. Because the environment is the real value. Not the symbolic one.

In other words, using money as a store of value destroys real value by replacing it symbolically. So then, clearly a good way out of this dilemma is sovereign public and environmental spending and good social goals, among them a living wage for everyone and putting us all to work to achieve the full potential of a good society. No?

I like how you put it very much. Basically, an economic system that is detached by design from healthy social goals (very clearly what we have now and what we call capitalism) is bound to run the world into the ground, both economically and ecologically.

So whether we call it dead or dying, matters little – what matters it is hurting us and not so slowly anymore it is killing us. And we – humanity – promptly need to construct and move our existence into a less sociopathologically oblivious to its impacts, wiser system.

We need help.

The newly elected prime minister of New Zealand, who cobbled together a coalition to govern in late September, is already facing a significant challenge to her policy proposals by those who control the foreign exchange markets and want to maintain the status quo. The New Zealand dollar appears to be in free fall, which I suspect will impede funding of her proposals, particularly given high private debt levels. Impressive tactical coordination in a short period of time by opponents of her policies. Telling that a small and distant country has received such attention.

It’s not surprising that a woman in a high place in New Zealand is speaking truth to power elsewhere, but what she’s asking her populace to do is renounce their gains on the housing bubble, essentially.

We’ll see how that flies…

Silver lining is that it will make NZ exports more competitive and serve to reduce the nation’s trade deficit. Will also presumably make the nation’s residential housing more attractive to many foreign buyers, although I don’t think the Jack Ma’s of the world care all that much about price when they buy.

The tourism market is the biggest ‘export’ earner for NZ, and now it’ll be even cheaper for those making a trip to the long white cloud. Kia Ora!

“Will also presumably make the nation’s residential housing more attractive to many foreign buyers,”

One of Ardern’s policies is to clamp down on the purchase of New Zealand real estate by foreigners. Another is to make housing more affordable.

The dollar is still high by historical standards. In fact when it first reached these levels there was a lot of noise about how it needed to drop because it was unsustainable and harming exports. Nothing really changed except that the dollar stayed high and people started accepting it as the new normal.

A consistently lower dollar would also give the Reserve Bank more room to raise rates, which they would probably quite like to do to put a brake on the housing bubble. They have been constrained in the past because if it gets too far ahead of US rates, hot money flows in from carry trades and the dollar goes up.

The main downside will be more expensive imports, but New Zealanders are already used to paying a lot for those.

Capitalism is dead, weakened @ Bernanke’s.

As long as we prop it up ala Lenin, but don’t let anybody see the corp’se, everything ought to be jake.

I will dance on the grave when capitalism dies! If only ..

The $64,000 question is…

What does it get replaced by?

Xactly. Capital assets exist in a modern economy by definition, unless you want to revert to hunter-gatherer status. The question is, in whose hands do they belong? (We’d all like to see the plan)

I just got off the phone with a Vietnamese engineer (Commies do do technical education well) who was describing in detail the nightmare swamp of SOE ‘management’ there. Who btw are now becoming the new capitalist class. Just as our bankster class would rapidly reappear as clubby, unaccountable alpha bureaucrats if we somehow became France (Meet the new boss).

…. So I suppose the grass is always greener where the thousand flowers are blooming. Or sumfink.

P.S. The Wukchumni comments are becoming an valuable externality in my daily NC browse. Let me know when you find a way to monetize your wit! Can’t have any corner of the commons unfenced and undeeded.

It is still a $ question?

“Using a mathematical model devised to mimic a simplified version of the free market, he and colleagues are finding that, without redistribution, wealth becomes increasingly more concentrated, and inequality grows until almost all assets are held by an extremely small percent of people.”

So Marx was right. hoocoodanode.

Capitalism n.: A perfectly cromulent word.

…and ecubian…(colorfully transparent)

It is impossible to discuss capitalism and whether it is dead or dying without having a widely accepted definition of what capitalism is. The term capitalism generally refers to the political/economic system that emerged with the industrial revolution. That system has three common traits.

1. Private ownership of the means of production

2. Wage Labor

3. Production for exchange and profit

I frankly have never heard any other coherent definition of capitalism.

Yves, you’ve got the wrong concept for a basic income. The proper way to do it in a capitalist society is the model of the Alaska Permanent Fund. This is untouchable politically, as everyone benefits directly, even though the poor benefit the most. Peter Barnes described how to extend this in “With LIberty and Dividends for All”. We’d all have shares of Microsoft, Google, Amazon, etc., not just oil, minerals, forests, airwaves, etc. This would be enough to give everyone a foundation, but not enough to cover special needs or cause massive inflation, though some modest inflation would shift away from speculative commodities toward the basics, such as housing, stimulating something closer to a full employment economy, a far happier and less divided society