CalPERS Chief Investment Officer Ted Eliopoulos has managed to outdo a CalPERS record of sorts in his roadshow for a half-baked private equity scheme. Eliopoulos told a truly impressive number of Big Lies in few minutes in a Bloomberg interview.1

As we’ll discuss in more detail in later posts, not only is it obvious that the plan, if you can even call it that, is rife with serious problems, but it is the polar opposite of the trend among private equity investors toward more direct investing.

“Direct investing” means bringing the investment decision-making process in house and having the pension fund acquire the private shares, usually through legal vehicles that still allow it to exercise operational control. That contrasts with making private equity investments via complicated and opaque vehicles managed by high fee middlemen where the investor has no say.

Since CalPERS provided only four pages with a mere 180 words on them describing its brand new whizbang ideas, we have to rely on Eliopoulos’ media tour to get more insight. You can watch his Bloomberg interview here; we’ll discuss key sections below. From the top:

Bloomberg Reporter Erik Schatzker: Tell me about this big push CalPERS is making into private assets

CalPERS Chief Investment Officer Ted Eliopoulos: Absolutely. You know, we’re announcing moving forward into direct investing in private equity through new partnership vehicles that our board has just authorized us to begin.

Stop right there.

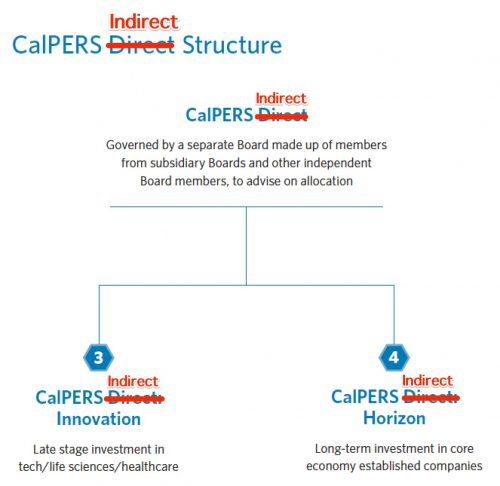

Big Lie #1: Calling these new private equity professional enrichment programs “direct”. Eliopoulos’ scheme is properly named indirect investing. It’s the polar opposite of direct investing.

Eliopoulos has managed to come up with a structure that gives CalPERS even less control and transparency than through investing in private equity funds. One might consider that a perverse accomplishment.

Recall that one new gimmick Eliopoulos has already unveiled, in a “Request for Information” last December, is investing through a fund of funds, which is normally the purview only of small investors who can’t get adequate diversification otherwise. For the biggest, best resourced pension fund in the US to pay another layer of unnecessary fees and costs is a great leap backwards.

The two new gimmicks that Eliopoulos unveiled last week are late stage VC and Warren Buffett wannabe investing. We’ll discuss in depth in later posts why these are certain to prove to be bad ideas from both an investment and fund manager incentive perspective.

Per the chart below, you can see that we are not exaggerating when we call Eliopoulos’ sales patter a Big Lie. Repeating the word “direct” does not make it so. any more than when Trump doubles down on things that are obviously false, like his inauguration getting record turnout.

Eliopoulos apparently wants to relegate CalPERS not only to being a mere limited partner, as in a passive investor, in its two additional investment rackets, but to interpose two layers of boards between them and CalPERS.2 One can only conclude he wants to make damned sure CalPERS has no idea what is going on with the money it commits to these vehicles, and that they are even more of a black box than private equity is already. It appears that avoiding even the weak disclosure called for by California law is of paramount importance.

Big Lie #2: Pretending that CalPERS’ board is on board. This is false. As we wrote in a post last week, Margaret Brown strenuously objected to Elipoulos’ and CEO Marcie Frost’s sales campaign, which they launched via a press release last Friday. She issued her own press release saying the board had not approved anything. A key section:

CalPERS incorrectly suggested that the retirement system has embraced a plan to “move forward with” re-structuring its private equity investment strategy and that implementation is pending only the formality of “final review and approval by the [CalPERS] Board.”

In reality, the CalPERS investment staff, acting in conjunction with Larry Sonsini of Wilson Sonsini, has yet to provide the board with written details including budgets, business plans, or a thorough analysis of risks and projected returns.

Fellow board member Richard Costigan provided confirmation via a comment in a May 18 Buyouts Magazine article, Some on CalPERS board raise questions aboutnew investment model, by Sam Sutton (paywalled):

California Public Employees’ Retirement System’s unveiled a new private equity

platform…But first CIO Ted Eliopoulos and staff have to convince the board that it will work.

Three members of the system’s board of administration said there are major questions

around the platform, including specifics explaining how it would be managed and

structured….The purpose of the CalPERS Direct public rollout was to bring the long-discussed proposal

into the public sphere, multiple sources said.“We gave the staff the authority to get it out there [in the public],” board member Richard

Costigan told Buyouts. “We want it to be scrutinized, we want questions to be raised, and

we want it to be transparent as we get it out there.”

Note that Eliopoulos in the Bloomberg interview made even more aggressive claims as to where things stood versus reality, falsely stating that his pet project was a done deal.

Eliopoulos appears to be telling these flagrant lies to undermine the board’s intent, which was to sanity test the ideas by publicizing them. Depicting them as a fait accompli is clearly meant to discourage input, save perhaps from private equity industry incumbents who think they can skim even more from CalPERS this way than they can through traditional fund structures.

Let’s return to the Bloomberg interview to witness more Big Lies. Proceeding from 0:18

Schatzker: You have long-existing relationships with the likes of Blackstone, KKR, and Apollo. Why take a different approach?

Eliopoulos: We’re going to continue those long-standing relationships well into the future. What we’re doing is CalPERS has a 7% rate of return requirement as we’ve talked about quite a number of times. Private equity is an essential component of our asset allocation in order to meet that target. It is our highest returning asset class over the last 20 years and going into the future, we believe private equity is an essential asset class for us to move forward. As a result, we’ve developed a comprehensive strategy to invest in private markets at scale. As you know, CalPERS has $355 billion of assets, and as we look forward to constructing a private equity portfolio, we know we’ll need to build a portfolio of scale of $40, $50, $60 billion private equity portfolio, so we need a number of tools in our toolkit in order to access the private markets

Schatzker: Why can’t you do that exclusively with outside managers? Why do you need to go direct?

Eliopoulos: Well, we again, it has to do with scale. We don’t think we can invest at the scale we need to solely in the traditional offerings of private equity general partners.

Schatzker: [sounding skeptical] Because of the fees?

Eliopoulos: Just the, just the size and the amount of capital that is pouring into these relationships. We’re not able to build a $50, $60 billion portfolio solely through the traditional general partnerships. That’s number one. Number two, there are real advantages to CalPERS to designing alternative business models in private equity, namely we have a very long term investment horizon. We have liabilities over a very long time horizon that we’re looking to pay 40, 50, 60, 70 years. Many of the traditional vehicles that we invest in have much shorter horizons. And these alternate vehicles that we are announcing today have evergreen, indefinite investment horizons, and that will allow us to match our liability stream much more directly.

Big Lie #3: That CalPERS is having trouble deploying funds in private equity due to not enough general partners who can spend its money. The idea that it is hard to deploy funds in private equity is silly. As the head of one private equity firm said, “It’s not hard to find investments. I could close a fund at breakfast and be fully invested by noon.” So to advance this as a serious argument without a great deal of additional explanation is highly misleading.

According to Preqin, CalPERS ranked number four in 2017 among all international limited partners in terms of total private equity investments. The CPP Investment Board, at $44.4 billion, and the Abu Dhabi Investment Authority, at $39.6 billion, aren’t whinging about the difficulties of deploying funds.

One in fact could argue that CalPERS’ staff being stringent at a time of nosebleed valuations is entirely prudent, even if the effect is to have CalPERS with a lower allocation to private equity than it might otherwise prefer.

But the real reason behind this Big Lie is that Eliopoulos is refusing to admit that he made a big mistake in the management of the private equity program, and his new Rube Goldberg plans are an elaborate way to divert attention from that fact.

One of Eliopoulos’ major initiatives as chief investment officer was greatly reduce the number of CalPERS’ private equity managers, the rationale being that it would reduce costs.

While cost reduction in private equity is generally a good thing, the problem with this particular approach was that the savings weren’t earth-shaking, and the offset was that this program wound up greatly reducing the diversification of CalPERS’ investments in private equity. It increased the concentration in mega-funds, whose returns overwhelmingly depend on leverage and financial engineering. CalPERS largely gave up the “growth-y” end of the market, such as portfolio companies sized $350 million and under, when the general partners uses less leverage and devote more energy to operational improvements.

CalPERS own consultant Meketa deemed Eliopoulos manager-thinning program to have been a bad idea. As Pensions and Investments reported last November in Meketa says CalPERS’ new private equity structure misses opportunities, produces challenges:

The $338.8 billion California Public Employees’ Retirement System, Sacramento, is in the midst of a multiyear process of reducing its number of private equity managers to 30 by 2020. CalPERS reported the number of managers had been reduced to 99 as of June 30, 2016, the latest date available, from more than 200 in 2015. The review notes that the decision to concentrate commitments to the “core 30” was “intended to reduce complexity and costs of managing the portfolio, help improve investment terms due to CalPERS being a larger investor and allow CalPERS to take advantage of the broad range of investment opportunities (e.g., co-investments and customized accounts) that may be available from certain managers.”

In its review, however, Meketa, which succeeded Pension Consulting Alliance as private equity consultant effective March 31, says the program may not realize optimal returns and may not be able to maintain the 8% target to the asset class.

The review says by relying on 30 managers who are concentrated primarily in mega- and large buyout strategies, CalPERS may miss out on better returns from other managers. “Other strategies such as mid and small buyouts, and growth could provide stronger returns as well as strategy and manager diversification,” the review said.

The review also said CalPERS has not received meaningful fee reductions that were not available to other limited partners, and the program has shown an inability to deploy the larger commitment amounts it desires to obtain. Also, since co-investment opportunities are not being pursued and discussions regarding separate accounts have not led to commitments, “CalPERS is not fully realizing the opportunities available to partner with the core 30 managers,” the review said.

Translation: Eliopoulos screwed up.

CalPERS’s ability to obtain special treatment is limited by “most favored nation” clauses which many limited partners obtain in their side letters. One way many general partners have decided to square that circle is to provide for explicit investment-size-based price tiering. The implication is that CalPERS would have been able to obtain fee discounts from the big funds by making big commitments (which they probably would have made anyhow) without cutting back on smaller funds and fund managers.

Even more important, however, is CalPERS failed to exploit the benefits it could have obtained from its strategy, such as freeing up staff time from evaluating lots of funds to instead making more co-investments, to build staff skills, to lower fees, and to in the longer term apply pressure to general partner fee structures by becoming more capable of credibly going it alone. As we’ve been saying for years, CalPERS best strategy is to emulate the now-proven strategy of the trailblazers who have been learning by doing more and also upgrading their staff. CalPERS with its international reputation, is better positioned than any public pension fund to hire competent professionals. Oxford professor Ludovic Phalippou has said he had well qualified graduates of his private equity classes who’d be receptive to working for CalPERS.

And in further confirmation that Wrongway Eliopoulos should consider a course correction, Caisse de depot et placement du Quebec, a Canadian public pension funds that at under $300 billion in total assets is a bit smaller than CalPERS, already does 2/3 of its private equity investing in house and plans to go further in that direction. From Reuters in March:

Caisse de depot et placement du Quebec (CDPQ), one of Canada’s biggest public pension funds, has relied on private equity firms to invest in leveraged corporate buyouts. Now it is building its own investing team to depend less on buyout firms as middle men…..

CDPQ, which manages almost C$300 billion ($229.2 billion) for retirees in Quebec, now makes two-thirds of private equity investments without the use of external managers…

CDPQ has much bigger plans for solo investing. The fund is looking to boost its headcount in Singapore – one of its three private equity offices along with London and New York – to more than ten in order to “have critical mass” for direct investing.

So what is CalPERS’ excuse?

Big Lie #4: Implying that the new schemes will meet or beat the returns CalPERS is getting from its overall private equity portfolio now. We’ll put aside the fact that Eliopoulos pointing to twenty year private equity investment returns is misleading. The entire industry has been suffering from a “too much money chasing too few deals” problem over the last decade. As we’ve pointed out regularly, in recent years, CalPERS has almost without exception failed to meet its risk-adjusted return benchmarks for private equity for the past ten years and every sub-period it tracks. That means that CalPERS’ own metrics show it is not getting paid enough for the additional risks of private equity3

We’ll discuss this issue longer form in a later post, but there is no reason to think any of these devices will produce returns even at the level CalPERS generally earns now.

Eliopoulos stunningly says his approaches aren’t about lowering fees. You’d think he’d be selling that even if that was not his main goal. Other top tier limited partners recognize that the best way to improve private equity returns is to invest at materially lower costs that the prototypical 7% all in annual expense.

One of the approaches Eliopoulos intends to keep is emerging managers, CalPERS’ worst performing strategy. Another that was already on deck that we’ve discussed at length is a fund of funds, which is likely to produce worse results by introducing another layer of fees.

As for late-stage venture capital, venture capital investment outperformance is very skewed, with the very top funds dramatically besting the averages. That in turn reflects the fact that one deal that makes a 100x return can make the entire upside performance for one fund. You will never achieve returns remotely approaching that with late stage venture capital. Late stage venture capital in fact is companies that should have IPOed by now, but for reasons good or bad, haven’t. There is thus no reason to expect them to outdo a tech stock index.

As for the Warren Buffett wannabe idea, CalPERS appears to be taking one of a misguided limited partner aspiration to a new level. So as not to tax reader patience, we’ll defer the in-depth treatment to a future post. However, we have discussed at length how the widespread fixation about finding top quartile private equity managers is a fool’s errand. Yet CalPERS has somehow persuaded itself that, in competition with family offices, sovereign wealth funds, private equity funds, and of course, Berkshire Hathaway’s own search for talent, that it can be a top 1% manager.

Big Lie #5: Stating that this scheme will match CalPERS’s pension commitments better than current private equity investments. Eliopoulos mouths bafflegab by saying that having a open-invested investment vehicle is tantamount to longer-maturity investments, and says that CalPERS new and improved private equity approach will “match our liability stream much more directly.”

I imagine the heads of any investment-literate actuaries are exploding. For the rest of you, let’s back up a bit.

Equities of any form, whether public or private, are not well suited to long-term investing where you have fixed commitments, like life insurance or pensions. You have reasonably well-known obligations, and the ideal approach is to match them as closely as possible with bonds, which are promises to pay interest and principal on specific dates.

Equities are a terrible promise. You get dividends if and when the company makes enough money and is in the mood to pay them. You get votes which can be diluted. One reason private equity is arguably a better investment strategy is if you buy a controlling interest, you can at least force the distribution of cash when the company has it. But you are subject not only to the vagaries of how the business performs, but that all other obligations of the company…like interest and principal payments on debt….come ahead of your interest.

But with more risk can come more return. Stocks were once considered completely unsuitable for pensions. But now pension funds seek their higher performance potential and manage around their negatives from the perspective of matching expected liabilities.

Eliopoulos is correct when he states that private equity limited partnerships aren’t a very long term investment. The prototypical fund life is ten years, but the average duration of how long the committed capital is put to work is only five years.

The flip side is that even though the parameters are very wide, the fundraising cycle of private equity somewhat constrains the otherwise complete control general partners have over when the limited partners get their money back. The general partners need to have sold some companies by year four of five to prove they have produced at least some profits before they start raising their next fund. And even if they haven’t sold everything off by year 10, they need to have liquidated most investments, otherwise they will be assumed to be holding dogs.

It is hard to fathom how CalPERS can make any guesstimates as to when it will get cash out of its late stage VC or Warren Buffett wannabe strategies. VC companies eat money. Paying dividends are seen as the kiss of death, an admission that they’ve entered middle age. That leaves selling as the get your money out is to sell…and if IPOs are uncool, why is this late stage VC anything other than a roach hotel, save the occasional flip to a big corporation?

You have similar issues with even greater uncertainty regarding getting cash to pay beneficiaries with the Warren Buffett wannabe approach. And that’s before getting to the fact that the lack of a forced selling discipline is an invitation to valuation fraud.

And with two layers of boards in between CalPERS and these two new schemes, why should the managers of these funds care any more that private equity general partners do now about when CalPERS needs to pay beneficiaries?

You don’t have to look at CalPERS’ thin outline to realize there’s a great deal not to like. Maybe CalPERS is being so closed-mouthed about details because providing more would make it evident how hare-brained these schemes are. But the even more frightening thought it that Eliopoulos is so desperate to exit CalPERS with an apparent win and the prospect of more cash and prized for his friends on Wall Street that he’s trying way too hard to get this deal done when he has nothing more than a high concept. If that is the case, this is not just reckless but also corrupt. And neither possibility reflects well on CEO Marcie Frost. She is culpable for backing a gross violation of her fiduciary duties.

_____

1 Recall that we lambasted now-departed Chief Operating Investment Officer Wylie Tollette for his “4 Lies in 25 Seconds” when he persisted in misrepresenting CalPERS investment costs even after having been warned that his effort to present data on an inconsistent basis to make CalPERS’ performance had been caught out. CalPERS retreated only after the Wall Street Journal got on the case.

Eliopoulos did not tell as many lies in as little time as Tollette did, but his lies were more varied and far more consequential to CalPERS’ beneficiaries and California taxpayers, so he gets an even bigger badge of dishonor than Tollette did.

2 Based on what Eliopoulos has said, one can infer these two new indirect investment vehicles will have CalPERS acting as a limited partner, which means it will have no say (save at best limited veto rights) over the fund. The reason is that in its July 2017 offsite, CalPERS touted the real estate fund Centerpoint as a model, and CalPERS is a limited partner in Centerpoint. Moreover, one would have expected Eliopoulos to have said explicitly that CalPERS was bringing more investing in-house and saving on fees if this complicated structure were somehow deemed necessary to add new internal teams.

3 CalPERS response has been to lower the benchmark.

.

Hard to imagine that Eliopoulos’s script was written by anyone but a PE fund manager, salivating at the new fees s/he expects to receive from CalPERS. And he’s bragging about it!

As you say, reducing in-house staff is a paltry savings. The cost of those savings is exceptional and systemic. CalPERS loses the talent needed to reach anything approaching its impossible-to-achieve 7% return objective, talent that could cry “foul” when vendors sell obfuscation and lies bigger than Eliopoulos’s. That cost includes increasing reliance on the expertise of higher-cost vendors, who have inherent conflicts of interest.

All in, the choice makes it harder to achieve CalPERS’s objectives, reduces the resources it has to achieve those objectives, and increases reliance on vendors, whose costs are higher but whose returns are not.

They should acquire a chain a payday loan shops. If they charged only 100% per annnum, they’d monopolize the business.

They could operate the business with a 25% per annum interest rate which would surely deliver a net of 7% per annum.

Or student loans, or buy credit card debt, or a chain of Bookies.

Rename themselves CALUPERS

U = Unsavory.

/s

We can’t die – we have an immortality requirement! I guess that’s asking a bit much.

Whatever it is T.E. thinks he knows it’s clear he doesn’t really know what he’d doing – assuming he’s an honest fellow. If he reads these NC posts he would gain valuable insight. Since he talks to Bloomberg perhaps he would read the current Ritholtz column and take it to heart, but I doubt it.

It is important for managers and public representatives to understand what they know, what they don’t know, and what they can’t possibly know. Some of the biggest mistakes in asset management come from not knowing the answers to those deceptively simple questions.

https://www.bloomberg.com/view/articles/2018-05-21/how-public-pensions-can-start-healing-themselves

CalPERS’ current investment direction will not end well.

https://en.wikipedia.org/wiki/Montparnasse_derailment#/media/File:Train_wreck_at_Montparnasse_1895.jpg

Thanks for your continued reporting on CalPERS.

Thank you for the link, flora. The first five basic questions Ritholtz mentioned seem particularly relevant here, even this: “What’s in the portfolio?”; i.e., [T]he increase in alternative investments such as private equity, hedge funds and venture capital during the past few decades means that parts of the portfolio are opaque. Being aware of exactly what is in the portfolio is a key to answering many of our other inquiries.”

Ditto: “What are our costs?” and “How much risk are we assuming?”

Under his list of “Known Unknowns”, besides opaque fee structures, I appreciated Ritholtz’ final observation:

“Last, many people seem to operate under a set of false beliefs that manifest themselves in the form of costly investment decisions. This is a challenge for both the future beneficiaries of any pension and the state that is obligated to fund them. Not coincidentally, lots of these costly errors are the result of doing business with individuals or firms with a vested interest in selling a product to the fund, or consulting on such products.”

Seeing increasing number of articles about problems in state and municipal pension plans, not just California. Difficult for me to understand with the huge rise in equity and bond prices and historically low funding costs we’ve seen over the past nine years courtesy of the Fed.

The problems of alternative investment strategies are as old as the hills. And it’s not just unsubstantiated naysayers — the OECD said exactly the same point in slightly more academic-sounding language:

Dear CalPERS: following a heard of lemmings is not a good strategy.

Sadly Bloomberg doesn’t have the chops to deal with the absurdities Eliopoulos is spouting. it makes you wonder if business reporters do anyting useful, or know anything about thier subject. At least they could read this seeries and learn the basics of pension investing.

In this case the key is the difference between direct and indirect investing. Given the sorry results for investors in private equity and the amount of fees paid out by investors, this is the elementary thing that the interviewer misses and Yves Smith notes. It should be the most important question for the Board: will this produce lower fees?

Equally important, everyone now knows that private equity has caused tremendous damage to US businesses, as in the Toys ‘R Us debacle. What does Eliopoulos think about that? Does he think he is helping his constituents, the employees?

Seems to be putting Lipstick on a Pig. Same valuation performance problems. They only admit to half the fees and expenses now so how do we know anything will work better. As I outline in book https://www.amazon.com/Public-Pensions-Secret-Invest the asset class will always have transparency problems and probably does not belong in public funds.

Ted knows which side his bread is buttered on.

It’s an election year, the fact that no major candidate has latched on to this issue says a lot about how California works…

Follow Adam Ashton if you want the party line.

On a related note: Michael Hiltzik of the LATimes has written an article, dated today 2:50pm PDT, that Charles Asubonten is no longer associated with CalPers.

He credits NC (Yves) for challenging his credentials.

Good article. Nice crediting of NC. This graph is particularly relevant, imo:

Asubonten’s departure should intensify questions about whether CalPERS management and its board members are up to the task of overseeing a $350-billion retirement and healthcare system serving more than 3 million present and past public employees and their families. The questions apply not only to Asubonten’s qualifications, but the process that led to his appointment to a post with responsibilities requiring top-flight management skills and experience.

Are current management and board members up to the task of overseeing a $350-billion retirement system?

That is the question. T.E.’s recent performance doesn’t inspire confidence.

If I was CalPERS and I had a truck load of cash to invest in some mob, I would be insisting on having a member of CalPERS sitting on their Board. That way you could get an idea of what is happening with that company.

When I think about it, maybe that is not such a great idea after all. Margaret Brown is on the CalPERS Board and she is having a helluva time finding out what the they are doing.

Expertise is getting a bit thin on the ground at CalPERS and it seems to be by intent. Other commentators have noted Charles Asubonten’s departure but that was really only because he was a bit of a lost cause. The person to watch is the one selected to replace him. I understand that Jeffrey Skilling will be available again on February 21, 2019 if they want to wait a few months extra.

PE can work. The question is who for, and how.

PE defined as “investment via general partnership” usually works only for the general partners. I define usually, as the vast majority of the investment goes into a few large companies, who eat a lot of it as fees. There are some small GPs that can deliver, but they are few and far between.

PE defined as “buying shares in private companies directly” can work for the investors. It can work either via the financial engineering, which strips the companies bare, or via a patient and long-term investing. CalPERS IMO definitely could, if it wanted, engage in either. Of course, doing a strip-mining is not a sexy proposition, especially for a public company, which may be the reason why CalPERS decided to outsource it (and then even more, so it can say “who, us? we can’t control it.. “). The latter, patient investing, requires skills and long term view. CalPERS IMO could justify the latter, and develop the former.

TBH, I believe CalPERS is in a very good position to develop the skills. Yes, it may not be able to pay as much as Buffet, some family offices, or top PE firms. On the other hand, it has a large portfolio, where good people could get valuable experience, and be seen as a prime stepping stone on larger things. But again, developing this would take time, and I don’t see the will in CalPERS to do things for long term.

What we get to see is a pretty dumb strategy where the explanations fly like leaden balls, and relies on the audience waving it through as “too much above our head”.

California is a Socialist looter art project, the object is to steal more than the previous guy, not generate returns.