Yves here. Consistent with Hubert Horan’s extensive analysis of Uber’s economics, the local transportation company’s losses widened, again demonstrating it has no path to profitability.

By Wolf Richter, editor of Wolf Street. Originally published at Wolf Street

Burning cash is easy; It’s quite flammable and just goes up in smoke.

Here it is in a nutshell, the philosophy of “growth at all costs.” Uber’s total revenue increased 29% to $3.81 billion in the third quarter compared to a year earlier, the company reported this afternoon. And that’s very good revenue growth. But to get this revenue growth, the company threw everything at it that it had. So, expenses increased even faster, and the operating loss ballooned.

Revenues by segment:

- Rideshare revenues: +19% to $2.9 billion.

- Eats revenues: +64% to $645 million

- Freight revenues: +78% to $218 million

- ATG and other Technology: $17 million

And here is what it threw at it: Total costs and expenses soared by 33% to $4.92 billion. This includes $401 million the company paid its employees in stock-based compensation. In other words, to obtain a $969 million increase in revenues, the company spent an additional $1.2 billion.

At this rate, when expenses grow faster than revenues, there is going to be a problem trying to get to this mythic breakeven the way the company is structured now.

As a consequence of expenses increasing faster than revenues, its loss from operations soared by 45% to $1.11 billion.

It’s net loss – after interest expense, other income, losses from equity investments, and provisions for income taxes – rose by 18% to $1.16 billion, up from $986 million a year ago.

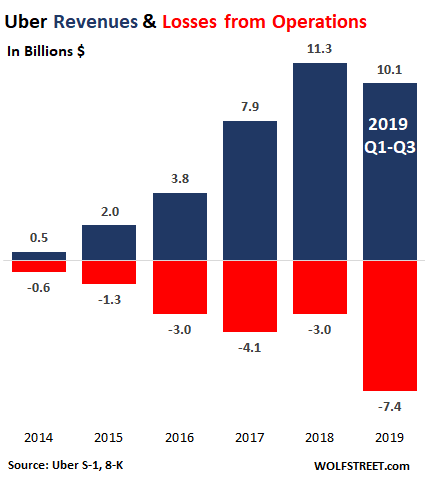

For the three quarters so far in 2019, Uber has lost $7.4 billion. You really have to try hard to lose $7.4 billion on $10 billion in revenues:

Cash flow from operations was a negative $878 million in the quarter, bringing the cash burn so far this year to $2.52 billion.

But don’t worry: it has plenty of investor-cash to burn, thanks to numerous fund-raising rounds, the cash raised during the IPO, and some monster debts. At the end of the quarter it still had $12.6 billion in cash to burn.

A big part of that cash is borrowed: Uber has $5.7 billion in long-term debt. Those creditors – despite Uber’s deep-junk credit ratings – aren’t worried as long as Uber as enough cash on its balance sheet to service and pay off the debt and a high enough a stock price to issue more shares and use the proceeds to service the debt. Creditors get very nervous when neither cash nor a high stock price is available to bail them out. So that’s what they’re keeping their eyes glued on.

Uber was founded over 10 years ago. It has about 27,000 employees – though there have been waves of layoffs this year, including another 350 folks two weeks ago. It has burned through enormous amounts of investor cash over the years. And yet, it is further away from making a profit than ever before.

In a brief interview on CNBC today, CEO Dara Khosrowshahi said the company is targeting “adjusted EBITDA profitability” in 2021. “We know there is the expectation of profitability, and we expect to deliver for 2021.”

“We haven’t finalized our planning, and it’s going to take a lot of work from a lot of folks, but we are actually targeting 2021 for adjusted EBITDA profitability for the year,” he said.

What does Uber’s “adjusted EBITDA profitability” actually mean? It means if Uber ever breaks even on this “adjusted EBITDA” basis, it will still lose a ton of money.

“Adjusted EBITDA” eliminates a lot of the bad stuff. Unadjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is a fairly standard measure of operating cash flow, not profit. Creditors use it to see if a company can make its interest payments over the near and medium term.

In Uber’s case, there is “adjusted EBITDA.” And in its earnings release at the bottom, Uber lists all the bad stuff that it excludes from it. Here are the biggies of the bad stuff that is excluded:

- Depreciation of property and equipment and amortization of intangible assets: But “the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect all cash capital expenditure requirements for such replacements or for new capital expenditure requirements;”

- Stock-based compensation expense, “which has been, and will continue to be for the foreseeable future, a significant recurring expense in our business and an important part of our compensation strategy”;

- “Other items” that are “not indicative of our ongoing operating performance”; so shit happens, and it doesn’t count.

- “Certain legal, tax, and regulatory reserve changes and settlements that may reduce cash available to us.” Of which there have been many, given all the scandals and issues with labor laws and taxi regulations in various jurisdictions.

So if Uber gets to “adjusted EBITDA profitability” by 2021, it will still be losing a ton of money, and it will be a long way from actual profitability, and it will be even further away from significant actual profitability that would create some kind of reasonable earnings multiple as appropriate for a taxi and delivery company.

Shares are down 5.2% in afterhours trading currently at $29.49, down 37% from its peak in June.

You’ve got to admire the guts to create something this big that burns up this much investor cash for a decade and on an ongoing basis, and that hasn’t yet figured out how to make a real profit, and apparently has no plans of doing so. Burning cash is easy; it’s quite flammable and just goes up in smoke. Building a profitable business in a competitive environment, that’s hard.

This is a holy-cow moment. Read... Tesla Discloses US Revenues Collapsed 39%. Americans Sour on its Cars, Pent-Up Demand Exhausted

I could lose them less money cheaper, why no-one gives money to me?

There must have been a change in MBA programs in the past few years based on what is seen with companies like Uber, WeWork and the fracking industry. They changed the bit about how corporations are supposed to make net gains and now try to make net loses. I don’t know. Maybe there was an accidental misprint in the text books that they were using back then. As far as I can see, they are still obeying the five commandments of modern corporations though, as encapsulated in the acronym “I SAID” which stands for Ignorance, Stupidity, Arrogance, Incompetence and Denial.

I think there is the ‘modern’ capitalism target to reach pseudo-monopolistic position on the markets. It shows up quite well in studies that market concentration has been increasing for past 20-30 years at least in the USA, and this fact was recently discussed here at Nakedcapitalism also if I recall correctly.

The matter is very simple and shows up in studies about market concentration also: Higher competition usually means smaller profit margins for the companies, and this shows in USA vs EU studies about market concentration and profits. Companies aim for the monopolistic positions as that’s where the actual profit margins are ‘hidden’.

The modern capitalism is not about the company owners, it’s about enriching the management.

Thank you and well said, Vlade.

I will write privately to you about that with regard the firm we know well.

> Uber Loses Another $1.2 Billion, Stock Dives Again

Seems like a sea change to me.

In the near future Pirate Equity, through the generous funding by public sector pension funds can buy this annual Nimitz sizes losses garbage barge for a minute fraction of a penny on the dollar and do a turnaround play by tripling Uber fares, and charging ambulance type fees by delivering a $5 hamburger for $40

The millennials will likely still buy at that price, as all sense of proportion has been lost by them, believing that food comes wholly formed in a bag at the door.

Adjusted EBITDA, who cares about proper accounting?

It seems to me that they have too many employees. Why does a middleman app need 27,000 employees? 27,000 doesn’t include the drivers I assume.

I was also shocked by this figure. I thought Uber had been waking up to their perilous situation when I heard about their layoffs, but their cuts have been far too small if they have 27K employees. I’m assuming they must need local recruiters and other functions within each market the operate. Previously, though, I’d heard that they would spend money like crazy on data scientists, forecasters, etc. at the corporate level

Maybe they need an app to handle the local functions remotely :)

Spot on assumption, seeing how Uber considers their drivers, well, absolutely *not* employees.

Exactly.

Paging David Graeber and BS jobs. This goes to the Techno-Feudalism of the valley. The “royalty,” founders and CEOs, have to overkill on spending on image and keep their courtiers fawning and spreading the techno-feudal gospel.

Additionally, it is an app that has trouble expanding globally and its hope for the future is on an automation fantasy that would require the majority of humans to give up driving and the rebuilding of the entire transportation infrasctructure.

For those keeping score at home, the share price as I write this is the lowest it has been since the IPO, down almost exactly a third from its opening price.

As I tell my neoliberal friends where Uber is concerned: enjoy the ride — while it lasts …

LOL, over at Yahoo Finance the headline-writers are spinning this as “Uber beats revenue expectations” and “Uber reports narrower-than-expected 3Q loss”. Both headline continue with “…but [negative stuff]” clauses, but note the ordering: Positive spin first, negative facts second.

And yet it is still worth approximately $50B according to the market, and has been for some time now. It’s tanked, but not nearly enough yet. This for a company whose long term plan is ‘flying robot cars will come and save us.’

This is not helping me get over my suspicion that capital markets are primarily a cash-out mechanism for scammers.

Why are none of these folks going to gaol?

It seems like fraud to me.

We’ve been going through a little ex-uber-ance here in British Columbia. Uber thought, it seems, that they were going to be able to walk in and take over after their naked propaganda, including the efforts of an astroturf consumer organization for “ride sharing,” along with the considerable and consistent boosterism by the CTV network in the province. It owns one of the three tv stations in Vancouver, the only network-owned station in Victoria (there is one independent locally worker-owned station, which has been mostly neutral), as well as the major radio stations in both cities.

The province has been accused frequently of dragging its feet, which I frankly think is partly true, I’m quite happy to say. They set rules for Uber to start up here, including demands for class 4 (taxi driver) licenses for all “independent driver-contractors” along with other tax rules. But Uber is likely to be on the roads in Vancouver, Victoria, and perhaps some towns in the Okanagan Valley before Christmas. Under the rules set down, they will be unlikely to be able to do much elsewhere–can’t get enough drivers–lack of suckers.