Yves here. By way of background, the US trade deficit with China reached a new high last year. From CNN in January:

Exports to the United States surged 15% in 2017, helping push the country’s huge trade surplus with the U.S. to a new record, according to Chinese government data released Friday.

The U.S. government hasn’t announced its own trade figures for the whole of 2017, but experts say they are also likely to show a massive deficit with China.

By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Cross posted from MacroBusiness

Say what you like about Donald Trump’s rhetoric on trade. The MSM is in a constant meltdown over it. But the fact is he is engineering the fastest reboot of the US/China imbalance that anyone can remember without having to fire much more than a beebee gun. China response has been to let the yuan roar higher:

Of course, China may also be happy to see the yuan rise to push forward its rebalancing. Especially since the last time it tried in 2015, the yuan crashed and threatened to take down the global economy. This time, the higher yuan is giving consumers greater purchasing power as it works against industrial over-capacity while capital outflow has been contained.

It will add to pressure on US yields but that may be offset by other benefiting surplus nations, like Japan:

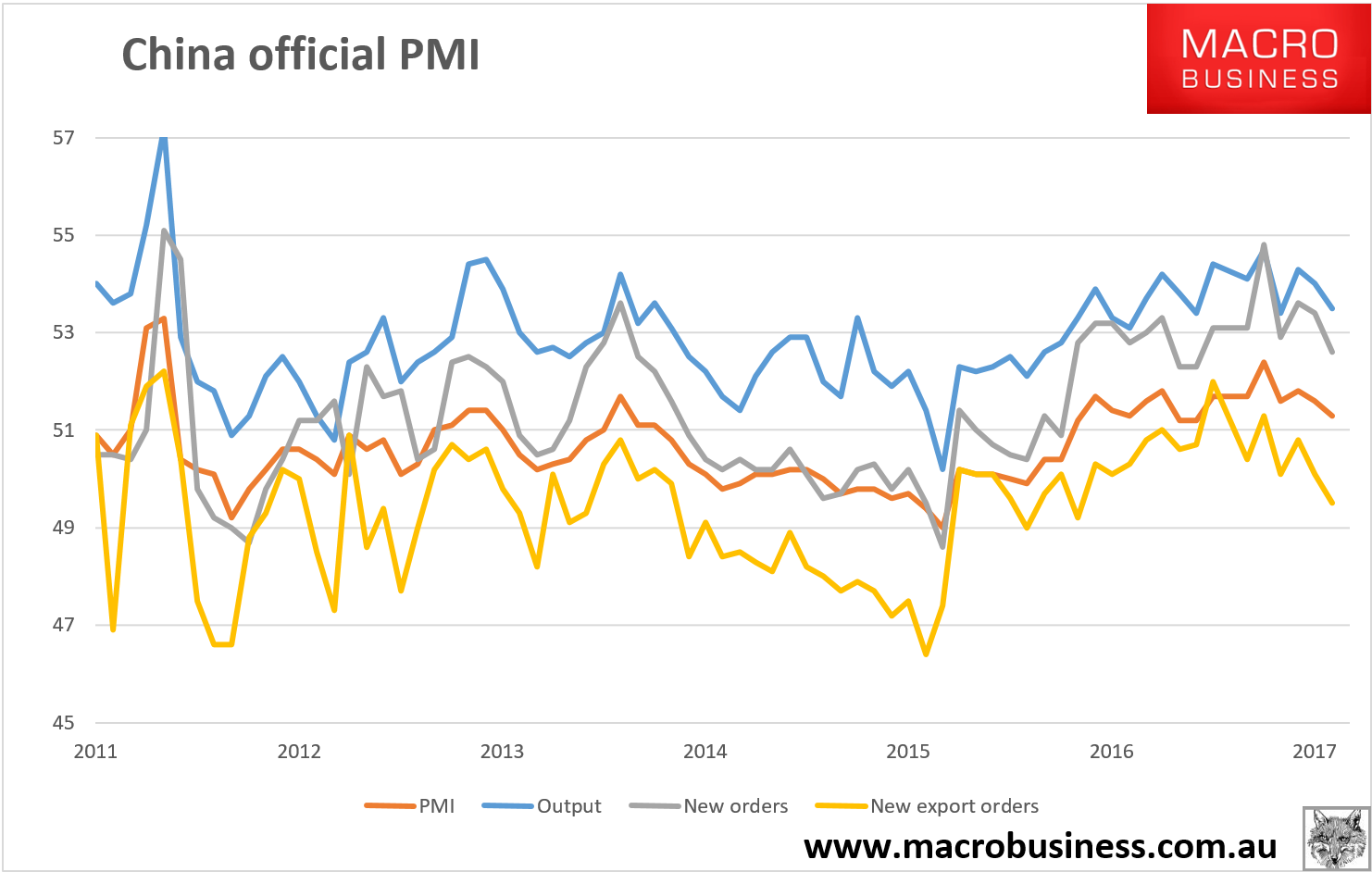

But it will also exacerbate the Chinese macro-level slowdown this year if it does not stimulate more domestically. We are already seeing such in the PMI with new export orders leading the growth fade despite “global synchronised growth”:

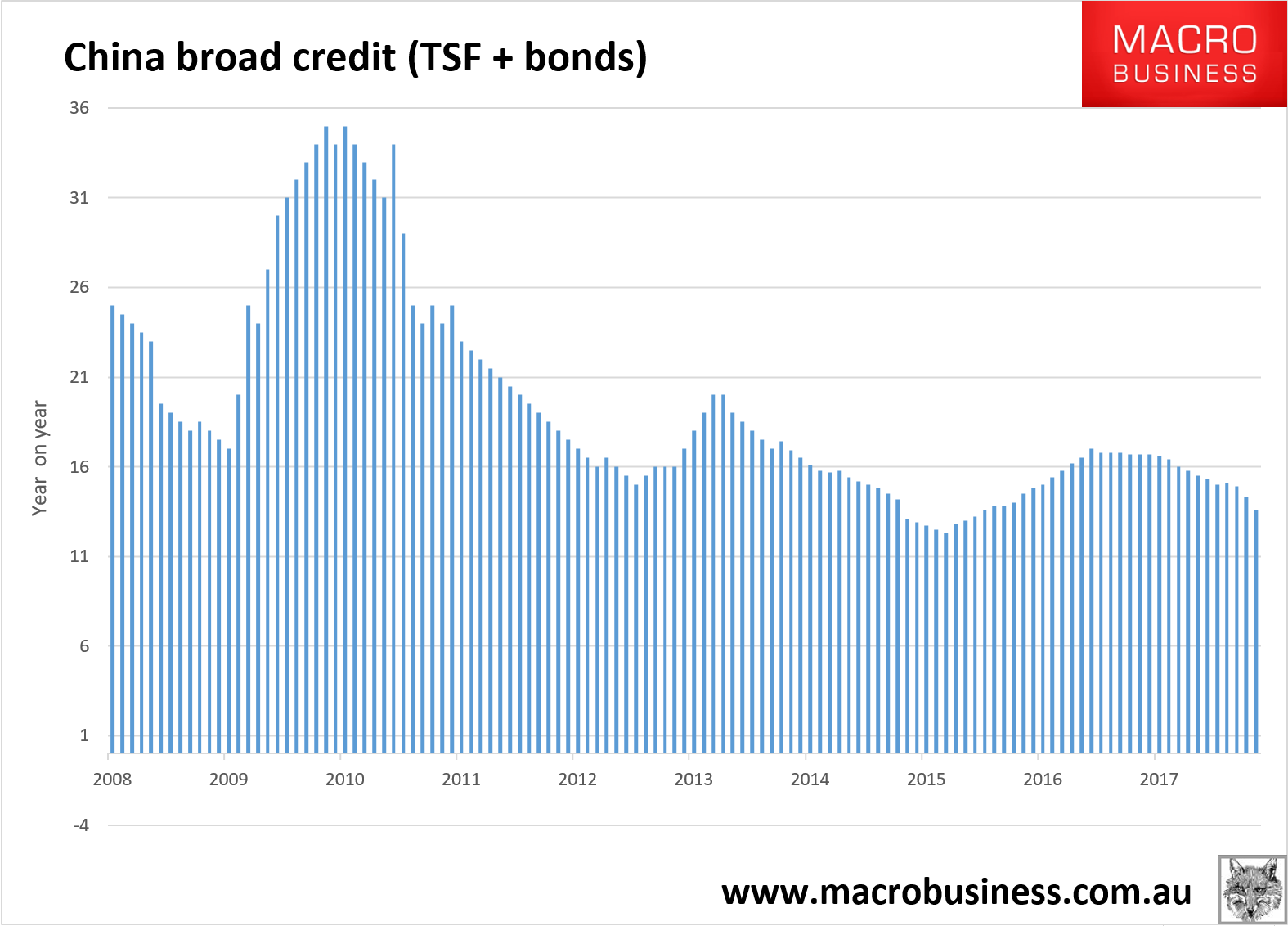

In commodities it is not all bad news. It means less Chinese production versus imports, though for bulks that is likely to be carrion comfort given China is also steadily slowing credit and building will most assuredly follow:

It suggests a few things for the year ahead:

- It would be downright bad manners for Trump to not ease up on the protectionist push in response (not rhetorically);

- “Global synchronised growth” is going to morph this year into global synchronised growth ex-China, and

- If you think Australia is about to join the global boom then I have a bridge to sell you.

Maybe fighting back against a currency-pegging, excess saving mercantilist is not so bad for your country.

I don’t know what to do about all this winning. I guess it’s time to stock up on some more Asian crypto currencies.

I find it hard to believe that this is really about Trump. Beijing has been clear about their need to raise the RMB for some time now. They have ambitions to become a consumer economy that is less sensitive to others’ purchasing decisions. They are heavily indebted and have been dealing with real (if unadmitted) price inflation for some time. They also want to expand their investments in other countries. All of these policies precede Trump, and a stronger RMB is part of all of them.

If anything Trump is helping China by criticizing trade and multilateralism which gives Xi Jinping an opening to court businesses and to present themselves as a stable alternative. International investors care little for Democracy, they may want to live in them but they want to invest where stability is guaranteed. At the same time Trump’s erratic behavior is also providing the communists in Beijing and Pyongyang with the perfect propaganda vehicle. They can sell their systems as stable and their military investments as necessary to hold the “bigger button” at bay.

Do you believe the Chinese are genuine in their “ambitions to become a consumer economy”? I recall the Japanese making similar noises in the 1980s. And if the Chinese are intent on becoming a consumer economy I am vague on the connection between that ambition and a stronger RMB. I think letting the RMB grow stronger against the dollar might have other more significant impacts than helping to build a consumer economy. I agree with Synoia that when “one has all the supply chains and accompanying expertise” a stronger RMB against the dollar would just mean the U.S. will have to spend more dollars to buy the same Chinese imports. And I agree with your belief that the rise in the RMB isn’t really about Trump.

I believe that they are serious about wanting to be a consumer economy for two reasons. First their current economy is so sensitive to everyone else’s buying decisions that some homegrown consumerism will be a bulwark against that. Second with their rapid youthful urbanization they have created a large number of individuals who are now (more) flush with cash and more in need of spending it. As this group has increased the government has made increasing steps to limit the influence of external brands which indicates a deliberate desire to keep that money within the country.

As to the connection I admit this is just semi-informed speculation but I think that a stronger RMB benefits this (at least on paper) because it would enable those same people to buy more with their money. Prices inside of the PRC have been rising rather rapidly. This has been posing problems for the government and I suspect that the goal of a strong RMB is about responding to that.

From M. Pettis blog, he says that TSF is no longer a good indicator of credit expansion in China because credit is concentrating in “informal” ways not accounted in TSF numbers.

Yes, Pettis is always a must read on China (even if his entries can be heavy going if like me you are not an expert in those areas). But he provides a pretty good argument that China’s real growth is 3% or less, and credit expansion is still ongoing and may simply be out of the governments control now.

Yes. Unlike the US China has both weak oversight of commercial credit funds (or at least dubious oversight) and a very strong cultural tradition of person-to-person lending. They also have a long history of selective reporting when it comes to economic figures. As a consequence it is doubtful that any top tier number is a true picture of what is going on.

Yes, I was remiss in not raising that issue. There has been tons of coverage in the Wall Street Journal, Bloomberg, and elsewhere about China’s large “shadow banking system”. Those are pretty much immune to being measured well until way after the fact, if then.

The key is that as flawed as GDP measurement is, in China it’s an input instead of a rough measure of output, the point being that if one subtracts the embedded losses due to mal-investment, which are still unknown and estimated, Pettis estimates that actual GDP growth is in the 3% range instead of 6%+ official Chinese government claim.

Thanks for the link. His way of explaining the difference between GDP as in input versus an output or result of economic activity using the example of the relationship between book stores and literacy is enlightening.

I’m wondering how Pettis figured out that 3%+ Chinese GDP has to be mal-investment every year. On the other extreme, some say that China GDP growth in 2017 was 13% once yuan appreciation was factored in.

I do not see how in this debt environment an increase in yields in the US will not be a disaster.

Budget deficit increasing.

Maybe the Fed pulling back and therefore more supply which will increase anyway with the deficit rising.

High yield bonds low and borrowing costs will go up. Junk bond issues?

Companies have a lot of debt but this I suppose, will be mitigated some by the tax changes.

The Fed will have to increase their reserve payments to the banks and will have to pay more to borrow.

Pension funds will be in a pickle as stocks will probably go down.

Mortgage rates will go up.

Things I have not even thought of that will happen.

This is not one issue and it seems to me this article is not addressing the whole sad, debt picture just a small piece (and no other repercussions).

Would love feedback on my thoughts.

Currency wars: trying to make your country richer by making its citizens poorer. Always a clever move.

The race to the bottom. “Let’s play a game of F*ck Off. You start”.

When one is a monopoly, a manufacturing monopoly because one has all the supply chains and accompanying expertise, one should raise prices (aka Appreciation of Currency), and beggar (impoverish) one competitors financially.

Is the author too close to the trees to see the forest?

Obama should have done this in 2009. But far be it from him to go against Rubinite strong dollar orthodoxy. As Ian Welsh has said, if the nice people won’t do the necessary things, they’ll get done by opportunists like Trump.

Obama = nice?

Methinks

Obama = bought.

“Nice” people.

After reading this post twice I think it might best be described as Delphic. All three concluding bullets appear non sequitur to the preceding discussion — or at least require me to draw inferences from less evidence than my poor grasp of international trade can support. I guess it’s hard not to agree that “Maybe fighting back against a currency-pegging, excess saving mercantilist is not so bad for your country.” But what supports that assertion in the preceding discussion and graphics? And commenter Ignacio pointed out that an analyst apparently well respected and highly regarded by those more knowledgeable than me asserted: “TSF is no longer a good indicator of credit expansion in China” thereby knocking the underpinnings out from one of the two graphics legible in my browser. Having acquired a strong distrust of the economic data reported by the U.S. government I come to the data on the Chinese economy with more than a little skepticism.

Maybe some factions in China used the threat of future Trump actions to force the yuan to rise by the government? After all, China must have as many different factions as America does.

MC always seems to have problems with charts. The ones in this article are illegible. Can we get links to the originals?

Thank goodness for Canada?

https://fred.stlouisfed.org/graph/?g=i2JW

https://fred.stlouisfed.org/graph/?g=i2K0

ya’ll can have the money. I want the goods!