In case you had any doubts about what the mortgage settlement was really about and why banks that were so keenly opposed to it are now willing to go ahead, the news of the last two days should settle any doubts.

As we had indicated earlier, one of the many leaks about the settlement showed that there had been a major shift its parameters. Of the $25 billion that has been bandied about as a settlement total for the biggest banks, comparatively little (less than $5 billion) is in cash. The rest comes in the form of credits for principal modifications of mortgages.

Originally, that was to come only from mortgages held by banks, meaning they would bear the costs. The fact that this meant that whether a homeowner might benefit would be random (were you one of the lucky ones whose mortgage had not been securitized?) was apparently used as an excuse to morph the deal into a huge win for them: allowing the banks to get credit for modifying mortgages that they don’t own.

The first rule of finance (well, maybe second, “fees are not negotiable” might be number one) is always use other people’s money before your own. So giving the banks permission to modify loans they don’t own guarantees that that is where the overwhelming majority of mortgage modifications will take place, ex those the banks would have done anyhow on their own loans. And the design of the program, that securitized loans will be given only half the credit towards the total, versus 100% for loans the banks own, merely assures that even more damage will be done to investors to pay for the servicers’ misdeeds.

Let me stress: this is a huge bailout for the banks. The settlement amounts to a transfer from retirement accounts (pension funds, 401 (k)s) and insurers to the banks. And without this subsidy, the biggest banks would be in serious trouble

Why? As leading mortgage analyst Laurie Goodman pointed out in a late 2010 presentation, just over half of the private label (non Fannie/Freddie) securitizations have second liens behind them (overwhelmingly home equity lines of credit). Moreover, homes with first liens only have far lower delinquency rates than homes with both first and second liens. Separately, various studies have found that defaults are also correlated with how far underwater a borrower is. If a borrower is too far in negative equity territory, it makes less sense for them to struggle to stay current, no matter how much they love their home.

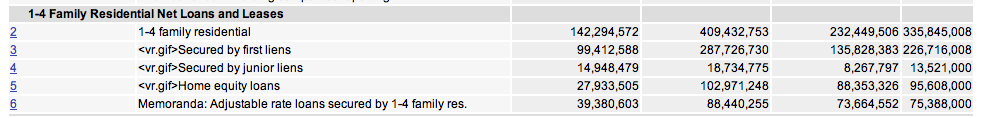

The second liens pose a huge problem to the banks. Courtesy Josh Rosner, this is data as of September 30 for Citi, Bank of America, JP Morgan, and Wells, respectively:

Compare these totals with the book value of their equity as of the same date: $42 billion in seconds for Citi versus $177 billion in equity; BofA, $121 billion in seconds versus $230 billion in equity: JP Morgan, $97 billion in seconds versus $182 billion in equity; Well, $109 billion in seconds versus $139 billion in equity. One of my mortgage investor mavens says that BofA’s seconds should bve written down by about $100 billion and JP Morgan’s by $60 billion. That writeoff would exceed BofA’s market cap and would make a major dent in Jamie Dimon’s touted “fortress balance sheet.” And a similar magnitude of haircut to Wells would expose it as being grossly undercapitalized.

Now the banks contend that the seconds are current or not all that delinquent, and hence no writeoffs are warranted. Please. Banks are doing everything in their power to preserve that fiction. First, they are engaging in far more aggressive debt collection against seconds than firsts, even though they service both. In addition, they can and do make insolvent borrowers look whole. They will reduce the minimum payment due when a borrower is close to being officially delinquent, and tell them to send a small amount and declare the loan current. Or they simply increase the credit line on the home equity line and let the borrower pay them with new funds lent to them. Neat, eh?

Finally, they also have been modifying first liens to preserve their second liens. If you reduce the payments on the first mortgage, the borrower has more money left to pay the second lien. From the transcript of Goodman’s 2010 presentation:

Clearly there’s a differential standard of managing second liens and securitizations versus second liens in bank portfolios. It’s very clear banks are doing all they can to get the, to keep, to get the first lien modified in order to keep the second intact, and that is just a huge conflict of interest.

Legally, the hierarchy of payment OUGHT to be clear: a second should be wiped out before a first lien is touched. That’s how it works in a foreclosure or a bankruptcy: only after the first lien was paid in full would a second lien get anything. But that isn’t what is happening now.

An important post by Dave Dayen, “HUD Secretary Expects “Substantial” Payment of Foreclosure Fraud Settlement with MBS Investor Money,” on a small group interview of Shaun Donovan, makes it clear that the Administration is well aware of, indeed almost giddy, about the way investor oxen are about to be gored. Guess they haven’t given enough to Obama to save their hides.

Per Dayen:

Donovan claimed that the money available in the settlement for principal reduction for underwater borrowers would actually come to $35-$40 billion, over double the $17 billion in nominal principal reduction that has been widely reported…

But how exactly does Donovan get to $35-$40 billion when the reports all claim $17 billion (as well as $8 billion in various penalties and checks for wrongful foreclosures, adding up to a $25 billion settlement)? He said that the topline numbers have always reflected the settlement with the five largest servicers. When you throw in the other 9 servicers who have been in discussions on the settlement, the level rises to more like $30 billion. Furthermore, “not all write-downs are created equal” in the settlement, Donovan said. The $17 billion on principal reduction always reflected “credits,” a number that the servicers would have to hit to comply with the settlement terms. Some of the credits are not dollar-for-dollar. For instance, principal reduction on loans that are over 175% LTV (loan-to-value ratio) would not get full credit because it would be a “reduction” on a house that will probably go into foreclosure anyway. “If a servicer is writing down a current first-lien mortgage, that has more value than a second lien 180 days delinquent,” Donovan gave by way of a separate example.

When you add all this up, Donovan asserted, “For every dollar of credit, we’ll be getting on average $2 or more of principal reduction. That’s how you get from $17 billion to $35-$40 billion.”

Notice that Donovan skips over the biggest item that will lead to bigger reductions than the nominal amount: the 50% credit that we noted above and in earlier posts, per a report by Shahien Nasiripour of the Financial Times, for modifications of loans that the banks don’t own.

Donovan tried to tell the journalists that there would be no problem with banks modifying these loans. That seems like a big stretch. The Pooling and Servicing Agreements all have a provision that says that the servicer is required to service the loan in the best interest of the certificateholders, meaning the investors. Modifying first liens owned by those investors pursuant to a settlement of legal and regulatory violations would not seem to pass muster. In addition, as we have reported earlier, a “safe harbor” provision, which was intended to provide air cover for banks to make mods as part of HAMP, was removed during reconciliation even though it had passed both houses. Why? Some investors had said that that provision amounted to a 5th Amendment violation, since it was taking property from private investors without providing compensation (note this is arguably a taking by government because preventing losses at BofA and Wells, which would be next in line if BofA were revealed to be insolvent, has the effect of benefitting the FDIC).

How does the Schneiderman MERS suit play into this? The consensus reaction to his Friday filing of a suit on MERS abuses seemed to be that he had at a minimum redeemed himself for taking the wind out of the dissenting AG effort by joining a Federal task force that looks likely to produce little and becoming coy on where he stood on the settlement deal. After Friday’s filing, some even thought he had outplayed Obama, by getting him to commit in a very public way to investigations and then filing a suit that put robosigning and other foreclosure abuses front and center. It looked as if he had gotten to have his cake and eat it too.

I’m skeptical of this cheery view. As readers know, I doubt that this investigation will produce much except some suits against small or at best medium fry. As Charles Ferguson of Inside Job put it, “Let Them Eat Task Forces.” There is a well established art form to stymieing people like Schneiderman: do the least important 60% of what they asked you to do, slowly.

Schneiderman got to be on a not-likely-to-do-much task force. What did he get? He allegedly gets more resources, and he might get more information, but the Administration scored a huge win by dragging out the settlement talks over a year and running out the statute of limitations on some of the best legal theories. I have to admit I was snookered. I thought the ongoing joke of the Tom Miller “we’re gonna have a deal any day now” was an embarrassing bug, but it was a feature. The AGs were being strung along as long as possible to keep them from filing suits. A few like Beau Biden, Martha Coakley, and Catherine Cortez Masto still did, but not soon enough or in enough numbers to embarrass some of the other fence-sitters into action (Lisa Madigan is an exception that proves the rule).

So what does his MERS suit mean? I’m mainly focusing on how it relates to the bigger game of the settlement, but let me make a few observations about his filing qua filing. It is gratifying to see a long form description of the MERS horrorshow. And this suit could be used to shift focus back to an issue that everyone in the mortgage industrial complex seems to want to push aside: servicers seem unable to foreclose legally and chain of title is a mess. Settlement deals and compensation to abused homeowners could be useful, but they don’t address the underlying mess (and neither do phony baloney OCC consent decrees).

And the media keeps taking the industry line on foreclosure problems. It keeps touting how long it takes to foreclose in New York as if this is the fault of the borrowers and the courts. In fact, it is the fault of the industry. In October 2010, New York implemented a requirement that all attorneys in residential foreclosures certify that they take “reasonable” measures to verify the accuracy of documents submitted to the court. From a formal standpoint, all this did was reaffirm existing law, but procedurally, it makes it much easier for borrower’s counsel to get attorneys who play fast and loose sanctioned.

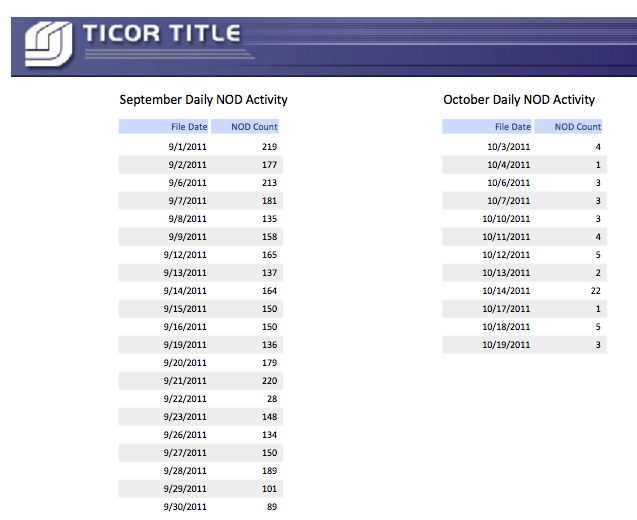

Look what has happened to foreclosure activity before the requirement was put in place versus this past October:

So foreclosures had already effectively stopped because there are now real consequences to submitting bogus documentation. The Schneiderman filing ups the ante by telling servicers that they are subject to fines of $5,000 per violation (arguably, per each piece of improper paperwork submitted).

But how does this suit move forward in practice? Even though the filing mentioned $2 billion lost recording fees, his filing does not seek any damages for that. Readers are invited to chime in, but I see that he has two big hurdles. The first is pinning liability on the banks, as opposed to MERS. MERS has fewer than 50 employees and I guarantee its only meaningful asset is its screwed-up database. It can’t pay any meaningful damages or do much of anything to fix the mess it created. The banks will seek to argue that any liability sits with MERS, LPS and its ilk, and the foreclosure mills. It will probably take some doing to establish bank culpability.

Second is establishing the number of violations per bank. In aggregate, it looks to be massive, but the AG needs to come up with some basis for arguing at least roughly how many violations took place. That probably means establishing how many foreclosures in the relevant time frame had liens recorded in the MERS system and coming up with a solid minimum number of violations per foreclosure. How do you do that? Maybe sampling 100 foreclosures with MERS assignments per bank? The only good news is the foreclosure procedures were so awful that the banks would be hard pressed to find any foreclosures that didn’t have document problems.

Let’s do some rough math. The chart above shows 153 foreclosures a day for September 2010. Let’s assume an average of 150 a day for 2008-2010 and half that for 2007, with 250 work days a year (the court calendar does drop to nada in late August and December). Further assume that the three big banks listed accounted for 30% of the foreclosure filings, and half of those used MERS. That’s roughly 20,000 foreclosures. Assume 2 violations per foreclosure, which is $10,000, plus the $2,000 in expenses per homeowner (this was a separate claim in the filing). $12,000 X 20,000 is $240 million, or $80 million per bank. If you think I’ve been conservative, double that. The point is you don’t get to bank-crippling numbers from this suit. And remember, this litigation will probably be settled, and settlements are for less that the full value of what the plaintiff might win (there’s no reason to settle if the defendant has to pay out the full amount he’s exposed to if he loses in court).

That means it might be better for Schneiderman to use this suit to keep the negative PR about the banks coming (the reputational damage is likely to sting more than the amount they’d need to pay to make the case go away) and to press for real solutions to servicing and foreclosure practices. That has FAR more value than what he looks likely to recover.

This is a long-winded digression. Back to the settlement jousting. Obama succeeded in getting Schneiderman on the sidelines as a leader of the dissenting AGs as the Administration mounted a final push. That destablized the opposition and fed the now widespread impression that the settlement is inevitable (remember, before the Schneiderman announcement, it looked like the Administration would have significant defections of Democratic AGs. At least one AG who had met with the dissenters, Oregon’s John Kroger, has now joined the settlement).

But does the Schneiderman MERS suit hinder or help the settlement effort? Perversely, it may help the Administration push it over the line. If the leak about the scope of the release via Mike Lux is to be believed, MERS-related liability is excluded from the waiver. Schneiderman has just demonstrated you can file what amounts to a robosigning lawsuit using the MERS exclusion. You won’t get the securitizations outside of MERS where the notes weren’t transferred properly, but you’ll get a large proportion of the defective securitizations.

Now why should the banks sign onto a deal to settle robosigning claims that leaves them exposed in a big way to robosiging claims? If they thought the Schneiderman suit revealed a problem in the release, you’d expect them to demand that the negotiations be reopened. It may be too soon to tell, but I’ve seen no sign of bank pushback, and this deal has been so heavily lawyered I am sure the banks were well aware of this issue. Similarly, as reader Pwelder pointed out, all the banks that were targeted in the suit were up on Friday markedly more than the market overall, indicating that investors do not see this suit as threatening.

So the fact that they seem so keen to go ahead on a deal that does not very much to shield them from attorney general suits on robosigning confirms our suspicions: the banks are willing to pay several billion of hard cash among themselves to create the impression that they are Doing Something for Homeowners as cover for a bailout. Nicely played all around.

And Donovon’s cheerleading confirms the Administration’s sense of priorities. He regards robo-signing, foreclosure fraud, and making a mess of title as unimportant, and applauds the this settlement as a way to get principal reductions and allow the banks to escape any meaningful liability or responsibility.

The Obama Administration may have decided that investors have acted enough like patsies, given how they have failed to react to rampant servicer abuses, that they judge the risk of investor litigation and a related PR embarrassment to be small. But this battle is not yet over. The rumblings I am hearing from investor-land remind of the sections of the Lord of the Rings when the Ents were finally roused. It isn’t yet clear that investors will act, but if they do, the Administration will be unprepared for the vehemence of their response.

This settlement as framed is the epitome of institutional failure; more accurately of institutional corruption. Since the Soft Coup of 08 when the banks effectively took over the financial assets of the sovereign USA (I say effectively because that is the result, not the process), we have seen a wealth transfer unprecedented in modern history. No crime by the banksters is to egregious to not merely escape prosecution but serve as a _profit_ opportunity for the transgressors against the assets of the state. We have a simulacra of society as usual on the surface but the reality of a radically unconstrained kleptocracy puppeteering bank and legal policy. Oh, it takes them some effort to rig the outcome, but we see the intent by what is pursued.

If you don’t own a bank, your property rights are nil at this point as far as the state in this country is concerned. Nothing will be done inside the Beltway to protect you from magnates of great malfeasance, and everything and anything will be done to protect those who, from the top of the financial hierarchy, loot and abuse you. That is what we see; no fantasy but the facts on the ground.

The end game of this kind of behavior is clear, only the timeframe is opaque. But gross thefts of this kind abetted by all the powers of the state will end the opposite of well. Aristocracies who descend into unrestrained looting of the populace while neutering the legal system get insurgency. How that ends has a diversity of outcomes, but in the end during modern times, those aristocracies lose. It didn’t have to come to this in the US, but it’s hard to see how things will change given the complete defection of the political class as of today from any interest in a common society.

The social world we grew up in this country is dead; let’s face that as fact. It didn’t end in 2001. It’s hard to pick a firm year, let alone date. I’d posit 1997 when the financial predators got themselves excused from legal obligation to the state for their behaviors. But regardless, we’re in a new country: No Country for the 99%. The state is hard at work for the 1%, 24/7/365. And the rest?: “We’re not concerned about them.” Doesn’t matter who uttered the quote, they all believe it, and act accordingly.

Well put. I am a teacher, in my last year due to Walker. This is what the kids need to understand. However, if you say this in a classroom, the one rich kid will go home, (he’s been brought up to look out for this), tell Dad, and Dad calls the president of the school board and the district administrator and frightens them. So, you have to present the opposite side, to be balanced. Anybody got the opposite side?

On the plus side, there won’t be any need for the pretense of public schools much longer either. When the 99% no longer have a future, there’s no point in educating them to that fact. Archaic word watch: public. It’s already morphed to include connotations of liberalism and socialism, words that have already been completely co-opted and stigmatized themselves.

The only ‘other side’ to money is social organization.

Anyway, you’re not going to convince any cowed principal (or complicit board) that you have a right to express such opinions by presenting an ‘opposite side’ in class, because the opposite side doesn’t care about having arguments, but only about winning arguments. As such, they are perfectly willing to do whatever to stifle, rather than ‘balance’ opinions.

Additionally there is the fact being “balanced” not only means presenting both “sides” to, say, forcing people into poverty because you feel “taxation is theft”; it also means “don’t talk about the really bad stuff in public at all” for fear of being found to be “shrill”, or “causing problems”.

Argument as the civilized means to assess/determine outcomes is long gone, i.e, the best argument has for decades failed to win. The aim now is to provide argument that has the appearance of expert minds at work, not the substance.

I suppose someone could argue that there were financial excesses on the part of both borrowers and lenders.

That few are truly without responsibility.

That the banks’ bonds are owned by the 99% through pension funds, 401K plans, bond mutual funds, insurance company portfolios and other portfolios.

That taking out the banks would take out the bonds, which would take out the equity market, take out the payment system on which commerce depends and take out what little financial underpinning the 99% possess.

That kow-towing to the banks is the “least bad” option, a turd sandwich that those in power must reluctantly eat.

That “let justice be done or the heaven’s fall” is a nice thought for an imaginary world but not a nice thought for the real world, where real and innocent people will suffer from it, even more than they have so far.

That letting “fat cats” pull down multi-million bonuses while evading their complex maybe-sort-of-crimes is a sad but sporadically unavoidable residue of shareholder-owned free enterprise, where the criminal law is blurry, somewhat subjective and hard to prosecute in jury trials.

That you can’t pull the lever on the apocalypse if you want to steer the nation through these straights.

That folks should get over their pique, come together and compromise, and move on for the good of America.

I don’t agree with the implied rhetoric in the above and I believe it can be picked apart line by line, but I suspect it’s something close to the Opposite Side — the justification and rationalization by the powers that be.

yes, we know the “opposite” argument… it’s been out there for a long time and can be squarely located in the mouths of both Republican and Democratic spinmeisters…

there’s the rub.

Occupy the TRUTH.

to borrow a list of options from a somewhat related article of jesses from another time

Globally, the monied interests seemed to have choose amongst three options: 1. Go along grudgingly with reform and accept a smaller percentage of the overall economy (Roosevelt), 2. Fund an oligarchic takeover of the government and seek to control it (Hitler), 3. Sew your wealth into the dresses of your children, and die with them in a basement (Russia).

You might be surprised to find that the president and other administrators are on your side. That is how the change will happen. When critical mass is reached everyone will understand what needs to be done and work together to oust these bankster thieves.

stop whining bolero. you lost an election because a lot of people don’t like

you or your union.

If only there were another election coming up. I RECALL hearing of one…. :-P

Whose simulacra? Our simulacra!

Whose metanoumena? _Our_ metanoumena!!

Richard, I was trying to work through these issues back here in longer form.

RK, thank you. “J’accuse” Barack Obama, President of the U.S.A., and all of his co-conspirators in Office, of high TREASON, for serving as Agents of a Foreign Power (the .01% Global MonopolyFinance Cartel) while in Office; and of willful participation in Organized Crime for the profit of this Cartel, a Foreign Power.

Who will bring “The Tyrannicide Brief” and RICO against Obama and every President living: from the Bush Dynasty’s Nixon-Kissinger through Obama-Kissinger, likewise guilty of Treason and of Grand Larceny, Embezzlement, and Willful Frauds made *legal* under their watch–de facto Crimes Against We the People, Crimes Against Humanity?

Well put.

I guess that’s why the government has spent its time building up the police state against average citizens rather than prosecuting the white collar mafia that runs this country.

The Attorneys General are simply providing a diversion as the getaway car speeds away.

you should be making a movie about this senario, be the first, because it makes wall street look boring…….

Dear monica;

There have been good films made about this phenomenon: “Sullivans Travels,” “The Sorrow and the Pity,” “Mephisto,” “It Can’t Happen Here,” “The Conformist,” “Open City,” “The Damned,” “The Night Porter,” the list goes on. Enjoy!

So ambrit, seen ’em all but ‘The Night Porter,’ which is long overdue. But I’ll say you left off the most releveant one of all: ‘Z’ by Costa-Gravas, where the sheer petty mediocrity of those who thrive in a society where private actors unrestrained by law run amok; it’s that punk-rottenness which is really indicted. One could add ‘State of Seige’ in a blink, and for those liberals and ‘populists’ who think elections will get it done ‘All the King’s Men’ has the final word on what the sugar of illusions on a stew of lies tastes like year after year. And of course ‘Brazil’ for where it all goes, though ‘Katyn’ too shows what The Big Lie really involves.

But for those who think *bang-bang* is the way out to a better society, ‘The Battle of Algiers,’ ‘Salvador,’ or the more recent ‘The Paper Will Be Blue’ and ‘Der Baader-Meinhof Komplex’ will dispute such conclusions.

I’d call ‘The Conformist’ and ‘The Battle of Algiers’ the best films, but they all have a lot to offer.

The settlement is a Bankster Obama Three Card Monte Finesse. By agreeing to phony principal mods limited to big ticket mortgages, the banks not only improve the seconds held in their own portfolios. They also get to play “Neither Admit or Deny” to all of the State AG allegations. Of course, they will face no further government action. But in addition, private litigants will now have to PROVE bank misconduct in all private litigation. This will allow the banks to stonewall individual suits and make sweetheart deals with class action lawyers providing the lawyers with career paydays, while simultaneously limiting homeowners to the chump change standard in the class action fandango. Lawyers representing individual homeowners will ignore anybody unwilling to fork over the big retainers necessary to support hourly pick and shovel work. Those homeowners who do provide them are unlikely to realize anything but battle fatigue.

The interesting question is what will happen to homeowners who simply stop paying their mortgages? One would think that nothing in the settlement can validate foreclosures by servicers unable to establish a valid title to the mortgage notes.

Well said; as you know, in ancient Rome, both before and after the slave rebellion a la Spartacus, much feverish debate was had as to how to best control these ‘slaves’. One Senator proffered the notion that they all be made to wear armbands——-quickly he was rebuffed by his fellows, who realized that there was grave danger in this: they might then all realize how many of them there were!

Despite the harlotry for which the law has long been suspect (servicing those who create/influence ‘her’, hence the blindfold since ancient times on madam justice), these ‘cats may mew, and, though Hercules himself may bar the way, every dog will have his day. That day is upon US—–watch as Zuckerberg and Jobs handiwork is lent to this echoing of discontent a la Chayefsky’s Howard the newsreader cum avatar: Mad as Hell………………

I wonder if the banks have received CDS payouts on these 1st or 2nd mtgs. I suppose since derivatives are unregulated we may never be able to find out, but it seems more than relevant that if banks were not financially damaged by a default then these foreclosures would simply become null and void.

I would think we could find a legal way to extract this type of CDS payout information, if it were so pertinent.

You raise an intriguing point, with many possibilities.

Seems the Feds didn’t get the memo.

No, the banks that bought CDS on CDOs were mainly Eurobanks, plus some of the US investment banks. Citi was caught with huge CDO exposures (remember they were sued by the SEC for misrepresenting how many they owned), JPM was really not much at all in this game. Wells is a really big traditional bank, again not a big CDO player.

Even then the banks were net long all this garbage, and ex AIG, the CDS failed. The counterparties could not pay out. That’s why we had a crisis. See Ch. 9 of ECONNED for details.

“mostly Euro banks” — got that, folks? Holy Roman Reich III-Reich IV in place.

In this race to the bottom I’m starting to wonder if maybe I should become an active participant. There doesn’t appear to be any downside, you know?

If what you speculate is true, I’m wondering if the Bush team, while certainly having the desire, would not have had the conniving intellectual power to pull this off. Obama may be able to play 11 dimensional chess, but he’s definitely not playing it for any of the people that voted for him. Or maybe lack of any moral decency opens up fertile options that a regular person just wouldn’t have. If so, maybe corruption is the way to go for me.

Thanks Yves.

Dirk77, looks like we have *nothin left to lose*. But let’s do go the election route one more time, and OCCUPY Charlotte 2012 in force for:

BILL BLACK/SUSAN WEBBER*YVES SMITH* 2012: ECONOMIC JUSTICE NOW!

Chris Hedges: Secretary of State

If not now, when? If this doesn’t work, well…, citizens?

Dear LBR;

If that doesn’t work, the Terror. It’s already built into the architecture, and the elites, thinking they are indeed the Lords of Creation, have climbed onto the Tigers back.

“Fasten your seat belts, it’s going to be a bumpy night.” Ah Margo, no truer words were ever spoken. The Long Night is nigh.

Richard is basically correct and, as usual, the post gets to the core of it. On the national/historical level the administration, actually Obama, represents a colossal sell out with immense immediate and long term decline in standard of living, level of democracy and even cultural life.

I find it amazing how dumb can a president be by working hard to achieve disrepute and derogations way worse than Hoover.

Who said Obama was “dumb”? Obama does what he wants to do. On The Eternal Question for the 1% — “Are they stupid and/or evil?” — I come down for “evil” with The Droner.

LS, “Go tell it on the mountain…”

“It isn’t yet clear that investors will act” –

Is this to say they’re the last bastion of defense? If they sit on the sidelines, then what? A virtual free pass to the banks?

How is it that literally millions of Americans be scammed due to massive fraud, enabled by our own government, and The People still take it in the rear?

They own the police you see. Now with NDAA they can roll out the Army too.

Bill, also *Boomers* are dug deep in the trickle-down trenches.

Look! Over there! The scary Republicans promise to be even worse!

No. Look over there! The Iranians are the next Hitler!

Actually. Let’s just watch the Super Bowl.

Walter, with Orville Redenbacher popcorn *premier* and a Euro beer: *Hog Heaven* for Sports Betting in the Heartland! (Now, where’s the Meth?)

If MBS investors/holders are going to get screwed, what in god’s name will happen to Bernanke and the Fed who own $1 trillion of MBS?

The Fed balance sheet was expanded/invented into existence, and to dust it shall return. It’s part of the asset bubble, just like the expansion of US government debt to pay off the bad mortgages. It’s all part of the great moderation brother. The Fed doesn’t need to coupon income, so I’m sure they won’t be hurt by a write-down of those MBS assets.

They bought mainly (I think entirely) Fannie and Freddie debt. The mods ought to be paid for by taxpayers. I didn’t work through that aspect in the post. My sense is that most of the stressed borrowers are private label. Default and delinquency rates on FF mortgages are still way way way below those of private label deals.

Could someone list the federal government initiatives concerning the economy since 2005 that were NOT stealth bank bailouts?

Still listening.

Yes. That’s the central fact.

from yesterday’s links, but related to this article…..

Re: The Vice President of the United States is……Bill Clinton (video interviewing high school students)

Summary: And so, according to these students…..Bin Laden is Vice President of the United States, the only country that begins with the letter U is not the United States, but Uruguay, Canada is a state, South America is the only country that borders the United States, and the United States, which does not begin with the letter U, nevertheless achieved its independence during the Korean War.

But have no fear. Despite having missed a few things, these clever young people, and millions like them all across the land, will surely see through the ruse of the Schneiderman Mers suit. Despite believing the United States achieved its independence during the Korean War, they’ll definitely understand the implications of the Mers suit, and that it amounts to a huge bailout for the banks.

At this point they’ll reject consumerism, reject the system *en masse*, and millions of young people will occupy Wall Street, demanding an end to the kleptocracy.

Oui ou non?

Well maybe not that, but let’s look on the bright side. Perhaps one or two of them will at least mute some of those $3.5 million 30 second commercials, while watching the Super Bowl this afternoon.

sounds like these kids were taught by a wisconsin teacher.

You get what you pay for. Decades of defunding public education leads to…?

Good teachers — those who are left — can’t do this alone. That’s why they’re unionizing. But you wouldn’t understand, “We must all hang together, or assuredly we shall all hang separately.” It was some radical who said it, after all. :-P

all across the country, until this recession, education costs have been

going up. and the kids are dumber than ever. teachers’ unions are simply

another special interest group. voters in wisconsin figured it out. others will

soon. adios……

No no, teachers and their unions are not the problem, but they do get blame. Is the goal an ever-more-stratified society of haves and have-nots? Banksters?

If we don’t want children to be the ‘raw material’ for innovation and for a better future then what’s the alternative? More misery, more exploitation and more prisons?

Andrew is just letting us know, again, which side of the class war he is fighting for.

Right, because “tuition costs going up” translates directly into “higher wages for teachers”. Not too bright, are you.

Better trolls, please.

PUBLIC schools and PUBLIC universities are what built this country from an agrarian backwater into a superpower after WWII. PUBLIC schools got us into space and to the moon. PUBLIC schools got us nice robot explorers on Mars, around Jupiter, Saturn, etc. PUBLIC schools got us the internet, computers, etc. It is only fairly recently that Reichwingers bent on defunding schools and dumbing them down with “creationism” and the like that education in this country has become a bad joke.

Norway: best, bar none, PUBLIC schools in the known universe. They don’t have private schools and their students REGULARLY score better than privatizing US students. There’s a reason for that. Privatizing MUST cost more and do less because it is the only way to make a profit for the CEO.

Why are there so few good teachers? Perhaps it is that they will have already been fired for mentioning things like “The US has a higher percentage of people in prison than any other country in the world”, or “the US spends as much as the entire rest of the world combined maintaining its Imperial army, or “science is a process of determining what is fact and what is fiction, and science overwhelmingly tells us that human activity is the leading cause of climate change.”

My comment had nothing to do with teachers. This country is being looted for the benefit of a few elites, and yet, for the most part, the people remain ignorant of what’s happening. Economists have nothing to say about this, and besides, it’s in the interest of elites to keep things the way they are.

Everywhere the system is too strong, hegemonic, too corrupt to be reformed. And yet, we can still dream of a reversal, some kind of breakdown. A weak link that breaks, resulting in chain failure.

Throw your support behind Occupy. These kids who are being beaten daily by the police, these youth of our country, are the future of America. Eventually they’ll take over control of the country, and when they do you’ll see the hope and change that Obama never was. We should stop beating our children in the streets.

But I support Occupy. Despite my view that this country is without hope, Patti Smith already won me over.

The day after the raid on the Occupation and the reacquisition of the People’s Volumes from the NY sanitation dept, she sent the People’s Library some words:

“i am with you all from across the sea

every concert, interview etc

i call out to occupy and support those

that do.

what you are doing is only a beginning.

if it gets too tough in the winter

get healthy regroup and come back.

don’t be sorry about anything.

give everyone a salute from me

people have the power”

patti

SR6719, ya think?

«Some investors had said that that provision amounted to a 5th Amendment violation, since it was taking property from private investors without providing compensation (note this is arguably a taking by government»

A taking by government is a taking even if it does not go the benefit of government but of third parties.

«because preventing losses at BofA and Wells, which would be next in line if BofA were revealed to be insolvent, has the effect of benefitting the FDIC).»

Please stop with the ignorant notion that the FDI is funded by the government, when it is funded by member banks. Even the FDIC is not funded by government, but by a fee charged to the FDI, which is funded by banks. Sure, if all FDI members capital were about to be used to pay off depositors Cognress would probably make a donation to the FDI from public funds, but until then the FDI (and the FDIC that manages it) do not cost the government a cent. Institutional arrangements do matter.

Preventing losses at BoA and Wells benefits just themselves and FDI member banks.

If BOA were to become insolvent, the FDIC would immediately be insolvent as well. Thus the FDIC WOULD become funded by the taxpayers, as the FDIC has a $500 billion line of credit with the US Treasury (in anticipation of such a possibility). In fact, the member banks prepaid premiums through the end of 2012 back in late 2009 due to a shortfall at FDIC and it currently has under $8 billion of funds remaining. It probably will be lucky to last until June.

LucyLulu, I guess Uncle Ben would *cut the check* for the good of the People if he knew what were good for him, n’est-ce pas? He wouldn’t want to become *strange fruit* would he, if Bund in the Heartland got mad, would he?

«If BOA were to become insolvent, the FDIC would immediately be insolvent as well. Thus the FDIC WOULD become funded by the taxpayers, as the FDIC has a $500 billion line of credit with the US Treasury (in anticipation of such a possibility)»

That’s the usual vastly ignorant myth. The FDIC is not the FDI, and it does not cost the government a cent. It charges all its operating expenses to the FDI.

And FDI is backed by the capital of all its members. The line of credit is just a temporary thing to pay out depositors quickly before levyign an assessment from members.

The FDIC was recapitalized by the government in the S&L crisis. It is NOT “ignorant” to suggest it is a government entity. Does it freely hire its own head? No, it is subject to Congressional approval. All Federal banking regulators (ex the New York Fed, which claims to be private) have the same pay scales. Do you see fixed pay scales in private firms?

And the Supreme Court says the government can redistribute among private sector parties. What do you think taxes do? The 5th Amendment issue applies to government takings.

Yves, but even with Eminent Domain payment in force, what would a *fair price* be deemed to be? Who’s got the Power?

Yves,

IIRC, PSA’s already stipulate that servicers have the authority to manage the loans to maximize financial outcomes, i.e. make modifications. So, if that is true, the proposed settlement isn’t giving the banks any more authority than they already have, so it isn’t “government taking”. If the servicers haven’t already been doing this all along (and I’m sure they haven’t), the question we/the investors should be asking is “why not”?

1. Some PSA bar ANY mods

2. Some PSAs put a cap on mods

3. Some have no restrictions.

The issue here is not the PSA restrictions, it is that banks can and do have incentives to mod not based on what is good for the investor, but what is good for them. The Laurie Goodman presentation discussed how they were already doing that. This gives them regulatory air cover.

«The FDIC was recapitalized by the government in the S&L crisis.»

Only some bridging finance was provided, because the FDIC does not have any capital and does not suffer any losses.

The problem is the confusion between the FDIC and the FDI.

The FDIC is just a government agency that administers the FDI scheme, and as such it has no capital and does not charge a penny to the government, similar to the way that the Social Security agency administers the Social Security scheme, which is funded by its members (or occasionally by Congressional donations).

The FDI scheme is a mutual insurance arrangement among members, under government rules, but it is entirely funded by the members. All members banks have unlimited (joint but not several) liability for all member banks insured deposits. It is in effect a PAYG system (not a funded one like OASDI). There is an account called DIF (Deposit Insurance Fund) but it is not “capital”, it is just advances from member banks to make paying out depositors speedier. If the DIF were insufficient, the FDI would not be insolvent, it would simply have run out of “petty cash”.

Anyhow the FDIC can borrow money from the government, up to a limit, and if the limit were reached depositors would just have to wait a bit longer for the FDIC to invoice members for whatever balance.

The FDI would be insolvent only if the capital of all member banks were insufficient to pay insured deposits.

This is the official statement from the FDIC:

http://www.fdic.gov/news/news/press/2008/pr08084.html

«As per our authorizing statute, any money we might borrow from the Treasury must be paid back from industry The fund is 100 percent industry-backed. Our ability to raise premiums essentially means that the capital of the entire banking industry – that’s $1.3 trillion – is available for support.»

«The FDIC receives no federal tax dollars – insured financial institutions fund its operations.»

«As per our authorizing statute, any money we might borrow from the Treasury must be paid back from industry assessments. Only once in the FDIC’s history have we had to borrow from the Treasury – in the early 1990s – and that money was paid back with interest in less than two years.»

How the FDI and the FDIC work is a bit of an arcane detail, but these institutional arrangements matter a great deal when the chips are down. My other favourite misunderstanding is the difference between the Federal Reserve System and the Federal Reserve Board, where the institutional arrangements also matter a great deal.

«because preventing losses at BofA and Wells, which would be next in line if BofA were revealed to be insolvent, has the effect of benefitting the FDIC).»

«It is NOT “ignorant” to suggest it is a government entity.»

The FDIC is a government entity (the law says that it is a government agency), but it is not government funded and has no capital. The FDI, which is a scheme administered by the FDIC, is not a government funded insurance scheme, and to me it looks like an industry mutual insurance scheme, regulated by government legislation.

So losses at BoA and Wells would have no consequences on the FDIC, or on government funds, but they would really annoy the other members banks, most of which are small and would really hate being shaken down to pay off the depositors of NYC systemically dangerous institutions.

All MF Global needed was some bridge funding too. Its Italian repo trade would have paid off it they had enough dough to get them through the liquidity pinch. Did the Congress consider even for a nanosecond rescuing MF Global?

Since when do private entities have Congress give them $50 billion because some Bad Shit Happened and they’d go bust unless they got a lifeline?

No, it is an underfunded insurance scheme which the government has recapitalized and would do so again if the need arose. There was discussion during the criss as to whether Congress would need to provide a cash infusion. And you also omit the bailout of AIG bailed out the FDIC since it prevented large bank failures. It is now capitalized at well below its statutory minimum. No regulator would allow a private insurer to operate that way.

http://finance.fortune.cnn.com/2010/06/23/fdic-funds-woes-deepen/

Numerous academice have written about how deposit insurance is grossly underpriced. Underpriced insurance is guaranteed to produce failures of guarantors, as we saw with credit default swaps.

Blissex wrote: “Only some bridging finance was provided, because the FDIC does not have any capital and does not suffer any losses.”

You are splitting hairs by differentiating between the FDIC and the FDI, that the insurance fund was depleted. You know what Yves and I meant, we certainly understand the difference, it isn’t complicated. The FDIC is the government agency that administers the FDI, the FDI being the actual insurance fund. An analogy would be Social Security vs. the Social Security Administration.

Yes, there was bridge financing provided along the way, however when all was said and done, the taxpayers ended up providing easily more funding than the DIF (I assume this is the same as FDI). From an article with accounting tables of the S&L crisis:

On strictly FSLIC failures (not including losses from RTC resolutions):

“For FSLIC failures, the loss from the beginning of

1986 forward was $63.0 billion, of which the public

sector accounted for $41.0 billion, or 65 percent, while

the thrift industry paid $22.0 billion, or 35 percent of

the total. All the FRF-related public-sector losses

were accounted for by the Treasury’s $43.5 billion contribution.

As of year-end 1999, however, the FRF still

retained $2.5 billion in equity that was expected to be

returned to the taxpayers, so the net loss was $41.0 billion. 19 (As mentioned above, the FRF was responsible

for settling accounts on all outstanding FSLIC

assistance agreements and receiverships.) The $22.0

billion in thrift industry funding for FSLIC losses

included: $8.2 billion that came from the thrift industry

through the sale of long-term FICO bonds; FSLIC

insurance premiums from 1986 forward and SAIF

assessments diverted to the FRF, accounting for an

additional $7.8 billion in spending; and $6.1 billion

from the original FSLIC insurance fund equity and

reserves as of year-end 1985.20”

Including RTC resolutions:

“Thus, the combined total

for all direct and indirect losses of FSLIC and RTC

resolutions was an estimated $152.9 billion. Of this

amount, U.S. taxpayer losses amounted to $123.8 billion,

or 81 percent of the total costs. The thrift industry

losses amounted to $29.1 billion, or 19 percent of

the total.”

http://useconomy.about.com/library/s-and-l-crisis.pdf

You are naive if you think that banks would chip in up to even close to the total amount of their capital to bail out another institution, or that Congress would require them to. These large banks are largely international now, e.g. Citi has branches in over 100 countries, would the FDI be responsible for bailing out foreign depositors? Currently, the DIF has a balance of approx. $7 billion on assets of $1.3 trillion. That is a 0.5% balance if my math is correct, and it has been depleted at a rate of approx 2%/year since 2009 (and after trillions of taxpayer money had been infused or the fund would have been bankrupted, or so the bankers said).

We have moved out of the transitional phase when if was necessary to maintain the pretense that such and such act was being done to help the masses and have now entered into the bold and confident “Putin” phase when a settlement is reached that will only help the insiders who crafted it. For those running the show, this is progress you can depend on.

Thanks Yves for writing about this. It helps me better understand what is for me a complex issue and it help illuminate one more aspect the ongoing breakdown of the system. In my mind, we’ve become a nation of predatory bottom feeders. I even see this occurring here in my little town, which is becoming increasingly corrupted, where local elites and their allies will do whatever they can to squash anyone opposed to their money agenda. Their greed is ugly and frightening.

«In my mind, we’ve become a nation of predatory bottom feeders.»

How many hundreds of years ago do you think this happened? Already in the 17th century or perhaps a bit later? Tocqueville’s “American Democracy” is from the 1830s and already describes the above.

«I even see this occurring here in my little town, which is becoming increasingly corrupted, where local elites and their allies will do whatever they can to squash anyone opposed to their money agenda. Their greed is ugly and frightening.»

That’s how many little USA towns have always been run. There are even plenty of “westerns” and other movies about this subject, and comics, and and novels, and historical tracts. There never was a “golden age” of USA little towns run by philosopher-kings, especially in Dixie. Local magnates owned and run company towns, old families controlling every branch of the local government, whatever.

Perhaps there was a better more honest culture in northern locales with a prevalence of recent European immigrants, or in Quaker yankee little towns, but Real America’s culture has become largely dixified.

A lot of little towns are still, in fact, run by the descendants of the people who founded them more than a century ago. Cross them and the town as a whole shuts its doors to you. That’s how small life in America has always been, and, come to think of it, replace founding families with the lord in the manor and that’s how Europe was and still is. Elections change little if anything.

To a certain extent you can see this in the Knickerbockers in New York and one or two powerful families in Los Angeles. People have always fled small towns for the comparatively freer air of city life, and always will.

Blissex, yep, “The Shock Doctrine” has been the American Way since Day One: Jamestown, Plymouth Rock, “Go West,” the “Vale of Tears”, “The Mind of the Master Class” (Fox-Genovese and Genovese). The model STILL is “The Opium Wars” of the British East India Company/Victorian Reich imposition of *free trade* for the .01%; unto BigOil/Chem/CIA Yale of Rhodes and Rockefeller’s University of Chicago March for Imperial .01% Re-Possession (via the “Encyclopedia Britannica” and the Strauss-Friedman Neoconservative Economics Blitz for *free markets–code for *free trade* Victorian-style).

“CHIEF JOSEPH OF THE NEZ PERCE…” a poem by Robert Penn Warren;

“AMERICAN DYNASTY” by Kevin Phillips;

THE SHOCK DOCTRINE” by Naomi Klein.

It’s the .01% global monopoly *religion*: Get with it or be exterminated.

“They don’t give a F%#K about you! They don’t care about you at ALL, at all, at all. … And now they’re after your PENSION, your Social Security!” The warning words of Patriot George Carlin, of blessed memory).

FIGHT BACK!

I wouldn’t be too worried yves about a threat from investors.

I’m in contact with some and that is not what I am hearing. That does not mean they will act, but some very big names are seriously considering pulling the trigger. And they don’t go to war casually.

What do the contracts with the banks say about a bankruptcy by MERS? What then becomes the status of all the “assignments” that MERS keeps track of in an internal manner?

Don’t look too close into how the sausage is made :-). Being a spoilsport worrywart never made anybody popular. :-)

The database would be sold in a BK.

Excellent post.

It might be clearer to note that the bank liabilities given after the table $42 billion for Citi, $121 billion for BoA, etc. are the sums of the junior and home equity loans in lines 3 and 4 of the table.

Schneiderman is part of the Establishment. So it was always not if but when he would sell us out. New York was always the key because virtually all of the securitizations went throught it.

I agree the statute of limitations angle is the great unreported story in all this.

I almost forgot. A lot of bank employees were also MERS officers. So I think the banks could be hit with liability this way because there was no real legal separation between between them and MERS.

Good catch, Hugh!

I’d only add that it was also, at least Fannie’s, policy to have MERS retain mortgage assignments, specifically in part to avoid recording fees.

From the 2006 Investigation in response to Lavalle’s allegations, an explanation of FNMA’s official policy:

“MERS is another innovation designed to add efficiency to the system. It eliminates the need for paper mortgage

assignments and the payment of recordation fees when mortgages are transferred. 118 Mr. Lavalle claims, however, that MERS has further hidden the chain of servicers and owners.”

That’s true but my sense is that most of the time, the MERS certifying officers were foreclosure mill employees. LPS and the other “information” vendors sat between MERS and the FC mills, LPS actually kept the FC mills from dealing with their clients. Schneiderman is going to have to find some smoking guns to pin this on the banks, and even then, it may operate in some foreclosures and not others.

Ally did have a ton of robosigning done by its staff, but they are not a target of this suit.

Yves, you’re likely right. History shows that the small fry do the dirty work for the Sharks–a time honored practice of Organized Crime.

It seems pretty obvious that MERS was basically a conduit of the banks. There seems to be many connections and a big question would be whether the banks had knowledge of the alleged fraudulent activities by MERS. Of course this entails investigation.

If these were poor black men instead of rich bankers, the police would surveil, wiretap, and prosecute lower level people to get evidence.

The authorities don’t want to find out what the big boys decided so they aren’t putting any pressure on them to find out.

Just think of the damage Geithner could do if he wore a wire. He would actually be useful that way.

Walter, they might have incentive enough to see him turn State’s Evidence.

I have this puzzling question. In the wake of civil charges

against Countrywide Financial and/or Mr. Mozilo, an

investigative team for criminal prosecutions based in

a US Attorney for the District of […] , somewhere in

California, was shut down. How could that have

happened, given all we know now?

So if banks are allowed to benefit by modifying loans they do not own does it explain why securitization fail/fraud has suddenly gone silent? Combining Schneiderman with the AG Settlement kills that noisy bird. The Settlement will have to effectively say, well the loans were never in the investors’ trusts in the first place – so what – that just means the banks can be the default holder and modify the loans. And Schneiderman then says, lets just blame MERS for these minor title oversights and all the perceived securitization fail and everyone will think we have legally addressed the failure. Can’t be fraud if it was merely incompetence and flawed software. Besides the MBSs failed because the bubble burst and all investors know there is risk.

But this overwhelming silence on securitization must mean they are on impossible legal ground. Where is the analysis on how housing was systematically commodified for the purpose of speculation?

Over my head.

Susan, right. It’s called *papering over* the evidence.

The link given in the post to Laurie Goodman’s analysis gives a pretty good understanding as to why there has not been more legal action. David Grais gives an introduction to the legal thicket involved:

” As I can see that there are three litigation

avenues open to investors in residential mortgage-backed securities. None of these avenues of litigation is for either the faint of heart or those with a short attention span.

In our view the first, and by far the best, avenue of litigation for investors is actions under the securities laws of the fifty states against the dealers who sold them the mortgage-backed bonds in the first place. This kind of litigation has two huge advantages. First, it’s necessary to prove very little. Really only just that there were material inaccuracies in the way the mortgage collateral was described in the disclosure documents for the deal. It’s not necessary to prove anything about the

dealer’s negligence, or fraud, or bad faith, or the investor’s knowledge, or due diligence or anything like that.

The second big advantage is that the remedy is that you just get your money back. You, as one client said, “Return the item to the store for a refund.” You don’t have to

prove damages, you don’t have to worry about how much of the loss in value of the securities was caused by macroeconomic factors and so on, you just return the bond

and get your money back. There are two big disadvantages to this course. One is that it’s available only to purchasers at, or shortly after, the initial issuance of the bonds, and the other is that it’s available only to investors in those states where the time limits are still open, and they are closing fairly quickly.”

http://www.orrick.com/fileupload/3159.pdf

If you pick up his comments where my quote leaves off you’ll see there are good reasons for not pursuing legal remedies to these gross, criminal modifications of property law that have occurred in what is known as ‘the mortgage and home building industry.’ It’s a huge pack of thugs and thieves and that corner branch of the TBTF bank that you’re checking account is stored in? Means, by a very circuitous route, we’re all involved.

The Russian Mafia called. Their reputation is missing, and they would like it back.

I would like to see some backup for the claim about 401ks in particular being affected by this–aren’t most people’s self-directed defined contribution 401ks in equities? Even if they are in bond funds, what are bond funds’ current exposures to MBS? For non-401ks, at least theoretically, participants in defined benefit plans are not directly exposed to mortgage-backed securities.

James, it’s touching to see to that such a pure soul exists in the world.

@LeonovaBalletRusse, not sure what you mean by your cryptic comment, but Yves addressed my question, or at least noted that it is in need of an answer, in her follow-up post of today.

The problem inherent to MBS financing is the amount of leveraging that was done on a wide scale by the financial institutions who set the investments schemes. It’s the principle of the key stone in architectural structure like arches; pull out the center stone and the arch collapses, the arch collapsing pulls down a wall, that wall falls on another part of the structure and soon damage to the whole structure is widespread if indeed any of it is left standing. When the MBS financing structure goes down (which it will sooner or later) it will pull a lot of stuff with it. I’m not sure how much MBS or asset backed securities are being written but I know it is still going on. The key is the leveraging which is the equivalent of toxic radioactivity left after a nuclear plant meltdown; it just keeps sinking into the center of the earth.

Excellent article in NY Times (Sunday) on the mortgage/MERS/Banks/ Fanny Mae/judicial by an individual over a period of years who became personally entangled by the fraud and set out to learn the facts. Fanny Mae ignored his findings presented to them in 2006 several years before the meltdown.

MERS and legal establishment and courts enabled the corruption and fraud to thrive while banks and GSEs like Fanny Mae etc carried out their business plans to thrive at the expense of the 99%.

American hubris and “the exceptional country crap” blocks people from recognizing and thinking about the ownership of America by corrupt 1%. There is no democratic way out since the two political parties are dependent on the 1% for their banal election campaigns and jobs.

ECON, read between the lines the implications of *Baker Hostetler*. Search.

it would seem to me that a class action lawsuit could be brought by the investors thru private counsel in a judicial forum immune from the politics of obama and if not blow this entire structure out of the water at least get it enjoined and stagnated

but then i’m just a retired deal lawyer never did the litigation thing

And of course the statute of limitations has been running while the authorities pretend to go after the crooks.

It was actually a very clever trick by Obama and his criminal gang: average people assumed Obama and the states Attorneys General would stand up for them so they sat back and didn’t assert their individual claims.

Now that Obama and gang have let the getaway car get out of sight they are revealing they never had any intention of really going after the criminals.

brian, I guess we need some *Old Southern Country lawyer* to intervene.

Except even ol’ southern country lawyers know that if they do, their careers are effectively over.

On the subject of regulatory capture broadly, I came across this recently. It’s the “vision statement” for a unit of the IRS enforcement division called LB&I (Large Business & International):

LB&I Vision

LB&I is a world class organization responsive to the needs of our customers in a global environment while applying innovative approaches to customer service and compliance.

LB&I applies the tax laws with integrity and fairness through a highly skilled and satisfied workforce, in an environment of inclusion where each employee can make a maximum contribution to the mission of the team.

So this is what it has come to: Rather than viewing itself as serving the public interest, the law, or justice, the unit of the IRS that does enforcement against big corporations defines those corporations as their “customer”.

privatizing the IRS…

FGA, this is standard *Mad Avenue* boilerplate.

Yep. It’s legalized money laundering.

The regulators and government lawyers are working FOR a vast criminal organization. There is massive ethical wrongdoing in our government.

One has to be a criminal to work for these agencies. I don’t see how one can work for the “Justice” department, for instance, unless one is comfortable taking orders from white collar criminals and covering up their crimes for them.

Eric Holder needs to be impeached immediately and investigated for possible crimes. Hell, the entire Obama administrations is simply the whitewashing unit for organized crime.

At least Hoover had a reason to cover up mafia crimes (they had pictures of him performing oral sex–plus there were the CIA connections to the mafia).

Maybe the banks have the same leverage on Holder and Obama . . . but I’m guessing they are simply part of the gang.

Lux is a D operative. (Technically, a “cut out” — somebody who passes a message from the inside to the outside.)

Nothing Lux says is to be believed.

LS, good point. Can we trust a *Lux* any more than we can a *Dux* or *Rex*?

I second the comment made by James Cole/11:25am about requesting “some backup for the claim about 401ks in particular being affected by this–aren’t most people’s self-directed defined contribution 401ks in equities? Even if they are in bond funds, what are bond funds’ current exposures to MBS?”

I really could use a “simple common investor” explanation of this in layman’s lingo.

Many thanks and excellent article.

Typical 401 (k) allocation is 60% equities.

401 (k) funds all contain bond fund options or “balanced funds” which are just an equity and bond fund in a certain ratio.

Many of those bond funds will hold MBS. Depends on the fund’s charter.

But Yves, don’t you think these *60% equities* in *customer* accounts got and will get the *MF Global/JPMorgue* treatment?

The first rule of finance (well, maybe second, “fees are not negotiable” might be number one) is always use other people’s money before your own. So giving the banks permission to modify loans they don’t own guarantees that that is where the overwhelming majority of mortgage modifications will take place, ex those the banks would have done anyhow on their own loans. And the design of the program, that securitized loans will be given only half the credit towards the total, versus 100% for loans the banks own, merely assures that even more damage will be done to investors to pay for the servicers’ misdeeds. Yves Smith

A universal bailout of the ENTIRE population could fix everyone from the bottom up including the investors in nominal terms. And in real terms, a universal bailout need not cause price inflation if it was combined with a ban on further credit creation.

As for title problems, so long as the homeowner has been making his mortgage payments in good faith to whom he thought was the note holder, it should not be his concern who the actual note holder is. I’ll leave it to the lawyers to translate requirement into legaleeze.

As for banks, who needs them? The Federal Government doesn’t since it can spend money into circulation without borrowing it. As for the private sector, why should the so-called “credit-worthy” be allowed to steal their neighbor’s purchasing power?

The trouble with being educated is that it takes a long time; it uses up the better part of your life and when you are finished what you know is that you would have benefited more by going into banking. Philip K. Dick from http://www.brainyquote.com/quotes/keywords/banking_2.html#ixzz1lWoulFhU

Personally, I am very glad I did not go into banking. WW III won’t be my fault.

“As for title problems, so long as the homeowner has been making his mortgage payments in good faith to whom he thought was the note holder, it should not be his concern who the actual note holder is. ”

Except when the mortgage service company knocks on the door of the faithful and says to them “You’re outta here!”

Also, it makes little sense, as the writer of the post stated, for folks under water to keep making payments. Given what I know about the housing market I’d say the future holds scenes of people singing

“I’ll tell you a tale of the bottomless blue

And it’s hey to the starboard, heave ho

Look out, lad, a mermaid be waiting for you

In mysterious fathoms below”

In that instance, if one sees the no bottom to the market, to protect and insure against court action, knowing that there is no known location, or the location of the deed is other than what’s on the paperwork, is the key to making a decision to stop making payment so you know the probable outcome of legal action.

Ray, backed up by the law of the *Sheriff* to evict.

Now I see why it’s hard to move your money out of 410(k)s.

After gov’t destroys private savings via ZIRP, mortgage modifications and not enforcing the laws that protect MF Global customer accounts they will say that the failure of private savings accounts an pensions means gov’t needs to assume those functions…

Fascism (socialism for the rich) creates a need for socialism for the poor. That should be no surprise.

(This post is excellent, but too taxing for my ordinary IQ–so I apologize for this basic question.)

But in addition to getting hit with the damages and fees that AG Schneiderman is going after in his lawsuit–wouldn’t the banks also NOT get the houses?

If MERS is a “fraudulent enterprise” as, I believe, DE AG Beau Biden described it in his lawsuit–and if MERS appears in connection with any particular property’s chain of title–won’t the banks have to back off of every MERS-involved property?

I checked the GSCCCA website (for Georgia land records) and there look to be about 225,000-250,000 (give or take)MERS-related Assignments filed. If Georgia’s Attorney General filed a similar lawsuit, couldn’t that potentially represent 220,000-250,000 properties that the banks couldn’t touch?

Or am I under-thinking this?

I am disappointed in Oregon AG Kroger’s decision to support the settlement and will tell him so in writing, again and again and again. Bastard………

Sure glad you brought that to our attention.

Yves, one small error in an otherwise excellent article:

So the plan is in essence to take other people’s pension fund money and try to reduce as many securitized first mortgage liens in front of bank owned second liens as possible. So… how long before the borrowers with the 2nd liens conclude that getting a reduction in their property’s debt from 175% of value , to say 150% of value, warrants continuing to pay, particularly when they can rent a foreclosed house down the street at half the cost? Until high loan to value second lien borrowers stop paying, the banks will continue to get away with saying the loans are performing and not face the consequences of their actions.

There is something that can be done to affect the outcome here. If there were a national “stop paying your second” movement to evolve, the banks would be forced to buy out the first lien positions pre-foreclosure in order to limit their loss. The banks likely see that coming and hence are pushing to get their borrower’s pension fund money to take a hit on those first lien positions now, in order to avoid taking most, if not all of the hit alone.

Collectively, those high lien second borrowers have the ability to change the course of economic history here and beat the banks at their own game. Just quit paying on those underwater second/home equity liens and wait for the collective strategic defaults to force the banks to suddenly get serious about mortgage modifications that come out of their pockets, rather than the pension funds of their borrowers.

Meanwhile, the fiduciaries of the pension funds need to wake up and fulfill their fiduciary duties to their plan participants, by putting a halt to the settlement via legal action. A two pronged attack from these two groups can change the course of this national disaster and put the onus back on the banks where it belongs. If the fiduciaries of pension plans continue to look the other way, they too shall likely get their just reward.

Bravo, this was the Fannie Freddie process for 1% looting of the 99% since at least the year 2000.

“Until high loan to value second lien borrowers stop paying, the banks will continue to get away with saying the loans are performing and not face the consequences of their actions.”

You’re almost there. This and every other thing that has been done so far, since ’07, is about hiding the nature and extent of the losses on the loans. To spare not only the banks, but the entire monetary system, which is “confidence” based.

Because the sames thing could happen to anything – and everything – in the system because is’t all the same.

Since the “subprime” crisis, that’s all anything the government has done has been about: salvaging the unsalvageable monetary system.

And elected officials will never change the monetary system. Even if they wanted to, they couldn’t, without destroying themselves career wise, and maybe worse than that. Ron Paul is tolerated as a safety valve. If he ever got any real traction as a candidate for POTUS, he would be killed.

All the power, wealth and influence the current monetary system provides to those at the top of it is in play if you seriously talk about changing it, so for understandable reasons of self interest, the idea is a “non-starter”.

The 99% have to learn how to become self governing, amend their constitution, and then hardest of all – actually govern themselves. I’m not optimistic at this point that it can be done:

http://strikelawyer.wordpress.com/2012/02/05/ag-schneiderman-sound-and-fury/

I feel in this case, we knew before hand what the perpetrators were going to do.

Thats progress from when we used to just discovery after the fact.

Now, we just need the cops from Minority Report.

“That means it might be better for Schneiderman to use this suit to keep the negative PR about the banks coming”

Or maybe, to keep negative PR about his sell-out at bay?

“Perversely, it may help the Administration push it over the line.”

Bug or feature?

I’d say, put a pitchfork in Schneiderman. As a liberal hero, he should be well done now. The Principle of Voluntary Association again – by their sponsors know them. Like Warren, Schneiderman is now part of the problem. Whatever the intentions, that by itself makes it impossible to be part of the solution.

b. — right, put a fork in Schneiderman, as *done* according to We the People, as an *example* with implications. Is this the tipping point for the People? What *strange fruit* shall we see now?

Dear LBR;

Beware what you wish for. It all depends on the proper manipulation of the masses. When the s— hits the fan, I’ll be hunkering down because of what I see all around me here in the Deep South. The old computer acronym says it all: GIGO. Just spend, (really, waste,) some time watching and reading the MSM a bit and you’ll see what I mean. The masses generally only embrace true revolution after a protracted period of real privation. If clever Reactionaries can put up straw men and other outsiders as scapegoats, we get State Socialism, or its’ cousin, National Socialism. Let the Games begin!

What kind of legal action would it take, and who might file it, to get the entire MERS database into evidence before it is ‘accidentally’ destroyed by some minimum-wage temp who hits the wrong button?

YVES, before MERS in the food chain, at the bottom, stands the original bank that signed off on the mortgage, before sending it off to the slice*dice brigade up the compound derivates food chain. Why can this bank not be held liable for failure to go through proper legal procedure at the local level where the original Mortgage was filed (or not)? This is where the Recorder of Mortgages and every State AG comes into play.

Because BOTH the Buyer and the Seller of the Real Property possess a Certified Copy of the Act of Sale. This is the hard evidence of what the Recorder must have on file, by law: the RECORD of the Act of Conveyance of Real Property, which will show the name of any Bank or other paperholder of Record as the one holding the Mortage. The first one to hold the Mortgage in this matter holds the bag. When this fact is acknowledged, the Trial Lawyers can make hay.

Civil suits by the AG are notoriously ineffective. Just props for the latest pol. Criminal referrals are actually not much better at this point because there’s too much fraud and criminality. They can only touch a handfull, who are terrible defendants from a prosecutor’s point of view anyway because they are well heeled and can fight back. They might get them eventually but they’ll be put through the paces.

Much easier to prosecute the weak and broke.

I’m sorry guys, but unless the 99% can get it together enough to amend the constitution there is no hope for this Republic at all. It’s 1789 France all over again, and who know what we’ll wind up with on the other side:

http://strikelawyer.wordpress.com/2011/12/27/saving-the-world-revised-edition-part-ii/

http://strikelawyer.wordpress.com/2011/12/27/saving-the-world-revised-edition-part-iii/

re first link: What, redemption through gold and not silver or other? And there are other *high and might* claims of what we must do “for the children” — this walks and talks like Trollspeak.

I do appreciate input. I like to get an idea of what other people think. I’ve made a lot of changes to my own proposals based on the feedback I’ve gotten. Not that it matters in one way, because I don’t think any of it is going to happen. Far more likely the situation will devolve into bitterness and violence, like the French Revolution of the 18th century.

But we try. That’s all we can do.

But there are some people who would not gain while at the same time losing a great deal, and so many things that people are used to relying upon would disappear: pensions, social security, bonds, t-bills, the entire derivative architecture, however many trillions or even quadrillions it “nominally” is.

All gone. http://strikelawyer.wordpress.com/2011/12/27/saving-the-world-revised-edition-part-ii/ [bold added]

And this is what you propose instead of a universal bailout, you silly gold-bug?