CalPERS seems determined to make lying a central part of its brand image.

On Tuesday at its Investment Committee meeting, CalPERS management is set to make yet more claims about the supposed advantages of its new private equity scheme. We will demonstrate that not only are many of these assertions false, but on top of that, CalPERS management has also told some significant lies of omission. In addition, CalPERS keeps changing its story on key issues like how its funds will be set up. At best, CalPERS is taking a “fire, aim, ready” approach, trying to launch its plan when it hasn’t even worked out what the giant fund is doing, or else it is making a deliberate effort to confuse.

The latest round of too-obvious misrepresentations includes CalPERS depicting its program as necessary, something it has never proven and is demonstrably inaccurate, as well as falsely stating that the newfangled private equity approach will save costs (when CalPERS has effectively said the opposite) and be more transparent than its current program. The only way these claims might be true is if CalPERS had made radical changes in its approach since its December board meeting. Given the lack of any mention of significant revisions to the plan, we can only conclude that CalPERS is resorting to even bigger lies to try to get the board to approve the scheme.

CalPERS has also taken to releasing its board meeting presentations much later than it once did. Its long-established practice was to post the slides on its website a week or sometime even more before the relevant board session. CalPERS has taken to often releasing private equity materials the Thursday or Friday before board meetings that typically start the following Monday. The later publication makes it difficult for interested stakeholders to review them and decide if they should come to the board meeting and make a public comment. This timing change means that either CEO Marcie Frost is incapable of getting her executives to perform at the level they did under her predecessor Anne Stausboll, or she is deliberately undermining transparency and accountability.

Background: CalPERS’ Private Equity Plan Makes No Sense…If You Assume Good Motives

Recall that the centerpiece of CalPERS initiative is that the pension fund will create two very large new entities where at least initially, CalPERS will be the sole investor in each. One vehicle will invest in late-stage venture capital, while the other will pursue the fad of “Warren Buffett style investing,” meaning much longer holding periods than the five year average for private equity funds. CalPERS too cutely calls the first one “Innovation” and the second, “Horizon”. CalPERS initially said it would allot $5 billion to each strategy; later comments suggest it plans to invest even more over time.

Remarkably, CalPERS also proposes to pay the startup costs for these vehicles, when successful private equity fund managers who strike out on their own stake their own businesses, and the fact of having such huge commitment amounts virtually eliminates the risk of establishing a venture. CalPERS’ putting up the expenses for these news fund managers is an unnecessary subsidy and raises questions not just about CalPERS’ acumen but its motives.

CalPERS’ justification for this move, which is contrary to the direction other major private equity investors are taking, of bringing more activities in house to save the huge fees and costs of private equity, makes no sense. CalPERS’ rationale has two elements, both of which are false, that it needs to be in private equity because it is the only investment strategy that will exceed its return targets, and that it needs these unorthodox entities to invest “at scale”. Neither is true.

Investing in private equity via middlemen offers unattractive returns. CalPERS is fooling itself and the public by trotting out “absolute returns,” as in misleadingly flogging private equity’s historical higher returns without factoring in its higher risks, as we discussed at Bloomberg. For instance, lotto ticket offer extremely high potential returns, but on a risk-adjusted basis, they are a bad deal. Anyone who is finance-literate knows that what counts are risk-adjusted returns, and CalPERS’ advisers, like Meketa and Wilshire, analyze CalPERS investments on that basis.

As we’ve written, private equity returns measured over the preceding decade have fallen short of their benchmarks, which is the level most professional investors set to evaluate performance. That means private equity has not been generating enough return to compensate for its additional risks. CalPERS’ own consultants forecast that private equity would not generate high enough profits to make up for the extra risk over the upcoming decade, confirming that that decline in returns is a lasting development, not a post-crisis fluke.

So what was CalPERS’ response? To cut the benchmark to make private equity performance look better than it really is.

There is no reason to think that CalPERS’ new gimmick will let it deploy more capital to private equity than conventional means.1 In fact, if CalPERS is so worried about not being as fully invested in private equity as it would like to be, it will have wasted two years plus in a status quo it says it doesn’t like thanks to this “new business model” folderol. It could just as easily have gone to one or several of the usual suspect heavyweights and set up what is called a “separate account”. On a $750 million or bigger commitment, it could not only have gotten rock bottom fees but also negotiated other special features, like its ESG (“environmental, social, and governance”) preferences.

The big reason CalPERS might have trouble putting much bigger amounts to work in private equity is environmental: too much money chasing too few deals. CalPERS has $17.1 billion in committed capital that its private equity general partners have yet to put to work. Newfangled funds won’t solve that problem. The only way to be sure to deploy more capital in private equity is to overpay. Is that what these vehicles are really intended to do?

None of CalPERS’ private equity experts can bring themselves to endorse CalPERS’ scheme. Tellingly, CalPERS private equity consultant Meketa has been kept well away this initiative. So too has CalPERS private equity staff, at least prior to November (and it’s not clear how involved they are now). Dr. Ashby Monk, who has spoken to CalPERS twice in the past six months, promptly issued a tweetstorm after his last presentation at CalPERS forcefully recommending the opposite of what CalPERS is doing, namely to bring private equity in house. Was Dr. Monk concerned that his visits to CalPERS might be construed as backing their plan and he thought it was important to lay down a marker otherwise?

Similarly, at the last board meeting, Jonathan Coslet, the Chief Investment Officer of top-tier private equity firm TPG, poured cold water on the “Warren Buffett” strategy, pointing out that very few companies were worth holding long term. Former Chief Operating Investment Officer Elisabeth Bourqui warned of the risks of this strategy….and made what appears to be a less-than-voluntary departure shortly thereafter.

CalPERS has misled the board by pretending other high-return strategies don’t exist. We’ve discussed them before. They include public market replication of private equity and simply adding more leverage to the entire portfolio (German investors, who are allergic to private equity, do this very successfully).

CalPERS obtusely ignores the most obvious solution to its private-equity dilemma: bringing private equity in house. CalPERS can get higher returns by bringing private equity in house because it would greatly lower its investment costs. Private equity fees and costs are on the order of a staggering 7% a year. While it would take some time to implement this approach, it has the potential to make private equity an attractive strategy again by boosting net returns.

CalPERS Doubles Down on Its Dishonest Sales Pitch

Even in a mere five substantive pages of slides to the board (the first is a cover page and the last is a joke), CalPERS continues to peddle misleading or flat out false information in defense of its planned private equity gimmickry. We’ve embedded the document at the end of this post.

It’s painful to see CalPERS trot out a chart going back to 1992 to try to pretend that private equity will continue to do well. One of the oldest sayings in investing is “Past results are no guarantee of future performance.” Private equity valuations are widely acknowledged to be at nosebleed levels and as we mentioned earlier, CalPERS’ own consultants forecast that the inadequate risk-adjusted returns of the past decade will continue for the nest ten years.

That chart conveniently starts after the leveraged buyout crisis of the 1990-1991 recession, when many deals went bust and private equity went into disfavor. It picks up the glory years of 1995-1999, and due to them coming relatively early in the timeframe, that period has a disproportionate impact on total returns. Those results are unlikely to be replicated absent another period of carnage in private equity.

It’s painful to see CalPERS provide a table (page 3) showing the supposed necessity of private equity when as we indicated above, CalPERS continues to falsely depicts private equity as the only hope for goosing its returns, when there are alternatives that CalPERS’ management has refused ever to present to the board. The chart is also dishonest by failing to provide any of its assumptions (time frame of analysis, various return assumptions), which looks like a deliberate effort to prevent assessment of their reasonableness.

On top of that, any forecast like the one on page 3 that shows a single outcome is deeply suspect. CalPERS should be presenting multiple scenarios and showing sensitivity analyses.

It’s painful to see finance professionals like Ben Meng and John Cole (who does have expertise, just not in private equity) engage in malpractice on page 4 by falling back on the absolute return canard that would have gotten them a failing grade had they tried that sort of thing in school. Here and generally, CalPERS refuses to acknowledge that private equity as presently constituted, no longer provides an adequate risk-adjusted return. Even industry leaders, the last people who would normally admit to problems, are signaling it will get worse, since they are warning of lower returns. CalPERS new private equity gimmicks won’t solve that problem. 2

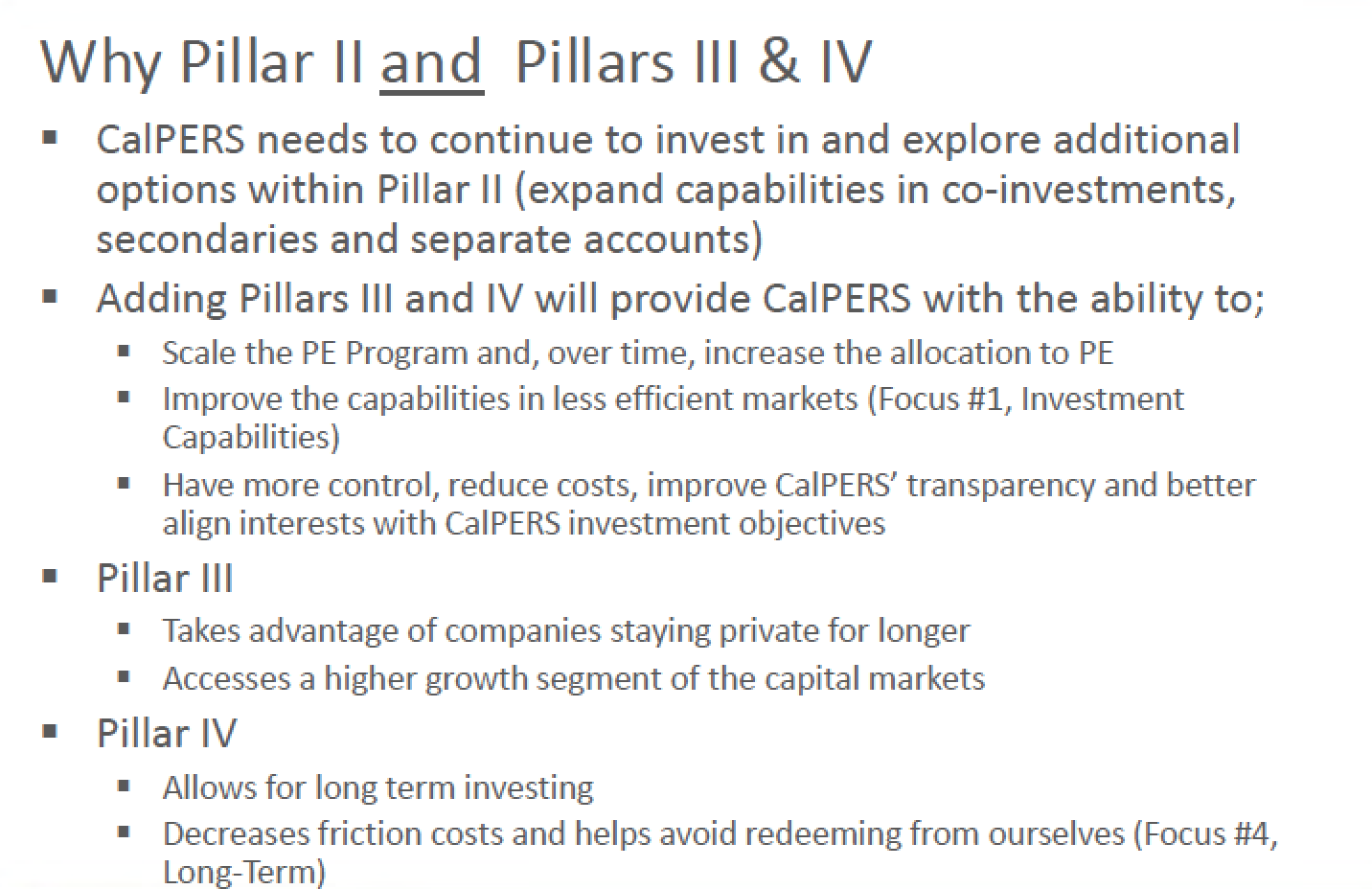

And then we get to this page, where virtually everything is false:

The first bullet point is meant to be an uncontroversial “apple pie and motherhood” sort of statement, when CalPERS yet again is refusing to consider bringing private equity in house. Recall that even a CalPERS-friendly expert, Dr. Ashby Monk, who spoke to the board twice in the last six months, recommending that approach to public pension funds across the board, and not just large, well-resourced ones like CalPERS. What is CalPERS’ excuse for rejecting the obvious? It’s like someone with heart disease refusing to take their medicine and instead acting as if merely giving up potato chips is a cure.

The second point is a complete fabrication:

– CalPERS asserts needs its new unorthodox approach with absolutely zero evidence that it needs to go this risky and untested route. CalPERS could have put money to work in “separate accounts” with the some of the major private equity firms and already be on its way. Recall that CalPERS now has a lower private equity allocation than it once did. It has gone from 14% to 8%. Not only is CalPERS’ private equity target allocation 8%, but its investments are actually above that level, at least according to its February board materials,1 so there is no evidence that CalPERS is having difficulty putting money to work in private equity. And as we pointed out, none of the players with bigger private equity programs have whined about trouble making investments.

– CalPERS management is simply lying when it says it is “building capabilities”. CalPERS is finding a novel and unduly complicated way to continue to outsource its private equity investing. Outsourcing is the opposite of strengthening internal capabilities.

– CalPERS has admitted it will not control the new vehicle (it will have only a toothless advisory board that it doesn’t even select!) and as we explained at length, that its costs will be higher and its expected returns will be lower. So how can zero control be depicted as “more control”?

– As we described at length in a recent post. CalPERS has similarly admitted that the costs for its new funds will be vastly higher than for commitments 1/10th the size until year 10, and only then drop to a roughly comparable level. So how can increasing costs be depicted as “reduce costs”?

– CalPERS admits on the very next slide that the new plan will not increase transparency to the public , which is what “transparency” is. So how can the same transparency be depicted as “improve” transparency?

– CalPERS claims that the new vehicles will create better incentives, when we’ve demonstrated that CalPERS is allowing the fund operators to take home on the order of a cool $80 million a year, risk free, for each fund. On top of that, the heads of the team managing the “Warren Buffett” fund could extract another $50 million a year in consulting fees. So how can letting fund managers get rich even if the new strategies deliver terrible returns be depicted as “better align interests?

On the third bullet point, CalPERS asserts it wants to take advantage of companies staying private longer and “access a higher growth segment”. But this is wishful thinking. Venture capital returns depend on getting in with an investment here and there that delivers 100x or even 1000x returns. That’s impossible with “late stage venture capital”. These are companies that are mature enough that they ought to be public…which means they can be expected to deliver public market tech stock returns. And that’s before you get to the valuation practices that lead to venture capital unicorns being overvalued on average by 48%, with every single unicorn being overvalued. So CalPERS is setting itself up to be the dumb money that buys overpriced wares.

On the final point: CalPERS acts as if long-term investing is inherently virtuous no matter what form it takes. It isn’t. In fact, CalPERS is turning finance principles on their head. Like all too many institutional investors, CalPERS treats the connection between long-term investments and higher returns as a law of nature, rather than as a financial economics teaching that they must demand higher returns for situations where their money is tied-up long-term.

The long-term investments deemed suitable for pensions are long-term bonds because the cash flows can be matched to expected actuarial payouts. Long-term uncertain investments are a negative, not a positive, for a pension fund. The monies are tied up and what the funds gets in the end may well fall short of its requirements. The only reasons for a pension fund to invest in anything other than bonds are asset class diversification (which reduces risk) and to obtain higher returns. The reason for private equity in particular is its high return potential.

CalPERS has admitted the longer holding periods of its “Warren Buffett” fund will produce lower returns than traditional private equity funds. That means the whole idea is a violation of fiduciary duty and should be scrapped. And it also means that whatever the “friction costs” are, they are more than offset by taking profits on a reasonably prompt basis.

CalPERS’ Lies About Transparency

Page 6 of the CalPERS presentation, on transparency, is an exercise in misdirection. All you really need to know is that is says, “Transparency to the Public is the same as it is for existing Private Equity Fund Investments.” Transparency of private equity now is unacceptably low. With captive vehicles, CalPERS could readily improve transparency but refuses to.

As for “transparency to staff,” CalPERS is trying to depict what is called “disclosure” as “transparency” to falsely claim a plus. This is another example of CalPERS misusing terms to try to score PR points. On top of that, as we’ll discuss, CalPERS focuses on not-useful disclosures and is silent on important ones, suggesting they’ve missed them.

CalPERS is refusing to increase transparency when it readily could. As board member Margaret Brown pointed out at the November board meeting, CalPERS could readily disclose its legal agreements involved in setting up the new investment schemes, most important, the ones with the fund managers.

Right now, private equity funds managers insist on keeping the “limited partnership agreement,” their contracts with investors, secret, making the incredible claim that the entire document is a trade secret. We’ve now published 26 on our site, and as we’ve explained, there is nothing in them that can be construed to be a trade secret.

Since CalPERS has said it will be drafting these agreements, there is no reason for them to be kept confidential, save that CalPERS is and remains anti-transparency. That has been apparent since we documented the organization in 2017 lobbying the California legislature to weaken the AB 2833 private equity transparency bill that became law. AB 2833 required private equity managers to make disclosures about portfolio company fees they receive.

It’s hard for CalPERS to pretend to be gung ho about transparency given its past behavior and its own admissions. For instance, CalPERS has given little more than handwaves about its scheme, with its initial rollout consisting of a mere four pages of napkin doodles with less than 500 words in total on them.

Similarly, in December, General Counsel Matt Jacobs confirmed board member Margaret Brown’s concern that one of CalPERS’ real objectives in devising this scheme was reducing transparency. That was when Brown had asked about disclosing the legal agreements with the new entities. This was Jacob’s response:

Well, at a high level, I suppose we could. I think that would defeat the entire purpose of the endeavor that the Investment Office is undertaking, which is that these are private investments, and they’re private for a reason, which is that the — the financial information needs to be private. And the people running them have these types of preferences.

CalPERS similarly has been obfuscatory about the legal structure of these new entities. CalPERS ought to be doing what law firms and business schools routinely do, which is presenting diagrams that show the legal entities and their relationships. CalPERS has gone from saying it would use a general partner-limited partnership structure, to claiming it would use two LLCs, presumably one for each strategy, but even then the CalPERS language is ambiguous.

The lack of explanation of how the newly-created fund managers will work is even more troublesome given that CalPERS is not just putting them in business by giving them such large amounts of capital but also bankrolling their expenses!

CalPERS is also kidding itself and the public on the level and value of the supposedly better information it will get. Since CalPERS is locked in illiquid investments and has no control over the fund managers, pray tell, what is the point of having more portfolio company information? Ironically, with conventional private equity funds, that sort of information would help make better decisions on whether to invest in a new fund by the same manager. But given that CalPERS has put itself in a position of having no control, having better information about portfolio company performance has only entertainment value.

Moreover, for the “late stage venture capital fund,” CalPERS is unlikely to get more information than it gets now as a limited partner in private equity funds (indeed, the poor and inconsistent disclosures made to Uber’s shareholders show it could even be worse). While board members of venture-backed firms do have access to a great deal of the company’s financial and operating information, buyers of late rounds of equity raising are in a different category. While they can negotiate for better information rights, that comes at the expense of pressing for improvements on other provisions that have concrete economic value, like IPO ratchets and automatic conversion exemptions.

If CalPERS has been giving accurate information about how it is compensating the fund managers, having budget information is an empty exercise too. The mere fact that CalPERS has agreed to fee levels that give each fun manager’s owner(s) close to $100 million of risk-free pay says this is another example of CalPERS abusing language. Moreover, CalPERS appears to have agreed to fee levels in advance. If that is the case, then the “budget” is merely a garbage-in, garbage-out exercise where the fund managers will generate a budget that justifies the fee that CalPERS expects to pay.3

Alternatively, even if CalPERS really does plan to negotiate a budget annually, the fact that it is publicizing paying such outrageously high compensation levels to the fund owners says CalPERS has bought into some extremely fund-manager-serving ideas. Put it another way: unless CalPERS has access to the fund manager’s full financial statements, any budget negotiations would be a sham.

More generally, what CalPERS needs above all is ongoing access to the books and records of the vehicles in which it invests and theparent private equity firm “management company” so as to prevent cheating or (more politely) unduly aggressive interpretations of the managers’ contracts. The SEC has found cheating to be widespread in private equity, so concerns about misbehavior are well founded.4

While there are clearly many employees at CalPERS who are truly devoted to helping beneficiaries and California citizens, that devotion to service is completely absent from this Tuesday private equity presentation. It’s hard to find any good explanations for the intense push to get a clearly half-baked scheme approved by the board. The unseemly eagerness is even more disturbing in light of red flags, like the admission that fees will be higher and expected returns lower than for current approaches. Those alone would lead any rational decision-maker to abandon the idea. So independent parties have good reasons to believe that something unsavory is cooking.

____

1 CalPERS’ consultant Meketa shows that CalPERS is currently above its target for private equity, with 8.3% allocated versus a 8% target. See page 4.

2 We’re skipping over other misleading items on page 4 in the interest of containing the length of the main text. Appallingly, one point depicts bad accounting as a virtue, but using bafflegab: “Provides drawdown mitigation as a result of the lag in valuations and market inefficiencies.” Um, please tell me how well that “drawdown mitigation” works in practice. CalPERS had to dump stocks at distressed prices during the worst of the financial crisis to meet private equity capital calls.

3 CalPERS has been disturbingly silent about what if any investment the fund managers will make.. The fact that CalPERS will be the “sole member” in the LLCs means the fund managers cannot be investing in it. Yet it is universally seen as important that fund managers eat their own cooking. As Nassim Nichols Taleb said, “Never trust anyone who doesn’t have skin in the game.”

Similarly, seasoned venture capital investor the Kauffman Foundation, in its classic report, , We Have Met the Enemy….and He Is Us, strongly recommended that the fund managers have substantial investments in the funds they operated, and urged investors to get proctological about the general partners’ financial wherewithall:

Additional misaligned behavior occurs when GPs choose not to invest their personal income and assets alongside LPs in new funds. It’s become the ‘market standard’ that GPs, as a group, will invest only 1 percent of committed capital in a new fund. This amount is grossly insufficient to foster alignment of interests. The Foundation expects a 5 percent to 10 percent GP commitment, and for any lower amounts we require a detailed understanding of the commitment amounts relative to personal net worth, especially for senior partners.

On the one hand, a 5% commitment on a $5 billion fund seems like an awfully big ask. On the other, one of the two CalPERS candidates whose names leaked out, former Silver Lake co-founder David Roux, is a billionaire, so it would not be unreasonable for CalPERS to seek a nine figure commitment from him.

4 John Cole has made CalPERS look like a mark with his rhapsodizing about the long conversations he had had with fund manager candidates about their shared values. Even readers of the business literature know full well what persuasive sociopaths populate the private equity industry. Cole should read the classic account in Barbarians at the Gate, where Henry Kravis and George Roberts had the RJR Reynolds board convinced that they were their sort of people and would be careful stewards of the company. To a man, they said they believed in the sincerity of the duo and were shocked and distressed when they did their usual asset stripping routine.

CalPERS February 2019 PE presentation

I could almost (almost) feel sorry for Frost, if her actions didn’t affect so many innocent Cal pension beneficiaries. The kindest way to describe this, imo, is that she has been seduced by an antiquated theory of economic liberalism that will dearly cost CalPERS pensioners, and all in the name of an antiquated theory.

That’s the kind interpretation. The less kind, the real world interpretation, you are all probably already thinking… and I don’t disagree.

The even less kind interpretation is that no theory is involved at all. It’s all a matter of paying the right people off through cut outs. You might very well think so. I could not possibly say.

Thanks for NC’s continued reporting on CalPERS, pension, and PE.

It is almost reminiscent of the way Nat. Guard troops in Iraq were used in Abu Ghraib, who coincidentally, had no training in recognizing and avoiding (or hiding!) war crimes. But is she is there because of her inexperience (and ethical flexibility), who put her there and where’s the money going?

It is the tenacity of that “antiquated theory of economic liberalism” that is so mind-boggling. Undoubtedly CalPERS has a state mandate to maximize returns for retirees, who will otherwise be living on diminished payments – in the sense that the dollar will continue to buy less and less. For how long is unknowable. But wait. Since everyone knows this present plot is unworkable, why doesn’t the mandate change? I’d think a better solution to all this undisclosed money “management” would be state participation in funding the shortfall. So it comes full circle and eventually smooths out. That would eliminate the need for all the sociopaths whose intuition is decidedly a bad thing. This must be the rationale behind Germany’s aversion to PE. Private equity requires lack of transparency. Good grief. But a public market “replication” of PE which adds the required leverage to the entire portfolio sounds like a better insurance policy. And short this kind of investment vehicle getting traction here, why not state funds doing a similar thing for CalPERS. Or stg. like that. I almost cannot believe the mess they are in.

This whole thing is starting to remind me of Downfall, an over-used metaphor to be sure. We take you now to the Frösterbunker:

RIP Bruno Ganz. …and follow the money.

Apart from robot, Czechs gave the world one more idiom, which admittedly is less well known.

Tunneling – as in taking a company, and (legally and illegally) stripping its assets out via related parties/companies etc. It was the way a lot of Czech “elites” made their money in the wild privatisations of 1990s. PE took it out later on, although I can say that even the US PE never reached the skill of their teachers in Central Europe (look at the current CZ PM for a good example).

CalPERS to me looks more and more like some of the Czech funds in the 1990s, which ended in a lot of tears.

the mafia did it before that; called maybe bustouts.

Wasn’t there a Soprano’s episode detailing just how they did this to Artie and Charmaine Bucco’s restaurant? Sometimes I think business schools should just ditch their textbooks and show mafia movies, its the same lessons, just more direct.

Vesuvio (The Buccos’ restaurant) was torched by Silvio to prevent Uncle Junior from staging a hit there.

There was an episode that featured a bust out when Tony’s childhood friend Davey got in over his head in gambling debt. To settle the debt, Tony and his associates ran up enourmous debts on Davey’s sporting goods store and stole all the merch, driving Davey into bankruptcy.

Different scale, trust me (we’re talking significant chunks of economy here).

I cannot see how CalPERS is fulfilling it’s Due Diligence obligation under this structure in respect of other investors in the fund or funds. CalPERS is not able to (due to the “hands off” management structure) identify and verify the identity of investors in the fund(s).

Without getting into the weeds on this, briefly, the party investing in a fund (CalPERS here, via a proxy) must either satisfy itself that it has identified and verified the relevant investors in the fund (how do they know, to be a little facetious, it’s not Vladimir Putin who is ponying up the rest of the cash in a PE investment?) or a regulated entity (it can’t merely be Marcie’s best friend or whatever) in an equivalent jurisdiction. It cannot be a third party.

CalPERS can’t have it both ways. If the entity it has created to manage the fund(s) is a genuine attempt at disintermediation, it can’t conduct the Due Diligence. Conversely, if it isn’t really is what CalPERS say it is on the tin (not a true arms-length management structure) then it can legitimately and validly do the Due Diligence but then CalPERS is clearly lying because it knows it is not placing any reliance on a person (say as part of the PE Management Vehicle they are creating) who is a separate third party to conduct the Due Diligence — its an admission that new PE unit isn’t just an investment manager, it is actually administering the fund.

I think it’s the former not the latter — CalPERS are simply unable to execute the Due Diligence appropriately. So goodness only knows what they might be getting mixed up in — and what shady characters they might be getting mixed up with — in these so-called investments.

Article XVI sec 17(c) of the Constitution of the State of California clearly states:

The clear impossibility of completing even the slightest due diligence under this cockamamie scheme is a ticket to personal bankruptcy for any Board member voting in favor of it. The will be personally sued, and their clear violation of the constitutional rights of the members and beneficiaries cannot be indemnified or insured by the fund. A less friendly Attirney General would be well within their discretion to prosecute them for misappropriation of public funds and violation of the civil rights of participants.

Staff are inviting the Board to toast puffy sweet marshmallows over a cozy campfire — after thoroughly dousing themselves with gasoline…

Starting to wonder how long before the entire board, (with a few notable exceptions) along with most of the staff, end up sharing a cell in San Quentin.

Don’t worry, Attorney General Becerra is going to be all over this!

There is the possibility of crude corruption on the part of the CalPERS people pushing this PE route so intensely, which should not be dismissed. But there is the possibility that Frost would have no idea how to manage a new PE department.

It would be a large, competing power center. It would be staffed by new, very highly-compensated managers. They would have technical skills that Frost would not understand. They would have the considerable networking and relationship skills necessary for their work. (As opposed to the schmoozing and polishing Frost herself may now get from her outside legal and wannabe PE vendors.)

This new group would responsible for a major chunk of CalPERS failure or success. Its work would constantly be of detailed interest to the board. In a short space of time, the lead manager of that group would be seen to be more competent and valuable to CalPERS than Frost.

Those do not seem to be attributes a manager as limited and as technically-challenged as Frost would contemplate bringing in-house.

GC Jacobs seems to be arguing – in a perspective borrowed wholly from PE itself – that investments in PE targets need to be private, or targets will refuse the funding. (A questionable assertion.) CalPERS therefor has to be as opaque as possible.

Jacobs is transparent only in his willingness to toss his own and his organization’s obligation to be transparent. Why? Psychological capture by PE is one possibility. As is that opaqueness hides the potential for corruption.

Another possible explanation is that current management predicts its own massive failure: its current investment initiatives will not achieve objectives without large new infusions of capital. A large new PE initiative might hide that for quite a while.

Those PE initiatives would be hidden behind intentionally designed process and contractual fences. That would make their nominal success or failure inexplicable, and make virtually impossible adequately assessing gross vs. net returns to CalPERS. At best, available of data would seriously lag events.

That leaves explanations of performance open to low-fact PR explanations of the sort that are right up Frost’s alley.