This is Naked Capitalism fundraising week. 1441 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, more original reporting

Conventional wisdom is that the failure of major grocery chains in recent years like Marsh Supermarkets, A&P/Pathmark, and Tops is due to their inability to keep up with “disruptors”.

Conventional wisdom is wrong.

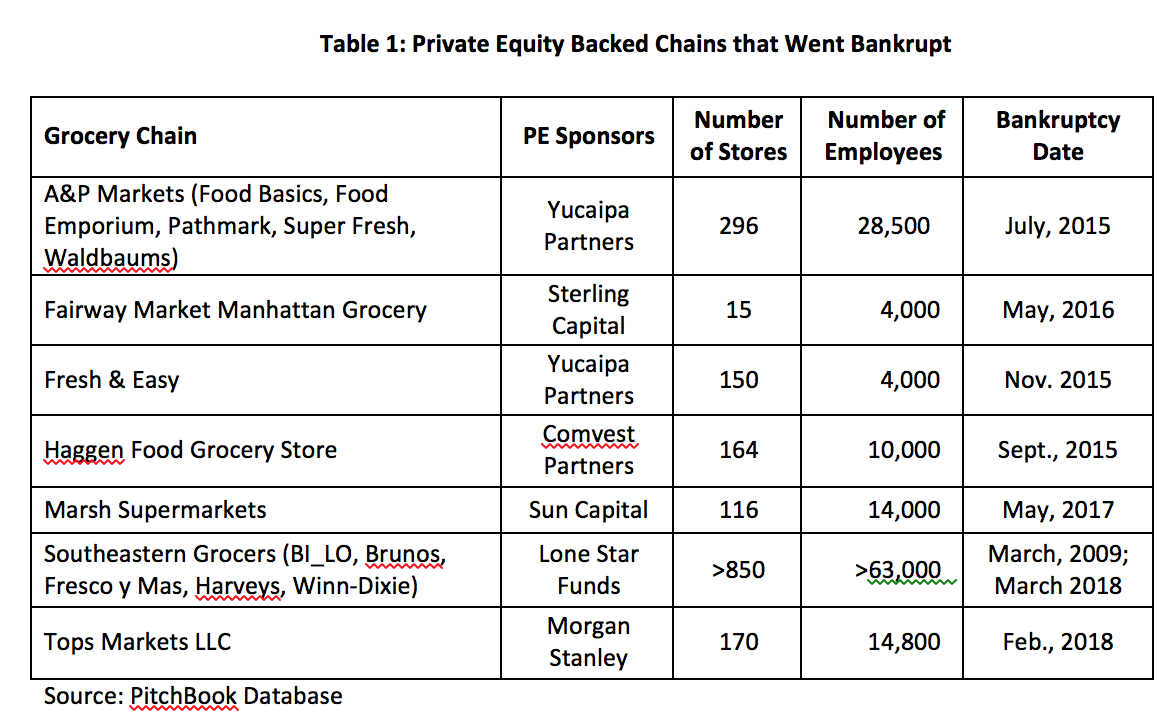

As Eileen Appelbaum and Rosemary Batt explain in a new article scheduled for American Prospect, Private Equity Pillage: Grocery Stores and Workers at Risk, the seven large grocery chains that filed for bankruptcy since 2015 all were victims of private equity firms overloading them with debt, which in turn kept them from investing in updating stores and their product lines. No similar publicly traded grocery chain suffered a similar fate during this period. And as the authors and others like your humble blogger have pointed out, private equity firms extract so much in fees relative to their meager equity investments in the funds they manage that they profit even when they drive the companies they bought into a ditch.

Appelbaum and Batt tell the story of three of these bankruptcies in detail. Southeastern Grocers, Tops, and Fairway. I can attest that two of the stores in the Southeastern portfolio that my family once shopped at, Winn Dixie and Piggly Wiggly, got much less of their business over time. They pretty much abandoned Winn Dixie, when they once shopped there occasionally. It’s an old-looking store, not great housekeeping standards, with mediocre fresh foods. The nearby Piggly Wiggly has done better by virtue of being owned locally. It had a very good wine section in the middle of an otherwise uninspired store; a relocated store has much better produce and carryout foods and added flowers. But otherwise, Publix is the grocery chain in the area to beat. From the article:

The bankruptcy of Southeastern (SE) Grocers, owned by private equity firm Lone Star Funds, provides a classic example of how PE drives companies into bankruptcy while extracting millions of dollars for themselves and their investors. It is the owner of well-known brands BI-LO, Fresco y Más, Harvey’s Supermarket, and Winn-Dixie, located in seven southeastern states…

Lone Star first bought out the predecessor of SE Grocers, BI-LO, in 2005 in a leveraged buyout and took the company private. It ran the company into bankruptcy by 2009 and emerged from Chapter 11 in 2010. It tried to sell the chain to publicly-traded Kroger and employee-owned Publix Super Markets, but they were not interested. After 6 years of ownership, Lone Star was overdue in paying promised outsized returns to its investors. So it executed a ‘dividend recapitalization” – meaning that it loaded the company with even more debt and used the debt to pay dividends to itself and its investors. Between 2011 and 2013, it paid itself and its investors $838 million in dividends – money that could have been used to make the stores more competitive. The struggling company, meanwhile, became saddled with interest payments on these loans. One loan of $475 million used to pay dividends required SE Grocers to pay $205 million in interest between 2014 and 2018. Lone Star’s owner, John Grayken, is a billionaire who famously renounced his U.S. citizenship to avoid paying taxes.

As if this wasn’t enough debt, Lone Star sent SE Grocers on a buying spree rather than invest in existing stores. In 2012, it bought out Winn-Dixie for $590 million, adding 660 stores and 63,000 employees. In 2013, it added another 165 stores (Harveys, Sweetbay, and Reids) in an LBO worth $265 million, as well as 22 Pigggly Wiggly stores in an LBO worth $35 million. Lone Star renamed the company ‘Southeastern Grocers’.

By 2014, the company had an unsustainable debt overhang of $1.32 billion due to dividend payments and leveraged buyouts. Looking for cash, the company sold the real estate of a distribution center for $100 million and several stores for $45 million, and then required the affected entities to pay rent on the buildings they used to own – further undermining their financial stability – referred to in financial parlance as a ‘sale/leaseback.’ In need of more cash, Lone Star managed to obtain a series of revolving credit loans and debt financings between 2014 and 2017, but the loans weren’t enough to keep it going.

By March 2018, SE Grocers filed a ‘pre-packaged’ Chapter 11 bankruptcy…When the company exited bankruptcy in June, 2018, about 2,000 workers had already lost their jobs. The deal reduced debt from $1.1 billion to $600 million, with creditors swapping debt for equity, and the company agreeing to close 94 stores affecting thousands more workers’ jobs.

In the case of SE Grocers, the sale of real estate and then its leaseback at an inflated price played only a marginal role. It was central to the demise of Marsh Supermarkets:

In the case of Marsh Supermarkets , private equity cashed in on its rich real estate before throwing it into bankruptcy. The private equity buyout dates to 2006, when the Indianapolis-based company with 116 groceries and 154 convenience stores was up for sale due to losses it incurred during the ‘grocery wars’ of 2005. Prospective buyers were thin until a footnote in one of the company’s financial reports showed that Marsh’s real estate was worth $100 to $150 million more than listed on its financial statements….by September 2006, Sun [Capital Partners] took Marsh private in a leveraged buyout. Soon after it acquired the chain, Sun did a sale-leaseback deal for the real estate of many of Marsh’s stores, raising tens of millions of dollars for itself and obligating the supermarket stores to pay rent on locations they had previously owned. Sun also sold Marsh’s headquarters building and saddled the grocery company with a 20-year lease to 2026 at an annual rent of $2.8 million, scheduled to increase 7 percent five years later.

Over the next decade, the supermarket chain struggled. Finally, with only 44 stores remaining in 2017, it went bankrupt, auctioning off the majority and closing 18. Richard Feinberg, professor of consumer science and retailing at Purdue University noted that Marsh might have remained competitive, like other smaller chains that managed to perform well. But this, he said, “would have taken an additional investment that Sun clearly did not want to do”.

Appelbaum and Batt stress that grocery stores are essential for communities; indeed, when poor urban neighborhoods are trying to redevelop, a grocery store (as opposed to a convenience store whose idea of produce is a few apples, oranges, and bananas, and if you are lucky, a tomato) is a critical piece. Even the little story I found about the relocation of a Piggly Wiggly near my mother’s house, in an upscale area where everyone has a car and can easily drive to shop, shows how much people value having a store close at hand:

Owners Andy Virciglio and brothers Basim and Naseem Ajlouny hoped to re-open in Crestline Village after they had to shut down their store at the corner of Euclid Street and Oak Street in November 2014 because the landlord chose not to renew their lease. Piggly Wiggly had been tenants there for 30 years. A CVS/Pharmacy has since opened at that location…

“We were fortunate to be able to find this property,” Naseem Ajlouny said. “We’ve had good support from the city, from the board of education and school system and from residents. People were there to support us.”

The old Crestline Pig didn’t go quietly before closing. A Facebook page called “Save the Pig” quickly earned thousands of “likes,” and community members gathered at the Emmet O’Neal Library to share memories of the store.

“Community support has been humbling,” Ajlouny said. “They needed and wanted this store to come back.”

The article describes how the new store has enlarged its wine section, now has the best craft beer selection in the region, added more organics and improved its store labeling of organic and non-GMO foods. Appelbaum and Batt describe how most grocery chains face similar pressures to update their selections:

Grocery chains employ 2.77 million workers, distributed in small towns and cities across the country. They still account for the majority of food at home purchases and are an important source of jobs in local communities. Their continued presence is important to the local economy and to a sense of community in the neighborhoods they serve….

What next for regional supermarkets and the jobs of workers in this sector in the coming years? Heightened demand for one-stop-shopping, organics, a wide variety of healthy products and services, online ordering and delivery, and more. Grocery chains find they must race to emulate the most innovative products and services while containing prices. This takes deep financial pockets.

Yet as with SE Grocers, private equity owners don’t want to spend the money. The authors compare the trajectory of the biggest grocery chains Kroger,s to number two, Albertsons, which is owned by Cerberus. Albertsons carries a vastly higher debt load than Krogers or Publix. Albertsons has lost money for three of the last four years. Moody’s downgraded Albertsons debt twice this year. Cerberus tried to take Albertsons public in April 2018, but cancelled the deal, as it had a fall 2015 IPO attempt. Cerberus then tried to have Albertsons do a reverse merger with Rite-Aid, but large Rite-Aid shareholders were opposed, so that deal was scuttled too.

Appelbaum and Batt argue that Cerberus could continue to bleed Albertsons or could invest to restore its chains and exit at a higher valuation as a result of improved performance. They quietly chide public pension funds like CalPERS for sitting pat:

The answer may hinge on what public pension funds do. These funds have increasingly invested in private equity, despite its unsavory and anti-worker practices, lured by the promise – if often not the reality – of higher returns. The question of whether the big pension funds should avoid private equity, or use their investment to reform its practices, has been hotly debated. (Pension funds cling to the hope of high yields despite the reality that half the private equity funds launched since 2006 have not beaten the stock market and many more have failed to provide returns high enough to compensate for the added risk of these illiquid investments.). CalPERS – the California Public Pension fund has a large stake in Albertsons via its investment in the Cerberus fund that owns the supermarket chain. Will CalPERS, which has responsibility for managing the retirement savings of California public sector workers, many of whom live in communities served by supermarkets Albertsons owns, insist that Cerberus abandon attempts at a quick exit, extend the time they are willing to hold the grocery chain, and commit to making investments that will improve store operations and increase profits?

The authors describe how Kroger, which has kept investing in its business, has not only been investing in its plant, but in improved online shopping, digital displays, employee training, and faster checkout. It is also increasing worker wages and benefits and devoting a billion dollars to bolstering its pension fund.

Appelbaum and Batt set forth a series of reforms to prevent private equity firms from pillaging companies:

Limit total debt leves, including capitailzed leases. The authors don’t recommend how to achieve this; a simple way would be to restrict the tax deductibility of interest expenses plus operating lease charges above a certain level.

Prohibit the payment of dividends for the first two years after a private equity purchase. This rule is already in place in Europe.

Require private equity firms to disclose all fees and expenses that they and their affiliates charge

Stop treating private equity owners as passive investors and acknowledge their role as joint employer along with the operating companies they own. The notion that portfolio company management has any independence from their overlords is a fiction to everyone but the courts, which allow private equity investors to escape from liability under the WARN Act (which requires 60 day notice of a facility shutdown) and under ERISA for termination of a pension plan.

It may see that bringing private equity to heel is an impossible task. But the great trusts of the Gilded Age and early 20th Century were even more dominant, yet the were eventually leashed and collared. The more the public understands how often their behavior is self-serving and destructive, the more support there will be for prohibiting those practices.

A first right of refusal, whereby the workers have the right to say no to acquisition by a PE firm and to purchase the business themselves, would be a solution to this. We would need to provide alternative financing arangements to facilitate the deal as capitalist banks don’t like assisting worker-owned initiatives.

Ok, hypothetically say I want in on this. I buy a going concern. I loot the pension funds. I issue lots of debt. I extract all of the value I can and leave a rotting husk in its place. Not necessarily in this order.

Who is buying this all of this debt and why?

Read wolf street for more. Its very likely average joes like you and me through our 401k investments, through pension funds (like Calpers), etc. As they say if you are not clear who the mark is, its probably you.

To me this offers the best hope for reform. Someone with a public platform needs to get burned and then make that public to galvanize change. Yves, Applebaum and Batt are lone voices in the forest of PE fraud.

Algos, once IPOs are executed.

The instruments of this debt are called ‘leveraged loans’ and they are most commonly packaged into Collateralized Loan Obligations ( CLOs ) so they can be sold to institutional investors. Wolf Street has a very good post about the recent growth of these high risk loans. According to their post:

“A “leveraged loan” is a loan that is extended to junk-rated (BB+ or lower), over-indebted companies. These loans are considered too risky for banks to keep on their books. Instead, banks sell them to loan funds, or they package them into highly rated Collateralized Loan Obligations (CLOs) and sell them to CLO funds and other institutional investors.”

The history of these products apparently dates back to Drexel and Michael Milken.

These businesses Were killed by “disrupters”. But it’s their p.e. owners who are the disrupters!

you misspelled “parasites”

This is a weird echo chamber. There is HUGE selection bias in a case like this.

That’s a handwave, not an argument. Appelbaum and Batt are meticulous scholars and are extremely careful with their claims. Go read their full article and try telling me PE isn’t responsible for the bankruptcy of each and every one of these grocery chains. And there’s no selection bias. They looked at all the grocery chains that filed for bankruptcy, and all were PE owned.

Better trolls, please.

Please find 1 historical case to support your claim of selection bias. Just 1. Or maybe you could try to address the facts that were presented here. Are you saying that what Applebaum/Batt found – that of PE owners paying dividends while saddling the operating company with debt – has never happened before? Is that what you mean by selection bias?

surely that is the crux of all case studies?

This article did lead me to a thought just now. Could it be that Amazon is providing the seed capital that these private equity firms use to take over all these companies and their chains at all? As all these companies are gutted and cannibalized leading to their closing, more and more people would be reduced to using Amazon’s services to buy the stuff that they use to buy at these storefronts that are no longer there. While waiting for this to happen, they would be raking in the money that they invested into these private equity firms. Of course it may be my evil nature that led me to this line of thought but still…

I believe there will always be a need for a local presence in grocery retailing.

Amazon may have effectively acknowledged this when it bought Whole Foods.

If the Republicans and Democrats required the employee pension liabilities of these acquired companies to be fully funded when these companies were acquired, I believe one would see far less PE activity.

There is some “prior art” in that the Republicans pushed the US Post Office to recognize, and pay more into, its pension liability, pushing it into a loss position the Republicans could rail against.

@John Wright

October 22, 2018 at 10:08 am

——-

“Republicans pushed the US Post Office to recognize, and pay more into, its pension liability, pushing it into a loss position the Republicans could rail against.”

Yes, they did. They required the Post Office to fund the expected pension and welfare liabilities for the next 75 years, and to do it in 10 years.

This does 2 things the privatization vultures want to see:

1. The Post Office is a money-losing operation, so, naturally, private enterprise can do better. Let’s sell it off.

2. The pension will be yuugely over-funded and the vultures can skim everything beyond the minimum assets required by PBGC. That’s going to be many billions.

And, they have already started. Nancy Pelosi’s husband is a Realtor with CBRE who has a contract with the Post Office to sell off it’s unneeded real estate from closing branches. No time to find it now, but there have been exposes on how he has sold a bunch of properties in sweetheart deals with friends.

It is Dianne Feinstein’s husband, Richard Blum, whom I believe you are referring to.

https://en.wikipedia.org/wiki/Richard_C._Blum

See the “Controversy” section of this page.

with “liberals” like that, who needs conservatives?

Diane threatens the funding of the U of CA when some of the kids think for themselves and join BDS too.

@John Wright

October 22, 2018 at 3:15 pm

——-

Yes, you are correct. But, in my defense, they are two peas in a pod.

PE companies have been at this game throughout all industries for the past 30 years. Usually buying up 2nd and 3rd gen family owned companies started after ww2. Thousands have lost jobs as their newly gone public company was blead to death by the PE overlord.

Here we sit in Jamestown, NY, once known as the “Furniture Capital of the World,” before those companies moved first to the union-hating southern states and then went off-shore to Mexico, China, and other low-wage venues. (Thereby lengthening those fossil-fuel hungry supply chain lines.)

Our Sam’s Club closed without warning last year. Big “For Sale” sign out in front of the enormous building surrounded by acres of asphalted parking lots.

BonTon, my mother-in-law’s beloved regional department store, went into bankruptcy this spring.

Sears, one of the anchor stores in the sinking Chautauqua Mall (along with BonTon and JC Penney … does anyone under the age of 70 still shop at Penney’s?), just declared bankruptcy, after years of debilitating and painful decline (thank you, Eddie Lampert, Venture Capitalist extraordinaire, worth $3Billion and counting.)

Sears-owned K-Mart, just down the road from the Mall, hasn’t had more than 5 cars in its parking lot at any one time, for the past two years. It will go down with Sears.

And, of course, the three Tops Markets in the Jamestown area are in bankruptcy. Thank you Morgan Stanley. And, according to the latest revision, top execs will receive their $3.6 Million in bonuses. Probably in recognition of their acumen in negotiating down the company’s liability to fund workers’ pensions. Another win for the oligarchy!

And the impact on the citizens of Jamestown? Employees lose their jobs. Their pension funds are decimated, thrown onto the mercies of the federal Pension Benefit Guarantee Corporation. They have less money to spend. And if they want to spend it locally? Want to buy shoes or a winter coat or bed sheets? The choice is now Walmart or the Salvation Army Thrift Store. Or, if you want depression, along a vanishing selection, go to Penney’s.

I checked WIKI to find out about Jamestown. You seem to be shedding population like crazy there. I suppose that’s another side to these PE sell-offs there.

Yes, people who can leave, leave. My spouse left for college and never came back. Until he retired.

When the major manufacturing firms, furniture and textiles, left, the death spiral began. I have gone on tours of former manufacturing sites, conducted by our local historical society. When I ask why the factories closed and left hundreds of people unemployed, I get hand waving, that’s the way the world works, it’s the free market, the unions were greedy. Nobody questions the national industrial policy that ok’ed the flight of manufacturers to countries that paid workers a pittance and allowed unchecked pollution, while beggaring our citizens.

So, yes, a declining population base was probably the reason the Sam’s Club closed. But Sears and K-Mart are national. Tops is a regional chain, and the entire western New York is economically hurting. But that is no reason for a private equity firm to stalk in and suck blood out of the corpse. Just because they can.

Wegmans, a privately held grocery chain that began in New York over one hundred years ago, is doing just fine here. The Wegman family are billionaires (they could probably afford to pay a $15 minimum wage; then they would be only millionaires.) On the lower end, there is Aldi’s, a kind of Dollar Store for groceries, also privately held.

It is really hard to look at PE firms without the metaphor of a shark coming to mind. First, they circle their prey, then when the prey is distracted, CHOMP! As the prey slowly dies, the shark bites off a bit, moves on, returns and tears off some more, and continues the cycle until there is nothing left.

One thing. Somebody has to sell off their business to the PE sharks. That is where the sin starts.

Another example of 1) transaction and management fees dictating business strategy and 2) pension funds being handcuffed by private equity working against its own best interests because labor can’t restructure on its own. What was going to happen will happen with fees extracted: a) the real estate will be re-positioned, recognizing the out-of-date footprint of American stores relative to Asian and European standards and b) union staff will be turned over with negotiated point-of-sale focused contracts repositioned to service and stocking, like Whole-Foods/Amazon. Smart Private Equity is playing at the fringes – look for regional local market competitors to eat at the Trader Joe’s model, changing how real estate is used.

Perhaps I’m reaching this conclusion from a small sample bias but I have no evidence of an upside to PEs for the country, ThePeople or the real economy. If there is more to them than blood sucking vultures asset stripping their way to profit I haven’t seen it.

Truly a late stage empire in decline.

“Everyone does whatever they want, society did break down, it’s terrible, and it’s great! You only look out for number one, scream at whoever disagrees with you, there are no bees because they all died, and if you need surgery you just beg for money on the internet.” – Eleanor, “The Good Place”, s03e05

Even a few academics have shed light on the looting. https://www.people.hofstra.edu%2FDaniel_J_Greenwood%2Fpdf

href=”https://www.people.hofstra.edu%2FDaniel_J_Greenwood%2Fpdf” rel=”nofollow”>

I am abundantly familiar with BILO which used to be headquartered in my part of South Carolina. The chain was arguably going downhill before they were bought out and perhaps that’s why they were bought out. With our local German industry this town was an Aldi early adopter and in my neighborhood the Aldi around the corner would seemingly gross multiples of the BILO–and in a store the size of a drugstore. Meanwhile middlebrow BILO also had to contend with the arrival of Publix and Walmart supercenter grocery sales so they were getting hit by competitors for both their low and high income customers. Finally that BILO store closed during the store closing wave mentioned above and honestly I doubt anyone around here misses it very much.

Surely PE firms are a menace but is it not true that they also tend to prey on the weak? Both Sears and Kmart were probably already in trouble (because of Walmart) even under their original owners. Our economic system creatively or not so creatively destructs.

Thank you for this post. Recalled the related article by David Dayen about the Haggen’s transactions and profound questions about the FTC’s role in those deals that you ran back in late 2015:

http://www.nakedcapitalism.com/2015/11/antitrust-incompetence-from-the-ftc-as-albertsonssafeway-divestiture-goes-awry.html

Remarkable on all fronts.

I previously submitted the following article for consideration in the links or water cooler:

https://data.postandcourier.com/saga/piggly-wiggly/page/1

A long read with lots of graphics. Can also be found by searching for Post & Courier “Stickin With The Pig”.

It is not an exact match for this article as I’m not sure it’s related to private equity, but it hits on many of the naked capitalism themes of financial shenanigans enriching the few and screwing over the workers.

If I bought a business, loaded it down with debt, refused to pay suppliers, and paid myself out of the debt/profit, then went BK I’d probably be in jail – maybe on RICO charges.

Where DO these guys get their lawyers?