The Big Whopper season is already upon us, in the form of presidential aspirants telling egregious lies about their track records. The Wall Street Journal tonight covers a section from Kamala Harris’ new book, in which she touts what a great deal she got for California homeowners in the so-called Federal-49 state National Mortgage Settlement in 2012.

The officials who played meaningful roles in the mortgage settlement negotiation should be run out of public life, rather than failing upwards, as Harris has. Hopefully, the millions who lost their homes to foreclosure will vigorously oppose her Presidential bid. But being a successful politician apparently means having no sense of shame.

Background: Why the National Mortgage Settlement Was a Bank Enrichment Scheme at the Expense of Homeowners and the General Public

In fact, as we and many others, like Dean Baker, Matt Stoller, David Dayen, Marcy Wheeler, Tom Adams, and Abigail Field recounted at the time, the settlement was a sellout to banks, a “get out of liability almost free” card. Due to widespread and probably pervasive corners-cutting during the mortgage securitization process, it appeared that the overwhelming majority of mortgages that had been securitized since the refi boom of 2003 had not had the mortgages conveyed to the securitization trusts as stipulated in the pooling and servicing agreements that governed these deals. Because these deals were designed to be rigid, for the ~80% that elected New York law to govern the trust, there was no way to straighten out these securitizations after the fact. Georgetown law professor Adam Levitin called these agreements “Frankenstein contracts” and argued that what had happened was “securitization fail,” that the securitizations had never been properly formed and thus the investors had bought what amounted to legal empty bags. Mind you, someone did have the right to collect the interest and principal from the mortgages, but that “someone” didn’t appear to be the servicers acting on behalf of the securitizations.

Nevertheless, in an early manifestation of what Lambert later called “Code is law,” everyone acted as if things had been done correctly. And weirdly, this might never have become a problem were it not for a tsunami of foreclosures. The dirty secret of mortgage servicing was it had been set up to be a high-volume, highly routinized business, which it could have been if servicers were dealing with on-time payments. But every time a servicer had a portfolio with a lot of delinquencies and defaults, it wound up engaging in a lot of fraud because it wasn’t paid enough to foreclose well, and certainly not enough to modify mortgages, as banks had done as a matter of course back in the stone ages when they kept mortgages on their books.

The securitizers and servicers all acted as if they could do the paperwork needed to convey the mortgage to the trust properly if and when they needed to foreclose. The wee problem with that was that for a whole bunch of good legal reasons we won’t bore you with (but we covered in gory detail back in the day) the mortgages had to have gotten to the trust by a date certain….which was inevitably well before the foreclosure. Only a time machine could fix this problem.

Servicers and foreclosure lawyers engaged in all sorts of creative frauds to try to make everything look OK. But with servicing so automated, botched, and too often deliberately abusive, quite a few of the people being foreclosed upon should have been salvaged. It would have been better for everyone, the investors, the homeowners, and the communities, except for those servicers (well, there was another bad incentive that we’ll get to in a minute). And many of the people who were foreclosed upon had missed only a payment or two, or would have been able to remain current with only a modest payment reduction. But some servicers like Wells Fargo would “pyramid” fees, impermissibly deducting a late fee first from borrower’s payment, guaranteeing that one late payment would result in all future payments being “short” and therefore late too, leading to more late fees.

And that’s before you get to mortgage horror stories of bad records combined with servicer refusals to make corrections. Foreclosures on houses that had never had a mortgage. Foreclosures on houses that had burned down where the servicer refused to take the insurer’s settlement check. Foreclosures by institutions the borrower had never dealt with. Foreclosures by multiple servicers on the same home. Foreclosures on active duty service members, which was prohibited by law.

Some homeowners who wanted modifications, aided by a small group of attorneys and activists, started to document the colossal mess of mortgage securitizations. Even though they usually lost in court, a few important cases did get to appeals and even state Supreme courts, and enough precedents were being set that the media was starting to treat the issue of foreclosure fraud seriously. It became national press in the fall of 2010 when GMAC halted all foreclosures due to what came to be called robosigning (which actually wound up being a huge break for the servicers, since it focused attention on false affidavits, which the banks spun as a mere paperwork problem for foreclosures which otherwise supposedly should go forward).

A sign that the problem of “securitization fail” was being seen as credible was when the Congressional Oversight Panel gave the issue prominent play in one of its reports.

Obama authorized a mortgage settlement initiative that was languishing in 2011. However, New York attorney general Eric Schneiderman and a group of about 14 other state attorneys general started working on a more ambitious settlement. Schneiderman’s campaign was gaining ground as of late 2011.

In early 2012, Obama succeeded in suborning Schneiderman. His price was getting to sit next to Michelle at the State of the Union Address and becoming co-chairman of a national mortgage task force that proved to be a complete joke. As we wrote in April 2012:

It was pretty obvious Schneiderman had been had. Obama tellingly did not mention his name in the SOTU. Schneiderman was only a co-chairman of the effort and would still stay on in his day job as state AG, begging the question of how much time he would be able to spend on the task force. His co-chairman is Lanny Breuer from the missing-in-action Department of Justice. And most important, no one on the committee was head of an agency, again demonstrating that this wasn’t a top Administration priority.

The Administration started undercutting Schneiderman almost immediately. He announced that the task force would have “hundreds” of investigators. Breuer said it would have only 55, a simply pathetic number (the far less costly savings & loan crisis had over 1000 FBI agents assigned to it). And they taunted him publicly by exposing that he hadn’t gotten a tougher release as he has claimed to justify his sabotage….

Mortgage Settlement Monitor Hires Firm that Has Worked on Countrywide Matters

But why, you might ask, was the settlement so bad? The headline amount was $25 billion across all banks and servicers, versus the potential liability of blowing up not just private mortgage securitizations, but even Fannie and Freddie deals. This was a meteor-with-the-potential-to-wipe-out-the-banks level liability. The Administration had all the leverage in the world to dictate terms. And instead it did what it liked to do best, a bailout with some gimmicks to improve the optics.

The banks didn’t come close to paying $25 billion. The cash portion of the settlement was under $5 billion. As we pointed out at the time, “That $26 billion is actually $5 billion of bank money and the rest is your money…That $5 billion divided among the big banks wouldn’t even represent a significant quarterly hit.” Contrast that with the $8.9 billion that one bank, BNP Paribas, paid to settle money laundering charges.

The rest was made up of non-cash items which cost the banks at best 10 cents on the dollar. It included giving them credit for things they were going to do anyhow, plus giving the banks credit for modifying mortgages they didn’t own, as in imposing costs on others.

Here’s one indicator of how well the settlement worked: Just 83,000 Homeowners Get First-Lien Principal Reductions from National Mortgage Settlement, 90 Percent Less Than Promised. And that gets to how the Administration likely rationalized it. Many of those securitized mortgages also had second mortgages on the same house. According to the lien priority, the second has to be modified first, and it has to be wiped out entirely before any modification of the first is to take place.

However, while banks securitized 75% of their subprime mortgages right before the crisis, they kept most of the seconds on their books. Yet the settlement explicitly allowed the seconds to stay put as the banks modified the firsts. From a February 2012 post:

As we had indicated earlier, one of the many leaks about the settlement showed that there had been a major shift its parameters. Of the $25 billion that has been bandied about as a settlement total for the biggest banks, comparatively little (less than $5 billion) is in cash. The rest comes in the form of credits for principal modifications of mortgages.

Originally, that was to come only from mortgages held by banks, meaning they would bear the costs. The fact that this meant that whether a homeowner might benefit would be random (were you one of the lucky ones whose mortgage had not been securitized?) was apparently used as an excuse to morph the deal into a huge win for them: allowing the banks to get credit for modifying mortgages that they don’t own.

The first rule of finance (well, maybe second, “fees are not negotiable” might be number one) is always use other people’s money before your own. So giving the banks permission to modify loans they don’t own guarantees that that is where the overwhelming majority of mortgage modifications will take place, ex those the banks would have done anyhow on their own loans. And the design of the program, that securitized loans will be given only half the credit towards the total, versus 100% for loans the banks own, merely assures that even more damage will be done to investors to pay for the servicers’ misdeeds.

Let me stress: this is a huge bailout for the banks. The settlement amounts to a transfer from retirement accounts (pension funds, 401 (k)s) and insurers to the banks. And without this subsidy, the biggest banks would be in serious trouble

Why? As leading mortgage analyst Laurie Goodman pointed out in a late 2010 presentation, just over half of the private label (non-Fannie/Freddie) securitizations have second liens behind them (overwhelmingly home equity lines of credit). Moreover, homes with first liens only have far lower delinquency rates than homes with both first and second liens. Separately, various studies have found that defaults are also correlated with how far underwater a borrower is. If a borrower is too far in negative equity territory, it makes less sense for them to struggle to stay current, no matter how much they love their home.

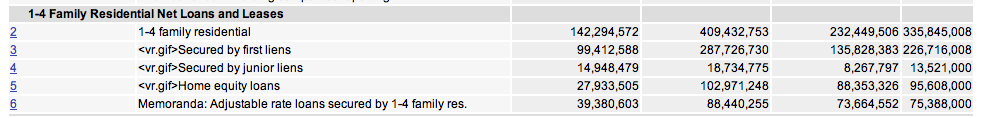

The second liens pose a huge problem to the banks. Courtesy Josh Rosner, this is data as of September 30 for Citi, Bank of America, JP Morgan, and Wells, respectively:

Compare these totals with the book value of their equity as of the same date: $42 billion in seconds for Citi versus $177 billion in equity; BofA, $121 billion in seconds versus $230 billion in equity: JP Morgan, $97 billion in seconds versus $182 billion in equity; Well, $109 billion in seconds versus $139 billion in equity. One of my mortgage investor mavens says that BofA’s seconds should bve written down by about $100 billion and JP Morgan’s by $60 billion. That writeoff would exceed BofA’s market cap and would make a major dent in Jamie Dimon’s touted “fortress balance sheet.” And a similar magnitude of haircut to Wells would expose it as being grossly undercapitalized.

And as Matt Stoller documented, one of the big ways that the settlement got better press than it deserved was that the states used some of the cash they’d gotten to buy off housing activists. Those organizations are chronically budget starved, so it took remarkably little to purchase their acquiescence.

Now you might be saying, “I understand how the settlement might have hurt people who were facing foreclosure. But I wasn’t one of them. How can you say it hurt me?”

Foreclosures hurt state and local tax revenues. A foreclosure depresses home values in the neighborhood, usually by 10%. Banks would typically do a terrible job of securing and maintaining the property. Private equity firms later swept in and tried acting as a landlords of single-family homes. For the most part, they did succeed in raising rents, but most have proven to be poor landlords, and don’t do a good job of maintaining the houses, even neglecting to address leaks, which do fast and serious damage. Having transient residents and not-well maintained properties isn’t good for housing values in the long term.

Kamala Harris’ Dodgy Role

Now it is fair to say that Harris got a better deal for California than the other state attorneys generals got. But that is what the Japanese would call a height competition among peanuts.

Ms. Harris writes that under the initial settlement offer, California would have received between $2 billion and $4 billion, calling it “crumbs on the table” that would have failed to properly compensate homeowners…

Ms. Harris describes a testy phone call in early 2012 with Mr. Dimon as they discussed the deal. “We were like dogs in a fight,” she writes.

“‘You’re trying to steal from my shareholders!’ he yelled, almost as soon as he heard my voice,” Ms. Harris writes of Mr. Dimon. “I gave it right back. ‘Your shareholders? Your shareholders? My shareholders are the homeowners of California! You come and see them. Talk to them about who got robbed.’”…

Two weeks later, Ms. Harris writes, the five banks relented and eventually agreed to a settlement that year of $26 billion, which ultimately provided about $50 billion in gross relief to homeowners. California’s share of the deal reached $20 billion in aid to the homeowners, a significant increase over the original settlement offer. The agreement involved 49 states and the District of Columbia and five major banks: Bank of America Corp. , Citigroup Inc., JPMorgan Chase, Wells Fargo & Co. and Ally Financial Inc.

This is nonsense. Harris did get a good bit more for California but the claim that she was responsible for a ginormous increase and that the total value of the settlement was on the order of $50 billion is unadulterated tripe. The larded settlement gross number was up to $19 billion with New York and California still dickering. Even though California, by virtue of having more foreclosures than any other state, did have more leverage than other states, Schneiderman filed a MERS suit that got folded into the settlement that also resulted in more concessions.

Curiously, Harris does not mention that Governor Jerry Brown raided most of the settlement money and diverted it to fill state budget gaps, with the legislature’s approval. Last year, a state appeals court ordered California to use the funds for their intended purpose: to help victims of foreclosures. This is now so many years after the fact that any monies will come after the former homeowners are past the point of their most acute distress.

But the piece de resistance comes from a Jacobin story on Harris’ record:

At the time [when Harris decided to push for a better deal], Harris was under pressure from union leaders, other politicians, and housing rights activists. As one member of the progressive coalition of groups put it, “It wasn’t like she was some hard-charging AG that wanted to take on the banks” — rather, “it took a lot of work to get her where we needed her to be.” Harris withdrew the day after these groups sent her a letter, signed on by Lt. Governor Gavin Newsom, a potential future rival, calling the deal “deeply flawed” and “outrageous.”

Even a Wall Street Journal reader was offended by the article:

Daniel Skoglund

MAGA idiots spamming this thread with BS talking points.I’m a “librul”, and I detest Harris for legitimate reasons:

-Didn’t prosecute Steve Mnuchin when she was CA AG.

-Is meeting with Wall Street donors while she claims to be AGAINST Wall Street?

-Endorsed Hillary and met with her donor network.She’s another corporate Democrat. I’m interested in grassroots people.

EDIT: Also, Hillary was rumored to make Jamie Dimon her Treasury Secretary, who apparently Harris despises, but she was okay with endorsing her? lol…

And if you need more proof of Harris’ puffery, we have lots more evidence in our archives. Some examples:

The Top Twelve Reasons Why You Should Hate the Mortgage Settlement

Abigail Field: Hiding the Enforcement Fraud at the Heart of the Mortgage Settlement

If this is the best story Harris has to tell, it doesn’t bode well to her holding up under meaningful oppo.

Input was ought from Kamala Harris for this article but unfortunately a comment was not available from either side of her mouth.

Cue the music from Jefferson Airplane’s White Rabbit:

“Go ask Kamala…”

Substitute “lies” for “pills” and you are on the right track.

But but but she is a person of color and a woman! She must be right!

So far the only candidate I am enthusiastic about is Elizabeth Warren. When she does declare I will donate time and money. Considering my track record this will be the death knell for her candidacy.

Found this through Benjamin Studebaker:

https://norabelrose.com/2018/12/31/elizabeth-warren-doesnt-deserve-your-vote/

Confirms what I have seen and is well argued, but YMMV.

Trump’s campaign slogan for Warren (1/2020th) combined with her negative net favorability means she’s done before she started. She’s in to sink Sanders and angle for a cabinet post in the possible Weimar democrat regime to follow Trump

That’s how it’s looking to me as well, though I hope I’m wrong.

I guess we’ll see if she’ll brake through that stained glass ceiling cum 2020 …

She’s running as a Democrat. This means forget about her doing anything worthwhile.

Look at what they did to Bernie. What makes you think Warren will get any further? Don’t wast your money.

Thanks for this excellent summary! I was just looking through the archives for an ‘Obama screwed people on robo signing’ explainer and this will do nicely. One quibble.

The press is entirely too cowed to push this on their own, Democrats won’t bring it up because it makes saint Obama look bad. Bernie hates going negative. It’s over Trump’s head and there were plenty of GOP AG’s that this makes look bad too.

The only way it gets out is in a similar manner to the Beto bashing which will get blamed on Bernie because we all know the entire left is just puppets waiting to do whatever Bernie asks.

Side note watch Kamala squirm when she gets asked about AOC and the GND. She goes off on a tangent and you can see the gears turning ‘Crap… how do I sound supportive but not commit’

Thanks but you miss my point. WSJ gives the impression that this is the best story she has and it’s not very good. A mortgage settlement won’t warm hearts. Conservatives think any help to assumed deadbeats is bad, and borrowers who fought to save their homes and mortgage investors know it was crap.

And there is tons of dirt on Harris that probably won’t be used against her till much later in the game, like her relationship with Willie Brown and multiple cases of significant campaign finance abuses.

Who was it I read suggesting it was Willie Brown who had advised her to bail Steve Mnuchin out? Perhaps it was you Yves? Something like “Never miss a chance to put someone rich in debt to you”.

Kamala Harris will continue faking it until she makes it, to the detriment of California voters that she is supposed to represent, and to the US in her role as Senator, committee member and all-around annoyance. She will continue faking through whatever abortive Presidential run she cranks up and has deep pocket supporters dictate to her.

The Beta freak out was a recognition that the Presidential primary process is different than most other elections. People in Iowa and New Hampshire really care (they want to keep it). The last two Dem cycles had HRC who was basically a sitting President in celebrity stature. Anti-Clinton candidates existed. In that environment, questions weren’t asked and loyalty wasn’t given away for nothing.

Harris won’t enjoy the sheen of Obama or HRC. If she doesn’t go to every little diner, she will be ignored, and if she does, she won’t be met by the msm as much as voters who will ask about plans for mental health, mortgage relief, etc.

A Clinton type masquerading as a progressive won’t have an HRC to run against. Running for President without a point or a sheen of celebrity won’t look good.

Yeah, but who publicizes it? Surely she isn’t stupid enough to center it. Obviously it has to go in the book but she’s a moron if she starts touting it. And WSJ doing an article is still far below the threshold for it to blow up in her face.

We knew at the time the mortgage settlement was crap. The only person I know who supported it wholeheartedly was Lynn Szymoniack, probably because she received an $18 million settlement for part of her otherwise frivolous whistleblower case (all banks that didn’t settle went on to decisively win). She used the money to put her kids on the payroll, in a penthouse overlooking Palm Beach Island, and move her in-ground pool a few feet, a total waste to any anti-foreclosure activities.

The settlement took a lot of steam off the agenda while plenty of people still lost their homes. Some servicers — most notably B of A — eventually did become better about offering principal reductions but that was because their stock price and brand were badly battered by the foreclosures, not because of the settlement. In other words, it was market pressure that made a different — the same pressure that shuttered the crooked David J. Stern’s firm — rather than legal pressure.

If we learned anything from this era it’s that legal pressure was entirely ineffective in bringing about social change; only money mattered. Attack them in court and they shrug, hiring lawyers who work out deals that screw everybody but the attorneys. Attack their stock price or brand and ears perk up in the C-suites.

You left out one very effective punishment, jail time.

If all anyone really has is time, forcing high-profile white collar criminals to do jail time is probably far more effective than “Attack their stock price or brand and ears perk up in the C-suites.”

In America the justice system is seemingly guided by a local bail bondsman’s tagline:

“Friends don’t let friends do time”.

And Gerald Ford led the way with the Richard Nixon, “he’s suffered enough” pardon, supposedly done so the nation could “heal”.

Loss of one’s free time seems to matter more than money, at least to me.

Several years back Glenn Greenwald discussed this pardon in some length in “With Liberty and Justice for Some.” He focused primarily on President Ford’s language that related to looking forward, not backward, and the effects of same moving forward.

A written transcript of this speech is found here:

http://www.historyplace.com/speeches/ford.htm

I focused on the reality at the time which was that Obama’s Justice Department wasn’t going to put anybody in jail and they knew it. His prosecutors were a bunch of white-collar criminal defense lawyers. So that leaves money at the source: their stock price and brand. They don’t care about civil suits. We used the tools we had, not the ones we wish we had (or, arguably, should have had).

Besides that, I personally was more focused on keeping the roofs over the heads of children than worrying about vengeance, no matter how well deserved.

You’ve got fingerprints all over this that a lot of people are unaware of.

I thank you for your efforts, and contributions.

Thank you! I tried. David Dayen wrote me an email saying something like “why did you bother?” (paraphrasing and going from memory but close enough). I answered, “to stop the evictions.” Like it wasn’t obvious.

In hindsight, Lynn worried more about money than foreclosures (to be fair she told me this once but I thought she was being facetious) and to David… Well, Mel Brooks sums it up well:

https://www.youtube.com/watch?v=_s2y7vc8HDA

IMO – Lynn also worried zilch about the guy who brought her the issue (as her client) & framed it for her, see-spot-run. He got not one nickel, from what I hear

Back to point: Kamila is Obama, the Sequal… More of the DNC’s annoying Last Gasp

– No matter how much she doth protest

Great piece

A good deal for WHO??? Steaming….

David Sirota tweeted out a link to this article…considering the freakout over a tweet he had about Beto O’Rourke last month, I wonder if we’ll see some of the usual suspects hyperventilating over this one.

Nah, we are the Blog That Must Not Be Named. Plus Sirota writes a ton more on campaign finance than we have or ever will, so his piece was taken seriously. The evidence was the over-the top effort to shout him down.

I don’t know what Harris was supposed to do in the face of Obama’s headwinds, and nobody is allowed to criticize St. Obama in Dem circles.

I feel like there’s some truth to this, and I was a California homeowner who lost a home to foreclosure.

My former colleague, a black woman and native San Franciscan, quit her job to go work for Harris as one of her top deputies in the SF DA’s Office. My friend found Kamala to be a duplicitous snake, only interested in promoting her insatiable political ambition at the expense of any sense of ethics, justice, or compassion for others.

But no worries: the Failing New York Times loves her. Kamala is nothing but another purveyor of the “You’ve got to have a public position and a private position” Third-Way sell-out.

Sounds like my acquaintance describing Cuomo after her time in his AGs office. Although they were there with Spitzer who really did want to prosecute the criminal activity in the financial industrial complex, so they also got to watch Andy eviscerate a system that was working.

Both rattlesnakes need to meet shovels with their names on it.

These are people involved in a major political party of course they’re duplicitous snakes only looking out for themselves. Doesn’t help that they happen to be in the party dedicated exclusively to the wealthy.

thank you so much…..somehow I knew you would do a great update for all of us to share.

I recognize that Harris is deserving of criticism, but let us not completely overlook the fact that she does have at least one strong redeeming characteristic: She has good teeth.

Thank you for the trip down memory lane.

In the context of the mortgage settlements, Senator Harris should select Pam Bondi as a running mate – they have plenty in common.

And when the mortgage settlement gets old, we can always talk about Harris and constitutional rights:

Kamala Harris’ New Book Tries to Massage Her Record as a Prosecutor, But the Facts Aren’t Pretty [Reason]

Not sure which possibility repulses me more, Gavin Newsom, or Kamala Harris, running for president, solely by virtue of identity politics – which identities, in their most oppressed realities, neither of them are actually empathetic to – both having been well schooled in the cesspool of Pay to Play California and San Francisco Cronyism, which incorporate ”Pat” Edmund Brown/Ronald Reagan, [Republican] Democrats™, to a person).

Why would anyone sane vote for a Millionaire[ess] Politician from the Republic of California, now world renowned for: its Billionaire Technocrats; Millionaire (only) Politicians ; and its teeming inequality, predominantly unsheltered homelessness, and homelessness deaths.

And look at Gavin offering Asylum™ when California can no longer offer anything but sleeping on cement to thousands of unsheltered homeless who were born in California, or worked there their entire adult lives, and once had jobs and a roof over their head: California Governor Gavin Newsom vows to offer ‘sanctuary to all who seek it’ in speech slamming Trump’s immigration policy.

Repulsive, both of them, even more odious than Trump – because they gut from the back, or hit one with a two by four while one is not at all expecting it.

https://www.cbsnews.com/news/kamala-harris-set-to-toss-hat-into-presidential-ring-sources-kcbs-radio/

Expected to officially announce MLK weekend at a rally in Oakland, CA.

Let the Diversity Hustle begin.

Did you see the recent Kamala Harris, Corey Booker, Tim Scott [SC] Anti-Lynching Bill identity trick? ‘Oddly,’ it didn’t include the dragging by vehicle, running off of the road, beating to death, drugging to lethal overdose, shooting first, denying housing, etc. and a horridly long list of Police Crimes – because black, hispanic, or otherwise the wrong class – issues which should also should have been Felonies ages ago (because: one step back at a time for the no ones!).

A repulsive, amoral play for power and Pesidential Runs on the back of others’ age long misery, which misery still won’t be alleviated, was my gut instinct.

I am still saddened and angry about this, it was the most overt abandonment of the Rule of Law during the Obama years and made it clear that the 99% were prey with no limits and no season limiting the take.

Great piece. I sorta liked Jerry Brown, but the ‘California Deal’ that he and Kamila Harris brokered with the banks went to the State treasury, not the victims of the scam like they promised. We had a Countrywide Special, and got to watch as the banks made out, the State treasury bulged, and as usual the troops got screwed. Demonstrates that ‘progressives’ lie just as much as all other politicians.

Great piece. For all the talk, both Jerry Brown and Kamila Harris lied through their teeth as they bravely bucked the system for the betterment of California homeowners. Sure, until they took the settlement money and put it in the State budget instead of providing actual relief to the homeowners who got scammed. We had a ‘Countrywide special’ loan and sat around watching our so-called progressive dems sell us out just like any other brand of politician.

Not excited about Kamala one bit, but I feel that the Dem establishment will support her running for president before Warren or Sanders. Kamala is a literal hybrid of Hillary Clinton and Barack Obama, and the Dems will use the fact that she is a woman and a minority to have her do its neoliberal bidding.

2012 was a disaster for mortgage borrowers. That was the year the IRS decided it wasn’t going to enforce the safe harbor requirements of the REMIC statute, so the trusts didn’t have to worry about taking title to properties after the closing date for the trust and risk losing their tax preference status. Foreclosures swung into gear immediately.