Yves here. While this paper confirms what I suspect are most readers’ intuitions about offshoring, it’s nice to have it made official.

By Christoph Boehm, Assistant Professor of Economics, University of Texas at Austin, Aaron Flaaen, Senior Economist, Research and Statistics Division, Federal Reserve Board, and Nitya Pandalai-Nayar, Assistant Professor of Economics, University of Texas at Austin. Originally published at VoxEU

What has caused the rapid decline in US manufacturing employment in recent decades? This column uses novel data to investigate the role of US multinationals and finds that they were a key driver behind the job losses. Insights from a theoretical framework imply that a reduction in the costs of foreign sourcing led firms to increase offshoring, and to shed labour.

One of the most contentious aspects of globalisation is its impact on national labour markets. This is particularly true for advanced economies facing the emergence and integration of large, low-wage, and export-driven countries into the global trading system. Contributing to this controversy, between 1990 and 2011 the US manufacturing sector lost one out of every three jobs. A body of research, including recent work by Bloom et al. (2019), Fort et al. (2018) and Autor et al. (2013), has attempted to understand this decline in manufacturing employment. The focus of this research has been on two broad explanations. First, this period could have coincided with intensive investments in labour-saving technology by US firms, thereby resulting in reduced demand for domestic manufacturing labour. Second, the production of manufacturing goods may have increasingly occurred abroad, also leading to less demand for domestic labour.

New Facts on Manufacturing Employment, Trade, and Multinational Activity

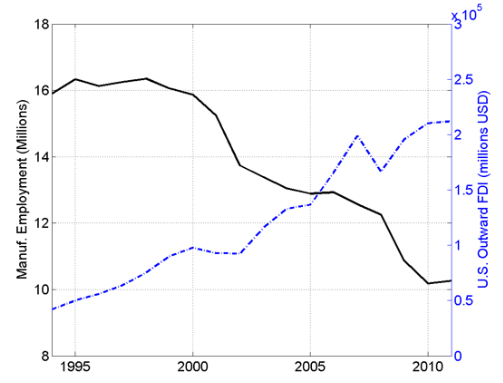

On the surface, the second explanation appears particularly promising. Manufacturing employment declined from nearly 16 million workers in 1993 to just over 10 million in 2011, shown by the black line in Figure 1. This large decline in manufacturing employment coincided with a surge in outward foreign direct investment (FDI) by US firms (the blue line in Figure 1). Nevertheless, existing theories of trade and multinational production make ambiguous predictions regarding the link between foreign production and US employment. Further, due to a lack of suitable firm-level data on US multinationals, there has been limited research on their role in the manufacturing employment decline (see Kovak et al. 2018 for a recent exception).

Figure 1 US manufacturing employment and US outward FDI

Source: BEA for FDI; Longitudinal Business Database (LBD) and authors’ calculations for employment.

In a recent paper, we address the question of whether foreign input sourcing of US multinationals has contributed to a decline in US manufacturing employment (Boehm et al. 2019). We construct a novel dataset, which we combine with a structural model to show that US multinationals played a leading role in the decline in US manufacturing employment. Our data from the US Census Bureau cover the universe of manufacturing establishments linked to transaction-level trade data for the period 1993-2011. Using two directories of international corporate structure, we augment the Census data to include, for the first time, longitudinal information on the direction and extent of firms’ multinational operations. To the best of our knowledge, our dataset is the first to permit a comprehensive analysis of the role of US multinationals in the aggregate manufacturing decline in the US. With these data, we establish three new stylised facts.

Fact 1: US-owned multinationals were responsible for a large share of the aggregate manufacturing employment decline

Our first finding is that US multinational firms, defined as those US-headquartered firms with foreign-owned plants, contributed disproportionally to the decline in US manufacturing employment. While 33.3% of 1993 employment was in multinational-owned establishments, this group directly accounted for 41% of the subsequent decline.

Fact 2: US-owned multinationals had lower employment growth rates than similar non-multinationals

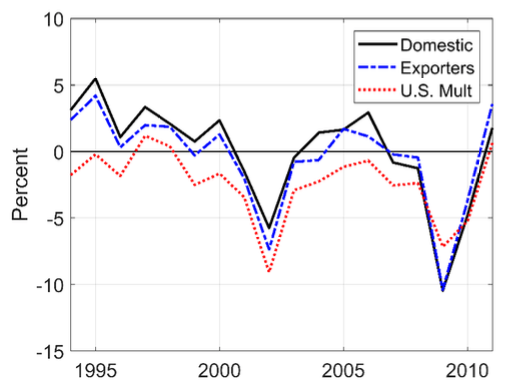

In Figure 2, we show that multinationals exhibited consistently lower net job creation rates in the manufacturing sector, relative to other types of firms. Compared to purely domestic firms and non-multinational exporting firms, multinationals created fewer jobs or shed more jobs in almost every year in our sample. Of course, these patterns may not be causal, and other characteristics of multinationals could be driving the low job creation rates. To address this concern, we control for all observable plant characteristics, and find that multinational plants experienced lower employment growth than non-multinational owned plants in the same industry, even when the size and age of the plants are held constant.

Figure 2 Net US manufacturing job creation rates by type of US firm

Source: Authors’ calculations based on the LBD, Directory of Corporation Affiliations (DCA), and Longitudinal Foreign Trade Transactions Dataset (LFTTD)

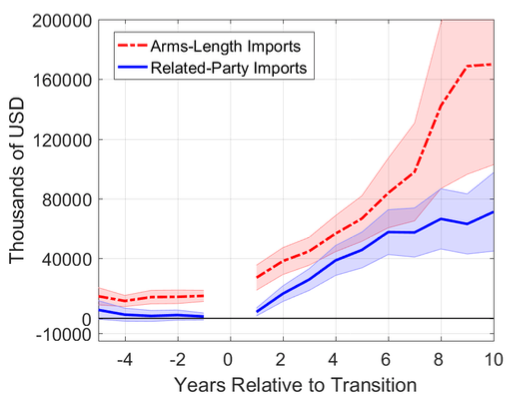

Fact 3: Newly multinational establishments experienced job losses, while the parent multinational firm expanded imports of intermediate inputs

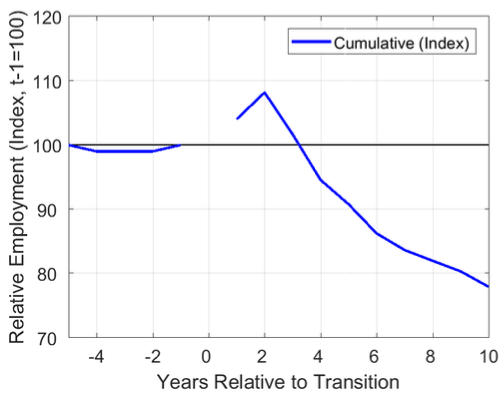

An alternative way to assess the role of multinational activity on US employment with our data is to use an ‘event study’ framework. We compare the employment growth trajectories of newly multinational-owned plants to otherwise similar plants in terms of industry, firm age, and plant size. As can be seen in Figure 3a, prior to the plants becoming part of a multinational, their growth patterns are not different from the control group. However, in the years following the multinational expansion, there is a brief positive but then sustained negative trajectory of employment at these manufacturing plants. Ten years after the transition, these newly multinational-owned plants have manufacturing employment that is about 20% smaller than an otherwise similar plant.

Figure 3 US employment and import dynamics at new multinational plants

a) Relative imports

b) Cumulative relative employment (Index)

Source: Authors’ calculations based on LBD, DCA, and LFTTD.

Further, these newly multinational firms increase imports following the expansion abroad. As Figure 3b demonstrates, these firms substantially increase imports both from related parties and other firms (at arms-length), relative to their control group. Taken together, Figures 3a and 3b suggest that offshoring might explain the observed negative relationship between trade and employment.

Structural Analysis: Did the Offshoring of Intermediate Input Production Result in a Net Employment Decline in the US at the Firm Level?

While the patterns we identify above are suggesting that increased foreign input sourcing by multinational firms led to a decrease in US manufacturing employment, they are not necessarily causal. Standard models of importing, such as Halpern et al. (2015), Antras et al. (2017) or Blaum et al. (2018), make ambiguous predictions as to whether foreign sourcing is associated with increases or decreases in domestic employment. At the heart of this ambiguity are two competing forces. First, a reduction in the costs of foreign sourcing leads firms to have access to cheaper intermediate inputs. As a result, their unit costs fall and their optimal scale increases. This ‘scale effect’ raises their US employment. On the other hand, firms respond by optimally reallocating some intermediate input production towards the location with lower costs. This ‘reallocation effect’ reduces US employment. Theoretically, the scale effect could dominate the reallocation effect and lead to positive employment effects of offshoring, or vice versa.

We use our microdata to estimate the relative strengths of these two competing forces. We show that in a conventional class of models and in partial equilibrium, the value of a single structural constant – the elasticity of firm size with respect to firm production efficiency – completely determines which of the two forces dominates. Our estimation approach is to develop a method to structurally estimate an upper bound on this constant using our data on the universe of US manufacturing firms. While a high value of the upper bound leaves open the possibility that foreign sourcing and domestic employment are complements, a low value of the bound unambiguously implies that the two are substitutes.

Our estimates of the bound are small, indicating that during the period 1993-2011, the reallocation effect was much larger than the scale effect. In other words, during this period of aggregate manufacturing employment decline, multinationals’ foreign input sourcing was leading to a net decline of manufacturing employment within these firms.

Aggregate Implications for US Manufacturing Employment

It is important to point out that the model we use only speaks to employment changes within existing firms and does not take into account general equilibrium forces that can also affect employment. Since such general equilibrium effects are inherently difficult to assess, estimates of how much of the observed aggregate decline can be attributed to offshoring of multinational firms are uncertain and often require strong assumptions. We thus proceed under two alternative sets of assumptions. In the first, we conduct a simple partial equilibrium aggregation exercise, which uses observed changes in firm cost shares of domestic inputs together with our estimated parameter bounds to obtain model-implied predictions of the employment loss due to foreign sourcing. This approach captures both the direct impact of foreign sourcing by existing firms as well as the first-order impact on domestic suppliers, holding all else equal. Under the second, we model these indirect, general equilibrium effects, such as firm entry and exit, explicitly. In both of these scenarios, we find that the offshoring activities of multinationals explains about one-fifth to one-third of the aggregate US manufacturing employment decline.

Policy Implications

Our research shows that the global sourcing behaviour of US multinational firms was an important component of the manufacturing decline observed in the past few decades. These firms set up production facilities abroad and imported intermediate goods back to the US, with the consequence of reduced demand for domestic manufacturing workers. While our research suggests that offshoring had a negative impact on employment, we caution that it does not support the view that offshoring and trade should be contained with tariffs or other policy interventions. Previous research has shown that both trade and offshoring are critical for consumers’ access to affordable goods in the US. Instead, our research implies that government assistance for displaced manufacturing workers could facilitate their transition to new jobs in other sectors.

Authors’ note: Any opinions or conclusions expressed herein are those of the authors and do not necessarily represent the view of the US Census Bureau or the Board of Governors or its research staff.

See original post for references

It’s not just big-ticket manufacturing (appliances, etc)….little stuff that a nation uses on a daily basis has been off-shored as well—electrical wiring, capacitors, even foodstuffs like cookies and candy.

Rx, military equipment parts…

https://regionalextensioncenter.blogspot.com/2019/08/china-rx.html

How does the research make such an implication? Every person a gig worker, I suppose?

our research implies….could facilitate their transition

Can we pay our bills with the “implied” income?

“implied” < 40% probability, "facilitated" < 40% probability, overall probability < 16%.

Nice, less than 1 in 4 get a new job.

I think an overlooked aspect is environmental protection and labor working conditions as well as wages.

We are offshoring our pollution by moving manufacturing to other countries with much less stringent environmental regulation. Similarly, labor rules in those countries don’t require as much worker safety, so we are offshoring injuries as well.

As the other countries become wealthier and more educated, they are starting to push for more of these protections as well as higher wages which is forcing the companies to move their production again to keep their costs low.

An interesting recent trend is the rejection of our “recycling” from countries that used to receive it, so the feel-good greenwashing of filling the recycling bins is started to boomerang back to North America as countries ship back the trash parts of the recycling. This will likely require a second recycling revolution with more domestic processing of recycling or an admission that it simply isn’t going to happen in which case the righteousness quotient of many suburbanites is going to plummet.

This is such an easy problem to solve from a policy standpoint- and it has been solved by countries as small as the Netherlands.

Legally mandate a small list of fully recyclable materials for manufacturers to use in production and packaging, and enforce it with punitive tariffs on non conforming goods. This can take many forms, one logical option being that of holding companies responsible for the costs of recycling their products.

This is as applicable to soda bottles as it is to large and complex products like automobiles; BMW is a world leader in lifecycle waste reduction and recycling of vehicles.

As usual, the impediment isn’t technology or consumerism, it’s corporate profitability and one time costs of adjusting the supply chain.

“We” didn’t offshore any of it. The International Free Trade Conspirators offshored all of it. Many Americans objected to that “offshoring” as it was being planned and plotted through Forcey-Free-Trade agreements.

So the writer says “that government assistance for displaced manufacturing workers could facilitate their transition to new jobs in other sectors.” I take it to mean that a policy such as “free college” as advocated by Sanders which would involve government funded vocational training in other sectors would go a long away toward helping those displaced by outsourcing?

It’s just another version of “Let them eat training!”

I remember all that BS back in the 80’s and 90’s… everybody was on the bandwagon about careers in computers, or any other hi-tech. I was one of those who had *some* training at least….. right before they offshored all those jobs to India. It was a double kick in the nuts.So, manufacturing went to China, computing went to India. And people wonder why I’m so bitter and cranky sometimes.

Napoleon: “Money has no Fatherland. Financiers are without patriotism and without shame. Their sole object is gain.” IMHO US manufacturing is the reason why we’re not all speaking German today. And we gave all that capacity away like a bunch of lemmings over the cliff…

“that government assistance for displaced manufacturing workers could facilitate their transition to new jobs in other sectors.”

This “implies” that there are “jobs in other sectors” that create as much economic value, expertise and “innovation” as manufacturing jobs do. What are they–“service” jobs? Taking in each other’s laundry? Delivering McDonald’s to your door? Netflix?

Manufacturing is not just a job category that can be changed out for something shiny and new, it’s vital infrastructure that represents a nation’s ability to provide for itself, and to create a standard of living that reflects that capability. Those “affordable goods” so important to american “consumers” are manufactured goods. It’s not just the price to buy them, it’s the ability to make them that’s important.

Like it or not, the once mighty american economy was built on the mightiest manufacturing capacity that the world had ever known. Trivializing it as being only about cheap stuff is a colossal mistake. We used to know that, and we’ve only begun to pay the price for forgetting.

We* might very well learn to make lasting things of value again .. on a lesser scale, after half the population is dead from despair, war, and disease ..

*not necessarily as one people, however ..

Nicely stated!!!

“…This “implies” that there are “jobs in other sectors” that create as much economic value, expertise and “innovation” as manufacturing jobs do. What are they–“service” jobs? Taking in each other’s laundry? Delivering McDonald’s to your door? Netflix?”

ahem….Agriculture.

fits in with the NC commonplace that there’s all manner of things that need doing.(including just sitting on the porch with old folks)

Non-Industrial Ag is necessarily labor intensive…it’s just that such jobs don’t pay, because people like me can’t “compete” with the slave labor used by multinationals.

this is a perennial problem in the economics of food production…farmers get screwed, while the bankers and speculators run wild.

see: charles walters, at acres usa: https://www.acresusa.com/collections/charles-walters for my favorite treatment of this.

if wages determine one’s value, then we…as a civilisation…seem to value warmongers and thieves more than anyone else.(men running with balls, too)

mainstream economists and the politicians and moguls that pay them want us to think that this is Holy Writ…or a Natural Law…unchangeable and just how it is.

but i respect the garbage man more than i ever will the bankers, or the congresscritters, i have known.

price fixing has a bad rep, i know…but surely there’s some method of fixing the parity problem in agriculture without bankrupting the producers, or the people who end up eating what’s produced.

I’m up to 250# of tomatoes out of this 20×50 plot, now…and even if i could sell it to a grocer or a distributor, it wouldn’t cover my gas to deliver it, let alone my labor, water, etc

(and i’ve done this almost accidentally, my labor is minimal, after the initial pedal to the metal phase. “smarter not harder”, etc)

40 years later?!?! This is the conclusion. Note it’s still not being done effectively.

They are full of it.

They may have an effective retraining program once there are about 10 manufacturing workers left in the country…

Let me tell you how useful this is in replacing your income when your 50 and the manufacturing you supported is gone.

Not so much!

Outsourcing of manufacturing jobs by multi-nationals contributed to job losses…..

Really! LOL!

30 years too late for this info.

Wasn’t hard to see even way back in the 1980’s how multi-nationals were working very hard to export jobs and import their “anti-labor” behaviour they were excising outside the laws and borders of the US.

Dear Mr Trump

Tariffs were historically used to protect domestic manufacturers. Both the fees and increased price were use to boot domestic manufacturing, and hence domestic employment.

What’s you intention for the tariff money?

So , you are implying there is a plan in the man’s head?

No, I’m asking if he has one.

I’m implying nothing.

Trump makes a lot of noise. I’m also familiar with the proverb “Empty Vessels make the most Noise.”

That’s a little different from the Zen story about the empty tea cup being more receptive.

Trump is not smart enough to understand any of that. But possibly another term of Trump might leave the International Free Trade Globalonial Plantation Order so thoroughly destroyed that smarter people can organize the restoration of National Sovereign near-zero-trade Survival Economies from the wreckage.

This is the only hope, I’m afraid.

Yes, during the wave of industrialization. But they don’t work so well once consolidation starts. 1875-1925(roughly) was the golden age of US manufacturing, even the WWII bounce was government DoD driven. Private ex-DoD manufacturing peaked in 1924 and was flat since then. Then we have the 97-05 downwave which then has boosted us about back to 1925’s ex-DoD high. Just like the tech wave, it ended.

I mean, by 1925 Portsmouth Ohio was done by 1925, by 1950 they just bled manufacturing while it consolidated around bigger cities after WWII.

We need self-efficiency not capitalists growth. It ain’t happening people. Its over. We need 10% contraction of GDP just to get manufacturing growing again from a much lower base. Tariffs are dead in the water for growth now, and act like the opposite. They are also creating a bubble in “base” consumption while killing domestic production and yes, eventually overcapacity will kill base consumption and it crash again like last years 4th quarter driving down domestic manufacturing further.

Anecdotally, in a field I worked in for a while, middle management in a small privately owned “needle trades” firm, the “growth” among our competitors was in firms that (we assumed) did their design work in US but manufactured overseas. Domestic manufacturers either adapted to this, or closed down.

At least in this field, automation had next to nothing to do with it.

Instead, our research implies that government assistance for displaced manufacturing workers could facilitate their transition to new jobs in other sectors.

Ah yes, the subsidised retraining for manufacturing jobs that, in fact, do not exist. Louis Uchitelle covered this policy failure in his 2006 book “The Disposable American: Layoffs and their consequences”. Is the phrase “got the T-shirt” relevant here?

The jobs exist as long as there are still people in the US who have decently paid jobs.

The plan is simple – train a whole bunch of people to be scabs in every decently paid line of work and drive those wages down.

For the government to re-employ workers who have lost their factories would be a form of industrial policy. Ours is never clearly stated, if there is one. But one thing is clear and that is the government gave the internationals every opportunity to offshore our national productivity without any safety net for labor except unemployment insurance. Which runs out. Michael Pettis has just backed a proposal to tax foreign capital saving and investment here in this country. Because most of it is just financial “investments”. Foreign investment for long term capital projects would be virtually unaffected. It is claimed that this tax on money parking would reduce out trade deficit and make it fluctuate within an acceptable balance. By doing something that sounds like real-time exchange rate adjustments for every transacted trade, now to include foreign investment and savings. So why didn’t the government, after offshoring all those jobs, re-employ all the laid-off workers as banking and investment managers? So all this unproductive foreign money is skewing our trade balance. Making our unemployment deeply structural. It is so bizarre that we are “trading” in money at all. We are trading in the medium of exchange, which is fiat, which itself is susceptible to exchange rate adjustments with other money and all of it supposedly backed by the productivity of that country. That foreign productivity is frequently nothing more than IMF money, stolen and taken out of the country. The P word. Because the world has reached manufacturing overcapacity, I assume, all this money is totally skewing the ledgers. It’s laughable except for the fact that the bean counters take it seriously. The mess we are in is something more fundamental than balanced exchange rates. It’s more like hoarding at its most irrational. Way over my head. And for us to fix unemployment here in the US will take far more than a tax on all this loose international money.

Yeah it’s nice to have it “officially” credentialed etc… its not like I haven’t been saying this since they passed NAFTA, but then I wasn’t “credentialed” so nobody listened…. its like, “No $#!t sherlock ???” pretty much *everyone* who has spent some time in the industrial sectors knows this by heart without even needing to be told. Of course maybe now its OK to say it out loud or something…. smh.

Can we also admit that American CEOs gave our jobs away?

Dirty furriners sho didn’t steal em… trying to get *anyone* to admit this is like pulling teeth

It’s good people are asking questions.

===the Role of Offshoring in the Decline in US Manufacturing Employment===

It is not just the role of offshoring in the decline of US manufacturing employment, BUT the effect the offshoring, and the competing with foreign manufacturers, had on the existing US manufacturing workforce. The manufacturers and manufacturing workers that remain in the US have to compete with their cheaper foreign competition for work.

I spent most of the last 25 years working in plastics injection molding. After spending the first six years of my career in plastics/ polymer research and development, I transitioned to injection molding. In the mid 90’s when I started in injection molding, globalization had already begun especially in the automotive sector. The car manufacturers were already setting up global and domestic supply chains. But even then the Chicago area (and the US in general) was heavy in mold making and injection molding businesses.

Then China became a major player in the world economy, NAFTA started, etc. and in the early 2000’s it was like the last manufacturer who gets stuck in the US gets to turn out the lights!

There were a lot of small to medium size mold maker shops and plastic injection molders in the Chicago area that went under because they could not compete with the cheaper foreign competition. It was very sad as I knew many small mom and pop mold makers and injection molders in the Chicago area who were in business for 20 – 30+ years that closed.

The fact that many businesses/corporations in the US, due to offshoring and globalization, are forced to compete with foreign competitors that have cheaper labor, less regulation, cheaper land costs, etc. etc. is beyond reason.

And to this day you can see the effects of neoliberal globalization in any manufacturing or other business you visit as they are dealing with consequences of having to compete directly with cheaper foreign competitors through cost cutting, low wages, and running the employees into the ground.

The tables were tilted against manufacturers and manufacturing employees in the US. It is like the US manufacturing (and other sectors) are trying to fight a battle with one hand tied behind our backs.

There is a good book that relates to this post. The book is called Failure to Adjust: How Americans Got Left Behind in the Global Economy by Edward Alden.

https://www.amazon.com/Failure-Adjust-Americans-Economy-Relations-ebook/dp/B01M03S1R4

NAFTA killed a bunch of material extraction jobs, but boosted a bunch of auto production jobs down the supply chain. You can see that on the data. Granted, auto sales have been flat for 20 year which has led to a flattening of employment growth since 2005 after the material extraction driven drop.

That is why the Trump Administration just basically rebooted it.

Has there been a study of a relationship between off-shoring and the rise of upper management compensation?

can the government itself, operating under a vague constitution, be treasonous?

Yes.

I’d say so.

I’ve long thought of the tippy toppers(including the pols) as traitors.

it’s only recently that that sentiment has been viewed with anything but outrage(how dare you poohpooh my favorite oligarch!)

if i were fool enough to run for office, instead of fleetwood mack:

https://www.youtube.com/watch?v=jTW0y6kazWM

https://www.youtube.com/watch?v=6ad4MH7fMLs

Consider it payback for colonialism and neocolonialism.

lol, but it created a bunch of debt finance jobs throughout the economy as well, that boosted existing manufacturing. Offshoring accounts for .1% of the job loss. Most of it is consolidation and technology. My great grandfather lost his job in 1925 during the first wave of consolidation. What about that?

This post reeks of globalist propa.

As someone working in manufacturing, while I am glad that there is some acknowledgement that outsourcing is responsible, I strongly disagree about not implementing tariffs. Effectively workers are competing for a race to the bottom in wages, working conditions, and other factors like environmental laws.

Guess what if there are tariffs? Things will cost more, but there will also be more jobs for the working class. Actually there will also be quite a few white collar jobs too. Engineering, HR, Finance, Sales, etc, are all needed in any manufacturing industry.

I suspect that net, most workers would be better off even if prices were higher due to the jobs. The thing is, the top 10 percent would not be and the 1 percent would not be. That’s the main reason for this outsourcing. To distribute income upwards so the rich can parasitically take it.

This is where I strongly disagree. As discussed above, I think that the net effect might be beneficial for the majority of society.

The other is the old retraining claims, which never pan out. What jobs are there? Visit the communities in the Midwestern US and Southern Ontario. Retraining for what? For jobs that are part time, minimum wage, with few or no benefits?!

Manufacturing may not have been perfect, but at least there were benefits, it was often full time, and the salaries allowed a middle class existence.

When I read things like this, as much as I dislike Trump, I can understand why people would support him.

We need training for the trades. Hard to find a plumber, carpenter, electrician anywhere and most are baby boomers who will be retiring.

For the life of me I don’t see how any other outcome could have happened. With the economic system we have embraced at least in my long lifetime, it was inevitable that “capital” would seek the lowest level playing field in the long term. Nation’s boundaries kept that flow “fenced” to a certain limit for as long as there have been physical borders between countries. Once the cat was let out of the bag of competing countries after WW2, for example the Japanese with computer driven machinery (lathes) that crushed American companies that in too many cases refused to invest and welcomed the slow destruction of organized labor here in the US, it was inevitable that that condition would be the future of manufacturing here. The advent of the Mexican maquiladoras gave a great push to the exporting of jobs. NAFTA put the nails in the coffin so many more of those good paying jobs. “Labor” was never invited to those global meetings that proved to be so destructive to so many countries.

But, again. The system we embrace can have no other outcome. “Tariffs” will eventually lead to wars. So in the words of that famous Russian: “What is to be done?”

Anybody have a solution? You will be saving civilization from itself. We need a complete rethinking of how we live on this planet. That will take better humans that we have now that lead nations. In the meantime it’s, “kill them all and let God sort them out!” The weak will succumb; the strong will continue to battle for territory, in this case jobs, jobs, jobs.

Unfortunately, the solution is for about 7 or 7.5 of the 8 billion people on the planet to die without being replaced.

Fortunately, both the Republicans and the Democrats in the US are pursuing policies that will get us there sooner rather than later. So we’ve got that going for us.

Jackpot.

For a look at what the numbers have been for the past half century:

Manufacturing employment

It’s surprisingly linear, and the inflection point at the last recession is curious.

Detail

Will the Larry Summers memo please pick up the courtesy white phone …. the sharing of uplift demands it …

Based on observation of what family members educate for and work at, social services and health care provide many of the jobs in Denmark. Education is mostly free, steady jobs pay for a good lifestyle and when needed a strong safety net really serves to get those in need back on their feet. In USA these people might be working insurance industry jobs instead of really taking care of people. I do not know much, but feel this is true.

I find it funny that after all this analysis you end up with what any reasonable persona applying logic could have guessed.

I ALSO find the conclusion ridiculous. Training workers for new jobs is a joke for most people. It is the same BS they have been selling for 30 years.

A 48 yr old plant worker with two kids, a mortgage, car loans and credit card debt is rightly frightened by offshoring. Even if they get 2 or 3 yrs of training to do something else how do they pay the mortgage, the car payments and care for the kids while that is happening?

Now, let’s say you DO train a plant worker to do cyber security work, now that person is 50 yrs old and off to compete for jobs against people 25 yrs younger and can probably afford to work for less, are more mobile etc. They still end up losing their community, the church they attend the school their kids went to, their neighbors. They will have to struggle to sell a home into a community that very likely is populated by similar people who also lost their jobs and a community that probably just became less desirable and in a community that has likely lost a large part of its tax base and had less money for schools, cops, maintenance of public infrastructure.

Whether anyone likes it or not, globalization is dead. DEAD. It was dead before Trump took office and it will be cremated by the time he leaves. I dare ANY politician to bring up any new free trade agreement.

I have little doubt that we are going to see more tariffs and higher prices. I also have little doubt that we are going to start seeing tariffs hit offshored services like computer programming.

The nation state is reaffirming its place in the world, international institutions are, if not outright dying, diminishing in their authority. The citizens of these nation states are going to demand jobs and that any trade that occurs benefits the state and its citizens over the profits of corporations. Nation states are going to reassert themselves over the interests of multinationals when it comes to exporting technology and know how and will begin to see allowing multinationals to invest in research overseas as a form of treason. Google comes to mind.

The neoliberal order has run smack dab into a rising wall of populism the world over.

The only question now is whether it will be a right or a left wing populism that wins.

From your lips to God’s ear!

I grew up in Sharon PA. 1970 Victor Posner bought Sharon Steel, gutted it and let the town rot. Soon GATX, Westinghouse, Nation castings were gone. The workers left. Created a new life. Those left our right populism were left with nothing to do but rock the boat. (Only the guy who isn’t rowing has time to rock the boat. – Jean-Paul Sartre)

Another thought…

Where would we be if the New Deal work programs if WWII had not intervened?

The United States was founded after the Columbian Exchange had decimated the native population of the Americas through exotic diseases and the introduction of European instruments of warfare, including horses, metal bladed weapons, and firearms. Genocide was simply a mopping-up operation.

Without a native population to exploit, the labor needs of large-scale agriculture was filled by slaves and those of large-scale industrial production by immigrants whose living conditions were little better than those of slaves.

The hatred of the “deplorable” worker by elites is baked-in to the American social system. Voter suppression and limited electoral choice currently keep these deplorables in check, but their resentments were quite evident in 2016.

The beatings will continue until morale improves!

Unions, Unions, Unions

Even more than the opportunity to make more money it was the opportunity to outrun unions that led to offshoring. Don’t forget the textile manufactures that migrated from the north (unionized) to the upper south (no unions), then when unions started to appear in the upper south they went to the lower south. Only when there were whispers of organization in the lower south did they go to near offshore and now to distant offshore. As pointed out above, this way they spend nothing on pollution mitigation or worker safety. Needless to say, this way they also have no one to answer to whenever they feel like indulging in a little rent seeking.

As Erik Loomis of Lawyers, Guns and Money, never tires of pointing out, subcontracting is now the preferred way for a multinational to deploy a fig leaf of deniability whenever another catastrophe occurs within their supply chain.