TSB is beginning to resemble Humpty Dumpty.

Readers might recall him from their nursery rhyme reading days. He could not, following his fall from a great height, be put back together again. TSB’s management are resorting to the same approach which onlookers to his accident had. TSB had originally called in “all the king’s horses” – well, Accenture, anyway, who got the gig originally here being eulogised in what must now sound like happier times for TSB – but that didn’t work. So now they are in the midst’s of calling in “all the king’s men” – IBM are having a go.

So how are they getting on? There’s a persistent background grumbling on Twitter about missing payments and some of the mainstream media (MSM) are continuing to run reports highlighting features that have apparently stopped working such as fraud monitoring and alerting. But as it’s been pushed out of the MSM here in the UK by the Royal Wedding, Korea, endless Because Trump and Because Russia stories plus the inevitable Brexit nonsense we get fed, there’s little bandwidth left for things like updating people on TSB. And for us Brits, we do tend to get browbeaten by dealing with this kind of situation and fairly quickly merely succumb to resigned acquiescence. Completely contrary to what, say, a New Yorker would do (there’s a reason it’s called a New York Minute; the British Minute, if we had one, could easily last several days).

As a TSB customer, I have been in the fortunate (?) position of having first-hand information on how the fault-fixing has progressed since the new TSB IT system went live a month ago. Once the scale of the problems had become apparent, I submitted a transaction on my TSB credit card, just to see what happened next.

Here, by way of an update, and we will continue to keep readers informed of developments in the future, is the current position.

First, the good news for TSB is that the basic system stability issues which either prevented TSB’s customers from logging into their internet banking service or made access a lottery, seem to be if not completely resolved certainly a lot less of a problem than they were. In my albeit limited testing, I was able to log in without issues and didn’t suffer from the random log offs which have made the internet banking service pretty much unusable for at least three weeks.

Once I got access to my product holding, however, matters were just a bad as before. The transaction which I had generated by using my credit card at the end of April is showing as an outstanding amount on the card account. But that is fine for TSB in terms of them knowing what their customers owe them. For we customers who might be now trying to settle our accounts, TSB merely kicks the settlement can down the road and lands it with us. Unfortunately for TSB, in order to make a debt enforceable, the indebted party – me in this case – needs to be notified of the outstanding amount and how they can clear their obligation.

For a credit card, this is served by sending the credit card account holder a statement. For my account the statement cycle should have been triggered on or around the 10th of the month (i.e. May 10th). For the past 10 days, then, I have been eagerly awaiting my statement to arrive (I never opt out of paper statementing) and even if the postal service had delayed it a bit, I should have received it last week.

Nothing has arrived.

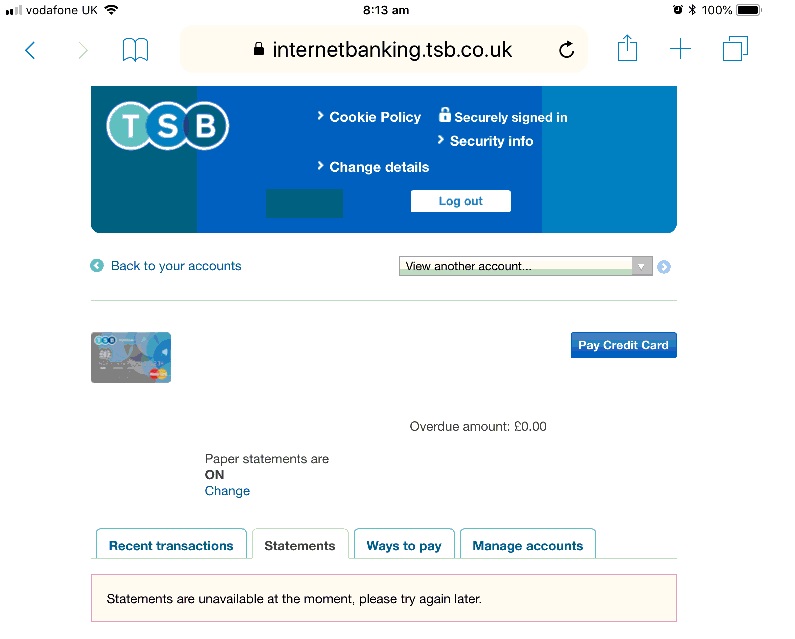

Looking online confirmed my suspicions – statement production is still not working:

That “statement unavailable” message or other errors have been displayed on this product since TSB’s IT migration. I always settle the balance in full anyway but I’m tempted to just do nothing and see how TSB end up responding. If they don’t bill me as per my instructions to them to do this by paper statements, there’s no legal or contractual obligation for me to pay them. Any late payment fees or interest charges are unenforceable.

And this is after a whole month. If something has broken and can’t be fixed in a month, that shows either there’s so much fire fighting to be done by TSB that anything which isn’t an immediate problem, like money transmission (which needs to happen on the day of instruction), is put on the to-do list but not tackled right now. This would explain why fraud detection and notification or statementing aren’t working.

Another possibility is that it’s simply not possible to fix those issues at all, or else if you fix them, you break something else as a result. Time will tell.

So stay tuned, folks, for the next exciting installment!

Great Googly Moogly Clive!

This phenomenon of ‘deconstructionist banking’ could happen to any internet based process, couldn’t it? Say, American Social Security or government procurement systems for an example. This TSB fiasco looks to have been a case of hubris. What about malicious actors? Say, the Heritage Foundation bollox up the SNAP (Food Stamps) meta system in the FDA? To return America to it’s former glory days of self reliant citizen soldiers. (Who could be against core values?)

With the cyber warfare continuum, anything and everything is fair game, and lethal more often than anyone suspects.

Just as elections would be safest with paper ballots, hand counted in public, so would public utilities so be. Water works; iron valves, hand turned by public servants.

EBT cards were a particularly pernicious development and a big gimmie to the company they were outsourced to. And people on SNAP certainly don’t need friends like this. And yes, if (actually, when, it does happen albeit not that often) the system goes down, it’s unlikely that SNAP benefits recipients have a nice wodge of cash kept by as a rainy day fund.

This made me think of an old, as in sixties, ‘Fabulous Furry Freak Brothers’ poster.

To wit: “Dope will get you through times of no money better than money will get you times of no dope.”

Sort of a ‘deplorables’ manifesto.

Arguably still worth it to limit the shame of paying with something that looks like it could be a debit card.

Yes, that was one of the “selling points”. Implicit, though, is the notion that SNAP recipients can’t get a bank account to get a direct credit from the government paid into or would then not be trusted to spend the benefit in the “right” way.

The former is symptomatic of a problem whereby the banks don’t want to provide a product for poorer customers. The problem with the latter speaks for itself.

Thank you for the update, Clive. The big question on my mind is, why has their not been a run on this failed institution? Had I any money with them, I would be down at the local branch withdrawing every penny. Or perhaps our debt-driven culture means hardly anybody has a net positive balance at the bank, so we’re stuck? I’m just confused about the seeming lack of reaction other than tweets from individual customers.

I agree 100%. If I had any funds on deposit, I’d move them elsewhere. I’m happy (-ish) to keep the credit card as there’s no money transmission facility for credit cards so limited opportunities for fraud. Not so cash balances, these can be whisked away before you know it’s happened. Then it’s up to you to prove it was an unauthorised transaction.

Why don’t the regulatory bodies intervene directly and take over the running of the company? As the GFC proved, scaredy-cat governments don’t want to take on the responsibility. They’d rather have accountability remoteness.

Thank you for the update, but I think you’re being a little too blase about this. Your current laws might not offer much timely protection if your CC ends up with thousands in bogus charges. That’s not a risk I would want to take, given the apparent disinterest of regulators and the increasing interest of the criminal element.

Back in the bad old days, the state-owned telephone utilities would distribute fraudulent calls onto random customers bills. Sometimes recouping the loss.

Customers had to prove that they didn’t make those “premium calls”.

Just saying!

Do we actually know that there has NOT been a run on TSB? Reporting earlier was that they were blocking transfers. Some of the dysfunction might be self-protective, though it seems unlikely they’re that organized.

One would expect “CASS” – Current Account Switch Service – to be the thing that will be fixed last. Never mind that they can’t find your money & stuff.

Perhaps, but you’d think statements and billing would have been one of the first in the queue as well.

Maybe statements telling customers that their money is all gone to Sudan are not really a priority either for “team pester”?

And billing? Really! Just more transactions to correct manually later. Because the DB is broken.

There *is* a plan, they are limiting the amount of information on all channels.

No.

However TSB is better run than the DNC or the DCCC.

And about even with CalPers.

How do you know this? What’s your measurement method? How was the method calibrated? Against what standard was the calibration completed? :-)

If there is a standard. /s

Great article, as usual. Thanks for pulling the curtain back in a fashion that mere mortals like me can understand.

So let me know if I have things straight…good news is you can log in…bad news is you can’t do anything but look.

Got that right?

I suppose it is that I can log in… but that only lets me see what a mess they are making of servicing my credit card account!

” I always settle the balance in full anyway…”

This does mean you’re a low-value customer. They really want you to run up a lot of interest charges and penalties. Whether that affects the service you’re now getting….

I’m tempted to suggest that you use the card heavily, since it’s starting to look like free money, but I fear the hassles of proving they didn’t even bill you and you therefor owe nothing would exceed the freebie.

However, some people will certainly try to take advantage, which is just one way this could bankrupt the bank. Do you suppose they’ve also lost a lot of mortgages? Free houses add up fast.

For a credit card, this is served by sending the credit card account holder a statement. For my account the statement cycle should have been triggered on or around the 10th of the month (i.e. May 10th). For the past 10 days, then, I have been eagerly awaiting my statement to arrive (I never opt out of paper statementing) and even if the postal service had delayed it a bit, I should have received it last week.

This suggests the bank still can’t do real-time posting. (bank function, not post office posting) Real-time posting is a core bank function. * If they aren’t confident their system is doing accurate real-time posting they might not send statements. Glad I’m not a TBS customer.

Thanks for this post.

* https://en.wikipedia.org/wiki/Real-time_posting

Real-time posting is a core bank function

Err, it never used to be because bank customers get upset if debits are posed before credits on a working day.

Something about penalties and interest if your account is negative…

Thanks, Clive for the update. This debacle sounds as a cautionary tale for us here in the US. I was just wondering if the ATMs are working and posting accurate account info.? For me, this is also another reason not to do on-line banking and keep receiving paper statements. Also, now that the problems are exposed, won’t this be an invitation to hackers to family blog up the system even more? Just wondering.

Yes, the ATMs are working but TSB has a very small ATM “house” estate footprint so they must be being whacked in terms of profitability with interchange fees (the costs other banks pass onto TSB for TSB customers using their ATMs).

They seem to have gambled on customers migrating to online for account access and away from cash for payments. To which strategy, with their IT debacle, they have just shot themselves in the foot.

Perhaps the lack of high visibility publicity is part of a system wide “circle the wagons” response. After all, if it can happen to TSB, many people will make the jump to, ‘it can happen to my bank.’ which would negatively effect online banking in general. Therefore, that one shot is like Oswalds’ “magic” Carcano round from back in 1963. It is hitting a lot of feet.

Thinking the reason there isnt a long line to transfer their accounts is they cant to them. now one wonders how the bank is dealing with payments to and from their customers. course i think we can all agree that we dont want to be in their customers shoes too. and maybe, we can understand why few banks ever go through,update what they have,but wholesale replacement? with some thing no one has used?????? now a new bank/credit union might use,but no one really wants to do it

Clive

Send a payment for your account to TSB. Let’s see what happens.

It’s a little test. Little tests are called testicles. /s

From my observations of migrations that experienced similar problems, the effects can drag on for years or decades.

Migration defects become exponentially more complicated to resolve if they actually find their way into the migration proper and result in bad data, transactions to be unwound etc. which compound for every day they remain live and unfixed. Generally the team that worked on the migration has limited capability to resolve them, at least without causing more problems (if they were capable, you wouldn’t have had the issues in the first place). Typically you need to bring in an independent party to fix things up, which means extra time for them to get up to speed on your specific business domain and systems architecture.

Finally if the target system was developed (or customized) by the same team that worked on the migration, there is every chance that it’s been done to a similarly poor standard. That means you are generally saddled with a huge amount of technical debt from day one – and you’ll be stuck with it for many years, since all the budget has been spent and it’s brand new and was supposed to solve all the kinds of problems that it’s now causing. And even if there was budget, no competent executive would ever sign off on a do-over without credible assurances that you aren’t going to cock it up as badly as the one you just delivered.

I, audrey jr, second the motion that you, Clive, remove your funds from this entity.

We NC’ers love you and don’t want to see you hurt, particularly by an institution such as TSB.

Thanks so much for taking the time to post on TSB, Clive.

I am now removing my ‘mommy’ hat.

Yes, but leave your debt behind. They might just loose it.

And keep a paper backup in case the find it after adding a few zeros before the decimal point.

Ah, I’m old enough to remember when there were no decimal points on UK Bank Statements

Apparently he doesn’t have deposits there, just the credit card account – a debt to the bank. It’s starting to look like free money. I think he should just wait and see what happens. And tell us about it, of course.

I developed trading systems for 25 years. I left that world 3 years ago for genetic testing. The current state of software development is terrifying.

I once wrote a system by myself to handle foreign exchange limit orders globally for a bank (with some assistance from admins to set up hardware). It handled about $1bn of orders continuously between Boston, Singapore and London and went from zero to live in four months. The system was expanded over time; after I left it ran bug-free, essentially unattended, for seven years (until mergers wiped that particular bank from the face of the earth). From a code perspective, it was a medium sized system at the end, on the order of 100,000 lines of code. It’s executables, between client, various servers, rate feed handlers, back-office integration servers was maybe 10Mb. Response time was within single-digit milliseconds from raw fiber optic latency, and it didn’t really do any special tricks to achieve that. It was my 7th trading system in my 4th different computer language and operating system, working my way up from junior to senior to team lead, manager, then, at that point, hotshot hired gun.

Something like that is inconceivable today. Simply not possible. You’d have at least 14 people involved today – and these would be low-level worker bees, not including managers. The overhead of communicating among those people would push the project out beyond two years, and the inevitable miscommunication and competing agendas between that many people would result in errors and instability. The result, even for 10,000 lines of code, would be several gigabytes of executables. It would be much slower, unless great care was taken that it not be. It would be expanded very slowly, because the team would then spend a large portion of it’s time upgrading versions of open source software due to security vulnerabilities and dealing with instability of not only production, but testing and development, too.

Most of the people on these projects were swept into software as a result of the dot.com boom and are there because it’s a good living, not because of aptitude. Their greatest professional achievements are things like configuring the build server, or mocking up the visual characteristics of a button. Their greatest professional aspiration is to be an early adopter of the next big thing, and they will relentlessly push to complicate your stack with ever more complicated tools. Most of them have only ever worked on small parts of one large uncontrolled system in the same tech stack, maybe a toy side project or two. They are completely averse to writing things down in English; they rely purely on word-of-mouth (or worse, slack) – for even the most crucial decisions. Getting them to write fully-formed sentences in the bits of the process mandated by procedures is like pulling teeth.

Nobody has any idea how these systems actually work, or where their vulnerabilities lie. Not even guys like me. Pointing this out to management is your basic career-limiting decision, they demand optimistic happy talk and a newer, fresher set of buzzwords.

My guess is disasters like TSB’s will become increasingly common.

(Sorry, bit of a rant. Rough day in the trenches.)

Thank you very much for your update on TSB as it is nice to know how things are chugging along – or not. Just saw an article at http://www.cityam.com/286219/exclusive-tsb-handed-business-customers-1500-free-android which said that ‘TSB handed out around 1,500 free Android smartphones to business banking customers – ones which were rendered almost useless amid the lender’s calamitous IT upgrade.” They were supposed to replace car readers but don’t know where those business owners are going to go from here.

I just came across this on /r/bestoflegaladvice: https://www.reddit.com/r/LegalAdviceUK/comments/8lbedb/tsb_thinks_my_cousin_is_dead_he_is_not_dead/. So I guess TSB is also killing their customers. :P

Hilarious, if you aren’t the “dead” guy or his mother.

Being declared dead by mistake is a huge mess our wonderful digital society. It’s one of those “this mistake never happens”-situations so every-single-thing in his digital existence now has to be recreated / resurrected Manually!

It is not enough to revert at TSB because all of his data is now “frozen”, archived, probably not even in the same databases anymore. The “live”-status doesn’t propagate.

—-

If those “Russian Hax0rz” really wanted to do a number on a western economy, just hack one of the “this person is deceased”-access points, like maybe the NHS, and declare everyone registered in their systems dead. That mess would take years to sort out while no taxes being collected, no pensions paid, inheritances now being processed and God only Knows what else that we automated years ago and happily forgot about.

Maybe they are keeping that one until we really piss them off?

Or maybe the NSA and its contractors are keeping such an attack on line and ready, in case ordinary people start to see too clearly, and resist, the Matrix and Panopticon.

“Nice set of accounts you have there. Be a real shame if something were to happen to them…”

Free plot idea for you writers of Tom Clancy-type fiction out there. Maybe it has already been done. Welcome to the world of infinite vulnerability and zero rights…

“He’s not dead, he’s sleeping”

Thanks for the update Clive. Are the UK banks similar to US in that they do not make their money from deposits, but rather from fees, etc.? If so, it would seem they could remain viable as long as people continued using their credit cards and loans. I would be careful too about not paying your “bill” if it ever comes. Here in the US, once you get a late payment on your credit it becomes a huge exercise in getting it cleared up even if it was not your fault. From your remarks though it would appear that the UK empowers their consumers with more protections than here in the US.