Yves here. New York City had long had developers focusing on luxury apartments at the expense of the rest of the market. But recent data shows this city is less extreme in that regard than most.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

There are plenty of brand-new apartments to choose from, thanks to a multifamily construction boom in major cities. These apartments are in good locations. They’re nice and have everything you’d want. But for many people, rents are just too damn high. Here’s why:

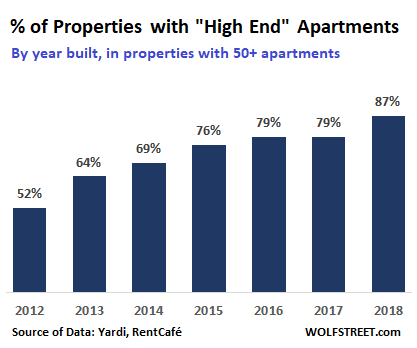

In the first half of this year, 87% of the completed apartment projects with 50 or more apartments in 130 major cities in the US are considered “high end,” according to a report by RentCafé, based on Yardi Matrix data on 80,000 large-scale apartment developments. This is up from 52% of properties completed in 2012:

“High end” here means “luxurious” – a marketing position for a building. In expensive cities, projects that are not luxurious are nevertheless expensive – such as San Francisco. You have to pay a lot in rent but you might not get a lot for it. An expensive dump in San Francisco is not “high end.” It’s just expensive. In other cities, for the same amount, you can rent a luxury apartment. But that kind of “high end” in San Francisco requires princely sums of money.

This is based on Yardi Matrix’s definition and classification of the apartment market of multi-family properties of 50+ units, where “high-end” or “luxury” rental properties make up the top two categories:

“A+” and “A” buildings: Renters by choice. Attracted to the extreme upper end of the apartment market; properties generally of resort quality, clearly appealing to households capable of owning a residence, but choosing to rent, or households with substantial incomes, but without wealth. The luxury rental category primarily focuses on empty nester households, or more particularly, high net worth households. The renter-by-choice household is demanding; finishing detail and amenities included in properties appealing to this category must be of exceptional quality.

“A-” and “B+” Buildings: Lifestyle renters. The high mid-range category appeals to double-income-no-kids (“DINK”) households holding income status similar to that typically required of discretionary property positioning, but not in possession of the wealth more probably associated with the renter-by-choice rental household category. Properties holding high mid-range status typically offer excellent finishing quality, and attractive common area facilities, and typically focus on an environment providing a more social experience.

These two categories are considered “high end.” A step down and no longer “high end” is B and B-, which is for “working professionals,” such as policemen, firemen, teachers, and technical workers. Then it goes down the scale all the way to “D.” Subsidized housing is in a separate category.

These “high end” apartments are marketed to high-income people. Alas, there are not that many high-income people around. Nevertheless, in many cities, 100% of new apartment properties being complete in 2018 are “high end.”

The percentage of high-end projects has soared in cities that are not among the most expensive rental markets in the US and have hit 100% in cities such as Oklahoma City, OK, Dallas-Fort Worth, TX, Kansas City, MO, Charlotte, NC, and Philadelphia, PA.

On the other hand, in ultra-expensive markets such as San Francisco, Los Angeles, and Seattle, there are still projects being built that (while expensive) are not in the “high-end” category.

The list below shows the 30 largest US cities (not metros) and their high-end properties as a percent of all properties with 50+ units completed in the first half of 2018. Of these 30 cities, 16 exclusively built “high-end” properties in the first half, up from 7 cities in 2017. Texas has four cities on this list where new high-end developments accounted for 100% of all large-scale apartment completions:

| City | 2018 |

| Dallas, TX | 100% |

| Forth Worth, TX | 100% |

| Boston, MA | 100% |

| Houston, TX | 100% |

| Jacksonville, FL | 100% |

| Charlotte, NC | 100% |

| Indianapolis, IN | 100% |

| Columbus, OH | 100% |

| San Jose, CA | 100% |

| Memphis, TN | 100% |

| Oklahoma City, OK | 100% |

| Los Angeles, CA | 100% |

| Chicago, IL | 100% |

| Detroit, MI | 100% |

| San Francisco, CA | 100% |

| El Paso, TX | 100% |

| Nashville, TN | 92% |

| Washington, DC | 91% |

| Baltimore, MD | 88% |

| Austin, TX | 88% |

| San Antonia, TX | 86% |

| Philadelphia, PA | 86% |

| New York, NY | 85% |

| Denver, CO | 83% |

| San Diego, CA | 83% |

| Las Vegas | 80% |

| Louisville, KY | 80% |

| Portland, OR | 80% |

| Phoenix, AZ | 78% |

| Seattle, WA | 72% |

Clearly, there is a trend among some high-income and high-wealth people to avoid the suburbs and go instead for convenience, views, short commutes to work, etc. This dynamic is spread over apartments and condos. Urban living has become cool. And these dynamics look good when the project is pitched to investors – and that’s where the money is.

But the market for high-end apartments is limited. Not that many people make enough money to be able to afford them. Flooding the market exclusively with these apartments, and not building apartments suitable for median incomes, the industry creates a mismatch of supply and demand that has been cropping up in major markets. And given the “high-end” projects underway, this mismatch will grow.

The solution is the market. These units will have to be rented out, either by the developer or by the creditors that will end up with the project if it fails. The way to fill these units is to cut rents until sufficient demand materializes. And this puts pressure on rents in lesser buildings that have to compete with these high-end units. In other words, it creates downward pressure on rents, from the top down.

It’s a lot of debt too: Multifamily mortgage debt outstanding rose to $1.3 trillion in Q2. Of this debt, 49% has been securitized, and many of those MBS have been guaranteed by Fannie Mae and Freddie Mac. Banks and thrifts own 32% of the multifamily mortgages. State and local governments, insurance companies, and other entities own the rest.

With most of the new funding going into high-end projects, creditors clearly are being charmed when these projects get pitched. On paper, one by one, they make a lot of sense. But the market might not play along.

And here are the rents, and how they’ve risen or fallen, by city, down to the neighborhood. Read… The Rental Markets in America, from Hot to Cold

Thank you, Yves.

Please trend can be observed in the UK and as far afield as Mauritius.The market must be getting frothy as I keep getting junk mail to invest in such developments.

A few minutes on foot from where I am typing, between Bank and Liverpool Street stations in the City, there are luxury apartments sold off plan to foreign, mainly Asian, investors next to pockets of deprivation.

The last greasy spoon in the City, on Worship Street, has just been demolished to make way for an upscale development.

Just to add a link to Brexit, BMW’s Mini assembly plant in Cowley, on the western side of Oxford, is under threat from Brexit. As readers can imagine, this site is coveted by developers and the local councillors who want further gentrification, vide the rebuilding of the Westgate shopping centre by the Crown Estate and new residences at Islip, a few miles north of Oxford, and the Grosvenor Estate’s new residential development.

TBH, in Oxford, it at least make sense – sterling will collapse, so the chinese students will flood Oxford, once May gets students taken out from the “immigrant” statistics, which I’m sure will be on March 31 2019, so they can show the immediate halving of immigration (students take about 40% of the 300k+ net immigration IIRC).

What’s there not to like?

They might get a shock if thats their plan. One of the big issues for Chinese students is that their qualifications will be recognised throughout Europe. An acquaintance who works in the Asian marketing section of a Dublin college told me that EU colleges are pushing hard the message that UK degrees may be worthless. Whether its true or not doesn’t matter – if Asian students are worried about this, they’ll go elsewhere.

I cannot believe a situation where a (real) Oxford degree would not be recognised in the EU. It would be a very ridiculous situation TBH.

Of course, the “University of Middle-of-Nowhere”, which popped all over the UK are an entirely different issue.. But Cambridge, Oxford, LSE, Imperial and a few others I believe would be extremely unlikely not to be recognised.

It applies mostly to technical qualifications, especially in the medical and construction field. Obviously the big universities will retain their aura, but its the ‘bread and butter’ type qualifications that will have question marks raised.

Another issue of course is visa and travel. Lots of students come to study in Europe so they can travel easily, and maybe settle. The UK will look significantly less attractive to many, especially as the courses tend to be more expensive than elsewhere. An economic downturn will also mean poorer students won’t be able to get casual work – this is a major factor for many from China and India in particular.

Chinese (or any foreign) studends in Oxford are most definitely not poor (hence my original comment – their parents often buy them an apartment, which they see as saleable later on too).

IIRC, Oxford trimester costs about 30k GBP just for the school fees (to a non-EU, shortly non-UK students). I doubt any of the above are really a too much of an issue for them..

Even that market is changing rapidly as even the richest and most well connected Chinese can’t get that amount of money out of China anymore. A friend in London came to the UK using that route 15 years ago (i.e. she was a ‘student’, but was also a conduit for her parents to buy two London apartments), she said it would be impossible now as her parents couldn’t get that amount of cash out of China for UK property.

Not to mention of course that a long term decline in sterling makes UK property look a lot less attractive for outsiders.

Russell Group institutions and their communities should see an incremental benefit (or smaller Brexit decrement?) relative to the outgroup. How that may translate into some housing impact is murkier.

Not at all surprised to find Charlotte on the list at 100%. It matches what I’ve seen these past few years.

I’m almost certain Charlotte already reached excess capacity of “high end” apartments before the last few “high end” apartment complexes were even completed.

Yes. Every square foot of land in Charlotte appears to have a “high-end” complex going up on it. And though they may have a “high-end” price they are uniformly and horrifically ugly and are a blight upon a once lovely city. If they look like a Soviet Gulag NOW I can only imagine what a few years wear and tear will do. It’s a travesty. Meanwhile the banker mafia foisting this upon the city is concurrently buying lovely homes in close-in neighborhoods and leveling them, and in their place are building cheaply made, gigantic McMansions that cover every square inch of dirt on the lot. It is repulsive.

The two main cities of my part of SC are down I-85 from Charlotte and can be considered Charlotte wannabes. All of the real estate energy (and it’s a lot!) is going into new and renovated downtown properties that are mostly being used for those “high end” apartments. James Fallows did an article about this small city phenomenon and called it The New Urbanism.

While I don’t have any figures I seriously doubt any of these new apartments are intended for low or middle income people and in fact the poorer residents and especially the homeless are what TPTB are now trying to move out of downtown. Having poor people around is not luxurious.

Same here in Durham, numerous high end condo developments going up all over the place, with prices advertised up to 1MIL. Who on Earth is going to pay 1MIL to live in sorta-downtown-Durham in an anonymously designed cube of condos? Beats me…

Hasn’t Duke set itself up as a place for Chinese students for years now? One attraction of the Pacific Northwest and British Columbia to Chinese, wealthy immigrants is familiar features already existing whether its shopping or availability of food or the attraction of fitting in. My guess is there are enough Duke exchange students and graduates around to make it seem like a comforting place especially if you are looking to get cash out of China.

Yes, a million for a condo in Durham. That better be some Condo.

Also observed in Wichita Ks.

After the first wave of financial deregulation in the 1980s, we got the first wave of real estate booms and busts.

“A Short History of Financial Euphoria” John Kenneth Galbraith 1994

Our guardians of financial stability, the independent central banks, should try reading it.

Fictitious financial wealth just disappears.

The fictitious financial wealth in real estate disappears.

1990s – UK, US (S&L), Canada (Toronto), Scandinavia, Japan

2000s – Iceland, Dubai, US (2008)

2010s – Ireland, Spain, Greece

Get ready to put Australia, Canada, Norway, Sweden and Hong Kong on the list.

The fictitious financial wealth in stock markets can disappear as it did in 1929, the dot.com bust and China 2015.

The famous 1920’s neoclassical economist, Irving Fisher, didn’t see it coming.

“Stocks have reached what looks like a permanently high plateau.” Irving Fisher 1929.

The current neoclassical economists believe pretty much the same things as the 1920s Irving Fisher and just don’t see that fictitious financial wealth that is going to disappear.

2008 – “How did that happen?”

The mainstream policymakers in Australia, Canada, Norway, Sweden and Hong Kong are no wiser than the 1920’s Irving Fisher.

By the 1930s, Irving Fisher had looked into his mistakes and realised The Chicago Plan would stop bankers inflating asset prices with debt.

Today’s policymakers are still at Irving Fishers 1920s level and haven’t looked back to see what he knew by the 1930s.

Just an idle thought here. Could all this be indicative of an hourglass shaped economy (https://en.wikipedia.org/wiki/Hourglass_economy)? By that I mean that economic goods & services are shaped towards the big end of town as well as the bottom end of town but not so much in the middle where your middle class sits. I read an article a coupla years ago that was arguing that this was the way the economy was evolving and if so many US cities are punching out these “high-end” properties, this might be partial confirmation.

I would go with the wine decanter shaped economy.

Most property developers are sheep. They really are – its very instructive to deal with these guys (yes, mostly guys). They’ve made a little money, made some connections, have some seed capital, and buy some land. They then ask the local property consultants what is likely to sell in 2 years time. Then they ask the bank what they’ll lend for. The banks then ask the same property consultants what the safest investment is. And everyone, and every bank, is doing the same thing. And nobody wants to look stupid, so everyone gives the same answer.

Hence, whatever is ‘hot’ (or apparently hot) gets overbuilt, while other sectors get ignored. You see the same dynamic everywhere. One year its all offices, the next its family homes (or whatever).

At the moment, even the rich are talking about inequality. And what do they make of it? ‘oh, with rising inequality, the only good market is the growing number of rich people’. Oh, and cheaper flats too for the children of rich people when they go to college. So thats what gets built.

And as the Col., says above, you see the same dynamic everywhere. In Ireland, despite a housing crisis, mid level houses and apartments are being ignored by developers in favour of large upmarket homes and student housing. A friend from Thailand said the same thing is happening in Bangkok – acres of upmarket apartments aimed at the ex pat market, not much else.

TBH, the “high end property” are usually a good margin scam too.

The buyers usually can’t see much past the flashy kitchen/bathrooms (which often are nice looking, but extremely impractical), and the other materials are as often as not “cost-effective”.

This is often compbined with a show-apartmnet that has the top-of-range kitchen/bathroom, but “standard” is something you’d not really call high end (and here I’ll point out that in the UK, they try to pass as “high end” stuff that is normal standard in the continental Europe). But of course you get an option to change it to what you saw in the showroom, for a small (not) costs.. They will even do it post-sale, selling it as post-sale fitting upgrade, so you save on stamp duty.

Works a treat for the developers…

So if the property developers are a sheep, a lot of the high-end buyers are even more so.

Thank you and well said, Vlade.

See you soon, perhaps in sight of one of these flashy apartments.

We have Czechs doing work for us and some friends and neighbours. They echo what you say about building standards. It’s why we always use them and want them to do some work for us in Mauritius, which they seem happy to.

It was Churchill (famous for his bathing), in 1930s IIRC, who marvelled at this “wonderful invention” of a mixer tap he run into in the US.

80 years later, the UK still believes that separate hot/cold taps are the pinnacle of high standard, especially when done in a gold-ish plating on a faux-marble.

Has anyone ever written a definitive explanation of the British love of separate taps? It’s a bigger mystery than Brexit.

It’s been a long time since I’ve read The Grand Alliance, but I think WSC’s encounter with the mixer faucet actually happened during his 1942 visit to the USSR.

Another issue is that when trying to ‘sell’ their proposal to a bank or other source of funds, its easier for a developer to tweak the valuation of an upper end apartment to justify a fairytale business plan. The value of, say a 70 sq metre mid range apartment is easy to established by anyone with google. But with an upper end apartment you can say ‘this will be top of the range, there is no established valuation, but our top secret research tells us we can sell them for 5 million each’. If a bank is desperate to lend money, they’ll accept such BS. I saw it happen all the time during the boom years in Ireland.

This is the prime reason why the Skyscraper Index is such a good predictor of the end of a boom. Its easier to sell a story of super high rents if your building is the biggest/flashest one on the market.

These buildings almost never make real profits – except for the developer/builder extracting their 10% at each stage of the game. Its the bank thats left holding the baby at the end. And we know who eventually bails out the bank…

I think this is closer to the underlying truth than the original article (which is good but focuses excessively on rents in my opinion, and doesn’t discuss the reasons why people might build or finance such an asset in the first place).

It seems to be symptomatic of a property bubble when land prices shoot up to unrealistic levels. When you have to pony up $500K+ just for the land, it doesn’t really make sense to build budget, since none of your potential customers would be able to afford it anyway. In extreme bubbles this extends to mid-range properties as well. So everyone builds high end and luxury, because that’s what the market says is needed – and the market is always right, even if it’s being driven by speculators and the lower end is under-served as a consequence.

It’s what the neoliberal types like to call “misallocation of resources,” except that per Minsky it’s not just a consequence of market distortions but happens in normally functioning markets as well.

Thank you, PK.

One of the regular invitations I get is for student accommodation in Liverpool.

Given the huge amount of surplus housing stock in Liverpool, I’m amazed at how much student housing they are building. Back in 1989 when I spent a summer doing my thesis in Liverpool I rented a very cheap room in a beautiful big Edwardian house owned by a lecturer. He said his main reason for taking the Liverpool job he was offered was the opportunity to buy a beautiful large house for the price of a broom cupboard anywhere south of Birmingham.

Developers have told me that they are driven by availability of funding. They admit that banks practically throw money at them when flush, to attempt to get some return on those funds and strive to be lent out. Lending standards get relaxed (yes, passive since few in bankland would acknowledge responsibility), terms are loosened and the next cycle gets a boost. Many have noted that the change from local ownership and control to distant headquarters folk tends to exacerbate such swings.

Any insight, perhaps from similar patterns in the past, of how long developers can keep those apartments un-rented/sold before they have to lower their prices?

I think it all depends on a variety of market issues and how deep their pockets are (or how patient their creditors might be). Sometimes for developers its better to keep places empty so they can maintain a paper valuation rather than rent/sell at a low price. In Ireland after the 2008 crash some largely completed apartments were kept empty for up to 8 years later before completion – all these were owned by banks or Nama (government ‘bad’ bank) – they preferred to sit on them and wait for a paper profit than liquidate their assets at a loss.

and around me, you won’t see rent reductions for that reason, but you might see a month or two of free rent thrown in there, which effectively is a rent reduction.

“But the market might not play along.”

It’s about squeezing as many people for as long they can. The “market” is full of short-term thinking, damn the consequences to people’s lives.

It doesn’t matter that it’s not sustainable. It’s all take as much as can be taken before each collapse, then repeat the same behavior.

How and why do State and local governments own high end apartment complexes? Or anything which isn’t considered ‘public’ housing at all?

I beg to differ. My city has been wringing its hands over what to do about affordable housing, even as they keep offering incentives to developers to build high end units. Is the best way forward to continue to overbuild on the high end and wait for the market to collapse? Haven’t we been down this road before about ten years ago?

I don’t think you should expect private businesses to serve the public good. If they can make more money building a high end project than building affordable housing, then they’re going to go high end.

If the government wants to make sure that the public has ample access to truly affordable housing, then the government needs to build it. If we can subsidize extremely rich oil companies to the tune of billions of dollars a year, we could certainly do the same for public housing. If the government can’t figure out how to do it, tell them to ask Jimmy Carter.

Back in the 70s, 80s, I was involved in many subsidized housing projects that procured investors for the tax bennies derived therefrom. As I recall there were many HUD hoops to run through, but a vast majority of the projects were successful in providing inexpensive housing in major metro areas. The developers made money and so did the investors although the biggest beneficiaries of these programs were the unions as all construction required “prevailing wage” rates. What happened to these programs?

I assume you are referring to Section 8 housing. Many of those projects really did produce nice, affordable apartments. Good question as to why it isn’t being done any more.

lyman alpha blob, same here in Seattle.

The city has declared a “homeless emergency”, yet continues to spend wildly on bike paths (to the tune of millions). The irony is that the use of bike paths is dropping.

Then there is the annual doling out of city cash to profitable sports teams, sports facilities, a profitable tourist industry and any corporation that comes to them with a begging cup. The city recently lavished $135 million on the local baseball team. The other corporate beggars then moaned about how they were being slighted.

As for the homeless population and their “emergency”, they are subject to midnight sweeps that has them moving from one green space to another.

Yup, I lived in Seattle back in the 90s and I remember vividly when the citizens voted down spending taxpayer dollars on a new stadium to which the local powers-that-be said “Wrong answer” and they went ahead and built it anyway.

So color me very skeptical that this problem will be solved “because markets” without any human agency involved.

Seattle area commenter, as well.

I have to go in to the city later (by bus) and that means that I’ll have a ‘window seat’ to look at all the small tents along the underpasses, on sidewalks near Stewart St, and people sleeping in Freeway Park. FWIW, I drove for years, but I simply can’t stand the freeway traffic any longer.

OTOH, if you want to cover your bets in this region (which I’ll draw widely – from Vancouver, BC all the way down to SF), you build high end flats. Because even if no one can afford the rent, you can still sell to overseas investors.

FWIW, my most trusted real estate source tells me the housing market (North End and Eastside) is softening in part because offshore money has slowed. (Some of the agents in his office are bilingual Mandarin-English, and they’ve become used to extremely high incomes the past few years.)

Whatever the Chinese are doing to clamp down on money flowing out of China is being felt here in Puget Sound. I still see tons of new Korean businesses in the North End suburbs, but that’s just anecdotal: I don’t have stats to assess what’s really happening.

Summer – yes it is that chancing/gambling strategy; reminiscent of our illustrious national leader. All of a piece really. In the inner suburb I’ve been living in for 34 years, the high rise, high end stuff is still going up along with re taxes, ruining the town. Most of my middle class friends are fleeing.

Rough beast Goldman slouched into town last year and put $100 million down for one of the towers. 666

This can go on for years.

Some of the early signs are “Free” upgrades or “Free” stuff.

The most extreme I recall was a “Free” high end automobile in your reserved parking space.

This was for multimillion dollar units in a high rise.

For SFR developments you see “Free” upgrades, usually Kitchen/Bathroom or landscaping, then you see “Broker Co-op” of 3% or more.

These subdivisions have their own in house marketing and sales staffs, usually salaried with a bonus structure.

When they offer outsiders a $15K plus commission to sell their homes…it’s not a price reduction.

Fox Hollow in Santa Rosa has been offering a 3% “Broker Co-op for a month or so and one of their reps showed up at yesterdays Sebastopol Broker’s meeting, something I have never seen before.

And when I got back to the office and checked my emails, there was a 3% broker co-op offer from a subdivision in Calaveras County.

I’m in Sonoma County…

A $10K -$25 credit is NOT a price reduction any more than offering 2 months “Free Rent” on a two year lease is a rent reduction.

If a developer reduces prices or rents it reduces the underlying value of the development, thus reducing the value of the collateral used to finance the property.

And this can, in some cases, trigger loan covenants.

If you are thinking about buying a home these days don’t worry, “Suzanne researched it”.

This is entirely the fault of financialization. Money lent for high-end construction is considered a better risk than anything lent for affordable housing. The politicians who are masters of wasting public money for no net benefit to the public are falling over each other to approve such projects to enrich themselves and their true employers. As Fritz Hollings famously said, “We’ve got the best government that money can buy.”

Out here at the edge of the metropolitan-flyovercolony divide, we have thousands of homeless people, living in the woods through a New England winter, often coming into the community college I teach at — housed in a former textiles factory — to use the bathroom or get out of the elements.

Meanwhile, next-door on the campus of this former major textile factory, new — you guessed it — luxury apartments are going up. But not to worry! The town has declared that ten of the hundred units going up will be “affordable” (nota bene: NOT low income, but affordable as measured against an average town income that is heavily skewed by the presence of …. luxury retirement housing! The self-licking ice cream cone continues). They are also going, I would put money on it, trying to enclose on the commons via beach access, but I digress.

The officials in our municipal governments are often quite literally the Real Estate-Developer Industrial Complex: contractors, realtors, etc. One state rep, who also owns the paper of record in town (!), got all huffy when I confronted him about also being a realtor on the side (our state legislature pays 60K a year, he has inherited money, so it’s purely greed on his part). How can a public official be an advocate for low income or even affordable housing, if their income depends on it being unaffordable?

He is part of the slimy local Dem machine, who won a Republican district by becoming one, just who doesn’t openly hate gay people. His pitch for re-election begins with how well he understands “the needs of the business community” — including stumping with McDonald’s franchise owners who are notorious locally for using super-sketchy foreign teenage workers from places like Thailand in some kind of exchange program each summer.

If I had the time I’d do an investigative piece on that — maybe someday soon.

With Dems like these…..

Ding!!

But they can sure talk smack about NIMBY’s, and rezone like madmen — and the part that you missed, is that (at least prior to 2008), they were also on boards of local mortgage banks, and had a lot of their money in those banks. Those were the very same banks that they hoovered billions out of TARP after Geithner, et al, ‘foamed the runway’ for banks and bankers.

Talk about a self-licking ice cream cone (!)

@readerOfTeaLeaves

Is there a problem with rezoning?

I’ve seen it done really well — when a municipality:

(1) has a good comprehensive plan,

(2) coordinates with transportation budgets and needs,

(3) maintains public safety budgets and staffing (cops, courts, social services),

(4) has adequate parks (planned and budgeted and safely designed), and

(5) coordinates with school districts (facilities primarily).

If you want to google the cities of Mill Creek, Bothell, Kirkland, Bellevue, Sammamish, Issaquah, Edmonds you’ll see some really fine examples of good rezones and redevelopment. Those happen to be white collar suburbs, where schools are a secular religion and form the basis of a lot of relationships. Ditto kids sports. Libraries are heavily used. So are parks. Public safety is a priority: they have excellent fire, police, and 911.

However, where I live, outside any of those lovely cities, zoning went from 1 du/acre -> 11du/ac or in some cases 12 du/ac via rezone applications. IOW, due to a regulations change that was then implemented as a rezone, we ended up with higher density residential (11 or 12 du/ac) than what you’d find in a multifamily zone (8 du/ac).

So if you were a builder, 4 du/ac = $400,000

That same acre with 11 du = $1,100,000

Multiply that by 10 or 20 acres…. infrastructure nightmare, bonanza for builders. Which attracted a lot of dumbass money.

These were done as ‘spot rezones’ of 1.5 or more acres, so that you have density without supporting services, with absolutely no hope of an Environmental Impact Statement. Instead of an EIS, you have only an ‘Environmental Checklist’, which is 95% check-the-box bullshit on a parcel-by-parcel basis. Impact fees were levied on these little rezones, but they are/were minimal and a one-time-pay-to-go fee.

No added transit runs.

No added transit stops, shelters, or bike paths — despite a tenfold+ rise in vehicles over a period of seven years.

Overcrowded roads –> unbelievable congestion that simply cannot accommodate roads built for maximum 4 du/ac, and now have to carry the traffic generated by 11 du/ac (multiply 11 du/ac by about 500+ acres, and you get a sense of the scale of the problem and how impossible it will be to address it without a lot of public investment).

School districts have been absolutely screwed — they can’t compete for land with private developers, and a developer can build thousands of units in two years, whereas the timeline for new school construction runs around ten years. And that’s if — and only if — the schools can get land in areas where density is increasing rapidly. (Our local government is too gutless to successfully compete with developers for land — the builders get it all and perpetually whine for more rezones 8^p

A big problem with my local government is that permit review funds the planning department, so basically the builders are viewed as ‘the customers’ and the citizens are just the hoi polloi who underwrite the escalating mess.

When permit review is viewed as a ‘service’ to private interests, the larger role in protecting public goods is muddied and lost. (This stupidity, I’m convinced, is driven by dumb economics.)

I could go on and on and on…

There are so many devils in so many details…

It has toxic political outcomes that make the problem worse: for instance, Trumpism is rampant in my little area, and I am convinced this is because many people perceive government as not working. At the local level, they’re correct. They are justifiably pissed, IMVHO. They’ve heard one broken promise after another, and they’ve stopped bothering to listen. Public engagement at the local level is almost negligible, and people have largely lost the civic arts (discuss, analyze, compromise, look out 20 years….)

Also, for several generations, the people funding elected political candidates have been housing developers (who get to write off their PAC political donations as business expenses), so… we have tons of crappy strip malls, lots of parcels up-zoned, and no coherent planning. And resentful, stuck-in-traffic citizens who distrust government.

One upshot of this mess is an amorphous public rebellion, like a low-level infection, at having to constantly underwrite the costs of sprawl, while also supporting families, and sending kids to overcrowded, heavily impacted schools. I can’t say that I blame my neighbors for their contempt and disgust at local government, but neither of those emotions will help us find solutions… Nothing will happen without rebuilding trust, and that can’t happen until people stop lying and making false promises.

It’s a terrible dynamic, and it was rapidly accelerated by idiotic, short-sighted rezone policies.

But I believe that these rezones have been fed by selfish, myopic, short-sighted economic beliefs that favor capital — and capital gains!! — far in excess of labor. (In my area, ‘labor’ can mean a surgeon, a software developer, a physical therapist… ‘labor’ is incredibly expensive and extremely valuable, whereas ‘capital’ could easily be a strip mall developer whose rezones degrade the quality of the community.)

I have huge respect for developers who build really nice communities, and I’ve seen some that work very well. It’s more art than science, and they are very smart people. But they’re not simply rezoning for a strip mall or a subdivision: they have a holistic, global view and a ton of creative vision.

More than once, I’ve heard: good developers gravitate to good communities. They have to, in order to protect their investments. Where I live, opportunists and scammers have held sway, and held power in almost every single case using *economic* arguments that are completely short-sighted and bogus.

From my experience, the cities that I recommended you google have had some *very* smart planners, but those planners draw a red line around their city boundaries and basically say: if you want to develop here, you will play by our rules. People (and builders) are drawn to our communities because community — in and of itself — has value. Homes hold their value because the community is safe, healthy, and people value living here.

But those planners articulate a view of economics that is holistic: where I live, it is the Wild, Wild West and the mindset is based on individual home ownership as the apotheosis of American achievement, with capital (i.e.., private property ownership) as *far* more valued than the labor of a heart surgeon or cancer researcher. Capitalism is about owning property, but where I live, that economic claim has been used as a rationale to engage in thousands of rezones that degrade the ability of government to maintain decent infrastructure: it is myopic capitalism.

Where I live, planners and policy makers do not see schools or parks as ‘job creators’. They see builders and strip mall developers as ‘job creators’, no matter how sh!tty or short term those jobs may be. It is a profound failure of economics that perverts every other aspect of human life and environment. The role of capital has completely eclipsed the claims of labor when an idiot strip mall builder has more clout — and more impact on a community — than labor (teachers, doctors, nurses, pharmacists, engineers, child care providers…)

Rapid growth, in and of itself, does not bother me — I’ve worked in startups (and frankly, that experience makes it absolutely impossible for me to work in government or any kind of more static business model). Growth can be exciting and pose lots of novel problems to be solved, and can pay a lot of dividends if done well.

But ‘growth’ — simply because it is somebody’s mantra, or enables someone to make additional compound interest from more mortgages, is mindless stupidity. Unfortunately, my local government can’t seem to distinguish between the two: they talk as if sh!tty spot rezones are some kind of Sorcerer’s Apprentice magic. I honestly think some of the dumber developers believe this idiocy, as well 8^(

Sheesh, I hope Yves and Lambert don’t ban me for banging on like this…. ‘sprawl’ and the crappy economics that drive it, are obviously a passion of mine.

Your comment was a treasure.

I hope that mine makes sense — !

Shorter: if we put more focus on labor in our economic conversations, we might build more livable, viable, vibrant, safe cities ;-)

Thank you for this comment–I love this subject and could talk about it all day. I am with you in that the level of development should correspond with the level of supporting infrastructure, and that growth for growth’s sake is, as Edward Abbey said, “the ideology of a cancer cell”. I also agree that the idea of a citizen-as-customer with permitting as a “service” is very problematic, probably the seep of MBA-think into our everyday lives.

Where we might disagree is on what “nice” community is and what something like that “should” look like. We might also disagree on what it takes to create such a place. I find sprawl ugly and depressing, but the strongest reason for my dislike is that it is inefficient and artificial. Sprawl is not the natural result of a free market. Sprawl is the direct result of lot size minimums, setback requirements, use limitations, mandatory parking requirements, and miles and miles of roads which effectively release people from the constraints of geography. And sprawl only works when you have a highly subsidized system of roads and petroleum fuel that makes it viable–if the federal government and state DOTs suddenly stopped spending billions of dollars every year fixing and expanding roads I guarantee that most municipalities would not step in to fill the gap, and the built environment would look vastly different. So wherever you live, part of the blame lies with the local planning department (especially the planners of 30-40 years ago) and part of it lies with the state and federal departments of transportation.

As for congestion,–dwelling units don’t cause congestion, because dwelling units don’t drive: people do. Assuming you are in the PNQ, think of two identical dwelling units in the San Juan islands, one on the ferry system, one not. How much congestion will each of these dwelling units “create”? The answer, of course, depends on the infrastructural context–a dwelling unit connected to a road (via ferry) is much more likely to see congestion/traffic than a dwelling unit that was not. Our investments in motor vehicle infrastructure drive motor vehicle traffic, not our construction of housing, businesses, or any other use (think of any road widening project you’ve ever seen–what was the result? Almost definitely increased traffic/volume, right?). Unfortunately the fallacy that land use is related to transportation mode choice is a misunderstanding enshrined in almost every zoning code in the US.

With this in mind, when you mentioned that with a recent development there were no added transit routes, shelters, or bike paths–did the municipality add any road space? The sad reality that for all the transit/bike/pedestrian infrastructure a municipality adds, if there is more infrastructure serving cars or anything that makes driving more convenient than anything else, then that is how people are going to travel.

My final question–in the neighborhood where you live, do people see their homes more as a commodity, or more as a living space? Does everyone expect to one day be able to sell at more than they bought for? Is a right to guaranteed return part of the American dream?

Thanks again for your response.

Well, we must have bored the sh!t out of everyone else reading here, but I have absolutely loved your comments. And the things that we are discussing are huge economic drivers.

None were added. Zero. Zilch. Nada.

The municipality can’t afford the road space, and the voters are so alienated and pissed off that it would be hard to get enough support to pass the bonds.

We have ‘impact fees’, but they are pretty much a one-time permit hiccup. Builders whine, but that money is only a one-time fund and can be spent anywhere in the transportation district, not necessarily in the neighborhood.

The impact fees are largely dependent upon how TSA’s (Transportation Safety Areas) are drawn during the permit review process — and scoping is always done in order to pre-ordain the desired outcome of a vested permit. And yes, TSA’s are scoped by the people paid to approve permits. Another self-licking ice cream cone.

Basically, the same people who oversaw the rezone nightmare then went to Sound Transit for super-duper promotions and more pay. Because traffic.

Yegads.

Commodity first; living space a bonus, but not primary.

Expect to sell for (much!) more than they bought.

Absolutely ‘guaranteed right’ to American dream — and given the diversity of the local population, that point should be taken verrrry seriously. Plenty of immigrants work very, very hard to achieve that dream. Plenty of second-and-third generation folks also work for that dream. For most people, ‘home ownership’ also represents access to reasonably good (often excellent) public education – primary, secondary, and higher ed.

I agree with all the points you made, and essentially agree 90% with your observations about sprawl — largely the result of hidden subsidies. And those ‘externalities’ are simply not sustainable over the long haul IMVHO.

However, this is also a problem of putting too much emphasis on capital, too little on labor, and being oblivious to our antiquated economic ideas that probably originated between the 1770s and the Civil War (1860s). A lot of things has changed since then, but economic theories (supply-demand, yield curves, tariffs) are intellectual cruft that still impedes our thinking.

Thanks to Yves, Lambert, et al, for tolerating these long comments. Deeply grateful.

How do you tell a resident from a visitor on the coast of Maine?

People from away have three houses. People from Maine have three jobs.

+1

A maybe related phenomenon that I see just north of PDX is the rise of assisted living senior housing complexes. They typically offer small apartments along with a central meal area, with more intensive care in a segment of the complex (say you fall and break something) and a memory care segment. Not particularly cheap, and up it goes if you need more services. Granted, these can draw people from a wide area, retired down sizers that liquidate their property. Probably have penciled out so far. Now, not far from me on half of an abandoned airfield a truly vast project has arisen, seems like maybe a dozen large buildings. There are already at least 4 of these complexes that I am aware of in this town.

The data can be more than ‘frothy’ and downright wrong due to localized factors. The west coast in general has had a high influx of Chinese hot money. London has had Russian hot money, and Miami, has had the hot money from South America. Most recently out of Venezuela but soon to become hot money out of Brazil when they ‘elect’ Jair Bolsonaro (when my tin foil hats goes on I suspect he arranged to be stabbed because he’s made a tremendous surge in the polls after that and was miraculously near a hospital). Anyway, the right sort of people support his candidacy and Lula remains in jail (probably for the rest of his life) but this guy endorses previous governments (e.g. the military juntas) and if he turns authoritarian (don’t have to wear my tin foil hat to make that prediction) the money will flow out of Brazil, next. Anyway, my point is rents are high but the cost of building is as well. Permitting is a nightmare in most places (NY, NY is a special case nightmare, e.g. unique to the world).

So you think rents are too damned high, eh? Then I have a modest suggestion. Why don’t you cash out your 401(k) and build low-rent apartments? Put another way, put your money where your mouth is! Anyway, now that I’ve tossed a small pebble into this small pond, I shall sit back and observe. It’ll be interesting whether hypocrisy reigns, or whether someone will take up my challenge do the ‘right thing’ by the poor. Hah!

Trump won because he said the game is rigged. Clinton lost because she said “America is already great.”

Trump voters know “doing the right thing” is a dead end.

I work on the permitting side of development–not in a high-end market, but I have seen similar trends even in my area. Because of the system we have set up, you just can’t make much money building mid-rise, moderately-priced apartments. If we want to change that we should either change the regulatory framework (zoning) or move to a system where we don’t rely on the private sector for housing provision. Here are some of the main reasons I have seen that people build either duplexes or luxury apartments:

-If you build below four units you don’t have to put in a sprinkler system or the more intensive ADA requirements.

-Even though minimum parking requirements generally decrease with the number of units, building 10-20 units still triggers a mandate for all sorts of parking and maneuvering space–basically requiring twice the amount of land to house a similar number of people.

-Larger projects will undoubtedly raise the hackles of any “my-home-is-my-asset” owners in the area, and which inevitably raises the cost of any project either in time or in concessions extracted by the local regulator/government.

One reason that I love NC is the quality of the comments, but this one is a particular gem IMVHO.

I know people who are mega-millionaires solely based on zoning.

They obsess on tax cuts, as if ‘investment’ (i.e., ‘capital’) is always and everywhere the critical trigger for economic growth. They also obsess on regulations, because for them that’s where the money is: changing a regulation or two can make them fortunes in the span of twelve months.

The devil is generally in the details, but it’s rare to find anyone who can explain them simply and clearly. Thank you.

Thank you for your response.

If you are more interested in this topic (and forgive me if this book is already known to you), I highly recommend U Michigan Professor Jonathan Levine’s book Regulation, Markets, and Choices in Transportation and Metropolitan Land Use, which might permanently change the way you look at the American built environment.

At the end of the day, zoning is essentially value insurance–it keeps everything (and everyone) in its right place (and that way someone can always profit!).

And the black sheep in this equation is Tokyo, where population has risen ~30% and home prices have…wait for it…also risen 30%. Compare this to London or SF, where a modest 6-10% increase in population has driven an astonishing 400-600% increase in price.

The Japanese market builds at a prodigious rate: Tokyo, with 13 million people, has around 130,000 housing starts per annum, whereas the entire state of California, with 40 million people, has around 80,000 housing starts per annum. Yes, the building itself is a depreciating asset and the average Japanese family doesn’t build wealth through dwelling. But the Japanese understand that the purpose of a house is to provide a place for people to live. There is no housing crisis, people have plenty of places to live and the market responds quite well when demand skyrockets in a particular neighborhood (like Minato).

In Tokyo, I lived on the same street (in Azabu) as a guy with three Rolls Royce’s, and we shared the neighborhood with a machinist, a bicycle factory, a few restaurants and schools, and a recycling depot. In Boston, that level of mixed income and mixed use would cause a coup. You’d have the zoning board out of a job within minutes. “But my neighborhood character” etc.

In the states, housing isn’t housing: its an asset class, a vehicle for wealth expatriation and money laundering. Zoning boards are wholly captured by small cabals of capital holders who use arbitrary euclidean requirements on height and setback to control stock, channeling gains to the select few who are allowed to build (not coincidentally, they’re all members of the same country club).

Thanks Hamdoctor. Great and informative comment.

On top of the 13 million in the city of Tokyo I think the entire Metro area of Tokyo has around 34 million people so their housing philosophy/policy is probably even more impressive!

I’m also in tokyo in the Azabu area, my apartment cost me less than 25% of what it was new in the mid 1980’s , Property here is viewed as a depreciating asset, you can also live in a super prime area as a waiter as the cost difference between the top and bottom areas is not that great, they are all safe. Just in Azabu / omotesando you have the highest concentration of Michelin stars in the world but ok rents/prices.

I dont see it as a problem that 100% of the stuff being built in the US is “Luxury” as when it fails to sell or ages blue collar folks will get to live in it , the developers loss will be residents gain, if you have to have 10,000 units built in a city its better that its nice stuff and the quality of the housing stock is better for all residents, if 10,000 tents are put up in the park instead everyone is worse off as competition for the nicer stuff becomes more fierce.

I will just mention (again) the 12,000 homeless in San Francisco itself and bleep knows how many in the rest of the Bay Area. This is a problem that has been ongoing since the 1980s and getting worse every year. Every year, it gets harder for most to afford shelter, but we have a surplus of luxury apartments.

We got jobs, lots of jobs, jobs of all sorts, but what we do not have is affordable housing. It has only been in the last 2-3 years that the victim blaming has declined albeit a little.

On the other hand, where housing is somewhat affordable in the deep countryside, there are no jobs. And BART and only long distance public transportation is usually DOA, and if not, it is a ginormous battle with the costs increasing, the scale of the project decreasing, and the time it takes going up, up, up. Even buses are resisted.

If you want to pass a law on some new civil right, on the horrible gunz, or maybe a bike path, no problem. Housing, healthcare, and education proposals can usually just be put in the shredder, especially if any taxes are involved.

California is not a leftist, or even liberal, state. It says it is, but that is just propagandistic Bovine Poo.

What if handguns had put in a performance like real estate, and a Glock would set you back $4,500, so few could afford to be armed & dangerous?

That is true as the reason we have a surplus of affordable guns is because we have a surplus of guns being made; the reason we have so many, often employed, frequently highly educated, people living shorten miserable lives is because the Golden State can not get its collective head out of its posterior. And build more housing. If parking was a concern, build them with carports, or underground parking, or actually expand all the variety of public transportation. There is a large amount of investors and banks with massive amount of excess money wanting to invest.

The gunz are attention grabbers and bike lanes are cool, but people becoming destitute just so they can have a place to live are just not important. Oh, people say it’s truly important to them. Cities and counties up and down the state and in the state’s legislators all bemoan the horrible, bad, no good, awful housing problem.

They been doing this for over thirty years and have not done much. Have a shooting somewhere and immediately pass some useless legislation that prevents no deaths and does nothing else except impede gun owners. Heck, I could use healthcare as a similar example. If helps the average Californian, but it actually cost extra money and inconveniences the donor class, it dies as quietly as can be. If it doesn’t, but gives the appearanceof doing something, it’s passed with loud pronouncements that They Are Doing Something. Kabuki politicking is what it is. Housing, healthcare, and in the economic wasteland of eastern California employment, would do far more to reduce any violence by any means than symbolic bs legislation. Oh well, we do have one of the largest prison population on Earth. Leftist state my big fat posterior.

The last 20 years has seen just about every possible spot in L.A. get built on, and luckless saps that drive an hour and a half each way to work because they bought a house in the hinterlands isn’t the answer either.

So, where exactly are we going to put all of this new housing you propose?

The situation is if anything, worse in the SF Bay area.

Oh no. While the Bay Area does have a lot of build up, it ain’t New York with San Francisco being Manhattan. Eastern and northern Marin, the large western and southern parts of San Francisco, much (most?) of the East Bay, Sonoma, Napa, Solano, even large chunks of San Mateo are either zoned for single family homes, or often no homes, and the various public transportation systems especially BART have had their planned expansions blocked and their budgets either restrained, or misallocated, such that maintenance has been substandard.

There is no good reason why the Avenues(Sunset District) which is something like 1/4 of San Francisco should almost be exclusively single family homes, often on lots that would make a Marinite happy, and this in a city of over 880,000 people in just 47 square miles.

So we have lots of land available if they were rezoned for multi-family buildings. Heck, speed the various BART expansions that they have been working on for forty years and build apartments on those lines. As an aside I would love to add San Francisco’s Pacific Heights but it’s the exclusive home of very wealthy people like Diane Feinstein, so they get the baronial mansions looking at the Golden Gate.

It is doable but too many people either don’t care or actually oppose such changes.

“The solution is the market. These units will have to be rented out, either by the developer or by the creditors that will end up with the project if it fails. The way to fill these units is to cut rents until sufficient demand materializes. And this puts pressure on rents in lesser buildings that have to compete with these high-end units. In other words, it creates downward pressure on rents, from the top down.”

Mmmm yeah, no. The Canadian housing market in urban areas has been waiting for this to happen for at least a decade. Having moved around in Toronto’s absurd rental housing market I can tell you with confidence that over half of any given upper-end condo building is empty a month after “launch”. Wealthy are told to buy as an “investment” and then decide if they can’t rent it at a price that will cover the massive monthly mortgage payment they got on their safe investment they won’t rent it *at all* to save the hassle/possible wear-and-tear, etc. They’d rather keep the place empty than rent to a poor person and (gasp) possibly lower the property value. Instead, they’ll just turn around and sell it to the next sucker who thinks they want an “investment property”. Inevitably, prices keep going up. The market is not correcting downward. This is *aside* from all the money-laundering, foreign investment, morgage loan rates, zoning, transit, and a zillion other factors that have lead to ballooning high-end investment in property. Face it, housing isn’t a “thing” that exists for a purpose any more, it’s just another “financial asset”.

Anyone walked the High Line lately? It’s INSANE what’s under construction and newly built. Down in the meatpacking/chelsea there’s a bunch of holes in the ground and half-built crazy looking concrete structures. The concert venue at Hudson Yard is wacky, and they have a shiny new subway stop with a dizzyingly deep entrance. Everyone’s going to be having so much fun there won’t be time for compassion towards the poors. They can live in Queens I suppose.

/sarc

One solution is to follow what Vienna did with its public housing.

https://huffpost.com/us/entry/us_5b4e0b12e4b0b15aba88c7b0

The issue is that all of the best land to downtown has already been taken in the US. Looking at Vienna, I disagree with the idea Wolf Ritcher suggested that the free market is the best cure. It could end up being a big housing crash too and that has tons of collateral damage.

I am also skeptical of trying to grow city population as much as possible, whether that be through internal domestic migration, immigration, or very high birth rates. Cities should aim for a stable population becuase land is a precious and limited resource.

I think that in a situation like this, it is best for the state to own the land and strictly regulate it. It may be that like healthcare, land is best controlled by the state. Of course that depends on the state managing it well and not being corrupt, which is a reality often.

On a separate note, I think that it is no coincidence that many unsavory figures, most notably Donald Trump, have their background in the real estate development and property management industry. Much like investment banking, and high finance as a whole, it seems to attract the least ethical people.