Overmuch has been made of US claims to energy independence and how that reduced US exposure to Iran using oil infrastructure as an avenue of retaliation. The fact that US gas prices have increased after perceived or actual threat to Middle Eastern supplies shows that the US is far from decoupled from the Gulf States.

Two new articles, one at Bloomberg, the other at OilPrice, explain how the US still depends on Middle Eastern oil. The OilPrice story also describes how Iran and its allies have many other Middle East targets for missile and cyber attack, such as water infrastructure and desalination and power plants.

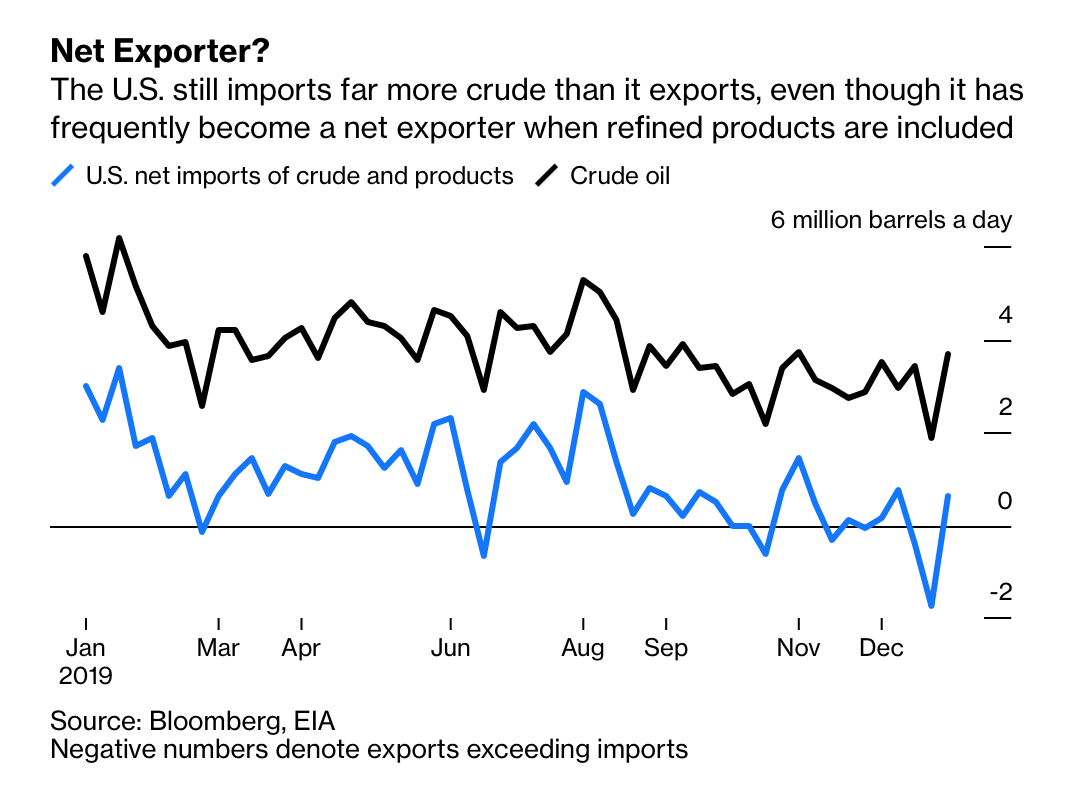

The fallacy of much of the commentary on US energy is to equate being a net energy exporter with energy independence. If you instead look at gross flows, the US still depends on Middle Eastern oil, albeit not as much as in the past, and that situation will not change soon.

The Bloomberg story by Julian Lee makes no bones about its position: Trump Is Wrong. The U.S. Does Need Middle East Oil. A key observation is that oil is not all that fungible. The US is a big consumer of the light, sweet crude that is well suited for refining into gasoline. That comes out of Saudi Arabia and Iraq (if their oil infrastructure were in better shape).

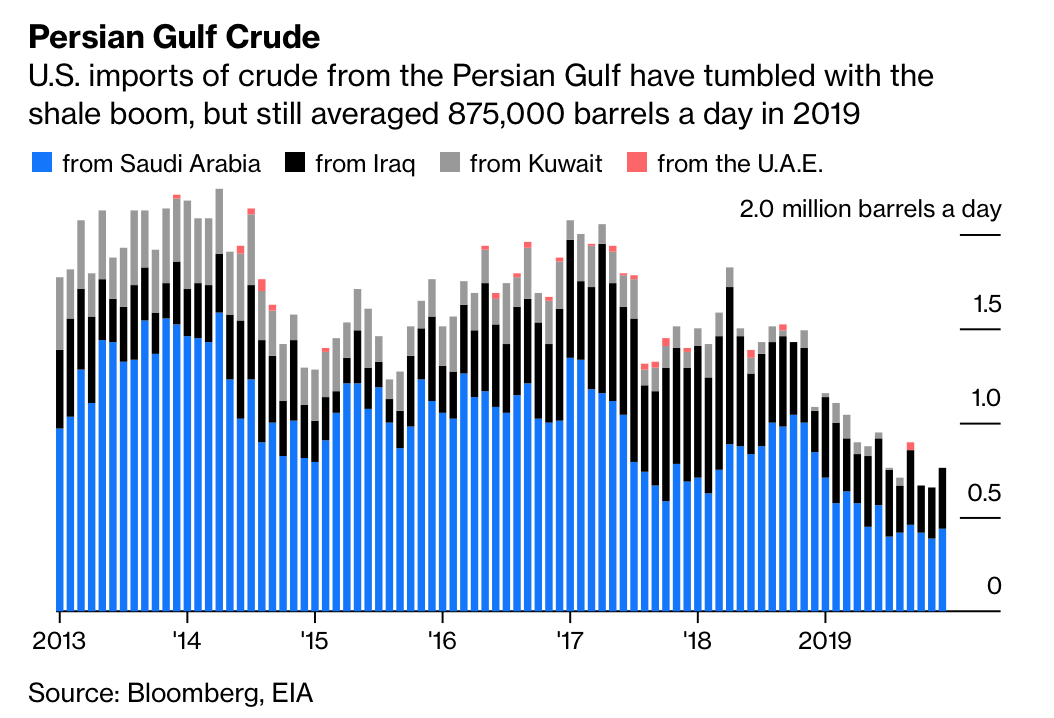

Even though US imports of Middle Eastern crude have fallen thanks to the shale oil boom and now account for only 5% of the oil shipped through the Strait of Hormuz, also making the US the #5 importer of that oil, it’s a misperception to think the US isn’t in need of Middle Eastern oil:

Lee at Bloomberg also points out that Gulf Coast refiners, who had tuned their operations to process heavy, sour crude (think Venezuela but also Iran and other Middle East exporters ex the Saudis). Since 2012 have been switching to lighter, sweet shale gas, but many still process heavier crudes. And those refiners even more than ever look to the Middle East:

And with tension now flaring with Iran, the fact that there are fewer sources from which to import the heavy, sour crude (containing high concentrations of sulfur) on which Gulf coast refineries depend is coming into relief. The U.S. imposed sanctions on Venezuelan oil exports in January 2019 and Mexico and Colombia are facing declining output as a result of a lack of new investment. For now, while Canada remains the biggest supplier to the U.S., the Middle East delivers most of the rest.

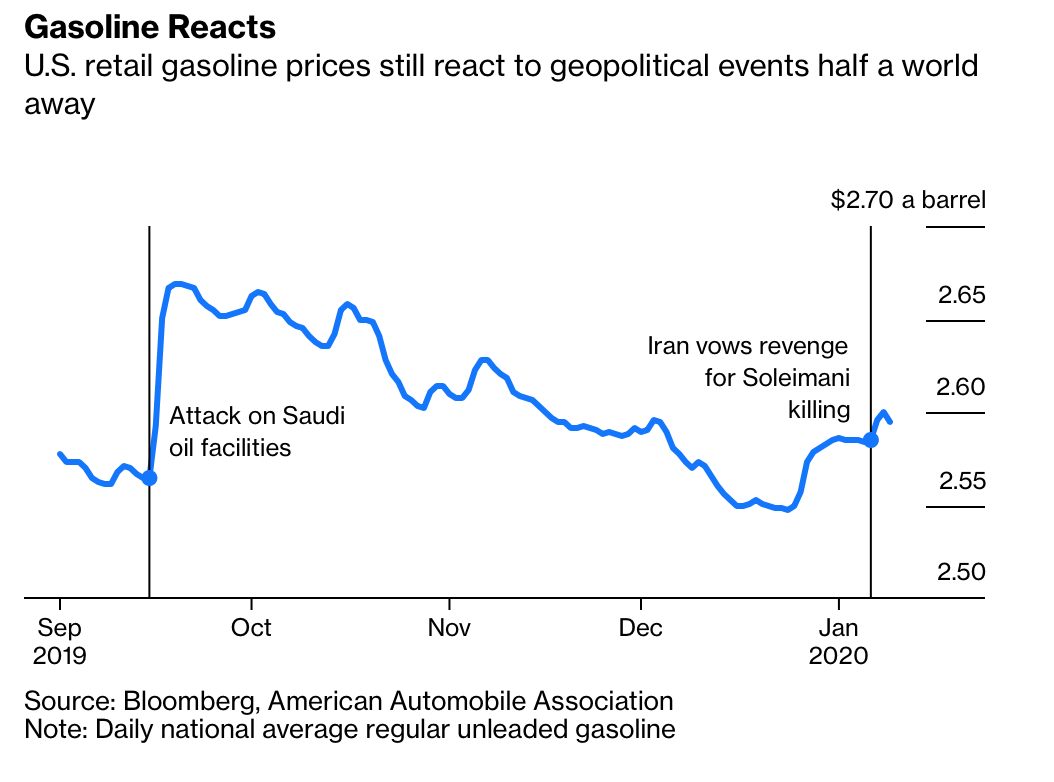

On top of that, US gas is sensitive to oil price changes:

No matter where oil from the Middle East is sold, the volume coming out of the region still has a profound impact on crude prices as well as those of gasoline and diesel fuel. Nowhere is that more true than in the U.S., where low taxes on fuels mean their prices are much more responsive to movements in global crude.

The national average price of regular unleaded gasoline jumped by 10 U.S. cents a gallon — the biggest two-day increase in more than two years — after attacks in September on Saudi oil installations, even though the world’s biggest oil exporter was quick to reassure customers that there would be no disruption to supplies. The kingdom lived up to its promise, but it still took three months for gas prices to return to their pre-attack level. That shows just how important the flow of crude from the Persian Gulf still is to Americans — and their president.

For now, the killing of Iran’s General Qassem Soleimani and Iran’s responses so far have had a smaller, but still noticeable impact on U.S. gas prices — even without any explicit Iranian threat to regional oil flows.

Dr. Cyril Widdershoven at OilPrice adds that cheery OPEC reassurances that it could handle any supply hiccups don’t align well with facts:

OPEC Secretary-General Mohammed Barkindo and UAE’s Energy Minister Suhail Al Mazrouei added to this bearish sentiment by saying that there is no risk of an oil shortage if hostilities do flare up. Al Mazrouei also reiterated that he doesn’t see any risk that Iran will close the Strait of Hormuz. This was confirmed by his Iranian colleague Zanganeh, who claimed that the crisis is profitable for Iran as oil and gas prices increased. These official statements need, however, to be taken with a truckload of salt. OPEC’s confidence that there is enough spare capacity in the market, and that there is ample supply, is a political statement to quell existing fears. The spare capacity of OPEC is at present almost totally in the hands of two main players, Saudi Arabia and the UAE, while the rest of the members are struggling to reach even their own set targets. In case of a military confrontation between Iran (or proxies) and the US, a real possibility exists that total OPEC spare capacity is taken out. No other producer could substitute a possible loss of Saudi oil production.

Dr. Widdershoven dismissed the notion that Iran might choke the Strait of Hormuz as riskier for Iran than its opponents.

Some of the possibilities instead:

Attacking the oil and gas installations of major Western and Arab national companies via proxies

Increasing attacks on Israel via Hamas or Hezbollah

Targeting energy and water infrastructure in Arab countries

Dr. Widdershoven elaborates:

Even if no direct war is expected, as indicated by UAE Energy Minister Suhail today at the UAE Energy Forum in Abu Dhabi, experts expect that energy and water sectors in the Arab countries could be targeted. As shown by the Abqaiq attack, all these operations are very vulnerable to drones or possibly cyberattacks. By striking critical infrastructure, Iran and proxies will be able to destabilize not only the economies of the GCC region, but deal a blow to global economies too.

A real asymmetric war threat is the use of cyberattacks to bring down specific or nationwide assets, such as oil-gas assets, desalination and power plants (IWPP). Tehran already has threatened to start a cyberwar against the U.S. and its allies, but at present no actions have been reported. Saudi Aramco, ADNOC or BAPCO could be targeted. Qatar’s energy installations are less vulnerable, looking at the reasonably strong relations between Doha and Tehran. Qatar, however, could get caught in the crossfire because of its large U.S. and Western military presence.

Dr. Widdershoven argues that Iran needs to retaliate soon despite that not being their historical pattern. Indeed, the regime may come to believe that its accidental shooting of PS 752 resulted from its rapid, targeted attack on a US airbase in Iraq. Had Iran not felt uncharacteristically pressured to strike back quickly, it would not have been on the high alert that led to the mistaken downing. The belief that the regime needs to make another show of force appears to be based on the idea that it has been severely damaged by having to make an embarrassing reversal of its claim that the plane had experienced some sort of malfunction. While Iran has certainly lost most of its moral high ground, the idea that the regime is in domestic hot water at this point looks to be exaggerated. CNN put the number of participants in fresh anti-government protests as in the thousands; BBC pegged it at mere hundreds.

Needless to say, even though experts debate when and what Iran will do next, they are virtually unanimous in believing that the targeted strike was a politically necessary jab back, and not the intended retaliation. And don’t forget that not only is Iran’s pattern to be patient, but also to retaliate disproportionately. Even though Dr. Widdershoven didn’t include assassinations, that would be the most fitting response.

saudi oil is medium-heavy/sour, not light/sweet. from the linked bloomberg article:

also see: World’s Most Important Crude Oil Grades

Your references do not quite prove your point.

The largest oil field in the world, Saudi Arabia’s Ghawar field, produces light crude oils ranging from 33° API (860 kg/m3) to 40° API (825 kg/m3). NYMEX considers any API < 42 to be sweet. Per the Aramco prospectus, Ghawar is still able to provide 1/3 of Aramco's total output. To your implicit point, observers had assumed it was capable of even now producing at a higher level. https://oilprice.com/Energy/Crude-Oil/Aramcos-Mythical-Ghawar-Field-Could-Be-Its-Weak-Spot.html#

So this isn’t black and white….Saudi Arabia is still producing a lot of light sweet crude even if the amount of medium sour makes it correct to depict Saudi Arabia on average producing sour crude. This was confirmed by the sensitivity of US gas prices to the strikes on Saudi oil fields.

And in any event, this is now moot. The US is producing so much shale gas that the old Brent-Dubai spread (sweet v. medium sour) has collapsed, which is a point I should have made.

Your are correct. Refinery cracking towers are build to process specific crude (from specific oilfields). While it is possible to switch to another type of crude (a different oil field), the process involves construction in a dangerous environment, the refinery, and significant down time for the cracking towers.

The oil business is a global business. Lack of supply from one area causes a flow of refined product to fill the gap.

historically. the biggest importer of light, sweet crude from the Middle East probably had been the Philadelphia Energy Solutions refinery complex in south Philly, but part of that blew up in June & it’s been shut down since…i think it’s on the auction block this week, it may end up being a toxic mall or contaminated amusement park…

that refinery, and other east coast consumers of light crude, had been using some crude by rail from the Bakken, but that spate of bomb train explosions we experienced a few years back seems to have slowed that transition down…Bakken crude is very light & sweet & probably as volatile as gasoline…

make no mistake, we have a glut of light sweet crude from shale; this table indicates all our shale grades are sweeter and generally lighter than the US benchmark WTI:

https://www.spglobal.com/platts/plattscontent/_assets/_files/downloads/crude_grades_periodic_table/crude_grades_periodic_table.html

but there are no major pipelines carrying shale crude from Colorado, North Dakota and Texas to the east coast refineries that could use it, so we’re exporting more than 3 million barrels per day of it from the Gulf while identical grades of oil from elsewhere are being imported by refineries on the east coast…

The most recent Iranian missile strike on US bases demonstrated their capacity for precision attacks with no apparent effort, or press acknowledgement, on missile defense. The US presence in Iraq is a force protection nightmare; they are too spread out to defend. Oil and other critical infrastructure in Saudi Arabia and UAE are similarly indefensible. Too many targets to choose from.

Also, there is very little press in the Western MSM on the PS752 shoot down; normally they would be screaming. Would it have happened if the Iranians weren’t on high alert (ie: dialed up to 11)? doubtful. Why were they on high alert? Soleimani. MoA had a good article covering the chain of command for missile defense and the likely vector of the error.

On par, I doubt the Iranian leadership will rush into any form of retaliation for Soleimani. They are in a good position to bide their time and maximize the pain of the eventual outcome. Keep checking to see if that red flag is flying over the Jamkaran Mosque.

Probably because missile defence is an iffy business, at best. Phalanx and so on might hit an incoming missile but the missile parts usually will have enough kinetic energy to continue right along their ballistic trajectory and still make a proper mess of the target.

The opposition can always fire several more missiles than the few that the defence systems can take on in ‘one setting’, if they are serious about it.

It just seems to me that in very many ways we are all atop a house of cards,

Consider the many vulnerabilities Iran might attack in the Middle East to retaliate against the U.S. attack — and remember Iran is not our only enemy in that region. Some of the targets would require the kind of assets only a State has access to — but not all of them. The flow of petroleum from the Middle East to refineries in the Gulf of Mexico is but one of many long narrow chains of supply for vital resources and goods entering the U.S. economy. I believe these other chains of supply hold many vulnerabilities analogous with those identified along the source and flows of oil. The complexity and fragility of the long and widely distributed webs of supply and production constructed by Neoliberal globalization are subject to many complex interactions of small and large failures which can occur through acts of Nature, bad maintenance, or deliberate violent attacks or sabotage. There are many vulnerabilities in the U.S.’Homeland’. Meanwhile, the U.S. government has worked very hard at making enemies in the world. It has several rivals which U.S. trade policies have strengthened and U.S. actions have angered through their arrogance and selfish stupidity. I agree we are all atop a house of cards. Continuing thoughts along that line it were as if we sat atop a giant unstable Jenga construction and our government is playing fast and loose removing pieces around its base.

The problem is Donald Trump’s transactional view of the world. “It is the money honey”.

He seized Syria’s oil fields and won’t willingly leave Iraq although the Caliphate is defeated. He threatened to cut off Iraq’s access to Fed bank account. He has only aggressive national security advisors left. The WaPo said that just months after being inaugurated he wanted to kill Iranian General Soleimani. Either this is true, or Jeff Bezos is trolling the President for not really being anti-war. The President needs a deal with Iran or North Korea bad. But human patriotism, culture and pride are too powerful. The Iraq War of Occupation 2.0 has started. It will escalate. Iran will have no control over it although it will get all the blame in the West. Donald Trump cannot buy his way to a second term. The fourth US war in Iraq in the last 30 years will be with the victorious, experienced, trained Iraqi Shiite militias armed with precision ballistic missiles. If the USA stays in Syria and Iraq, lots of dead Marines and Soldiers will be coming home through Dover – American Contractors in airline cargo bays.

This would elect Bernie Sanders if he is the Democrat candidate.

It seems to me the role of the Saudis in the proxy wars in the ME re downplayed at every turn. I see their aggression in Yemen as their Liebensraum and probable support of ISIS as a reach for more oil reserves by access to Iraqi reserves. After its public offering of ARAMCO stock there will be a lot of incentive to see that happen. I am troubled by the Trump’s lapdog response to Saudi flattery and the Saudi ability to enrich the Family

To give the United States a bit more flexibility with oil supplies, Trump should cut one of his famous deals with Venezuela though I am hard pressed to think of any big international deal that he has done since being elected. But we all know that Trump is more likely to double down instead here. Does he realize behind his bluster how close he came to starting a war with Iran? Maybe. But only in terms of how it would effect his re-electibility this coming November.

As for the Iranians, I have no doubt that they are still preparing their plans. They put the Pentagon on notice that they can be hit hard with little to stop such an attack and with accuracy to boot. Obviously they could hit Saudi Arabia and the Gulf States using proxies if so minded. Their oil would still be shipping and fetching higher prices to any crisis that they may have instigated. The oil supply sounds much more brittle than I thought from the sounds of this article. In a bit of synchronicity with Yves’s other article today, I too thought of a Sherlock Holmes metaphor to describe what it will be like for the United States with Iran. Sherlock Holmes’s nemesis Moriarity is saying to Holmes-

‘You crossed my path on the 4th of January,’ said he. ‘On the 23d you incommoded me; by the middle of February I was seriously inconvenienced by you; at the end of March I was absolutely hampered in my plans; and now, at the close of April, I find myself placed in such a position through your continual persecution that I am in positive danger of losing my liberty. The situation is becoming an impossible one.’

And I think that this is how it is going to be for the Coalition in the Middle East over the coming years. Already Coalition forces have drawn back into more defensible bases in Iraq as it is obvious now that they are once more occupation forces. The Coalition has been ‘incommoded’ now. And I seriously doubt that we will be seeing a carrier sailing up and down the Straits again.

I don’t believe we actually killed Soleimani. Whoever did was rolling the dice to set us up for a big hot war. So who would have liked such a war? I can think of a few. Not many. And it is a relief to see the international reaction to prevent escalation at all costs. Everybody was on it. Even Trump. That’s interesting.

Trump claimed in his recent speech on Iran that “America has achieved energy independence.”

So far as I, an outsider, can see, the USA and its citizens don’t know what they mean by America. One minute it’s a continent or two, eg. NAFTA, OAS. The next it’s 50 states and not even Puerto Rico.

The article states that the US is importing large amounts of crude oil from Canada, an American country which many in the US see as a sort of semi-autonomous bit between the 48 states and Alaska, an oil producing region that must and will obey and co-operate. (Canada’s position doesn’t seem to be that different.) The US sees that oil as theirs by right, even if they have to pay for it, and Canada seems quite willing to supply it. The US also has its eyes on Venezuela’s oil; the purpose of the sanctions appears to be to replace the government with one that will hand it over happily, and only to the US and whoever they permit (ie. not Cuba etc.).

So perhaps there is more truth in what Trump says than the article makes out. If the USA can get by on American (US + Canadian + maybe Venezuelan) oil, then perhaps ‘America’ (I expect Trump, like many, sees the distinction between America and the USA as hair-splitting, and the confusion as convenient) is close to some kind of energy independence.

Also, while rising prices might hurt the consumer and the overall economy, wouldn’t they also make the fracking industry more profitable, moving the US further toward energy independence from the Middle East as well as keeping the likes of the Kochs happy?

Finally, an important point is that if President Trump believes that the USA is energy independent, he is likely to behave accordingly, regardless of the truth of the matter.

For any politician to make such a fleeting claim as “America is now energy independent” is pointless. For how long and at what price to the atmosphere and water will “America be energy independent?” And what exactly are the details? For America to be energy secure might be a better goal. It encompasses all sources. And the difference between the words “independent” and “secure” are pretty vast. Security for the world is a good goal right now. But to have the US be energy independent implies all sorts of atavistic politics. imo

The liar and con artist Orange Man will make the claim that ‘America has achieved energy independence’ even if it weren’t true. His political base would believe this just as they believe his other nonsense.

Maybe worse still, he might believe it himself. His entire message comes across to me as ‘America’ can go it alone, all it has to do is defeat the rest of the world.

Funny thing with both Venezuela & Iran, both countries have huge oil reserves, and both are financial basketcases as far as their currencies are concerned, which is queer as oil is a license to print money that should be accepted everywhere, but not with the aforementioned dynamic duo.

It was 4 Rials to the $ when the Shah was in power, now it’s 42,000 to $, not anywhere in the neighborhood of the hyperinflation Venezuela has been through, but it doesn’t matter at some point, which is where things are in Tehran.

If your currency is worth bupkis, then going about destroying other currencies will do you no harm.

The Iranians showed what they could do by ripping off Adelson’s casino to the tune of $40 million 6 years ago and making off with customers credit card info, social security #’s et al.

Hacking has been heretofore, all about taking something.

What if the Iranians took a different tack and instead flooded accounts with money, with the resulting cyberinflation finally putting paid to what’s left of the Bretton Woods agreement 76 years later, in bringing about it’s demise, along with the USD no longer being the world’s reserve currency?

*Sigh*

First, we have written before that Venezuela’s claims about its proven reserves are widely believed to be greatly exaggerated:

https://blogs.platts.com/2017/07/10/venezuela-oil-reserves-kick-reverse/

And from a bit older piece:

https://www.forbes.com/sites/rrapier/2016/07/01/venezuelas-oil-reserves-are-probably-vastly-overstated/#f48e49444974

Shorter: the oil in Venezuela and Iran is particularly heavy and sour, and thus less valuable than less sour heavy/sour oil.

Not too concerned with actual Venezuelan reserves or Venezuela’s ability to counter American threats to their well being under Maduro, there being no there, there. Not my focus.

It’s Iran who will call the shots, and they’ve already demonstrated what they’re capable of doing, and i’d like to think that a casino would be a hard thing to knock off, and they’ve had 6 years to perfect their game of sleight of and, since.

How many people would’ve thought that they would retaliate against us assassinating Solemani, by launching a precision missile strike that obliterated targets, yet didn’t kill a single person. We’d never do that. They have a completely different tack of going about things.

Well, I know that the US is still dependent on Mid-East oil, because the military is still there.

Maybe they US does not want the military to come back? What would all of those veterans do!? Some of them would do what they were trained to do: Join the HA or the mob, maybe sign up with the local SWAT-team, train local police in warfare tactics. And so on.

Possibly, on balance, it is safer for the ‘homelands’ to keep them deployed forever?

“Targeting energy and water infrastructure in Arab countries.”

Bullish for distributed generation! especially solar + batteries + a RODI still. Oh, and stillsuits.

Di$a$ter Kapitalee$m, für den Sieg!

Squeeze them, Rabban!

Also if the sanctions were removed from Iran, they would most likely produce a lot of oil and drive down the prices, which will hurt US oil industry. That’s the middle east war is all about oil theory.

Not only US, but Russia and Saudis too. Siberian oil is not cheap to produce, and wells can’t be stopped even when prices are low. As for the Saudis, it is all about maximizing their Ricardian rent.

And remember climate driven demand destruction is going to build in the 20’s and become a full force hurricane on oil assets in the 30’s.

Why this obvious? Hardly a word was mentioned about the same ‘error’ done by the US in shooting down an Iranian ‘Airbus’ flight (IR655) no less, with a missile, killing even more Iranians….(290).

But this event is being ‘milked’ at the expense of each country’s taxpayers. Forget it, the sheer hypocrisy is smelling up our global environment as though we don’t have enough with the smoke from ‘Climate Caused’ fires.

All wars in the Middle East and later Venezuela were done on varying countries taxpayer tabs, (US, France, Italy, Britain ) just so the big welfare-subsidized international oil companies can finally take over the oil profits, regardless of any countries sovereignty.

Same ole, dirty business that’s been going on since oil was discovered. Wish taxpayers would finally take their collective fear-driven heads out of the holes they’ve dug themselves, in order to hide from acknowledging their silent complicity to millions now murdered, and fleeing the weapons used, in these phony conflicts to profit defense/arms corporations, world-wide.

Getting a bit long-in-the-tooth to continue saying any of the Western country/multinationals give a damn about people or sovereignty. Corporations now have control, no more political lies or phony gas uses needed. Once these trade deals are set to override the ‘rule of law’ and their individual court systems, then the only wee road left is for taxpayers to redistribute their hard-earned money on severely cut programs and services(neglected in lieu of corporate greed).

Rockets are still crashing down on Balad air base in Iraq – so far injuring mostly just Iraqis.

The emphasis on Iran misses that Iraq, especially the militias, is also an aggrieved party and has not retaliated yet, except by asking the US (and all foreign) military to leave.

The article mentioned that there are now fewer Americans at Balad, without saying where they went. Out of the country, is my guess. The logical course for the US military at this point is to let Pompeo continue to harrumph while quietly evacuating from Iraq. The remaining issue will be the embassy, which was obviously intended as a viceregal seat.

Iran and China have something in common – they both have time on their side. It behooves Iran not to rush into a war.

First, multiple reputable outlets are saying that US tight gas/oil production may peak in 2022. Oil/gas production curves are symmetrical – the faster they rise, the faster they fall.

Second, even the IDF mouthpiece debka.com was visibly shaken by the precision of the Iranian missile strike on the US Ain Al-Asad airbase in Iraq. These guys never give Iran credit for anything, but they are loudly proclaiming that Iran’s Long Range Precision Strike capabilities have reached a whole new level. The photos speak for themselves in my opinion.

The more time Iran has to deploy precision missiles to Syria and Lebanon, the better positioned they will be to make 2006 look like a teddy bear picnic. Personally I am convinced it is these factors that have Bibi desperate for war.

My point of view is they Soleimani execution was not an answer to an attack that lead to the death of a contractor, but was the carefully timed response to the Abqaiq attack. Equally important IMHO was the « 52 targets » tweet just following the attack : it was just a notice that if Iran ups the ante through its now well demonstrated capacity to strike any target in Saudi Arabia or Israel, it means the US and its allies are ready to go full «Yugoslavia 1999 », I.e. massive air attacks but no boots on the ground (I don’t believe the hype on Russian sourced air defense systems, Israeli F35 ran round over Tehran in 2018, which led to the removal of Iranian Air Force chief, which seems not having been replaced by someone more competent…).

Once Iranian industrial infrastructure is dismantled (hard to manufacture missiles with no electricity or even gasoline), the Saudi and Israeli air forces are capable enough to make sure it stays that way for some time. Think Yemen on steroids, without the capacity to build drones and missiles.

This is where I disagree with the premise of the article. It is a better strategy for Iran to hunker down, develop a nuclear deterrent just in time for Trump to be out and for China to have a Navy who can challenge anyone in the Indian Ocean and help them overcome the Arabian peninsula.

Eventually, Iran will win because of its better educated and bigger population, but I still believe that Iran will win when there will not be a prize any more for victory : by then, the world will have engaged its transition to « Fossilless » energy and they will lord over a quite barren piece of land.

I am sorry but this is not the 1990s anymore. Pilot’s no longer shout “time to club some baby seals”, jump in their planes and bomb water filtration and sewerage plants to help kill hundreds of thousands of civilians through diseases like they did to Iraq. Take out Iran’s infrastructure? Sure, you can try that. But kiss goodbye to ALL of Saudi Arabia’s oil and water filtration plants while the attempt is made. What would that do to the world economy? How would the Saudis sell oil in US dollars if there is no oil to sell plus an unknown number of people to evacuate because of the sudden lack of water.

And the Israelis? They could not stop eight of their F-16 going underwater this week in flash floods. How are they supposed to stop precision attacks on their infrastructure and maybe even the Negev Nuclear Research Center. You think that the Israelis want to risk that? They typically, like the Saudis, specialize in attacking people that cannot attack back. Lebanon in 2006 showed what happens when this was no longer true. And did it surprise you that not one solitary Iranian missile was shot down in the attack on those two US bases in Iraq? Maybe the truth was they could not. Time will tell.

I agree with you that it is not the 1990s anymore for Iran, but would suggest that it is for Yemen. I think the difference is that the US has not declared a formal “no fly zone” over Yemen. I don’t think that Putin will let that happen again – every time “the west” gets away with declaring a no fly zone, they believe even more strongly that they have the inalienable right to do so.

And those water desalination plants in Israel are marshmallow-soft targets.